Virtual card, bank card: LCL Bank and insurance, virtual card – LCL

LCL virtual card

Although this system is for single use, it can however be used for payment in several times by modifying the validity date of the blue e-card when it is created.

Virtual card

To pay your purchases while waiting for the reception of your bank card or continue to pay in the event of an opposition on your card

When subscribing to a new bank card, but also after opposing and during the repair of your bank card, your virtual card is immediately available in the LCL my accounts. It allows you to pay all your purchases on the Internet or in stores thanks to the mobile payment while waiting to receive your new bank card.

Virtual card characteristics

The virtual card is issued at no additional cost

The virtual card can be available immediately in the LCL my accounts app

It can be used immediately to pay all your purchases on the Internet and in mobile payment within the limit of the payment ceiling of your virtual card

My physical card is eligible for the virtual card ?

During the’opposition or repair of your bank card with new physical card order, the virtual card will be created automatically For the following cards:

How can I consult my virtual card ?

From its creation, you can consult it on your confidence apparatus in the LCL my accounts app. It is not yet accessible in your Espace Accounts on LCL.Fr.

How can I pay with my virtual card ?

This virtual card allows you to continue to pay all your purchases:

- At the store Thanks to mobile payment: Paylib in store (only on the CB network) or Apple Pay (on all CB / Visa / Mastercard networks),

- On the Internet,

- In applications.

What is the payment ceiling for my virtual card ?

- The payment ceiling for your virtual card is the standard ceiling of your physical bank card.

- It can be viewed on the Virtual Card screen in your LCL my accounts.

- If necessary, you can increase this ceiling by 2 levels directly in the LCL APP APPLES.

How is my bank account debited ?

- The virtual card is a Systematic authorization card with balance.

- At each transaction, your bank account will be questioned and immediately debited.

- The debit on your account can therefore be different from that with your usual physical card, especially if you have a delayed debit card.

I paid a recurring subscription (TV, magazine, …) every month with my physical card, what will happen ?

To avoid any refusal of payment following your opposition, you can update the numbers of your virtual card on the merchant’s website.

Can I make withdrawals from Ticket Distributors with my card ?

No, this feature is not available.

What options do I have on my virtual card ?

In your LCL APP MY ACCOUNTS, you can :

- Enable Mobile payment (Apple Pay Or Paylib in store))

- Activate / deactivate Internet payment

- Increase The payment ceiling virtual card

- Benefit from Citystore

- Benefit from System’eptine If you have already activated it on your physical card

- Benefit from Cityexplore If you have already activated it on your physical card

How long does my virtual card last ?

Your virtual card is deactivated as soon as you activate your new physical bank card by withdrawal from a ticket distributor.

Do I have insurance and assistance on my virtual card ?

Yes, you benefit from the same insurance and assistance as your physical bank card.

If necessary, you can consult the virtual card services on the card space of the LCL Apps My Accounts.

What should I do if assistance or insurance is needed with my virtual card ?

Go to virtual card services in the LCL my accounts to declare your claim to the assistance or insurance of your physical bank card.

I need information on my virtual card

At any time, you can get help 7/7, by calling the number appearing in SOS card or on the back of your physical bank card.

Full of services and guarantees in your bank card

Your bank card supports you in your daily life. Whether to pay your everyday purchases, pay for your transport or finance your outings, you always have it on you. Consequently, what could be more normal than finding in your bank card the services and guarantees of which you ..

How are your purchases covered by the guarantee of your bank card ?

Did you know ? Your bank card may contain the Purchasing guarantee. What does she really cover ? How to use it ? We…

Our other products

These products may also interest you

Infinite LCL Visa Bank Card

The card that opens the doors of a world of excellence and privileges

System’Apargne option

System’Apargne option

Save with the water and effortlessly

A bank account with a wide range of cards to choose from

Virtual card

During the’opposition or repair of your bank card with new physical card order, the virtual card will be created automatically For the following cards:

How can I consult my virtual card ?

From its creation, you can consult it on your confidence apparatus in the LCL my accounts app. It is not yet accessible in your Espace Accounts on LCL.Fr.

How can I pay with my virtual card ?

This virtual card allows you to continue to pay all your purchases:

- At the store Thanks to mobile payment: Paylib in store (only on the CB network) or Apple Pay (on all CB / Visa / Mastercard networks),

- On the Internet,

- In applications.

What is the payment ceiling for my virtual card ?

- The payment ceiling for your virtual card is the standard ceiling of your physical bank card.

- It can be viewed on the Virtual Card screen in your LCL my accounts.

- If necessary, you can increase this ceiling by 2 levels directly in the LCL APP APPLES.

How is my bank account debited ?

- The virtual card is a Systematic authorization card with balance.

- At each transaction, your bank account will be questioned and immediately debited.

- The debit on your account can therefore be different from that with your usual physical card, especially if you have a delayed debit card.

I paid a recurring subscription (TV, magazine, …) every month with my physical card, what will happen ?

To avoid any refusal of payment following your opposition, you can update the numbers of your virtual card on the merchant’s website.

Can I make withdrawals from Ticket Distributors with my card ?

No, this feature is not available.

What options do I have on my virtual card ?

In your LCL APP MY ACCOUNTS, you can :

- Enable Mobile payment (Apple Pay Or Paylib in store))

- Activate / deactivate Internet payment

- Increase The payment ceiling virtual card

- Benefit from Citystore

- Benefit from System’eptine If you have already activated it on your physical card

- Benefit from Cityexplore If you have already activated it on your physical card

How long does my virtual card last ?

