Paylib with friends, mobile payment: LCL Bank and Insurance, Paylib, Payment with friends | BNP Paribas

How to use Paylib

I will surely disappoint some of you, but Paylib requires some specific technologies. First, the smartphone used must be equipped with the NFC or Near Field Communication. It makes it possible to establish a communication between two compatible devices. To do so, he uses short waves worn. So do not hesitate to check that your mobile has this technology. Second, the Paylib application is not compatible with the old smartphones that run below Android 4.4.

Paylib with friends

Transfer money instantly thanks to a mobile number !

With Paylib with friends, all you need is the beneficiary’s phone number to send her money. This service is accessible from the LCL my accounts application.

10 seconds max

Discover Paylib with friends

What are the advantages of a paylib with friends ?

A paylib with friends allows you to transfer money for free and in a few seconds (compared to 24 to 48 hours now) thanks to a pre-recorded mobile number in your contacts or entered for the occasion. In addition, the beneficiary is informed of receipt of funds and may immediately have them.

How to make a paylib with friends ?

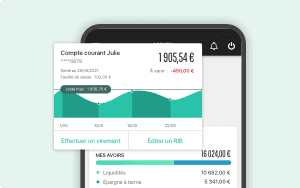

Go to the section transfer of the LCL my accounts application. After choosing your debtor account, select “Towards a mobile number with Paylib” and let yourself be guided !

When you first use, you can activate Paylib with friends easily in the LCL my accounts application. Thereafter, you can manage your options in “my transfer options”.

How to activate Paylib with friends ?

FAQ PAYLIB with friends

A paylib with friends is limited by going up ?

Yes, a paylib with friends is limited to € 500 per operation. The amount of paylib with friends made is integrated into your transfer ceiling. However, there is no minimum amount to make a paylib with friends.

Can I make a paylib with friends to any mobile number ?

You can send money to a French mobile number (mainland France, overseas departments and regions, overseas communities) and Monegasque.

What if I change mobile number ?

We invite you to update in your agency or by calling an LCL advisor on 09 69 36 30*

* Monday to Friday from 8 a.m. to 7 p.m. and Saturday from 8 a.m. to 5.30 p.m. Hours valid in mainland France. Non -surcharged call for any operator in mainland France.

Can I cancel a paylib with friends ?

At LCL, a paylib with friends is treated instantly. Once validated, it will be executed and you will no longer be able to cancel it. So make sure the beneficiary’s mobile number before confirming your paylib with friends.

To obtain a refund, you can contact the beneficiary in order to ask him to reimburse you or request a return of funds from your LCL advisor. However, the return of funds is subject to the beneficiary’s agreement.

How to receive a paylib with friends on one of my LCL accounts ?

- If you have not activated Paylib with friends, LCL automatically associates, Subject to eligibility*, Your mobile phone number at the IBAN from the first EURO deposit account open to LCL so that you can receive your paylib without any action from you and benefit from an automatic credit on your account. To do this, your phone number has been sent to Paylib. If you are not eligible, To recover your money, you must go to the Paylib site from the link sent by SMS to enter your IBAN.

- If you have activated Paylib with friends, you will automatically receive funds in your account.

*To be eligible, you must at least have a monotitular deposit account in Euro, a mobile phone number recorded at LCL and be major.

I have accounts in several banking establishments, how to make sure that the transfers received via Paylib with friends will be credited to my LCL account ?

You have a deposit account in another banking establishment: your phone number may already be associated with this account. In this case, transfers via Paylib with friends will be received on this other account.

To check if LCL is the favorite bank for receipt of funds: Activate Paylib via the LCL My Accounts Application (version 5.5.1 Required at least) then check your status in “Translands / My transfer options / Paylib with friends: Activate, Disable, Modify or Delete my data at Paylib”:

- Status “Activated for reception” and “Activated for sending”: the funds will be received on your LCL account

- Status “Disabled for reception” and “Activated for sending”: the funds will not be received on your LCL account. To choose LCL as a favorite bank for receiving funds: Click on “Activate to receive”.

I have not activated Paylib with friends, how to know if I benefit from the automatic reception of funds ?

Meeting on the LCL Mes Accounts Application (version 5.5.1 required at least): “transfers / my transfer options / paylib with friends: activate, deactivate, modify or delete my data at Paylib”.

You benefit from the automatic reception of funds on your LCL account: you visualize the status “Activated for reception / deactivated for sending” then on the screen according to the options “Activate to send” and “Disable Paylib”.

Your phone number has been sent by LCL to Paylib but LCL is not the favorite bank for receiving funds via Paylib: you have the “Activate Paylib” options and “Delete my data”.

You do not wish to benefit from the automatic funding of funds on your account and do not want your phone number to be kept by Paylib: Click “Disable Paylib” or “Delete my data”.

