VIVID: Mobile Banking on the App Store, Vivid Money: our opinion on this neobank in 2023

VIVID Money: Our opinion on this neobank in 2023

Like a real broker on the stock market, this vivid service gives you The choice to invest in more than 2,000 shares and FCB (including companies that experience strong growth such as Netflix, Amazon, Tesla or Apple. ) that you can follow in real time in order to be reactive on the purchase and sale of shares, and to withdraw your profits without delay.

VIVID: Mobile Banking 4+

Finally the ideal banking app: the interface is simple and refined. We feel that a lot of efforts have been made to make the application simple to use without sacrificing the features.

Regarding the features, the one that made me choose Vivid rather than another is the possibility of having an IBAN for each sub-account. For me, it is essential: every beginning of the month I ventilate my salary on sub-accounts for internet services, insurance, utility (water, gas, electricity), etc. and creditors can come directly from the sub -Counts without intervention on my part. And of course, I have a sub-account for my savings. In this way, I have total control over my finances and I finally manage to put money ! I don’t want to be too long but you will understand: I recommend VIVIVER !

Developer Response ,

Thank you very much for your opinion! We are happy to hear that you are satisfied with our services. It is a pleasure to have you among our customers and we will make sure that your experience continues to be so positive ��

Map

Very professional thank you

Developer Response ,

Thanks to you Bruno, we are delighted to count you among our customers ��

Pocket Crypto 2 opening concerns.0

I have been at Vivid for over a year. So far everything went well, I have managed to invest and the application is well done and trusted bank but big worries. During the novelty of the Pocket Crypto 2.0 I wanted to try, except that the concern being too young I did not have a tax number and so I could not add one in order to finalize the procedures. Recently Vidid has implemented their cash back update on this famous Pocket to replace the Gain and Action section. But that you surprise my surprise when I discovered that Vidid had blocked my access to this section for lack of tax number. Ajrd I was able to add it by thinking of solving the problem but nothing helps . Customer service does not know what to do and all my emails sent ends up in a vacuum.

Help me solve the problem of access following this commercial refusal so that I can continue to invest my money in cryptocurrency otherwise I am blocked without access to this new mandatory feature since my old pocket will be put in sleep .

Developer Response ,

Good morning,

Thanks for your feedback. We are sorry that our customer service has not yet resolved your request and that you have not had your emails. We are delighted to look in more detail with you what is going on in order to restore you to access as much as possible to cashback in cryptocurrency. To do this, please contact us via our online form on https: // vivid.MONEY/FR-FR/, Click on “Contact us” then choose “Reference code” and indicate your F199 reference code in your message. We will take care of your request immediately. Good day to you. Your VIVIVID Money team ��

Privacy app

The Developer, Vivid Money GmbH, Indicated That the App’s Privacy Practices May include handling of data as described below. For more information, see the development’s privacy policy.

Data used to track you

Data Linked to You

The following data may be collected and linked to your identity:

- Financial Info

- Rental

- Contact info

- Identifiers

- Data use

- Diagnostics

Data not linked to you

The following data may be collected but it is not linked to your identity:

Privacy Practices May Vary Based On, for Example, The Features You Use or Your Age. Learn More

Information

Provider Vivid Money Gmbh

Compatibility iPhone requires iOS 14.0 LATER. iPod touch requires iOS 14.0 LATER. Mac requires macOS 11.0 or later and a mac with Apple M1 Chip or Later.

English, French, German, Italian, Spanish

Copyright © VIVID MONEY GMBH

- Developer Website

- App Support

- Privacy Policy

- Developer Website

- App Support

- Privacy Policy

VIVID Money: Our opinion on this neobank in 2023

VIVID is a relatively recent neoban which has the particularity of highlighting new banking uses such as cashback or the management of sub-accounts. Investment also takes a large share of experience: business action, cryptocurrency and even precious metals. But is this a neobank that has its place among the managers of the genre ?

Characteristics of Vivid Money

| �� Opening premium | None |

| �� Income condition | None |

| �� Bank card | VISA |

| �� Initial deposit | None |

| �� Count of account | None |

| �� Sponsorship | YES |

| �� Application | Android/ iOS |

| �� Mobile payment | Apple Pay / Google Pay |

| �� 3D Secure | Yes |

Vivid

Money

in a few words

In recent years have seen a good European new European neobancs born on the same mobility model and seeking to stand out from each other. VIVID Money is one of them and put above all on its investment features and cashback.

