In the United States, the new Apple box is … A bank account, Apple makes banks tremble with its “revolutionary” savings account at 4.15 %

Apple makes banks tremble with its “revolutionary” savings account at 4.15 %

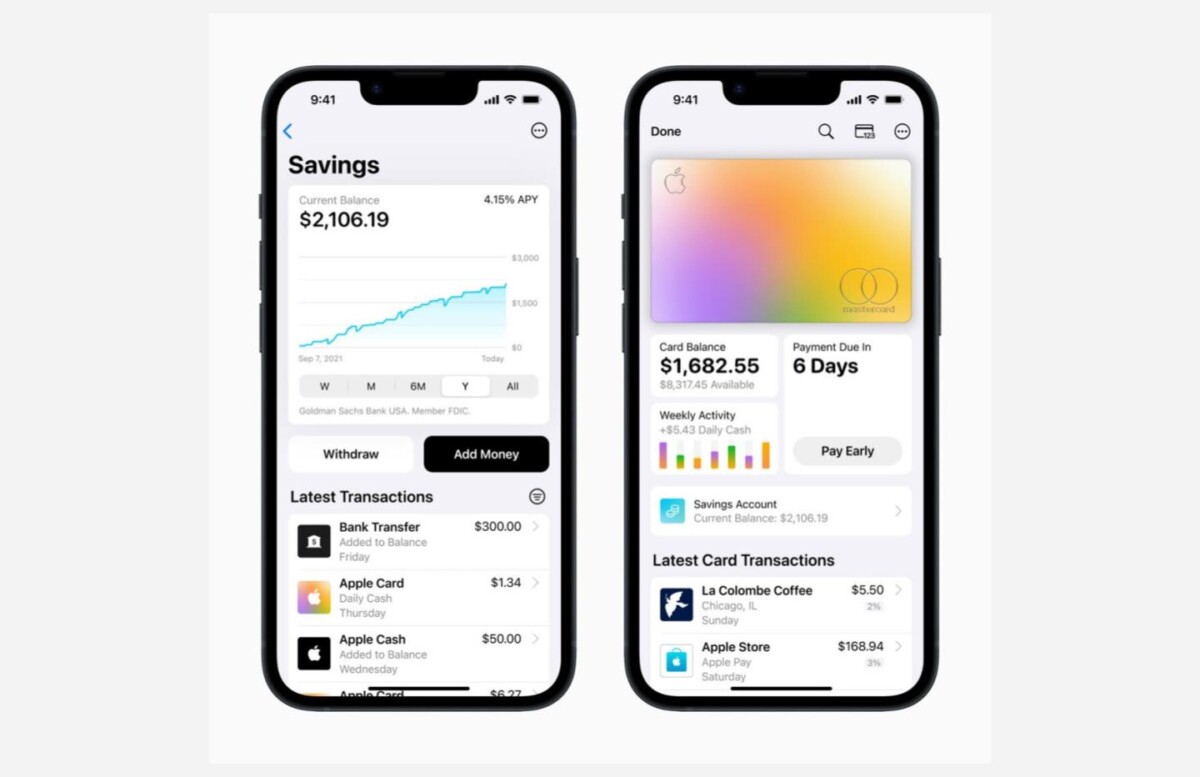

This new product fits perfectly into the Apple Fintech ecosystem, allowing Apple Card users to redirect their awards to the savings account and win interest on them. The simplicity of use and integration with the Wallet application strengthen the attractiveness of the offer for iPhone users, whose market share in the United States exceeds 50 %.

In the United States, the new Apple box is … a bank account

In four days, the new product launched by Apple collected nearly a billion dollars. And it is. of a savings account. It allows in particular to store the “cashback” provided by purchases with the Apple bank card: Apple Card.

Apple’s latest novelty is neither a computer, nor even an app … but a bank account. And more specifically a savings account. It was launched on April 17 and this week, Forbes magazine said that around 240,000 accounts were opened and nearly $ 1 billion dollars was placed by US customers. For comparison, Boursorama, the largest French online bank, has just over 50 billion euros in its savings accounts.

So this savings account, it is added to the Apple Card offer which has existed since 2019 in the United States, a mobile bank made for the iPhone which works a little like what companies like Revolut or N26 offer. with the Apple key to show off; The card is not in plastic but in titanium. So far the offers had trouble taking off but with this Apple savings account hit a big blow.

A paid account ten times more than the American average

Two factors explain the craze for this account: the first is the interest rate of this savings account: 4.15%. It is ten times more than the national average of interest rates in the United States. But the second factor is that this savings account is above all thought to place its “cashback”, a mechanism that Apple uses on its accounts.

“”Whenever you pay with the Apple card, you get a share of money every day. We called it Daily Cash. So when you buy your morning coffee or do the shopping, each payment with your iPhone or Apple Watch, you get 2% of the amount of your purchases in Daily Cash “, Explained when Apple Card Jennifer Bailey was launched, vice-president in charge of this device. “And it’s cash, real money, you can do what you want.””

Goldman Sachs weighed down by Apple banking offers

Part of your purchase donated directly to your card. And 2% of each transaction spared on an account with more than 4% interest, it is starting to be advantageous.

And this is good news for Apple and especially for the Goldman Sachs bank to which Apple was leaning against to launch its own accounts. Since its launch, the Apple Card has caused money to Goldman Sachs for lack of customers and movements, with up to four billion dollars in losses in two years. This savings card is therefore a breathing for Apple and its partner.

