LOA, LLD or Credit: What is the best choice to buy a Tesla?, Tesla: A 7 -year car loan is now possible to buy a car

Tesla: A 7 -year car loan is now possible to buy a car

So, Tesla a Updated his online configurator To add a new loan option of 84 months, a period of reimbursement over seven years. This decision aims to offer an alternative to customers who wish to acquire a Tesla while maintaining more affordable monthly payments, taking into account the current high interest rates.

You plan to buy a new or used Tesla and you wonder what is the best way to finance it ? There are three main options.

Rental with purchase option (LOA), long -term rental (LLD) or classic credit. We will not talk about cash, which remains the simplest solution. Everyone has advantages and disadvantages that you must understand before you start. In this article, we will present the characteristics, advantages and disadvantages of these three methods of funding to help you make the right choice when buying your Tesla.

Rental with purchase option (LOA)

A LOA is a rental contract which allows you to rent a car for a fixed period (generally 2 to 5 years) for monthly payments. At the end of the contract, you can choose to buy the car by having a purchase option for a predetermined amount, or by restoring it to the rental company.

LOA advantages:

- Your monthly rent is lower compared to traditional loans because you do not have to pay the entire price of your vehicle.

- You can change your car regularly and enjoy the latest technological models and innovations.

- You don’t have to worry about the resale or reduction of your vehicle.

- You can sometimes benefit from services included in the contract, such as maintenance, insurance or assistance.

Disadvantages of LOA:

- You only become the owner of the vehicle when you exercise your purchase option, which generally represents a large sum.

- You must comply with certain conditions, such as the annual mileage or the condition of the vehicle, otherwise you will be penalized.

- You must pay a deposit or increase the deposit to reduce the monthly rent.

Long -term rental (LLD)

An LLD is a rental contract which allows you to rent a car for a fixed period (usually 1 to 5 years) in exchange for monthly rents. At the end of the contract, you must return the vehicle to the rental company, it cannot be purchased.

Advantages of LLDs:

- Your monthly rent is lower compared to traditional loans because you do not have to pay the entire price of your vehicle.

- You can change your car regularly and enjoy the latest technological models and innovations.

- You don’t have to worry about the resale or reduction of your vehicle.

- You can sometimes benefit from services included in the contract, such as maintenance, insurance or assistance.

Disadvantages of LLDs:

- You never become the owner of the vehicle and you cannot buy it at the end of the contract.

- You must comply with certain conditions, such as the annual mileage or the condition of the vehicle, otherwise you will be penalized.

- You must pay a deposit or increase the deposit to reduce the monthly rent.

Classic credit

Classic credit is a bank loan that allows you to borrow a sum of money to buy a car. You then reimburse the capital and interest by monthly payments over a fixed period.

The advantages of classic credit:

- You become the owner of the vehicle as soon as you buy and you can dispose of it freely and modify it

- A conventional credit can offer flexible or anticipated reimbursement options

- You can resell the vehicle when you wish

The disadvantages of classic credit:

- Long -term engagement: classic credit can engage the borrower with regular payments over an extended period, sometimes up to five years or more.

- This can limit the borrower’s ability to engage in other financial projects.

- You do not benefit from services related to a LOA or LLD

- You will have to resell your car yourself, whether it is an individual with the risks that this implies, or via a garage with a value can be less.

Is the LOA more expensive than the purchase ?

