Mastercard N26-Open an N26 account and receive your card, N26 card: should you fall for the free N26 card?

Card N26: Should you fall for the free N26 card

To obtain a MasterCard card as a N26 customer, simply open a bank account. Each N26 account is associated with a MasterCard card, whether it is a virtual card or a physical card.

N26 – Your MasterCard card

Premium N26 accounts are associated with a MasterCard card available in several colors to choose from. Open your account in 8 minutes, add the digital version of your card to your wallet and adjust your purchases by mobile payment even before you receive your MasterCard.

Your browser does not support the HTML5 video.

+ 8000000

Account opening in

+ 280,000

5 -star reviews on iOS and Android App Stores

A mastercard card that suits you

As a customer N26 Smart and N26 You (or their business version), choose your MasterCard card from 5 colors: ocean, rhubarb, sand, mint and slate. With N26 Metal, you can order an elegant metal card, in three colors to choose: carbon black, pearl gray, Quartz pink pink. Standard N26 customers, the free account associated with a virtual card, can order a transparent mastercard card for only € 10 (delivery costs). And you which card do you prefer ?

Your browser does not support the HTML5 video.

A mastercard to pay wherever you are

Your mastercard is accepted worldwide and you do not pay any exchange costs on your card payments in foreign currency. Pay online, in store or in your applications, without commission. With premium accounts N26 You and N26 Metal, your withdrawals in foreign currencies are also without exchange costs. For other accounts, a 1.7 % commission is applied to the amount of withdrawals made with your Mastercard N26 bank card.

Mastercard Travel Rewards: Treat yourself when traveling

With your N26 account, you already have a simple way to spend less when you travel. Indeed, your N26 MasterCard card allows you to receive cashback when you pay your purchases in participating businesses. With Mastercard Travel Rewards and N26, your cashback is automatically paid to your account within 30 days.

Mastercard 3D Secure

All your online payments with your mastercard are secured by 3D Secure, which allows you to pay your online purchases safely.

NFC technology

Your mastercard is compatible with NFC technology and you can pay your purchases securely in a store, online or in applications as soon as you see the NFC technology logo.

Push notifications in real time

With push notifications with each transaction, you always know what’s going on in your bank account.

Protection of your deposits

As N26 has a banking license and applies European regulations, your deposits are guaranteed up to € 100,000 by the German deposit protection fund.

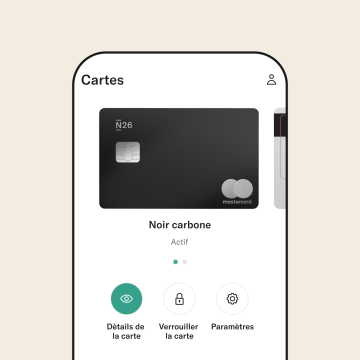

Control of your MasterCard – 24 hours a day

At N26, you manage your account and your mastercard. Check all the parameters of your MasterCard from your application and in real time: LOVER OR DEVEL your card, Modify the PIN code of your card and fix your own ceilings. Wherever you are and when you want. Need more flexibility ? You can even order an additional card (optional).

Your mastercard, your style

A MasterCard Business or Personal ? An optional transparent card with the standard N26 account, a color card or a metal mastercard card ? It’s up to you to see which card meets your needs ! Adopt the Mastercard that suits you and discover a new banking experience.

Frequently asked questions

What is the Mastercard N26 bank card ?

All N26 Bank Cards are MasterCard flow cards with contactless NFC technology, including the Mastercard in stainless metal. N26 does not offer a credit card, prepaid card or delayed debit card.

Can I receive a Maestro card with my N26 account ?

Only our customers residing in Germany, the Netherlands and Austria can order an additional Maestro card, in addition to their MasterCard card.

How to choose my mastercard ?

Mastercard cards associated with accounts N26 You, N26 Metal or N26 Business You are available in several colors. The cards offered with the N26 You and Business You accounts are available in five colors, and the N26 Metal card is available in three different colors.

