How to credit your bank account – N26, N26 Credit

N26 Credit – give life to your projects

The new generation premium account and its metal bank card

Credit your bank account quickly and easily

When you have a bank account, you must regularly credit your account. In other words, you must add money to your account to have a sufficient balance to be able to make expenses or pay for future payments. This guide explains to you how to credit your account and how N26 facilitates this task.

Crediting, what is ?

Crediting a bank account means depositing money. You can also credit a prepaid card without being associated with your account. In both cases, you add money to increase your current balance.

There are many ways to supply an account or card: in person, online or through an application. Continue to read this guide to find out more.

Prepaid card or bank account ?

A prepaid card makes it possible to make payments, transfers or withdrawals of money such as a bank account, within the limit of the available balance. In addition, a prepaid card does not allow you to make transfers or withdrawals of money.

Learn more about debit cards, credit cards and prepaid cards here, and discover what differentiates them.

How to credit an account ?

Putting your account in person means that you should go to a subsidiary of your bank and put the amount of money you want to deposit on your account.

You can credit your account by digital way using mobile payments, instant transfers, separate transfers or payments with a debit or credit card.

How long does it take for an account to be credited ?

Depending on the way you feed your account, your new balance may take some time before appearing. Certain ways to credit your account allow you to see your new balance instantly, while others will ask you to wait up to 5 days, especially in the case of a transfer in foreign currencies.

How to credit an account ?

Often the fastest way to feed an account is to use a bank card, or go through a payment platform like Apple Pay.

EU residents can also make a separate transfer in euros to credit a bank account in the SEPA area. N26 account holders can send, receive and request money instantly with MoneyBeam from other N26 users.

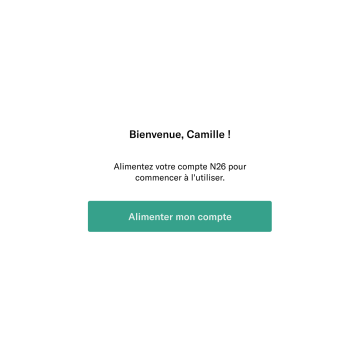

Open an account in less than 8 minutes and discover Moneybeam.

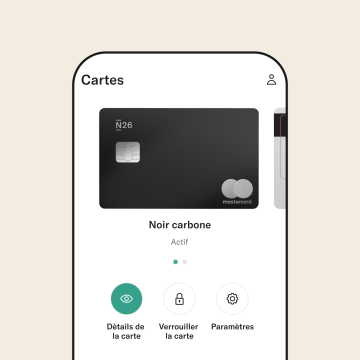

Credit an N26 account with a debit or credit card

You can also use a debit or credit card to credit your N26 account instantly. Just open the application, select Receive And Debit or credit card, then enter the desired amount. Follow the instructions and enter the contact details of your card to finalize the transaction. You can feed your account this way with an amount between 20 € and 150 € per transaction, with a maximum ceiling of 450 € per month.

Credit an account live with Apple Pay and Google Pay

Credit an account with Apple Pay and Google Pay is as simple as with a debit or credit card. In the N26 application, press “Add money”, select “Apple Pay” or “Google Pay” and follow the instructions. Again, you can add between € 20 and 150 € per transaction, with a maximum ceiling of € 450 per month. When you open an N26 account, you can add money via Apple Pay or Google Pay, and directly make payments.

Credit an account by sepa transfer

If you have an account in the EU, you have access to transfers, withdrawals and payments by card to accounts in the single payment space in euros (SEPA). This cross -border transaction service allows food to be food, as is domestic transfers. If the two banks are in SEPA zone, direct transfers are processed in a few seconds, conventional transfers under 1 working day, and automatic samples within 2 to 3 working days.

Your browser does not support the HTML5 video.

N26 clients: credit instantly with moneybeam

Moneybeam allows you to instantly receive the money sent by another N26 customer. To request to receive money on your account, enter the email address or telephone number of your contact, as well as the desired amount. Your contact must then simply confirm your request. You then receive your money in the blink of an eye.

Moneybeam is an exclusive functionality reserved for N26 customers. Open an account today to try it.

Credit an account by secure transfer

All transactions made from an N26 account are secure: you connect with a password, your fingerprint or by facial recognition, confirm outgoing transfers with your 4 -digit validation code but also confirm certain payments that you make online By identifying you in the application. The transactions carried out with your MasterCard N26 debit card are protected by 3D Secure.

Find out more about N26 security measures and 3D Secure here.

