International payment: Travel at a lower cost abroad – SG, International Société Générale option: Save abroad! Wise

International Société Générale option: Save abroad

How to pay on the Internet in foreign currency ? What are the conversion costs and how to avoid them ? What precautions should be taken ? Focus !

International option

Occasional travelers, with the international option, reduce your bank charges outside the euro area.

Why opt for the international option ?

Freedom

With the international option (1) , You no longer have to worry of your costs during your trips.

Economy

You are exempt from commissions (2) SG On a certain number of payments, withdrawals by bank card and/or international transfers (3) excluding euro zone.

Simplicity & Flexibility

An option to activate directly from your customer area, without commitment to duration.

We have the formula you need

Request for subscription Online, simple & fast.

The offer is reserved for jazz (4) or Sobrio (5) holders .

I select my age to find my formula:

Student level

Your stay extends, YOU You install abroad.

- Card payments

(excluding euro zone) Unlimited (8) - Withdrawals (excluding euro zone)

in a distributor Unlimited (8)

Initial level

You pass A few days abroad and only make a few Purchases and/or withdrawals with your bank card.

- Card payments

(excluding euro zone) Until

6 payments (7) / month - Withdrawals (excluding euro zone)

in a distributor Until

2 withdrawals (7) / month

Intense level

You go several days And use frequently your bank card on site to make purchases or withdrawals.

- Card payments

(excluding euro zone) Unlimited - Withdrawals (excluding euro zone)

in a distributor Unlimited

Unlimited level

Your stay extends, YOU You install abroad and/or you needperform or receive transfers international.

- Card payments

(excluding euro zone) Unlimited - Withdrawals (excluding euro zone)

in a distributor Unlimited - International transfers

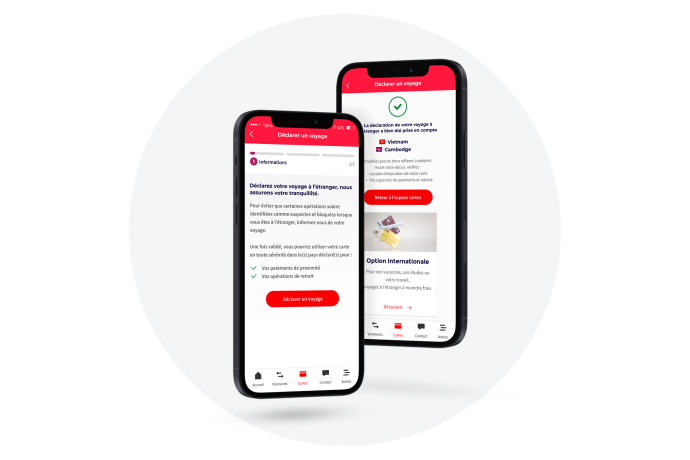

Remember to declare

Your trip abroad

As a safety measure, it can happen that your card is blocked during a transaction abroad. To avoid blocking, declare Your dates and your destination travel, in your space, in 2 minutes top time !

Most frequent questions

Which can benefit from this option ?

It is accessible to customers with Sobrio or Jazz from 16 years old.

My contribution to the international option is quickly amortized ?

- To amortize the subscription, you just need to perform in the month:

- Initial level: 3 payments of 50 euros, 1 withdrawal of 50 euros

- Intense level: 2 payments of 50 euros, 3 withdrawals of 50 euros

- Unlimited level: 3 payments of 50 euros, 2 withdrawals of 50 euros, 1 transfer initiated from the internet to the international of 1,000 euros

How to terminate the international option ?

The termination is made by simple written request to your advisor. Any civilian month started is due.

This may interest you

On vacation in all serenity

Discover some advice from prudence to leave the mind quiet, without forgetting anything.

Our tips

You wonder how to be independent and pay on site abroad? Discover our advice.

Studies and internship abroad

Our tips for preparing your stay but also your CV and your cover letter.

(1) Paying option, accessible to jazz and Sobrio holders from 16 years old. Customers aged 18 to 24 benefit from a reduction of 50% compared to rates excluding promotion. Customers aged 25 to 29 benefit from a reduction of 20% compared to rates excluding promotion. Prices excluding promotion, initial level: € 10/month; Intense level: € 17.50/month; Unlimited level: 25 €/month.

(2) Excluding exchange commissions and any commissions levied by the corresponding bank. See the countries of the euro zone in the price brochure.

(3) Exemption of costs for emission or receipt of international transfers taken by Société Générale on all international occasional transfers (non SEPA) received and issued in agency or on the Internet. Maximum amount authorized for a transfer on the internet: € 4000. Beyond, contact your advisor.

