Revolut review: The British neobank is made for you?, Revolut review (2022): My test after a year of use

Revolut review (2022): My test after a year of use

Packages development, growth And big business Also include advantages in many partners, including Google Ads or WeWork, as well as a priority support which can be very useful in the event of a glitch. Finally, in all subscriptions (including free), blue e-cards can be generated in order to share the account between the different members of a team.

Revolut review (2023): Is the British neobank made for you ?

Revolut is known worldwide and for good reason ! Over the years, she has kicked the anthill by coming to shake up mobile banks. Today it has more than 30 million customers around the world

With more than 10 years of experience in the market, Revolut is among the leaders of mobile banks. It has been able, in fact, to offer simple and effective solutions for travelers and other customers eager for autonomy. But is it enough to stand out from the competition ? What really it really ? Here is our review on Revolut.

- No income conditions

- A professional account open to all companies

- Ideal for travel abroad

- No credits and loans available

- No savings booklets

- Revolut presentation

- The time offer at Revolut

- Revolut Opinion: The current account

- Revolut Opinion: The joint account

- Revolut Opinion: The Youth Account

- Revolut Opinion: The pro account

- Revolut Opinion: Bank cards

- Revolut Opinion: Credits

- Revolut Opinion: Savings

- Revolut Opinion: The Stock Exchange

- Revolut: Clubic opinion

Revolut presentation

Created in 2014 by two friends passionate about travel, Nikolay Storonsky and Vlad Yatsenko. During their journeys, they could see that the costs of traditional banks were far too high and the services dedicated to their uninteresting trips. It is on this observation that they then decide to launch Revolut, a multidism solution without commissions.

Its 100 % mobile solution allows customers eager for autonomy and travelers to manage their finances anywhere in the world, without undergoing the exorbitant costs of traditional banks.

Unsurprisingly, the neobank managed to quickly win the hearts of consumers. Today it has more than 30 million customers around the world, including almost 2 million in France.

The time offer at Revolut

Like its competitor N26, the Revolut online bank does not offer a welcome bonus. Its offer being ultra-accessible and adapted to both individuals, professionals and the youngest, it does not see the interest of offering a premium to attract new customers. The quality of its services itself works.

However, the Revolut mobile bank offers various advantages for existing customers. The rewards, stays and shops categories allow you to receive cashback and discounts for each purchase made via the revolut card. While a gift category offers customers the possibility of making a donation to a cause that is close to their hearts.

Revolut Opinion: The current account

The opening of an account at Revolut

Revolut has the distinction of being available both on mobile and online. The current account is therefore very accessible and requires only a few steps to be able to access it.

It has the advantage of being available for everyone, without income conditions and without commitment. Depending on your needs and your profile, you can opt for a simplified formula that allows you to easily manage your daily money, opt for a formula that accompanies you during your trips, or choose a full account that helps you invest your money better and to make your capital grow.

What conditions to open a current account ?

As indicated, there are no income conditions or engagement to be able to open a current account at Revolut. However, certain conditions are still present:

- Be a natural and capable person;

- Have a phone that is compatible with the Revolut mobile application;

- Being older than 18 ;

- Have an address in France;

- Be able to justify your identity and home;

- Not to be based on the Banque de France, nor prohibited banking.

If you are eligible for all these points, you can choose from 5 different formulas. But one thing is certain, you will not have a multitude of documents to join. Revolut, it is above all efficiency and accessibility.

How to open a current account at Revolut ?

To open a current account at Revolut, nothing could be simpler:

- Go to the Revolut website and click on “Get a free account”;

- Scan the QR of the mobile application, if not already done;

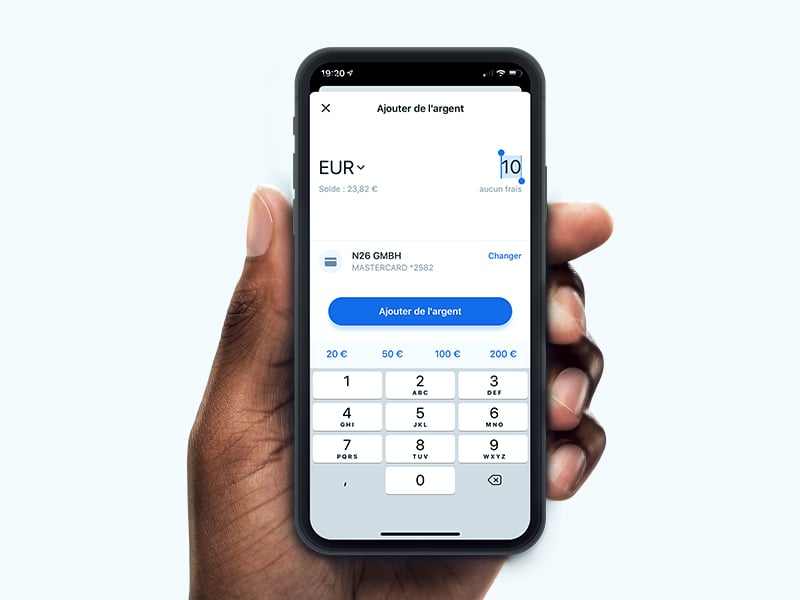

- Credit your € 10 account (this step can be postponed);

- Inform your personal information;

- Take a photo of your identity document to confirm your identity;

- Choose the offer you want from the four available;

- Order your Revolut bank card and voila.

In a few minutes, you open a current account on the mobile bank and you can use it. The bank card you have chosen will arrive in the coming days at the French address you have provided during registration.

The specifics of the current account at Revolut

Food

Again, Revolut advocates above all the efficiency and simplicity. To feed your account in complete freedom, several solutions are available to you:

- Wire Transfer : From another bank account, you can send money to your revolut account. You will have to choose the motto in which you wish to receive money.

- By credit card : On the mobile application, by pressing “adding money”, you can enter the figures from the bank card of your choice as well as the amount to pay.

- Via Apple Pay or Google Pay: On the mobile application, by pressing “adding money”, you can choose one of the two payment methods as well as the amount to pay.

- Via money from other revolut users: In the “Virements” section, you can select a contact with an “R” next to their name. They will then receive a notification to pay you money.

- Via linked accounts: If you already have a revolut account (joint, young or pro), you can simply click on “Transfer to Revolut” and choose the amount to be transferred.

The ceiling

As with all online and mobile banks, there is no ceiling in the current account. That is to say, it is possible to have several thousand euros on your account without ever being limited.

However, if you have more than 100,000 euros on your account, it is recommended to embark on investments or savings. The neobanque offers several services on this subject.

The costs applied

The mobile bank has no additional hidden fees. The entire revolut services is included in the different offers offered.