Choose the bank account that suits you

The free bank account that allows you to better manage your daily money

Virtual bank card

The bank account that allows you to better manage your daily money

5 colors available

The Premium account and bank account for daily life and travel

5 colors available

The new generation premium account and its metal bank card

3 colors available

The term “credit” refers to the addition of funds to an account from another source, either by depositing cash in a subsidiary of your bank, or by transferring funds in a digital manner.

Why credit your account ?

As a rule, customers feed their account to ensure that they have sufficient funds to cover future transactions.

How can I credit my account ?

There are many ways to feed your account. The easiest way is to transfer funds with your debit or credit card using the contact details of the card associated with the account. You can also credit your account by depositing cash or a check in a branch, by making external transfers or using wallets like Apple Pay or Google Pay.

What maximum amount can I turn on my account ?

Traditionally, the amount you can credit to an account is limited, so you must read the general conditions of your bank and the issuer of your card. With N26, debit and credit card recharges are limited to € 450 per month.

Is an instantaneous supply ?

Due to the various options available to feed an account, the period of receipt of funds may vary. Certain methods allow you to see the new balance instantly on your account, while others may ask you to wait up to 5 working days. All N26 recharge methods are instant or are treated within 2 working days.

What is a prepaid card ?

Prepared cards are fixed payment systems that allow the card holder to transfer a certain amount of money to a prepaid debit card which is not necessarily linked to a bank account. Once the recharging is made, the holder can use the card in the same way as a debit card: to make online shopping or in stores.

Is my prepaid card ensured ?

If the transmitter of your prepaid card is approved and ensured, the amount added on your card should be protected in the event of judicial administration or insolvency of the transmitter. Otherwise, the money left on the map could be lost, without any possible compensation.

Which is Bank N26 ?

Bank N26 was launched in 2015. It has a German European banking license. N26 is present in 25 markets and now has 8 million users, including more than 2 million in France.

N26 Credit – give life to your projects

You want to borrow to buy a new car, to visit America or to furnish your new apartment ? Get a quote directly from the N26 application for a credit ranging from € 1,000 to € 50,000. With N26 Credit, you receive an answer immediately.

The amount of the required loan

Credit_calculator.purposes.label

Credit_calculator.duration.label

Simulate your credit request with N26

Amount to repay

Credit_calculator.radios.label

Fixed taeg debtor rate

Credit

Choose simplicity

N26 does all the work. You will have a quote according to your profile and your financial history.

Compare without committing

We immediately make an offer to you. Final validation, once your choice is confirmed, takes less than 24 hours.

Pay for you

You decide the period during which you wish to repay your credit, between 6 to 72 months.

A paperless process

Formalize your credit with an electronic signature. Save time and space in your drawers.

Receive your loan on your account

Younited Credit provides the credit, but it arrives directly on your N26 account.

Automatic direct debits from the N26 application

By making N26 your main account, you are sure you never miss a payment.

Open an N26 account in 8 minutes, activate your account and ask for a credit

Frequently asked questions

How do you calculate the interest rate ?

The proposed interest rate depends on several factors: the amount you want to borrow, the duration of the reimbursement and your solvency. Depending on these factors, N26 Credit and Younited Credit offers fixed borrower rates (TAEG) which vary from 3.60% to 15.96% and with a borrowing period between 6 and 72 months.

How is the validation process of a credit request ?

You will receive a pre-validation after answering the necessary questions. This validation is not final. Final validation arrives within 24 working hours following. To confirm your credit, you will need to make an electronic signature. You will then receive your loan a few days later directly on your N26 account.

When will I receive my credit ?

Once you have read and accepted the quote for your credit, you confirm it with an electronic signature. From there, you should receive your money within 7 to 13 days. You will be notified upon receipt of the borrowed sum.

Who is younited credit ?

Younited Credit is the only loan platform for individuals in Europe with its own credit institution approval. N26 has set up a partnership with Younited Credit in France because they respond to N26 user experience standards, combining simplicity and dematerialization.

*Example of personal loan for a total amount of € 1,000 refundable in 72 monthly payments of € 15.35 (excluding optional insurance). Global effective annual rate (TAEG) fixed of 6.83% (excluding optional insurance). Fixed debtor rate of 3.35%. Costs of 90 €. Total loan cost: € 195.20 (including service costs). Total amount due by the borrower: € 1105.20. The monthly cost of the total and irreversible death and irreversible death insurance of work-interruption following accident or employment illness is € 1.50 or an effective annual insurance rate (TAEA) of 3 , 62% and a total amount due of € 108, and is added to the monthly payments for the loan of the loan. First maturity due between 30 and 60 days from the provision of funds, the monthly payments are deducted on the 4th of each month. Offer valid at 29-11-2017.