Fortuneo Pro: is it possible to open an account?, Pro fortneo account – can we subscribe, and how?

Pro fortneo account-can we subscribe, and how

You would like your money to be safe, but that it is available at any time ? Opening a book A with Fortuneo Bank is therefore the best solution. With this savings solution, you can pay and withdraw money when you wish. In addition, theopening of your booklet A is completely free And there is no management fees.

Fortuneo Pro: Everything you need to know !

Fortuneo is an online bank offering an online current account with a bank card from the Mastercard Network included. You are professional and you want to open a current account dedicated to your activity �� ?

Know that if you are self-employed, you have different options to open a pro Bait account. Does it exist A pro offer at Fortuneo Banque ? Can I open an individual current account at Fortuneo to manage the budget of my professional life ? What are the conditions requested by the online bank ? What are the supporting documents to be provided when subscribing ? What alternatives to Fortuneo for professionals ? What are the banks offering an account dedicated to self -employed workers ?

To answer all of this question, here is a file dedicated to Fortuneo for the pros. ��

Alternatives to the pro fortneo account

N °

Broker

Key

Learn more

Qonto

✔️ Best Pro Bank of the Market

PROSSORAMA PRO

✔️ 80 € offered + checkbook

Shine

✔️ low prices

What is the pro account offer of Fortuneo Banque ?

Fortuneo Banque does not yet offer an account for professionals, however if you want to open a current account as a self-employed person for Manage the budget for your activity, You can because French law does not ask you to open a professional account. Indeed, you can open an individual personal account like that proposed by Fortuneo to manage the budget of your professional activities. As a self -employed worker, you can open different types of account to manage your activities: ��

- An individual personal account ✔️

- An account dedicated to self-employed ✔️

- A professional account ✔️

By opening an account dedicated to your auto-entrepreneur activity, you will be sure to make the difference between your personal and professional expenses and thus manage the budget of your activity more easily.

Attention ⚠️: Fortuneo is entitled to close your individual current account if the online bank realizes that you use your Current Fortuneo account for professional purposes.

�� What are the conditions to open a Fortuneo account ?

If you want to open a Fortuneo account for your professional activity, then you should know that online bank asks its future customers to fulfill certain conditions. To find out if you are eligible, here are all the conditions requested by Fortuneo ��.

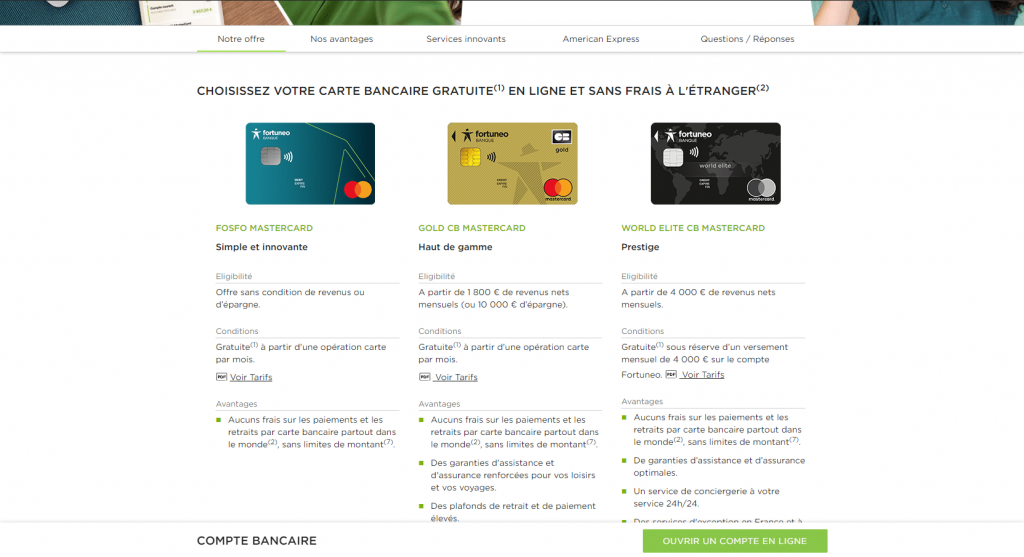

To open a Fortuneo Pro account, you must fulfill certain conditions required by the online bank Depending on the card you are going to choose. At the time of subscription, you have the choice among three bank cards in the Mastercard network. The Fosfo bank card is accessible Without income condition, The GOLD bank card requires minimum income of € 1800 / month or € 10,000 in outstanding and the World Elite bank card is accessible from € 4,000 in income or payment / month.