The N26 Mastercard is free ?

If you are a premium customer, your N26 MasterCard card is provided with your membership. Just open a bank account in a few minutes and choose your favorite color.

The standard free N26 bank account comes with a virtual card. Just add it to your mobile wallet to pay in store, online or via applications from your smartphone. You can also order a physical mastercard to use with your bank account with single delivery costs of € 10.

What are the advantages of a premium account N26 ?

You have a set of Allianz insurance for your daily life, your trips and travel. These insurances include medical coverage in the event of an emergency abroad and coverage in the event of damage or theft of a vehicle rented in self-service from an application (car, bicycle or electric scooter). N26 Metal customers also benefit from insurance for their mobile phone. All holders of an N26 Premium account take advantage of unlimited withdrawals and without exchange costs in all currencies and exclusive partner offers.

Is Mastercard N26 a credit card ?

Currently, we do not offer credit cards. As a premium customer, your bank account comes with a mastercard debit card.

The MasterCard Associated Au Accounts N26 is a prepaid card ?

No, your MasterCard N26 is not a prepaid card. This is a mastercard debit card accepted worldwide, allowing you to make transactions with the money available in your account.

What is the difference between a visa card and a mastercard card ?

Mastercard and Visa are the two most important payment system companies, both in France and abroad. They have a relatively similar positioning, with a network of traders and automatic distributors in almost all countries. This means that on a daily basis, for the holder of a mastercard card or a visa card, there is virtually no difference between the two.

What are the advantages of the MasterCard card ?

The MasterCard card issued by N26 gives you access to the Mastercard Travel Rewards. When you set a purchase with your MasterCard N26 in one of the businesses participating in the MasterCard Travel Rewards program, a money back is automatically paid to your account.

How to get a MasterCard card ?

To obtain a MasterCard card as a N26 customer, simply open a bank account. Each N26 account is associated with a MasterCard card, whether it is a virtual card or a physical card.

Similar articles

These articles could interest you

Card N26: Should you fall for the free N26 card ?

The N26 neobanque offers four bank cards for all customer profiles, ranging from a free card to a high -end card: N26 Standard, N26 Smart, N26 You and N26 Metal. N26 cards can be virtual or physical, and allow payments to the world around the world. What are the characteristics of each N26 card ? Which one to choose ? Overview.

- Standard N26 card: 0 €/month

- N26 Smart card: € 4.90/month

- N26 You: € 9.90/month card

- N26 Metal card: € 16.90/month

- Bank account offers without income condition

- A free bank card offer (standard N26)

- An intuitive and functional mobile application

- Reduced costs, or even free on current operations on the 4 N26 account offers

- Attractive prices on the use of the N26 card abroad: 0 € on all withdrawal costs/payments abroad on N26 You and N26 Metal offers

- Securing bank deposits (N26 has a European banking license)

���� The price of bank cards N26

Comparison of N26 cards

N26 offers 4 current account offers, Without income conditions: standard, smart, you and metal. All N26 bank cards are in systematic authorization and the flow rate is immediate. No overdraft is authorized, regardless of the income level and the chosen offer.

Among these offers, N26 offers a free virtual card (standard offer), a classic card (Smart offer), as well as two premium cards (you and metal offers) with extensive insurance covers.

N26 You and N26 Metal customers can order a Additional card N26 For only 10 €. This allows you to have a spare card.

