Open an online bank account: LCL Bank and Insurance, what to do to avoid account holding costs? Challenges

Can we avoid account holding costs

from € 1,000 to € 50,000

Open an online bank account

Choose the bank account adapted to your needs, or Take a request online account opening.

Discover our bank accounts

A simple and practical offer ! For € 2 per month, you benefit from: a bank account, an international card, a dedicated advisor and the LCL mobile application.

LCL à la carte allows you to choose the banking products and services adapted to your needs while enjoying reductions. You benefit from a wide range of bank cards to choose from the authorized overdraft service, the LCL Mes Accounts Application.

LCL Student allows adult students to choose the products and services they need to support them throughout the duration of their studies.

A credit commits you and must be reimbursed.

Check your repayment capacity before you commit.

Open a bank account to your minor child

You want to open a bank account to your child ?

At LCL, there are many solutions to prepare for the future of your child, from birth to his majority.

And if you are already a LCL customer, you can immediately open their 1st bank account online from your customer area online

Our bank accounts

Compare our bank accounts

Payment ceiling

Withdrawal ceiling (max)

€ 700 (France) / € 500 (foreign)

Choice of end -of -month speed

Accounts holding costs

LCL APP MY ACCOUNTS

Possibility of joint account

Card choice

Payment ceiling

from € 1,000 to € 50,000

Withdrawal ceiling (max)

€ 3,000 (France) / € 2,000 (foreign)

Choice of end -of -month speed

Accounts holding costs

Yes, under conditions of domiciliation of income

LCL APP MY ACCOUNTS

Possibility of joint account

Card choice

Payment ceiling

from € 1,000 to € 8,000

Withdrawal ceiling (max)

€ 1,000 (France) / € 1,000 (foreign)

Choice of end -of -month speed

Accounts holding costs

Yes, up to your 26 years old

LCL APP MY ACCOUNTS

Possibility of joint account

Card choice

Card choice

Payment ceiling

from € 1,000 to € 50,000

from € 1,000 to € 8,000

Withdrawal ceiling (max)

€ 700 (France) / € 500 (foreign)

€ 3,000 (France) / € 2,000 (foreign)

€ 1,000 (France) / € 1,000 (foreign)

Choice of end -of -month speed

Accounts holding costs

LCL APP MY ACCOUNTS

Possibility of joint account

FAQ Bank account opening

How to open an LCL bank account ?

You can Open an LCL bank account directly online by choosing the formula that suits you best.

How to open an LCL bank account ?

From my smartphone, my computer or my tablet:

1. I choose my banking services

2. I complete my personal data

3. I validate my choices

4. I transmit my supporting documents and I electronically sign my request

To finalize your file you will be contacted by an LCL advisor to agree on an appointment in your agency or even remotely by videoconference.

This meeting will be an opportunity to welcome you, but also to activate your account by performing your 1st payment by bank card. Account opening is also possible in agency, take Meet with your advisor.

If you are not a customer, search The agency closest to you.

If you want Open an account for your child, You can do it directly online.

To be able to open an LCL bank account, you must present an identity document and a recent proof of address. A minor must be accompanied by his legal representative for a first opening account which must be able to justify his quality by presenting the family book and an identity document.

Which can open an online bank account ?

The opening of an LCL online account is subject to acceptance by LCL. You must also fulfill the following eligibility conditions:

- You are a capable natural and major person, or an individual entrepreneur

- You have a mobile phone number and an email address.

- You hold an account with your name open in a bank in France or in the European Union to make your 1st payment by bank card.

- You are not already holder of an account within LCL.

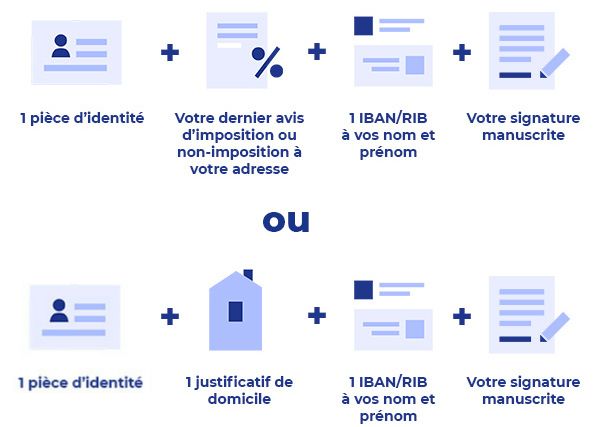

What documents to open an online bank account ?