VIVID Money is a bank of German origin (just like N26) and relatively recent since it was born in 2019 under the leadership of two Russian entrepreneurs: Alexander Emeshev and Artem Yamanov. The latter are not unrelated to the world of finance since they previously worked as executives for the Russian bank Tinkoff Bank.

THE Business Model De Vivid Money was created around the Baas platform (Banking-as-a-service) of Solarisbank, fintech specialist. This allows him to take advantage of a banking license while offering his customers its own specific products such as business action, on the stock market, but also in cryptocurrency.

Today, the neobank Vivid Money is available in most European countries and intends to extend its activities again thanks to the regular investment of which it makes the benefit. The company is now estimated at 775 million euros.

Prices: a free card, another paid, that’s all !

Vivid Money’s banking offer could not be readable. Only two types of cards are available with very distinct services:

| Standard VIVID | VIVID PRIME | |

|---|---|---|

| Price | Free | € 9.90 /month (1 month offered) |

| Initial deposit | None | None |

| Type of flow | Systematic authorization | Systematic authorization |

| Income conditions | None | None |

| Payment abroad | Free (in foreign currency) | Free (in foreign currency) |

| Withdrawals abroad | Free (in foreign currency) | Free (in foreign currency) |

| Payment ceiling | 999.999 € /month | 999.999 € /month |

| Removal ceiling | 200 € /month | 1000 € /month |

| Cashback | 20 € maximum cashback per month | 100 € maximum cashback per month |

| Cryptocurrency | 1.49 % of costs per transaction, with a minimum of € 0.79 | Unlimited cryptos transactions |

| Closing account | Free | Free |

The formalities are similar to what other online banks can offer and especially neobancs. This is also the case for payments and withdrawals abroad even if the approach is a little different. VIVID MONEY does not offer free of-payment or withdrawal, it is necessary to buy foreign currencies yourself from the application in order to store them in a “travel” sub-account. Fortunately, Vivid Money automatically detects the corresponding currency, and therefore the right sub-bar so as not to have to undergo a fee. We would have liked it could be done more simply, because you have to know this system upstream before going on a trip abroad.

How to feed your account ?

It is not necessary to make a defined and compulsory contribution to have access to your VIVID Money account. However, from the opening, the bank offers you to make a first transfer to have the full use of it. By default, if your account is linked to a Gmail address, the transfer of money by Google Pay is selectable, but it is of course possible to make a punctual transfer from another account via the card number, an IBAN or adding Another bank among the hundreds available. Be careful however: if you have a free vivid money account, transfers cannot go beyond 1000 euros. To exceed this limit, it is necessary to benefit from a premium VIVVID account or subscribe to a monthly boost (3.40 euros).

The best online banks

Our opinion and full test on VIVID Money 2023

VIVIVE presentation: the free German account for all that saves money ��

Created in 2019, the German neobank Vivid belonging to the historic banking group Tinkoff Bank established since 1986, aims to give access to a bank account to everyone while earning money.

Concretely, Vivid Money provides you A free bank card where you are going to earn money during your purchases with the principle of the cashback program accessible on the mobile application. With Vivid Cashback, the neobank promises to reimburse up to 25% of purchases in brands like Lidl, Carrefour, Nike, Ikea, Amazon, SNCF or Zara to recite nobody else but them. It is thanks to partnerships with major brands that VIVIVID MONEY BANK offers a completely free bank account.

In addition, VIVID offers a complete offer for invest without commissions on the stock market on business shares & ETF but also on cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Cardano, EOS, ChainLink. And this from a few cents of euros.

At a time when most of our purchases are made more and more on websites and by bank card due to the Covid 19 health crisis. It becomes advantageous to obtain a CB which pays according to our purchases.

We therefore offer you a Guide, opinion & full test on VIVIVE, a bank intended for everyone. Discover our detailed analysis of the famous free bank card that reports, in order to have impartial opinion on the advantages and disadvantages before opening a bank account at VIVID MONEY.

