Hello Bank: All about the opening of a professional account., Hello Bank reviews! Pro before opening a business account ✅

Our opinion and full test of Hello Bank! Pro, the business offer for the self -employed in 2023

To benefit from Hello Business, the conditions to be fulfilled are the same as those allowing to open a professional bank account. From the subscription date, you have a withdrawal period of 14 free days, except for the costs of sending the letter.

Hello Bank! : All about the opening of a professional account

Depending on the status of a company, it may be compulsory to open a professional bank account. It makes it possible to better separate commercial operations from those carried out as an individual, but also to take advantage of services reserved for professionals.

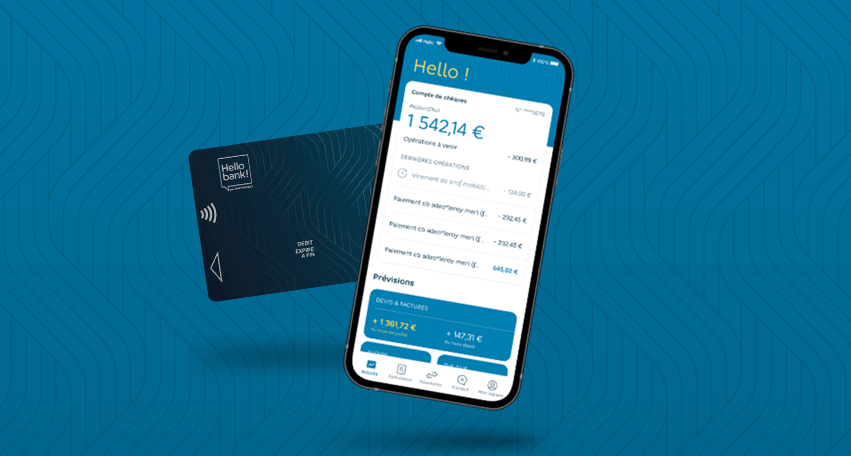

With this in mind, Hello Bank! offers the self -employed a pro account dedicated to them.

To whom hello bank is addressed! Pro ?

Today, Hello Bank! Pro allows you to manage on a daily professional account. The Hello Bank professional account! is intended for natural persons with the status of self-employed or individual entrepreneur, either the self-employed.

We therefore find among them freelancers, liberal professions or even slashers. The latter also represent a high potential and natural target as an extension of Millennials for Hello Bank!, since they generally exercise several activities as an entrepreneur.

Mobility being an important point for these professionals, the Hello Bank application! Allows you to follow your account in real time. If you belong to one of these categories of independent entrepreneurs, Open a professional account At Hello Bank! can therefore be interesting, in particular due to the solutions proposed.

Hello Bank! Pro, advantageous solutions

Any independent wishing to open a professional account at Hello Bank! must comply with certain eligibility conditions. Among them, we find the fact:

- To be over 18 years old.

- To reside in France.

- To have a SIREN number in his possession.

- To be declared micro-entrepreneur or individual entrepreneur.

If you meet these conditions, then you can take the next step.

To open your professional hello bank account! Just make four steps. The first is to fill out a form. In particular, you will need to send your SIREN number and specify if you are already a customer at Hello Bank! or BNP Paribas, before signing your contract electronically.

You will then have to send supporting documents, except in case you are already a customer. In order to finalize the opening of your account, a payment between 10 and 300 euros must be made on it.

When all these steps have been carried out, you can take possession of your professional account and decide or not, to also opt for Hello Business.

Hello Bank collection solutions! Pro

The professional bank account hello bank! gives access to various collection solutions, such as the bank card, species or even checks. We detail them here:

- Reception by check. The check for check, available on the application, will save you precious time and you can also place your checks in one of the 1,800 BNP Paribas agencies.

- Bank card payments. They can be received via a card reader. And for an even more practical side, Hello Bank! offers you the opportunity to transform your smartphone into a payment terminal, through Lyf Pay Pro. In this way, customers can be cashed without them needing to move.

- The species. For professionals still receiving regulations of this type, it is possible to file them directly in a dedicated DAB or PLC. A secure and practical solution at the same time, which can be reassuring for you, professionals.

The only condition to benefit from these collection solutions is to open a professional bank account at Hello Bank!. You will then be able to associate it with the Hello Business offer, which will bring you a 360 ° vision on your account.

Associate your pro account with the hello business offer, to better control its activity

In order to better control your activity and do it in real time, it is possible to associate your professional account with the Hello Business offer.

