N26 The online bank we love, online banking comparison: the best offers in 2023

Online banking comparison: the best online banks in 2023

In addition to their generous welcome bonus and their free card, online banks are deemed to their particularly low or even free banking costs. This is particularly the case for daily banking costs.

The bank we love

Join the bank of the future, simple to use, 100 % mobile and already adopted by millions of people.

The free bank account that simplifies everyday life

Discover N26, the 100 % mobile online bank, guaranteed without paperwork and without hidden fees. Manage your money in real time from your phone, with customer service available 7 days a week.

N26 Smart – Manage your account more simply on a daily basis

Discover N26 SMART, the Premium bank account which gives you control of your money through intuitive features and customer service reachable by phone. Choose your N26 card in color, create up to 10 sub-accounts to save alone or with others. You also access the statistics of your monthly expenses, and to offers and discounts from our partner brands.

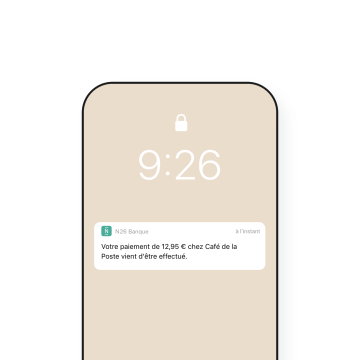

The online bank in real time

The push notifications in real time warn you of everything that happens on your account: payment, entering or outgoing transfer, direct debit … Online bank N26 sends you a notification with each transaction: more unpleasant surprises.

Travel without borders and at no cost

Use your mastercard wherever you are

Zero costs on all your payments made with your Mastercard virtual debit card, even abroad.

Caps and peel off

No need to warn us. Activate or deactivate payments abroad from your phone yourself and adjust your ceilings.

Take advantage of the best exchange rate

N26 applies the real Mastercard exchange rate on your currency transactions, without increase. Our partner TransferWise also allows you to make international transfers in 38 currencies from your application, with costs up to 6 times lower.

Our premium accounts assure you

With an N26 You or N26 Metal account, you have in addition to Allianz insurance to cover yourself on a daily basis, during your trips and your trips, pandemic risks included.

The automatic categorization of your expenses

How to better manage your expenses and your budget ? By having an overview of how you use your money. To do this, N26 automatically classifies your expenses by category. You can also personalize this follow -up by adding hashtags to your transactions.

How to save with spaces

Discover spaces, the premium functionality that allows you to create up to 10 personalized sub-accounts to organize your budget and put money aside for your projects. “Holidays”, “new computer”. It’s up to you to personalize them !

Use the rules to move money automatically to your spaces, or rounds. They allow you to round your purchases to the upper euro and the corresponding amount is automatically put aside in one of your spaces.

Your daily bank with a French IBAN

Receive your salary and manage all your payments in a single application thanks to your N26 account. The new N26 customers now have a French IBAN for all their transactions, whether it be incoming transfers, automatic samples or permanent transfers.

Online banking comparison: the best online banks in 2023

More than 6 million French people have gave the step of the online bank, why not you ? We compare all services: free bank card, reduced bank charges in France and abroad, generous welcome offer, or even innovative banking service.

up to 120 € offered

Monabanq offers you up to 120 € For a first current account opening.

Boursorama Banque offers you Until 100 € For very first account opening.

Up to € 230 offered

Fortuneo offers you up to 230 € For a first account opening.

