The standard N26 free bank account is 100 % digital, N26 Business – The free entrepreneur bank account

The free bank account for auto-entrepreneurs

Discover the high -end account at the service of your business, with an elegant metal card, 0.5% cashback on your transactions, insurance and exclusive advantages

Discover N26 Standard, the 100 % digital bank account

The Standard Free Bank* N26 account now offers a 100 % digital experience to its users.

Reading time: 4 min

As a bank thought for a mobile experience, we are convinced that you must be able to manage your money in a simple and intuitive way, wherever you are. For several years now, we have been welcoming an increasing number of customers ready to manage their bank account from their smartphone with N26.

It is for this reason that the standard N26 account is now associated with a virtual bank card. Our new customers in some markets can now choose to adopt a 100 % digital offer when they open their free bank account at N26. While we have always guaranteed an experience without paperwork to our customers, we now offer them the choice of a plastic experience.

Manage your money intuitively in the all-in-numeric

In these uncertain times, we are proud to be able to contribute to the security of all by avoiding unnecessary tours in banking agency. Online bank and digital payments are now part of the standard, and we know that many have turned to us to provide this secure and transparent digital banking experience. Today, this service is more essential than ever.

Our incredibly talented team was able to accompany the general public in the adoption of digital banking experience, despite the difficulties linked to the Pandemic. We look forward to presenting you even more innovations and features to our users in the coming months.

One of our main objectives is to give our customers more flexibility and more choices to allow them to carry out their banking operations and pay safely in the digital age. We are always working on new ways to develop our product, by remaining turned to the future. Our objective ? Continue to offer smart features to always help you manage your money.

Why now ?

In recent months, many months have forced many people to have to change their habits in order to adapt to a new daily. The use of cash has dropped considerably in France. The number of withdrawals to the distributor fell by a third party during the pandemic, while the payments made with Apple Pay and Google Pay increased by 74 % compared to the previous year. With more and more people managing their online money, we have increased our efforts to explain how to protect you when you spend online. We have also introduced new ways to manage your online finances more easily thanks to different features: the Iban scanner for your transfers, a QR code reader for Moneybeam, a button to activate/deactivate contactless payments, or even rounded, to allow you to put money automatically.

We arrived at the stadium where we think we have to ask ourselves the following question: are physical cards essential or now accessories ? While many customers continue to display their preference by choosing the N26 card adapted to their style, others already seem to have made the choice to give up the plastic card, whether for ecological concern or simply by practical sense. It therefore seems important to us to offer you the possibility of adopting a 100 % digital experience when you open your N26 account, guaranteed without paperwork or plastic.

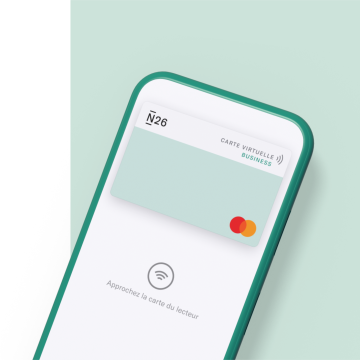

N26 virtual card

Take advantage of a free additional virtual card with a premium N26 account.

A virtual card in your mobile wallet (wallet)

The new virtual card that is offered with the standard N26 standard bank account will be deployed today in some of our European markets. The virtual card will be used immediately as soon as the account is opened, a simple procedure that takes 8 minutes on average.

No need to wait until your physical card reaches you by post to be able to pay your purchases. N26 customers can immediately add their virtual N26 mastercard to their digital portfolio (their wallet). This new feature will be accessible to all customers who open a free bank account, allowing them to pay their online purchases as well as in store thanks to mobile payments with Apple Pay or Google Pay.

The standard N26 bank account is free and without account holding costs. Customers wishing to acquire a physical bank card can do so against a single payment covering the delivery costs of the card. Your physical as well as virtual card can be fully managed from the N26 application, each with its own card number.

While the way we manage our money evolves and is increasingly moving towards digital, we are looking forward to discovering what the future has in store for us. We are delighted to present you always more new innovative products and services that give you more control over your budget.

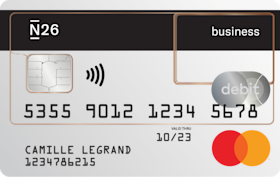

The free bank account for auto-entrepreneurs

N26 Business is the bank account dedicated to self-employed entrepreneurs, at no cost. Open your account for free in 8 minutes and immediately access your virtual card. With N26, manage your money in real time while focusing on what is really important: your activity and your customers.

Your free mastercard virtual card

Adjust your purchases in the blink of an eye and safely thanks to contactless payments, in all stores, online or in applications thanks to Apple Pay and Google Pay.

You need to make withdrawals or prefer to have a physical bank card ? Order your MasterCard debit card for only € 10 (delivery costs).

Take advantage of a 0.1 % cashback on your purchases

Do you know the cashback or money back ? The free auto-entrepreneur bank account* N26 Business allows you to benefit from a cashback of 0.1 % on all your purchases made with your Mastercard.

