Our opinion on Lydia in 2023, after more than 4 years of use!, Lydia – an app and a card for all your expenses

Effective. Free

So of course no need to take out a Lydia account to be able to transfer money, a simple binder with another current account does the trick, the vast majority of banking establishments available in France being compatible.

Lydia in 2023: our opinion after 5 years of use !

➡️ I tested for you all the features of Lydia in detail and here is my opinion !

Our opinion in short on Lydia in 2023

- A free card and a French IBAN in 5 minutes, without conditions

- No international costs, even if limits apply

- Innovative and easy to access features

- An ergonomic and practical application

- Discounts for 18-25 year olds

- A super practical common account

- No account dedicated to minors

Right now, try Lydia+ for free for 1 month and receive € 10 with the HEROS code !

As a bank. Simpler. And free.

Lydia’s promise

Lydia does not present itself as the replacement of your main bank, but rather as an extension that offers you additional services and innovative features. Nevertheless, the mobile bank also wishes to reinvent the current account and have already attracted more than 2 million customers, positioning itself as a serious competitor to other neobancs already well installed.

What makes Lydia’s success ? And above all, do you really know all its possibilities and what it could bring you ? This is what I wanted to present to you in this detailed and objective opinion ! ��

10 € and 1 month Lydia+ offered with the HEROS code

Presentation of Lydia: the mobile bank which reinvents the current account ?

Mobile Bank Lydia was launched in France in 2013 by Cyril Chiche and Antoine Porte. It is above all a mobile application allowing you to send money with friends simply, with an online kitty system that has been a huge success. Have you never heard “” “I give you a lydia ?» From your colleagues or friends ? ��

The name Lydia comes from the kingdom of Lydie, a land of the Aegean Sea of which the king would have invented the currency, in -700 BCE. And what is the name of the river that crossed this kingdom ? The jackpot ��

But today, Lydia is also a current account, payment cards, and rather interesting features, which we will see together in this full opinion !

Our opinion on Lydia’s current account

The French neobank allows any adult to open an account, without income conditions, and without commitment.

In order to take advantage of all Lydia payment features, you will need another bank account or a credit card to be able to feed your account. This is also the case for all other mobile banks, with the exception of Nickel.

✅ To help you differentiate them, I tested Lydia’s offers in 2023 and that’s what I retained:

Free Lydia Standard account

Accessible free of charge and in a few minutes, the Lydia account allows you to have:

- A visa physical card offered and valid for 3 years.

- Up to 20 free virtual cards To secure your payments online.

- International payments at no cost: up to € 3000 per month.

- Free withdrawals up to € 250 per month.

- Access to all the flagship features of Lydia: Summons, instant money sending.

Lydia+ at € 4.90/month or € 49/year

Lydia+ allows you to remove the limits of the free account, in particular:

- Up to € 3000 in transactions per month : Payments Card and transfers combined.

- Unlimited operations, Except withdrawals: 3 per month and 250 €.

- A subscription to € 2 per month for those under 25.

- Without engagement : You easily stop the subscription when you wish.

- A participation in Lydia roulette for each payment: A chance to have your operation reimbursed.

10 € and 1 month Lydia+ offered with the HEROS code

Lydia Green+ (unavailable for the moment)

Lydia Green+ (unavailable for the moment)

The Lydia Green+ account has the same advantages as Lydia+ and adds:

- A green cardcustomizable To display your commitment.

- The guarantee that the money deposited in your Lydia account does not finance fossil fuels.

- On the contrary, Your funds finance local and eco -responsible projects, In partnership with the nave.

�� However, the Green+ offer is currently on a break. If you are looking for a green bank Find our selection of the best green, ethical and ecological banks.

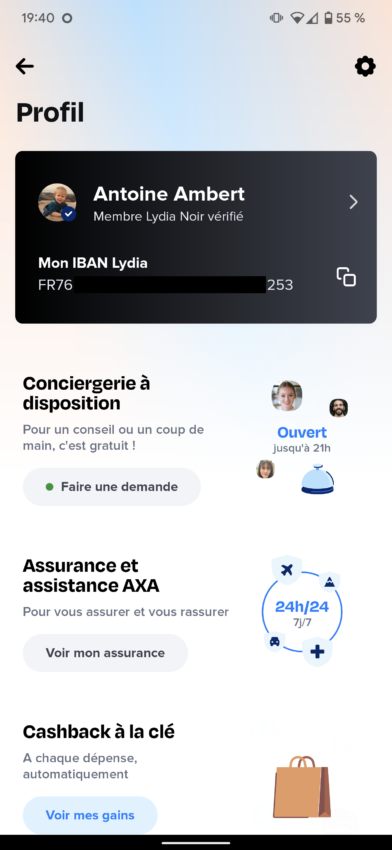

Lydia Black+ at € 9.90/month or € 99/year

With the Lydia Premium offer, you are entitled to:

- Up to € 25,000 in transactions per month: Card payments and withdrawals.