✅ Advantages of subscribing to the mobile bank Vivid Money

- �� A completely free account with a bank card without contribution

- Subscription in less than 3 minutes and Activation of the account from € 10

- A completely free offer and free of charge

- 1 rib without changing bank

- An ultra-secure free metal visa card Without making your card numbers or CVV visible

- Payments free of charge in France and abroad

- Contactless and secure payment via Google Pay and Apple Pay

- Possibility of creating up to 15 currencies to travel free of charge or to prepare projects (savings, purchases, investments. ) with RIB/dissociated IBAN

- �� Up to 25% cashback and promotions on major brands

- Possibility of investing on Global Business Actions (Stock Exchange) but also Crypto-monnaies

- Simple and intuitive mobile application

- Available and responsive customer service available on the cat 7 days a week directly on the application

- Without engagement : Resiliable in 1 click via the application

- The deposited money is protected up to € 100,000

❎ Disadvantages of the free banking offer from VIVIV MONEY

- Free cash withdrawal worldwide from € 50 withdrawal (and up to € 200 per month on the free account)

- No possible overdraft

�� Banking prices and costs of the neobank Vivid Money

VIVID MONEY offers 2 offers:

✔️ A completely free and non -commitment formula

- Withdrawal conditions: free up to € 200 per month with the free account (beyond, 3% are applied with a maximum of € 1 of costs per withdrawal). Withdrawals of less than € 50 are invoiced with these conditions.

✔️ A formula at € 9.90 per month without commitment (the first 3 months of which are free to test)

- Withdrawal conditions: free up to € 1,000 per month with the VIVID Prime account (beyond, 3% are applied without ever exceeded 1 euro). This condition applies for withdrawals below 50 euros also.

To have no withdrawal costs, you must at least withdraw 50 euros, and not exceed your monthly ceiling. But in any case, the costs will never exceed more than 1 euro per month.

Payment Terms : free and completely free in France and abroad on both formulas.

☑️ Opinion on VIVID BANK and its secure metal card of Connectbanque experts

After a complete test of the VIVIV Money banking offer to establish this opinion, we confirm that everything is done to earn money while spending less Because banking costs are eliminated and is therefore one of the Best mobile banks According to Connectbanque experts. So we give A very positive opinion in Vivid Banque with one of the most complete offers on the market.

First of all, we like the fact that you can Subscribe to the VIVID offer for free and without commitment. This is a guarantee of trust that proves that they have nothing to hide.

Then what is very interesting with this bank account is that you will be able to Earning money while shopping thanks to cashback proposed by Vivid, this changes traditional banks. However, It is limited to 20 euros in gain per month on the free offer. By subscribing to VIVIVE’s Premium offer, you will be able to benefit from a refund on your purchases up to 100 euros maximum with the cashback. The Subscription to VIVID Premium (€ 9.99 / month) is therefore very quickly profitable with the cumulative cashback each month.

To complete this opinion, we also love Its secure metal card, where the figures of your bank card as well as the visual cryptogram do not appear on the card. These figures will be accessible only via the mobile application. It is a significant security in the event of loss or theft of your VIVIVE bank card.

With Vivid, we particularly appreciate the fact that you have the possibility of investing in Actions but also on cryptocurrencies at no cost and without commission from € 0.01 in a few clicks.

Finally, according to our opinion, VIVID BANK is a bank account without income conditions and an ideal card for banking prohibitions and students.

To conclude this opinion, Vivid Money does not offer No overdraft authorization To date, this is the reason why we advise you to opt for this bank in addition to your current bank because it is a criterion to be taken in the event of an exceptional situation, so if this is not yet the case We advise you to discover also cheapest online banks.

⭐ VIVIVID Money customer reviews

To conclude our advice page, we want to specify that we are not the only ones to give a positive opinion to the neobanque vivid Money. VIVID Bank user customers, which offers a cashback program, a metal visa card, an investment, payment solution, a simple mobile application. And many other services without bank charges have given notes to Vivid who are final and a clear opinion: 4.7/5 on the App Store on more than 3,800 reviews, 3.7/5 on more than 9,000 reviews On the known Trustpilot platform and a note of 4.2/5 on Google Play.

Note that on the Trustpilot certified opinion platform, VIVID posters An excellent note of 4.5 out of 5 according to more than 5,000 customer reviews.

�� How to open a free bank account vivid money ?

In our opinion, The opening of the Vivid account is very simple, it lasts a few minutes : Suffice To download the application on Google Play or the App Store to become VIVIV customer without commitment.

You do not need proof of address, uniquely of an identity document (it is important that the photo is clearly visible without shade or too much light) as well as a photo taken in selfie and voila.

You can instantly use your VIVIVS mobile account and immediately make your purchases on the Internet or use contactless payment of Google Pay and Apple Pay While waiting to receive your beautiful metal card.

�� The VIVID Money free account: characteristics, withdrawals, rib, cashback, actions, .

- Free account without obligation

- Up to 15 free accounts with separate IBAN in different currencies (each account has a separate IBAN)

- Payment at no cost and completely free in France and abroad

- Withdrawal conditions: free up to € 200 per month

- Up to 25% reimbursement on major brands such as Nike, H&M, Zara, Lidl, Carrefour, Aldi, Total, BP or Uber Eats.

