Free online bank: Best comparison – Wise, HSBC: Traditional Bank and International Online Bank

HSBC: international online bank

Fortuneo

Free online bank: comparison

You are looking for the best free online bank? Here is a comparative list of different free payment providers. Also find out how to save money using Wise.

Free online banks: are they really free ?

The term “free online banking” can be confusing.

Admittedly, there is no monthly contribution, but several services are paid: bank card (it can be free, but subject to certain conditions) or transactions outside the EU (operating costs and a surcharge of the exchange rate are predictable).

That said, opening an account in a free online bank allows you to save money. In addition, registration is facilitated compared to traditional banks. Account management can be done entirely on mobile. As for the subscription costs are low, even absent.

Even if there are costs to be expected, online banks offer competitive prices for transactions abroad. Take Wise: you will benefit from the interbank rate on international transfers, without surcharge (as is the case in a traditional bank).

Here are the best free online banks. Consult our general presentation table below or compare the characteristics of bank cards by going below the page.

The best free online banks.

The best free online banks.

Fortuneo

HSBC: international online bank

�� HSBC site

HSBC: a world leader in banking and financial services

Founded in 1865 to facilitate growing trade between Europe and Asia, HSBC – Hong Kong and Shanghai Banking Corporation Limited – is one of the world leaders in the banking and financial services market. With more than 150 years of experience, HSBC is now located in 70 countries. It totals 37 million customers on all continents.

In France, HSBC combines the power of an international group and the local council. It holds nearly 400 agencies spread over the territory. In 2016, HSBC had around 800,000 customers and 10,000 employees in France.

Via its website, HSBC has a full range for individuals, businesses and professionals. Such as current accounts, savings products, life insurance, personal and real estate loans, stock market investments, provident and insurance solutions.

A full online bank offer for individuals

HSBC offers many products and services via its daily bank offer. Four types of bank cards are available, which include degrees of increasing services and guarantees. Current operations are free. You will find there in particular:

- opening and closing of account,

- Punctual or permanent transfers in France,

- Opposition on check

- replacement of the payment card

Finally, the number of species withdrawals is unlimited in all postal distributors in the euro zone.

In addition, HSBC offers great cash flexibility. Indeed, it is possible to benefit from a cash facility of up to € 3,000. Insurance of means of payment is included, as well as a package of 25 e-mail or SMS alerts per month. This allows you to follow the state of your account remotely. All current operations can be carried out on the internet, via a mobile application or by phone.

In addition, thanks to the 100 % free HSBC Easy service, HSBC takes care of all the formalities related to the change of account, regardless of the number of organizations to inform. The transfer of recurring transfers and samples is taken care of free of charge by HSBC, and customers can follow the list of operations in real time for which the change of domiciliation is effective. The steps to open an account are also simplified, since 48 hours are enough to subscribe online.

Consumer opinion

Customers first appreciate the personalized support that HSBC offers. The advisers can be reached by phone from 8 a.m. to 10 p.m. on weekdays, and from 9 a.m. to 5.30 p.m. on Saturday. It is also possible to dialogue with an expert directly online or via Twitter. You can finally make an appointment in one of the 400 HSBC agencies in France, which were rewarded by the study “Choosing my bank” of a famous broker for the quality of their welcome, their geographic proximity, time d ‘waiting and opening hours.

Via a secure personal space on the HSBC site, it is also possible to benefit from the free monthly e-receiver. The latter contains the same information as the paper version, but also allows the classification and storage for 30 years of important documents. Practical and easy to use, this service provides for the possibility of carrying out research by period and by account, and all files can be downloaded and printable.

At the same time, HSBC is often mentioned for its international expertise. The withdrawals of species are free in all HSBC distributors around the world, and no exchange commission is invoiced on the transfers in foreign currencies. In an emergency, HSBC provides you up to $ 2,000 in cash, in the agency of your choice. The Magellan Circle – Professional Network for Exchange and Information – also elected HSBC “Expatriate Bank” for the sixth consecutive year.

Online bank abroad: which offer to choose ?

Whether it’s simple stays abroad, a business trip or a world tour, traveling abroad requires good organization and a certain budget. In addition to expenditure related to travel, catering, accommodation or leisure, it is also necessary to think of banking costs.

These can be higher or lower depending on whether you are traveling in or outside the euro zone. To lighten its expenses, use the services of a Online bank abroad can be an effective solution. Certain platforms even offer a bank card at no cost abroad, in particular with Free account holding costs. Before going on a trip, here are the key elements to remember to choose an online bank.