But little chance that we see this system arriving in France: the arrival of Apple Card in Europe is an Arlesian since 2019. Technically on the iPhone, everything is ready to accommodate Apple accounts next to your traditional banks, but each rumor of imminent launch has been denied.

The cashback still not widespread in France

Above all, if such a product arrived in France you have to keep in mind that it would be very different: first because in France our usual cards are rather debit cards The Apple card is a credit card, based on A loan that must be reimbursed with interest. It is much less popular here than in addition to Atlantic. Then because the hyper enticing cashback of Apple could not exist in France, it is allowed in the United States by the fact that the credit card commissions are much greater and therefore that the banks can donate a little more money.

Cashback offers in France are rather limited to a limited number of partners with whom agreements are concluded, and via external services to banks.

Apple makes banks tremble with its “revolutionary” savings account at 4.15 %

How far Apple will go ? The Cupertino firm launches its savings account offering particularly attractive conditions. This initiative represents a real challenge for traditional banks, which must now face size competition.

If you have not followed the news, Apple is closer to the banking sector. In the United States, the Cupertino firm launched Apple Card four years ago and an option called Apple Pay Later which makes it possible to make immediate purchases and to pay them later, in several deadlines.

One more step towards the traditional banking sector

Today, Apple takes one more step towards the traditional banking sector with the launch of the Apple savings account. Announced in October, Apple’s savings offer is now revealed in detail. In partnership with Goldman Sachs, the savings account offers an annual interest rate of 4.15 % for a maximum balance of $ 250,000, with a real rate of 4.07 %. The account does not include any commission and does not require a minimum deposit or minimum balance.

In comparison with traditional American banks, Apple offers competitive interest rates. If some banks offer rates of up to 5 %, others, as Chase and Bank of America, offer only 0.01 % on their traditional savings accounts. However, it should be noted that the interest rates of the Apple savings account are likely to fluctuate, as for any current account.

This new product fits perfectly into the Apple Fintech ecosystem, allowing Apple Card users to redirect their awards to the savings account and win interest on them. The simplicity of use and integration with the Wallet application strengthen the attractiveness of the offer for iPhone users, whose market share in the United States exceeds 50 %.

A threat to traditional banks and fintech startups

The Apple savings account represents a threat to traditional banks and fintech startups, which are struggling to compete with Apple’s power and resources. At the moment, the Apple savings account is only available for American citizens and is guaranteed by the Federal Deposit Insurance Corporation (FDIC).

As for a possible availability in France, it seems difficult for the moment. Although Tim Cook mentioned in 2019 his wish to see the Apple Card extend to other countries, no information suggests an upcoming arrival. Collaboration with Goldman Sachs for Apple Card and the savings account is a major obstacle, but agreements with local financial institutions could possibly facilitate future expansion.

The future of Numerama is coming soon ! But before that, our colleagues need you. You have 3 minutes ? Answer their investigation

Success for Apple’s savings account, which competitions banks

Apple Savings, launched on April 17, offers liquidity remuneration of 4.15% per year. A proposal that would have won 240,000 people in a single week, allowing Apple to approach the billion dollars in deposits.

May 02, 2023 \ 14:20

My news customizable

Enjoy key information at any time according to your interests.

Select the themes that interest you:

Label Tag Quality Label Main Tag Tag Tag Precision Label Tag Quality Label Tag Main Tag Precision Label Tag Quality Label Tag Main Label Tag Tag Tag Precision Label Tag Quality Label Tag Main Tag Tag Tag

Manage my favorite themes validate the selection

Apple launched on April 17 a savings account for American users of its Apple Card payment card, paid 4.15%. A particularly attractive offer, which would have allowed him to count $ 990 million in deposits in just four days, according to Fortune. 240,000 accounts would have been opened the first week.

Savings, the last brick of Apple’s payment ecosystem

Called “Savings”, this account is managed in partnership with the American bank Goldman Sachs, which also takes care of the accounts dedicated to the Apple Card, a means of payment launched in 2019. It fits completely into Apple’s ecosystem, designed to retain its users by leading them to choose the ease of managing their finances from a single tool, the iPhone, which equips 2 billion people around the world.

Savings is automatically fed by the sums identified by the Apple Card cashback program, which according to Crone Consulting, quoted by Fortune, would generate $ 3.8 billion per year. The savings account displays all transactions in Wallet, the on -board electronic portfolio of the iPhone, which since 2014 allows you to pay without contact via the Apple Pay application.

An increasingly aggressive competitor for banks and fintechs

Savings is the latest illustration of Apple’s development strategy in financial services (and more generally in services, a month after the launch of Pay Later, its fractional payment offer.

Banks are attacked on one side by fintechs, on the other by the diversification of GAFAM. In this context, we can see the recent EPI announcement, which will begin to operate at the end of 2023 an electronic payment method using instant account of account at account, as a defensive strategy. The solution will allow the debtor to pay easily with his mobile, simply using the telephone number or the e-mail of the individual creditor, or the QR code issued by a professional.

The launch of Savings also intervenes in a context of bankruptcy of several American banks and consumer confidence test in their financial institutions, the latest being First Republic Bank which will be bought by JP Morgan.

Selected for you