Online banking – PROCHESEDESCREDITS, List of 35 online and neobanc banks operating in France (2022)

Online and neobank banks in France

The online banking model is not necessarily intended for all French. Indeed, it requires in a first a certain ease with digital, new technological and of course the internet. The clientele targeted by these banking groups is therefore essentially young and … easy.

online bank

Boursorama, Bforbank, Fortuneo, Orange Bank, ING, Monabanq, Hello Bank … It is not always easy to find the right one online bank, especially today, with the large number of players present on the market. Fortunately, pursedescredits puts a free comparative online banking. With this tool, you can see, at best, the choice that will be the most beneficial to you.

To find out more and find the best bank, you can also refer to our online bank guide. Discover the list of professionals and services they offer, as well as the different welcome offers available. You can also directly ask for help from one of our advisers. In any case, we will help you choose your bank online.

- What to think of an online bank ?

- What are the advantages of online banking ?

- What are the disadvantages of online banks ?

- How the electronic wallet works ?

- How does the separate transfer work ?

- What bank has the least bank charges ?

- How to opt for an online bank ?

- Why spare online ?

- Why use an online banking comparator ?

- How to change banks ?

What to think of an online bank ?

An online bank does not differ a lot from a traditional bank. Services are often almost identical. Among these basic services, we can thus note the opening of a bank account, the account holding, the joint account, the bank card, the checkbook, credit financing services for certain establishments or even placements Financial and banking.

The fundamental difference comes from the absence of physical agencies in the case of online banks. Indeed, operations are only done on Internet, via a computer, a smartphone, a tablet or through a mobile application. The advantage of this absence of agencies and banking advisers is that it allows online banks to offer Very competitive banking costs. So this is a cheaper online account.

But it is not finished. Two types of online banks are distinguished in the financial landscape. The first category brings together establishments offering complete services on the Internet, while keeping a physical distribution network. All of the major financial establishments in the country are in this group. The second category brings together online banks proper, also called pure player. These brands are completely dematerialized, without the help of the slightest agency, window or physical point of sale.

What are the advantages of online banking ?

So why go to the online bank today ? These banking establishments offer all the services available in a traditional network: credit, savings booklets, financial investments, current account, etc. Big difference, however, most of these benefits are cheaper, or even free. Thus, going through an online bank is, in the vast majority of cases, a way not to pay accounts for accounting or credit card costs.

Another advantage, despite the absence of physical agencies, these remote banks are ultimately more accessible. It is, in fact, possible to contact them permanently, freely. The online bank is thus intended to be accessible day and night, even during holidays and the weekend. Most brands also offer interviews by webcam, email or telephone to their customers.

The arrival of the best online banks has enabled a real transformation of the banking market. New services, banking products and innovations have appeared, such as the electronic safe or the electronic portfolio. Likewise, due to the online management of services, customers are able to carry out several types of banking operations themselves, directly from their home, without being forced to move to an agency or at the headquarters of their creditor. Among these operations, there are transfers, the subscription of a credit, the opposition of a bank card, the management of placements and all current operations.

What are the disadvantages of online banks ?

Conversely, online banks can also have drawbacks for a number of customers. For example, if you are used to frequently meet your advisor in the agency of your traditional bank, online bank may not be made for you. Indeed, the absence of a physical agency and dedicated advisor dedicated the relationship with the online establishment. Customer relations in an online bank is also, online.

Another barrier for certain customers, the conditions of registration in mobile banks. Many establishments, even with free products, require a minimum of income or savings before the opening of an account. However, these limits are not insurmountable. Only between € 1,200 and € 1,600 in monthly income are requested. Finally, last limit of certain pure players, liquid money or checking operations are complicated and must be made by mail.

How the electronic wallet works ?

This is one of the assets put forward by online banking establishments: the electronic wallet. Mainly used by online banks for certain bank accounts, the ewallet is an increasingly appreciated means of payment by the French. It allows you to transfer small everyday sums. Indeed, in the vast majority of brands, the system does not allow operations to be carried out beyond € 30. As for the ceiling generally practiced on an electronic wallet, it is around 100 €.

You should know that this virtual wallet is completely rechargeable. To supply it, you can do it using a bank card, as with a first visa card for example, or via the purchase of amounts of 10 or 20 € on the supplier site, such as for example Money Or Orange cash.