It offers products and services at a price of 10.90 euros excluding tax per month. Among them, we find free separate sepa, insurance and pro assistance or even cash facility.

As a customer, you also have access to a dedicated hello team pro service. Advisers can be reached directly via your personal space or from the Hello Bank application!, Monday to Friday from 8 a.m. to 10 p.m. and Saturday between 9 a.m. and 6 p.m. And of course, the virtual assistant Helloïz will answer your questions about the realization of operations, as well as on the operation of the site and the application via a cat.

And if you are not yet a customer, it is possible to contact an advisor by phone from Monday to Friday between 9 a.m. and 6 p.m.

The operation of Hello Business

To benefit from Hello Business, the conditions to be fulfilled are the same as those allowing to open a professional bank account. From the subscription date, you have a withdrawal period of 14 free days, except for the costs of sending the letter.

As for the duration of the contract, it is of an indefinite duration. The termination of the contract can be requested at any time, knowing that it takes two months notice.

On the operation side, Hello Business offers various tools to simplify the daily management of professional activity. We find my business assistant start. This service allows you to create, modify and edit invoices and quotes, as well as assets.

You can also create your customer sheets there and create your service and products base by specifying their characteristics. In this way, your quotes and invoices will be set up faster.

In conclusion

Open a professional bank account at Hello Bank! therefore has many advantages when you are a business manager. There are many services made available and you benefit from both the advantages of an online bank and those of a conventional bank.

Thus, Hello Bank! accompanies you throughout the development of your activity and saves you time through your professional account. Another positive point, a cash register of 1,550 euros is offered in the event of cash offset or any other unexpected.

In summary, open a professional account at Hello Bank! is a simple, free and secure approach. So you just have to get started.

VERIF services

- Create a watch on a business

- Get a business file

- Find all business rankings

- Search for the NAF/APE code of a company

Our opinion and full test of Hello Bank! Pro, the business offer for the self -employed in 2023

HELLO BANK presentation! Pro, the online bank for independent professionals from the BNP Paribas group

We no longer present Hello Bank! This famous subsidiary of the BNP Paribas group created in 2013 which is one of the first online banks for French individuals who knew how to grow and internationize in Europe in the following countries: Germany, Belgium, Italy, Czech Republic and Austria.

8 years later, the online banking services market has changed well. Today, the online bank has won over 600,000 customers to date has been able to develop their

Offer for individuals in order to cope with the emergence of new online and neobanc banks.

Hello Bank! decided to decline its offer to professionals and it is logically, that they launched Hello Bank! Pro with the hello business offer to target the self -employed which represent 75% of business creations in France in 2020.

We remind you that the Pacte (Action Plan for growth and transformation of companies) law promulgated on May 22, 2019 specify to auto-entrepreneurs and micro-entrepreneurs that they have the obligation to open a bank account dedicated to their company from the moment when the turnover exceeds € 10,000 excluding tax for 2 consecutive years. Nevertheless, according to Connectbanque experts, it is important to isolate your activity with a second bank account in order to have better management and avoid errors, especially in the event of control.

This is the reason why we offer you through this guide and full opinion to provide you with a deep analysis of the entire Hello Business banking offer for the self-employed (freelancers, liberal professions, micro-enterprises, etc. ) online bank Hello Bank! and thus give you objectively The advantages and disadvantages before opening a pro bank account online hello bank! Pro. So discover without further delay Our opinion and full test carried out by our experts in the Hello Business offer !

If you are an individual, you can consult our Full review on Hello Bank! with The Hello One and Hello Prime accounts.

✅ Advantages of subscribing to online bank Hello Bank! Pro (Hello business)

- �� Pro account at € 1 for 3 months For new customers

- Pro accountwithout engagement !

- A single price including all banking services without movement commission !

- Specialized advisers.

- Possibility of a Professional credit between € 100 and 25,000 € Without case fees or security deposit where funds are available in 48 hours.

- Online bank for independent entrepreneurs, without engagement, You can unsubscribe at any time at no cost.

- Services adapted to your needs for only € 10.90.

- A Visa card of International withdrawal and payment with immediate or delayed debit (RFreestying and payments around the world)

- Free species deposit Through the BNP Paribas network (ATMs)

- Unlimited checks thanks to the function Check scan

- Possibility of cash facility (overdraft authorization) up to € 1,550

- HEELLO PAY PRO free physical TPE (without purchase or rental fees).

