Virtual payment card – Lydia, virtual bank card: where to find it and at what price?

Blue e-card: where to find a virtual bank card

Updated data September 2023

Virtual payment card

Generate virtual card numbers for free to pay for your online purchases safely, without revealing your main card information.

Create a virtual card

All your secure online payments

Virtual cards are digital cards with different numbers from your physical card.

We can thus pay online safely, without revealing your bank details on the web.

Frauders manage to hack your virtual card numbers ? It is automatically destroyed after payment.

A virtual card created in 2 minutes

Virtual cards are created in an instant, directly from the Lydia mobile application.

In two clicks, the card is generated with its number, validity date and 3 -digit cryptogram.

It only remains to copy/paste information from the virtual card in the online merchant’s payment form.

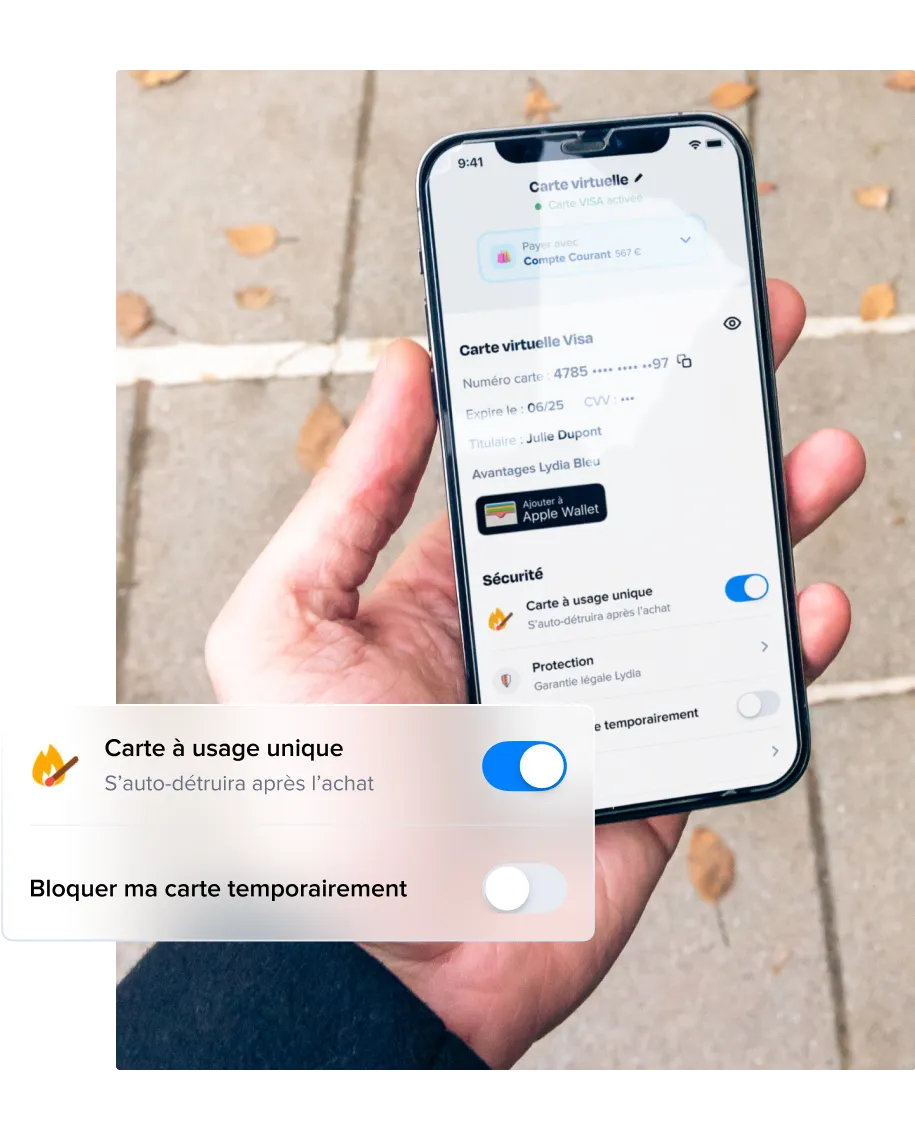

A configurable virtual card

You can rename your virtual card, block it, unlock it instantly and generate a new one when you wish.

For a unique purchase on the Internet, it automatically self-destructs after the transaction.

For monthly samples, simply create a card for the duration of your choice.

