Visa Premier – SG, what are the insurance of your Visa Société Générale card?

Société Générale visa insurance

Benefit from additional security, for your bank card and online payments.

Visa Premier bank card

The Visa Premier card is available with Sobrio.

What do you want to do ?

Account holding included

Account holding included

Visa Premier bank card

My advantages

Comfort of use and exclusive advantages

Contactless, higher ceilings, immediate or delayed flow and accepted with millions of merchants around the world, the Visa Premier CB card offers you even more !

Travel, leisure, gastronomy, shopping …You benefit from preferential rates and advantages with many Visa Premier partners, and you save money. Everything is negotiated for you, you just have to take advantage of it. With the press service first privileges, available on 01 73 60 01 78 (9), you subscribe and receive your favorite press titles at your home, at the best price. It is without any commitment. The cancellation or modification of your subscription is possible at any time on simple call..

Find the offers and advantages reserved for holders of the Visa Premier CB on https: // www.Visa.FR/FR_FR/Advantages-Offres/

Insurance and guarantees

Wherever you are, the Visa Premier CB card assists you and assures you, you and your loved ones.

– Assistance: medical/repatriation, helps in continuing the trip;

– Insurance: damage to rental vehicle, cancellation/modification/interruption of travel, loss/flight/deterioration of luggage, delay in transport/luggage, snow and mountain warranty, death/invalidity, civil liability abroad;

– Purchase guarantee (2) which reimburses you up to € 800 per object damaged or stolen within 48 hours of its purchase;

– Card or cash breakdown service in France and abroad.

For more details concerning insurance and assistance, see the Practical Guide CB Visa Premier.

Features

Which can benefit from the first visa card ?

Any holder or co-holder customer of an individual Société Générale account, aged at least 18 years old.

What are the removal and payment ceilings of the Visa Premier CB card ?

You can withdraw up to € 6,100 per 7 -day period:

– Without exceeding € 770 per day in Société Générale, Credit du Nord and abroad distributors,

– Without exceeding € 900 per period of 7 days in distributors of tickets to all banks in France. The payment ceiling is customizable with your advisor, up to € 137,300 per month.

What are the exclusive advantages ?

Travel, leisure, gastronomy, shopping …You benefit from preferential rates and advantages with many Visa Premier partners, and you save money. Everything is negotiated for you, you just have to take advantage of it. With the press service first privileges, available on 01 73 60 01 78 (9), you subscribe and receive your favorite press titles at your home, at the best price. It is without any commitment. The cancellation or modification of your subscription is possible at any time on simple call..

The rates

FIRST VISA CB card contribution

– 135 € per year

– Contribution of the card included in the framework of Sobrio (excluding options): € 13 per month for 18-24 year olds and € 13.90 per month for those over 24 excluding pricing advantages. Prices on 01/01/2023 Free payments in euros zone (10)

Cash withdrawals

Free in euros zone (10)

Prices on 01/01/2023.

All prices can be viewed in the price brochure conditions applied to the banking operations of individuals

With the Visa Premier CB card, benefit from high removal and payment ceilings worldwide, guarantees of extended assistance and insurance (3), and preferential rates for your leisure.

For my daily purchases

- Payment capacities and high withdrawal

- Exclusive advantages (LOC discounts. cars, trips, etc.)

- Free withdrawals in all distributors in the euro zone (10)

- Immediate or delayed flow

- Contactless up to 50 euros (1)

My insurance and guarantees

- Rental vehicle damage insurance

- Travel insurance including snow and mountain guarantee

- Purchase guarantee (2)

- Card or cash breakdown service in France and abroad

- All the details of the card

Included in your first visa cb ..

Your rental car is protected

If you have an accident with your rental car, thanks to the rental vehicle insurance (4) the material damage is covered.

With the snow and mountain warranty (3), you are covered when you are skiing

If you are the victim of an accident during your ski stay, the snow and mountain warranty covers your medical and hospital costs up to € 2,300 (3) .

