Orange Bank: Customer area, account, contact and review, connect to your Orange Bank account online: tutorial!

How to connect to your Orange Bank account online

Share on Facebook Share on Twitter Share on Flipboard Share on Linkedin Share by email print

Orange Bank

All information on Orange Bank online bank

Online bank of the Orange telephony operator, Orange Bank facilitates the bank on a daily basis thanks to its 100% mobile banking offer for families and professionals.

Summary of the Orange Bank bank sheet

- Presentation of Orange Bank

- Contact details and contact

- Customer service hours

- Current account

- Online saving

- Online credit

- Frequent questions about Orange Bank

- Customer opinion

- The opinion of the editorial staff

Presentation of Orange Bank

Launched in 2017, Orange Bank is the online bank of the Orange telephony giant (formerly France Telecom). According to the press release published by the group on October 1, 2021, Orange Bank currently has 1.6 million customers (in France and Spain).

Orange also bought the company in 2016 specializing in banking and insurance products, Groupama. Founded in 2003, Groupama Banque brought together 530,000 customers, when it became Orange Bank. The French historic operator can also count on his experienced experience with Orange Money. This service opened on the African continent allows customers to transfer money and authorize mobile payment, a particularly popular service in Africa. Orange Money displayed 20 million customers in September 2016.

Orange Bank offers a simple, complete, transparent and different offer, 100 % mobile to facilitate the daily bank of its customers. The online bank relies on instant services that perfectly meet the current expectations of users.

Orange Bank distributes insurance thanks to the redemption in March 2020 of Orange Courtage. Orange Bank offers a consumer credit offer (personal loan and assigned credit) based on the partnership developed with Younited since June 2021.

Online bank plays the mobility card as well as that of the physical agency. Thus, the banking offer is marketed in 300 orange stores out of the 700 that it manages. These vast orange stores offer a dedicated space, with specific signage. The idea is to provide a more effective service for the customer: instead of receiving his bank card by mail, he leaves directly with the agency. Customers are supported by the 2,000 orange advisers equipped with tablets and electronic signature terminals in order to present a digital and interactive course.

Orange offers Apple Pay and Google Pay for mobile payment. The company finally works with IBM on an artificial intelligence device called Djingo with the setting of chatbots.

Active in Poland, Orange Bank is developing in different countries after France, notably in Belgium and Spain.

In January 2021, Orange Bank acquired the neobank Anytime; which allows it to develop its banking offer for independent professionals and companies.

Contact details and contact

Orange Bank postal addresses

THE Orange Bank headquarters is located at the following address:

Orange Bank SA

67 Rue Robespierre

93107 Montreuil Cedex

Customer service address

Orange bank

TSA 10 948

92,896 Nanterre Cedex 9

For Make a check for Orange Bank, You must send your check by mail to the following address:

Orange bank

TSA 10 948

92,896 Nanterre Cedex 9

Contact Orange Bank by phone

Here are the telephone numbers as well as the schedules to contact the various services of Orange Bank as you need (customer service, head office, opposition):

| Service to contact | Phone number |

|---|---|

| Client service | 01 43 60 01 52 (Non -surcharged call – Costs according to operator – Hours in mainland France) |

| Commercial service | 01 43 60 01 52 (Non -surcharged call – Costs according to operator – Hours in mainland France) |

| To oppose your bank card | (+) 33 9 69 32 82 88 (call not surcharged) |

Customer service hours

Orange Bank customer service

| Monday 25/09 | – 8 a.m. – 8 p.m |

|---|---|

| Tuesday 26/09 | – 8 a.m. – 8 p.m |

| Wednesday 09/27 | – 8 a.m. – 8 p.m |

| Thursday 28/09 | – 8 a.m. – 8 p.m |

| Friday 29/09 | – 8 a.m. – 8 p.m |

| Saturday 30/09 | – 8 a.m. – 8 p.m |

| Sunday 01/10 | Farm |

Current account

By subscribing to a Orange Bank current account, customers can access The standard card for 0 €/month without duration limit, A Mastercard card with immediate debit, as well as:

– Loss and theft insurance of means of payment,

– Payments and withdrawals in euros in France,

– transfers and samples in euros in the SEPA zone from the application and by SMS,

– Mobile payment via Apple Pay and Google Pay,

– Instantly updated account consultation,

– Alerts on the situation of the account by SMS or email,

– Balance is updated in real time,

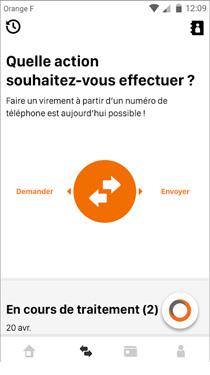

– Shipping money and instant money request via SMS,

– Secret CB code available and modifiable,

– Configuration of payments and card withdrawals abroad and in France.

