The means of payment hello bank – bank culture, hello bank ceiling: what are they?

Hello Bank ceilings: transfer, withdrawal, payment, everything

�� The withdrawal ceilings are fixed by the bank according to the bank card. The most comfortable withdrawal capacities are those of the Hello Prime bank card, nevertheless this limit is defined according to income (between 500 and 1200 € over 7 days). HEELLO PRIME bank card holders also have the possibility of temporarily increasing their ceilings subject to acceptance of online banking.

Hello Bank means of payment

In the case of a joint account, each holder can take advantage of a free card in his name.

Hello Bank bank card ceilings

Of course, the payment and withdrawal ceilings differ from one card to another. Payment ceilings are always defined over a period of 30 consecutive days. The withdrawal ceilings, on the other hand, extend over 7 consecutive days. The ceilings of the various Hello Bank cards are as follows:

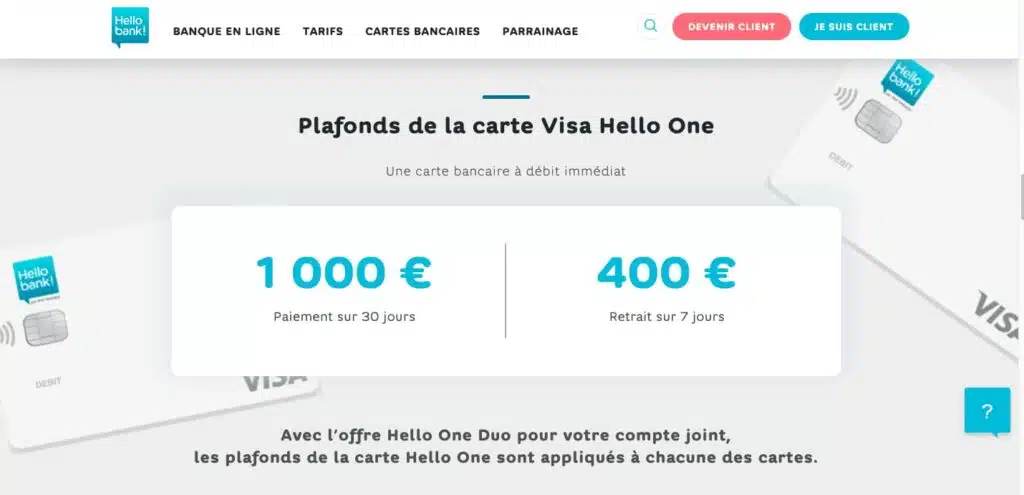

- € 1,000 payments and € 400 withdrawals for the Hello One card;

- Between 1200 and 2500 € in payments, and between 500 and € 1,000 withdrawals for the Hello Prime card;

- € 500 payments and € 200 withdrawals for the Electron Visa card;

- € 1,200 in payments and € 500 in withdrawals for the Visa Classic card;

- € 3000 in payments and € 1,000 withdrawals for the Visa Premier card;

- The ceilings of the infinite visa, on the other hand, are completely customizable.