(4) Jazz is a group offer of banking and non -banking services with which the member can associate the international option. The price conditions of jazz and the international option indicated in the brochure Conditions and prices applied to banking – individuals are available in agency and on individuals.SG.Fr.

(5) Sobrio: Sobrio is a group offer of banking and non -banking services accessible from 15 years old. Tariff conditions in force of Sobrio according to the age and type of card subscribed indicated in the brochure Conditions and prices applied to banking operations – individuals available in agency and individuals.SG.Fr.

(6) Reserved for students under the age of 30 upon presentation of proof of valid student status at the time of subscription. The student level does not benefit from any price reduction.

(7) Exemption from Société Générale commissions on a number of payments by bank card and withdrawals in automatic ticket distributors, excluding the euro zone and according to the level chosen. Excluding exchange commissions in the case of a conversion into currencies and any commissions levied by the corresponding bank. See conditions and prices applied to banking operations – individuals available in agency and individuals.SG.Fr.

(8) Exemption from Société Générale commissions on payment by bank card and withdrawals in automatic ticket distributors, excluding the euro zone and according to the chosen level. Excluding exchange commissions in the case of a conversion into currencies and any commissions levied by the corresponding bank. See conditions and prices applied to banking operations – individuals available in agency and individuals.SG.Fr.

- Our bank cards

- Savings and investments

- Our consumer credits

- Our life insurance

- Personalize your bank card

International Société Générale option: Save abroad !

Thanks to the Jazz option, Société Générale customers with an expatriation project can benefit from advantageous prices on all foreign currency operations. The international jazz offer (which is now called Sobrio) is available in several levels: initial/intense/unlimited. Depending on the age of the subscriber, the price and the options differ.

If they have the advantage of flexibility, these offers remain relatively expensive. Like all banks, Société Générale charges a subscription and taxes the exchange rate on all currency operations.

In recent times, new players have appeared on the international transfers market. One of them, Wise, offers operations at the real rate without any monthly subscription.

In the table below, we compared the Wise and Sobrio International offer for those over 29.

| “Initial” international jazz option ¹ | Jazz international option “intense” ¹ | “Unlimited” international jazz option ¹ | Wise | |

|---|---|---|---|---|

| How many free payments per month ? | 6 | Unlimited | Unlimited | Unlimited if you spend the currencies that you already have |

| How many free withdrawals per month ? | 2 | Unlimited | Unlimited | As much as you want as long as you do not exceed £ 250 |

| How many free transfer per month ? | 0 | 0 | Unlimited (+ correspondent costs) | 0 (but unlimited transfer at low prices) |

| Rate used | Increased | Increased | Increased | Real |

| Monthly option | 10 € | 17.5 € | 25 € | Free |

| Card price | From € 6.2/month² | From € 6.2/month² | From € 6.2/month² | € 5 shipping costs |

| Open a free multi-you account ! |

|---|

Société Générale International option: how much does it cost ?

The price grid of the Jazz International Offer is indexed to the age of the subscriber and the “level” chosen.

For 18-24 year olds¹:

- Initial (€ 5/month): 6 payments + 2 withdrawal withdrawals

- Intense (€ 8.75/month): unlimited payments and withdrawals

- Unlimited (€ 12.75/month): payments, withdrawals and transfer free

For other age groups, the price¹ is different, but the advantages of each level remain the same.

| Initial level | Intense level | Unlimited level | |

|---|---|---|---|

| 25-29 years old | 8 €/month | 14 €/month | 20 €/month |

| Over 29 years | 10 €/month | € 17.5/month | 25 €/month |

The shipping costs for international transfers depend on several parameters: place of the operation (online or in agency), type of costs, amount of the transfer. All costs presented in this article may be modified without notice by the bank.

International student offer price

The student jazz offer costs 2 € per month. You can make withdrawals and payments outside the euro zone without paying bank fees¹.

However, the exchange commissions and possible withdrawal costs of the bank in which you take money remain your responsibility.

Why subscribe to the international option of your bank: the FAQ

How the Jazz International option works ?

The international jazz offer (or sobrio) is an option that adds to the classic Sobrio package. It is available from € 2/month for students and € 8 for individuals who are no longer in studies.

Each age group, Jazz International offers 3 levels: initial, intense and unlimited. Each level allows you to benefit from certain operations without bank charges.