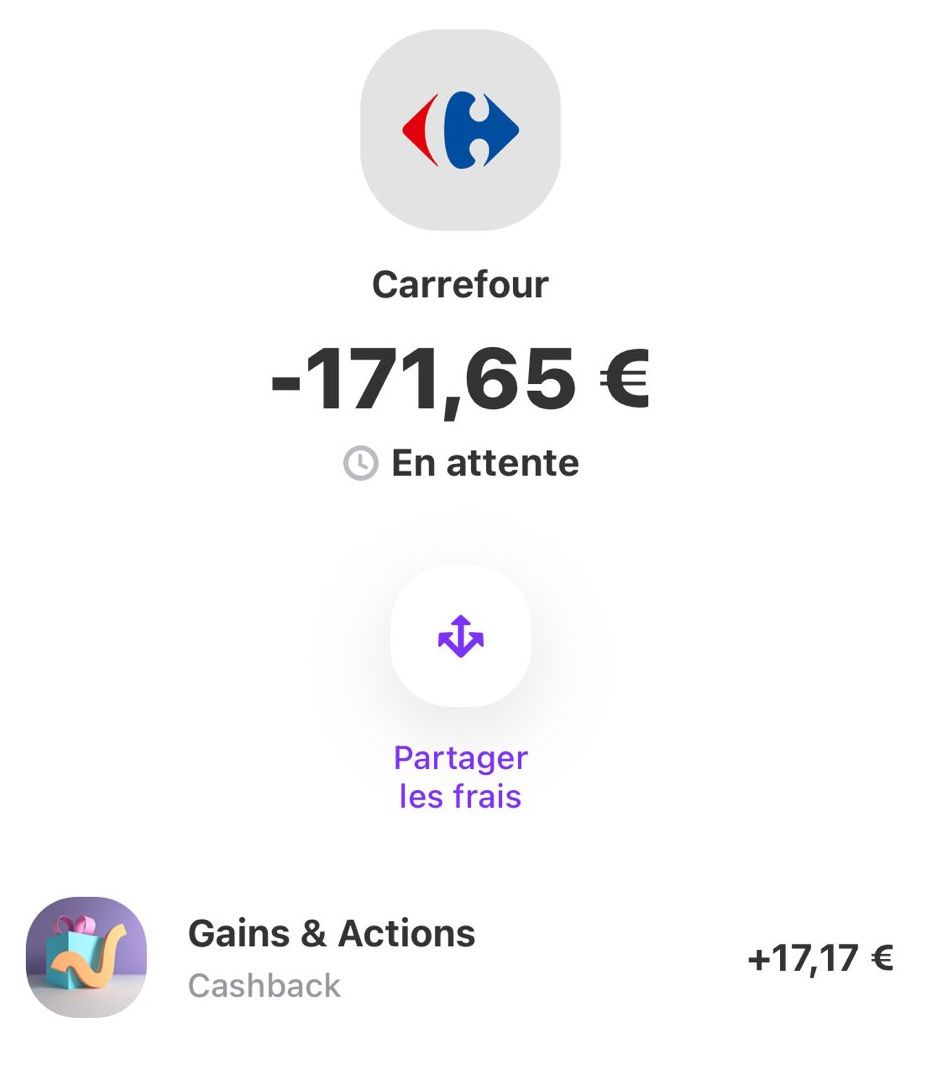

Below, an example of 10% cashback at Carrefour On races at € 171, a money gain of € 17:

�� The characteristics of the Premium VIVID Prime account: withdrawals, cashback, currency accounts.

- VIVID PRIME account at € 9.90 per month without obligation (3 months offered without obligation))

- Up to 15 free sub-accounts with separate IBAN in different currencies. Each account has a separate IBAN

- Up to 25% reimbursement on major brands such as Ikea, Amazon, Adidas, Veepee, Lidl, Aldi or Total, BP or Shell stations with a maximum of € 100 per month.

- Payment at no cost and completely free in France and abroad on the 2 cards

- 1% cashback on absolutely all purchases made outside Europe

- 3% cashback on all restaurants and cafes outside Europe

- Withdrawal conditions: up to € 1,000 per month (Beyond, 3% is applied without ever exceeded 1 euro). This condition applies for withdrawals below 50 euros also.

�� A VISA METAL VIVIVE bank card at no cost for your withdrawals and payments abroad

What we particularly like with the Vivid bank card, in addition to its beautiful pink color, is that you have the possibility first to withdraw money and pay free of charge worldwide (up to 200 euros per month with the free card and 1,000 euros per month with the Premium card). Regarding payment by bank card, there is no ceiling.