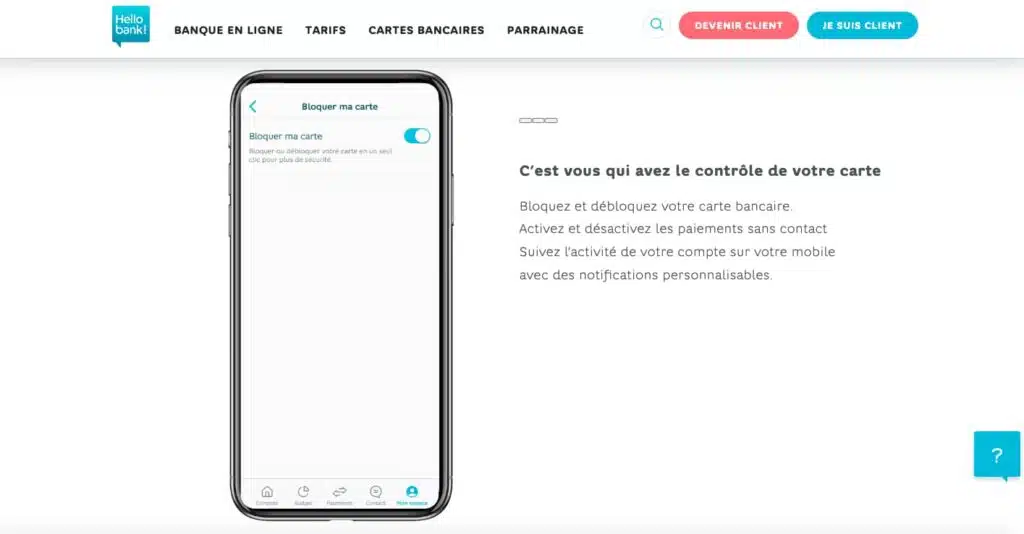

These ceilings can also be modified from the Hello Bank mobile application or from your customer area on the Internet. To do this, just request it. Subject to acceptance of Hello Bank, this modification may take effect immediately. This is always a temporary change which has a maximum duration of three months. If the standard ceilings of your card do not suit you, and you want to benefit morely from an increase in ceilings, it is necessary to request a rise of bank cards.

Request the delayed flow

Usually, the bank cards offered by Hello Bank are immediate debit. In other words, the payments and purchases you make are immediately debited from your account. However, it is possible to request a delayed debit card. In this case, all the payments made by cards are accumulated until 28 of the current month. They are all debited simultaneously on the last working day of the month.

Only Hello Prime customers can take advantage of a delayed debit card. This operation is excluded from the hello one offer. To obtain one, simply select a delayed debit card during your subscription.

If you already have an immediate debit card and want to transform it into delayed debit cards, just contact the hello team, by phone, email or cat.

Obtaining the secret code

The secret code of bank cards hello bank is necessarily sent by mail. It is always addressed to the recipient in a fold separate from the card, for security reasons. Generally, sending the card code is done a few days after opening the Hello Bank account.

Insurance of means of payment

Hello Bank bank cards are all ensured against fraudulent use. However, if this use follows a loss or a flight, the card holder is subject to a deductible of € 50.

The checkbook

How and where to put a Hello Bank check ?

Discover several ways to credit a check on his hello bank account!

- By going to one of the agencies of the BNP Paribas network. These are provided with an automaton that accepts checks. To do this, simply slip your bank card and follow the instructions on the screen;

- By scanning or photographing your checks from your Hello Bank application, before sending them by mail. The shipment is free;

- By depositing your checks in one of the ballot boxes provided for this purpose, at the reception of BNP Paribas agencies. In this case, it is necessary to fill in a check for checking.

Order an online checkbook

Hello Bank customers can enjoy a checkbook for free. To do this, they just have to request it directly online, from the “checkbook” section then “order a checkbook” from the customer area, on the internet or via the application.

The checkbook is then sent to the customer within a few days, directly to his home.

Go to a check

In the event of loss or theft of your checkbook, it is possible to request an opposition directly from your customer area, on the Hello Bank website.

Get a bank check

If you want to obtain a bank check, you must request it by secure messaging, from your hello bank customer area, on the Internet or on the application of the online bank. To do this, it is necessary to indicate the amount of the check, the order which it must be established as well as the reason for which you ask it. Upon receipt of your request, the bank check is sent within 48 working hours, directly to your home.

The transfer

How to make a transfer from a Hello Bank account ?

The transfer can be requested to an internal account in Hello Bank or to an external beneficiary.

If it is a transfer to one of your accounts, it is useless to add a beneficiary. On the other hand, if it is an external recipient, it is necessary to add it beforehand to your list of beneficiaries. This addition can now be activated instantly thanks to the digital key, a new security system implemented by Hello Bank.

Even better: always in search of responsiveness, Hello Bank now offers instant transfer. Thanks to him, the amount you send to the beneficiary appears instantly to his account and he is immediately usable.

Add a beneficiary

The “Performing” section also allows you to manage your beneficiaries list. To add one, you just have to enter your name, first name, IBAN and BIC/SWIFT. From now on, it is no longer necessary to wait 48 hours for a new beneficiary to be activated. It is possible to activate it instantly thanks to the digital key or thanks to the sending of a single -use confidential code by SMS.

