Standard card, Premium bank card | Orange Bank

Premium card

N ° 1 of banks for individuals in France. Orange Bank ranking from the Trustpilot France ranking, Bank category in the private sector at 02/14/2023 capable of development.

Standard card at 0 €/month

Certain banks may pay costs during payments or withdrawals from their automatic distributors; They must in principle inform you by any means before the operation. These costs remain at your expense. Conversion to the Mastercard exchange rate, without additional commission from Orange Bank.

Standard card insurance

Insurance included in the standard card subscribed to Mutuaide Assistance (its capital of 12,558,240 € fully paid – 383 974 086 RCS Bobigny – 126 rue de la Piazza – CS 20010 – 93196 Noisy le Grand Cedex) and Groupama Paris Val de Loire (Regional Caisse d’Assurance Mutuelles Agricoles Paris Val de Loire – Mutual insurance company – 382 285 260 RCS Nanterre – 1 bis avenue du Docteur Ténine – 92184 Antony Cedex), companies governed by the insurance code, subject to the Prudential control authority and resolution located 4, place de Budapest – CS 92459 – 75436 Paris Cedex 09. Guarantees within the limits and conditions of the information notice.

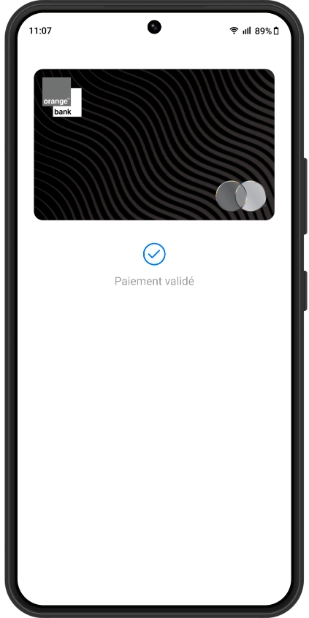

Contactless payment

See conditions and ceilings on the Orange Bank app and in contractual documentation.

Account holding fees

Subject to holders of the standard card to make at least 1 payment or withdrawal/month with their Orange Bank mobile card or mobile payment. Otherwise, € 5 account holding fees. See conditions in contractual documentation.

.jpg)

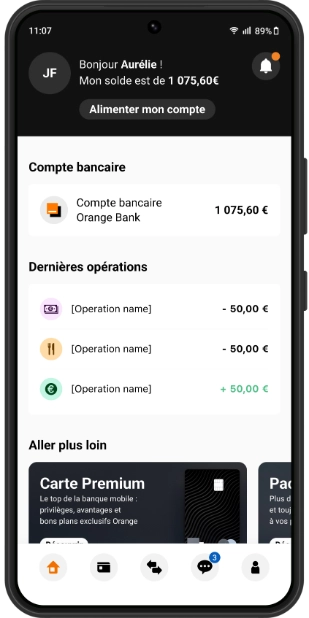

An app to manage everything

�� Orange Bank elected Best Banking App 2022 by Moneyvox

�� Orange Bank elected Best Banking App 2022 by Moneyvox

Updated balance in real time

Updated balance in real time

Notifications for all your operations

Notifications for all your operations

Contactless payment by card and mobile with Google Pay and Apple Pay

Contactless payment by card and mobile with Google Pay and Apple Pay

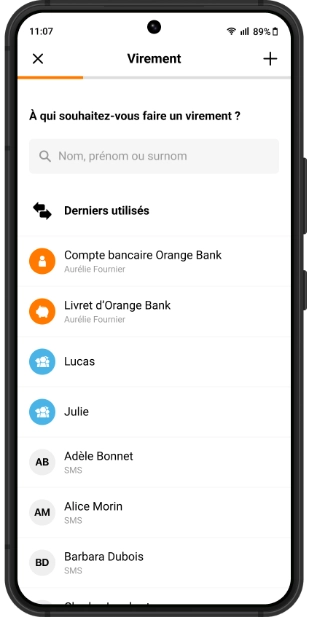

Shipping and requesting money by SMS

Shipping and requesting money by SMS

Personalization of your card code

Personalization of your card code

Instant blocking and unlocking of your card

Instant blocking and unlocking of your card

Terms

App

Orange Bank application to download on the mobile, available only on Android and iOS, with compatible mobile equipment (Android 5 or higher with a version of the Orange Bank application greater than or equal to 3.3.0 and a Google, or iPhone 6 or higher account with iOS 10 or higher and an iCloud account).

Trustpilot review

N ° 1 of banks for individuals in France. Orange Bank ranking from the Trustpilot France ranking, Bank category in the private sector at 02/14/2023 capable of development.

Instant balance

Subject to conditions and subject to monetic merchant rules. Balance given as an indication. See Conditions on Orangebank.Fr.

Contactless payment

See conditions and ceilings on the Orange Bank app and in contractual documentation.