If you opt for a high -end card like the Gold Mastercard and the World Elite Mastercard, you will have to justify significant income, however Fortuneo offers a bank card accessible to everyone without income conditions: the Fosfo card. In addition, you must hold a current account in another bank in France, because you must make a transfer of this current account to your Fortuneo Pro account.

�� What are the supporting documents to create a pro fortneo account ?

To benefit from the Fortuneo offer to open a professional account, you must provide the online bank with supporting documents When subscribing. To accompany you in this approach, here is the complete list of documents that will be requested by Fortuneo for constitute your account opening file ��:

- A valid identity document (identity card, passport, residence permit)

- a tax notice

- A bank identity statement with your name of another bank in France

- Revenue proof if you opt for a high -end card (salary slip, tax notice, school certificate if you are a student)

To know ��: If the signature on your identity document is different from the current one, then you must also complete a signature change certificate form.

If you are not in possession of a recent tax notice, then you must provide a second proof of identity and proof of domicile.

For faster subscription, we advise you to bring together the supporting documents Before starting the account opening procedure.

3 interesting alternatives to the pro fortneo account

As we have seen, you can open a personal account to manage the finances of your professional activity. Nevertheless at Fortuneo, it is an individual personal account so the services adapted to professionals are limited ⚠️.

If you want to open A account dedicated to auto-entrepreneurs, You will be able to access banking services and products more suited to your needs as a professional: more important overdraft authorization, an advisor specializing in professional banking issues, the possibility of obtaining a payment terminal to collect your customers, export your bank data to integrate it into accounting software, etc.

To help you Find an alternative to the pro fortneo account, Here are three banks offering accounts dedicated to self -employed workers: Boursorama Pro, Qonto and Shine.

1- qonto

Qonto is a French neobank addressing self-employed entrepreneurs and companies. Among its bank account offers, we find The solo formula, adapted to self -employed and freelance workers from € 9 per month. You have the choice between three bank cards in the Mastercard network, it will determine your monthly subscription: Solo One at € 9 / month, solo plus at € 15 / month, solo x at € 29 per month.

The Qonto account for self-employed entrepreneurs provides access to various services: your money and money expenses are classified by category which will allow you to better manage your accounting, You can collect in check by sending it to the neobank by post, you can cancel a transfer if the sum and / or the indicated beneficiary includes an error and the VAT is directly included when you scan your payment proofs.

In addition, you have access to an intuitive and ergonomic application from which you can consult the balance of your pro account updated in real time, carry out your current operations and more broadly manage the budget of your professional life.

So that you can access your account statements under five years, Qonto sends you a monthly alert by email To invite you to download them.

Opening a professional account at Qonto is easy and quick, as you can subscribe in less than ten minutes from home. ⌛

2- Boursorama pro

Among the alternatives to Fortuneo Pro, we find the account for professionals offered by Boursorama. For € 9 / month, you can get a bank card from the Visa network (Visa Classic or Visa Premier) and a bank account adapted to individual entrepreneurs and self-entrepreneurs. For the collection of your customers, you have several options: check, bank transfer and payment terminal for bank cards (billed € 19 excluding tax + commission on transactions).

If you need to deposit species following your customers’ payments, then we advise you to turn to a traditional bank. You can also emit checks and transfers ��.

If you feel the need, you can apply for an authorized overdraft maximum € 2500 if you meet the conditions required by online banking. The only costs linked to the authorized overdraft are agios, because Boursorama Pro applies no higher and / or movement commission.