International beneficiaries can also be added from the Hello Bank customer area. On the other hand, the “international transfers” option must have been activated beforehand.

Set up or modify a permanent transfer

In the same way, it is possible to set up, modify or stop a permanent transfer at any time from the Hello Bank Customer Space.

International transfer

Once the “international transfer” option has been activated, you just have to add an international beneficiary to be able to send him money in a foreign country. Please note: if transfers in France are free, international transfers are subject to fixed costs as well as to a currency exchange commission. If the transfer is intended for one of the subsidiary banks of the BNP Paribas, Hello Bank however makes you benefit from a preferential rate.

Sampling

Set up a sample

To set up a direct debit, you must send your RIB Hello Bank to your creditors. Also note that you can, if you wish, create a list of direct debit issuers to take from your account. In other words, all issuers not present on this list will see their direct debits automatically rejected. If this is a very reassuring solution, you have to think about updating this list at the risk of passing for a bad payer ..

In general, the levy is still based on a double mandate, according to which the customer authorizes the creditor to issue a levy from his account, while also authorizing the bank to debit his account of the amount of the withdrawals.

The mandate, on the other hand, is always identified by a single mandate reference (RUM).

Levy a sample

If you wish to stop a direct debit, it is first necessary to notify your creditor, to avoid any disappointment. Then a sample can be stopped at any time. To do this, just ask for your opposition. This is a free operation.

Oppose a levy

In the event of disagreement, it sometimes happens that a continuous creditor to send requests for direct debits when you do not agree to pay the amounts he claims. In this case, you may work immediately to stop the execution of a sample. At any time, the hello bank account holder can revoke a payment order, by applying for an online opposition, directly from his customer area or through the hello team. Oppositions may affect a single levy, a series of samples, all the samples issued by the same beneficiary or all the withdrawals presenting on the same account.

The Paylib system

The paylib, what is ?

Hello Bank is compatible with Paylib, this solution can be used to:

- Pay online without having to enter your bank details. To do this, simply connect to its system through an identifier and a mode is happening;

- Pay in stores using your mobile phone;

- Send or receive money between individuals, thanks to a simple mobile number, up to a maximum of € 500 accumulated per day and per transfer.

Register for paylib

To register for the Paylib service, start by downloading the Hello Bank app and then go to the “Mobile payment” section. There, you will have to configure your account, first choosing an identifier, followed by a password. Then, the digital key from Hello Bank allows you to finalize your registration.

Send money with Paylib

To send money to one of your friends from Paylib, the process to follow is as follows:

- From the Hello Bank mobile application, select the “Payments” section;

- Choose “pay”;

- Select “Mobile payment”;

- Choose the bank card and the bank account that you wish to use by default to make mobile payment or send money via Paylib;

- Validate this registration using your digital key.

Your Paylib account is ready to be used and you just have to pay with your mobile or follow the instructions on the screen to send money to one of your loved ones.

Be very vigilant when entering the phone number from the loved one to which you want to send money. Only the holder is held responsible in the event of a transfer error to a bad mobile number. Be aware that the sending of money from the Hello Bank application can be canceled for a few minutes in the event of a false manipulation.

Receive money with Paylib

If Paylib allows you to send money to a loved one, this service is also used to receive it. When you receive funds on your account, an SMS informs you and the amount in question is automatically credited on the account you have selected by default when registering Paylib.

If the person receiving funds does not yet have the Paylib service, they are invited to finalize their registration. In parallel, an SMS containing a reference to copy on the Paylib site is sent to him. It allows him to recover his funds safely, simply by entering his bank details.

Summary of the opinion

Summary of the opinion

David Audran

Culturebanque blog manager. Professional experience in retail, corporate finance and financial analysis.

Hello Bank ceilings! : Transfer, withdrawal, payment, everything !

You want to know more about Hello Bank ceilings! ? You are in the right place �� !

The ceilings consist of maximum limits that it is not possible to exceed. They serve several uses, for example to limit the use of the bank card with the ceilings for payments and withdrawals, or to cap the amount on which it is possible to capitalize on interests with booklets. Some ceilings are dictated by law while others depend directly on the bank.

