Teens: How to choose your bank card | Invest, bank card for teens: I crack or not?

Bank card for minors & teens: I crack or not

If you are between 10 and 11 years old, you can get a children’s bank card. This card is linked to a bank account opened by a legal representative, generally a parent. The card is limited to a predefined amount and does not allow you to be discovered, making it an ideal solution to teach children to manage their pocket money safely.

Teens: how to choose your bank card

Networks, online banks and some specialized players compete in inventiveness to seduce 12-17 year olds. Beyond the cost, you must be vigilant on the services offered.

Posted on August 10, 2023 at 9:09 am

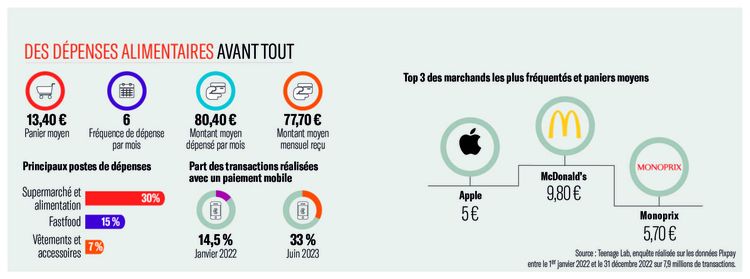

They write SMS in their own language (” tkt, g not courses ajd “, either ” worry, I am not going today ), Lie on their age to register on social networks and begin to find their “relous” parents. The 21st century teens are, like their parents at their age, in search of independence. On the finance side, it involves learning to manage its budget and the start of autonomy. Exit the piggy bank in the shape of a pig in which the parents slide some pieces or tickets as a pocket money. From now on, ” The bank card is a statutory object: young people are proud to leave it to pay for their snack when leaving college », Notes Caroline Ménager, co-founder of Pixpay, an app offering a bank card at 10-17 year olds.

Large choice

The choice is wide: parents can open an account to their teenagers in their bank. All networks as well as certain online banks offer minors an offer. And two specialized players, Kard and Pixpay, have developed services dedicated to young people. “” These apps were designed around the needs of children. Conversely, banks’ apps for minors are just a “lightened” variant of the classic version for adults », Summarizes Basile Duval, the spokesperson for the comparator of Panorabanques prices. On the price side, the offer is free in certain establishments such as BNP Paribas, Boursorama, Bred, La Banque Postale, Revolut or Société Générale, and costs up to 2.99 euros per month at Kard and Pixpay. “” Many banking networks are making an effort on prices, even offering a bonus of a few tens of euros when the account is opened to capture the children of their customers “, Complete Basile Duval.

Whatever the establishment chosen, teenagers have access to a card with systematic authorization: withdrawals or payments are only possible on condition that the account is sufficiently supplied. So there is no risk of overdraft. The child’s account can be powered by transfer or by bank card, this solution having the advantage of always being instantaneous. The teen can then spend the amount paid immediately. The parent keeps his hand on the child’s account via his own app: he visualizes all his teenagers and can configure the use of the card. For example, this is to block certain features such as withdrawals to the distributor, operations abroad or online payment. In this case, in this case, to buy a new game for PlayStation without requesting the authorization of dad or mom. “” This makes it possible to arouse dialogue. If he agrees, the parent instantly unlocks online purchases via his app while the child makes his “Indicates Laure Berkovits, head of the youth market at SG.

Evolutionary features

The use of these features evolves, of course, over time because the needs and risks of budgetary skid are not the same at 12 and 17 years old. Note, moreover, that certain types of traders are blocked by the apps themselves such as tobacco offices or game sites and online Paris. What reassure parents. Finally, most actors give access to mobile payment. Apple Pay is accessible from 13 years old and Google Pay from 16 years old. “” 33 % of our users use mobile payment, it is a real plebiscite “Confirms Caroline Ménager de Pixpay.