- 3 withdrawals per month (up to 1000 €), at no cost abroad.

- An exclusive and customizable black card: with a sentence.

- AXA insurance for your trips: and even winter sports.

- Customer support by exclusive phone : on appointment.

- A concierge service close to a personal assistant : reachable every day from 9:00 a.m. to 9:00 p.m. by SMS, to make your daily life easier.

Lydia for professionals

The French mobile bank offers a collection application dedicated to professionals called “Lydia Pro”, which will not be treated in this opinion.

�� If you are looking for a professional account, you can consult our comparison of professional banks online.

➡️ The hero finance notice on the Lydia banking offer

Lydia’s banking offer is, in our view, very good. Both practical and accessible, Its free account gives you access to all the innovative features of the mobile bank, whose blue gaps to secure your payments online. On the same subject, we particularly appreciate that the prize pools remain completely free, without commissions taken by Lydia.

On the side of paid accounts, you have the choice. Lydia+ and Black+ allow you to unlock certain limits of the free account, in particular on payment and transaction ceilings. In my opinion, Lydia+ will be enough for most of you to take advantage of all that the neobank can offer you.

And for the most demanding customers, Lydia Black+ offers very high -end services (like the concierge) worthy of an infinite visa, for less than 100 € per year. Impossible for traditional banks to compete !

10 € and 1 month Lydia+ offered with the HEROS code

We will now study in detail the pricing of Lydia. Are there hidden costs ? Is it really cheaper than a traditional bank ? I tell you just after. ��

What are the costs of Lydia ?

Overall, using Lydia will not cost you anything. Indeed, its account offers essential services free of charge, including a French IBAN and a card with comfortable payment ceilings. And if you punctually need more, Lydia+ and Black+ subscriptions are without commitment.

On the incident fee side, you have a small room for maneuver, with two discharges of direct debits offered per month. We only regret inactivity costs, even if it is very easy to avoid them. ��

✅ Here is the essential to remember concerning Lydia costs:

- A free current account or clearly cheaper than a traditional bank (and some online banks).

- Watch out for inactivity costs: 30 € for 12 months of consecutive inactivity.

- Atmosphere payments and prize pools Between Lydia users.

- Discounts for those under 25: Lydia+ at 2 €/month and green+ € 3/month.

➡️ The hero finance notice on Lydia costs

Global, Lydia pricing is, in our opinion, completely honest. You access the best features of the mobile bank for free. Whether you easily send money to your loved ones, or participate in prize pools, Lydia does not take commissions. In addition, apart from rare exceptions, your account cannot be uncovered, which limits incident costs.

In use, the application is completely transparent and warns you as soon as you exceed a ceiling that will cause costs. Likewise, you receive a notification to supply your account if a direct debit arises and your balance is insufficient. In 4 years of use, I have never had unpleasant surprises ! ��

We will now look at the three types of cards offered by Lydia and their particularities. ��

10 € and 1 month Lydia+ offered with the HEROS code

Lydia cards: which one to choose ?

I attended the appearance of the first blue Lydia card, then to Lydia Noir now called Black+, of which I was surely one of the first users. Originally seduced by its sleek design (and a month of free trial), I was then able to take advantage of free payments and withdrawals during my trips abroad. ��

If you want my opinion, it is a logical extension of the Lydia account which allows, among other things, to very easily use the money collected in the prize pools. Today, I mainly use it as a secondary card to travel, or to take advantage of the cashbacks that interest me.

✅ Here are the main characteristics of the cards offered by Lydia:

- Immediate debit visa cards: The 1st is free and valid for 3 years.

- Free payments and withdrawals all over the world, But beware of the limits.

- Contactless and mobile payment: Compatible with Apple, Google and Samsung Pay.

- Up to € 25,000 payment per month With Lydia Black+ ! ��

- Free virtual cards With all Lydia accounts.

➡️ Our opinion on Lydia cards

The range of cards offered by Lydia is very well thought out, and accessible without conditions. The monthly payment ceilings are fairly high (€ 3,000), even if they are shared with the operations carried out on your Lydia account (withdrawal, shipment, transfers, etc.).

Withdrawals, however, are free only on small amounts and limited in numbers (3 or 6 per month). In any case, international payments do not cost you anything, which makes Lydia an excellent secondary account to travel free of charge abroad.

Let us now see what are the unique and innovative features offered by Lydia ! ��

10 € and 1 month Lydia+ offered with the HEROS code

All the features of Lydia screened

Our opinion on the Lydia application

In several years of use, I saw the application evolve very regularly, with frequent updates to add new features. But where the Lydia application stands out is on its design and its impeccable handling.

Thanks to tutorials that systematically accompany the new possibilities offered not Lydia, I have never been lost in the application. And this, despite the overhaul of its interface. Not to mention that I was not the victim of bug major, who could have spoiled my user experience. It may be a detail for you, but for me it means a lot ! ��

The Lydia application offers an ergonomic and refined interface, including many innovative features such as:

- Complete management of your physical and virtual cards : No need to call your banker in the other end of the world to unlock your card.