With the “unlimited” level, you have access to transfers/withdrawals/payments in currencies without banking costs. Sobrio’s “unlimited” offer costs¹:

- € 12.75 per month for 18-24 year olds

- 20 € per month for 25-29 year olds

- 25 € per month for people over 29 years old

On the other hand, operations will be done at a increased rate. For withdrawals, it is possible that the bank to which DAB belongs to you to pay the provision of the PLC.

Sobrio is a non -binding offer. So you can terminate it at any time.

Why and how to register ?

The Sobrio option is ideal if you go abroad. Depending on the duration of your stay and the frequency of banking operations you are thinking of, Société Générale will offer you several levels that will perfectly meet your needs. Thus, you will not pay for options that you will not use.To subscribe to the Sobrio offer, go to agency, or on the Société Générale website.

What options to choose ?

The most advantageous jazz travel option depends on your profile and the duration of your expatriation.

- Stay of a few days abroad with a limited number of transactions: initial level

- Average stays (2 weeks/1 month) or frequent: intense level

- Expatriation project: unlimited level

- Student between 16 and 29 years old: student level

Please note: To have access to these offers, you must have previously subscribed to the Sobrio option. Otherwise, withdrawals, payments and transfers will be billed to you at the normal price.

Société Générale Jazz International option: what is the duration of engagement ?

The jazz offer is without obligation. As long as you pay the subscription, you benefit.

If you don’t want to take advantage of it anymore, just notify your advisor in writing. You can also call customer service and announce that you want to terminate.

Which can subscribe to this option ?

Only customers of Société Générale have subscribed to the Sobrio offer can claim the international option.

The first component of the offer is reserved for students, aged 16 to 29.

The other 3 are accessible under age conditions: “18-24 years”, “25/29 years” and ” + 29″.

Wise: an alternative to your bank

The international jazz plans of the General Company adapt to all the needs. The problem is that they are expensive.

If you are over 29 years old and you are looking to expatriate, you will have to spend € 300 per year to benefit from an exemption from costs on withdrawals, payments and transfers !

Whether you are going abroad for a few days or a few months, the Multi-Devised account of Wise is much more interesting.

First, you can keep up to 40 different currencies on the same account. Then you can convert your different sales to the real market rate.

If you plan to settle abroad, know that you can receive payments without additional costs in 6 different currencies, including the euro, the US dollar and the pound sterling.

The Multi-Devision account gives the right to a mastercard debit card. Thanks to it, you can pay free of charge in a currency you have. If a conversion is necessary, Wise will do it at the real rate and you will only pay a commission below 1 % for most currencies.

Finally, the subscription is free: it is done online and in a few seconds.

- Société Générale international options

- Société Générale Bank Bank Carte

- Société Générale Pricaire P.26

Check for the last time on March 16, 2020.

This publication is provided for general information only and does not aim to cover all aspects of the subjects it deals with. This is not the only source of advice on which you should rely. You must obtain professional or specialized advice before taking, or to abstain, to make any decision on the basis of the content of this publication. The information contained in this publication does not constitute legal, tax advice or other professional advice from Wise Payments Limited or its affiliated companies. Past results do not guarantee a similar result. We do not make any declaration, guaranteed, express or implicit, that the content of the publication is exact, complete or up to date.

Here and elsewhere, your money at all times

Personal finance

Foreign check for euro check: everything you need to know

How to collect a foreign check in Euro ? What are the costs to be expected ? Are there better alternatives to be paid in currency ? We are talking about it !

Soufiane Baba

30.06.23 Read in 4 min

Personal finance

Pay on the Internet in foreign currency: how to avoid conversion costs?

How to pay on the Internet in foreign currency ? What are the conversion costs and how to avoid them ? What precautions should be taken ? Focus !

Soufiane Baba

30.06.23 Read in 4 min

Personal finance

Repatriate your money in France: how it works and what are your choices?

How to repatriate your money in France ? What is the protocole ? What are the costs to be expected and how to reduce them to the maximum ? Focus !

Soufiane Baba

30.06.23 Read in 3 min

Personal finance

Pay in Book Sterling on the Internet: How to save on conversion costs?

How to pay on the Internet in Sterling Book ? What are the conversion costs and how to avoid them ? We talk about it in this focus !

Soufiane Baba

30.06.23 Read in 4 min

Personal finance

Exchange office without commission: how to save on your exchange fees?

What is a commission -free exchange office ? Does it really exist ? How to choose your exchange office ? Investigation !

Soufiane Baba

30.06.23 Read in 5 min

Personal finance

Revolut Switzerland: all about the account, the card and the costs

Is it possible to have a revolut account in Switzerland ? What are the proposed features ? Costs for operations in currency ?