Also, be sure to check the prices for ticket withdrawals before choosing an establishment. Because teenagers sometimes prefer to pay in cash rather than card in order to escape the “surveillance” of parents (” I see that you made a purchase in Franprix at 11am at the other end of the city. You didn’t have a math this morning ? »). As for payments in foreign currency abroad, they are most often paid, except at Boursorama, my French Bank, Revolut, SG and Kard for its comfort version. To check before sending your teenager on a school trip to London.

Pallet of investments

Beyond the bank card, network banks have an additional asset to argue. They all offer a palette of placements accessible to young people, ranging from booklet A to the youth booklet (reserved for 12-25 year olds) via the housing savings plan (PEL) and life insurance. “” This allows the teenager to learn to put money aside for a future need. Without the risk of seeing him spend everything as he pleases since the teenager cannot make himself the transfer between his account and his savings book, this always goes through the parent “Underlines Elodie Doll, Banxup product manager, the offer dedicated to 10-17 year olds at SG, who specifies that 80 % of banxup holders hold a savings product (booklet A or life insurance).

Conversely, Kard, my French Bank, Nickel, Pixpay and Revolut do not give access to investments. “” We are thinking of offering at the end of 2023-early 2024 a savings book for teens and their parents as well as, for young people who have become adults, investment education modules, both in shares and in cryptocurrencies », Advocals Scott Gordon, the co-founder of Kard. This app, launched in 2019, continues to address its young customers after their majority, but their parent no longer has access to the account, unless specific permission by the young. For its part, Pixpay also continues to address its customers after their majority, and has set up partnerships with a handful of bank to allow them to open an account in an establishment without necessarily choosing that of Papa-Maman.

Our videos

Stock Exchange: What are the impacts of interest rates on shares, bonds, real estate ?

The Fed has decided to mark a break in the rates. What does it change for the scholarship ? What are the consequences on monetary and bond markets ? Where real estate prices go in this context ? François Monnier, editorial director of Investing and Sarah Thirion, head of action research at TP ICAP answered questions from Cédric Decoeur on BFM Business.

Bank card for minors & teens: I crack or not ?

” Mom ? You didn’t give me my pocket money this month “,” Dad, you can give me 10 euros to buy my magazines ? “,” Come on, we said we would take a subscription to Spotify … “. These are the kind of sentences that we often hear in the mouths of adolescents … Do you know that there is a simple way to answer these questions, or even avoid them: the bank card for minors. Pixpay gives you the pipe.

What is a bank card can bring to a teenager (and her parents) ?

Since the appearance of neobanques – these fintechs which offer digitalized and accessible financial services for the customer – the offers of bank card adapted to the uses of young people (and the needs of parents) flourish. And for good reason, they offer many advantages to minors.

The assets of the teen bank card on the parents’ side

As we know, the central point for a parent is the security. With a teen bank card, especially at Pixpay, no risk of exceeding for customers, because the overdraft is not allowed for the young person regardless of his age, it is also possible to set up limits on the amounts or the Frequency, block precise merchants or types of merchants (bars, tobacco, online casino, etc.) or purchases on the Internet for example, and to follow the expenses of your adolescent in real time.

Small daily practical bonus: the parent can program Automatic transfers (or do them in instantaneous) to give pocket money to your children: hop, we reduce his mental load ! (Practical if it is abroad, be careful to check the costs in and excluding the euro zone.))

The minor bank card is also a tool pedagogic Perfect for opening the discussion around money (sometimes a little sensitive subject) with your teenager and to start his financial education: how to manage a budget, compare prices in store or online, save to buy a product later , etc. By fixing rules together, you give a autonomy and independence that empower your teenager, and you show your trust towards him.

The advantages of a bank card for teens

On the youth side (who is advised not to exhaust their parents too much), having a bank card avoids claiming your pocket money from your parents (because yes, they often forget), allows you to buy a crescent or chips Quiet when leaving college or high school, to shop on Vinted (and even to recover the money from the Vinted wallet directly on his Pixpay card !), or even not to have to drag 150 coins on yourself and to no longer ask your parents as soon as you want to buy on the Internet … it also limits the risk of loss or flight. And then having your own CB is stylish.