- The unlimited creation of sub-accounts, private or shared.

- Sending and receiving facilitated payments, Whether the recipient is Lydia customer, or not.

- Skills and common commission accounts.

- Secure virtual blue cards and mobile payment, Accessible from the opening of the account.

- Sending money by SMS or immediate transfer, no additional cost.

✅ Reviews on Lydia in the Apple Store are excellent overall With a note of 4.6 / 5 out of 19,000 reviews. The Google Play version is not to be outdone with 4.2 / 5 of more than 22,000 reviews.

➡️ Our opinion on the Lydia application joins that of users: It is a model of ergonomics and simplicity. The different features are really easy to use and you are guided step by step, each operation. In addition, features are added regularly, such as the trading account in partnership with Bitpanda, allowing to exchange actions, cryptocurrencies and even raw materials (gold, silver and platinum).

10 € and 1 month Lydia+ offered with the HEROS code

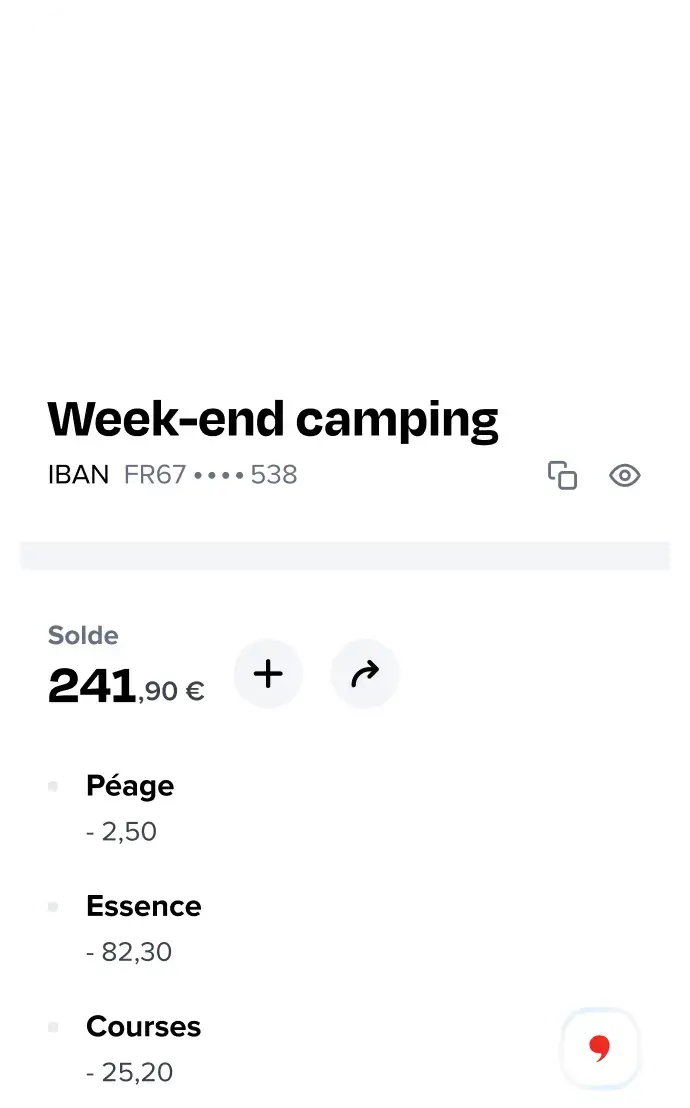

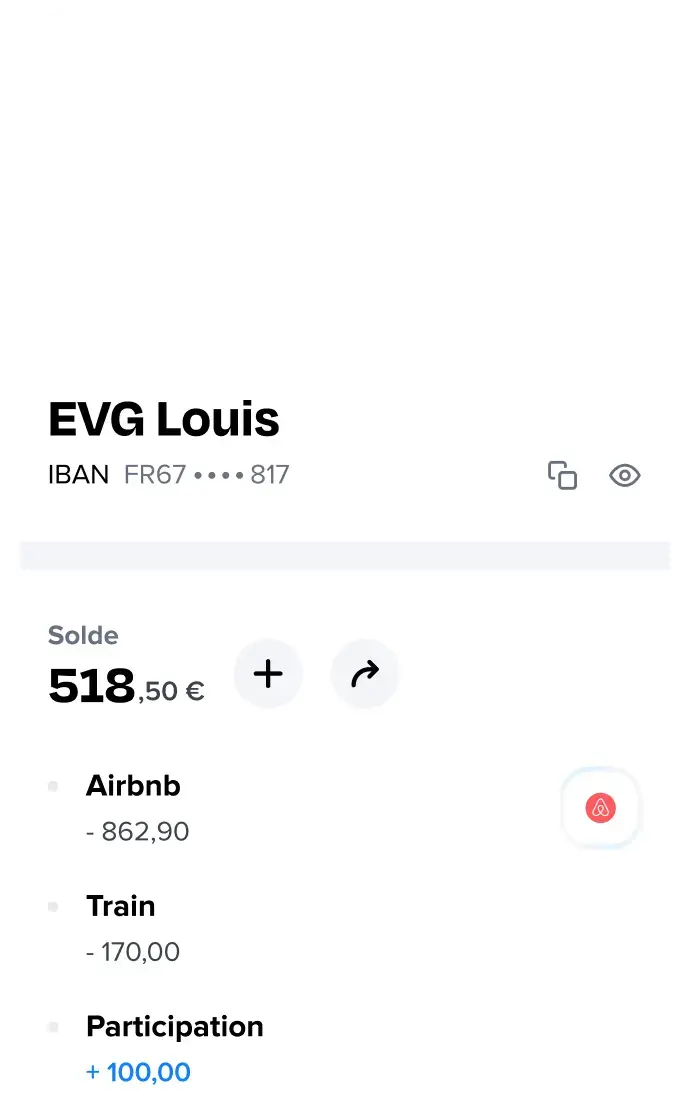

The free common account by Lydia

You are in a relationship, in a roommate or a group of friends and are looking for a free account to simplify the management of your daily expenses ? Lydia has a solution for you.

If you have already tried to open a common account in a traditional bank, you know how complicated it can be … With Lydia, the account opens in 2 minutes, for free and without.

✅ The common account has its own French Iban, all payments are traceable and the absence of an authorized overdraft avoids any unpleasant surprises. In addition, you can add or remove participants in the common account at any time and everyone can have their own payment card for free.

And when you no longer need it, the account closes as quickly as it was created. ��

10 € and 1 month Lydia+ offered with the HEROS code

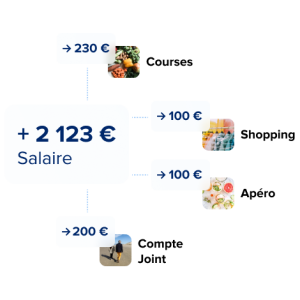

Virtual envelopes to control your budget

