Should we ensure when we circulate by bike? |, Electric bike insurance: what you need to know before choosing – Numerama

Electric bike insurance: what you need to know before choosing

With the legal protection guarantee, your insurer will defend you before the courts in the event of a dispute linked to an accident.

Should we ensure when you circulate by bike ?

It depends on the type of bicycle you use (classic bike or electric assistance bike – VAE), its power and its speed.

Answer successive questions and answers will appear automatically

Bike without electric assistance

It is not compulsory to take out insurance to circulate with a bicycle. Nevertheless, you must repair the damage you are talking about to others. You can subscribe to the warranty public liability for that. To cover your own damage and your bicycle, you can subscribe to the accident guarantee . It can be completed with the warranty Flight and damage to cycling or the warranty juridic protection .

Civil liability guarantee

Civil liability insurance covers the damage you can cause to others, including when using a bicycle.

It is notably included in multi -risk home contracts. It also covers family members who live under your roof, especially children.

If you do not have a home multi -risk contract, you can take out a contract with the warranty public liability with an insurer.

If you cause an accident by driving your bike and you have no insurance public liability , You will have to personally assume the repair of the damage you have generated.

Accident guarantee

If, as a cyclist, you are injured in an accident involving a motor vehicle (car, scooter. ), you will be compensated by the insurer of the accident manager.

This compensation fully covers your body damage, unless you have committed an inexcusable fault: Titlecontent .

Your material damage will only be compensated for the circumstances of the accident.

If there is no person responsible for the accident, the management of your damage will depend on your personal insurance.

You can take out insurance Individual accident which may include the following points:

- Daily allowances in the event of a work stoppage

- Care reimbursement

- Payment of capital in the event of disability or death

Verde and damage to cycling

Compensation for the theft of a bicycle or degradations is low in insurance contracts classic .

To guarantee this risk, you can take out a specific contract, such as a Multirisque-Bicyclette . It guarantees theft and damage to your bicycle as a result of an accident or a fall.

It is important to verify the contract clauses, because certain contracts exclude the guarantee of a bicycle whose value exceeds a certain amount.

Legal protection guarantee

With the legal protection guarantee, your insurer will defend you before the courts in the event of a dispute linked to an accident.

He will take care of the necessary procedures and costs for you to be compensated if you are entitled to it.

This guarantee is useful in the event of an accident, if the author of the damage does not want to recognize his responsibility.

VAE whose power does not exceed 250 W and whose speed does not exceed 25 km/h

Insurance is not compulsory for bicycle with electric assistance whose power does not exceed 250 W and whose assistance is not activated beyond 25km/h.

Nevertheless, you must repair the damage you are talking about to others. You can subscribe to the warranty public liability for that. To cover your own damage and your bicycle, you can subscribe to the accident guarantee . It can be completed with other guarantees.

Civil liability guarantee

Civil liability insurance covers the damage you can cause to others, including when using a bicycle.

It is notably included in multi -risk home contracts. It also covers family members who live under your roof, especially children.

If you do not have a home multi -risk contract, you can take out a contract with the warranty public liability with an insurer.

Accident guarantee

If, as a cyclist, you are injured in an accident involving a motor vehicle (car, scooter. ), you will be compensated by the insurer of the accident manager.

This compensation fully covers your body damage, unless you have committed an inexcusable fault: Titlecontent .

Your material damage will only be compensated for the circumstances of the accident.

If there is no person responsible for the accident, the management of your damage will depend on your personal insurance.

You can take out insurance Individual accident which may include the following points:

- Daily allowances in the event of a work stoppage

- Care reimbursement

- Payment of capital in the event of disability or death

Verde and damage to cycling

Compensation for the theft of a bicycle or degradations is low in insurance contracts classic .

To guarantee this risk, you can take out a specific contract, such as a Multirisque-Bicyclette , which guarantees theft and damage to your bicycle in particular as a result of an accident or a fall.

It is important to verify the contract clauses, because certain contracts exclude the guarantee of a VAE.

Legal protection guarantee

With the legal protection guarantee, your insurer will defend you before the courts in the event of a dispute linked to an accident.

He will take care of the necessary procedures and costs for you to be compensated if you are entitled to it.