These cards for children are interesting because they allow you to pay everywhere, like adults. However, they can be very expensive for parents. The note can increase by adding all the costs: the purchase of the prepaid card can go up to € 50, you must add the payment of an annual subscription of a few tens of euros per customer as well as costs of Refill billed up to 10%.

At what age can we have a bank card ?

In France, the legal age to have a bank card depends on the type of card you want to obtain. Regarding a debit card, you must be at least 13 years old to be able to obtain a. However, for a credit card, you must be 18 years of age or over and be able to prove sufficient income. It is important to remember that even if you meet these criteria, the bank may decide not to grant you a credit card. At Pixpay, we are here to help you find the solution that best suits your needs, whatever your age. We offer children’s payment cards, designed for young users and supervised by a parent or a tutor, in order to allow them to learn to manage their money safely.

What precautions should be taken ?

Before taking out a minor bank account with a card, take the time to study these few important points as a customer.

Choose the right offer

What are the needs of your adolescent: use your card for cash withdrawals only or payments ? occasionally or permanently ? Is this your bank’s offer would suit him ? You have to set up specific ceilings or authorizations via an application ? Is registration free ? Whether it is a withdrawal card, a prepaid card or a debit card, a visa or a mastercard, there are offers adapted to each use. In any case, opt for a systematic authorization card to avoid unpleasant surprises. Indeed it is the card that offers the most security for the minor.

Set limits and adapt features according to age and maturity

Even if you have confidence in your child, it is better to be careful, especially at the beginning of the use of his bank card. Many offers offer free services to configure a whole bunch of cursors or ceilings For our young people: maximum amount of withdrawals and payments, monthly sum not to be exceeded, blocking of merchants, deactivation of contactless payment … Parents thus keep control and children autonomy. Of course, these characteristics will adapt over time, depending on the evolution of minors and their budget management.

Follow his expenses and give him the keys to manage his money well

It seems that confidence does not exclude control. This is why it is possible to to consult The operations carried out by your teenager. It is not a question of spying on your child, but rather of discussing with him possible slippages (which would not fall for this pack of 100 packs of candy candy …). Certain offers only allow you to follow the balance while others (like Pixpay) have developed applications “Mirror” (one for the teenager, one for the parents) to view the details of each of the child’s transactions and help him in his learning and his management by setting limits (ceilings, prohibited merchants, etc.)).

Most applications also make it possible to classify expenses by categories (shopping, cinema, fast food, etc.): a good tool for analyze and adjust your expenses. In addition, you can configure automatic savings, ideal for teening your teenager to manage his pocket money: new pair of sneakers, Bluetooth helmet, etc.

Types of minor payment cards

Before requesting your payment card, it is necessary to know the different possibilities available to you and your teenager. Indeed, there are different types of payment cards between which you can choose the one that suits you best.

ATM card

The withdrawal card removes money from automatic distributors. As its name suggests, it is only possible to withdraw money, because it does not allow payments to traders or on the Internet. Generally, parents can choose a weekly withdrawal ceiling to limit its use;

Payment card or debit card

We group under the name “Payment Card” the cards with systematic authorization and prepaid cards. The same as that of parents, often associated with their accounts, you can withdraw money and pay for store or online purchases and even abroad.

Prepaid bank card

This card is not associated with a bank account. The prepaid bank card is a rechargeable card. It is often at systematic authorization and makes it possible to make purchases or withdrawals after an automatic and systematic verification of the provision available on the deposit account. This is the only card that does not require a bank account: it simply debits a payment account. Please note, recharging costs are sometimes high (between 1 % and 10 % of the transaction).

Systematic authorization card

The systematic authorization card remains the same as the prepaid card, except that the payment terminal depends on the balance of the account in real time. If the flow is insufficient, then the transactions cannot be carried out. In addition, certain payment terminals are likely to refuse your card even if it is supplied, in particular if they cannot perform the balance before the transaction. This is the case for service stations, telepected, parking lots or for car rentals.