Your luggage is insured in all circumstances

If at the airport you collect your damaged suitcase, the loss, flight or deterioration warranty reimburses you up to € 800 per luggage (4) .

Your goods are insured with the purchase guarantee (2)

If you buy a property and break it within 48 hours of its purchase, you are reimbursed up to € 800 thanks to the purchase guarantee (2), SG exclusivity.

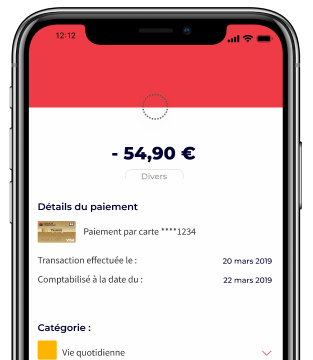

Your bank in your pocket, to control everything

Balance and real -time operations anticipation of exceeding payment solutions from your mobile

Receive from the SG app (5), by e-mail or SMS, notifications to remain informed of each new event on your account.

With my account in short, do not risk red and receive notifications from your app before reaching the ceiling on your card

Paylib (7) and Apple Pay (8) are free mobile payment solutions to pay for your shopping in stores and on the web without using your card

I choose the card

that looks like me

Over 180 visuals to personalize your card

All our services and options with the Visa Premier card

International option

Travel at a lower cost abroad.

Secret code choice

Just choose the secret code of your bank card, to be sure not to forget it.

Dynamic crypto option

Benefit from additional security, for your bank card and online payments.

Blue e-card service

Make your purchases remotely safely, without communicating your real card number.

Visa Premier and Gold Mastercard cards

(1) Functionality available for any card issued from the first half of 2018.

(2) guaranteed events, conditions, limits and exclusions of guarantee appear in the contract. Insurance contract signed by Société Générale, through SPB, with Allianz Iard. Companies governed by the insurance code.

(3) guaranteed events, conditions, limits and exclusions of guarantee appear in the contract. Insurance contract signed by Visa Europe France with AXA France Iard and Axa France Vie through CWI. Companies governed by the insurance code.

(4) guaranteed events, conditions, limits and exclusions of guarantee appear in the contract.

(5) Access to certain features requires membership in the remote bank service (free, excluding connection costs billed by your Internet access provider). The SG app can be downloaded for free on Google Play and the App Store . App Store is a registered trademark of Apple Inc. Google Play is a brand registered by Google Inc.

(6) Subject to function eligibility and acceptance by SG.

(7) Paylib is a mobile payment solution close to contactless technology, online with mobile validation and between individuals from the SG app. See General Conditions.

(8) Apple Pay works with the iPhone 6 (or subsequent model) in stores, within apps and on websites in Safari; with the Apple Watch in store and within the apps (requires the iPhone 6 or later); With the iPad Pro, the iPad (5th generation), the iPad Air 2 and the iPad Mini 3 (or subsequent model) within apps and on Safari websites with an iPhone or Apple Watch on which Apple Apple Pay is activated. To obtain the list of devices compatible with Apple Pay, consult support.Apple.com/km207105. Apple Pay: eligible SG payment cards are CB V Pay, CB Visa, CB Visa Alterna, CB Visa Premier and CB Visa Infinite.

(9) Monday to Saturday from 9 a.m. to 6 p.m. Communication cost according to operator.

(10) Country of the euro zone: Germany, Austria, Belgium, Cyprus, Spain, Estonia, Finland, France, Greece, Ireland, Italy, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia. For payments and withdrawals outside the euro zone, the prices can be viewed in the price brochure “Conditions applied to the banking operations of individuals”.

(11) Indicative rate excluding account holding costs: contribution on the basis of an annual direct debit, according to the tariff conditions in force.

Supply of a Visa Premier CB card – € 135/year (prices in force on 01/01/2023). Tariff conditions according to age and type of card subscribed, indicated in the brochure “Tariff conditions applied to banking-start-up operations” available on SG.Fr

Société Générale visa insurance

Société Générale offers its customers 3 Visa cards . These have assistance and insurance offers according to the card model and the geographic area in which you are at the time of the loss. Travel cancellation insurance, ski insurance or car rental insurance, covered by your Visa blue card offers ? Find in detail the offer of Société Générale cards .

