Test your eligibility for conversion premium | Carizy, 2023 scrap bonus: new conditions – legipermis

Break bonus 2023: amounts and conditions

To see what is the most profitable solution for you, you can estimate the online car rating for free on our LEGI site allowed .com to see how quickly you can sell it. This will prevent you from potentially losing money.

Benefit up to € 6000 of conversion bonus !

The conversion bonus offers you the opportunity to scrap an old vehicle for the benefit of a more virtuous model.

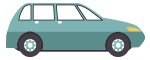

Discover the amount of the conversion premium to which you can be eligible according to the system defined by the government applicable since January 01, 2023.

Don’t wait any longer to take advantage of it !

Carizy accompanies you

to get

The conversion bonus

1. Recycle your old vehicle

Your old vehicle is recovered from your home and transported to a Vhu center State approved recycling 95% of its weight. You receive a valuation of your car between 50 € and 500 €.

2. Buy a clean vehicle

Buy a clean vehicle inspected on 100 control points with a Minimum 6 month warranty. We take care of all the formalities and secure payment.

3. Obtain the conversion bonus

Place your request on the government’s website and receive your premium !

Frequently asked questions

Can I benefit from the conversion bonus if I am always attached to the tax household of my parents ?

Yes. For example, if your parents’ tax household has a reference tax income less or equal At 22,983 euros, then you will be considered as a reference tax income by share less than or equal to 22,983 euros.

Should the vehicle to be put in the same name as that intended to be purchased ?

The approved VHU centers for the destruction of vehicles are the subject of an approval issued by the prefect of the department. These centers are easily identifiable by an approval number which must be affixed to the entrance to their establishment.

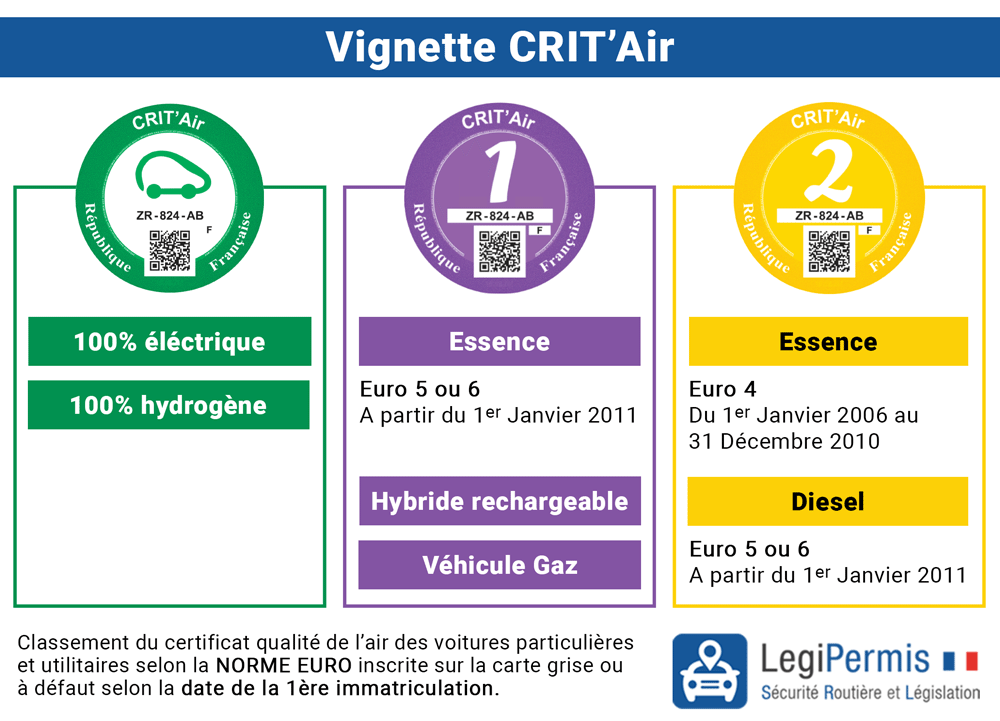

What is the Crit’Air certificate ?