We invite you to consult the Hello Bank ceilings! In this table: ��

Hello Bank! ceiling :

summary

What are the Hello Bank ceilings! For cards ?

Here are the Hello Bank ceilings! For cards:

- Hello One : € 1000 out of 30 days (payments) and € 400 out of 7 days (withdrawals)

- Hello prime : up to € 2500 out of 30 days (payments) and up to € 1,000 out of 7 days (withdrawals)

- HELLO Virtual CB : up to 1200 € out of 30 d

- Hello Origin : € 500 out of 30 days (payments) and € 200 on 7 days (withdrawals)

CB calculation of CB at Hello Bank! For payments and withdrawals depends both on the subscribed CB and your income. For Hello One and Origin cards, the maximum limit is set in advance for both payments and withdrawals. On the other hand, With the Hello Prime card, you can ask to increase ceilings according to your monthly income.

Note that the ceiling in contactless payment with Hello Bank! is identical for all CB, or € 50 per transaction. Beyond that, you must enter your card code.

�� In order to modify the Hello Bank ceilings!, You can go through the application or customer service. Indeed, it is possible that you need to occasionally make substantial purchases over a short period. You can temporarily increase the Hello Bank withdrawal ceilings! (or payment) before finding the normal limits some time after (no later than 3 months).

In order to establish new Hello Bank ceilings! final, however, it is necessary to contact an advisor. This is only possible with the CB Hello Prime.

Hello Bank ceiling! : FAQ !

This faq on the hello bank ceiling! answers the questions most frequently asked by consumers, for example concerning the ceiling of transfers. We also return to the limits applicable to payments and withdrawals, transfers, savings booklets, authorized discovered, etc.

�� What is the ceiling of hello bank transfers! ?

The ceiling for hello bank transfers! is € 15,000 / day For a standard transfer or an instant transfer (ceiling decreed by the European Central Bank). This ceiling limits the risk of fraud as well as transfer errors. In the case of an instant transfer, for example, the sum is immediately transferred to the beneficiary’s account. This Hello Bank ceiling! For transfers therefore represents security.

The Hello Bank ceiling! For transfers is set for the day, unlike the limits for payments (out of 30 days) and withdrawals (out of 7 days). This means that you can perform a single transfer or more accumulated: as soon as the limit is reached, you must wait until the next day to make new transfers.

For the standard separate transfer as for the instant transfer, the Hello Bank ceiling! € 15,000 is equivalent to other online banks.

�� In order to modify the transfer ceilings hello bank!, You should go to the online bank application, Then activate your digital key. You can then modulate the ceilings. Note that it may be necessary to contact a hello bank advisor! in order to increase your ceiling beyond the limit displayed by the application.

�� What is the payment ceiling at Hello Bank! ?

The payment ceiling at Hello Bank! are :

- Hello One : 1000 € / 30 d

- Hello prime : up to € 2500 /30 days

- Virtual CB : 1200 € / 30 d

- Hello Origin : 500 € / 30 J

First, the ceiling of the bank card Hello Bank! Hello One is set in advance. This means that you cannot modulate them, whatever your income. This is also the case for the original bank card, which is aimed at minors and whose ceilings are logically lower than for Hello One.

Once the hello bank ceilings! affected, it is necessary to wait until expiration of the deadline before being able to pay again.

�� However, the Hello Bank payment ceilings! are modular with the CB Hello Prime. This premium offer at € 5 per month (€ 8 for the joint account) is accessible from € 1,000 in net income per month: at this level, the payment ceiling is € 1,200 for payments and € 500 for withdrawals.

Then to change the Hello Bank ceiling! From your CB Hello Prime, you must comply with certain income conditions. This is also the case for the Hello Prime virtual card, the ceiling of which is at least € 600 and can progress up to € 1,200.

�� What are the hello bank withdrawal ceilings! ?

Hello Bank withdrawal ceilings! are :

- Hello One : 400 € / 7 J

- Hello prime : up to 1200 €/7

- Hello Origin : 200 €/7 J

�� The withdrawal ceilings are fixed by the bank according to the bank card. The most comfortable withdrawal capacities are those of the Hello Prime bank card, nevertheless this limit is defined according to income (between 500 and 1200 € over 7 days). HEELLO PRIME bank card holders also have the possibility of temporarily increasing their ceilings subject to acceptance of online banking.