What are the travel guarantees of the Visa Société Générale card ?

Insurance guarantees of the Société Générale Visa card

If a simple travel companion cannot be covered by your visa insurance, some people around you can be. Thus your spouse, a child or a tax-dependent child (- 25 years) or a dependent ascendant is covered by your CB Visa insurance .

To note : The insured is not necessary to travel together to benefit from the coverage.

The assistance guarantees of the Visa Société Générale card

Ceiling: € 46,000

Ceiling: € 310,000

Ceiling: € 620,000

Franchise: 50 €

Ceiling: € 155,000

Franchise: 50 €

Ceiling: € 156,000

- IPT: total permanent disability

The insurance and assistance offers offered are very variable depending on the visa cards . Our travel insurance comparator allows you to get an insurance quote easily and free to find the offer perfectly suited to your needs when traveling abroad.

As an insurance broker, our mission is to inform you and advise you on the insurance offers offered on the market. These advice sheets are intended to present the products of our partner insurers to you as those with whom we do not maintain links. These sheets give you our objective analysis on insurance contracts but also information on membership formalities.

Ski Société Générale ski insurance

Package reimbursement ceiling: € 300 if < 3 jours, 850 € si >3 days or seasonal

Reasons: accident resulting in total ski incapacity

Package reimbursement ceiling: € 300 if < 3 jours, 850 € si >3 days or seasonal

Reasons: accident resulting in total ski incapacity

Ceiling: Real costs

Franchise: 30 €

Ceiling: 2300 €

Franchise: 30 €

Ceiling: 2300 €

Franchise: 20 %

Ceiling: 800 €

2 claims per calendar year

Franchise: 20 %

Ceiling: 800 €

2 claims per calendar year

What are the car rental guarantees of the Société Générale Visa card ?

Ceiling: € 46,000

Ceiling: € 310,000

Ceiling: € 620,000

Ceiling per object: 250 €

Total ceiling: 1600 €

There are a multitude of auto insurance contracts that our online car insurance simulator allows you to compare free of charge in order to obtain insurance quotes at the best prices.

What are the insurance related to your purchases with the Visa Société Générale card ?

If insurance linked to your credit card do not seem satisfactory or adapted to your needs, Why not go see what other banks do ? Our tool compares more than 30 financial institutions and will offer you the best offer both in terms of bank cards and placement accounts or products.

The best banking offer according to your needs and budget

How to contact Société Générale ?

If you wish to obtain your insurance certificate and repatriation or even information on the insurance and assistance services of your credit card Visa Société Générale, you can reach your insurer by the following means:

- Phone : Société Générale Cards Service: 09 69 39 33 39 (Call not surcharged outside the possible additional cost operator)

Infinite concierge service: + 33 (0) 1 47 92 49 90

- Address :

29 Boulevard Haussmann,

75009 Paris, France

Premier visa card

The Visa Premier card, also available with the Premier Pack, allows you to benefit from a multi -service banking offer and privileged support in the management of your assets.

The Electron Visa card is enriched with several assistance and insurance guarantees:

See Practical Guide for Société Générale Cameroon bank card insurance.

Pricing

8,705 FCFA TTC per month

In detail

Eligibility

Any private individual holder of a check account opened in Société Générale Cameroon

Withdrawals

Up to 2.500.000 FCFA per week 24 hours a week and 7 days a week in Cameroon and around the world within the limit of the available balance.

Payments

Up to 10,000,000 FCFA per week in Cameroon and up to 5,000,000 FCFA internationally.

Type of flow

Validity

Operations monitoring

A consultation of your accounts 24 hours a day via our remote banking services by Internet, SOGEC@m, and by SMS with the Messalia offer

For more tranquility, think about loss and hibiscus loss and flight insurance