Note that there are costs related to certain services:

Account holding costs are free if there are less than 1 withdrawal operation or 1 payment per bank card or mobile payment in the month. Otherwise 5 €/month are taken.

€ 5 per operation carried out by an Orange Bank expert for actions that can be done independently from the customer area.

Renewal of the bank card: 0 € and 10 € before its expiration date and € 70 (for a standard CB) / 0 € (for a premium CB) if it is sent to another address than the home following an opposition,

Shipping you registered chequier: € 8,

Payment and withdrawal by bank card in currencies (excluding euro zone): 2% of the amount.

Orange Bank also offers at the opening of the current account, a Premium card for € 7.99/month (ultimately expired). It is a high -end bank card that allows access to all the services related to the standard card, but also in addition:

– Free payments and withdrawals around the world,

– Apple Pay and Google Pay mobile payment,

– The free free express return of the card in the event of loss or theft, even abroad,

– Access to MasterCard Privileges Programs,

– Free Insurance Means of Payment,

– Repatriation assistance up to € 155,000,

– Access to travel assistance and insurance services (rental vehicle guarantee and snow and mountain guarantee),

– the ceilings of higher pensions and payments than the standard card,

– Priority access to Orange customer service,

– A 5% reimbursement of the amounts set to purchases made on the Orange store or the Orange website (cashback).

Orange Bank finally offers a Premium pack which for € 12.99/month Allows you to have an orange bank account, 2 premium bank cards, as well as the possibility of associating with them up to 5 bank accounts for children from 10 to 17 years old with a card more in the name of each child. This premium pack gives 2 distinctive access to the designated persons (1 parent + 1 other designated person) for account management.

This formula allows you to always have an eye on the expenses of your children thanks to the piloting shared with another person for children. It is possible to configure notifications on operations (withdrawal and payment) of children, to make transfers to that used by the child, to block or unlock the means of payment used by the child.

For his part, the child can manage his account thanks to all the features offered by Orange Bank. However, they have no overdraft authorization.

Right now, Orange offers up to 100 € offered (50 € if 10 bank card operations with the Premium card + an additional € 50 for Orange Bank customers who set up an invoice from their account within 3 months of the opening). See Conditions on the Orange Bank website.

| Individual account | Yes | |

| Payment at the opening of account | 50 € | Initial amount conditioning the account opening |

| Promotional offer | 100 € | 50 € for 10 payment with CB and € 50 if ER Draw of 1 orange invoice |

| Fresh held account | 0 € | Free if 1 operation/month otherwise € 5/month, or € 60/year if conditions not respected for 1 year |

| Annual SMS cost | 0 € | Unlimited SMS |

| Internal transfer | 0 € | Free – 15 € for an urgent transfer on D -Day |

| Out of separate transfer | 25 € | + € 14 exchange costs/operation |

| Insurance of means of payment | 0 € | Free |

How to connect to your Orange Bank account online ?

Elected Best 2019 digital offer for the second consecutive year, Orange Bank stands out from its competitors thanks to the quality of its digital offer, a 100% mobile offer.

From your home or from any other place in the world, it is possible to consult your Orange Bank accounts on the Internet by authenticating you via your identifier and your password.

Discover the features of your Orange Bank online account, how to get your Orange Bank connection identifiers,

How to access your Orange Bank customer area ? How to recover your access codes if you have lost them ?

Why is the connection to your Orange Bank space my account is currently impossible ? Finally, how to attach the Orange Bank customer relations ?

By Mélanie Mossaly modified on 02/21/23 at 13:17

Share on Facebook Share on Twitter Share on Flipboard Share on Linkedin Share by email print

What can you do and consult on your Orange Bank personal space ?

To allow you to better understand the usefulness and possible functions in your space Orange Bank my account, We have listed part of what you can Consult on your Orange Bank customer area ::

- Know the balance of your Orange Bank account in real time, at any time of the day (or night).