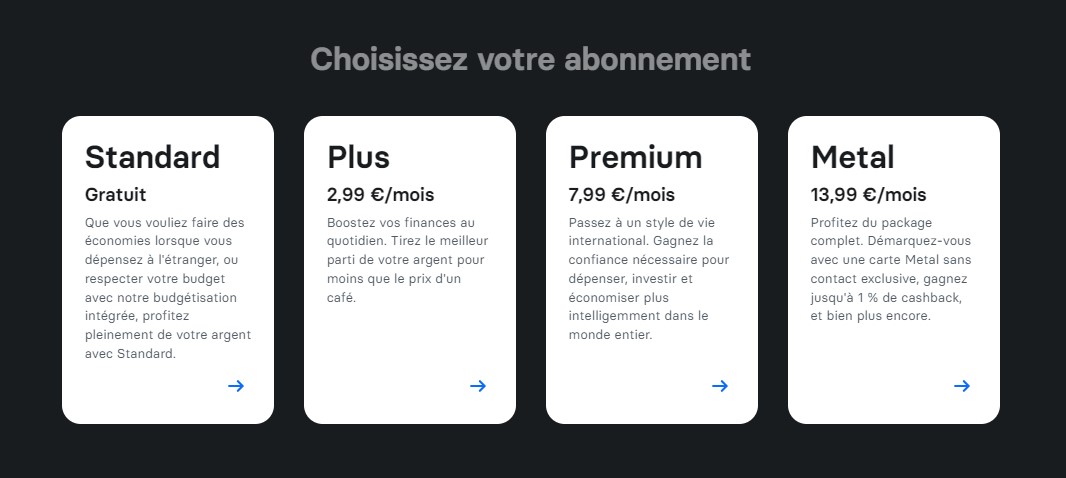

If you opt for the Revolut Standard offer, you will not have monthly contributions since it is free. However, if you choose the Revolut Plus card, Revolut Premium, Revolut Metal or Revolut Ultra you will have monthly contributions to be taken into account, which can go from € 2.99 to € 45 per month.

Discoveries

Very common for mobile banks, there is no possibility of discovering at Revolut. Indeed, the systematic authorization system prevents being on a negative balance. All automatic regulations and samples are refused if there are not enough funds available on the account.

Revolut Opinion: The joint account

It is also possible to open a joint account on the mobile bank. Whatever the person you want to open an account, Revolut applies no income conditions or specific commitment.

The available formulas are exactly the same as for the classic current account. Note all the same that the joint account is ultimately a classic account with the possibility of ordering several bank cards. It does not have specific services for co-holders.

Revolut Opinion: The Youth Account

Because Revolut also wants to meet the needs of the youngest. The mobile bank offers a specific account for children under 18. From 6 years old, it is possible to have an account dedicated to their expenses so that it can better manage their money, in complete safety. What can they do ?

- To earn money by sponsoring a friend;

- Send money to relatives instantly;

- Receive money from relatives for free;

- Learn to save money;

- Follow the expenses made on the account in real time;

- Have a physical or virtual and fully customizable expenditure card.

Revolut Opinion: The pro account

One of the objectives of the neobank is to be accessible to the maximum. It is for this reason that even professionals can benefit from the services of this mobile bank.

Thanks to the application, companies, associations, self-employed and freelancers can have all of their finances in one and the same place. What do they have in this offer ?

- More than 25 currencies supported, whether you are in France or abroad;

- More than 100 countries supported for payments;

- No fees applied to the management of the Count Pro;

- Ultra-competitive exchange rates for transfers abroad;

- Analysis tools for real -time control of business expenses;

- Smart bank cards for the whole team;

- Automation of possible expenditure to simplify management;

- An intelligent billing tool to save time.

Today, the Revolut online bank has more than 10,000 new businesses every month.

Unlike the majority of neobancs, it is not limited to micro-enterprises. All companies and associations can also benefit from it.

Revolut Opinion: Bank cards

All offers from bank cards are available from any account. Thus, it is possible to benefit from the same advantages and services in a current account, young or pro.

The standard revolut card

Presentation of the standard revolut card

There Standard revolut card is a 100 % free bank card, without income conditions and without commitment. It is possible to choose between a visa or mastercard payment card, whether physical or virtual.

The advantages of the standard revolut card

In addition to being free, it has other interesting advantages:

- Possibility of a French and European IBAN;

- Immediate debit card with systematic authorization;

- Free and unlimited payments and withdrawals in the euro zone;

- Free payments and withdrawals up to 1,000 euros in currencies;

- Payment ceilings at 7,000 euros per 4 days and 200 euros for withdrawals per month;

- Operation in more than 29 currencies and at no additional cost;

- Features included, whose rewards with cashback and discounts;

- Card accessible to the young accounts under 18 years old.

Note that to benefit from travel insurance, you must choose a higher subscription.

The Revolut Plus card

Presentation of the Revolut Plus card

There Revolut Plus card is offered at only € 2.99 per month and is always accessible without income conditions and without commitment.

It is the ideal bank card for everyday life. It is available for all accounts (current, joint, pro and young).

The advantages of the Revolut Plus card

Several advantages are offered with this card:

- Possibility of a French and European IBAN;

- Immediate debit card with systematic authorization;

- Free and unlimited payments and withdrawals in the euro zone;

- Accessible with a revolut account

- Free and unlimited payments and withdrawals in France and abroad;

- Payment ceilings at 7,000 euros per 4 days and 200 euros for withdrawals per month;

- Free payments and withdrawals up to 1,000 euros in currencies;

- Guarantees on purchases up to 1,000 euros, as well as 3 % cashback;

- Currency exchange rates at no additional cost in more than 29 different currencies.

The Premium revolut card

Presentation of the Premium Revolut Card

There Premium revolut card is offered at € 7.99 per month. This is the first premium card available at Revolut. Much more interesting for international life, it offers more specific services for travelers or people regularly on the move.

The advantages of the Revolut Premium card

The card comes with many advantages:

- Possibility of a French and European IBAN;

- Immediate debit card with systematic authorization;

- Free and unlimited payments and withdrawals in the euro zone;

- Unlimited exchange operations in more than 29 different currencies and without hidden costs;

- 5 % cashback on reservations made with the bank card;

- Travel guarantees and insurance for all your trips in France and abroad;

- Instant and free transfer of money in France, and 20 % discounts on costs for each international transfer.

- Payment ceilings at 7,000 euros per 4 days and 400 euros for withdrawals per month;

- Also available for Revolut account

The Revolut Metal card

Presentation of the Revolut Metal card

There Metal revolut card is offered at € 13.99 per month. It is one of the very premium cards with a price much higher than what is usually available on the market.

This card comes in reinforced steel of 18 g and is only available with the metal offer. Finally, it is also available on Revolut account

The advantages of the Revolut Metal card

Of course, this card comes with a multitude of additional advantages:

- Possibility of a French and European IBAN;

- Immediate debit card with systematic authorization;

- Free and unlimited payments and withdrawals in the euro zone;

- 1 % cashback in any currency, including cryptocurrencies;

- Immediate transfer of money and free of charge in France, and 40 % reduction on costs for international transfers;

- Payment ceilings at 7,000 euros per 4 days and 800 euros for withdrawals per month;

- Premium guarantees and insurance for travel in France and abroad;

- Free and unlimited exchange operations in more than 29 different currencies;

- 10 % cashback on reservations in France or abroad.