The Lydia envelopes are secondary accounts that allow you to distribute your money, more defined budget: shopping, shopping, leisure, invoices ..

✅ Thus, you can use the paper envelopes method to master your budget directly in the Lydia application !

Likewise, you can automate the distribution of your money between your different envelopes and connect your Lydia payment card to that of your choice. Besides, this feature is accessible to all Lydia users, whether paid or not.

10 € and 1 month Lydia+ offered with the HEROS code

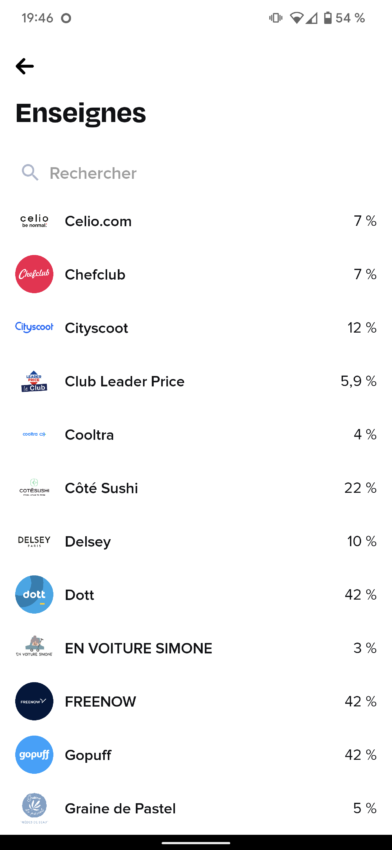

Lydia’s cashback: really advantageous ?

Lydia offers two cashback systems for its paid customers:

- Lydia paid users benefit from cashback up to 30% among partner merchants For any payment made with the application or a Lydia card. We can cite major brands like Franprix, Burger King or Castorama, but the list evolves every month.

- Lydia Black+ customers took advantage of a 1% cashback on their investments in cryptocurrencies : We regret that this promotion is not permanent, especially when we compare the cashback of competing premium offers, Revolut and Vivid in mind ..

- We can also mention the Lydia roulette, Kind of “Cashback based on luck”: all Lydia customers have a possibility of being drawn and being reimbursed a payment made with their Lydia card, real or virtual. The gain is doubled for Lydia Black customers+.

➡️ In short, this cashback system is obviously welcome : it offers interesting discounts to popular partner brands, to all its paying users. What quickly make his subscription profitable. On the other hand, too bad that it does not automatically apply to each payment, whatever the store, as at Revolut for example.

Lydia Black+cashback on cryptocurrencies was a nice little bonus to encourage you to get started with their trading account. Besides, if the subject interests you, I invite you to consult our guide to start investing in cryptocurrency ! ��

Borrow with Lydia: is it really interesting ?

