Go to an electric car: the condition helps you |, discover the aids for your electric car |

Discover aid for your electric car

Finally, more and more local authorities (regions, departments, municipalities) offer, in addition to those granted by the State, different aid for the purchase of an electric vehicle. Significant point, These subsidies are combined with the ecological bonus and the conversion bonus .

Go to an electric car: the condition helps you

Rolling by electric car reduces emissions of air pollutants and greenhouse gases, as well as saving fuel. To speed up the transition, the condition helps the acquisition and rental of electric cars and ensures the good deployment of charging stations.

Conversion bonus, ecological bonus … What aid can I benefit ?

The conversion bonus is a financial assistance for the purchase of a new or used vehicle, in exchange for the rebate of an old vehicle.

For’Acquisition of an electric car, The premium can go up to 6,000 euros.

If you live or work in a low -emission zone (ZFE), you can benefit from a Additional bonus of 1,000 euros.

In addition, if you have received help from your local authority to buy or rent a cleaner vehicle, this surprise is increased within the limit of 2,000 euros more.

The ecological bonus is a financial assistance with the purchase of an electric vehicle (or operating in hydrogen).

For’Acquisition of a new car, The bonus amount can rise Up to 7,000 euros.

A bonus of 1,000 euros is also accessible for the acquisition of a used car. The ecological bonus and the conversion bonus are cumulative.

The government has also set up a microcredit system for the acquisition or rental of clean vehicles.

It helps people excluded from the conventional banking system, with low incomes or in a fragile professional situation, who wish to acquire a little polluting car, including an electric car.

The government also helps the transformation of a thermal vehicle into an electric vehicle (transformation called ” retrofit »Electric), with a bonus of up to 6,000 euros.

Transform your thermal car into an electric car with the “retrofit” !

Where to find charging stations for my electric vehicle ?

One of the essential conditions for the development of electric mobility is the ease of use by all of charging infrastructure.

To do this, 1,300,000 terminals have already installed in France, Whether at home, business or public space for example.

The State has mobilized significant financial means to accelerate the deployment of charging stations, notably :

- 100 million euros in the recovery plan have been allocated for the implementation of rapid charging stations in almost all of the service areas of the motorway network and national roads.

- 300 million euros from the Investment Plan France 2030 accompany rapid charging stations in metropolises and territories.

- 320 million euros in the programAdmitwill be deployed for the installation of more than 175,000 charges, in particular collective residential buildings.

In order to support road users in their trips, Bison Futé provides a real -time interactive card identifying fast charging stations for electric vehicles in service

Discover aid for your electric car

Ecological bonus, conversion bonus and local subsidies: many aids are available today to allow you to buy an electric car.

To encourage the purchase of little polluting vehicles, the French State offers two main financial aids: the ecological bonus up to 7,000 euros, and the conversion bonus which can reach 6,000 euros. To this are added subsidies paid by certain local communities.

Upon purchase, these subsidies are considered by dealers as a contribution and make a more economical electric vehicle ! And all the more if you benefit from the double conversion bonus. Thus, it is now possible to acquire an electric vehicle for long -term rental from 89 euros per month.

As part of its “France revival” plan, the government has strengthened aid for the purchase of electric and hybrid vehicles rechargeable.

Aid to reduce the cost of purchase

Ecological bonus for all

By choosing an electric vehicle rather than a thermal model, you benefit from a substantial financial aid of the State: the ecological bonus. Conversely, people buying a thermal vehicle pay the ecological penalty, a tax ranging from 50 to 20,000 euros depending on CO emissions2 the model chosen and which allows you to finance the ecological bonus. You can thus receive up to 7,000* euros by choosing an electric city car while you could have paid up to 140 euros for a thermal equivalent.

*An increase of 2,000 euros is granted when the vehicle (new private car or new van) is acquired or rented by a natural person whose reference tax income per share is less than or equal to 14,089 euros.

The ecological bonus is paid during the acquisition of a new electric car by a person domiciled in France. This aid represents 27% of the purchase price all taxes included, increased by the cost of rental of the battery if necessary (up to 7,000 euros for individuals or 3,000 euros for legal persons). Most of the time, it will be directly deducted from your invoice by the dealer. If it has not done the advance, it will be reimbursed to you after making the request from the Service and Payment Agency.