You will have the possibility to convert your money into the currency of your choice to the real exchange rate Before your departure, and place your money in a specific sub-account (POCKET) in the currency selected in a few clicks via the application. Like this, during your trip, you will not have to worry about the exchange rate each time because you will spend in local currency.

�� VIVID, the ideal solution for the transfer of money at no cost and without commission

Between holders of a free bank account Vivid Money, you can receive, request or send money instantly using the phone number of your contact. This is in France or abroad.

�� Notice VIVVID INVESTISSE: How to invest your money in equity with your VIVID BANK account without commission ?

We wanted to raise this point because one of the main advantages with your VIVVIVE bank card is the investment part. Through its application, Vivid gives you The possibility of investing on the stock market in American and European companies by buying Tesla, Amazon, Google, Disney, Uber and many others from € 0.01 only and without any commission. You do not need to have a starting investment of € 1,000 like other platforms to invest in these beautiful growth companies.

As you can see in our example (screen copy), the gain accumulated in a few days by investing in Tesla with a very low starting bet.

Like a real broker on the stock market, this vivid service gives you The choice to invest in more than 2,000 shares and FCB (including companies that experience strong growth such as Netflix, Amazon, Tesla or Apple. ) that you can follow in real time in order to be reactive on the purchase and sale of shares, and to withdraw your profits without delay.

Regarding our opinion on VIVID INVESTISSEMENT, In order to reassure you, be aware that your investment deposits are protected and secured by the EDW (German compensation organization for investors and securities negotiate companies). Even in the event of failure of the company VIVID (which has just raised 60 million euros in April 2021), the EDW undertakes to compensate you up to € 20,000 on your titles.

�� With VIVIVE Investing and buying free -charge cryptocurrencies

With your Vivid Money account, you have the possibility to buy crypto currency safely, at no additional cost and this without minimum amount amount (from a few cents).

VIVID does not debit on the purchase of 10 cryptos proposed: Bitcoin, Ethereum, Litecoin, Cardano, EOS, Bitcoin Cash, ChainLink, Nem, Algorand and Basic attention token.

You can recover Your earnings directly on your VIVID account And this immediately.

VIDIVOI on savings and investment with pockets

Check your budget with the VIVID account

Saving is good, saving is better ! Before starting to save and in investing, there is a feature that we appreciate with the VIVID bank account: you can Check all of your subscriptions which are taken every month On your click account with your VIVID Money application.

This personalized view allows you to better manage your budget because with all these small monthly samples (TV, telephone, music, application, etc.), you can quickly exceed your budget of the month. With this VIVID MONEY service, you can also block the payment or withdrawal of a subscription that you have stopped and that a supplier continues to take (this type arrives far too often).

Sprinkle for your projects or to better manage your money with Vivid Money

By opening a VIVID account, you have the possibility to open sub-accounts (called Pocket on the VIVIVE application) in one click allowing you to put money aside quickly. This VIVID Money service is interesting especially for punctual or regular travelers because these sub-accounts can be in foreign currencies, which will allow you when you are in a foreign country to spend your money in the local currency while avoiding exchange and conversion costs.

In addition, with pockets, whether money comes from cashback or your current account, you will have the possibility either to save it or make it grow with the placements offered by VIVID MONEY (actions or cryptocurrencies).

Security Opinion: is the neobank VIVIVER secure ?

First of all, we would like to specify that VIVIVE is a bank of German origin therefore European. VIVID is therefore regulated by the ECB (European Central Bank) as French banks via the ACPR Banque de France. So when you put money on your Vivid account, Your funds are secure up to € 100,000 As if you put money in a French bank.

VIVID’s secure metal visa metal

The Visa card offered by Vivid Money is a Metal card where only your name is written on it. Therefore, there are neither the numbers of your card nor the CVV number. To access these numbers, you will have to go to the VIVIV mobile application secured by one or two authentications. this is very practical in the event of loss or theft of your bank card where you risk no fraudulent action.

In addition, you will have the hand at any time to activate or deactivate the contactless function as well as block or unlock your VIVIVE bank card.

VIVID virtual cards for secure online purchases

VIVID offers internet purchases to use virtual card functionality via their application. This service allows you to make your online purchases with a virtual card that you can reset at any time with different numbers if necessary In order to secure your purchases.

With virtual cards, VIVIV also allows you to have an ecological approach and reduce its carbon footprint.