This guarantee is useful in the event of an accident, if the author of the damage does not want to recognize his responsibility.

VAE whose power exceeds 250W or whose speed exceeds 25 km/h

Insurance is compulsory for VAE whose power exceeds 250W or whose speed exceeds 25 km/h, because it is assimilated to a motorcycle. The insurance to be taken out is the same as for a motorcycle.

Laws and references

- 2002/24/EC directive of March 18, 2002 relating to the reception of two or three -wheel motor vehicles

- Highway Code: article R311-1 Definition of different categories of vehicles

- Highway Code: Articles L324-1 and L324-2 Rules relating to the insurance obligation

Electric bike insurance: what you need to know before choosing

Theft and accident are the two main risks to which you expose yourself when buying an electric bike. Although it is not always compulsory to insure your electric bike, cover yourself against the flight or breakage of your VAE, and of course in the event of an accident, remains a good idea. So when you have to subscribe to electric bicycle insurance ? How to choose your insurer ? Numerama takes stock of what you need to know before choosing your electric bike insurance.

Faced with a constantly increasing number of cyclists, local development policies have led to the construction of new cycle paths. This personal means of transport is democratized, is increasingly sure and the sale of electric assistance bikes explodes. In this context of transition to soft mobility, perhaps you too are thinking of swapping your passage of transport against a bicycle.

If the choice of your new frame should not be left to chance, it is important to devote a reasonable budget to it and consistent with the offer. Today, a good VAE costs between 1,500 and 3,000 €. Beyond that, we enter the high end. Below, not sure that the experience can be satisfactory. If you still hesitate to invest this amount in a bike that you are afraid of using only a few months, the electric bike rental will give you a fairly good overview at a lower cost. It is important that you are comfortable with your bike.

But if you have opted for a brand new VAE, the question of insurance arises. Discover in this guide, everything you need to know to choose your electric bike insurance.

Should we ensure an electric bike ?

You must first know that ensuring a bicycle is not compulsory. But an electric bike is considered a simple bike ? Are all electric bikes housed in the same brand ?

There are two types of electric bikes:

- Electric assistance bikes, abbreviated VAE;

- Speedbikes who are faster motorized bikes.

If you are not a big bicycle enthusiast or you have no great distances to go, it is a safe bet that the speedbike does not concern you.

Insurance for a classic VAE

It is not compulsory to provide an electric bike.

All electric assistance bikes have a power engine not exceeding 250 W. Their speed does not exceed 25 km/h, beyond, the assistance ceases to operate. As soon as the engine displays a higher power or a speed exceeding 25 km/h, insurance (and a whole bunch of things) becomes compulsory.

Not really about a motorized two-wheeler, insofar as if you do not pedal, the bicycle will not advance alone at the power of the engine, ensuring a VAE is optional.

Insurance for a speedbike

Speedbike, with an engine exceeding 250 W of power and capable of driving at more than 25 km/h, is considered a real moped in the eyes of the law. Insurance for a speedbike becomes compulsory in the same way as motorized two-wheelers such as scooters and motorcycles.

Why ensure your VAE if it is not compulsory ?

Several reasons motivate the use of insurance for its VAE: the management of the repatriation of an injured bicycle towards a repair workshop, the presence of a civil liability, especially in the event of bodily damage, but the main thing remains protection of your electric cycle against theft. Several criteria will define your real need and the degree of coverage required:

- your place of residence;

- the use you make of your cycle;

- the possibility of park your bike in a secure place in your workplace.

If you know that you will only use your bike between a protected bike garage at home and the bike garage also protected from your workplace, flight insurance may not be necessary. A good GPS tracker in addition to solid anti -thefts should be enough. At home, do not hesitate to verify that your multi -risk home insurance also covers the common areas: very often, theft of a bicycle in your garage is covered, remains to be seen the cost of a possible deductible.

But, if you will often hang your bike on the street, until you leave it out of several hours, there is no doubt that insurance will soothe your mind. No honest bicycle seller will tell you that this or that anti -theft is infallible: the best anti -thefts can discourage an opportunistic thief, but they will not resist the most advanced techniques, going as far as the use of discuses. Each year, several thousand bikes are stolen from their owners, powerless.