�� Comparison of the best online banks in 2023

✔️ up to € 230 offered

From 0 €/month

�� Fosfo card (free)

- Free card

- Systematic authorization card

- Without income

- Immediate flow

- Classic Visa Insurance

- Discovered authorized from € 200 after 6 months

- 100% free payments and withdrawals abroad

�� Gold Mastercard (free)

- Free gold card

- Immediate or delayed flow

- Income conditions: € 1,800 in net monthly income or € 10,000 savings

- Gold Mastercard insurance

- Discovered authorized from 200 €

- 100% free payments and withdrawals abroad

�� World Elite Mastercard card (free)

- Free Black Card

- Immediate or delayed flow

- Income conditions: € 4,000 in monthly net income and to pay each month

- World Elite Mastercard insurance + concierge service

- Discovered authorized from 200 €

- 100% free payments and withdrawals abroad

- A fairly wide range of banking products

- A free card at no cost abroad

- An attractive scholarship offer

✔️ 100 € offered

From 0 €/month

�� Welcome card (free)

- Free card

- Systematic authorization card

- Without income

- Immediate flow

- Classic Visa Insurance

- Discovered authorized up to € 2,500 after 3 months

- Free foreign payment

- 1 free removal/month abroad

�� Ultim card (free)

- Free card

- Systematic authorization card

- Immediate debit: without income conditions

- Delayed flow: € 1,500 in net monthly income or € 3,000 in savings

- Premier visa insurance

- Discovered authorized up to € 2,500 after 3 months

- Free foreign payment

- 3 withdrawals/month abroad free

�� Ultim Metal card (€ 9.90/month)

- Paid metal card

- Systematic authorization card

- Immediate debit: without income conditions

- Delayed flow: € 2,500 in net monthly income or € 5,000 in savings

- Premier visa insurance + protection of payment means and electronic devices

- Discovered authorized up to € 2,500 after 3 months

- 100% free payments and withdrawals abroad

- Full offer of banking products

- Among the most advantageous banking on the market

- Free and free income bank cards (in immediate debit)

✔️ 3 months of premium subscription offered

from € 0.00/month

�� Standard card (free)

- Free card

- Systematic authorization card

- Without income

- Immediate flow

- French RIB

- Free foreign payment

- Unlimited ephemers virtual cards

- 2 Removal/month abroad free

- Travel insurance abroad and in the mountains

- Systematic authorization card

- Immediate debit: without income conditions

- Free living room access with smartdelay for 1+1 friend

- Cashback program

- Priority customer support

- Free foreign payment

- Junior revolut account included (2 children)

- French RIB

�� Metal card (€ 13.90/month)

- Travel insurance abroad and in the mountains

- Systematic authorization card

- Unlimited currency changes internationally

- Immediate debit: without income conditions

- Free living room access with smartdelay for 1+1 friend

- Cashback program up to 10% on your reservations

- Priority customer support

- Free foreign payment

- Junior revolut account included (2 children)

- French RIB

✔️ Unlimited ephemeral virtual cards

✔️ Bonus: Pockets + Cashback

✔️ Free account with French RIB open in a few minutes

✔️ Efficient tools for budgeting and expenditure analysis

✔️ Discounts and cashback on major brands (Nike, Amazon, Adidas, etc.)).

✔️ withdrawals and payments abroad free of charge and at the real exchange rate, within the limits of your subscription

�� original card (€ 2.90/month)

- Systematic authorization card

- Without income

- Immediate flow

- Classic Visa Insurance

- No authorized overdraft

- Free payments and withdrawals abroad

- Systematic authorization card

- Without income

- Immediate flow

- Card at € 2.90/month for 6 months then € 6.90/month

- Premier visa insurance

- No authorized overdraft

- Free payments and withdrawals abroad

- Opening in a practical post office

- Offer for the whole family

- Interesting cashback

✔️120 € offered

From 3 €/month

- Visa Classic or Visa Premier (+€ 3/month)

- Without income

- Overdraft

- Payments and withdrawals in 100% free euro zone

- 3 free withdrawals per year outside the euro zone

- Visa Classic or Premier Insurance

- Visa Classic, first visa (+€ 3/month) or Platinum visa (+€ 9/month)

- Without income

- Overdraft

- Payments and withdrawals in 100% free euro zone

- 25 withdrawals and 50 free payments per year outside the euro zone

- Visa Classic or Premier Insurance

- Average payment insurance and electronic devices included

- Visa Classic, first visa (+€ 3/month) or Platinum visa (+€ 9/month)