Mobile payment

Mobile payment subject to conditions, reserved for holders of a bank card “new Orange Bank” offer with compatible mobile equipment (Android 5 or higher with a version of the Orange Bank application greater than or equal to 3.3.0 and a Google, or iPhone 6 or higher account with iOS 10 or higher and an iCloud account).

Android, Google and Google Pay are registered trademarks of Google Inc. Apple, Apple Pay, Apple Wallet, Apple Watch, App Store, iCloud, iOS, iPhone, Touch ID and Face ID are registered trademarks. Apple Pay works with the iPhone 6 (or higher) in store, within apps and on websites in Safari; With the Apple Watch in store and within the apps (requires an iPhone 6 or higher). To obtain the list of devices compatible with Apple Pay, consult support.Apple.com/km207105.

See information on Orangebank.Fr.

Apple Pay

Apple Pay is a registered trademark of Apple Inc.

Google Pay

Google Pay is a registered trademark of Google Inc.

SMS application

Orange Bank sends an SMS to the payer at the customer’s request to invite him to make a payment for the benefit of the latter on an Orange Bank space. See conditions in contractual documentation.

Blocking and unlocking of the card

Temporary card blocking and/or mobile payment. Unlock by the card holder. If permanent loss, necessary opposition. See Conditions on Orangebank.Fr

Premium card

Paid card issued after Orange Bank agreement. See conditions and prices in force in contractual documentation.

.jpg)

Free payments and withdrawals all over the world

Premium insurance for your purchases and travel

5% refunded on purchases and orange invoices

Priority access to customer service

Higher withdrawal and payments ceilings

Orange Bank savings book at 2.5% preferential rate

Terms

Free payments and withdrawals abroad

Certain banks may pay costs during payments or withdrawals from their automatic distributors; They must in principle inform you by any means before the operation. These costs remain at your expense. Conversion to the Mastercard exchange rate, without additional commission from Orange Bank.

Premium insurance

Insurance subscribed to Mutuaide Assistance (its capital of 12,558,240 € entirely paid – 383 974 086 RCS Bobigny – 126 rue de la Piazza – CS 20010 – 93196 Noisy le Grand Cedex) and French Legal Protection Society (SA in Capital From 2,216,500 euros – 321 776 775 RCS Paris – 8-10 rue d’Astorg – 75008 Paris), companies governed by the insurance code, subject to the prudential control authority and resolution located 4, place de Budapest – CS 92459 – 75436 Paris Cedex 09. Guarantees within the limits and conditions of the information notice.

Purchasing and invoices cashback

For purchases of orange equipment paid with your Premium Orange Bank card (mobile payment included) or, if you hold the Premium pack, with the Plus card or your child’s mobile payment (age condition): 5 % of TTC amount of these purchases reimbursed on the bank account debited, at the latest during the real debit of the purchase, up to € 100 / purchase made in stores or on Orange websites in mainland France and Reunion / Mayotte (telephone/internet subscriptions and excluded prepaid offers). Advantage valid from 02/02/23, susceptible to modifications. More info in operating methods on Orangebank.fr (cashback = refund).

If you hold the Premium Orange Bank card, 5% of the amount of orange invoices (Internet or Mobile) in France (except Saint-Martin and Saint-Barthélemy) taken from your New Orange Bank Bank account are reimbursed in The limit of € 3 per month. Payment on your Orange Bank bank account during the real speed of the amount of orange invoices on your account. Advantage likely to modify, at any time, at the initiative of Orange Bank. More info in operating methods on Orangebank.Fr. (cashback = refund).

Premium card payment ceilings

Within the limits proposed by Orange Bank, after analysis of your file.

Savings rate

Gross annual rate on 01/05/2023, before income tax and social security contributions, likely to be modified.

As a reminder :

• gross annual rate from February 16, 2023 to March 31, 2023: standard rate: 0.6 %, preferential rate with Premium card: 1.5 % and preferential rate with Premium Pack: 2 %;

• gross annual rate from April 01 to April 30: standard rate: 1.5 %, preferential rate with Premium card: 2 % and preferential rate with Premium Pack: 2.5 %

Preferential rate

The preferential interest rate will only apply if you always hold your Premium card or your Premium Pack on December 31. The interests of all civilian fifteen of the past year (from February 16, 2023) will then be calculated at the preferential rate in force during each of these fortnight.

If you close your premium pack during the year while retaining your Premium card on December 31, the interests of all civilian fifteen of the past year (from February 16, 2023) will be calculated at the preferential rate of holders of a premium map, in force during each of these fortnight.

If you close your premium card (per unit or with your premium pack) during the year, the interests of all civilian fifteen of the past year will be calculated at the standard rate in force during each of these fortnight.

If you close your account on booklet during the year (or at the initiative of the bank according to the terms provided in the general conditions of the Orange Bank booklet), the interests of all civilian fifteen of the current year will be calculated at the end at the standard rate in force during each of these fortnight.