What is the cost of an electric assistance bike insurance ?

For the year, a flight+breakage bicycle insurance will cost a bit of 300 euros on average for a high -end electric bike worth € 3,000.

The price for a more entry -level bike at € 1,500 is between 150 and 200 euros per year for good coverage.

As for conventional car insurance, the prices of your contributions will depend on the model of your VAE, the guarantees chosen in your insurance contract and sometimes even your place of residential.

Which electric bike insurance ?

The first thing to do is to find out about your insurer to find out if he offers something for electrical cycles. Some insurances have arrangements which, taken in packs with home insurance, could save you a few euros. If the programs are not suitable (do not take motorized two-wheeled insurance, for example), there are several specialized insurance in France.

Your attention must mainly focus on the presence of civil liability insurance, which will support bodily and material damage, and protection against breakage and theft. Exclusions to contracts are decisive and must be read with caution to avoid any unpleasant surprises in the event of a disaster.

Civil liability insurance

Often included in your home insurance contract, civil liability insurance (RC), could be the only compulsory insurance when driving an electric bike.

Heavier than a conventional bike, a VA weighs on average more than twenty kilos. Accidents are not necessarily more numerous, but can hurt. The law obliges you to take care of damage, bodily and materials, of which you are the author. In other words, if you are responsible for an accident, it is up to you to pay. Civil liability insurance is used to cover repairs or health costs caused by the accident of which you are the guilty.

Casse and flight insurance

These are most certainly the reasons that encourage you to consider the assurance of your VAE. Insurers know this and sometimes end their insurance contracts of exclusions clauses canceling any care in the event of breakage or theft. These paragraphs, often written in very small, clarify the conditions for taking care of insurance.

Effectively ensure the flight

Several criteria are to be checked when subscribing to a flight warranty:

- compensation ceilings;

- the number of fixed points and anti -thefts to be respected during parking in town;

- the list of approved anti -thefts recognized by the insurer.

This non -exhaustive list is only a basis allowing you to guide your choice. Some insurances will require the evidence of the flight, such as photos of a cut anti -theft or a door, when others will only take care of flights with break -in or attack.

Also be careful to keep all of your purchasing documents concerning the safety of your bicycle. Often it is best to buy anti -thefts before any subscription.

The manufacturer Vanmoof has become known for its flight insurance: either your bike is recovered by the rescuer team, or Vanmoof offers you another. You can choose flight insurance, breakage (€ 290, 3 years) or both (€ 490, 3 years). Angell also offers insurance of this type.

Obsolete rate and franchise

Other words specific to the vocabulary of insurance that should be explained.

- The vertical rate actually represents the wear of the property over time. The more time passes, the more your bike waste its value, the less you will be compensated in the event of a claim. Often set at 1 % per month, the vertical rate will be used to calculate the discount, that is to say the amount that we will subtract at the price of the new bikes.

During your comparative offers for tenders, do not stop at the monthly or annual amount to pay. Be sure to consider these two clauses which can drastically vary the amount of your compensation. Sometimes too attractive offers reveal overly high levels of dilapidation and deductibles.

What are the best online electric bike insurance ?

After questioning cycling customers and specialized sellers who were able to obtain opinions from their customers, we have selected some insurances that hold the road. All offer different formulas, with different options and in all cases, read the specificities of contracts.