- Incommensurate

- Overdraft

- 100% free payments and withdrawals around the world

- Visa Classic or Premier Insurance

- Average payment insurance and electronic devices included

- Bank offers without income conditions

- Wide range of banking products

- Available mortgage

Welcome offer: ✔️ up to € 80

From 0 €/month

�� Hello One (free)

- Free systematic authorization card

- Immediate flow

- Without income

- No authorized overdraft

- Free euro zone withdrawals

- Withdrawals excluding euro zone: 1.50%

- Payments all over the world free

- No insurance card insurance

�� Hello Prime card (€ 5/month)

- Paid systematic systematic authorization card

- Immediate or delayed flow

- Income conditions: € 1,000/month

- Discovered authorized negotiable

- Payments and withdrawals all over the world free

- Premier visa insurance

�� Visa Classic card (free)

- Free Visa Classic

- Immediate flow

- Income conditions: € 1,200/month

- Free payments and withdrawals

- Payments and withdrawals outside the euro zone: 1.95%

- Classic Visa Insurance

�� Visa Premier card (free)

- Free Visa Card

- Immediate or delayed flow

- Income conditions: € 1,600/month

- Free payments and withdrawals

- Payments and withdrawals outside the euro zone: 1.95%

- Premier visa insurance

�� Infinite visa card (200 €/year)

- Infinite visa black card at 200 €/month

- Deferred debit

- Income conditions: € 4,000/month

- Free payments and withdrawals

- Payments and withdrawals outside the euro zone: 1.95%

- Infinite visa insurance + concierge service

- A very large range of banking products

- Free bank cards (Visa Classic and Premier) and an accessible infinite visa card

- Low high banking costs

Classification after consideration, by Selectra, of the price of the offer and its various characteristics. Updated data in September 2023

Which online bank to choose ? After analyzing market offers, it is Fortuneo the big winner of our online banks comparison ! Fortuneo offers free card offers, at no cost abroad, with a most attractive welcome offer. For customers having the plan to save or invest, Fortuneo also responds since it has various banking products: savings booklets and stock market products.

❓ Why choose an online bank ?

�� attractive prices

Free card, no account holding costs, reduced costs on current operations, free payments abroad, etc. : online banks have considerably broken the prices. Choose a bank online is therefore the assurance of save money On your bank charges: you can save up to € 250/year, compared to a traditional bank. Online banking prices are therefore extremely attractive for those who wish find a cheap bank.

✨ Various and accessible banking products

If their offer is more felt, the online banks today offer savings products (booklets, life insurance, etc.) as offers of Consumer credits or real estate loans. Their banking products are generally cheaper and more accessible that those of traditional banks: 0 file costs, attractive TAEG on the side of the loan; little or No brokerage fees and an input ticket accessible on the side of Placement solutions.

�� Flexibility and availability of customer service

THE Online banks attach particular importance toremote customer experience with some Customer spaces and simple and ergonomic banking applications, thoughts to give you More daily autonomy. Online banks also offer several devices to contact an advisor: telephone line, cat, secure messaging, etc.

��️ Safety and stability

Are online banks safe ? Yes, because they rely on large banking groups and are regularly controlled by ACPR.

In addition, the Online banks are required to apply French, European and international regulations in terms of banking security. In France, they are notably registered with the ORIAS and controlled by the ACPR, an entity from the Banque de France in charge of compliance with the rules of prudence.

�� What disadvantages ?

Online banks do not have a network of agencies : therefore impossible to go to the counter or benefit from a dedicated banking advisor. For those who like to move to an agency, go to online bank may drastically change your habits. In addition, the Check and liquid silver deposit can be more complex with an online bank.

�� Our advice on how to choose your bank online

�� Determine my need for my online bank

Before peeling all Online banks offers, take the time ofIdentify your criteria and needs : this will allow you to identify the bank cards which suit you more quickly.