By choosing to open an account for auto-entrepreneur and individual entrepreneur at Boursorama, you can benefit following insurance and guarantees ::

- means of payment insurance for professionals (compensation in the event of fraudulent operations) ✔️

- Guarantee in the event of flight or breakage of your mobile phone / professional computer ✔️

- Compensation for locks, keys and wallets ✔️

You can open a Boursorama Pro account from home with 100% online subscription.

3- Shine

Shine is a mobile bank for both self -employed and businesses. You have the choice between two formulas according to your budget and your needs.

At first the Standard formula at € 3.90 / month excluding tax which gives you access to a Mastercard Business bank card, A French banking identity statement, around twenty transfers and levy included, a tool to invoice, the possibility of consulting all of your transactions and an automatic calculation of your charges.

Then, Shine offers you a premium formula at € 14.90 / month Excluding tax including a bank account at the French banking identity statement, the possibility of depositing a check, a Mastercard Buisness World Elite bank card, various insurance and guarantees and the services included of the standard formula.

In addition, you can export data from your professional current account to integrate them into accounting software, Access invoice models that you will simply have to complete with your billing information ��.

Pro fortneo account-can we subscribe, and how ?

With the obligation for self-employed entrepreneurs to have a bank account dedicated to their activity, many French people are looking for a cheap pro account. To do this, the best solution is to turn to online banks, and open a pro fortneo account, a pro hello bank account or ing direct.

Is it possible to take out a pro fortneo account ?

No dedicated pro fortneo account yet

Unfortunately, There is no pro fortneo account yet as such. Currently, Fortuneo only offers its customers. Companies (Sasu, SARL, SCI, SA …) will therefore not be able to open a Fortuneo account.

Here are the services that the online bank currently offers:

- Individual bank account

- Fortuneo joint account

- Mastercard, Gold Mastercard and World Elite Mastercard bank card (all free on income condition)

- Savings solutions (life insurance, booklets, scholarships, etc.)

- Mortgage

In addition, the offer of fortuneo is almost completely free. Only a few services, such as operations abroad, are paid.

However, if there is no pro fortneo account, is it not possible for certain legal status, such as self-employed people, to open a simple bank account ?

Subscribe an individual bank account instead of a pro account ?

Self-employed entrepreneurs have different legal status from other companies. In order to take into account this specificity, the law stipulates that, if they must have a bank account dedicated to their activity, this bank account should not Not necessarily be a professional bank account.

This means that micro-entrepreneurs can therefore open an individual bank account. They just have to own two: an account dedicated to their personal expenses, and another to their professional expenses.

Theoretically, a customer can therefore use an individual account as a pro fortneo account. It is enough for him to Subscribe as a usual customer. The advantage of fortuneo being that this bank account is free.

First problem However: Fortuneo requires income conditions or savings. We are talking about the customer’s income, and not the company. However, if the activity is recent, income is not necessarily very high … The conditions are as follows:

- MasterCard : € 1,200 income or € 5,000 in savings

- Gold Mastercard : € 1,800 in income or € 10,000 in savings

- World Elite : € 4,000 in income, domiciled at Fortuneo, or € 40,000 savings

Second problem : online banks generally refuse that an auto-entrepreneur opens an individual account for his activity. And as a bank can refuse the opening of an account without having to justify itself, things are complicated. At this rate, therefore difficult to obtain a pro fortneo account ..

The solution to obtain a pro fortneo account would be to open an individual account without reporting the use that is made of it, but if the online bank later realizes the “deception”, it will then be able to close the bank account.

Pro Fortuneo account: alternatives

Fortunately, there are alternatives to the pro fortneo account. Some online banks have set up Specific offers For self-employed. Fintechs have also launched on the market, such as Qonto, and have specialized in the development of professional bank accounts.

