Open an online bank account – Crédit Agricole, up to € 850 offered by the best banks online ��

Until 850 € offered by online banks, these bonuses decrypted for you

Answer 7 questions To discover the offer most suited to your needs.

Opening an online bank account is simple !

You wish to open an individual bank account in Crédit Agricole ?

We invite you to associate one of our 5 offers group service, each including a bank card and services to meet your daily needs. (1)

A 100% human and 100% digital bank

On your Credit-Agricole site.fr, your my bank application (2) or in agency, we are by your side at all times.

A bank at the heart of the territories

With 39 regional funds, we are permanently committed to the development of the local economy.

A bank in your image

Join our 10 million member customers to participate, too, in the life of your bank.

Choose the bank offer adapted to your daily life

By choosing one of our 5 offers, you benefit from a bank card and services associated with your account. Without commitment, without income conditions.

The prestige of unlimited

Unlimited services to facilitate your daily life

Comfort and simplicity

An international map and extended guarantees

The essentials on a daily basis

The essential card and services

1 card, 0 costs abroad, for 18/30 year olds

Exclusivity under 30

1 card, 1 app, 1 agency

Simple, fast and security

Open your individual account in 15 minutes

1. Choose your offer

For the opening of a joint account, the opening of an account without associating a group service offer or the subscription of a grouped service offer if you already have an account, please contact your regional fund.

2. Create your secure space

3. Find out your personal information, proceed to your remote identity and download your proof of address and a photo of your signature

4. Electronically sign your request to open your online account and subscribe to your service grouped service

Get advice on choosing the right banking offer.

Contact an advisor

Answer 7 questions To discover the offer most suited to your needs.

Practical, reliable and accessible

Simplify the bank on a daily basis

Manage your accounts online at any time

From the application or the website, you are connected to all your accounts. When you want and wherever you are, manage your accounts in peace.

Pay with your mobile with ease

From the mobile payment application, you pay your purchases and refund your friends of a simple gesture. Your smartphone becomes a real practical and reliable payment tool.

Take advantage of advisers to listen

From the application, the website or by phone, our advisers are there to accompany you.

You wish to transfer your accounts to Crédit Agricole ?

With the mobility assistance service, changing banks becomes easier. You have nothing to do or almost (3) .

Open an account

You choose a banking offer and open an account in your new Crédit Agricole bank.

Sign a mandate of banking mobility

With the opening of your new account, you sign a mobility mandate to Crédit Agricole, your new bank.

We take all your steps

Samples, transfers, checks issued, we take care of all the steps related to your change in bank account (electricity, gas, telephone, wages, etc.).

Join a cooperative and mutualist bank

Become a member of a cooperative bank means being able to make your voice heard during the general meetings of your local fund is also participating in initiatives in your region and benefiting from concrete advantages for a win-win relationship like our 10 millions of members.

FAQ “opening of a bank account”

How to open an online bank account at Crédit Agricole ?

You can become a customer online on the https: // www website.agricultural credit.Fr/. Count on average about fifteen minutes to choose your offer and complete the online account opening request as soon as you have all the necessary documents requested. Our teams will then take 48 hours on average (excluding weekends and holidays) to validate your account opening request and send you an IBAN.

What are the conditions for opening an online account at Crédit Agricole ?

To become a customer online, you must fulfill the following conditions:

- be over 18 at the time of subscription;

- have legal capacity at the time of subscription;

- hold a bank account or a booklet in a bank of the European Economic Area. This is a regulatory obligation linked to the opening of a remote account: indeed, to activate the account, you will have to make a transfer of 20 € minimum from this.

There is no income condition.

If you are not a French tax resident, if you wish to open an account for professional purposes or if you do not meet the aforementioned conditions (including legal capacity), you can go to a Crédit Agricole agency in order to study together an offer adapted to your need and your situation.

What is the time required for the opening of an online account ?

Your account opening request will be studied upon receipt of your complete file with all supporting documents.

Our teams then take 48 hours on average (excluding weekends and holidays) to validate your account opening request and send you an IBAN.

So that you can use your new account you must make a transfer of minimum € 20 on this IBAN from an open account in the European Economic Space and of which you hold.

What are the documents to provide for the online opening of my bank account ?