N26 Standard

Free

N26 Smart

€ 4.90/month Make this card

N26 you

€ 9.90/month

N26 Metal

€ 16.90/month

Virtual card only

CB In addition: 10 € Shipping

International MasterCard card with systematic authorization

International MasterCard card with systematic authorization

METAL METAL CARTE with systematic authorization

✔️ Immediate debit

✔️ Immediate debit

✔️ Immediate debit

✔️ Immediate debit

✔️ No income condition

✔️ No income condition

✔️ No income condition

✔️ No income condition

- �� Death / Disability Guarantee

- �� Transport delay guarantee

- �� Luggage delay guarantee

- �� Loss or Luggage Luggage Guarantee

- �� Civil liability guarantee abroad

- �� Rental vehicle warranty

- ��️ Interruption/travel cancellation guarantee

- ❄️ Snow and mountain guarantee

- �� Death / Disability Guarantee

- �� Transport delay guarantee

- �� Luggage delay guarantee

- �� Loss or Luggage Luggage Guarantee

- �� Civil liability guarantee abroad

- �� Rental vehicle warranty

- ��️ Interruption/travel cancellation guarantee

- ❄️ Snow and mountain guarantee

- �� Medical coverage

- ��️ Voyage cancellation

- �� Pandemic cover

- �� Transport delay guarantee

- �� Delay or loss of baggage guarantee

- ❄️ Snow and mountain guarantee

- �� Medical coverage

- ��️ Voyage cancellation

- �� Pandemic cover

- �� Transport delay guarantee

- �� Delay or loss of baggage guarantee

- ❄️ Snow and mountain guarantee

Updated data September 2023

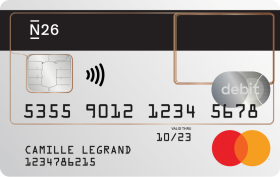

N26 virtual card

There virtual bank card N26 is the only one Free card N26 and offers many advantages similar to those of physical cards. The virtual card is stored exclusively on the phone and can be used for online payments or in stores in contactless mode thanks to Apple Pay or Google Pay. She has her own number, expiration date and CVC.

There N26 virtual card is secure by the European banking license enjoyed by N26, which offers customers the same guarantees as those of credit institutions located in France. On the security side, it is also possible to set up a double factor authentication to protect yourself against fraud.

Differences between virtual card, digital card and disposable card The virtual card only exists on phone, while the digital card is a copy on the phone of an existing physical card. A disposable card, on the other hand, is a virtual card with unique use.

Personalization of N26 cards

N26 offers attractive feature by allowing customers to Customize the color of their bank card. Personalization possibilities depend on the chosen offer:

- Free virtual card N26 : free offer customers can order a Transparent N26 card for only € 10;

- Smart and you n26 cards (Classic version or business): customers have the choice between the 5 ocean, rhubarb, mint, slate and sand colors;

- Metal card N26 : customers benefit from a metal card and can choose between the 3 black carbon colors, pearl gray and quartz pink.

�� The ceilings of the N26 cards

THE Payment and withdrawal ceilings of N26 cards are the same For all the offers offered by the bank. Here is the detail:

- Payment ceilings N26 : daily and monthly ceiling of € 20,000;

- N26 withdrawal ceilings : weekly ceiling of € 1050 in France and € 2,500 abroad (except in Italy where the ceiling is € 2,000).

Beyond the sums limited by the ceilings, Payments abroad are free and unlimited With all N26 offers. As for withdrawals, they depend on the chosen offer and the place of withdrawal (in the euro or excluding euro zone):

- Withdrawals in the euro zone : 3 free withdrawals per month for the standard card, 5 free withdrawals for Smart et You, 8 Free Metal Card Cards. Any additional withdrawal is billed € 2;

- WHOLOWS Outside Euro Zone : 1.7% exchange fees for standard and smart cards, no exchange fees for You and Metal cards.

�� How to activate your N26 card ?

When opening a N26 account including a bank card, the Reception time of card N26 Varies between 3 days (express delivery) and 10 days (free standard delivery).

To achieve theActivation of a N26 card Once received, you must go directly through the N26 mobile application. The process is carried out in just a few minutes. Here is the approach to follow:

- Open the N26 application and click on the section “Cards” ;

- Choose the card to activate and select it;

- To push on “Settings” card then on “Enable” ;

- Enter the 10 -digit number on the front or rear side of the card (depending on the type of card);

- Define your Personal Pin Code.

For standard offer customers, The virtual card is already activated and can be used as soon as the account is opened. For other cards, as for traditional banking bank cards, you must first make a withdrawal to finalize the activation of the card.