The ultra revolut card

Presentation of the ultra revolut card

There Ultra revolut card is offered at € 45 per month. Released only a few months ago, it presents itself as the most expensive card on the neobank market.

Like the other revolut bank cards, it is not under conditions of income and has no commitment. It comes in platinum plated metal for a ultimate nick design.

The advantages of the ultra revolut card

With such a monthly contribution, many advantages are available:

- Possibility of a French and European IBAN;

- Immediate debit card with systematic authorization;

- Free and unlimited payments and withdrawals in the euro zone;

- 1 % cashback in any currency, including cryptocurrencies;

- Many advantages with Revolut partners, such as Classpass, WeWork or NordVPN;

- Unlimited payment ceilings in France and abroad;

- Withdrawal ceiling limited to 2,000 euros per month worldwide;

- Up to 5,000 euros in reimbursements on trains, flights, hotels, accommodation and events in the event of cancellation;

- Unlimited access to airport salons;

- Ultra-Premium insurance and guarantees;

- Advantages of trading with the possibility of making 10 stock market operations without commissions per month and costs of 0.12 % of the amount of the order;

- 1.49 % exclusive trading costs on raw material transactions;

- 10 % cashback on reservations;

- Dedicated customer service and available by phone.

Revolut Opinion: Credits

Unfortunately, the Revolut bank does not offer an offer to contract a credit or personal loan.

Revolut Opinion: Savings

Online bank also has no savings booklets, but still offers two ways to save as you wish: chests, remunerated accounts and the term contract.

The chests

THE coffers allow customers to put money aside in a very specific account.

There are no payment conditions or limited ceiling. Each trunk created can correspond to a project and you pay the amount you want and when you can. Namely that it is possible to save in the motto of your choice.

The paid account

Although it is very like a savings book, this is not the case !

THE paid account is a simple bank account in which it is possible to save money and receive up to 5.2 % annual interest. The rate varies according to the chosen currency.

You can pay and withdraw money from this account when you wish.

The term contract

THE forward contract is only accessible to pro accounts. It allows companies to lock future exchange rates and better manage the volatility of currencies.

Revolut Opinion: The Stock Exchange

One of the strengths of this neobank is also to have a very interesting stock market space. Revolut offers customers the possibility of investing in raw materials, stocks and negotiated funds on the stock market.

To do this, it is possible toOpen a titles account directly from the mobile application. You can buy gold, money and other precious metals as well as actions in more than 1,000 French and foreign companies of your choice from only 1 euro.

It is also possible to invest in the Stock Exchange (FNB) funds, more than 100 FNB are available on the revolut platform. These are mainly ETF, bonds, etc.

According to the bank card formula chosen, operations are without commissions within the limit of the authorized quota. Once the quota has been crossed, trading costs are applied:

- 1 free trade for the standard formula;

- 3 Free Trades for the Plus formula;

- 5 Free Trades for the Premium formula;

- 10 free trade for metal and ultra formulas.

Revolut: Clubic opinion

Revolut

Revolut is a high -end mobile bank and it is not for nothing that today is one of the most popular on the market, alongside N26. But it must be conceded that Revolut seems not to play completely on the same painting as his competitor.

If the base of its offer is indeed accessibility and payments in unaccompanied foreign currency, the neobank offers a large range of services by providing in particular stock market investments and dedicated services to companies.

It is an online bank that will appeal to the majority of profiles. Not only is it a safe bet for customers who travel a lot, but it can also be a solution for the whole family. It offers, in fact, an account for those under 18, as well as the possibility of opening a joint account.

- No income conditions

- A professional account open to all companies

- Ideal for travel abroad

- No credits and loans available

- No savings booklets

- No income conditions

- A professional account open to all companies

- Ideal for travel abroad

- No credits and loans available

- No savings booklets

This article contains affiliation links, which means that a commission can be donated to Clubic. The prices mentioned are likely to evolve.

Read the Trusted Charter

Top Best Banks

The latest opinions

Boursobank reviews (Boursorama): is it still the best online bank in 2023 ?

WIX reviews (test 2023): the most complete service to create your website

Orange Bank review: What is the online bank worth that will join BNP Paribas ?

Cleanmymac X review: Is this the best cleaning software for Mac ?

PCLOUD review (Test 2023): Our full assured Swiss online storage test

Join the Clubic community

Join the community of new technologies enthusiasts. Come and share your passion and debate the news with our members who help each other and share their expertise daily.

Comments (8)

They are extremely dangerous and to avoid absolutely ..

As soon as you turn a large sum on your account they block it without warning or explanation.

Customer service in India who speaks only English … whole days between the answers. All this to ask to justify the origin of funds that have been on life insurance for 10 years … They ask to prove the origin before that … A ton of paper impossible to provide ..

At best hours of paperwork and request to your bank.

Once all the papers have been provided and well … It’s been more than ten days that I am waiting for an answer … Account always blocked !

And beware that is with a premium account ..

They were interesting to travel at one time but now many other solutions exist with more serious people who do not run a risk to your money and will not plant you without recourse.

Revolut: To avoid ! Avoid Absolutely !

Join all the neobancs you want but avoid revolut !! I cannot access my account for 6 days or withdraw money although my scale is positive (+ € 3000 !) (see photo 1) Cat and coarse customer service below everything ! Revolut to avoid absolutely

Not only can I no longer access my account but it’s been six days since I was waiting to have me checked We plan to stand the umpteenth time ! (see photo 2)

Avoid this bad customer service and have you blocked your money without mediating and without warning + a customer service that takes hours to answer and then lets you wait for hours to answer your questions then !

Share and avoid your friends and relationships to be fooled !

And I’m not the only one ! Always the same automatic answer

https: // fr.trustpilot.com/review/www.revolut.com

To avoid absolutely. My money has been blocked for months and I can’t get it back. The so -called advisor tells me that he cannot explain to me why. Run away !

I also think I have a traiding account and an investment at the beginning everything is fine then nothing more I wrote to revolut France 113 place de pyramid 92800 Puteauxils gave me this address unknown address return from the mail such 0973051606 deleted

So scam or not since nothing more inqitant

Attention confidentiality and data protection

Hello I change my opinion good at the start. Ditto that Sam Hot.

Account blocked following transfer on my account. Revolut asks me to justify the origin of the funds. Given the amount, I understand and I execute myself I prove the origin of the funds. Despite this revolut asks me to justify my liberal professional income. Amounts invoiced to my bank customers, other sources of income, tax sheet, etc. There it goes too far for me I refuse, closed definitively ! This information is private and that this data revolves ? Fortunately feeling the blow I was able to turn the backgrounds before blocking ! Be carefull.

To all those who complain, do not hesitate to transmit your case to the DGCRF. They do not hang out to put pressure on business to solve these kinds of problems ! Signalconso

For my part I find revolut very well for online purchases. You can have lots of cards, create, delete, block/unlock and customize all the ceilings. For 2 cases of a bank card scam I had no problem to be reimbursed.

Well I have a free revolut account for 3 years, no problem. The only bank that allows you to recharge your Top-up account at no cost. Possibility to have free virtual cards. Whenever I opened a cat with customer assistance, I had my answer within deadlines that reasonable that reasonable. And in addition now I even have an iban in fr.