Fortuneo

Online banks have revolutionized the banking sector. Among these actors, there are Fortuneo with its hundreds of thousands of customers. It stands out from its competitors by offering high -end offers, but accessible. Enticing, isn’t it ? If you are interested in opening a bank account at Fortuneo, it is imperative that you know more about this dematerialized bank. Immediately the details.

Compare banks online

Fortuneo: online bank saving its customers

If you didn’t know yet, know that Fortuneo Banque is a subsidiary of the Crédit Mutuel Arkéa group. Its launch dates back to the year 2000 and it has been able to make its place among giants like Boursorama Banque and ING Direct. It goes without saying that Fortuneo enjoys a rather solid reputation. To retain its customers, it relies on its range of services which is very rich and its most competitive prices. It is therefore not surprising that this online bank has more than 600,000 customers across Europe.

THE Fortuneo clients do not appreciate that the inexpensive prices. They also like:

- Welcome bonuses (variable amount)

- The sponsorship system

- The efficiency of customer service (note, however, that some customers regret a lack of responsiveness from this support)

- Online brokerage service

- The simplicity of use of the website and the dedicated application

- Ease to carry out current procedures and operations

- A wide choice of banking products (savings, scholarships, life insurance and mortgage)

The Fortuneo current account in detail

The Fortuneo account is reserved for individuals. Current operations are free and there is an absence of current account management fees. Bank cards, whether high -end or not, are also free. Which represents a source of significant savings. Fortuneo still applies certain peripheral rates. These concern:

- Withdrawals and payments outside the European Union billed at 1.98 % of the amount of the operation

- Outgoing transfers outside the euro zone at 12 €

- Returning transfers outside the euro zone for a minimum of € 23 at a price of 0.1 %

- Discovered authorized 7 % and 16 % for unauthorized overdrafts

- Rejections of a levy and a transfer to € 20 each

- Exchange costs estimated at 0.5 % for each cards

With such prices, Fortuneo actually stands out among the cheapest banks alongside Boursorama and ING Direct. The latter also offering common operations free of charge. On the other hand, the difference is observed in terms of premium offers (bank card) where Fortuneo is cheaper than its competitors. In addition, Fortuneo gives its customers the possibility to place checks on their account by post. The discount slips are simply and quickly ordered from its customer area.

The different bank cards offered by this online bank

Many see fortuneo bank cards as one of his main strengths. Indeed, The online bank offers a wide range of cards : the Fosfo Mastercard, the Gold Mastercard and the World Elite Card.

The Fosfo Mastercard of Fortuneo

With This bank card which has a pricing of 0 € per month, You can take advantage of many free services, including:

- Payment and withdrawal in Euro

- International payments

- Withdrawals made worldwide

- Virtual cards

The Fosfo Mastercard of Fortuneo is obtained without income condition. On the other hand, if it is not used at least once for a month, it will be billed to you at € 3.

The Gold Mastercard

This Fortuneo high -end card offers the same free services as the Fosfo card with other premium advantages. These are assistance and insurance guarantees for leisure and trips as well as high payment withdrawal ceilings.

To obtain the Gold Mastercard, which is free, you must be able to justify € 1,800 in net income or have € 10,000 in savings at Fortuneo. On the other hand, if you do not use this card for a month, the digital bank will invoice it at € 5.

The World Elite Mastercard

There World Elite Mastercard is free and makes free of the same services benefit as the Gold version with in addition:

- A concierge service available 24 hours a day

- Quality services in France and abroad

The condition for enjoying the World Elite of Fortuneo ? Justify € 4,000 in net income. Like her sisters, she also has a condition of use. This consists in paying the sum of € 4,000 to its account. Otherwise, a billing of € 50 per quarter is to be expected.

The Fortuneo application

The dedicated Fortuneo application is accessible on iPhone, iPad and Android. It is not only efficient, but also easy to use. Better yet, the Fortuneo application allows you to manage your account in real time at any time and anywhere.

In addition, all current operations can be carried out directly from the application:

- Transfers

- Payments

- Purchase and sale of stock market values

- Use of the bank card abroad

- Modification of ceilings

Obtaining virtual payment card has also been done since the application. This type of card is an undeniable security guarantee for your online purchases.