Personal loans and renewable credit

Unlike the majority of other neobancs, Lydia offers financing solutions of up to € 3000. Let’s see together if it’s worth it ! ��

Lydia offers her “small express loan” whose characteristics are as follows:

- From € 100 to 1500 € for immediate release.

- From € 500 to 3000 € for a release within 8 days.

- From 3 to 36 months.

- Taeg between 18.29% and 21.05%, excluding optional insurance (!))

- Accessible to all Lydia users, without case costs.

➡️ To summarize, it is a very easily accessible cash flow, to help out in the event of a blow, or a favorite. But given the TAEGs superior to some authorized overdrafts, You would have every interest in looking at the side of other online banks if you are looking for funding at competitive rates.

The mobile bank also offers a revolving credit of € 3000 that works as follows:

- A reserve available at any time and unlockable in one or more times.

- In 4, 5, 10 or 20 months, with a minimum monthly payment of € 15.

- Usable as you wish: with the card, mobile payment or by transfer.

- Count a period of 7 to 8 days after agreement to access it and use it.

- Taeg between 13.90% (10 and 20 months) and 16.90% (4 and 5 months).

- Free of charge.

➡️ In conclusion, the loans offered by Lydia do not seem really interesting to us. On the one hand, they are very easy to access and practical, and on the other, they are quite expensive if we relate to the TAEG. When subscribing, The fixed costs give the impression that they are low But to look there, it gives overall rates that are really not competitive.

The fact remains that this “functionality” is not always available from its sisters, and we must underline it. ☝

10 € and 1 month Lydia+ offered with the HEROS code

Place and save with Lydia

Lydia investment and investment possibilities are continuously developing And now allow you to invest in the stock market, in cryptocurrencies and in four raw materials (gold, silver, platinum and palladium).

✅ Let us quickly talk about the possibility of creating accounts with defined objectives, in order to save for your projects, alone or with several. They combine very well with the free of charge prints that have made Lydia’s success. ��

The trading account according to Lydia

After having tested the Lydia trading account at length, I was seduced by its ease of use, in particular to place the purchase or sales orders. I was also able to take advantage of the 1% cashback on cryptocurrency purchases as a Lydia Black customer. Unfortunately, this cashback no longer exists.

✅ The Lydia trading account is offered in partnership with Bitpanda and is reserved for paid customers.

This is what we remember:

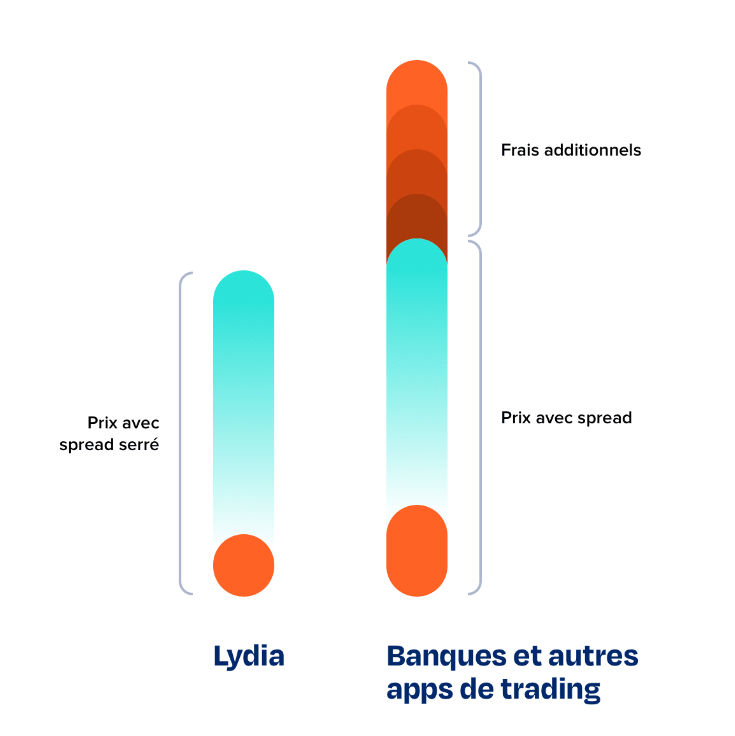

- A secrecy to buy actions, without commission

- Easily invest, from € 1 : with costs that are limited to the Spread, which Lydia promises us tight.

- You can buy fragments of actions or cryptocurrencies

- Simplified access to more than a hundred cryptocurrencies and tokens.

- A wide choice of ETF and 4 precious metals on the side of raw materials.

- No inactivity fees and childcare rights.

Please note, Lydia’s partner on behalf of Trading, Bitpanda, is located in Austria. If you use it, you will have to declare this digital asset account abroad.

Fortunately, Lydia provides a tax statement before the annual declaration period. In the meantime, you can consult our article dedicated to securities taxation.

A savings book at the boosted rate

✅ Finally, Lydia offers a paid savings book to its paid customers Here are the details:

- Rate boosted at 3% per gross year for the first five months, Then 2 % per year.