- Free payment terminal solution (application on your smartphone) for your receipts via LYF PRO with a commission rate negotiated at 1.35% excl

- Create your quotes, invoices and assets with the integrated billing tool “My business assistant start”

- Customer service dedicated to professional customers hello team pro

- Contactless and secure payment via Apple Pay

❎ Disadvantages of subscribing to the HELLO BANK online pro account! Pro (Hello business)

- Offer only limited to self -employed, micro-enterprises, self-employed entrepreneurs, liberal professions, etc. The other statutes cannot access the services of Hello Business

- Does not have Google Pay and Samsung Pay contactless payment

- The deposit of species is not available in the DOM TOM, only in mainland France

�� HELLO BANK Professional Bank Prices and Bank costs! Pro

Hello Bank’s Hello Business offer! Pro is easy to remember with A single price at € 10.90 excl. Tax/month for a large number of services included that you will find below: (without hidden costs)

- No opening and fence costs

- No account holding fees: 0 euro of movement commission costs, discovery intervention commission (within the limit of authorized overdraft) or account management.

- No costs on payments in France and abroad.

- No costs on withdrawals in France and abroad. Some establishments abroad may apply exchange fees.

�� Payment and withdrawal ceilings for the Hello Bank card! Pro

Your ceilings are adjustable according to your needs. The maximum you can have for ceilings at Hello Bank! Pro:

- The payment ceiling of € 3,000 per month.

- The withdrawal ceiling of 500 € per week.

☑️ Opinion of the Connectbanque experts on HelloBank! Pro and hello business

After a full test, we confirm that the online bank Hello Bank! has evolved well by launching its offer dedicated to professionals. With this offer reserved only for the self -employed, the subsidiary of the BNP Paribas group arrives on the market for professional banks with a complete offer called Hello Business for which we give a positive opinion. For Connectbanque, the Hello Business account is one of the best bank accounts for auto entrepreneurs.

To start this opinion, we appreciate the fact that Hello Bank! Pro has adapted to online banking offers for professionals. The subscription to Hello Business is without commitment, without costs of opening and closing of account, No bank charges and without movement commissions unlike the pro account of the parent company BNP Paribas.

Hello Bank’s professional offer! Pro Simple, transparent and without hidden fees. This is the reason why, a single rate is offered where all service costs are included.

In order to stand out completely from its direct competitors, Hello Bank! given the possibility of the self -employed to accept all the means of payments in order to refuse any customers. Because by opening a hello business professional account you can also collect checks and species through the BNP Paribas network as well as by bank card with the Hello Pay Pro payment terminal. In addition, you will be entitled to a cash facility (overdraft authorization) up to € 1,550.

What we greatly appreciate at the Hello Business offer is its single price at € 10.90 excl which includes a large number of services, insurance. You can pay and withdraw money in France and internationally at no additional cost.

Finally, to complete this opinion, Hello Bank! Pro is becoming much more than online bank with all the collection solutions offered (checks, cash, bank cards). In order to have any frustrated customer, the subsidiary of the BNP Paribas group has teamed up with The Lyf Pro mobile collection solution for the self -employed Who move or receive their customers so that they can accept all means of payments and collect their transactions in peace with a commission rate negotiated at 1.35% including tax instead of 1.60% excl. % TTC).

To conclude this opinion, we confirm our very positive opinion because the hello business offer is complete and offers a whole set of services allowing you to start your activity in peace.

We regret that as a mobile bank, that contactless payment via smartphone is only available on Apple Pay. But also that the deposit of species is only available to the self -employed of the French metropolis (the DOM TOM are still forgotten). Furthermore, there is no free start -up offer like some online pro accounts and that the hello business offer is limited only to the self -employed (Freelancers, self-employed, micro-enterprises, liberal professions. )).

But rest assured, according to our sources, a banking offer for other business statutes should be born. We keep you posted, in the meantime, do not hesitate to subscribe if you are eligible for the Hello Bank account! Pro or leave your email via our contact page to be aware of the evolution of the hello business offer.

⭐ Customer opinion on Hello Business from Hello Bank! Pro

Since the launch of the Pro hello Business account, the opinion of customers hello bank! pro is final for its start -up, whether in terms of the very easy and fast pro account opening, very educational support for customer service by an expert as well as the transparency of the costs.

�� Zoom and opinion on the services of the HELLO Business offer

Hello Bank’s Bank Bank Bank! Pro is a complete offer with A single price For the self -employed to focus on their activity and do not care about hidden costs, a definite advantage for doing good in its cash flow !

How to supply my bank account pro hello business ?