Customer service made up of finance professionals

Fortuneo customer service is actually provided by finance professionals. Thus, you are sure to benefit from effective support. This team is based in France, more precisely in Paris and Brest. Customer service can be reached from Monday to Friday from 9 a.m. to 5.30 p.m.

In addition to being available by phone, customer service is also by email and mail. Currently, we can deplore that the Fortuneo application does not have a cat service.

Real estate loans

Fortuneo not only offers all the services of a virtual bank, but also offers and services perfectly suited to the needs of the customer. Among his services, there is the mortgage loan. One of the main advantages of this type of loan is that all of the bank customers can access it, without having to pay their salary to Fortuneo, unlike other banks. Zoom on the mortgage of one of the most used online banks in France.

Fortuneo mortgage: financial assistance for real estate acquisition

This unique loan offer offered by Fortuneo is accessible to those who finance the purchase of a residence in France. It concerns all types of accommodation: house or apartment in the old with work, new (excluding construction) including VEFA, credit repurchase, lies with possible work.

Fortuneo offers its customers a loan of € 80,000 to € 1,000,000 to TAEG fixed for a period of 7 to 25 years for the purchase of a main or secondary residence and 7 to 20 years for a rental investment. All file processing is free and there are no additional costs for reimbursement, unless there is a special agreement to renegotiate debt with another bank. In addition, you can freely choose the moment of the start of withdrawal of your money. You can also modify the date for free.

How to get a mortgage on Fortuneo ?

Subscribing a loan on Fortuneo is simple. In addition, you will not need to move, because all the steps are taken online. To do this, you must submit a loan request to the Fortuneo site by completing all the compulsory fields in the dedicated form such as the amount of money you want to borrow, your monthly income, the fact that you still have to money to another bank or someone else … These answers must be accompanied by evidence.

Once the information required in the form is met and all the requirements of the bank is met, you can get a loan agreement.

Conditions to benefit from a Fortuneo loan

To benefit from fortuneo mortgage services, some conditions must be met.

- You are a natural person, salaried or exercising a liberal profession, residing in France in France.

- Have at least 10 % of the amount you want to borrow, except in the case of a credit repurchase or a rental investment.

- Real estate is for private use and in full ownership or for rental use outside tax exemption.

- You must open a Fortuneo bank account, but it is not compulsory to pay your salary on this account. In addition, know that Fortuneo does not charge a penny for the creation of an account if it is used to repay the debt.

Once Fortuneo has received all the identification information that you have transmitted, it will process your request directly and send it to the services related to the loan within 30 days. You have 10 days to carefully examine your file before the final signing of contractual documents. After that, you will only have to wait for the final decision, but you can always follow the evolution of your request on the Fortuneo site or by e-mail.

Savings booklets

Available and secure savings, this is what Fortuneo promises. Thus, 4 types of booklets are currently offered by this bank: the booklet +, the booklet + child, the booklet A and the LDD booklet. Immediately the details.

The booklet +

This savings book is accessible to all people over the age of 18, whether or not they hold a Fortuneo account. In addition, it can be opened in the form of a joint booklet. However, a person can only have a single booklet +, regardless of the type of booklet + chosen (joint or individual).

THE main advantage of this savings solution, it is that it represents no risk of loss of capital. In addition, its rate is very attractive, because even if the remuneration is 0.3 %, it allows you to benefit from a welcome offer of 2 % gross during the first 4 months.

Note that only cumulative interests are subject to social security contributions and income tax (IR).

The Booklet + Children

So that everyone can take advantage of the fortuneo service, it offers a variation of the booklet + intended specially for children of its customers. It then belongs to the legal representative or the parent to open it from his customer account, the initial payment being limited to € 10. The real advantage of this booklet is its rate of remuneration of 1 %, which is really very attractive compared to the adult booklet. However, unlike the Ceiling of the Booklet + which can climb up to 10 million euros, the bank limited the payment ceiling to € 10,000.