- Boosted rate up to a limit of € 75,000 in deposit and 300 euros in remuneration.

- Minimal deposit of € 1,000 at the opening.

- The booklet must be kept until December 31, 2023 to take advantage of the boosted rate.

➡️ To conclude, Lydia offers practical and very easy -to -access savings solutions. The remunerated booklet is a correct alternative to your traditional savings booklets, especially for its boosted rate. Apart from that, to make your cash work, it would be an interest in looking at the best placements and investments available currently, as well as accounts.

The trading account, meanwhile, allows you to learn smoothly from € 1 and almost free, excluding Spread. However, this remains a secondary functionality, dedicated to novices. We rather recommend BforBank, Fortuneo, or a specialized broker for demanding investors, or simply to take advantage of the taxation of the PEA.

10 € and 1 month Lydia+ offered with the HEROS code

Everything you need to know about Lydia in practice

How to open your Lydia account ?

I opened my account on the Lydia application several years ago, and already at the time, It was extremely simple and quick. As part of this opinion, I therefore opened a new account to see what it is in 2023. ��

✅ The basic account opens in a few seconds, just enter your contact details and you can immediately use the virtual card, recharge your account or send money without.

On the other hand, to take advantage of all the features of Lydia, you must check your account and here is how to do:

- Bring an identity document that you can scan with your phone.

- Take a video selfie or add a bank account to your name to check your identity.

- Check that his contact details are up to date: name, addresses, profession, etc ..

- Wait about 30 seconds for your documents to be validated.

- It’s over !

You are really guided step by step when you do any action for the first time on Lydia. Their help center is well designed and Lydia teams even offer video tutorials !

10 € and 1 month Lydia+ offered with the HEROS code

How to create a Lydia kitty ?

You may have already participated in a Lydia kitty but have never been on the organizing side ? Do not panic, I explain step by step how to create a kitty. After downloading the Lydia application:

- Choose the tab ” Accounts “ application.

- Click on the ” ➕ “At the top right then” Create a kitty »» .

- Find a name for your kitty, like “Antoine birthday” (it’s in April ��)

- You can add a cover photo. It will be the first image that contributors will therefore see the good choose !

A web page is then created, with a unique link. Then just share it to whoever you want to harvest the participations. ��

Not only Lydia does not take any commission on these prize pools, But in addition, it is very easy to use the harvested money. Whether by instantly turning it, or By spending it directly with your free, real or virtual Lydia card. ��

Even better, you can offer gift cards that will benefit from a small bonus through Lydia partners (€ 10 for 100 € for example).

Lydia customer service

✅ Lydia offers a customer service that can be reached from Monday to Friday, from 9:30 a.m. to 6.30 p.m.

You can contact him by email, instant messaging, or by phone if you are a Lydia Black customer+. In this case, you must first make an appointment with an advisor via the application.

We should also underline the concierge service offered to customers Lydia Black+ And which allows them to ask for help for concrete things, as for ideas, for example:

- Call on a craftsman, a baby-sitter, a home teacher or movers.

- You have any object delivered, even drugs, or recover your packages.

- Find a pressing, a shoemaker or a rental car.

- Organize events or trips.

- Manage your administrative procedures and your reservations for trains or planes.

- Find a place for a show or the match of your favorite team.

The concierge can be reached by SMS, every day from 9 a.m. to 9 p.m. You only pay the price of the requested service, without additional cost.

Our opinion on Lydia customer service

In addition to 4 years of use, including two years of black/black Lydia+, I never needed to use customer service, as the application is easy to use and the well -designed help center. ��

Regarding the concierge service, since it is a service usually reserved for (very) high -end card owners, like the infinite visa, I could not help testing it. Thanks to my concierge, I was able to attend a booked concert for months or find gift ideas at the last minute ! ��

Conclusion: When to open an account at Lydia ?

✅ As a conclusion, our overall opinion on Lydia is excellent : It is an innovative and very accessible French neobank, which constitutes a very good extension of your main account.

After years of use, Lydia keeps surprising me and I always enjoy testing her new features. ��

➡️ Here are the important points to remember from our long -term test:

- Free physical and virtual cards, Without income and customizable conditions.

- An ideal solution to create prints or share accounts.

- Sending easy and free money, By SMS or instant transfer.

- Payroll cards without any international costs.

- Innovative and practical investment possibilities : actions, ETF, cryptocurrencies and precious metals.

- A very ergonomic and functional application, who accompanies you with each operation.

- A paid savings account boosted at 3 % the first five months, then 2% annual (gross).

- Express loan possibilities, To help out in the event of an unexpected.

To whom the Lydia account is addressed ?

If you need to create a kitty or send money Easily money to a loved one, you may already know Lydia And you could be tempted by paid accounts in order to remove the limits of the free account. Do not hesitate to try Lydia+ for a month for a month if this is the case, there is no commitment. For my part, I was not disappointed. ��

Likewise, if you are looking for a good companion on your main account or a common account without cost, able to save you when you travel, Lydia will surely suit you. Finally, budding investors can find an ideal account to learn the purchase of ETF or cryptocurrencies, almost free of charge. Before going to more complete trading platforms ? ��

10 € and 1 month Lydia+ offered with the HEROS code

What alternatives to Lydia ?