That said, I have never had more than a few of hundreds of euros on it (the account serves me for online purchases, it avoids exposing my main account).

Note: If you want to descend Revolut, avoid swinging a Trustpilot link which displays 85% positive reviews (4 and 5 stars) on 140,000 testimonies.

Sorry but I was also in the case of the others above, blocking my free revolut account for a bank transfer from my own account … a wound to re-activate.

Before you are mistaken for a recipient for a transfer, impossible to recover … Now it’s good … but shit more than 2 years for a basic function ..

Withdrawal of certain functions of my revolut account, because it is necessary to provide an identity piece every 2 years when it is valid for 10 years … It is notified the expiration date on it but obviously they do not know how to read ..

Conversion costs have increased well ..

Personal Wise is much more effective as secondary account or when departure abroad, except for limited cash withdrawal

Revolut review (2022): My test after a year of use

You dream of dropping your advisor who still lives at fax time and never answers the phone when you have a question ? Good news, because the Neo-Banque Revolut wanted to use the payment card and markets free (and paid) accounts for all profiles-from the youngest to the most experienced. I tested its value proposal for you, and here is now my opinion on Revolut.

In the pioneers of Fintech, I ask revolut. Founded in 2014 in London, the company is no longer a startup since it has multiplied fundraising – the last of $ 500 million made last February – but, as its name suggests, offered a real momentum of novelty in a sector still plagued by old principles of 2.0: the bank.

User for over a year now, I had time to discover all the features of this application and to identify their strengths and weaknesses. The ideal opportunity to make an inventory of the possibilities offered by the Neo-Banque Revolut.

Revolut: Understanding the neo-ban

Everything in five minutes on Revolut accounts. Below, I prepared the main questions that we may have at the time of opening account. Below, I will detail all the elements of the application and the service, as well as my opinion and my opinion on Revolut.

Who can become a revolut customer ?

Unlike conventional banks that force you to go to an agency to sign a paper contract and photocopy documents that will end up in oblivion, the neo-banque revolut requires very little effort to become a member of it. The only two conditions to be eligible are indeed to be major and have a smartphone, it doesn’t matter if it is an Android or an iPhone.

The supporting documents which are long to bring together (such as the tax declaration or the proof of domicile) are thus of ancient history, and it is only enough for a few minutes to open an account on Revolut. It’s super practical, the procedure is fluid and there is no chance to encounter a difficulty.

Open a revolut account in 5 steps

But then precisely, how to create your revolut account and be able to start using your card ? Here is the approach to follow – which is obviously completely free:

- Go to the official revolut website

- Enter your mobile phone number in the field provided for this purpose

- Click on the link received by SMS to download the Revolut application

- Take a photo of your identity card as requested by the app

- Finally, order your revolut card, which will be delivered in less than a week

Customer service is up to ?

According to the reviews verified about Revolut published on Trustpilot, the firm receives 79% of “excellent” notes and 12% “Good”. Our colleagues also have an excellent note for revolut à global, but also on behalf of free. Returns are a little more mixed on Glassdoor, with 77% of employees who approve the CEO, Nikolay Storonsky.

Finally, on the App Store, the application obtains the excellent global note of 4.9 in 5 stars, against 4.7 on the Google Play Store. This also incorporates a cat to interact with a bot in the event of a question, the conversation that can be re-drafted to a human if necessary. In short, nothing to say from this point of view in my opinion on Revolut.

Professionals are also entitled to their revolut card

In addition to its accounts for individuals, the Revolut online bank has also set up packages for companies. Again, a free subscription provides access to basic services, but three paid offers are offered. Count between 25 and 100 euros (or more) per month with access to the API of its application to be able to integrate software or other applications.

Packages development, growth And big business Also include advantages in many partners, including Google Ads or WeWork, as well as a priority support which can be very useful in the event of a glitch. Finally, in all subscriptions (including free), blue e-cards can be generated in order to share the account between the different members of a team.

Revolut application test

Seduced by its positioning and ease of use, so I registered with Revolut several months ago, and I was able over time to try all the features of its application on my iPhone. Most options are also available on the Android version of the mobile application.

Design & UX

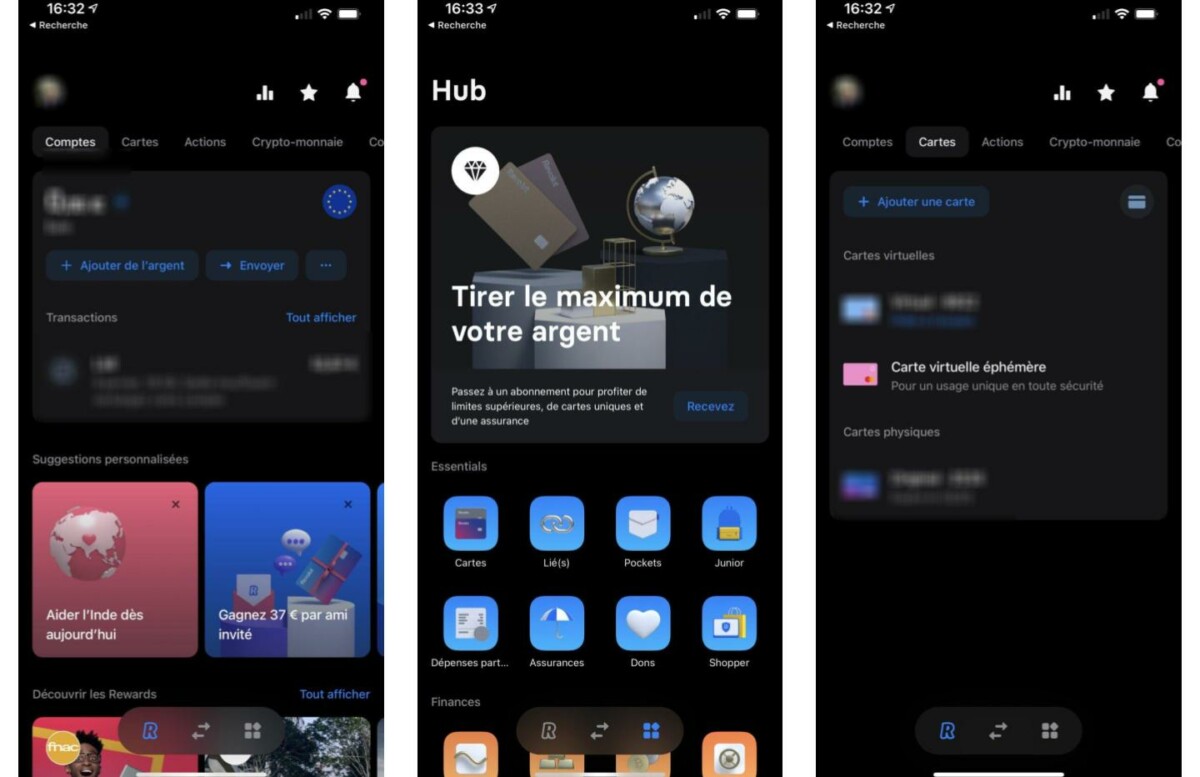

The Revolut application benefits a minimalist ergonomics and refined in the era of time. Unfortunately, no dark fashion on the program as we know that users love it lately, but a white interface with color pictograms that very well describe the different tools. By testing the Revolut mobile bank, I really made an opinion very quickly on its IU: it is intuitive, without frills, and we find ourselves very easily between the different accounts in.