The booklet A

You would like your money to be safe, but that it is available at any time ? Opening a book A with Fortuneo Bank is therefore the best solution. With this savings solution, you can pay and withdraw money when you wish. In addition, theopening of your booklet A is completely free And there is no management fees.

With this placement, you will also benefit from a rate of 0.75 % net. In addition, interests are not taxable in taxes and social security contributions. Regarding the maximum payment ceiling, it is limited to € 22,950. Namely that all natural persons residing on French territory can open this type of booklet.

The Sustainable Development Booklet or LDD

Mainly used to finance SMEs and energy savings in ancient buildings, the LDD booklet is an essential complement to the booklet A. State regulated, it is risk -free savings. Its remuneration rate is set at 0.75 % net and the placement ceiling at € 12,000.

To open this booklet, you must fulfill the following conditions:

- To be a French natural person and resident;

- Have a bank account, a + booklet or a cash account at Fortuneo;

- Collect personal income;

- Not holding another LDD in another banking establishment.

Life insurance

Want to diversify your investments to make your savings grow ? Fortuneo Life, the Fortuneo online bank insurance contract promises you an attractive return. Moreover, this contract has been rewarded several times by a professional jury for the attractive and regular yields of its funds in euros.

What is Fortuneo Life ?

It is a multi-support group life insurance contract managed by Suravenir, a subsidiary of life insurance and provident of Crédit Mutuel Arkea. Just this year 2020, this contract was rewarded by 4 awards:

- Life Insurance Grand Prix in the Multisupporting Contract Category.

- Mention in the Grand Prix of Funds in euros.

- 2020 gold trophy in the “Internet contracts” category.

- Oscar for the best Internet life insurance contract.

To take out a Fortuneo Life contract, you must hold a bank account with online banking.

Fortuneo life insurance

The online bank, a subsidiary of Crédit Mutuel Arkea offers two types of life insurance:

- Euros funds.

- Units of accounts (UC).

Euros funds

Fortuneo offers two funds in euros:

- Abandonment

- Opportunities: a real estate orientation fund.

Payment on these funds in euros has been subject to condition since December 3, 2019. Among other things, your payments on the fund in euros in an efficiency must include 30 % of supports in units of account in capital. To overcome opportunities, payments must include 50 % unit supports.

Consequent units of account

Fortune gives you access to more than 200 media supports including 9 ETF/Trackers, 3 SCPI, 2 OPCI and 1 SCI selected from the most prestigious management companies.

Fortuneo life insurance benefits

- Free and 100 % online subscription.

- 150 € offered for any first membership with an initial payment of € 3,500 minimum. Nevertheless, it is possible to take out a Fortuneo Life contract from € 100 and € 1,000 with mandate management.

- Very competitive costs: 0.60 % of annual management fees for funds in guaranteed capital – whatever the management method (free or under mandate). And 0.75 % for unit unit in free management,

- 0.85 % if you choose mandate management.

- 0 € entry and exit costs.

- The payments (excluding costs specific to the SCPI, SCI, OPCI, and ETF) and the arbitrations on demand passed from the Fortuneo site are free. On the other hand, automatic arbitrations are invoiced at 28 euros lump sum. In addition, additional transaction costs of 0.1 % of the course are charged on trackers.

- Attractive yields: 1.60 % in 2019 to make an appointment and 2.40 % to be upcoming opportunities.

- Two management methods: Free management with 4 automatic arbitration options (revitalization of capital gains, progressive investment, arbitration on evolutionary threshold alert, arbitration with trigger threshold) and mandate management with 3 different profiles: moderate (federal finance Management), balanced (DNCA Investments) and dynamic (Allianz Global Investors).

- Support by advisers throughout the life of your contract.

The online scholarship

Whether you are an amateur or confirmed investor, a natural person or a legal person, Fortuneo offers you their online scholarship solution to make your savings grow.