- Choose an online bank: questions to ask:

- Your financial situation : income, expenditure habit, etc.

- Your needs : free card, authorized overdraft, etc.

- Your habits : regular trip abroad, revenue and outings of irregular money, etc.

- Your projects : purchase of real estate, moving as a couple, etc.

�� review the eligibility conditions

At the Online banks, Free often has a price, even among Best online banks : most of bank card offers are subject to income conditions, A fortiori for premium cards. Check that your income is entitled to you.

Several online banks will however offer Offers without free income and entry -level condition or some paid high -end offers without income conditions.

Monabanq or Boursorama offer all of their cards without income.

�� Watch the conditions of the various banking services

THE Online banks certainly offer Current account offers + free bank card, But beware, conditions often apply:

- minimum use of the bank card

- minimum payment condition monthly on account

�� Welcome bonus and online banks sponsorship offer: the little extra

The welcome bonus is the “little more”Who can help you decide. Beware not to consider that this argument : you could miss an offer more suited to your profile.

Be attentive to promotions the banks offer Additional welcome bonuses For the subscription of additional services: savings book, life insurance, etc. This is how welcome premiums can go up to 130 € or even 160 €.

ℹ️ Opinion on all the main online banks

To refine this online banks comparison, Here is a detailed analysis of our experts.

☑️ Boursorama Banque: online bank “the cheapest”

Subsidiary of the Société Générale group, Balance Bank is considered one of cheapest banks on the market, in particular thanks to low bank costs and a range of 3 particularly accessible bank cards.

2 free bank cards, a metal card at € 9.90/month and fees abroad Ultra reduced: Boursorama has an attractive current account offer coupled with a Innovative and ergonomic mobile application.

Online bank does not stop there and has a wide range of competitive secondary products To seduce savers and investors: CTO, life insurance, savings book, etc.

Want to know more ? What is the BOURSORAMA BANK online bank worth ? Discover our full opinion on Boursorama Banque.

☑️ Fortuneo: a demanding online bank ?

More discreet, Fortuneo is however one of the most popular online banks : the online bank of Crédit Mutuel is also distinguished by the loyalty of its customers, proof by the facts of its quality of service.

Made of 3 free bank cards, Including the Mastercard Black Carte, the Fortuneo offer details on the online banks market. It is also among the Best banking offers to travel : Fortuneo does not derive any costs abroad, and this from the Fosfo card.

Want to know more about Fortuneo ? Fortuneo, what do customers think ? Discover our full opinion on Fortuneo.

☑️ Monabanq: the local online bank

A subsidiary of the Crédit Mutuel group, Monabanq assumes a positioning very different from its competitors: 4 paid offers, but accessible to everyone and the provision of the network of Distributors CIC Crédit Mutuel.

Her Reinforced customer service like his Check and cash deposit service make Monabanq the ideal candidate for a Passage to the Digital Bank very gently. However, we regret a watchful mobile application and the absence of a free card.

Want to know more about Monabanq ? Customer reviews, advantages and disadvantages of Monabanq: form an opinion with our full opinion on Monabanq.

☑️ Bforbank: Haut-de-Gamme online bank of the Happy-Few

Launched by Crédit Agricole, BforBank has led a long high -end positioning and selective before reviewing your copy, with a more accessible offer.

With 2 Visa Classic and Visa Premier Free under income conditions and a Infinite visa black card, At an attractive price, Bforbank will seduce the wealthy customers. We also like its offer of extensive additional products, especially its life insurance, as well as its proximity to the Crédit Agricole network to offer extensive services.

☑️ Hello bank! : the advantages of the BNP Paribas

Created by the BNP Paribas, Hello Bank!! today benefits from proximity to his parent company to offer A very wide offer of banking services, especially in terms of savings and insurance.

With only 2 bank card offers, an entry -level card without income condition and a black card offer, Hello Bank! is now a major player in online banking.

We also like theErgonomic and design mobile application Like reduced foreign costs.