It is clear that the developers have thought of designing a safe and fluid service: no slowdown is to be reported, whether on iOS or elsewhere. Only downside: there is no variation on Mac, and there is no desktop version either. It will therefore be necessary to be satisfied with the Revolut Mobile app on iPhone or Android only. Which can be handicapping for certain professional profiles such as traders, especially when you know that online banking N26 has thought about this alternative, but we will come back a little later.

Functions available on Revolut

Let’s move on to this revolut opinion. What can we do with neo-banque from its mobile application ? To tell the truth, many things. There are many possibilities, but if we should only remember about twenty here I will classify among the best:

- Alerts to monitor the values of certain courses (euro, dollar, etc.)

- Summary of daily transactions and operations

- bank transfer

- Shipping and instant money requests to contacts that are also at Revolut

- Budgeting, to manage your accounts by category (food, leisure, subscriptions, etc.)

- Complete statistics in the form of personalized and colored graphics according to the time frame

- Additional sharing: Practical for Netflix or evenings at the restaurant

- Recurring samples

- payment links, to receive money by sharing a simple URL

- Detection of revolut users around you, like Airdrop

- Sponsorship: you can win 22 € when a friend creates an account on Revolut

- Unlocking the Carte Bleue Pin code

- Immediate card blocking: no need to wait on the phone

- exchange of currencies with live exchange rate

- “Boxes” are virtual sub-accounts to put aside

I would come back in detail in the next points on the features of the Revolut app.

Revolut compatibility with iOS

The Revolut application is particularly well integrated on the iPhone. The software weighs more than 300 MB, but it is compatible with more than 25 languages that range from French to English via Spanish or also German.

The iPad, Apple Watch and iPod Touch can also download the Revolut online bank application, and this can be unlocked thanks to the Biometric Face ID sensors (TrueDepth) on the iPad Pro or Touch ID on the iPhone Se. In addition, neo-banks can be scanned in Wallet, to be able to pay purchases with Apple Pay technology.

Furthermore, there is also an app Revolut Junior which allows you to manage accounts for children. Finally, family sharing offers the possibility of a whole family to use the application jointly using up to 6 different devices. Also practice for roommates who share the meal budget.

Connected payment

Like all online banks, Revolut allows you to pay on the internet and provides double factor of 3D-Secure factor on all its cards, whether it is Mastercard Securecode or Verified by Visa. Reverse cards also integrate an NFC chip, to pay without contact in stores, and also synchronize without problem with the wallet google pay.

Invest with the Revolut application

The Revolut app certainly offers no profit-sharing on your accounts, but however allows to invest in several values, including cryptocurrencies, actions of certain companies or even raw materials. But all these theses are not as advantageous as each other with this intermediary. This is a positive point in my revolut opinion. Here are all the details below.

Buy bitcoin

The Revolut online bank has a key advantage compared to conventional banks: it allows you to invest in cryptocurrencies. Customers can thus select, to the choice, Litecoin (LTC), Bitcoin Cash (BCH), Ripple (XRP) or Ether (ETH). Obviously, the global success of Bitcoin (BTC) is also within click.

But there too, there is a problem: Revolut does not offer a real virtual wallet as is the case with the Binance, Coinbase, Wirex or Coinfalcon apps. Understand that you will not be able to send cryptocurrencies to someone or receive them, or even benefit from a BTC address. You can only bet on the growth of certain virtual currencies, and then make a capital gain by transforming your classic currency again.

Stock market

Similarly, the Revolut App allows you to invest in the stock market without experience, which is not possible with traditional banks. This is the trading part of the app that allows us to indulge in these operations which, we will never recall it enough, are also risky. Here are some titles on which it is possible to invest:

- Fox, Viacom and Disney studios

- Adobe, Autodesk and Oracle publishers

- The banking sector, with American Express, Axa, Santander, Bank of America, Goldman Sachs, Mastercard, Morgan Stanley, Visa, Wells Fargo and Western Union and Fintech Paypal and Moneygram

- The Berkshire Hathaway, Blackrock and JPMorgan funds

- Manufacturers AMD, Broadcom, Canon, Xerox, Cisco, IBM, Intel, Nvidia, Qualcomm, Roku, Seagate, Texas Instruments, Western Digital, Blackberry, Caterpillar, Corning, LG, Motorola, Dell, HP and Sony

- GAFAM Alphabet, Amazon, Apple, Facebook and Microsoft

- E-commerce with Best Buy, Ebay, Etsy, Home Depot, Macy’s, Target and Walmart

- The future food with Beyond Meat

- Fitbit, Honeywell and Gopro connected objects

- Batx Baidu and Alibaba

- Operators Altice, AT&T, China Mobile, T-Mobile, Verizon

- Airlines American Airlines, China Southern Airlines, Delta Air Lines, JetBlue Airways and Southwest Airlines (and the manufacturers Lockheed Martin and Boeing)

- Lyft and Uber

- Streaming: Netflix and Spotify

- The New York Times

- The trip with Booking, Expedia, Hilton, Hyatt, Marriott, Tripadvisor and the Cruises of Royal Caribbean Cruises and Norwegian Cruise Lines

- Box, Cloudflare, Dropbox and Godaddy accommodation

- The Saas Docusign, Eventbrite, Fiverr, Hubspot, Salesforce, Shopify, Slack, Twilio, Zendesk and Zoom

- Pinterest, Snap, Twitter and Weibo social networks

- Clear Channel

- Virgin Galactic

Raw material trading

On the other hand, the Revolut application also allows you to invest in certain raw materials. For the moment, only gold is eligible but other metals should arrive in the near future. This new feature was added at the beginning of 2020. To be able to participate, however, you must be holder of a premium or metal account, which means that free users cannot trade with this tool.

In addition services

In addition to trading, Revolut offers some very practical advantages, especially for the most nomadic. They are generally included in the various packages offered by the neo-ban. Below in my review on Revolut, the additional elements.

Revolut insurance and guarantees

Revolut protects your mobile device worldwide, covering it in particular against screens or even damage due to liquids. Knowing that one in four people damages their phone every year, it is security in addition to the warranty provided by the manufacturer who is welcome especially if you do not use a shell.

In terms of cost, revolut insurance would be 65% cheaper than having your iPhone in Apple Store repaired: indeed, you have to count a hundred euros minimum for this kind of financial operation. The costs of this service are calculated according to your equipment. For an iPhone XR 256 GB, for example it will be necessary to count on € 2.21/week for an annual subscription, with a franchise of 125 euros and a free revolut package.

With this, Revolut also makes it possible to ensure medically abroad. A winter sports option is also available, and the covered regions are very wide since in addition to Europe, North America and most other countries recognized by the UN are affected. Among eligible care, there is emergency dental treatment and rapid reimbursement of commissions directly to the user’s revolut account.