�� What is the ceiling of checks at Hello Bank! ?

There is no ceiling for checks at Hello Bank!. No law specifies a maximum limit for the amount of a check. On the other hand, a rule is fixed: it is necessary to have the provision on the account, so that it can be collected by the beneficiary. Otherwise, the bank will request to regularize the situation and, failing this, will enroll the issuer of the check for the Payment Incidents of the Banque de France.

�� For significant sums (such as buying a vehicle), it is recommended to apply for a bank check, Also without ceiling at Hello Bank!. When a check for this type is issued, the amount is directly deducted from the account. There is therefore no risk of a provision without a provision. To obtain a bank check, simply contact an online bank advisor.

�� What is the discovery ceiling at Hello Bank!

The discovery ceiling at Hello Bank! is 250 €. Note that the implementation of the authorized overdraft is only possible with the Hello Prime offer, it is not available for CB Hello One and Origin. This € 250 ceiling means that if your overdraft reaches € 250 or less, you pay the interests equivalent to the authorized overdraft, or 8%. Beyond that, you switch to an unauthorized overdraft, and the rate then goes to 18.40%.

�� Hello One and Hello One Duo customers do not benefit from an overdraft authorization, So it is not possible to increase the hello bank overdraft ceiling!. Be sure to take into account the availability of the service if you need a flexible banking offer like Hello Prime. To take advantage of a solution adapted to its situation, you must contact the customer service of the online bank.

�� What is the ceiling of the Hello Bank booklets!

Here is the ceiling of the Hello Bank booklets! ::

- A booklet : 22,950 €

- Sustainable and solid development booklet : € 12,000

- Hello booklet + : without ceiling

- Young booklet : 1600 €

First, the Hello Bank ceiling! For booklet A and LDDS is determined by the Banque de France. These are indeed regulated booklets and banks, including Hello Bank!, are required to comply with the conditions set. This is also the case for the young booklet. Note that the Hello Bank ceilings! do not take into account the capitalized interests, but are based only on the payments made.

�� Regarding the Hello +booklet, it is a booklet specific to online banking. The Hello Bank ceiling! For this booklet is nonexistent, which means that you can make as many payments as you wish and combine your savings. You can for example start with the regulated booklets and then, once the ceilings have been reached, continue to save on the hello booklet +.

�� How are the ceilings calculated at Hello Bank!

Ceilings at Hello Bank! are calculated according to your income. This is valid only with the CB Hello Prime: for Hello One, the maximum limits are set in advance. If you have subscribed to the hello prime offer, you immediately benefit from a ceiling of € 1,200 / 30 d for payments, € 500 /7 J for withdrawals and € 600 /30 d for payments with the CB virtual hello prime.

�� According to your income, you can modify the ceilings of the Hello Prime card from the application or the customer area. In a few clicks, you can temporarily increase the Hello Bank ceiling!. On the other hand, to definitively establish new ceilings, it is necessary to reach a hello bank advisor!, which will calculate the ceiling of CB hello bank! on the basis of your monthly income to determine the new limits of payments and withdrawals.

�� How to know your ceilings at Hello Bank! ?

You can know your ceilings at Hello Bank! via the bank site, the customer area or the application. In the Frequently Questions on Banking and Checks, Online Bank details the HELLO BANK cards ceilings! For withdrawals and payments. You can also access your personal space (via app or web browser) in order to consult the withdrawal and payment ceilings hello bank!.

�� Regarding Hello Bank booklets!, The ceilings can be viewed on the online bank website. You can also go through the customer area directly if you have subscribed to one of these savings products. Note that there is no ceiling for the hello booklet +. If you ordered the CB Hello Prime, you can check the amount of the overdraft authorized via the application after having requested the implementation.

�� Can we increase the Hello Bank ceilings! ?

It is possible to increase the Hello Bank ceilings! up to a maximum determined according to your income and your CB. The ceilings of the Hello Prime card (premium offer) are modular. You can apply for a change in hello bank ceiling! From the app or using a hello team advisor. Subject to the bank’s acceptance, you can modify your ceilings temporarily (a maximum of 3 months).