�� Comparison of the best offers of banking banks online banks

Online banks offer at least two types of bank card, classic and high -end. They are generally free, with or without income conditions.

- What to be careful to choose the right bank card ?

- Income conditions : some offers are universal, others more exclusive.

- Free bank card conditions: if the bank card is free in most online banks, conditions, payment and/or use, vary from one bank to another.

- Bank card range : the more upgrade you go up, the more your insurance cover and your immoderation ceilings will be important.

Free card offers

THE Online banks will offer regularly one to several free bank cards. Attractive, these bank cards are often accompanied by conditions of grant or use specific. Fancy a free bank card ? Discover our selection of Best free bank cards In online banks.

�� Fosfo card

✔️ No income condition

€ 1,800 in monthly net income

from € 4,000 in monthly net income

Free conditions: monthly payment of € 4,000

�� Welcome card

✔️ No income condition

�� Ultim card (Immediate flow)

✔️ No income condition

Learn more

�� Welcome card

✔️ No income condition

�� Hello One

✔️ No income condition

Updated data in September 2023

Cards without income conditions

For those with more modest income, it will be necessary to choose a card without income conditions, preferably free. THE Online banks will generally offer their entry -level card for free without income conditions We will also find High -end cards without income conditions but paid.

�� Fosfo card

�� Welcome card

�� Ultim card (Immediate flow)

�� Ultim Metal card (Immediate flow)

�� Hello One

�� Pratiq account+

From € 3 to 12 €/month depending on the chosen card

�� Uniq account

from € 6 to 15 €/month depending on the chosen card

�� Uniq account+

from € 9/month to 18 €/month depending on the chosen card

Updated data in September 2023

Premium bank cards

For more demanding customers, Online banks offer High range cards and even punctually Black Cards. By breaking the prices and in reducing the requirements of granting, online banks have considerably participated in the Democratization of premium bank cards. Overview of Best offers of high -end online banks !

€ 1,800 in monthly net income

from € 4,000 in monthly net income

Free conditions: monthly payment of € 4,000

�� Ultim card (Immediate flow)

✔️ No income condition

�� Ultim Metal card (Immediate flow)

✔️ No income condition

�� Uniq account

from € 6 to 15 €/month depending on the chosen card

✔️ No income condition

�� Uniq account+

from € 9/month to 18 €/month depending on the chosen card

✔️ No income condition

�� Hello Prime card

from € 1000 in net income per month

�� Premier visa card

�� Infinite visa card

Updated data in September 2023

Cards at no cost abroad

Renowned for their low banking costs, online banks lower prices of withdrawals and payments abroad. With some free or CASI offers abroad, in particular outside the euro zone, the bank cards of online banks are Ideal for traveling.

Whether you are an used traveler or an all-terrain globe-handler, discover the Best offers from online banks for your trips or trips.

Fosfo

0 €/month

✔️ Standard mastercard insurance

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: 30 €/year

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free and unlimited

�� Withdrawal outside the euro zone: ✔️ Free and unlimited

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: 0.07

�� Unauthorized discovered: 0.16

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free

�� SEPA transfer: ✔️ Free

�� International transfer: 0.1% min. 23 € + exchange costs: 0.1% min. 15 €

Gold Mastercard Fortuneo

0 €/month

✔️ GOLD MASTERCARD insurance

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: 30 €/year

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free and unlimited

�� Withdrawal outside the euro zone: ✔️ Free and unlimited

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: 0.07

�� Unauthorized discovered: 0.16

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free

�� SEPA transfer: ✔️ Free

�� International transfer: 0.1% min. 23 € + exchange costs: 0.1% min. 15 €

World Mastercard Elite Fortuneo

0 €/month

✔️ WORLDELITE MASTERCARD insurance

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: 30 €/year

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free and unlimited

�� Withdrawal outside the euro zone: ✔️ Free and unlimited

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: 0.07

�� Unauthorized discovered: 0.16

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free

�� SEPA transfer: ✔️ Free

�� International transfer: 0.1% min. 23 € + exchange costs: 0.1% min. 15 €

Welcome

0 €/month

✔️ Visa Classic insurance

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: 5 €/month if no CB use in 1 month