Revolut allows you to make donations

Like Lydia, the Revolut application makes it possible to make donations to charitable associations. Among the eligible organizations, we find in particular doctors without borders, Save the Children, Rainforest Alliance, Movember, WWF and Ilga-Europe, which defends LGBTQI rights+. Revolut specifies not to apply any costs and take no commission, all donations being sent directly to NGOs.

Save time with the concierge

The Revolut Metal package allows access to a concierge service to carry out everyday operations for you such as booking hotels, restaurants and thefts or the organization of events. Request submissions are done directly from the mobile application, while the requested actions are confirmed by Email return.

Obviously, the final amount at your expense will not be taken from your Revolut account before you have validated it yourself. The concierge is permanently open, at any time of the day or night and every day of the week. This is an argument that weighs positively in my revolut opinion, but that is not why I asked it.

The bonus for travelers

If you are used to traveling, whether they are professional or leisure journeys, be aware that Revolut can also allow you to access more than 1,000 private airport salons at an advantageous price. In addition, the functionality Smartdelay Offer this free access if your flight is delayed by more than one hour, an option also available only with a paid revolut package.

Note that with a Revolut Metal subscription, the first lounge access is offered.

Comparison of revolut formulas

Revolut currently offers 3 packages to his subscribers, and I will quickly detail them in my review Revolut below.

The first subscription, the standard plan, is generally free. However, there are a few hidden costs, such as a commission of 2% on withdrawals beyond 200 euros per month slippery. Currency exchanges are also without additional cost, up to 6,000 euros monthly, but it will then be necessary to pay 0.5% during each transaction. Finally, all card transactions and transfers are offered.

With a premium package, we take advantage of the same advantages with in addition eight stock market operations offered each month. This subscription also unlocks the trading of raw materials and the Smart Delay, while customer service is announced as more reactive. This package also makes it possible to have access to medical insurance for 0 € more, covers late luggage at the airport and offers a 20% discount on your smartphone insurance. DAB withdrawals are free, this time up to 400 euros per month, and exchange operations without any limit. Count 7.99 euros per month for Revolut Premium.

Finally, by paying 13.99 euros per month with Revolut Metal, you will have access to the best offer from the online bank. This saves 1% of cashback on all payments per card, and unlocks the concierge. All the benefits of Revolut Premium are also included, while withdrawals to distributors are offered up to 600 euros per month. It’s time now to give you my opinion on Revolut.

French Ibans in 2022

Since the creation of Revolut, all French customers have had a Lithuanian Iban on their behalf. Even if few people use it, each user has a bank account with an IBAN. This allows for example to feed your account by bank transfer, or send funds to a traditional bank. Since Revolut was recorded in Lithuania, the accounts had a Lithuanian Iban.

And this is sometimes a problem in Europe, where there is still real discrimination in Iban (which is a practice however illegal). For example, an employer could refuse to pay you your salary on an Iban which was not French. Likewise, an energy supplier or a telecom operator could (illegally) refuse to take samples from non-French accounts.

Since the middle of the year 2022, Revolut has evolved: French customers have now have the right to a French IBAN. This is one of the few neo-banks to offer such a service-which is not the case with N26 for example (which has a German Iban). This allows you to revolve a main bank account, without limit.

Conclusion: make your life easier with this bank application

In my opinion, Revolut is an ideal application for all smartphones users in era 3.0 who like speed, fluidity and efficiency. Its few faults are quickly overshadowed by an experience without the slightest reproach, features updated regularly and a contemporary positioning which clearly contrasts with the traditional “bank”.

Finally, everyone can use Revolut, students in the tight budget for the most demanding executives. The free offer allows you to try the product – and you will be very quickly convinced by migrating to the paid offers. That said, by default, the free offer is already sufficient in itself if you mainly use it in France.

Share us your opinion on Revolut in Comments.

Revolut review: Is this the best online bank ?

With an ecosystem entirely turned to dematerialized, the British neobank Revolut has convinced millions of users in Europe thanks to its ease of access and its avant-garde features. So in the end, Revolut is the revolutionary bank that it claims to be ? Answer in this opinion.

Revolut characteristics

| Opening prime | 3 months free premium subscription |

| �� Income ratings | None |

| �� Banking | Visa or MasterCard |

| �� Initial | 10 € |

| ��Frais of account | None |

| ��Parraine | Yes |

| �� Application | Android/ iOS |

| Mobile | Apple Pay/Google Pay |

| ��3D Secure | Yes |

Revolved in a few words

Coming from Fintech – Finance and technology contraction – British, Revolut is a neobank launched in 2015 by two young Russian entrepreneurs named Nikolay Storonsky and Vlad Yatsenko. Their ambition was to create the Amazon of Financial Services, a bank swearing with the achievements, which erase the opaque borders between individuals and the giants of finance. With dazzling growth in recent years, Revolut has convinced many investors to raise hundreds of millions in order to extend its activities in Europe and to various sectors such as insurance, credit or cryptocurrency. Today she has her own banking license and, before Brexit arrived at the end of 2020, Revolut had her activities transferred and all of her customers to Lithuania. With 2 million customers in France and some fifteen million customers across Europe, Revolut recently launched the United States to attack. Here is our review on Revolut.

Revolut is not the cheapest of neobancs, but not the most expensive either

Revolut offers four accounts, each with cards, adapted to a budget and a need, as is the case on most neobancs on the market. Interestingly, Revolut is not positioned on a specific organization to deliver its cards, but by the two main entities on the market, namely Visa and Mastercard. Customers cannot therefore choose the type of card that is issued according to the location, the language of the user and the type of subscription. Here are the different cards offered by Revolut:

- Standard: classic physical or dematerialized card (visa or mastercard)

- More: classic card (visa or mastercard)

- Premium: Customizable premium card (visa or mastercard)

- Metal: Personalized Premium Card (Visa or Mastercard)

| Standard | More | Premium | Metal | |

|---|---|---|---|---|

| Price | Free* | € 2.99 /month | € 7.99 /month | € 13.99 /month |

| Initial deposit | 10 € | 10 € | 10 € | 10 € |

| Type of flow | systematic authorization | systematic authorization | systematic authorization | systematic authorization |

| Income conditions | none | none | none | none |

| Payment abroad | Free and unlimited | Free and unlimited | Free and unlimited | Free and unlimited |

| Withdrawals abroad | Until 200 € per month, then 2 % of the amount of withdrawal | Until 200 € per month, then 2 % of the amount of withdrawal | Up to € 400 per month, then 2 % of the amount of withdrawal | Up to € 800 per month, then 2 % of the amount of withdrawal |

| Payment ceiling | € 100,000 /month | € 100,000 /month | € 100,000 /month | € 100,000 /month |

| Removal ceiling | Up to € 200 monthly, then 2 % of the amount of the withdrawal with a limit of € 5,000 /month | Up to € 200 monthly, then 2 % of the amount of the withdrawal with a limit of € 5,000 /month | Up to € 200 monthly, then 2 % of the amount of the withdrawal with a limit of € 5,000 /month | Up to € 200 monthly, then 2 % of the amount of the withdrawal with a limit of € 5,000 /month |

| International transfer | Entrant / unlimited outing in € | Entrant / unlimited outing in € | Entrant / unlimited outing in € | Entrant / unlimited outing in € |

| Account opening and closing | No fees | No fees | No fees | No fees |

* Possibility to obtain a physical card for € 5 (at once)

Again, like N26 or other banks of this type, the characteristics are similar. Be careful however, if the bank announces free and unlimited payments abroad on all of its cards, it should be noted that beyond € 1,000 in transactions (with currency change), costs of 0.5 % are applied to the amounts exceeding this limit. In addition, on weekends, all transactions are taxed at 1 %. This is an important thing to know if you are used to traveling and your account is based in France.