The French application is positioned as an alternative to traditional bank accounts. But some features are lacking in the call, such as, for example, the possibility of having an authorized overdraft. Here are some alternatives to the alternative:

- For cash deposits : Monabanq, Sogexia or Bunq.

- To invest in the stock market : Fortuneo, Bforbank or a specialized broker.

- To travel abroad at no cost : Fortuneo or Revolut.

- To have an authorized overdraft : see our comparison of the best banks online.

Faq

How to take advantage of the € 10 offered with the HEROS code ?

If you already have the Lydia application, just click on this link.

If you do not have the application, once downloaded and your account created, you can click on the link.

Last solution, follow these steps:

– Once your account has been created, go to the “profile” tab.

– then click on “Sponsorship”.

– Return the “hero” sponsor code.

– If you have gone through the link, you can check that the sponsorship worked.

How to make a Lydia kitty ?

– Choose the tab ” Accounts “ application.

– Touch the ” ➕ “At the top right of the screen.

– Then ” Create a kitty »In the menu that appears.

– Take the name of your prize pool.

– Add a cover photo (optional).

– Your kitty is created and you can share it thanks to its unique link.

How Lydia works ?

Lydia is a mobile application that allows you to create a French bank account, in a few minutes and for free.

How to put money on her Lydia account ?

Several possibilities are available to you to put money on your Lydia account:

– by transfer to your RIB Lydia.

– by recharging by credit card.

– by binding your bank account to the application.

– by creating a kitty.

– by asking for money by SMS.

How to turn money from your Lydia account ?

You just have to add the RIB or IBAN of your beneficiary and to make your transfer. Unlike traditional banks, transfers are instantaneous and free.

How to “make a lydia” ?

Doing a Lydia has entered customs and simply means getting money from Lydia. You just have to know the mobile number of your beneficiary to fire her money, without commissions.

Antoine was heritage advisor and private banker before joining Finance heroes. He puts his service and his experience in the banking environment at your service.

Effective.

Free.

In short, for Gé rer all his money quickly done, well done.

Create an account, without paperwork and without commitment.

Payment receipts and instant transfers

No more paper receipts. Compatible with Apple Pay and Google Pay, the Lydia card highlights immediately after each purchase or withdrawal to the distributor.

No need to wait: all transfers are instantaneous.

Several accounts

Money on Lydia can be organized in as many accounts as necessary, to see more clearly and regain control. Ideal for couples, projects, spending budgets and holidays.

Online reimbursements and prize pools

Farewell, checks and species. A phone number or an email address and 3 clicks are enough to make a transfer.

And for all the occasions that matter, the Lydia online prize pools are there. So simple.

Lydia: our opinion on this French banking application

First thought as a simple rapid money transfer application, Lydia quickly managed to develop her offer to become a full -fledged banking application. Is this an offer comparable to the best online or other neobanc banks on the market ?

Lydia characteristics

| Opening prime | None |

| �� Income ratings | None |

| ��carte banking | VISA |

| �� Initial | None |

| ��Frais of account | None |

| ��Parraine | Yes |

| �� Application | Android / iOS |

| Mobile | Apple Pay / Google Pay / Samsung Pay |

| ��3D Secure | YES |

Lydia in a few words

“” Give me your number and I do a little lydia “, It was with this marotte that the company made a name for itself. The application launched in 2013 by two French entrepreneurs aimed at facilitating the exchanges of money between individuals. She gradually developed by adding ever more banking services until offering a paid offer from 2018 with bank cards and specific services.

But where Lydia stands out from other online and classic neobanc banks is that it is not a “real” bank, because it does not benefit from any own license or the possibility of transforming the Credit deposits. However, Lydia is a successful alternative since it now has more than 3.5 million users in Europe with an average of 2000 new daily users.

What are Lydia’s prices ?

Lydia is obviously accessible for free, it is the basis of its offer which, let us recall, is not a bank like the others. It still has two paid cards whose advantages concern above all the amount of authorized transactions as well as the insurance issued by the Visa organization (Lydia Black + offer only). All the Rib delivered by Lydia are very French.

| Lydia Standard | Lydia + | Lydia Black+ | |

|---|---|---|---|

| Price | Free | € 4.90 /month or 49 € /year (1 month offered) | € 9.90 /month or € 99 /year |

| Initial deposit | None | None | None |

| Type of flow | Systematic authorization card | Systematic authorization card | Systematic authorization card |

| Income conditions | None | None | None |

| Payment abroad | Free (depending on the ceiling) | Free (depending on the ceiling) | Free (depending on the ceiling) |

| Withdrawals abroad | Free (depending on the ceiling) | Free (depending on the ceiling) | Free (depending on the ceiling) |

| Payment ceiling | 3000 € /month | 3000 € /month | € 25,000 /month |

| Removal ceiling | 3 free withdrawals and 250 € /month max (1.5% beyond) | 3 free withdrawals | 5 free withdrawals |

| Closing account | Free | Free | Free |

It should be noted that the creation of cards for the Lydia + and Lydia Black + accounts is free, but that a sum of 5 euros will be requested for the editing of a physical card for the paid accounts. For online purchases, we appreciate the presence of virtual cards that can be edited at envy and which are used to pay a unique purchase on the Internet. Reception of the physical card can take 5 to 15 days.