You wish to benefit from all the advantages of the Paylib service with friends for sending and receiving funds: Click on “Activate to send” or “Activate Paylib”.

Our other products

These offers may interest you

Paylib

A phone number is enough to receive or send

Money to more than 30 million people in France.

Discover Paylib (1)

Immediate (2)

Make transfers for free (3), without entering Iban and in a few seconds using a simple phone number.

Universal

Use Paylib with the 30 million people already registered in Paylib with the 21 partner banks in France (4) .

Direct

The beneficiary receives money directly on his bank account.

How to use Paylib ?

Activate PAYLIB on your my account application (5)

Visit the my account application and select “Mobile payment” in the menu. Select the bank account you want to use with Paylib. Secure and validate this registration using the digital key.

Send money to anyone in France, whatever their bank, using their phone number

Simply enter the amount to be sent as well as your contact, then confirm the transfer by entering your digital key. It’s done ! Your contact is immediately informed by SMS or a notification.

Receive money in less than 10 seconds

No need to share your RIB or your IBAN, just give your phone number and receive money in less than 10 seconds.

Activate Paylib now in the my account application.

additional service

Pay contactless in store

Pay in store with your Android smartphone from all traders who accept contactless, even beyond 50 €.

Good to know

Since October 2022, the online paylib service is no longer available from e-merchants.

Need help on Paylib ?

You have not yet subscribed to Paylib ?

- Go to the my account application

- Select “mobile payment” from the application menu

- Choose an identifier (your email) and a Paylib password

- Select the card (s) as well as the default bank account that you want to use for your future mobile payments and money sending with Paylib

- Secure and validate this registration using the digital key

- Paylib features online, contactless Paylib*, and Paylib with friends are automatically activated

* Service available on all mobiles equipped with an NFC antenna (Near Field Communication or Communication in the near field) and a compatible Android version.

You have already taken out Paylib from the my account application ?

- Go to the my account application

- Select “Paylib mobile payment” from the application menu

- Select “Activate Paylib with friends” Paylib with friends is activated !

If you have a Paylib account with friends, you will automatically receive the funds on the account used when activating the service. An SMS will inform you of making this transfer. If you do not yet have a Paylib account with friends, you will receive an SMS inviting you to go to the Entremeis site.paylib.Fr. To receive funds, enter your IBAN within 7 days.

You can send money to any natural person holding an account domiciled in mainland or Monaco France and with a valid French or foreign mobile phone number.

The registration and use of the Paylib service with friends are free*.

* Excluding connection costs billed by the Internet access provider.

If the beneficiary is eligible for Instant separate transfer ::

From the moment the shipment is confirmed, the transfer is executed within 10 seconds, 20 seconds maximum in the event of exceptional difficulties. Your beneficiary may have funds upon receipt of the operation by his bank.

If the beneficiary is not eligible for Instant separate transfer ::

In the event that the bank of your beneficiary does not offer the reception of instant transfer, the sending of money will be made by standard transfer (execution time between 1 and 3 working days)

The paylib solution with friends allows the transfer of money within the limit of maximum € 500 in one or more times a day.

Yes of course. Just think about updating your contact details with your advisor or on the mobile application. Do not forget to inform your contacts so that you can receive the transfers sent to you.

After validation, your Paylib automatically gets the number you have informed. Be particularly vigilant to this information to avoid this problem. Nevertheless, if this happens despite your great vigilance, we invite you to quickly contact your advisor to try to solve the problem. A tip in passing: rather than hitting your beneficiary’s phone number by hand, select your contact directly in your directory.

You can send a paylib only to people who have a bank account domiciled in mainland France or Monaco. If your beneficiary is abroad but he has a French or Monegasque bank account, no problem, he will receive your paylib . On the other hand, you cannot send a paylib to a foreign bank account.

You can add, modify or delete your bank cards associated with Paylib:

From your Mabanque customer area.BNPPARIBAS*, section “Virements and services”> “Paylib”;

Since your application My Accounts*, section “Mobile payment”> “Paylib”> “Paylib parameters”.

To note : If you have received a new bank card to replace the previous one, you must add your new card to Paylib before you can delete your old card.

In the event of a problem, please contact an advisor.

*Subscription to remote banking services (Internet, landline, SMS, etc.): free and unlimited, excluding communication cost or provision of internet access and excluding alerts by SMS.

If you have activated Paylib in different banks, you will receive the payments on the account you have configured and activated last.

To define your BNP Paribas bank account by default, go to your my account application, section “Mobile payment”> “Paylib”> “Paylib parameters”.

To receive Paylib payments with friends on your BNP Paribas bank account, simply define BNP Paribas as default in the Paylib settings, accessible from the “Mobile payment” section of the My Accounts Applications.