Deactivation of previous cards in the event of receipt of several cards (due to a double order or a delay in delivery in particular), Only the last card ordered can be activated. All previous cards are invalidated and unusable after ordering a new card. An exception, however, applies to Premium accounts which offer additional cards.

⭐ Our opinion on the N26 card

The N26 neobank offers 4 different offers of bank cards with characteristics that can be taken into account:

- N26 Standard: Free offer Without income conditions, ideal for daily management and travel. It includes payments at no cost abroad but paid withdrawals. The free card is virtual, but it is possible to order a physical card for € 10;

- N26 SMART: Intermediate offer with additional features to manage spending and customizable design;

- N26 You: Premium offer For travelers, with unlimited payments and withdrawals out of euro and travel insurance;

- N26 Metal: high -end offer With a metal card, unlimited payments and withdrawals outside the euro zone, extended insurance coverage, exclusive experiences and dedicated customer service.

N26 offers are designed to respond to a Variety of financial needs with great accessibility. One of the main advantages is The standard N26 standard offer which allows everyone to access basic banking services without monthly expenses.

Premium offers, N26 You and N26 Metal, are marketed at Price much lower than high -end offers of traditional banks. They include Additional advantages Particularly turned to regular travelers, such as unlimited withdrawals abroad, travel insurance and assistance guarantees:

- Medical cover ;

- Travel cancellation;

- Delay or loss of baggage guarantee;

- Delay transport warranty.

Whatever the offer chosen, theIntuitive mobile application N26 Facilitates the management of money on a daily basis, with features such as the change of PIN code, instant blocking of the card, the management of ceilings, or even payment in several times.

Despite these advantages, N26 offers also have certain drawbacks:

- Instant transfers only between N26 accounts;

- Absence of physical banking agencies in France and online customer service;

- Offer of limited financial products for customers wishing to carry out investments.

However, The advantageous prices of N26 cards, the ease of use of the application as well as the responsiveness of customer service compensate for these drawbacks. N26 is a Interesting alternative to the offers of traditional banks, and significantly cheaper.

THE Choice of N26 offer To favor then depends on the profile of each client, in particular their expenditure habits, their travel needs and the interest in additional functionalities such as the personalization of the card or access to exclusive events.

�� Your questions about the N26 card

Lost, blocked or locked N26 card: what to do ?

In the event of loss or theft of the N26 card, it must be immediately Lock it on the N26 application in the tab “Cards”. This temporarily blocks it and prevents any fraudulent use.

If the card is not found or there is suspicion of theft, then you must order a new card, which will definitely deactivate the previous one. The command is also carried out from the N26 application, in the tab “Cards”> “Order a new card”.

It can also happen that the card is locked in case of incorrect pine code Three times in a row. In this case, then it is necessary Contact customer service n26 Since the lived in the application to request the release of the card.

Can I pay in several times with the N26 card ?

N26 offers a service called N26 financing, that allows you to pay in three times. This service is currently only available for customers who have opened their account in France. Financing N26 makes it possible to divide a payment by bank card in 3 monthly payments equal directly from the application. Payment must be eligibly to be split.

This service allows a flexible management of its budget and important expenses. The overall effective rate is 7.49% to 18.99%, depending on the client’s financial situation, and the eligible purchase amount must be between € 20 and 200 €. It is possible to activate the use of this service and follow its financing plan at any time from the N26 application.

How can I feed my N26 account ?

It exists Several ways of credit your N26 account ::

- Securities transfer in euros: make a transfer from another bank account, which takes one or two working days when it comes from another bank, or can be instant from another N26 account;

- Credit or debit card: feed your account instantly using the N26 application, in the tab “Receive”> “Debit or credit card”. Transactions must be between € 20 and € 150, up to a limit of € 450 per month;

- Apple Pay or Google Pay: The conditions are the same as for credit cards or debit;

- Moneybeam: send or instantly receive money from another N26 customer, only thanks to the telephone number or an email address.