You can power your professional bank Hello Bank! Pro in 4 different ways:

- Species in an agency on the BNP Paribas network in mainland France with a deposit automaton

- Checks via the check function of checks

- By instant transfer (SEPA)

- By international transfer (Swift)

How to get a professional credit with Hello Business from Hello Bank! Pro ?

Independent status (self-employed, micro-enterprise. ) is a special status because your professional activity (company) belongs to a person (physical), there is therefore no separation between personal goods and those of the company.

Therefore, when you take the choice to opt for a professional credit, your bank will take into account all the loans you may have in progress (real estate, consumption. ) to determine your eligibility. This can lead you to guarantee your main residence, which can be very risky !

This is the reason why The online bank for independents Hello Bank! Pro decided to expand its offer Hello business with online professional credit for self -employed (Auto-entrepreneur, individual entrepreneur, micro-enterprise, EIRL) who want to obtain a professional loan with less restrictive conditions.

The first condition is to be a customer of the pro hello business bank for minimum 6 months (this allows them to know their customers a little better). Once this period has passed you can contract professional credit online as follows:

- Free of charge

- Without warranty

- You can borrow between € 100 and 25,000 €

- Loan refund between 24 months and 84 months

- The funds are fired under your bank account Hello business In 48 working hours

There is still a study made beforehand by the parent company of Hello Bank! Pro (BNP Paribas) for acceptance of your file.

We remind you of an important detail: “A credit commits you and must be reimbursed. It is important to check your refund capacities (your solvency) before committing “. And this also applies to your pro activity.

Free mobile TPE and integrated into your hello business application to collect your customers

Hello Bank! has set up a partnership with the Lyf Pro collection solution so you can Create your customers’ transactions from your smartphone With the HELLO BANK mobile application! Pro.

This completely free service and no additional cost will allow you to have a payment terminal in your pocket and accept contactless payments.

By implementing this partnership, Hello Bank! negotiated a preferential commission rate: 1.35% including tax instead of 1.60% excl. Tax (1.92% including tax) for the amount of each transaction.

You will also have the possibility of offering payment in several times. Since then, the health crisis, it has become rare that a bank card has not been equipped with NFC technology that allows you to make contactless payment. However, we remind you that The bank card ceiling is 50 €.

It is important to note that you will receive the amount that your transactions each end of the quarter by transfer via the Lyf partner. These transfers will be made on your HELLO BUSINESS professional bank account on J+1 worked.

If you want to have a physical payment terminal that accompanies you everywhere, we invite you to discover Hello Pay Pro.

How to collect your customers with Hello Pay Pro, the connected payment terminal of Hello Bank! Pro ?

By launching Hello Business, the BNP Paribas subsidiary aims to give the self -employed all the services that a large company can hold at a lower cost. And this involves collection solutions such as TPE (Electronic Payment Terminal). Because it is important as a business to accept all possible means of payments so as not to refuse customers.

Hence the launch of Hello Pay Pro, a portable payment terminal with a Bluetooth connection available from the opening of a Hello Business professional account, the advantages of which are as follows:

- Free and without rental or subscription fees DUTPE

- Accepts bank cards with or without contact: Mastercard, Maestro, Visa & Visa Electron

- Accepts the contactless payment of smartphone: Google Pay, Samsung Pay, Apple Pay

- Follow -up of your receipts in real time

- Transfer on your pro hello business account on J+1 worked

- Commission of 1.60% TTC per transaction

In case you want to take the checks on your pro account, this is possible with the Hello Business account where we explain how to drop the checks online with Hello Bank! Pro.

How to deposit a check via the online bank Hello Bank! Pro ?

Opening a Hello Business account will allow you to accept a large number of payments, including checks thanks to the scanner integrated in the Hello Bank mobile application! Pro.

Find out how to take a 3 -step check through the Hello Business check scan function:

- Click in the “Payments” section then “collect a check”

- Take a picture of your check using your smartphone by clicking on “scan a check”

- Send your postal post for free in a non -freed envelope without forgetting to sign on the back of the check.

Finally, if your customers pay you in cash (species), you can do it without problem with your pro hello business account. So find out how to deposit your species with the online bank Hello Bank! Pro.

How to make a species deposit with the online bank Hello Bank! Pro ?

This service is so rare in line banks that we have considered it important to emphasize it.

Indeed, depending on your professional activity, you can still be brought to be paid in cash. This is the reason why through the BNP Paribas network, Hello Bank! Pro gives you the possibility to deposit your species in all BNP agencies in mainland France only from the moment the latter have a deposit automaton.