The air quality certificate, called Crit’Air, classifies vehicles according to their exhaust pollutants emissions. Classifications (electric criminal, 1, 2, 3, 4, 5) depend on the energy of the vehicle (diesel, petrol, electric, . ), and of its date of first registration (the Euro standard).

Electric Crit’Air : Electric or hydrogen carCrit’air 1 : Rechargeable or petrol hybrid registered after January 1, 2011Crit’air 2 : Essence registered between January 1, 2006 and December 31, 2010 or diesel registered before January 1, 2011Crit’air 3, 4, 5 : Not eligible for conversion bonus

Can I combine the conversion premium and the ecological bonus ?

The ecological bonus and the conversion bonus can be combined for the purchase of a new electric vehicle. For more information, go to: https: // www.Ecological-Solidary.gouv.fr/bonus-malus-ecologique-Prime-Conversion-et-Bonus-Velo.

Can I benefit from the conversion bonus and pay the penalty ?

The ecological bonus and the conversion bonus can be combined for the purchase of a new electric vehicle. For more information, go to: https: // www.Ecological-Solidary.gouv.fr/bonus-malus-ecologique-Prime-Conversion-et-Bonus-Velo.

How to check that the VHU center in which I will recycle my vehicle is authorized by state ?

No. The conversion premium applies for vehicles whose CO2 emission rate is less than or equal to 137g/km. The penalty affects vehicles emitting at least 137g of CO2/km.

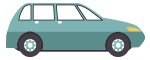

Break bonus 2023: amounts and conditions

last news : Modifications of the amounts on 01/01/2023

The conditions are evolving from 01/01/2023

- The scrap premium is deleted for households with an RFR/share greater than € 22,983;

- The rechargeable hybrids are no longer eligible for the scrap premium;

- Diesel vehicles are always excluded from the device (for the car to buy);

- The premium of € 6,000 for the purchase of an electric or hydrogen car is reserved for very modest households with an RFR/share less than or equal to € 6,58 or households with an RFR/share less than or equal to € 14,089 But which are large rollers (+30km from the workplace or more than 12,000 km/year);

- For these same people, a Premium of € 4000 is planned for the purchase of a petrol car with a Crit’Air 1 sticker, whether new or used;

- For households with an RFR/Part less than or equal to € 14,089 without being large roller, a € 2,500 scratch bonus is provided for electric and hydrogen vehicles and € 1,500 for petrol vehicles Crit’Air 1 new or used;

- For households with an RFR/Part greater than 14,089 € and less than or equal to 22,983 € Souahting buy an electric or hydrogen vehicle, the amount is € 2,500;

- The maximum acquisition cost is 47,000 euros including tax for an electric or hydrogen vehicle. It remains at 50,000 euros including tax for a Crit’Air 1 petrol;

- A natural person can only benefit from the premium once;

- The conditions concerning the vehicle to be scrapped are not modified;

For vehicles ordered before December 31, 2022, the invoicing period will be possible until June 30, 2023 with the calculation of the old conditions of the bonus at the Casse of 2022.

A change on CO2 thresholds since 01/01/2023

- For a new vehicle or registered for less than 6 months: the maximum CO2 emission rate is 12z g/km CO2 in WLTP standard;

- For a used car: the maximum CO2 emission rate is 132 g/km CO2 in WLTP standard;

A higher bonus for light utility vehicles (Vul)

Class 1, 2 and 3 vans have a higher scrap bonus since July 26, 2021 regardless of the price of the utility (source: decree n ° 2021-977 of July 23, 2021).