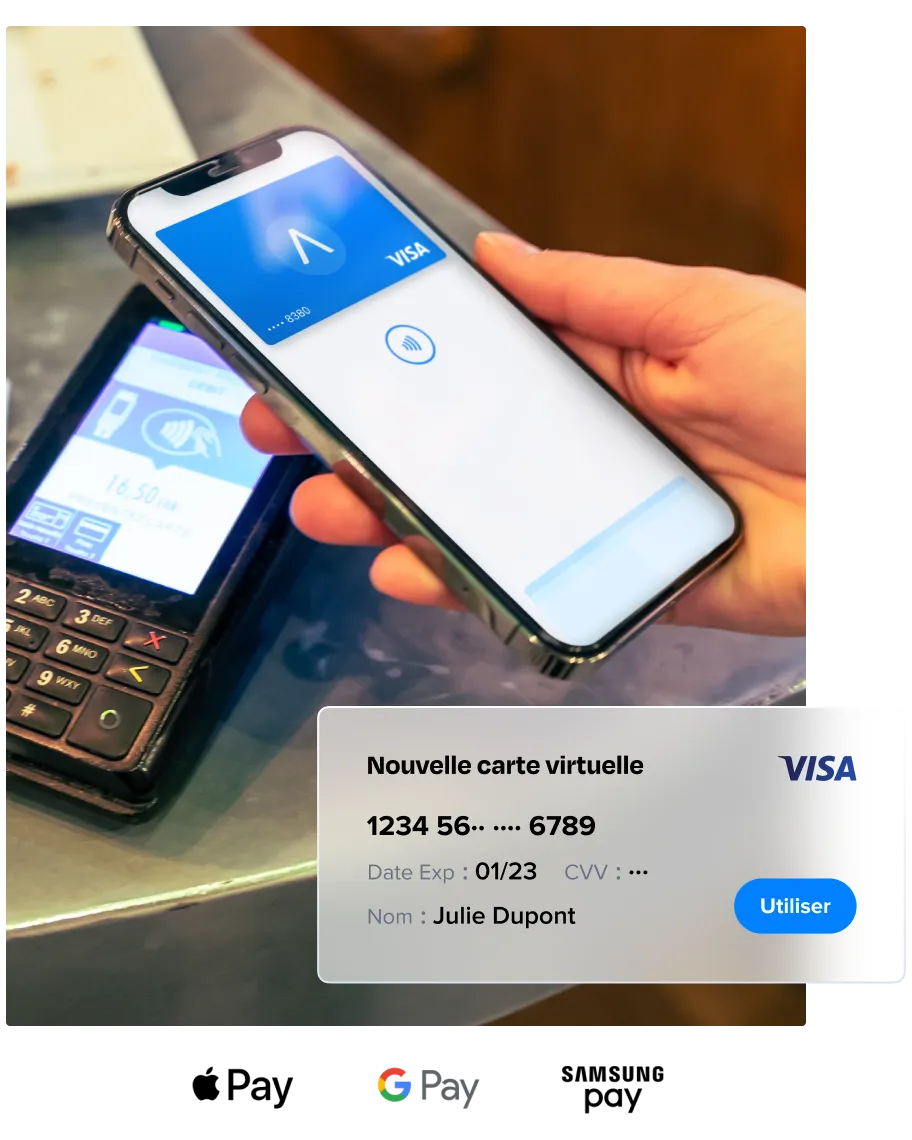

A payment card to use everywhere

No need to wait until you have your Lydia card in hand to start using your balance money.

Create your virtual card for free and add it to your wallet : you can now pay in contactless mobile payment via Apple Pay and Google Pay.

Learn more about the virtual card

How to have a free virtual bank card ?

What is a virtual bank card ? How to get a virtual bank card for free ? Lydia gives you all the info.

How to make a secure payment on the Internet ?

For your internet purchases, Lydia gives you essential information and tools (virtual card) for secure online payments.

You have questions about Lydia virtual cards ?

How to generate a Lydia Internet card ?

To obtain a Lydia virtual internet card and use it to set your online purchases, it’s simple. Just go to the app and then:

- to go to the tab ” Cards »»

- Click on the symbol ” + ” top right

- select ” Create an internet card »»

- Choose between generating an internet card for a single payment (it will be destroyed right after) or for several payments (regardless of the number of payments): it will be destroyed when you wish.

The Internet card is created and ready to be used ! If you are on mobile, a button allows you to copy the ephemeral number which appears on your internet card and paste it in the merchant’s payment form: you pay securely in an instant ! On a computer, it will be necessary to click on “Display” to reveal the ephemeral number indicated on the map and copy it in the form.