Electric bike insurance

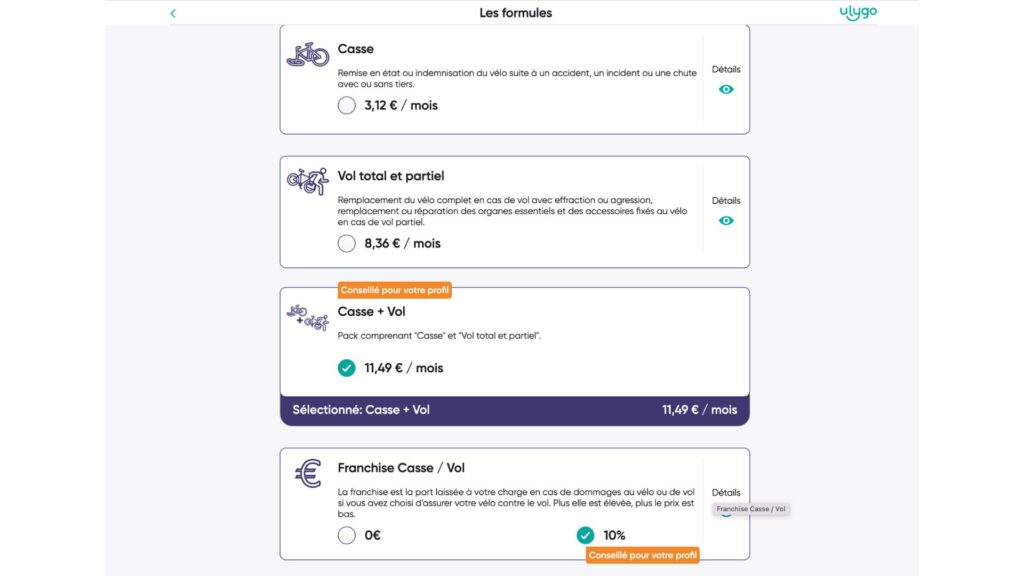

Ulygo

Ulygo is a 100 % online insurance specialized in EDPMs, motorized personal travel machines, such as electric bikes and scooters. For a new electric bicycle worth € 2,000, insurance costs € 172.61 per year and covers breakage and flight with a franchise at 0 €. Ulygo leaves the choice of a monthly payment over 10 months after the payment of a first increased contribution. As with many insurance, photos and proofs of purchases will be requested from the subscription. Ulygo stands out from its competitors by taking care of breakage and “partial” flight. The insurer also offers to complete your home insurance to avoid paying double services while covering all cases of claim.

Cyclassur

This is a Vol+Casse Voyage insurance, which provides electric bikes or not. Its prices are average, namely € 280 per year for an electric bike at € 3,000. It is valid for a year, renewable twice, or 3 years maximum. Cyclassur does not provide a deductible in its flight warranty and reimburses you with. On the other hand, to benefit from it, you must secure your electric cycle with two street fixing points in large cities, a fixed point, in addition to a high -end anti -theft. She is the one that was the most cited for us for its effectiveness.

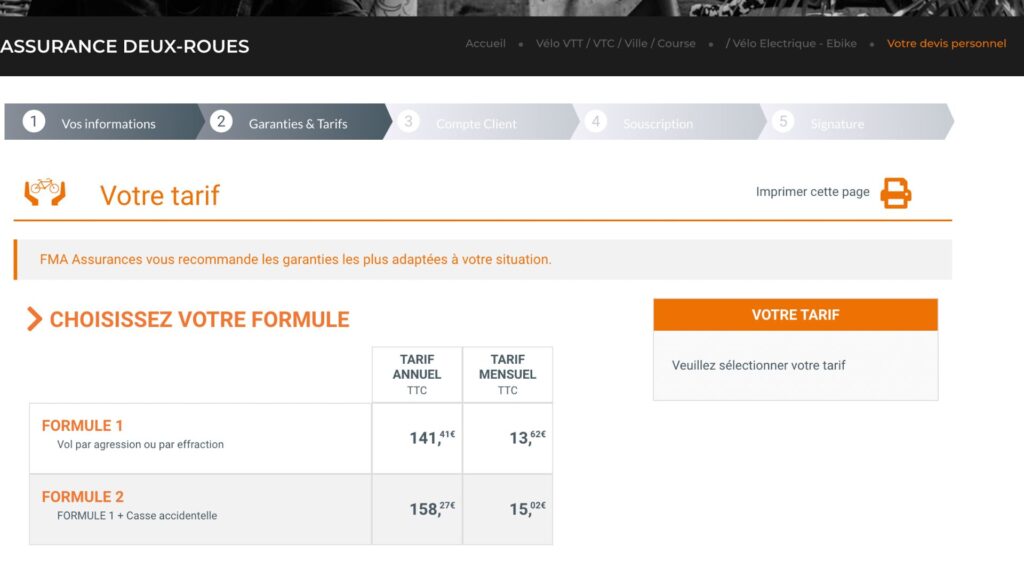

FMA

The FMA insurer offers specific insurance and has flight+breakage insurance for bikes. The prices are a little higher than Cyclassur (€ 330 for an electric bike at € 3,000, 10 %deductible), but it only requires an approved anti -theft and can be renewed up to 5 years.