The scholarship according to Fortuneo

To expand online, the online bank of Crédit Mutuel Arkea offers its online scholarship solution from 2000. Today, she is one of the leaders in this market. It must be said that its offer is very attractive:

- A 100 % online opening

- 0 € of duty and account holding.

- Lower brokerage fees.

- Free real -time trading tools: streaming, technical analysis, fast order passage.

- 100 orders offered for a first opening.

- 100 % of the transfer fees reimbursed up to a limit of € 2,000.

- 4 brokerage rates to choose from.

- Three types of scholarship accounts: PEA, PEA-PME and ordinary securities account.

- A wide range of financial instruments: stocks, bonds, subscription vouchers, OPC shares, alternative investment products, SRD, Warrants, Turbos, Certificates, etc.

- Several investment opportunities: SICAV and funds with more than 9,000 funds.

- A management method of your choice: free management or mandate management.

- Decision assistance tools: Live Trader (to view your portfolio, your orders and your value lists in real time), intelligent orders (to control your own investment strategies), standard portfolios (to help you in your Investment decisions), streaming course (to follow in real time the value of your favorite values), Thescreener analysis (to find out the risks and interests of more than 250 values and indices) and notifications on mobile (to follow the courses of the stock market in real time.

Fortuneo brokerage rates

As we said above, Fortuneo offers 4 prices:

Optimum

For any order less than € 500, the price is € 1.95. Between € 500 and € 2,000, this will cost you € 3.90. Beyond, it is 0.20 % of the amount of the order that will be billed to you.

The optimum rate is accessible without minimum outstanding or transactions.

Active trader

Each order less than or equal to € 10,000 is billed € 9.50. Beyond this amount, the price will be 0.12 at the value of the order.

For this offer, you must make at least 30 transactions per month or have made at least 90 transactions in the last 3 months.

Trader 100 orders

For an order less than or equal to € 100,000, you are billed at € 6.50. Beyond, you pay 1.10 % of the amount.

100 transactions per month at least or 300 transactions in the last 3 months are required.

0 brokerage

You benefit from 0 € for the first two orders less than or equal to € 10,000 issued in a month. From the 3rd order, € 20 is billed on each order of a value of up to € 10,000. Beyond, you are billed at 0.20 % of the value of the order.

A minimum of € 50,000 in outstanding is required. This price is therefore intended for large investors.

This price is not valid for the PEA and the PEA-PME.

Payment methods

Fortuneo provides its customers with various means of payment to pay for their online purchases or with traders in both France and abroad. The details

The credit card

The 4 fortuneo bank cards allow you to pay for free purchases in France and abroad unlimited.

To make your life easier and secure your operations, bank cards are equipped with contactless payment allowing you to pay your purchases while protecting your bank data thanks to a unique code.

Mobile payment

Paying with your smartphone via Apple Pay, Google Pay or Samsung Pay is a payment solution offered by the Mobile Bank of Crédit Mutuel Arkéa. Mobile payment allows you to directly pay your shopping in stores or on the Internet in a confidential manner. Indeed, the data of your cards is not stored on your device, and is not shared either at the time of payment.

To take advantage of this feature, you just need to save your card data on your Google account. So you no longer need to type your secret code, nor take out your card. In addition, you can also keep your loyalty cards; your plane tickets … on your smartphone.

In addition, with Samsung Pay, you earn points on each payment and can exchange them for coupons, vouchers, gift cards in your favorite stores.

Fortuneo also offers payments via your connected watch for more security and confidentiality. A specific transaction code and card number are used at the time of payment. This type of payment is compatible with Fitbit, Garmin Pay, Samsung Pay (Galaxy Watch and Gear) and Google Pay.

Payment by check

To satisfy its customers, the online bank offers payments by check, generally remained the prerogative of traditional banks. This type of payment is privileged for purchases whose amounts are very high: purchase of a house or a vehicle, acquisition of a work of art, etc.

To pay your purchases by check on Fortuneo, the process is as follows:

- Connect to your customer area.

- Select the account concerned.

- Inform information on the check: amount, beneficiary, order and send address.