You will need, at the time of your subscription, to bring the following supporting documents:

- An identity document of your choice among those listed below and valid:

- National identity card (front/back)

- Passport (pages 2 and 3)

- Residence permit (front/back)

- Sign on free paper

- Scan the signature or take a clear photo

- Rent receipt (less than 3 months old)

- Last tax notice on the housing tax or the property tax (under 1 year)

- Income tax notice (under 1 year)

- Invoice (less than 3 months old): electricity, gas, water

- Fixed phone bill (less than 3 months old)

If you are hosted with a third party, you will also need to provide a certificate of accommodation as well as the identity document of the person hosting you and their proof of address.

Is there a minimum payment to open a bank account at Crédit Agricole ?

So that you can use your new account you must make a transfer of minimum € 20 on this IBAN from an open account in the European Economic Space and of which you hold.

How to transfer my accounts to Crédit Agricole ?

With the bank mobility assistance service, you are quiet and waste less time in administrative chores. You can automatically group your recurrent banking operations on your new Crédit Agricole account.

Legal Notice

(1) EKO, Trotter, essential, premium and prestigious offers are reserved for private customers and subject to conditions: the conditions and prices are detailed on this website, and in the current price scale bearing the main general bank conditions of the regional fund. The contribution is subject to development in accordance with this same price scale in force. The products and services that make up these offers can be taken out separately: ask the regional fund to find out the applicable conditions and prices.

The final opening of your account as well as the granting of payment means are made subject to acceptance of your file by the Regional Caisse.

When your account opening request is made remotely, you have, in accordance with the provisions of the Monetary and Financial Code and the Consumer Code, a period of 14 calendar days to withdraw you without having to justify support for penalties

(2) Free download and access to the MA Bank application, excluding communication costs according to operators. The use of the application requires the holding of a communication terminal compatible with internet access and the subscription to the Crédit Agricole online service. Services that can vary according to your regional fund.

(3) The banking domiciliation assistance service is reserved for natural persons who do not act for professional needs and wishing to make the transfer of domiciliation of their recurrent direct debits and transfers. The transfer only concerns deposit accounts and is made of individual account with an individual account, an attachment to an attachment (if all the holders are the same) or from account to joint ownership (if all holders are the same) and an individual attached account (if the holder of the individual account is one of the holders of the joint account).

Until 850 € offered by online banks, these bonuses decrypted for you !

Connectbanque.com has selected for you the welcome offers and bonuses of the most interesting online banks.

You want to save money and make money ? You are going to be spoiled because the advantages of the online bank are numerous: Reduced bank charges even nonexistent in some cases, No income conditions, offerings without commitments, a free bank card, high -performance mobile applications, etc and especially Bonuses when opening an online account.

This is the reason why the online bank is experiencing an impressive boom and this only accelerates in recent months with several million active customers for these actors of the digital bank like Boursorama, Monabanq, Hello Bank!, .

To speed up their development, Online banks offer welcome bonuses to open a free bank account. Combined between the main online banks if you open several accounts, It’s € 850 of bonuses to pocket !

We offer you to earn money and achieve real savings by subscribing to online banking… knowing that an online account opening takes only a few minutes with a 100% digital course (including the sending of supporting documents).

So what are the conditions of eligibility to take advantage of these premiums ? You just have to Being major French and resident.

�� Hello Bank! : the online bank of BNP Paribas which offers you up to € 180 by premium

Online bank Hello Bank! has reviewed its offer since the beginning of 2020 to adapt to the habits of the French and have a more competitive offer against the new free banks (Neobanques) of which you will find details in our article: Hello Bank! changes its offer with Hello One and Hello Prime.

An entry -level offer The most flexible and complete market is offered without income conditions and completely free: Hello One.

You also have a premium offer with Hello prime : minimum income condition of € 1,000 monthly. This Hello Bank offer! with a contribution of € 5 per month is made up of a first visa card at no cost abroad and therefore particularly suitable for passenger profiles.

�� Right now, there is an offer for new customers: Up to 180 € offered for the opening of a Hello One and Hello Prime account. And take advantage of Hello Prime/Hello Prime Duo with € 1 for 6 months !

�� A premium of € 120 offered when opening your Monabanq account

The Federal Crédit Mutual Crédit Federal, Monabanq has been “Elected customer service of the year 2023” for 6 consecutive years.

This online bank which claims the positioning “online bank that places people before money” offers a current account Without income conditions accessible to all.

You have the possibility to win up to € 120 at the opening of a current account without hidden costs with the first or platinium visa and with a first deposit of 150 €.

✔️ Fortuneo The ideal option for a high -end card: Gold Mastercard with € 230 offered

Indeed, Fortuneo propose The Gold Mastercard card for free provided that you justify € 1,800 in monthly income.