Notifications, account balance and real -time transfers

Follow your finances in real time. Receive notifications for any activity on your free auto-entrepreneur account N26 Business: invoice payment, direct debit or reception of your cashback N26. With push notifications, you are warned of everything that is happening in your bank account.

Instantanity does not stop there: discover the moneybeam, instant transfers to do the accounts easily with your employees who also use N26.

Get control of your professional expenses

0 hidden costs

Your free auto-entrepreneur bank account is free, without condition of deposit or income.

Safety first

N26 uses 3D Secure – two -step authentication – to guarantee the safety of your professional expenses online.

Your categorized professional expenses

Create #tags and associate them with your transactions to personalize the categorization of your professional expenses.

Your protected deposits up to € 100,000

N26 is a fully licenseed German European Bank. Your money is protected up to € 100,000 by the German Deposit Protection Fund.

How to save money and organize with spaces ?

Discover spaces, the functionality that allows you to create up to 10 personalized sub-accounts to organize your professional budget, offered with N26 Premium accounts.

Personalize your sub-accounts and move the desired sums, according to your projects. To save money without worrying, use the rounding: your purchases are rounded to the upper euro and the corresponding amount is automatically put aside in one of your spaces.

Your browser does not support the HTML5 video.

Download the history of your transactions

For more comfort when you do your accounts, you can download your bank account readings for self-employed entrepreneurs in CSV or PDF format and print them.

Your online customer area

When you need it, you can consult and manage your account on the big screen, from your online customer area.

N26 Business Metal, the self-employed account

Discover the high -end account at the service of your business, with an elegant metal card, 0.5% cashback on your transactions, insurance and exclusive advantages

Your browser does not support the HTML5 video.

Our customer service is there for you

You can contact us 7 days a week. Our customer service speaks French. You can also consult our support center if you have any questions about your free auto-entrepreneur bank account.

And if you were going further with N26 Business Smart ?

Even more simply manage the finances of your self-enterprise ! In addition to 0.1 % money back on your purchases, choose your card from 5 colors, access a dedicated line to reach customer service by phone, open up to 10 sub-contracts to organize your pro budget. Don’t wait any longer to discover this account and all its advantages.

Open your free auto-entrepreneur bank account* or a N26 premium account in just 8 minutes

Open your bank account for free auto-entrepreneurs N26 Business or discover our Premium accounts. Whatever your choice, the opening of your account is guaranteed without paperwork and is done in 8 minutes.

Frequently asked questions

What are the advantages of the free auto-entrepreneur bank account N26 Business ?

The standard Business N26 account is the free and flexible self-entrepreneur bank account that helps you manage the finances of your activity. Get a free debit mastercard virtual card to make your shopping, online or applications thanks to Apple Pay and Google Pay, and easily manage the budget of your self-business in real time.

You can order a physical mastercard card if you wish and thus benefit from 3 paydown without fees in DAB. You have access to the statistics of your expenses, can make all your SEPA transfers, from instant Moneybeam transfers to other users and more. For more information, see our general conditions of use.

What does it take to open a free auto-entrepreneur bank account N26 Business ?

- You will use this bank account in a professional setting

- You are not yet a user of N26

- You live in a country where N26 operates: Germany, Austria, Belgium, Denmark, Spain, Estonia, Finland, France, Greece, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Norway, Netherlands, Poland, Portugal , United Kingdom, Slovakia, Slovenia, Sweden, Switzerland and in the United States

Do I have to open an auto-entrepreneur bank account for my activity ?

As an entrepreneur, you must have a bank account dedicated to your activity. This allows you to separate your personal and professional finances and facilitates the management of your accounts. With the N26 Business free auto-entrepreneur bank account, you can manage your business finances from anywhere, from your smartphone or your customer and real-time customer area.

The bank account for N26 Business auto-entrepreneurs is free ?

There are no online account opening fees, or account holding. It is a very simple free self-employed bank account: it only takes a few minutes.

Can I open my free auto-entrepreneur bank account on behalf of my company ?

No. To open a free auto-entrepreneur bank account N26 Business, you must use your name and surname. This account is only intended for auto-entrepreneurs. So you cannot have a card on behalf of your business with N26 Business.

How do I get my cashback ?

Your 0.1 % cashback will be automatically deposited on your free auto-entrepreneur bank account N26 Business at the end of each month. You have nothing to do. Focus on your self-entrepreneur activity, N26 takes care of your cashback.

Can I have both a personal N26 account and a self-entrepreneur N26 Business bank account ?

Currently, it is not possible to have two N26 bank accounts, a personal account and a self-entrepreneur bank account. If it were to change, we would communicate it on our online platforms.

Can I use my N26 Business Free Entrepreneur Bank Account, for my personal expenses ?

In France, the free auto-entrepreneur account N26 Business is designed for professional use and therefore for the management of your professional expenses and what is linked to your activity such as payment of your office rent, your business trips etc … you can Use it for some of your personal expenses but they must remain in the minority.

Blog articles N26

These articles could interest you