Credit card

The credit card is a type of bank card, presenting itself as a reserve of permanent money. For payment, you can employ this credit or pay cash. The purchase made by credit card is specially dedicated to adults. You will therefore not be able to benefit from it for your child.

Delayed flow or immediate flow ?

You should know that when choosing these cards, you must also choose between the flow option, either immediate or delayed. In the first case, the flow of your transaction is carried out immediately on your account, even if the transaction does not necessarily appear instantly on your bank account. On the other hand, transactions are only debited at the end of the month for the delayed debit card.

How to have a bank card being a minor ?

If you are a young person and want to have a bank card, do not worry, there are several options. Here’s how to have a bank card being a minor:

How to have a bank card from 10 years old ?

If you are between 10 and 11 years old, you can get a children’s bank card. This card is linked to a bank account opened by a legal representative, generally a parent. The card is limited to a predefined amount and does not allow you to be discovered, making it an ideal solution to teach children to manage their pocket money safely.

How to have a bank card between 12 years and 14 years old ?

For young people aged 12 to 14, some banks can issue a bank card dedicated to minors, which is linked to a bank account opened by a legal representative. This card can be used for online and store purchases, but it is subject to amounts of amount and expenditure ceiling.

How to have a bank card between 15 years and 17 years old ?

If you are between 15 and 17 years old, you can open a bank account for minors with the authorization of a legal representative. Some banks can also issue a credit card for young people, under certain conditions. It is important to understand the terms and conditions related to the use of this credit card to avoid unpleasant surprises.

How a bank card intended for minors works ?

These bank cards, dedicated to teens, are generally accompanied by reinforced security for the minor: supply by parents, alert purchase, spending history, no discovery possible, etc. And offer many features: simplicity of opening, scheduled distribution, instant operations, personalization card, etc.

Finally, the cost varies according to the banking establishment, but it is quite high in traditional banks while the neobancs offer reduced costs, sometimes free depending on operations and areas, and transparent with more services. At Pixpay, it’s simple, the monthly subscription costs € 2.99 per month and per card, all inclusive and without commitment. A mastercard with systematic authorization and in addition two applications to teach it the management of a budget regardless of its age !

How is the Pixpay card different from that of traditional banks ?

First, Pixpay is not a bank. OUR assignment, It is to offer a bank card and a mobile application specially designed for teens and their parents, not to sell savings products, credit or insurance for customers.

Then, the teen bank card developed by Pixpay offers many advantages and advantages compared to traditional banks:

- The subscription is simple, fast and 100 % digital, No need to go to an agency;

- A mobile app for the teenager and one for his parents, for better follow -up;

- Everything (or almost) is configurable In real time, directly from the application, no blabla or paperwork;

- Possibility to send money in instant On the teenager’s bank card, no need to wait 2 days after a transfer;

- Cashback program Pix & Love, To be reimbursed up to 10 % of its expenses with partner brands appreciated by teenagers: Undiz, Cinemas Pathé Gaumont, Citadium, Sofoot Club, Back Mark, Ornikar, Kartable, etc. ;

- Creation of prize pools to save easily and set aside money to buy the new pair of sneakers, a connected watch or prepare a common gift for a birthday for example. You can even invite relatives to participate and it is free: no commission is taken from the kitty;

- Possible payments with Apple Pay or Google Pay in addition to the Mastercard payment card;

- No costs in the euro zone, a practice for school trips abroad;

- And many others to discover !

Without forgetting that with the Pixpay teen bank card, no need to change the bank for the parent, it is just connected to its current account, and it is compatible with all banking establishments ! (In addition the shipping of the card is free !))

- Parents

- FUNCTIONS> 1 card + 2 apps

- FUNCTIONS> Financial education

- Features> Safety

- Features> Customizable cards

- Prices

- Notice

- Contact

- Our vision

- Dream on by Pixpay

- Faq

- Blog

- Press

- The teenage lab by pixpay

- Join us

- We recruit !

- Banks for teenagers

- Bank accounts for teens

- Pocket money for teens

- Bank card for teens