Added to this is A welcome bonus of € 230 + € 100 in vouchers. In addition to this exceptional welcome bonus, Fortuneo transfers the same sum to the Surfrider association, on the occasion of World Ocean Protection Day.

In addition, Fortuneo also offers high -performance and competitive banking services: mortgage, savings, scholarships and in particular Life insurance with a premium of € 300 at the opening of any new contract.

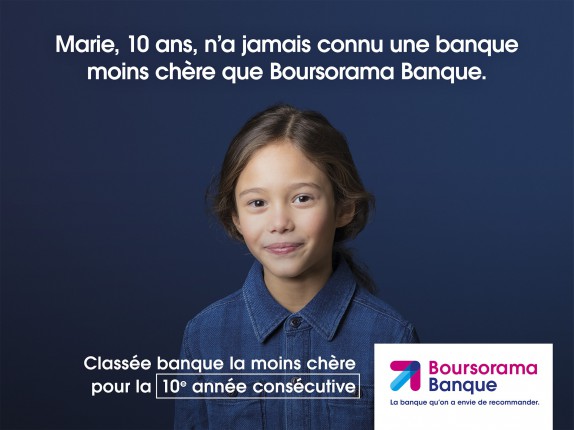

✅ Until 130 € Bonus for the Leader Bank: Boursorama Banque

It’s online bank classified number 1 on our comparison and also elected the cheapest bank !

Société Générale online bank is on the rise and displays at the end of the first quarter of 2020 more than 2.3 million active customers. This success is partly due to the extension of its product portfolio which allows more customers to attract with a range adapted to all.

Indeed, Balance Bank has expanded his range of tenders to meet everyone’s needs: for Travelers with its Ultim offer (Discover our article concerning Ultim card)), an entry -level offer and accessible to all With Welcome and finally An offer dedicated to young Freedoms.

The good news : The 100 € premium is applicable to all of these offers for new customers.

To remember that the offers Ultim and Welcome are completely free, without income condition and without obligation to domicile its income … which allows you to benefit from this home bonus without !

�� € 10 premium offered on the Revolut account

BANK REVOLUT, The famous neobank which has everything of a big one, because it even has offered since 2023 an overdraft authorization as well as the possibility of having a credit !

Revolut has taken the bet to offer in Connectbanque partnership for all new customers of their accounts without commitment (Revolut Standard completely free, Revolut Plus, Revolut Premium, Revolut Metal as well as the latest arrival Revolut Ultra) A welcome bonus of 10 euros !

The revolut offer is complete with different bank cards to satisfy all customers:

- Standard revolut (free offer) : the account for all budgets.

- Revolut Pusat € 2.99 per month : the current account for your daily expenses.

- Revolut Premium at € 7.99 per month : the account which allows the change of currencies in an unlimited way at no cost.

- Revolut Metal at € 13.99 per month : the account that offers all the advantages of a metal card

- Revolut Ultra at € 45 per month : the account which seems to have no limit in France as well as abroad

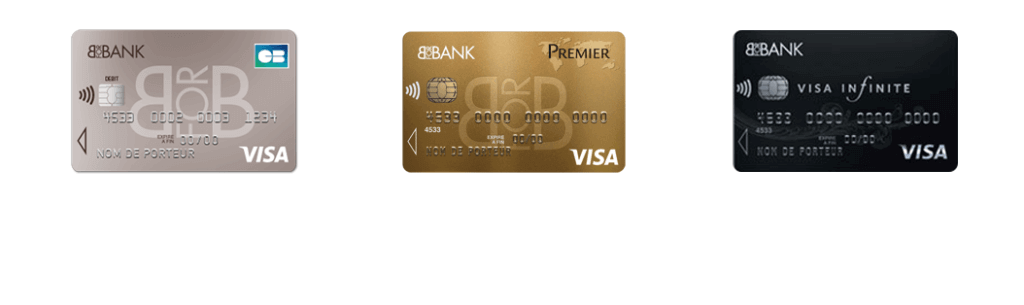

�� Bforbank, the online bank of the Crédit Agricole group with a bonus of € 80 offered

A subsidiary of the Crédit Agricole group, Bforbank is one of the first online banks that have been existing for 13 years. Its reputation is well established both on its customer service which is available 6 days out of 7 and on the exhaustiveness of the financial products offered such as life insurance, PEA (Stock Exchange), Booklets, Consulting and Consumer Consumer.

With Connectbanque, there is A welcome bonus of € 180 for new customers Right now but the Visa Premier Map No cost and a savings book.