(1) Paylib is a free payment solution, accessible to all customers acting for non -professional needs, holders of a deposit account as well as a Visa BNP Paribas Bank Bank Compatible. Paylib subscription can be carried out from the Mes Accounts application, mobile payment section. Paylib with friends allows customers, natural persons acting for non -professional needs, holders of a deposit account and holders of a French or foreign phone number, to order transfers via the MOBI APPLIES BNP Paribas. (Available on all iOS and Android mobiles) without entering the bank accounts of the account (open to the books of a banking establishment in mainland or monaco) of the beneficiary but simply in support of the mobile phone number (French or foreign ) of this. In the event of fund receipt, if the beneficiary of the funds is enlisted in Paylib, no action is necessary from him. The amount is credited directly to the account attached to its mobile number. If the beneficiary has not activated Paylib, he must enter his IBAN on the web page https: // recup.paylib.FR/ within 7 days to be able to receive funds. The service is free, excluding internet and mobile connection cost.

(2) Subscription to remote banking services (internet, landline phone, SMS, etc.): free and unlimited, excluding communication cost or provision of internet access and excluding alerts by SMS.

(3) Instant SEPA transfer is executed within 10 seconds from the transfer of the transfer order by the service provider of the principal to the provider of payment service of the beneficiary. Provided that the payment institution in which the beneficiary holds his account is eligible for the instant transfer. Delay of up to up to 20 seconds in the event of exceptional treatment difficulties. The beneficiary may have funds upon receipt of the operation by his bank. Service soon available to eligible beneficiaries of the entire SEPA zone (Single Euro Payments Area). In the event that the beneficiary’s bank does not offer the reception of instant transfer, the sending of money will be made by standard transfer (execution time between 1 and 3 working days).

(4) See list of partner banks on Paylib.Fr

(5) Excluding connection costs billed by the Internet access provider.

You have a question ?

Paylib iPhone: how it works ?

For some time now, I have been using my smartphone as a mobile portfolio. For example, I go to a store to do my shopping and I use my phone to pay the bill. We must admit that it is quite practical and we save a lot of time. This system is already well established across the Atlantic, but it begins to spread slowly worldwide. Today we’re going to talk about Paylib iPhone, For those who do not know it is a very popular means of payment on Android. Nevertheless, Paylib arrives on the apple brand terminals. Note that this is a small revolution since Apple already has a similar service which is Apple Play.

The creation of a Paylib account

If you ask yourself questions like: “How to use Paylib ? ” Or ” How to pay with Paylib ? “”. Know that you are in the right place to have concrete answers. I will precisely develop the steps to do to benefit from this service. The first thing to do is create a Paylib account. It’s quite simple, because just go to the official website and follow the stages indicated. Everything is well explained so that any internet user manages to follow the procedure.

For information, you will only have one paylib account per bank. For example, if you have several accounts at BNP Paribas, only one of these accounts can be affiliated with Paylib. During a particular step, you are asked if you have a smartphone operating under Android or iOS. You have to opt for the second answer if you have an Apple mobile. You will then be redirected to AppStore and all that remains is to download the software on your mobile and voila. Know that these procedures are completely free, you will have nothing to pay.

The operation of Paylib on smartphones

You have already downloaded the application to your mobile, but you don’t know yet. Questions like: ” Paylib how it works ? “, Taraud your mind again. Know that I am here to give you some answers. Take a very specific example, you go to your usual store and take a bag of peanuts. Arrived at the checkout, you only take out your smartphone, you go to the application and select “pay without contact ? “”.

You will only have to authenticate yourself via the fingerprint, facial recognition, or confidential code. It only remains to put the mobile on the merchant’s payment terminal and it’s over. The transaction is secure and there is nothing to fear. It should be noted that this generally only takes a few seconds. As soon as you used to use this service, you could not do without it, so it is practical and fast. Know that at the very beginning, I was quite reserved for this technology, but over time, I had changed my mind. From now on, I am a fervent defender of contactless payment on smartphones.

Some conditions to respect to use Paylib on mobile

I will surely disappoint some of you, but Paylib requires some specific technologies. First, the smartphone used must be equipped with the NFC or Near Field Communication. It makes it possible to establish a communication between two compatible devices. To do so, he uses short waves worn. So do not hesitate to check that your mobile has this technology. Second, the Paylib application is not compatible with the old smartphones that run below Android 4.4.

Fortunately, this operating system is no longer used, so there is a good chance that this does not concern you. For information, there was a time when Apple completely refused Paylib. The American giant sought to impose its contactless payment system, namely Apple Pay. Nevertheless, the latter did not have much success in Europe (Great Britain and France). The Cupertino firm had to make some concessions and accepted other payment methods like Paylib on iPhone.