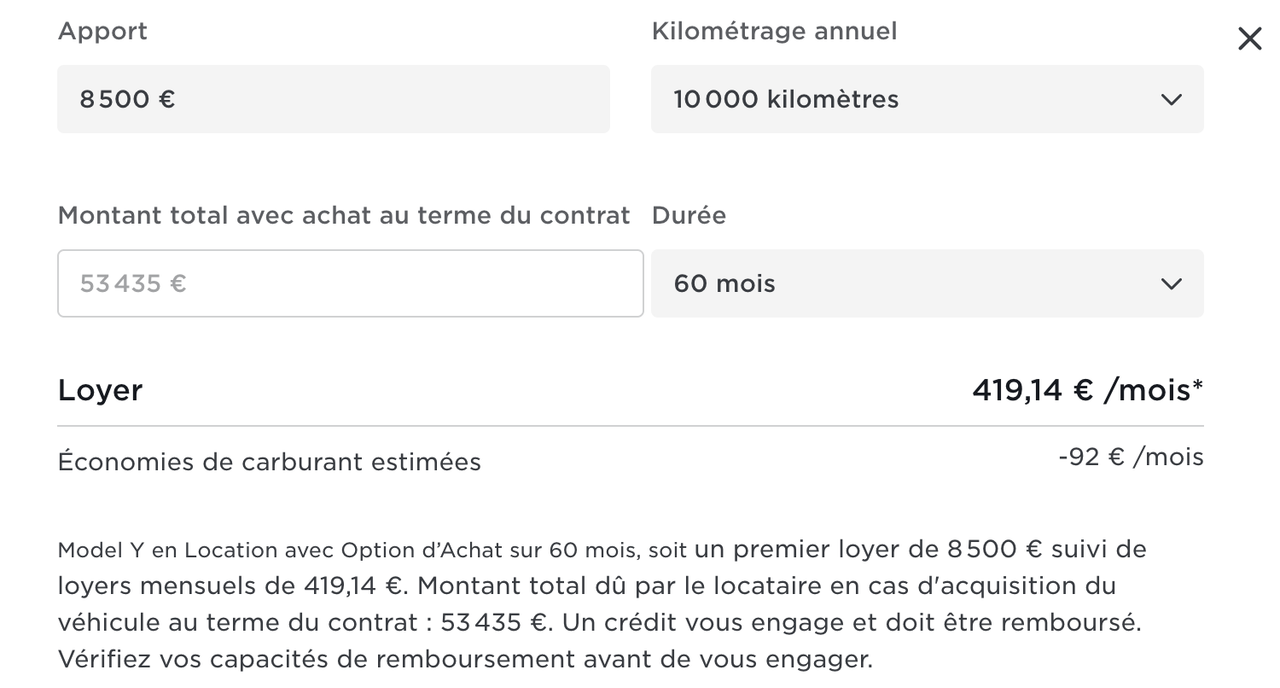

Take the example of a Tesla Model Y, in its basic version it is offered at 41,990 euros for purchase (deducted bonuses) or 419 euros per month in LOA, for 60 months and with a contribution of 8,500 euros , the total cost with purchase option is then 53,435 euros ! If you want to keep the car for a long time, the LOA is not necessarily adapted in this example.

An LLD with 10,000 km / year for 48 months will cost you 554 euros per month. This is an option to consider.

Blogtesla’s opinion:

You have understood, each solution to its advantages and disadvantages, there is not a single answer but three solutions which will more or less match with your needs, finances and your expectations in the short and long term. The difference between LLD and LOA is mainly in the fact that with the LLD there is not planned a possible takeover of the car at the end of the contract, you will have to return it to your rental company.

Overall, if the financial part is not your first concern, classic credit and cash payment are certainly the fastest and simplest solutions for the purchase of a Tesla.

In any case, before choosing a conventional credit to buy a car, it is important to carefully examine all the advantages and disadvantages and compare the different financing options available in order to make an informed decision.

And you, what are your preferences for the purchase of a tesla ? LOA, LLD, credit or cash ? For what reasons ?

Tesla: A 7 -year car loan is now possible to buy a car

Faced with the rise in interest rates, Tesla now offers loans over 84 months, or 7 years, to buy its electric vehicles. A novelty that leaves some rather skeptical commentators.

Tesla recently started to Offer loans over 84 months (7 years) for its electric cars in order to Reduce monthly payments to high interest rates. In the United States, economic policies have caused high interest rates, which affects most people ‘borrowing capacity, especially for big purchases, such as houses and cars.

High interest rate ? Tesla offers loans over 84 months for its electric cars

Elon Musk, CEO of Tesla, complained over this situation, saying that this is the main reason why his business must reduce the prices of his vehicles to maintain demand with production. Faced with this problem, the automaker has decided to explore New financing options To try to remedy the situation, and this results in the introduction of longer loans.

So, Tesla a Updated his online configurator To add a new loan option of 84 months, a period of reimbursement over seven years. This decision aims to offer an alternative to customers who wish to acquire a Tesla while maintaining more affordable monthly payments, taking into account the current high interest rates.

This loan offer is accompanied an interest rate estimated at 6.39 %. For example, in the United States still, with a monthly payment of $ 551 for a basic Tesla Model 3, this would result in a total amount of more than $ 46,000 at the end of the term, assuming an initial deposit of 4 $ 500.

Some commentators have expressed their skepticism Faced with this financing option. They point out that if we have to spread payments over a period as long as seven years to buy a car, this could indicate that the vehicle is simply too expensive for the budget of certain customers, all the more with rates of ‘so high interest.

Admittedly, the financing options are always welcome and it is appreciable that Tesla offers more choices to consumers. But of course, any potential buyer must carefully consider his financial situation before engaging in a loan over such a long period. The new Tesla, which should be offered below 25,000 €, be a better alternative ?

�� You use Google News ? Add Tom’s Guide to Google News not to miss any important news from our site.