How to feed your account ?

You can feed your Lydia balance freely via any external account that you have saved, by applying for one of your contacts via your phone number, or by making an express loan.

The money is then deposited on the Lydia balance or on the card account you have asked for. Note that it is not possible for a third party to deposit money directly on an external account, it will therefore be necessary to make the transfer yourself.

How to open a Lydia account ?

Everything has happened from the Lydia application available on Android and iOS. To have access to the basic services of the application, there is no need to provide any information other than your phone number, name, first name and email. Regarding the creation of an account, it will be necessary to provide a two -sided photo of your identity card, and that’s all ! The operation only takes only a few seconds.

Initial deposit and overdraft management

Lydia is not a real bank, there is no need to make an initial deposit, whether with a free or paid account. It is not even necessary to link the card of your regular bank account to start using the service, even if it will be necessary for the transfer of money.

Inevitably, no possibility of having a Lydia debtor account and therefore an impossibility of overdraft.

Welcome premiums

Again, Lydia is not a banking establishment, its acquisition strategy can hardly be compatible with welcome bonuses. The account opening is free and we must be satisfied with it. However, it may happen that Lydia makes occasional partnerships with other banks, but this implies opening an account in the bank and accompanying it with a paid bank card.

Sponsorship premiums

Lydia offers a sponsorship program. The bank offers € 10 for each sponsored person as soon as they made 5 payments at 5 different merchants (with a minimum of € 5). All information concerning the sponsorship program is noted here.

Lydia insurance and services

To benefit from the Visa organization insurance, you must go through the Lydia Black+ offer which is the only one to benefit from it. There are in particular protections for online purchases and against fraud. But it is especially for travel that it turns out to be useful since the offer includes dedicated insurance with repatriation and winter sports insurance in the event of an accident.

A slightly shy cashback

By launching her paid offer, Lydia immediately bet on the interest of the cashback system to stand out. This part is not as much highlighted as the rest, the menu giving the reimbursement rates on compatible brands being hidden in the “gains” part of the application. The compatible shops are also very few compared to what is done at N26, Revolut or Boursorama Banque. To see if this offer will be better developed in the future.

Note that after participation in the Lydia cashback, the account is automatically credited with the sum of all discounts on 20 of each month.

Customer service

If the telephone service is currently reserved for customers Lydia Black+, an online cat is made available from the mailbox of the application. The bank has also set up a Help Center in French which answers the majority of questions. It is also possible to contact the support by email at this address: [email protected]

And cryptocurrency ?

Like a certain Vivid Money, Lydia quickly understood the added value of a trading system within its application ecosystem. If it is possible to invest in corporate actions or in precious metals, this is also the case with cryptocurrencies. Everything has happened from the Lydia application in a dedicated menu soberly called “catalog”. It must be said that the system is particularly simplified and above all very attractive. Just open a trading account by entering some personal information. This is a way for Lydia to ensure your solvency and your investment capacity. It is also an opportunity to realize that Lydia is a partner of Bitpanda who integrates her API directly into the Lydia application.

Once the trading account has been created, you have access to all the values recorded on the platform with an immediate purchase possibility from a LYDIA account balance or other.

A super-app that takes shape

If you had already used Lydia punctually as a simple money sharing application, you will be delighted to see that she has finally a bank application of choice to manage her money. However, it will take some time to adapt to neophytes to get used to it, in particular to understand the organization of the menus. It would however be pitted as the general presentation is clean and the functionalists numerous. Lydia’s home screen gives access to all the accounts at a glance and it is possible to transfer money to a simple swipe.

So of course no need to take out a Lydia account to be able to transfer money, a simple binder with another current account does the trick, the vast majority of banking establishments available in France being compatible.

It is in the “Account” tab that most of the advanced features of the Lydia platform are found. We think in particular of the generation of very practical virtual cards to place ephemeral orders on the Internet safely. But that’s not all since the last big novelty, we talk about it above, allows each user Lydia to open an investment account. Finally, other products appear to be the possibility of obtaining paid savings or carrying out loans to consumption or immobility via the various partners of Lydia.

Finally, the Lydia application naturally supports security functions such as blocking and unlocking accounts and especially fingerprint unlock for compatible smartphones.

Too bad that Lydia did not see fit to deport its application on a web platform, everything happens only on mobile.