There is also a difference in size concerning withdrawals abroad, capped at a few hundred euros depending on the offer before being the subject of costs. In addition, these costs are different depending on the withdrawal period between a weekday and weekend. We therefore advise you to avoid using your revolut card in a country where payments are mainly made in cash. Note also that unlike N26, Revolut offers French Iban.

Revolut also highlights its advantage of being a bank with no hidden costs. Nor does it require special income apart from the possibility of making a first transfer of 10 euros to validate the opening of your account. Thus, there is no problem creating a revolut account, even being banned banking. No need to use your card a defined amount of times a month, where costs can be applied to a majority of online or traditional banks.

In its logic of universality, Revolut offers cards allowing to pay in more than 150 different currencies. The prices charged are generally lower than the prices charged by other neobancs, notably N26. The free offer is however much more interesting than that of its German counterpart Since it offers the same price characteristics as other levels, which is not the case with its rival. The difference will be done above all, once again, on the additional advantages such as the insurance and the features that we detail later in this opinion. It should also be noted that if you do not wish to subscribe to a monthly card, Revolut offers annual payment in anticipation, generating a saving of 20 % on prices.

As for N26, the standard revolut level allows you not to have a physical bank card. The latter is virtually present on your phone and you can use it via the NFC functions of the latter. It is however complicated to use this function in France, physical shops being still little provided with terminals capable of considering mobile payments like Apple Pay or Google Pay. However, it is quite possible to order a standard card for 5 euros when ordering.

Recently, and in order to align with its competitors, Revolut offers a card dedicated to professionals called Revolut Business. On this point, the neobank does not do things by half since in addition to conventional options such as the management and visibility of collaborative expenses, it offers unprecedented functionalities for pros such as accounting tools, payment automation or even the native integration of productivity applications or APIs like Slack or Xero.

How to feed your account ?

Revolut does not supply your account via species filing and check. It is therefore necessary to go through bank transfers. Fortunately, the bank offers a very practical system called ” top-up “Allowing to add funds from your regular bank account thanks to its main bank card.

Everything is done without exchange, since in euros if your bank is domiciled in France. This is the only neobank to do so, N26 invoicing for example these operations up to 3 %. This feature then becomes very practical for travelers who can use their revolut account as a card that can be used abroad and not undergo exchange costs during trips outside the euro zone.

A revolut account ready in a few minutes

In the same way as N26 or most neobancs, Revolut focuses on the speed of registration and use of accounts. It is therefore very simple and very fast to register and the creation of the account does not take more than 10 minutes. We have registered via the mobile application, all the stages being one by one up to the (digital) signing of the contract. These steps correspond to the usage coordinates, to the recto -back photocopy of the identity document – which is carried out directly from the phone – and to the supply of a selfie photo, again achievable from the selfie camera of your smartphone. It only remains to pay shipping costs of 6 euros to receive your card in an announced time of nine working days. In our case, she arrived in five days, in the meantime, you can use your smartphone.

Whatever the level of subscription, Revolut requests its customers an initial deposit of at least 10 euros for the opening of the account. Question authorization to overdraft, it should be noted that the cards issued by Revolut are at systematic authorization. Therefore, it is impossible for your account to be negative, and therefore in their open. If however you try to carry out a payment operation without having enough funds on your account, it will be refused.

Welcome premiums

Revolut does not offer a welcome bonus and is not intended to carry out operations, even temporary, to attract its potential customers. The neobank prefers to highlight the attractiveness of its offer by the speed of implementation, the absence of hidden costs and free access to its product.

Sponsorship

One of the neobank acquisition strategies comes from word of mouth and formulates its system of loyalty by the contribution of sponsorship premiums. Revolut is no exception and offers its customers a premium of 6 euros for each sponsored person and having subscribed to one of the offers offered. Each customer can go up to 100 sponsorships for a total potential of 600 euros in gain. To do this, it is enough that the sponsored ordered a card and made at least one purchase so that the gain is activated at the godfather.

Insurance, offers and revolut services

In addition to the insurance issues issued by bank card organizations, Revolut does not offer notable services. If these are accessible via the subscription to a premium or metal offer, they are not automatically for standard cards and more. On the other hand, Revolut proposes to subscribe to it in a single click on the application via a subscription fixed to one euro per day. A very practical feature to be covered on a trip without subscribing to the insurance package all year round. One of the benefits of revolut in payments management is the possibility of creating ephemeral virtual cards. These will be useful to you when you buy a good or a service on the Internet without fear of seeing your pirated bank details then shared online. This can also be used in case you need to share bank details in the event of a reservation of a hotel or a flight.

Cashback reserved for business accounts

The functionality of cashback is only usable via a revolut metal subscription. This option allows you to obtain a return on investment on all the purchases made with your card. The rate is set at 0.1 % of the amount of the transaction. The whole can be combined via a dedicated wallet of which it is possible to transfer the amount wanted at any time to its revolut account. It is a pleasant surprise that this system is accessible via a particular account where at N26, the cashback is reserved for business metal accounts.

Efficient customer service … depending on your account

Having neither physical establishments nor providers from a traditional bank, Revolut counts on a fully dematerialized customer support and customer service from his mobile. The privileged form is online cat, but it is also possible to have an agent on the phone to ask a question or share the slightest problem. The latter has the advantage of being reactive and operational for all bank customers, even for the free offer.

Obviously, customers who have subscribed to the metal offer are privileged, but we had no trouble having an interlocutor via cat and in French with a free offer, a good point. In addition, for the loss of a card, Revolut undertakes to provide you with another within three days.

A precursor bank in the field of cryptocurrencies

Part of the new uses that necessarily attract the attention of banks. Some detach themselves completely, even going so far as to prohibit the transfers from which they come, others on the other hand, follow suit to be the pioneers in the field and necessarily attract a ready -made clientele. This is the case of Revolut which was one of the first neobanks to interfere in the breach.

Concretely, the bank allows you to directly buy some different cryptocurrencies among the most popular such as Bitcoin, Ethereum or Litecoin. Note that you must have subscribed at least to a premium account (7.99 euros/month) to take advantage of it. On the other hand, no trading directly via the application, again, it will be necessary to go through an external provider. It should be noted that Revolut also allows the purchase and sale with high speculative potential such as gold or precious metals thanks to a dedicated space, directly from his phone. It is however impossible to use your current account, and therefore your card to send money to Coinbase.