In addition, the payment terminals of equipped stores, telephone cabins, post offices and a number of banks also have equipment to be able to recharge the Ewallet without cost.

The electronic wallet can take different aspects. Four kinds of Ewallet are marketed in France: the 3rd-failed faces placed in an electronic smart card, those inserted in a bank card, those installed on a USB key, and finally, those integrated into a smartphone. This last category is mainly aimed at smartphones equipped with technology NFC, allowing it contactless payment.

How to explain the success of the Ewallet for a few years ? First of all, it has the advantage of ease of use. Unlike regulations with bank cards, payment by electronic portfolio does not require any validation by code. To use it, you just have to insert the bank card or pass the electronic smart card in front of a payment terminal. Another significant asset, the use of the system is secure.

How does the separate transfer work ?

THE SEPA transfer aims to make transactions simpler and faster in the European economic space. Thanks to this advantageous device, the processing time for transaction orders (samples, transfers, etc.) and the delivery of funds has shortened considerably.

The deadline set by the banking authorities is at a maximum of three working days. But the transfer is sometimes faster if it is made from an online bank. As for the cost billed by banking establishments, it differs according to each bank, which is free to set its own prices on the transfers operated, according to the SEPA standard.

To give a range, the cost of a transfer of this type varies between 2 and 4 €, whatever the recipient country. Note that, if the payments are made via a pure player (online banking), such as Boursorama Banque and Monabanq, this charge can however be zero.

What bank has the least bank charges ?

According to the latest survey of the Consumer Association CLCV (National Association for the Defense of Consumer and Users), bank charges have further increased in 2018 in conventional banks. In question, a generalization of account holding costs, also denounced by the State and a number of associations. In short, good advertisement for remote banks.

Indeed, the latter display much lower prices than traditional banks. The customer of an online bank can thus achieve annually up to € 150 in savings. The reason ? No physical agency and no dedicated advisor. At the key, free account holding fees, a free bank card also and a set of services cheaper than those of large banks.

How to opt for an online bank ?

The online banking model is not necessarily intended for all French. Indeed, it requires in a first a certain ease with digital, new technological and of course the internet. The clientele targeted by these banking groups is therefore essentially young and … easy.

Indeed, to reach an online bank, it is necessary beforehand to claim a minimum of monthly income or savings. On the side of ING, for a classic visa or mastercard card for example, it’s € 750 per month. At Boursorama, it’s € 1,000. For the gold or first card, you must justify a minimum monthly income of € 1600 at BforBank or € 1,800 at Boursorama. For platinum or infinite cards, it will be necessary to justify even higher conditions (around € 4,000 in income). Note that these conditions are however regularly revised downwards.

These establishments are also intended for people who rarely need contact with their advisor, or to move to an agency to validate a banking operation, or even for withdrawals. If the relationship with your banking advisor is essential for you, online bank is not necessarily made for your profile.

Customers who frequently make cash deposits are not the most interesting for these banks. Indeed, due to the absence of physical agencies, regularly depositing cash or checks is more complicated. However, some online banks are attached to a traditional establishment, such as Hello Bank, whose customers can contact customer service and a banker in any BNP Paribas agency.

Why spare online ?

Some online banks, such as Bforbank, only proposed online savings solutions. Recently, all these establishments have also been offering conventional banking services. Among these investments, online banks especially offer what one might call a Super Banking Bank.

This banking product directly competes with booklet A, losing speed following the drop in its interest rate (and recently the LDD and the PEL). These booklets thus offer yields higher than the A Livret A, thanks to a standard rate often slightly higher (on average between 0.75 and 1.50 %) and above all, a promotional rate frequently highlighted, around 2.50 % to 3 % for a few months, often three.

The first year above that of a conventional savings book, thanks to a completely secure placement. The sum placed in these products can also be removed or mobilized at any time, if necessary. Only negative point, this placement is taxed.

Second flagship placement of online banks, thelife insurance. In this context, establishments generally offer several funds in euros, whose yields are greater than those available in traditional banks. These yields oscillate between 2.60 and 3.50 % approximately, when the national average of life insurance yield is only 2.20 to 2.30 %.

Why use an online banking comparator ?