- Class 1 van with a weight less than 1305 kg: € 5,000;

- Class 2 van with a weight between 1305 kg and 1760 kg: € 7,000;

- Class 3 van with a weight greater than 1760 kg: € 9,000;

Minimum resale period set at 12 months

In order to deal with abuses related to the resale of electric vehicles, the government has set a new minimum period in a decree in a decree in a decree (compared to 6 months before) to resell its car after benefiting from the Casse premium (decree n ° 2022-669 of April 26, 2022). This period entered into force on April 27, 2022.

We update this page according to regulatory developments on LEGI allowed .com . If you are not eligible for the premium, We also offer a tool to estimate for free, have a recovery offer and sell your car.

Not eligible for the premium ?

If you are not entitled to the breakage bonus (vehicle too recent or because of your income).

You can make a free estimate in 1 minute of the value of your car.

Reliable, fast, free

Service provided by

Not eligible for the premium ?

If you are not entitled to the breakage bonus (vehicle too recent or because of your income).

You can make a free estimate in 1 minute of the value of your car.

Reliable, fast, free

Service provided by

How it works ?

Since 2018, a new scrap bonus entered into force under the name of conversion bonus. This aid for the resumption of the State concerns petrol, electric or hydrogen cars for the purchase of a new or used car against the breaking of an old polluting car in a VHU center (vehicle outside the ‘use). For example, this recovery bonus makes it possible to pass in particular from an old diesel for an essence or an electric.

Coming from the Energy Transition Law, the Breakage Prime aims to help households replace an old vehicle polluting with a more recent car with low emissions of carbon dioxide (CO2) and fine particles.

Standard bonus of the 2023

Conditions from January 1, 2023

In exchange for the breakage recovery of an old car (including Crit’Air 3), you can buy a new car within the limit of € 47,000 including tax (including with the possible cost of rental of the battery) For an electric car and € 50,000 including tax for a thermal car with a Crit’Air 1 sticker. You will benefit from Prime amounts following:

For the purchase of a petrol car Crit’Air 1 new or used

For a Crit’Air 1 petrol with a CO2 emission rate of 132g/km maximum (WLTP) on occasion or maximum 122g/km in new (WLTP), the amount of the bonus to the Casse is:

- 4000 € Limited to 80% of the vehicle price for the most modest households (reference tax income per share ≤ € 6,358 per share) and those who have an RFR/share ≤ 14089 € obliged to long professional trips (living at least 30km of the workplace or making 12,000 km per year to go to work with a personal vehicle);

- 1500 € For households with an RFR/Part ≤ 14089 €.

- 0 € for the others.

The maximum price of the thermal automobile cannot exceed € 50,000 including tax.

For the purchase of a fuel or diesel car Crit’Air 2

Petrol or diesel vehicles with a Crit’Air 2 sticker are no longer eligible for the scratch bonus whether new or used since July 1, 2021.

For the purchase of a new or used or hydrogen electric vehicle

With a CO2 emission rate ≤ 20g/km, the scrap premium is:

- 6000 € Limited to 80% of the vehicle price for the most modest households (reference tax income per share ≤ € 6,358 per share) and those who have an RFR/share ≤ 14089 € obliged to long professional trips (living at least 30km of the workplace or making 12,000 km per year to go to work with a personal vehicle);

- 2500 € For households with an RFR/Part ≤ 22983 €;

- 2500 € legal persons (companies);

- 0 € For households with an RFR/Part greater than € 22,983;

The price of the electric car will not be able to exceed € 47,000 including tax since January 1, 2023.

For the purchase of a rechargeable hybrid car

Loadable hybrid vehicles are no longer eligible for scratch premium since 01/01/2023.

For the purchase of a new electric motorcycle (2-wheeled motorized)

This bonus concerns two-wheelers, three-wheeled motorized and new electric quadricycles with the following amounts:

- 1100 € For households with an RFR/Part ≤ 14089 €;

- 100 € For all others with an RFR/Part ≤ € 22983;

- 100 € for legal persons (business);

Not eligible for the premium ?