What is the payment limit of a Lydia Internet card ?

The payment ceiling and the limits of Lydia Internet cards are the same as those of the user’s physical visa Lydia card. They are defined by the limits of the latter’s Lydia account: Lydia Standard, Lydia Green+ or Lydia Black+. You can find all the details in our comparison table.

Do I have to pay online with a Lydia virtual card ?

To make a payment on the Internet or manage an online direct debit in complete safety, we advise you to use this means of payment but nothing prevents you from using your Lydia Physical Visa card or the bank card of your bank account ( whether or not linked to your Lydia account). In addition, you freely benefit from all other Lydia means of payment such as contactless mobile payment or instant transfers.

Blue e-card: where to find a virtual bank card ?

In the digital age, securing its online transactions is essential. To do your shopping online without stress, the virtual card, also called blue e-card, is ideal. How does she work, where to get it and how much does she cost: we explain everything to you on the virtual credit card.

Hello Bank! : Take advantage of 180 € offered with Hello Prime and Hello One !

Here is the detail by offer:

- One: € 80 offered for any 1st account opening + € 100 in vouchers (for any bank mobility with Hello Start +)

- Premium: 80 € offered for all 1st account opening + € 100 in vouchers (for any bank mobility with Hello Start +) + € 1 per month for 6 months

Take advantage of this offer from August 17 to October 9, 2023

What is a virtual bank card ?

A virtual bank card is a single use bank card intended to protect you In the event of theft of your banking information When payment on the Internet.

Information from the caster, Number, verification code and expiration date, are all ephemeral and linked to the current purchase.

There virtual card Protects you effectively against hacking: if your card information were to be stolen, they would be made immediately deciduous.

How the virtual bank card works ?

How to create an ephemeral bank card ?

The procedure to follow for Create an online virtual bank card is the following :

- From your customer area, access special virtual card service

- Enter the payment ceiling and the desired validity duration for your virtual bank card

- Pay online using the contact details of the single use bank card generated on your customer area.

- Your purchase is validated: Virtual card information become unusable.

Virtual bank card: what precautions for use ?

There virtual bank card is a dematerialized card, generated at your request to your bank.

L’caster being in fact a Ephemeral bank card, It cannot be used in some cases:

- Regular sample: Online subscription including a direct debit.

- Purchase with order withdrawal : Tickets to withdraw from SNCF terminal, hotel reservation, etc.

- Payments in several times : the virtual card is ineligible for payments in several times.

My bank does not offer a virtual card: what alternatives to secure my online purchases ?

From Free solutions, We find the 3D Secure 3D protection system, today very widespread. It allows you to identify each online purchase via single use code or validation on your customer area.

Second alternative, proposed by a few banks, the electronic portfolio: this device makes it possible to store a fixed amount of money online in order to avoid taking the bank account directly at the time of payment.

Finally, there will be an option paid, dynamic cryptogram cards in certain traditional banks, such as Société Générale for example.

Free virtual bank card: comparison

✔️ 80 € offered + Sobrio 1 €/month for 12 months for a Visa or Visa Premier card

from € 3.00/month (Sobrio)

Updated data September 2023

Virtual card and dematerialized card: stop to confusion, N26 or Hello Bank! say they offer virtual cards. These virtual cards are not ephemeral : their banking information is not renewed with each purchase. We can pay as many times as you wish with and save them on Google or Apple Pay. Also, we will more willingly talk about dematerialized card For N26 and Hello Bank!.

What alternatives to the virtual bank card ?

Dynamic CVV card, biometric bank card: the latest innovations

THE Fraud rate on bank card payments In France is one of the lowest in the world: 0.034% of transactions, which still corresponds to more than a hundred million euros per year. Securing banking data and online transactions remains at the heart of concerns.

The dynamic cryptogram card generates a random code instead of the three figures that appear on the back of all bank cards (cryptogram or CVV). The card is equipped with a mini screen that works on battery. The screen displays a Modified CVV code every 45 minutes. The CVV code being requested from each online transaction, a person having hacked the coordinates of the card will therefore not be able to use it.

What price for the dynamic cryptogram card ? This option is available for Visa and Mastercard CB in many banks and has been very successful when it was launched. At Société Générale, or BNP, the card costs a total of more than € 50/year.

There Bankless bank card with biometric authentication seems to be the next great innovation in the banking field. This card incorporates a fingerprint reader. No need for secret code: to pay, just have your finger on the fingerprint reader and approach the payment terminal card. An innovation that saves a little time and secure payments.