�� Note that the ceilings of the Hello Bank cards! Hello One and Origin are fixed. Thus, payments are limited to 1000 € / 30 d for the Hello One and 500 € / 7 J card for the Origin CB. The withdrawals are capped at € 400 /7 J for Hello One and 200 € / 7d for Origin. Unlike the ceilings of the Hello Prime card, these cannot be modulated according to your income.

�� How to modify the Hello Bank ceilings! ?

Here’s how to modify the Hello Bank ceilings! ::

- Open the application or go to the customer area

- Go to “my account” or “payments”

- Go to “my cards” or “manage my cards”

- Edit the Hello Bank ceiling!

After changing the ceiling from the application or the customer area, the modification is taken into account immediately. This means that, if you have reached the payment ceiling for example, you can increase the ceiling and pay again directly with your bank card. This is practical if, for example, you do your shopping, want to pay and the transaction is declined because you have reached the ceiling.

In this case, you can temporarily increase the Hello Bank ceilings! (for 3 months maximum) and finalize the transaction.

�� Note that there are Hello Bank ceilings! that it is not possible to modify. This is the case of banking products, such as savings booklets, the limits of which are defined in advance by law. The hello + booklet is him without ceiling and you cannot change it. Regarding the authorized overdraft with Hello Prime, it is necessarily 250 € and it is therefore not possible to increase it.

Ceiling at Hello Bank! : in conclusion !

In conclusion, ceilings at Hello Bank! are transparent and can be modified in a few clicks for the CB. You can consult the payments of payments and withdrawals via the application or the website. Depending on your CB and your income, you can then modify the ceilings by yourself or call on a bank advisor who will study your request.

As a reminder, here are the different ceilings at Hello Bank! For bank cards:

- CB hello prime : 500 to 1000 € / 7 d (withdrawals) and 1200 to 2500 € / 30 d (payments)

- HELLO Virtual CB : 600 to 1200 € / 30 d (payments)

- CB Hello One : 400 € / 7d (withdrawals) and € 1000 /30 d (payments)

- CB Origin : 200 €/7 J (withdrawal) and 500 € / 30 d (payments)

Here are the ceilings for other banking products and services:

- A booklet : 22,950 €

- Ldds : € 12,000

- Young booklet : 1600 €

- Hello booklet + : without ceiling

- Standard transfer : € 15,000

- Instant transfer : € 15,000

- Check : without ceiling

- Overdraft : 250 € (hello premiums only)

�� You can change the Hello Bank ceilings yourself! via the customer area or the application. It is thus possible to temporarily increase your ceilings in real time, which is practical if you have reached the limit and must make new purchases. However, the change is temporary (3 months maximum); To permanently increase your withdrawal and payment ceiling at Hello Bank!, You must contact an advisor directly.

A suggestion or the desire to give your opinion on the Hello Bank ceilings! ? Put us a little comment, we will be happy to answer you or bounce back on your remarks ! ��

Hello Bank!

Hello Bank! Online bank at high -end customer service. Free bank card and lack of fees. Current account, joint account, booklets and investments, mortgage mortgage.

Updated information on September 19, 2023

- Description

- Further information

- About Hello Bank!

Hello You!

Between Exorbitant banking costs among traditional banks and Total absence of customer service Among the neobancs, can we still hope for an impeccable banking experience ? A modern banking application, the absence of bank charges on current operations and an advisor always available when you need it … an illusion in many banks but a standard Hello Bank!

Hello Bank! is an online bank that allows you to have an account, a card and all the banking services you will need For you and your couple. In addition to a modern application and of theabsence of fees On payments and withdrawals, Hello Bank! provides you with Reactive and qualified advisers To satisfy all your requests in record time.

In short

- 2 clear banking offers: 1 free offer with most of the online bank and 1 high -end offer with insurance and payment facilities.

- Available, responsive and competent customer service to quickly respond to customer requests.

- Modern mobile application to carry out all common operations without difficulty.

- Alternative to Boursorama Banque, ING, BforBank and Fortuneo.