If you are not entitled to the breakage bonus (vehicle too recent or because of your income).

You can make a free estimate in 1 minute of the value of your car.

Reliable, fast, free

Service provided by

Am I eligible with my income ?

What year to take into account for tax income ?

Am I eligible for the premium according to my tax situation ? On your tax notice from the previous year (document to be provided for the file), the amount of your reference tax income is written. Thus, for the purchase of a vehicle in year N (for example in 2023), the tax notice of year N-1 (therefore 2022) is taken into account, it is therefore the income of the year n-2 (therefore 2021 in the example) which are taken into account.

Reference tax income by share less than or equal to € 14089

Here are the income conditions for 2023 to correspond to a reference tax income per share of 14089 euros:

| Tax share (s) (s) | Boundary reference tax income | Example |

|---|---|---|

| 1 | 14089 € | Single, partner, divorced, widower without dependent child |

| 1.25 | 17611.25 € | Single or divorced with an alternating child |

| 1.5 | 21133.5 € | Single or divorced with a dependent child |

| 1.75 | € 24,655.75 | |

| 2 | € 28178 | Married or PACS couple |

| 2.25 | € 31700.25 | |

| 2.5 | 35222.5 € | Couple with a child (same tax household) |

| 2.75 | € 3,8744.75 | |

| 3 | € 42,267 | Couple with two children (same tax household) |

| ½ additional share | 7044.5 € | |

| ¼ additional share | € 3522.25 |

Reference tax income by share less than or equal to € 22,983

Here are the income conditions for 2023 to correspond to a reference tax income per share of 22,983 euros:

| Tax share (s) (s) | Boundary reference tax income | Example |

|---|---|---|

| 1 | € 22983 | Single, partner, divorced, widower without dependent child |

| 1.25 | 28728.75 € | Single or divorced with an alternating child |

| 1.5 | 34474.5 € | Single or divorced with a dependent child |

| 1.75 | 40220.25 € | |

| 2 | € 4,5966 | Married or PACS couple |

| 2.25 | 5,1711.75 € | |

| 2.5 | € 67457.5 | Couple with a child (same tax household) |

| 2.75 | € 6,3203.25 | |

| 3 | € 68,949 | Couple with two children (same tax household) |

| ½ additional share | 11491.5 € | |

| ¼ additional share | € 5745.75 |

Reference tax income by share less than or equal to € 6358

Here is the maximum tax tax income depending on your number of share to have an RFR/share less than or equal to € 6358 for 2023.

| Tax share (s) (s) | Boundary reference tax income | Example |

|---|---|---|

| 1 | € 6358 | Single, partner, divorced, widower without dependent child |

| 1.25 | 7947.5 € | Single or divorced with an alternating child |

| 1.5 | 9537 € | Single or divorced with a dependent child |

| 1.75 | 11126.5 € | |

| 2 | € 12716 | Married or PACS couple |

| 2.25 | 14305.5 € | |

| 2.5 | 15895 € | Couple with a child (same tax household) |

| 2.75 | 17484.5 € | |

| 3 | € 19074 | Couple with two children (same tax household) |

| ½ additional share | 3179 € | |

| ¼ additional share | 1589.5 € |

Example: I am in a couple with a dependent child, I then have 2.5 shares, and the reference income of my home is € 15,000. I can pretend to the double -sided breakage bonus because my RFR reference tax income is less than 15895 €.

Conditions of the Casse Bonus

The scrap bonus is subject to specific conditions on the vehicle to be put on the one hand and the vehicle to be acquired on the other hand.

Conditions for the vehicle to be pamped

This reinforcement designed by the Ministry of Ecology mainly concerns the recovery of cars over 10 years old at the low residual car coast. This is the first date of vehicle registration which is to be taken into account. Crit’Air 3 vehicles are taken into account. The recovery conditions are therefore:

Not eligible for the premium ?