Always in the field of investment, Revolut also allows you to place your money in very real values as rare metals intended for speculation and exchange. To date, we find gold (at) and silver (GA) as well as platinum (xpt) and palladium (XPD). These investment possibilities are guaranteed for all Revolut Standard, Plus, Premium and Metal customers directly via the application.

Our opinion on the Revolut mobile application

As is often the case with neobancs, the application that accompanies the Revolut account is at the center of the user experience. On this point, the Revolut application available on Android and iOS is very complete, perhaps even too much. No, nothing that has an impact on fluidity, but the heaviness of the interface may surprise the least accustomed. The main page of the application allows you to see your latest transactions at a glance, as well as overall expenses in recent weeks.

It also ensures a good number of settings. First of all, of your card, such as defining your own ceilings, adding a limit of punctual or permanent monthly expenditure or even deactivate payments online. Otherwise, the application includes several well thought out features such as the possibility of rounding up your purchases to the upper euro and multiplying – or not – the difference by 2. All this in order to place this sum in a ” chest »Intended to prepare significant purchases. A kind of savings in the form of a piggy bank in short. Crypto has also become an important element of experience with the highlighting of the trading space directly on the application.

The Revolut application has changed well, to the point of becoming a form of ” Super-app »». It is possible to book a hotel or accommodation worldwide directly from the application while benefiting from a return on investment. This latest feature competes with online accommodation books like Booking or Airbnb. This service is nevertheless intended for customers holding a premium or metal account.

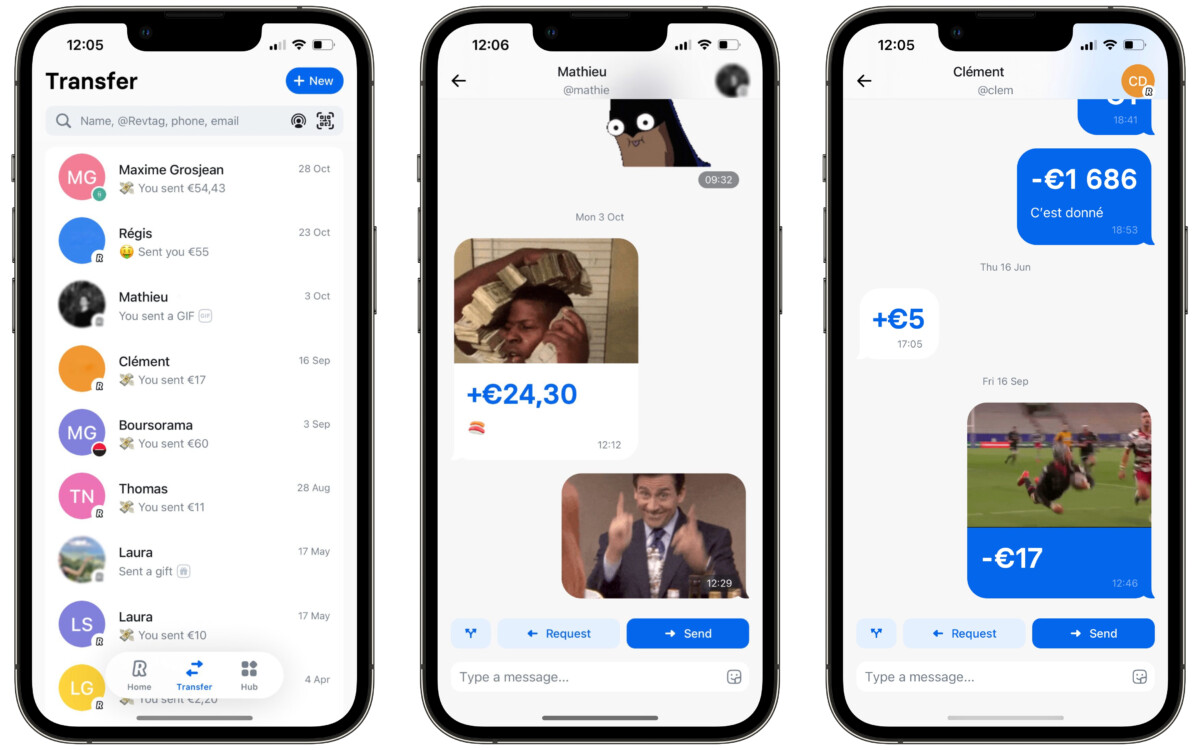

Recently, the application has incorporated a new cat function allowing you to exchange messages like a WhatsApp (stickers and GIF included) while sending and asking for funds to other customers. Revolut guarantees an end -to -end encryption of the exchanges as well as the possibility of deactivating the function if necessary.

In addition to the 3D-Secure authentication method, Revolut offers another security to its users for online purchases: the neobank allows you to create an ephemeral virtual card that is only used to make a purchase, to avoid any too much hacking important. Finally, we already talked about it above, Revolut also allows you to pay without contact with a smartphone or its connected watch through Apple Pay and Google Pay.

Our opinion on Revolut

Revolut is an excellent neobank and encompasses everything that can be expected from such a service. Travelers are highlighted by the contribution of zero costs on payments abroad, even if it is necessary to do with capped withdrawals, whether in France or outside the borders. The application is also of good quality despite the necessary adaptation time. We would also have liked more related services inherited from traditional banks that will certainly come to be grafted in the future. Finally, Revolut is one of the first neobanks to highlight the management of cryptocurrencies with welcome features in this sense.

- Opening speed

- The very practical “Top Up” system for travel

- Very supplied application

- Accessible without income condition

- Corned withdrawals with fresh beyond

- Systematic authorization cards

The note is representative of five elements: the opening of the account, the prices, the application, the features and the bank cards offered. The remuneration of savings, financial products and credit solutions are not taken into account in this note.

Revolut FAQ

How to open an account at Revolut ?

The account opening procedure at Revolut is particularly simple. It is made from the mobile application to download from the Android Google Play Store or the iOS app store. You must first enter your phone number and follow the procedure. In particular, she will ask you to provide your contact details, two front and back photos of an identity document as well as a selfie. Then add a 6 euros levy on your first deposit to receive your card after about a week.

How many revolut bank cards cost ?

The cheapest card is free at Revolut, without account holding costs, without minimum use condition. This is the “standard” offer. It is also possible to subscribe to the “Premium” offer against 7.99 euros per month. In particular, it gives higher payment ceilings and certain services. Finally, Revolut “Metal” costs 13.99 euros per month and goes even further on services and ceilings.

How to contact Revolut Customer Service ?

Revolut being a neobank, the customer relationship is carried out mainly through the cat integrated into the mobile application. You can also reach a voice server in an emergency (to oppose for example) at +44 2033 228 352.

Which neobanque to choose: revolut or n26 ?

The two online banks are acclaimed by the general public and criticism for their quality of service. At Frandroid, we made a comparison opponent N26 and Revolut. It appears that Revolut offers more options on its application to manage your balance from your personal space. The prices in place are also more interesting.