The Hello Bank application! Allows you to perform all common operations from your mobile. Hallo Bank cards! are compatible with Apple Pay, Paylib and Lyf Pay.

Hello Bank! Notice: 4.8/5

This review on the HELLO BANK product! is a reflection of our experience and our tests. It is limited to the box below. The rest of the content of this page comes an informative and objective character (excluding customer reviews on Hello Bank! at the bottom of the page).

Hello Bank! : Writing opinion

Our opinion on Hello Bank! is very positive. Hello Bank! is a well -established online bank. It is in terms of competition in terms of services and pricing. It benefits from an important asset by being part of the BNP Paribas Global Network network which will appeal to people using species regularly.

Benefits

- BNP Paribas Global Network network

- Very low prices

- Intuitive mobile application

Disadvantages

Hello Bank services and features!

- 1 current account staff or a joint account (your choice at the opening of the account)

- 1 card Banking Visa Classic. Visa Electron bank card for her children (s)

- 1 virtual bank card With Hello Prime

- 1 free checkbook in his name or in the name of his couple

- Automation of banking mobility with the hello start function allowing to transfer its regular samples without effort

- Terceo option (payment in 3 times) for delayed debit cards Visa Classic, first and infinite

- Apple Pay, Google Pay, Paylib and Lyf Pay compatibility.

- Blocking of the means of payment from the mobile application

- Immediate transfers (paid outside the BNP Paribas network)

- Delayed and discovered payment authorized with the Hello Prime offer

- Booklets A, LDD, Hello and Hello booklet+

- Real estate and consumer credit

- Risk investments (scholarship)

- Consumer credit at the rate of 3.49%, until October 04, 2023 included

Insurance and assistance

| Insurance | Hello One | Hello prime |

|---|---|---|

| Insurance and assistance guarantee | No | Yes |

| Sending a troubleshooting card | No | Yes |

Hello Bank customer support! is one of the best online and neoban banks. It can be reached by email, cat and telephone every day except Sundays and holidays.

The two offers from Hello Bank! contain most of the online bank. It is however possible to enrich your offer with optional insurance and services such as reducing costs abroad.

HELLO BANK CARDS PRICE!

Free without condition

From 12 years * 1 Electron visa or visa card None Debit virtual card immediate Withdrawals paid Outside BNP Paribas Global Network network – –

From 18 years old 1 Visa 1 Debit virtual card immediate or delayed Withdrawals free Outside BNP Paribas Global Network Network Insurance and Assistance Sending a troubleshooting card

* THE Minors aged 12 to 17 can also claim a bank card attached to the account of their parent. In this case, this is the Visa Electron card. This is free.

Hello Bank cards ceiling!

| Hello One | Hello prime | |

|---|---|---|

| Payment ceiling per month | 1000 € | According to income |

| Withdrawal ceiling per week | 400 € | According to income |

The Hello Bank application! offers full control on its bank account, expenses and investments. This is one of the best applications in the categories of online banks.

Costs on current operations

| Operation | Bank charges |

|---|---|

| Supply of a simple certificate | € 20.50 |

| Inactive account for 1 year | 30 €/year |

| Search and/or modification of a missing or erroneous address | 18 € |

| Issuance of a RIB via an advisor | 5 € |

| Withdrawal in the event of troubleshooting, made without a bank card at the counter of a BNP Paribas SA agency in mainland France | € 4.80 |

| Paid withdrawals | 1 € /withdrawal + 1.5% of the amount |

| Reissue of the secret code | 5 € |

| Map repair before maturity (Electron Visa, Visa Classic, Hello One) card | 15 € (free for Hello Prime) |

| Document search costs, invoice request or proof of withdrawal | € 12.90 |

| SEPA transfer | 5 € in agency and free online |

| Transfer denominated in euros or in a motto different from the Currency of the Beneficiary’s country | € 3 to BNP Paribas subsidiary, € 15 otherwise |

| An international check | 27 € |

| Costs by occasional incomplete transfer | € 12.90 |

| Home checkover expenses | Free or € 5 by registered mail |

Open a Hello Bank account!

Conditions of eligibility :

- Be French tax resident

- Be over 18 for Hello Prime and at least 12 years for Hello One (accompanied by a tutor).