Several conditions must be met to benefit from this aid. Thus, the new electric vehicle must:

- be purchased or rented for a minimum duration of 2 years

- be registered in France

- Do not be sold within 6 months of the purchase, or before having traveled 6,000 kilometers, or 24 months in the case of a rental.

Conversion bonus to replace a more polluting vehicle

To allow the greatest number to drive with a cleaner vehicle, the State has set up the conversion premium. You can thus benefit from help when acquiring an electric vehicle, whether new or used, provided you are breaking a diesel model or older petrol.

The conversion bonus prompted me to switch to electric.

Sébastien, 38, Haute-Garonne

Several conditions apply to the vehicle reinforced with an approved “vehicle” vehicle center. It must be a car or a van whose total authorized load in charge does not exceed 3.5 tonnes and be:

- A diesel vehicle registered for the first time before 2011

- A petrol vehicle registered before 2006.

In addition, he must have been acquired for over a year and have always been subject to an insurance contract. Finally, its breakage must take place within 6 months of the invoicing date of the newly acquired vehicle.

The amount of aid varies according to the status of the applicant, whether it is a legal person (companies, associations or communities) or an individual person. In the best of cases, it can reach 6,000 euros (up to 80 % of the purchase price including tax including !))

In any case and whatever the amount of the aid, the buyer undertakes not to give in his new vehicle within six months of the first registration and without having traveled at least 6,000 kilometers. As part of a rental, you are committed to a minimum period of two years.

As with the ecological bonus, the conversion bonus can be directly deducted by the seller.

No gray card to pay !

Added to this is the exemption from the payment of the registration certificate for all electric vehicles. This can represent a hundred euros in savings !

How much it costs in the end ?

In the end, once the aid has been deducted, an electric vehicle can be cheaper to purchase than a petrol or diesel model.

The ecological bonus and the conversion bonus can be combined and allow you to reduce the purchase price of the electric vehicle. In addition, some local communities offer subsidies as part of an air quality improvement policy.

What aid available to buy an electric vehicle ?

Aids to install a charging station

An electric vehicle is more economical than a thermal model: only a few euros per 100 kilometers when you recharge your car at home. Because yes, your accommodation becomes your personal service station !

Several aids are available to allow you to install a point of charging at home at a lower cost, whether you live in a single house or a collective building. Many car manufacturers have also associated with installers of charging stations and support part of the installation costs.

For all individuals living in individual house or collective building

Since December 31, 2020, the energy transition tax credit (CITE) has given way to ” Maprimerenov ‘ », In fact deleting the tax credit dedicated to charge systems. In order to maintain support for home recharge solutions equipment, the government has created a similar system within the framework of the finance law for 2021: a tax credit for acquisition and installation of loading systems for electric vehicle. The latter will be valid until December 31, 2023.

- Beneficiaries ::

- Taxpayers, owners, tenants or occupants free of charge of accommodation which they assign to their main home and their secondary residence (only one per taxpayer)).

The program Adverse for all individuals living in a collective building

If you live in a condominium, you can benefit, in addition to Maprimerenov ‘, from a subsidy from the Adverse program.

This private program is accessible to everyone, without income conditions, and allows you to benefit from a help of 50 % of the amount excluding tax of supplies, equipment and work, up to a limit of 960 euros for the installation of a individual terminal and 1,660 euros for the installation of a shared terminal.

This aid can only be offered to you by an installer referenced by the Adverse program. The latter may deduct the amount of assistance directly from the final estimate that he will offer and take the administrative procedures for you.

It is not over since some communities also offer aid for the installation of charging stations by living in collective.

Aid to buy an electric car: what are the boost of the state ?

Several aids to buy a car exist. But in recent years, the government has set itself the objective of reduce our CO2. Objective, renew the car fleet by replacing the old polluting vehicles. To do this, the public authorities encourage the French to orient themselves more towards Buying a clean vehicle.

This is how several aid devices have emerged to make Acquisition of an electric vehicle accessible to the greatest number. Between Ecological bonus, conversion bonus, micro-credit “Clean vehicles” or local aid, We take stock of these devices.

Conditions of allocation, amounts and procedures to be taken to benefit from it, find the list of devices for the purchase of an electric car in the rest of this article.