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free and unlimited

�� Withdrawal outside the euro zone: 1 free withdrawal per month 1.69% beyond

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: 0.07

�� Unauthorized discovered: 0.16

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free

�� SEPA transfer: ✔️ Free

�� International transfer: In euros: € 20 in currency costs: free

Ultim

0 €/month

✔️ Visa Insurance Premier

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: 9 €/month if no CB use in 1 month

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free and unlimited

�� Withdrawal outside the euro zone: 3 free withdrawals per month 1.69% beyond

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: 0.07

�� Unauthorized discovered: 0.16

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free

�� SEPA transfer: ✔️ Free

�� International transfer: In euros: € 20 in currency costs: free

Hello prime

5 €/month

Choose

✔️ Premium insurance cover

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: 30 €/year

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free * Free in a distributor of the BNP Paribas network, otherwise € 1/withdrawal

�� Withdrawal outside the euro zone: ✔️ Free and unlimited

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: 0.08

�� Unauthorized discovered: 18.40%

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free between Hello Bank accounts

�� SEPA transfer: ✔️ Free

�� International transfer: ✔️ Free

Boursorama Ultim Metal

€ 9.90/month

✔️ Visa Insurance Premier

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: None

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free and unlimited

�� Withdrawal outside the euro zone: ✔️ Free and unlimited

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: 0.07

�� Unauthorized discovered: 0.16

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free

�� SEPA transfer: ✔️ Free

�� International transfer: ✔️ Free

Updated data in September 2023

Online banks and costs abroad banks

THE Online banks will attract occasional and regular travelers with Reduced foreign prices. Side entry -level offer, We will gladly opt for Fosfo card of fortuneo: very advantageous, the Fosfo offer, it is zero costs all over the world and standard mastercard insurance. The offer Boursorama Welcome is also very interesting to travel. Want to go upmarket ? We will select, here again, the Boursorama Banque, Ultim or Ultim Metal or the Gold Mastercard of Fortuneo. At the key, Premium travel insurance and almost no fees during your trips.

Banking costs: what is the cheapest online bank ?

In addition to their generous welcome bonus and their free card, online banks are deemed to their particularly low or even free banking costs. This is particularly the case for daily banking costs.

If you are more cicada, think of Check the online banks overdraft costs. Spending profiles will appreciate the Free Intervention Comissals and the much lower overdraft costs than in traditional banks.

Online banks and bank banks. Online banks align with each other on costs in the event of bank incidents and make the difference with traditional banks in terms of free intervention commissions, taken in case of overdraft.

�� Borrowing: The best Immo and Cons consumer credit loans on online banks

The best credits consumption of online banks

Low price champions, the Online banks do not derogate from the rule for their Personal loan offers. We like attractive fixed taegs as the possibility of quickly making an online estimate.

What online bank For a consumer credit ? Personalized, Consumption credits rate will evolve according to the duration and amount of the loan.

However, it appears from our personal loan comparison that Balance Bank offers a lower entry rate for the personal loan.

- Our special article on consumer credit

The best real estate loans of online banks

Invest in real estate by contracting a Loan loan to an online bank has many advantages: Very fast online simulation, response in principle in a few days, attractive taeg, etc. However, for more complex projects or to be able to Negotiate with a banking advisor, It is better to move towards a traditional bank.

What online bank for a mortgage ? Personalized by definition, real estate credits must be compared to the light of the applicant’s file.

However, Boursorama Banque emerges as one of the Best online banks For a mortgage, thanks to the increased flexibility on the reimbursement period as well as on the maximum borrowable amount.

- Our special article on online mortgage

Savings: comparison of booklets, life insurance and other investments

THE Online banks today offer many investment solutions. Savers can thus open a booklet, a stock exchange account or even online banking insurance.