Discover our comparison of the best online banks abroad to travel: ��

Best online banks abroad

Payment / withdrawal of currencies

Learn more

Monabanq

Visa Classic

6 to 9 €/month

✔️ € 120 offered + 3% boosted booklet for 6 months !

Fortuneo

Gold Mastercard

Free

✔️ Until 150 € offered !

Balance Bank

Visa Ultim

Free

Free / 3 free per month

✔️ Until 130 € offered !

My French Bank

Ideal visa

€ 6.9/month

Hello Bank

Visa Hello Prime

5 €/month

✔️ 80 € offered + hello prime -50% for 1 year

N26

N26 you

€ 9.9/month

Bforbank

Premier visa

Free

Choose your bank online to travel: the criteria to check

Before opting for an online bank abroad, many criteria must be taken into account, of which here are the main ones:

- �� The price : It varies from one platform to another and some even offer free services (bank card, account holding fees, etc.)

- Payment and withdrawal ceilings : Better to favor online banks that offer modular and customizable ceilings.

- ��The guarantees of insurance and assistance linked to the bank card : Premium (Visa Premier and Gold Mastercard) bank cards allow you to benefit from insurance and assistance during a trip.

- ✔️ online bank efficiency : Just consult the opinions and forums dedicated to dematerialized banks to determine the reliability of a banking platform.

- �� The network of partner agencies abroad : this criterion is important because the presence of a partner bank abroad makes it possible to reduce bank charges during withdrawals from a DAB for example.

Bank card at no cost abroad: which bank to choose ?

Outside the euro zone, there is no bank card at no cost properly speaking. However, it is possible to benefit from free account holding costs in certain online banks and neobancs.

�� Online banks

Dematerialized banks are appreciated for their varied services and their competitive prices. Here is a non -exhaustive list of the main offers on the market to help you choose the best online bank abroad.

Balance Bank

To benefit from an international bank card with this Société Générale online bank, it is simply necessary to justify a minimum monthly income of € 1,000. Withdrawal and payment fees are billed at 1.95 %.

Bforbank

By justifying a minimum monthly income of € 1,600, the customer benefits from a premium bank card suitable for travel. This is accompanied by more comprehensive insurance and assistance guarantees. As with Boursorama, account holding costs are offered, while those of withdrawals and payments are billed at 1.95 %.

Fortuneo

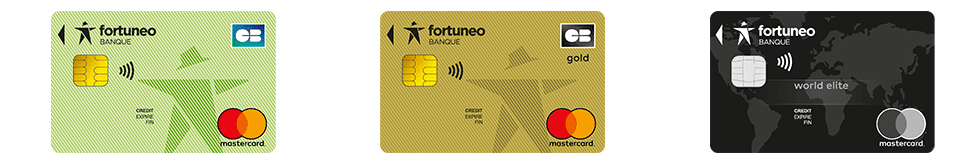

This online bank of Crédit Mutuel Arkéa offers 3 types of high -end Mastercard bank cards. They are accessible from a minimum income of € 1,200. At Fortuneo, withdrawal and payment fees outside the euro zone are set at 1.98 %.

Monabanq

Unlike previous offers, that of the online bank of Crédit Mutuel CIC is accessible without income condition, but for a monthly subscription of € 6. It includes 25 withdrawals and 50 free payments outside the euro zone. To benefit from insurance and assistance guarantees abroad with the Visa Premier Monabanq card, the customer must pay € 3 more per month.

Hello Bank and ING Direct complement this list with identical withdrawal and payment fees of 2 %.

If you do not yet know which online bank abroad to choose, you can always turn to 100 % mobile banks.

�� Neobanques

Although the offer of an online bank abroad is interesting and more advantageous than that of a traditional establishment, It is today preceded by those of 100 % mobile banks. As proof, some of the latter allow you to benefit from a bank card at no cost abroad, especially at N26.

This German neobank indeed offers a bank card that can be used internationally with zero payment costs outside the euro zone. Withdrawals are however billed at 1.70 %.

Otherwise there are other alternatives such as:

- The Anytime prepaid card : Payment and withdrawal costs are billed at 2.50 % with an additional € 3 for each withdrawal of € 300.

Learn more about the Anytime offer - Nickel account : withdrawal costs outside the euro zone are set at € 2 against € 1 for payments.

- The neobank C-ZAM : If payments with the C-ZAM card are free outside the euro zone, withdrawals from a DAB are billed 40 € per year.

Learn more about the C-Zam offer

Copyright Image on the front page: backpacker.com