Account opening :

- Click on Opening an account

- Enter your personal information then choose the offer of your choice

frequently asked Questions

Can I benefit from an overdraft with Hello Bank!

Yes. Hello Bank! offers a cash facility with its premium hello prime offer. This allows you to be a debtor for a period of 15 days per 30-day slice. The amount is defined when signing the cash facility contract. Please note, being a debtor generates agios.

How to contact Customer Service ?

Hello Team advisers can be reached:

- by phone From Monday to Friday from 8 a.m. to 10 p.m., and Saturday from 8 a.m. to 6 p.m., excluding public holidays on 01 43 63 15 15 15

- by mail at service HOLL BANK customer complaints!, TSA 80 011, 75318 Paris Cedex 09

- by cat From the mobile application or from the online customer account.

What are the cards available at Hello Bank!

Hello Bank! offers several cards inside his two offers and outside:

- Visa Classic present in the two default offers (Hello One and Hello Prime)

- Electron Visa Optional in the Hello One offer. It is also the bank card for Hello Bank miners!

- Optional American Express Platinum card for € 590 / year

- Map American Express Gold Optional for 185 € / year

- Map American Express Green Optional for 95 € / year

Note that the Visa Classic card of the Hello Prime offer is reinforced with the insurance of BNP Paribas.

Further information

Hello One, Hello Prime

online bank

Medical care, means of payment (loss or theft)

€ 1,000 in income /month, Belgian resident, 12 years old and over, 18 and over

3D Secure, Apple Pay, Google Pay, contactless payment, Paylib

About Hello Bank!

Hello Bank! : online banking leader

Hello Bank! is a French online bank created in 2013 in Germany and extended to Belgium. Since its acquisition by BNP Paribas, the international online bank has been deployed in France and Austria. Hello Bank customers! therefore benefit from privileged access to the network of BNP Paribas agencies. This parentage also allows online bank to offer a full range of banking services ranging from the current account to life insurance, mortgage, consumer credit, savings and stock markets. Hello Bank! has more than 600,000 customers, which makes it the third largest French online bank.

- 3.3 million in Europe

- 700,000 in France

Bertrand Cizeau, CEO of Hello Bank! and hello bank! Pro.

Notice

There is no opinion yet.

Be the first to leave your opinion on “Hello Bank!» Cancel the answer

More reviews of alternatives to Hello Bank!

- bunq reviews

- Bunq Business Reviews

- Paypal Business Reviews

- N26 Business Reviews

- Qonto opinion

- Nickel Card Opinion

- SOGEXIA Business Opinion

- Revolut Business Reviews

- Canb Opinion

- Nøelse opinion

- Lydia Avis

- Pixpay Reviews

- Coinbase opinion

- Curve review card

- My French Bank Reviews

- Monese opinion

- Binance Card Avis

- Orange Bank Reviews

- PCS Card Reviews

- Wise Avis

Hello Bank!

- BNP Paribas Global Network network

- Very low prices

- Intuitive mobile application

�� up to 180 € of advantages offered

From 17/08 to 09/10: up to 180 € of advantages offered on Hello One and Hello Prime + 1 €/month for 6 months on Hello Prime. See details on the site.

1 card. Zero costs.

Best ethical bank

The most modern green neoban !

Find the best bank card

The SpendWays site promotes the best bank cards and accounts for adolescents, couples, travelers and single people. For professionals, SpendWays brings together the best pros accounts, business bank cards and payment terminals. Users are free to make a banks comparison and choose bank accounts and payment cards that suit them best thanks to detailed pages. However SpendWays cannot be considered as a bank comparator, as it is remunerated by banking establishments who wish to acquire more visibility. Information provided on SpendWays.com are purely informative and in no way constitute advice, recommendation or request to conclude a transaction.

Spendways

Finance blog

About

Legal Notice

Contact

All rights reserved – SpendWays 2023: Promotion site for means of payment

- In my opinion

- My company

- �� Professional card

- �� Professional account

- For micro-enterprise

- For business

- �� Bank card

- Minor card

- Cryptocurrency card

- Traveler

- Card aggregator

- Joint and common account

- Count for minor and teenager