Savings solutions, especially booklets, are less diverse, but make the difference by displaying attractive rate of return and costs.

Where to place your money ? The diversity and complexity of financial investments to build up diverse and solid savings can put off. Consult our guide where to place your money ? who will give you the keys to invest better.

✔️ Supevenir Opportunities: 2.10%

✔️ Abandon yield: 1.80%

Classification based on average yields of life insurance

Updated figures in 2023

For more details :

Discover our comparisons dedicated to savings solutions:

- Discover our comparison of the best life insurance

- Compare online banks to secure

- Find the most efficient online PEA account

- Choose the best booklet for your savings

- Discover all our online banking comparators

- Online banks comparison for banking prohibitions

- Online banks comparison for young people

- Online banks comparison for minors

- Our versus: Boursorama vs hello bank!!, Ing vs Fortuneo, Bforbank vs Fortuneo.

Online bank – 20/09/2023

Boursorama Banque or Fortuneo: choose the best banking offer

Boursorama vs Fortuneo Comparison: What bank corresponds to you ? ☑️ Comparison Bank Cards ✔️ Comparison life insurance ✔️ Online scholarship ✔️ Credit.

Online bank – 19/09/2023

Online banking comparison: the best online banks in 2023

Online bank – 19/09/2023

What is the cheapest bank in 2023 ?

Online bank – 19/09/2023

Neobanque: comparison of the best mobile banks in 2023

Online bank – 19/09/2023

What online banks without income condition ?

Online bank – 09/13/2023

Which neobanque to choose: n26 or revolut ? Our opinion

Online bank – 09/13/2023

Best French banks in 2023: offers and comparisons

Online bank – 09/13/2023

Online joint account: the best common online accounts

Online bank – 08/29/2023

Species deposit: how to deposit money in an online bank ?

Online bank – 08/17/2023

The best welcome offers for online banks

Online bank – 07/08/2023

Best banks for young workers

Online bank – 07/08/2023

Where to find a free bank card ? Our complete comparison !

Online bank – 07/08/2023

Online banks classification: our top 5 in 2023

Online bank – 07/08/2023

What online bank for a student ? Our comparison

Online bank – 07/08/2023

How to open an online bank account ?

Online bank – 07/21/2023

Hello Bank! or Boursorama Banque: comparison – cards, bank charges, customer service

Online bank – 07/20/2023

The best banks to travel: which online bank to go abroad ?

Online bank – 07/20/2023

Fortuneo or ING: which bank to choose ?

Online bank – 07/20/2023

What is the best online bank for a minor ? our selection

Online bank – 07/20/2023

Online bank: which bank account without deposit to choose ?

Online bank – 07/20/2023

Which online bank to choose ? Our comparison

Online bank – 07/20/2023

BforBank or Fortuneo: which bank to choose ?

Online bank – 06/22/2023

How to contact a bank advisor in an online bank ?

Online bank – 06/21/2023

What online bank for a banking prohibition ?

Online bank – 24/05/2023

Online banking prices: bank charges and bank card cost

Online bank – 24/05/2023

Online bank with agency: comparison and classification

Online bank – 04/04/2023

Are online banks safe ?

Online bank – 01/18/2023

What online bank in the French overseas departments ?

Online bank – 03/10/2022

Online bank for an SCI: comparison and procedures

Online bank – 03/10/2022

Bank for association: which bank account to choose ?

Online bank – 04/07/2022

Boursorama or ING: our comparison – what is the best ?

�� Good deals ��

Banking promotions

up to 120 €

See the offer

Until 100 € offered to see the offer

until 230 €

See the offer

The most read finance guides

- Your consumer credit quickly and at no additional cost: our guide !

- CONSO Credit rate: Find the best loan of the moment

- Comparison life insurance: the best life insurance 2023

- Bank cards: comparisons and prices

- IBAN number: where to find it ? What is it used for ? What is its format ?