AssurtonVelo

Flight insurance+Assurtonvélo breakage is average prices at 250 € per year for an electric bike of € 3,000. The guarantee against the flight is included with a 10 %deductible, provided you have your bike identified and attach it with an approved anti -theft. The contract is renewable up to 5 years.

Ffvélo

The French Cyclotourism Federation is a somewhat special case since you have to join it in order to be able to take advantage of its insurance – the price calculation is therefore variable. It has no duration limit and can provide old bikes flight+breakage (with a deductible linked to dilapidation, 8 % per year and up to 70 % maximum, in addition to the franchise of 100 € in case of theft).

Comparison table of the best bicycle insurance

| Electric bike insurance | Franchise | Anti -theft | Price /year for a VAE at 3,000 € | Duration | Documentation |

|---|---|---|---|---|---|

| Cyclassur | None | 2 including 1 approved | 280 € | 3 years | |

| FMA | 10 % | 1 approved | 330 € | 5 years | |

| AssurtonVelo | 10 % | 1 approved | 250 € | 5 years | |

| Ffvélo | 100 € | 1 | 214 € | Nc |

Vincent Sergère, cyclist, journalist for Frandroid and entrepreneur, helped us compile this data. Do not hesitate to report to us in the comment an insurance offer of which you are satisfied and which would not appear in this guide.

All questions around electric bicycle insurance

When to insure your VAE ?

The deadline to ensure its bike generally varies between 30 days and 60 days after purchase and all require a engraving or identification of the bicycle. Those which offer long -term subscriptions add 1 % per month of dilapidation to franchise. The anti -theft must most often be approved and bought before subscription.

How to engrave or identify your electric bike ?

There is a data bass listing the contact details of the owners of VAE having recorded their electrical cycle. This register, the FNUCI (unique national file of identified cycles), is accessible by the police services and allows:

- to more easily find the owner of a stolen bicycle;

- to check before purchase that the bicycle was not stolen;

- to dissuade thieves who will prefer to focus on a bike that is not identified.

Since 2021, the Transport Code has required traders to mark all new and used bikes with an identification number. It’s kind of the community license plate for cycles. The State has appointed the apic, the association for the promotion and identification of cycles as manager of this famous FNUCI file.

If you have not yet bought your bike, you only have to make sure that the seller correctly identifies the identification, or marking, of your bike. In accordance with one of the 7 approved operators, the merchant severe your bicycle, or permanently affixes a label with an identifier. It is up to the seller to fill the database with your contact details. You then receive by email access to your personal space on the apic website. You can then modify your contact details and mention the status of your bicycle: on sale, lost, stolen or in service if all goes well.

The marking is billed between 10 and 30 € by the merchant depending on the technique used.

If the purchase of your bike goes back before 2021, it is not too late to identify it. Ask an approved operator with proof of purchase of your bike, as well as your identity document. Proof of domicile may possibly be necessary.

List of approved identification operators:

- Bycicode;

- Paravol;

- Recobike;

- MFC;

- Auvrey Security;

- Decathlon;

- Starway.

What are the approved anti -thefts ?

Each insurer, if he requests an approved anti -theft, provides his list. Unsurprisingly, these are high -end models of the most famous manufacturers that are most often requested. On the other hand, it is a U or a chain. Above all, keep your cash receipts preciously which will act as proof with date of purchase, essential to operate insurance in the event of theft.

- Abuse : note 10/15 (example: Citychain granite 15/15 at 130 € or U 540 at 94 €)

- Kryptonite : note 6/10 (example: cryptolock 6/10 at 52 €)

- Onguard : note 60/100 (example: Onguard Brute 97/100 at 35 €)

- Decathlon : Uvelo 920

The anti -thefts approved by the French Federation of Bicycles users, or FUB, are generally also recognized by VAE insurance.

The future of Numerama is coming soon ! But before that, we need you. You have 3 minutes ? Answer our investigation