Main aid to buy an electric car: the ecological bonus

What is the ecological bonus and what is its amount ?

The ecological bonus is a State financial assistance Given to new owners of a new or used vehicle not emitting CO2.

Its amount varies according to the vehicle purchased, its characteristics as well as the profile of the buyer (natural or legal person).

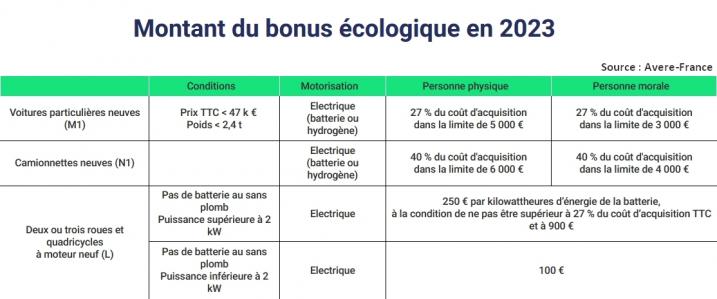

Here are the various scales applied since January 1, 2023:

- For the purchase of a new private car vehicle, the ecological bonus is set at 27% of the acquisition cost. The amount of aid is capped at 5.000 € for individuals. If you are a legal person , Maximum help is3.000 € .

- For the purchase of a van vehicle, the amount of the bonus is set at 40 % of the acquisition cost. He is capped at6.000 € for individuals And 4.000 € for legal persons .

- Finally, for electric used vehicles and/or operating in hydrogen, the amount of the subsidy is set to 1.000 € .

Be aware, moreover, that these amounts can be increased by 2.000 € For households with a reference tax income less than or equal to 14.089 €, or maximum aid of 7.000 € for a car and 8.000 € for a van.

What are the conditions to benefit from it ?

To have the ecological bonus, you must be at least 18 years old and justify your residence in France or a moral person justifying an establishment.

Since 01/01/2023, you can only get the ecological bonusOnce the three years By vehicle category. In addition, the acquisition of your vehicle is subject to several conditions:

- The ecological bonus applies to passenger cars or the trucks operating exclusively to electricity , at the hydrogen or to a combination of the two .

- The weight of the car should not exceed 2.4 tonnes.

- Maximum purchase price: 47.000 €.

- Whether in the case of a private car or a van, the vehicle must not have been the subject of a first registration. It must be registered in France, in a final series.

- Finally, the car cannot be sold in the year following its first registration or before having traveled at least 6.000 kilometers.

How to get the ecological bonus ?

To benefit from the ecological bonus, two cases are possible. If your dealer is attached to the Service and Payment Agency (ASP), it is able to Deduce the amount of the bonus directly from your invoice , which must be identified by a specific line. In this case, he will then be reimbursed with the ASP.

Otherwise, you will have to request it from the ASP (Service and Payment Agency). The process is carried out online and must be carried out at the latest within 6 months of the billing date.

Acquire an electric vehicle thanks to the conversion bonus

What is conversion bonus ?

Also called scrapping bonus, The conversion bonus is an aid paid to any new buyer of a little polluting vehicle subject to that its old vehicle is withdrawn from traffic to be destroyed .

It can be combined with an ecological bonus, which, in some cases, can be a help for the purchase of a substantial electric car.

What are the conditions to benefit from it ?

Since 1er January 2023, The conditions for the allocation of the conversion premium have been modified.

It is indeed limited to households whose RFR by share is less than or equal to 22.983 € .

It can be increased for the most modest households or considered “big rollers”. It can also be reinforced by 1.000 € if you live in an area called low mobility emissions (ZFE).

In addition, the conditions to benefit from the conversion premium depend, at the same time, the type of the vehicle to be destroyed and the new vehicle purchased.

The old vehicle must be destroy in the 3 previous months where the 6 months following the billing date of the new vehicle and meet the following criteria:

- The old vehicle must have been registered for the first timeBefore 1erJanuary 2011 If its fuel is diesel and before 1erJanuary 2006 for the others.

- The vehicle must have been acquired for at least 1 year by the beneficiary, be registered in France in a normal series or with a final registration number.

- It should neither be pledged nor damaged.

The vehicle bought, meanwhile, must:

- Belong to the category of Particular Cars or some van operating at electricity, hydrogen or a combination of the two.