- Know the details of banking operations, whether it be debit or credit.

- Categorize your expenses and income.

- Proceed to transfers to external accounts via the mobile number of the beneficiaries.

- Know and modify the withdrawal and payment ceiling of your Orange Bank card.

- Activate or deactivate the options “online payment”, “contactless payment”, “payment and withdrawal in the abroad”.

- Temporarily blocking your Orange Bank CB in the event of momentary loss.

- Put your Orange Bank bank card in opposition.

1st visit to your Orange Bank application: how to create your account for a first connection ?

- Download your Orange Bank application On Play Store or on the App Store

- Indicate your 8 -digit identifier received by email at the opening of your Orange Bank current account.

- Enter the activation code you received by SMS on your mobile phone.

- Change your 6 -digit access code and personalize the.

Well done, you can now Consult your Orange Bank bank account on your mobile phone.

A advice: activate the digital imprint authentication. This will allow you to Connect to your Orange Bank space faster.

Go further Floa Bank reviews

Where to find your Orange Bank Orange identifier and password ?

For Connect to your Orange Bank online account, You must enter your identifier and confidential code when you authenticate your personal space.

When you open your account and all supporting documents are sent, Orange Bank addresses you a welcome email at the email address entered.

On this email is indicated your 8 -digit identifier allowing you toAccess your Orange Bank personal space.

As for your password, Orange Bank sends you by mail with acknowledgment of receipt, a few days after finalizing the opening of your current account, your password.

However, if after 3 attempts, Your access to your Orange Bank Internet space is blocked and that you failed to Go to your Orange Bank account online, We advise you to reach your customer service by phone, email or cat so that a advisor can send you your connection identifiers.

How to connect to your Orange Bank customer area ?

To allow you toAccess your Orange Bank personal space quickly, Here is the procedure to follow in 3 steps:

1st step :: Go to the official website of your Digital Bank Orange Bank by indicating to Google ” orangebank.Fr “,” Orange Bank connection “,” Orange Bank my account ” or ” Connect Orange Bank »».

You can also enter the official address of your 100% mobile bank at the following address: ” https: // www.orangebank.Fr/ ” Or ” www orange bank fr »».

Go further how to choose between online banking and traditional banking ?

2nd step : Click on ” log in », The character icon located on the right, at the top of your screen.

3rd step : Inform your 8 -digit identifier and click on the box ” Memorize my identifier So that you no longer have to compose your customer identifier during your next connections. Check the box ” I am not a robot “To authenticate yourself and finally click on” Log in »».

Once these steps have been taken, you are Connected to your Orange Bank Internet space And you can now follow your account online.

Client identifier and lost password: how to recover them ?

The only way to Recover your Orange Bank Orange identifier and password in the event of loss or oblivion is to join your customer relations service and ask your advisor to send you by sms or mail your identifier and access code.

At time Identify your Orange Bank customer area, click on ” Forgotten identifier ? », A message tells you that you can Recover your user from your Orange Bank application and contact your cat advice for more information.

Unable to connect to your Orange Bank account online: why ?

You do not understand Why today your Orange Bank access is blocked ? Why you can’t go to your Orange Bank online account ?

- When you authenticate your Orange Bank customer area, you composed 3 false passwords, causing the blocking of your access. We advise you to contact Orange Bank customer service by phone so that your advisor can send you new connection identifiers.

- Your web browser is not up to date, which explains why you cannot access your Orange Bank accounts on the Internet. Put your internet browser and try to log in.

- Orange Bank refuses to access your personal online space. Contact them by chat or phone to ask them for the reasons for this blockage.

- You have not activated your computer keyboard which prevents you from going to your Orange Bank my account.

Go further how to open an account at Orange Bank ?

How to contact Orange Bank customer service ?

- Declare the loss or theft of your bank card : Call at +33 (0) 9 69 32 82 88. Be careful, upstream oppose your Orange Bank CB by connecting to your banking application.

- Dialogue with an Orange Bank advisor via social networks :: Facebook – Twitter – Linkedin.

- Consult the Orange Bank Forum.

- Consult the Orange Bank FAQ (Frequently Asked Questions).

Passionate about figures and mainly the scholarship, real estate investment and investments in its entirety, discover through my content, the answers to the questions you ask yourself about your finances.