This welcome bonus of decomposing as follows: 80 € offered from bonus to the opening of a current account with card.

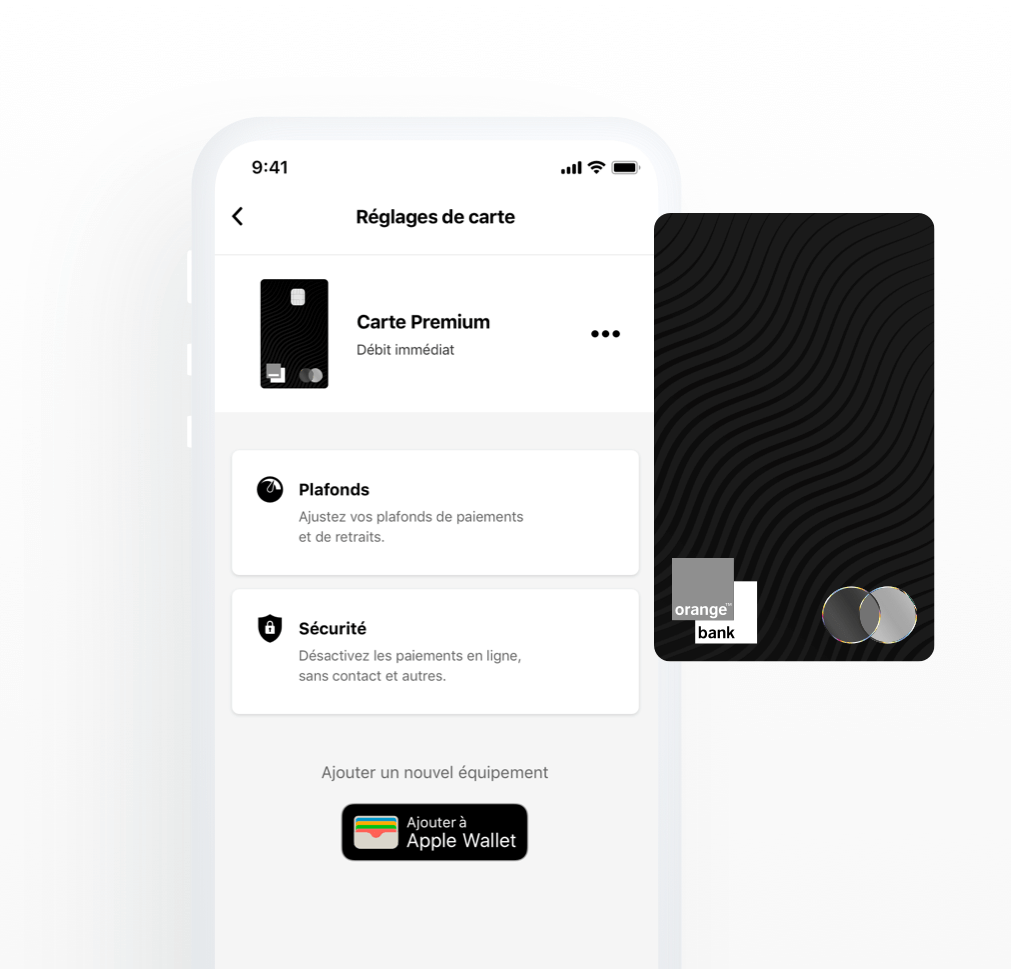

�� Orange Bank, the mobile bank with a premium up to 100 €

Orange operator’s mobile bank has had more than 500,000 customers since its launch at the end of 2017.

This successful launch is explained by an offer with advantageous conditions for these customers: a current account and a free credit card … and an easy account opening. In illustration, operator’s customers can Open an account in a few clicks without the need to provide their identity document.

Next to that, Orange Bank propose A 3% boosted booklet one of the most efficient booklets on the market ! To find out more consult our Ranking of boosted booklets.

To receive the premium of € 50, the following conditions must be complied with: choose the Premium card or a Premium pack and make 10 withdrawals or payments during the first 30 days ! You have an additional bonus of € 30 if you are already an orange mobile or internet box customer.

Now it’s up to you, to earn money and save money on your bank charges by opening an online bank account !

To conclude, the welcome bonus should not necessarily be your only criterion of choice To open an account with an online bank. To guide you and Choose the online bank most suited to your needs, We provide you with Online banking comparator.

You are a parent or minor ? Offers and Bank accounts dedicated to teens exist, you can consult all the offers on Our comparison of bank cards for adolescents here !