Shipping money via Paypal: how to avoid paying costs?, With Paypal, the transfer of money with relatives becomes free

With Paypal, the transfer of money with relatives becomes free

The transfer of money can be done via the Paypal website or directly on its application, revamped at the start of the year, by entering the mobile number or the email address of the recipient. The latter is notified by SMS or Email when he receives the money. He has the choice between credit his Paypal account or directly his bank account. A service that until then gave rise to a commission of 3.4 % and 25 cents of fixed costs. Gratuity only concerns personal transactions, with friends or members of the same family, and non -commercial (with act of purchase). If parents will be able to send money to their child who left for Erasmus, individuals doing business on Leboncoin cannot have recourse for free in Paypal. The seller will have to pay a commission, and the buyer will be covered by the paypal warranty.

Sending money via paypal: how to avoid paying costs ?

Paypal is an extremely practical service, for all web players led to remote transactions. On the other hand, the service has costs of levy costs, which few know. And that it would be wise to consult. Because indeed, there are several cases in which PayPal costs do not apply. And it is possible for everyone to avoid paying costs unnecessarily and thus save considerable money on transactions. Here’s how to do !

What are the cases in which Paypal costs apply ?

It is always wise to recall even if most of you know, that the opening or even the fence of a PayPal account is a completely free operation. As long as the transfer of funds concerns the European area, no fees is applied. The costs are starting to be billed, as soon as the transaction is made between the European area and the outside of it. If the transaction concerns two professionals, costs apply and it is systematically the seller of the service or the property or the service which supports these costs. On the other hand, when it is a transfer of money which is not substantial to a transaction of a commercial nature, such as the sending of money to a loved one is debited.

What is the amount of commissions on Paypal ?

Another case where paypal invoices costs, is when the buyer’s currency is different from that of the seller. Supply of the Paypal account using a bank card is considered by service to a commercial transaction. Commissions are then levied by Paypal from the amount credits. The commissions are inversely proportional to the amounts at stake. They range from 3.4 % increased by € 0.25 per transaction if the amount paid is less than € 2,500 to € 1.4 % more € 0.25 per transaction beyond € 100,000. For more details, everything is explained on this page.

How not to pay for paypal fees ? Avoid paying extra fees is possible !

The most used tip is to link the Paypal account to a bank card. And ensure that the Paypal account remains empty. It is then a question of making purchases, with the empty Paypal account, but by ensuring that the account assigned to the bank card is sufficiently supplied. It is interesting to note that with this configuration, there is no need to supply your Paypal account and therefore you will be able to avoid the costs related to the supply in question.

The tip of sending a loved one to a loved one: free on PayPal !

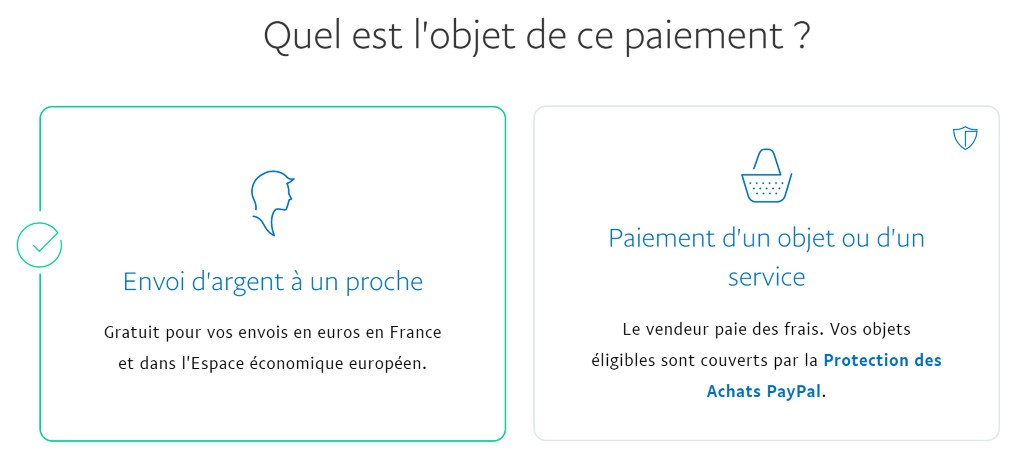

Paypal, does not charge any costs as soon as you declare that the transaction is a transfer of money to a loved one. You can systematically use this transfer method, you will then avoid paying money transfer fees. The transfer is considered to be a transfer a loved one as soon as it is made between two accounts of individuals both domiciled in the European space.

In order to perform this type of transfer, just go to the “Transfers” tab and select “Send money to a loved one”. It is only at this time when the transaction is free. However, we must ensure that this potion is not systematically used. The service has powerful algorithms, capable of quickly detecting fraud cases.

With Paypal, the transfer of money with relatives becomes free

The payments giant, which has 7.1 million customers active in France, wishes to increase their frequency of use. Paypal wants to go from twice a month on average twice a week.

Paypal intends to become essential in the daily life of the French. To achieve this, the online payment champion makes one of his historic services free, the transfer of money between individuals. “We can now send money for free to a loved one, whatever the credit card used or the amount, in France as well as throughout Europe,” explains Damien Périllat, Managing Director of Paypal France.

The transfer of money can be done via the Paypal website or directly on its application, revamped at the start of the year, by entering the mobile number or the email address of the recipient. The latter is notified by SMS or Email when he receives the money. He has the choice between credit his Paypal account or directly his bank account. A service that until then gave rise to a commission of 3.4 % and 25 cents of fixed costs. Gratuity only concerns personal transactions, with friends or members of the same family, and non -commercial (with act of purchase). If parents will be able to send money to their child who left for Erasmus, individuals doing business on Leboncoin cannot have recourse for free in Paypal. The seller will have to pay a commission, and the buyer will be covered by the paypal warranty.

The company, which this year crossed the 7 million active users’ mark in France, hopes to simplify the daily life of its users. “The money must be able to exchange in two clicks and not in two days, without it being necessary to scratch the 23 digits of his RIB,” adds Damien Perillat, who bets on a “halo effect”.

Paypal is not intended to become a bank, promises his boss. It does not prevent, with this new playground, the operator walks on their bedbags. He thus hopes to conquer new customers and increase the frequency of use of current. In charge since the end of 2014, his boss, Dan Schulman, does not hide his ambition: he wants to go from twice a month to. twice a week. France – which is the only market where this service is now free – is one of its priorities. “We are convinced that France is at a time of inflection on mobile payment”, continues the director general of Paypal.

In a two-digit e-commerce market (65 billion euros in turnover in 2015), mobile payments now represent 27 % of transactions. 45 million people today have a smartphone. “We are the best placed to capture these opportunities related to online payment,” says Damien Perillat.

Several start-ups, like Flooz.Me, hear a place for themselves in this segment of the transfer of money between individuals at no cost. Paypal relies on critical size in France and Europe (65 million active users) to make the difference.

The group, which has taken its independence a year ago, wants to continue to accelerate in a boom market. “We have been an ebay brand for years, which allowed us to move from the status of Californian start-up to that of Payments Giant,” comments Damien Perillat. Our independence allows us to go to the end of our mission, which is to democratize the way people pay “. Paypal has thus multiplied partnerships in recent months, with telecom operators (Vodafone. ) as with groupings like Visa and Mastercard.