Your virtual card is deactivated as soon as you activate your new physical bank card by withdrawal from a ticket distributor.

Do I have insurance and assistance on my virtual card ?

Yes, you benefit from the same insurance and assistance as your physical bank card.

If necessary, you can consult the virtual card services on the card space of the LCL Apps My Accounts.

What should I do if assistance or insurance is needed with my virtual card ?

Go to virtual card services in the LCL my accounts to declare your claim to the assistance or insurance of your physical bank card.

I need information on my virtual card

At any time, you can get help 7/7, by calling the number appearing in SOS card or on the back of your physical bank card.

E LCL blue card, how to get it ?

The blue e-card is a secure means of payment to pay for purchases on the Internet. Offered by the Visa distribution network, it is only available in certain French banks. How to get a LCL Blue E-Carte ? What alternatives are there at this service ? Focus on this secure means of payment.

E-Carte Bleue: what is it ? Definition

A blue e-card is a dematerialized bank card which allows its user to Set a single online purchase in a specific amount thanks to a virtual card number. With this card, you therefore benefit from additional security since you no longer need to enter your real banking data. It thus limits the risk of hacking your physical bank card.

Although this system is for single use, it can however be used for payment in several times by modifying the validity date of the blue e-card when it is created.

Good to know : He is not recommended to use a blue e-card for Set Purchasing like the concert places or shows requiring the presentation of a bank card to withdraw to a counter or to settle monthly subscriptions (telephony, VOD, Internet, etc.)).

A blue e-card benefits from same insurance and guarantees than a conventional bank card. Being a virtual extension of this one, the Expenses carried out with a blue e-card are also added at your current expenditure ceiling.

This service is generally billed in addition to your conventional bank charges according to banks (bank card subscription, etc.)). To find out the exact rate, you must consult the brochure of your bank’s bank rates or ask your bank advisor or to your bank’s customer service.

Can we benefit from the blue e-card service at LCL ?

To find out if you can benefit from this service, you must consult the list of services offered by your bank. Indeed, all French banks do not make this service available to their customers. Unfortunately, the LCL bank stopped marketing the blue e-card service at the end of 2016. So you can’t get it anymore. However, you can benefit from another alternative to secure your payments online.

Insurance of your physical bank card

With the cessation of its blue e-card service, the LCL bank has stopped offering virtual payment methods that can replace your physical bank card. However, the bank still offers Some insurance and guarantees as :

- There Purchase guarantee : it is included in your LCL payment card. It allows you to benefit from insurance covering the damage caused by deterioration or theft of objects set with your credit card. The amount of the object must be between € 75 and € 800.

- L’Average payment insurance LCL : the average payment insurance offered by the bank offers you a guarantee on purchases made online. If your property is not delivered to you or if it has a defect and does not comply with the property ordered, LCL reimburses the height of the purchase value of the object concerned. You also benefit from a guarantee covering you in the event of identity theft and sums taken from your account without your knowledge.

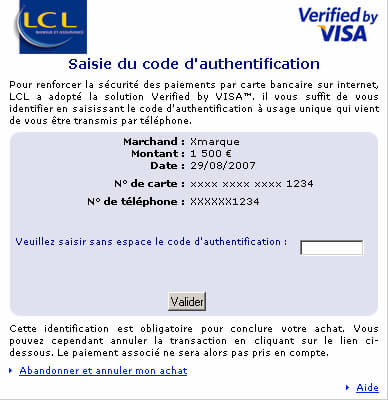

The 3D Secure solution

LCL provides you with another service to secure your purchases: the 3D Secure. This online payment security service is available on sites displaying “Verified by Visa” logos and / or “Mastercard Securecode”.

The principle of 3D Secure is simple. When you make your purchase:

- You enter it Number of your bank card, her visual cryptogram and his expiration date on the merchant site.

- After validation, you are redirected to a interface corresponding to your bank reminding you of the name of the merchant, the amount, the date as well as your card number and your partially encrypted telephone number.

- A message is also displayed that you are about to receive an SMS including a code to enter To validate payment. The SMS is sent to the mobile number available to your bank and whose latest numbers are recalled just below.

- Enter the received code in the box provided for this purpose and validate.

- Your payment is accepted, You just have to keep the summary received a priori by email.

1 comment on “e Carte Bleue LCL, how to get it ? “”

Tintin 44 08/21/2022 at 6:09 p.m

So on LCL if you are not on a Verified by Visa site you have no protection, that’s how I got my account at Amazon, which does not respond to any registered mail two at the headquarters and the other to the logistics platform France concerned

Response from 08/22/2022 at 11:21 a.m

We are sorry for your disappointment ! But you are right, measures must be taken to secure online purchases for LCL customers in the absence of a blue e-card in the services offered: you must request reinforced authentication for each online purchase to secure the transactions. To do this, we recommend that you never record the contact details of your bank card on e-commerce sites that offer it, like Amazon or other major recurring purchasing brands. These rules remain valid for all customers of other banks too, especially for those who do not use a virtual card for their online purchases.

Good to know: you can contest online purchases directly from your bank within 13 months of the date of debit on the account. The law that protects the consumer specifies that it is not useful to file a complaint to challenge these fraudulent purchases online !

I advise you to contact your bank as soon as possible to regularize and find a solution to your situation. You can also read our various articles on the subject of fraud by bank card.

We remain at your disposal ! The PriceBank team