Which online bank to choose ? Where to find the lowest banking prices ? THE digital banks, digital and totally in lines are always more numerous. Among this large banking offer, we find subsidiaries of large traditional groups and deposit banks.

Among these neobancs, We can note Boursorama, a subsidiary of Société Générale, just as a direct agency, Hello Bank!, The Net Agency and Cortal Consors, all three subsidiaries of BNP Paribas, but also Bforbank, a subsidiary of Crédit Agricole, Monabanq, the online bank of the Crédit Mutuel-Cic group, MonbanqueniLigne de la Caisse d’Epargne, E.LCL, LCL online establishment or Fortuneo, a subsidiary of Crédit Mutuel Arkéa.

Finally, we also find ING, Axa Banque, Allianz Banque, Available of Banque Populaire Bred, CMUT La Banque remotely from Crédit Mutuel, Coopanet du Crédit Coopératif, or Son d’Axa Banque among the various banks on the Internet.

CONSTROSESCREDITS MOVES PUBLIC ONLINE, free and non -binding tools, intended to simplify customer search. Among these tools, the Online banking comparator, also called simulator online banking or comparative Online banks, will allow a future user to discover the offer of the most interesting banks according to his profile.

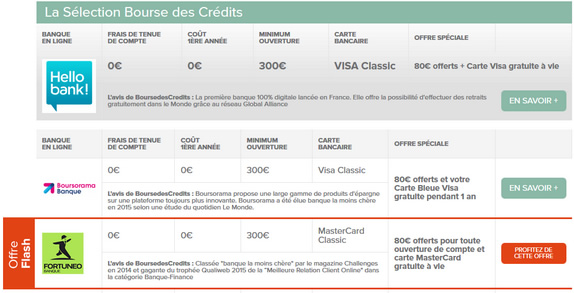

Going through an online bank comparator like the one offered by Boursedescrédits is the opportunity to identify and compare, upstream, the different proposals available on the market, offered by all banks, before opening a Internet bank account. The objective of this comparison of banks is to assess the various promotional offers or welcome offers different players in the sector. Indeed, very frequently, online banks offer this type of offer: € 80 for the opening of a bank account, € 50 offered for the opening of a super bank book, € 100 offered for subscription to subscribe ‘life insurance, etc.

These offers have only limited durations and conditions must be met to access them. It is therefore important to Compare banks online. Several criteria can thus be retained for this: account holding costs, bank card costs, promotional offers, the minimum amount for the opening of an account, yields of the placements offered, etc.

How to change banks ?

There are many customers who, simply for lack of information, hesitate for a long time before choosing a new bank. Discover on video the advice of Benoit Grisoni, director of Boursorama Banque, to change their banking establishment by leaving all its concerns aside.

Register for our weekly newsletter

Join 20.000 subscribers then receive our news and good deals for free and without commitment

Your email address is only used to send you the newsletter information letters. You can use the unsubscribe link integrated in the newsletter at any time to find out more about your rights, you can consult our privacy policy

A credit commits you and must be reimbursed. Check your repayment capacity before you commit.

Fraud alert ! You can be contacted by false brokers working supposedly for scholarshipscredits.com. Under cover of a credit proposal, they will ask you to transmit documents, funds and bank details. Be vigilant: in no case.com will not ask its customers to turn sums loaned by banks to its accounts, with the exception of agency fees. In addition, our brokers will always contact you via an XXX [email protected]. Any other address can be considered as an attempt to bay. Thank you for your vigilance and understanding.

Online and neobank banks in France

This listing includes 14 online banks and 21 neobancs or online account formulas accompanied by an application. Online banks developed in the early 2000s with the development of the Internet and the possibilities offered to banks to digitize their offer. It was not until more substantial development of digital uses that online banks reach their 1st million customers.

Today fashion is neobancs and account formulas accompanied by a mobile application. Unlike traditional banks, which were mostly French banks operating on French soil, online banks and especially neobanks operate in France from Europe or from countries outside the world.

To read also:

- List of French banks

- Comparison of the best French banks in 2021

- All banks’ codes

This site is in no way the site of a bank. For more information: legal notices.

All rights reserved – Copyrights © 2012-2023 – Quelbanquechoisir.FR: online banking services comparators – Contact

Ex. Current research: “a special offer”, “a bank with low banking costs”, “a bank without deposit”, “open an account quickly”, online banking forum.