- Have a lower mass at 2.4 tonnes.

- Have a cost less than or equal to 47.000 €.

- Do not have been the subject of a first registration and be registered in France, in a final series.

- Do not be sold by the buyer in the year following his first registration or before having traveled at least 6,000 kilometers.

What is its amount ?

The amount of the conversion premium depends on Type of vehicle purchased as well as Your reference tax income.

For the purchase of a private car using electricity, hydrogen or a combination of the two as a source of energy:

- Your Reference tax income by share is less than or equal to 14.089 € And you constitute what is called a ” roller »(You perform more than 12.000 kilometers per year with your personal vehicle as part of your professional activity): the amount of aid is set at 80 % of the acquisition cost And capped at 6.000 € .

- Your Reference tax income by share is less than or equal to6.€ 358: The amount of aid is set at 80 % of the purchase price And capped at 6.000 € .

- In all other cases, the amount of aid is fixed at 2.500€ €, Within the limit of a reference tax income less than or equal to 22.983 € .

For the purchase of a van using electricity, hydrogen or a combination of the two as a source of energy:

Depending on whether the vehicle is class I, II or III, the amount of aid, F IXÉ 40 % of the purchase price , can vary from 5.000 € at 9.000 € .

This help is increased by 1.000 € if :

- The reference tax income of the purchaser is less than or equal to 6.358 €.

- If the buyer is considered to be a “big roller” and his reference tax income is less than or equal to 14.089 €.

What are the steps to benefit from the conversion bonus ?

In the same way as for the ecological bonus, your dealer, if he is empowered to do so, may operate an advance and directly deduct the amount of the premium on the amount of your invoice.

If it is unable to proceed to this advance, it will be yours, within 6 months of the date on your invoice, to request it from the Service and Payment Agency. Again, the process is done exclusively online.

Clean vehicle micro-credit: help to finance an electric car

To allow the most modest households to acquire a little polluting vehicle, the government has, since 2021, set up a specific micro-credit. It is intended for people whose income is very modest, and in particular to people who do not have access to the classic banking system, or to people in professional precarious situations.

The amount of this credit is variable depending on each situation. He is capped at 5.000 € And he must be Refunded within a maximum of 5 years .

To benefit from this micro-credit, several conditions must be observed:

- Your reference tax income must be less than or equal to € 6,300

- The requested aid must be used for the purchase or long -term rental (LLD or LOA) of a new or little polluting vehicle.

To be eligible for this credit, you must turn to a social support service (for example the local mission, different associations such as the Red Cross, etc.) which will accompany you throughout your administrative procedures, will help you to build a file and present it to approved banks.

Help for the purchase of an electric car: Local devices

Finally, more and more local authorities (regions, departments, municipalities) offer, in addition to those granted by the State, different aid for the purchase of an electric vehicle. Significant point, These subsidies are combined with the ecological bonus and the conversion bonus .

Their amount as well as the conditions of allocation vary according to the communities. To find out the aid implemented around your home, you can go to the Jechangemavoiture site.gouv.Fr.

In Île-de-France, for example, there are 4 of them:

- Up to 6.Euros Help in the purchase of an electric car for individuals who live in large crown, who work in a ZFE (low -emission zone), and who will replace their old vehicle (Crit’Air 3, 4, 5 or not classified) by an electric car.

- Up to 15.Euros For very small businesses that invest in an electric truck in order to create a traveling business activity in rural communities.

- Up to 2.500 euros Help for the purchase of an electric car for individuals and small businesses using the retrofit technique to transform the engine of their vehicle.

- Up to 9.Euros For small businesses that buy clean vehicles as part of their activities.

Electric car: what aid for the installation of charging stations ?

Faced with the increase in sales of electric cars in France, the government wishes Encourage the installation of charging systems . To do this, several aids for tenants, owners or condominium unions have been implemented.

There are 4:

- The premium to adverse (accessible without income condition) whose amount can go Up to 960 € for the installation of an individual load terminal.

- The tax credit: it can cover 75 % of the costs on the purchase and installation of a charging station and is limited to 300 € per load system.

- Reduction in VAT rate: it gives you the benefit of 20 % discount on the installation and maintenance quote of the charging stations.

- Finally, communities aid: they are specific to each region, department or commune. Do not hesitate to inquire with your community.

the forum