To open a bank account in France, it is compulsory to justify your identity as well as its domiciliation.

To open an online account at LCL, the list of documents is as follows:

- A valid proof of identity: National identity card (front/back) or passport (pages with photo and signature) or residence permit (front/back)

- Tax or non-imposing notice to your address or proof of address of less than 3 months (fixed telephone invoice; internet service provider invoice; multi -risk insurance certificate (MRH); rent receipt / rent maturity issued by a company Public or private real estate management (HLM, professional trustee, real estate agency)

- Your IBAN/RIB (French banking establishment) corresponding to the account associated with the bank card that you will use to activate your account (payment of € 50)

- Your specimen of your handwritten signature: On a blank page, affix your handwritten signature and transmit the scanned or photographed copy

Depending on your situation, additional supporting documents will be asked (if you are hosted or if you have non-resident status for example).

Can we avoid account holding costs?

By Laure-Emmanuelle Husson on 28.12.2015 at 5:43 p.m., updated on 04.03.2016 at 5:32 p.m. reading 4 min.

From April 1, LCL will apply account holding to its customers, such as 85% of banks. But it is possible to avoid them.

Large banks are preparing to invoice the holding of current accounts

LCL joins the movement started by many banking groups in 2015. As of April 1, 2016, the Lyonnaise bank will charge its customer account holding costs, that is to say the simple holding of a current account. The latter will now have to pay 24 euros per year to benefit from this service offered so far free. “There will be only 16 banks out of 116 which will continue to apply free account holding costs”, is alarmed by Serge Maître, president of AFUB, the French association of banks users.

Indeed, concerned with catching up the shortfall linked to the cap or the prohibition of various costs (intervention commissions, sending paper statements, emission of checks. ) and the increase, according to them, of the costs of securing transactions, the banks have generalized the accounts of account. According to the association of CLCV consumer, 85% of them today apply costs against less than one in 2010 in 2010.

Same tempo, same amount

Thus, since January 1, 2016, Société Générale and BNP Paribas have been paying 24 euros and 30 euros annually respectively to their customers. The establishment of the rue d’Antin justifies the end of gratuitousness due to a “constant increase” of account holding costs due to the intensification of the fight against fraud and one more legislative framework more demanding.

In October 2015, Crédit Mutuel also decided to remove freely in force in seven federations. Account holding costs are now 24 euros annually there. An average price that also seems to be generalizing. Thus, against the tide, the Chaix bank has changed its account of account holding, having passed, since January 15, 2016, from 146 euros per year to . 26.40 euros.

Which suggests a possible agreement. AFUB thus seized the competition authority and the ACPR, the gendarme in the banking sector to verify it. Bercy, who launched an online comparator in early February listing 150 banks, also asked for “a clarification” on the content of account holding costs to the financial sector Advisory Committee (CCSF).

More than a few exceptions

In the meantime, only a few regional funds from Crédit Agricole and the BPCE group (Banque Populaire-Caisse d’Epargne) preserve the total free of this service. Online banks also continue to offer this service and, in front of the rising discontent, multiply advertisements on the subject. Note that young people under 26 years old, people in over -indebtedness procedure or have low resources as well as customers who have subscribed to a “package” are exempt from these costs.

Normally, customers must be informed by mail at least two months in advance of a change in prices. AFUB thus advises customers concerned by an upcoming change in accounting costs to send a registered letter to the agency director invoking article L.312-1-1 of the monetary and financial code to justify the refusal to pay these new costs. Because the acceptance of these new prices is tacit for banks.

Online banks in ambush

At the end of December, Serge Maître said that 20.000 customers complained to their banks. Several cases are then emerging: either the banker refuses to cancel the new prices, or he agrees to decrease them, or he offers his customers to subscribe to a “package” integrating the account holding costs and others services with a higher rate.

This generalization of account holding costs is thus a boon for online banks. “The media have talked a lot about account holding costs in recent months and, in this sense, the dynamics have been favorable to us, explains Marie Cheval, director of Boursorama (Société Générale) group. Our customers come to us for several reasons but bank charges represent an important trigger “. Boursorama thus noted a significant increase in new customers at the end of January when the annual bank charges were sent.

Example of letter to send to his bank to demand the continuity of free:

Good morning,

Learning to establish by your establishment of account ownership fees from January 1, 2016, I inform you of my refusal of this new pricing.

This request is made in application of the prescriptions of the Monetary and Financial Code in its article L312-1-1 II as well as on the recommendation of the AFUB.

With my greetings,

Signature.