If you are not entitled to the breakage bonus (vehicle too recent or because of your income).

You can make a free estimate in 1 minute of the value of your car.

Reliable, fast, free

Service provided by

Other additional conditions for the vehicle to be destroyed:

- It must have been acquired by you for at least one year compared to the date of invoicing of the new vehicle,

- He must be a private car (VP) or a van (CTTE),

- It must be registered in France,

- It should not be a damaged vehicle (when the amount of repairs is greater than the vehicle value),

- It must be scrapped in an approved center “Out of use” VHU or a depollution and disassembly installation of out -of -use vehicles within 3 months preceding or the 6 months following the invoicing date of the new vehicle,

- He must have auto insurance on the date of his delivery for destruction or on the date of invoicing of the new vehicle.

- May 2019: In terms of names on registration certificates, the government has asked the agency which deals with the files (ASP) to accept the files with different names on the gray cards of the old vehicle to be destroyed and the new vehicle for married and PACS couples subject to providing proof such as family booklet.

Conditions for the vehicle to buy or rent

The conversion bonus concerns any vehicle new or used Taking a maximum of 132g of CO2/km for a used car according to the WLTP scale or 122g/km in WLTP scale for a new car or which has been registered for less than 6 months.

- A vehicle essence Crit’Air 1 sticker whose registration date is After January 1, 2011 For households with an RFR/Part ≤ 14089 € (with the CO2 emission conditions listed above);

- A vehicle 100% electric or hydrogen vignette Crit’Air 0 emitting less than 20g of CO² per km for households with an RFR/share less than or equal to € 22983 or for legal persons (company);

- A 2 wheels, 3-motorized motorized and new electric quadricycles Vignette Crit’Air 0 for households with an RFR/share less than or equal to € 22983 or for a legal person (company);

- A Electric utility vehicle (electric van) Vignette Crit’Air 0 for households with an RFR/Part less than or equal to € 22,983 or for a legal person (company);

Other additional conditions for the new vehicle to buy:

- A maximum scrap bonus per natural person since January 1, 2023;

- The vehicle must be registered in France with a final number,

- In the case of rental with purchase option (LOA), the duration of the contract must be at least 2 years,

- For passenger cars and vans: the vehicle should not be sold within 12 months or before having driven at least 6000km,

- For 2 wheels, 3 wheels or quadricycle: the vehicle should not be sold in the year following its first registration or before having driven at least 2000km,

- It should not be a damaged vehicle (when the amount of repairs is greater than the vehicle value),

Can we touch the premium without buying a vehicle ?

No, obtaining a scrap bonus without a vehicle repurchase is impossible.

If you are not eligible for the premium, We also offer a free and immediate tool to estimate its car rating.

Meaning of Crit’Air vignettes

Is it cumulative with the ecological bonus ?

Yes, The scrap premium can be combined with the ecological bonus only for the purchase of a new electric vehicle (or rental of at least 2 years).

In 2023, if we add the bonus to the breakage of € 6,000 (for the acquisition of an electric vehicle) with the ecological bonus of € 7,000 maximum (new electric car), that Total help of € 13,000.

How to benefit from the scrap premium ?

It is possible to make your request online or by mail from the government teleservice available on the internet on this page.

To follow the progress of the file, you can contact the direct contact, namely the Service and Payment Agency (ASP) which validates all the Prime Prime application files. You will find the agency you depend on the ASP website.

Estimate your car to compare

To see what is the most profitable solution for you, you can estimate the online car rating for free on our LEGI site allowed .com to see how quickly you can sell it. This will prevent you from potentially losing money.

Not eligible for the premium ?

If you are not entitled to the breakage bonus (vehicle too recent or because of your income).

You can make a free estimate in 1 minute of the value of your car.

Reliable, fast, free

Service provided by

- Find a permitted point internship

- Frequent questions – internships

- Secure internship payment

- Legal Notice

- Contact