- Select the sending mode: simple, free or recommended.

- Enter the single -use security code to validate your request.

You will receive a confirmation email, and the seller will receive the check by post.

The transfers

Fortuneo also offers transfers to pay your purchases safely. These are capped at 6,000 euros per operation, up to a limit of 10,000 euros per day and per week. In addition, you can do 5 operations per day and 20 operations per Ois.

To make a transfer from your Fortuneo account to an external account:

- Connect to your customer area.

- Click on “Virements”.

- Comfort the information requested: account to debit and credit, amount of the operation, type of transfer.

If you make a programmed punctual transfer, you must mention the date on which you want the transfer to be made as well as the label of the operation.

Withdrawals

To order the samples, you must simply send a request to Fortuneo.

How to open a bank account ?

Take advantage of an account opening 100 % online or by mail with Fortuneo and benefit from an advantageous offer adapted to your needs. Find all the steps in the lines that follow.

Fortuneo bank account: for whom ?

To be able to open a bank account at the online bank, You must meet certain conditions ::

- Be a major natural person.

- Reside tax in France.

- Have a bank account opened with a French establishment.

In addition, you must also answer on income conditions ::

- € 1,800 net income or € 10,000 in savings for the GOLD CB MasterCard card.

- € 4,000 in income domiciled at Fortuneo for the World Elite CB Mastercard.

Open a Fortuneo step by step

L’Online account opening On Fortuneo is very simple:

- Go to the online bank website and click on “Open an online account”.

- Complete the bank account opening request

- Choose the account type: individual account or joint account.

- Request the creation of a subscription file by entering your personal information (civility, name and first names, date of birth, mobile phone number, email address, country and postal code).

- Inform information relating to your income for the request for a bank card.

- Choose the bank card.

- Opt for the means of payment of the online bank.

If you have chose the account opening by mail ::

- Print the request for a bank account opening and fill it out.

- Bring together the requested supporting documents.

- Send the paper folder to the following address:

Fortuneo – Customer Service

Free answer 26157

29 809 Cedex 09

As soon as your account is actually open, you receive your identifier by email and 4 -digit code by mail. This information allows you to access your customer area. You will also receive your bank card and its code by separate letters.

List of necessary supporting documents

The supporting documents requested by the online bank are almost the same as those requested by all banking establishments. You will therefore have to have no trouble bringing them together. More generally, you will have to send:

- A Proof ofIdentity: this can be an identity card, a passport, etc.

- Proof of domicile valid of less than three months; A rental contract, the housing tax of your main residence, the tax notice of the current year, an electricity, gas bill, insurance certificate, etc.

- A Rib issued by a French banking establishment in your name.

- A proof of income: your last two salary slips, the last tax notice, a student card with a schooling certificate, etc.

- THE scan of your signature on white paper.

- A deposit check if the opening account is made by post.

To accelerate the opening procedure, remember to bring these supporting documents together before starting any approach.

How to contact Customer Service ?

You are not Fortuneo customer and you wish to have more information on their services, or you have a Fortuneo account and you want to contact its customer service as soon as possible ? Discover all the contact points of this online bank, whatever your situation.

Numbers to reach Fortuneo customer service

The Fortuneo online bank is a French institution which is renowned for the diversity of its banking services, its wide range of products and especially its very reactive customer service. If you are a fortuneo client, simply call the number 08 00 80 00 40 to contact customer service. The call is free if you call from France. In addition, the bank can be reached Monday to Friday between 9 a.m. to 8 p.m., and Saturday from 9 a.m. to 1:30 p.m. On the other hand, if you call from a foreign country, you can contact the number + 33 2 29 00 49 17 directly, the call cost varies depending on your operator.

In addition, if you have already opened an account at Fortuneo, here are the numbers to call according to your request:

- For information concerning the current account, savings booklets, life insurance and stock market products, call 02 98 00 29 00 directly;

- To request information on car insurance, you can contact customer service on number 09 70 80 94 25;

- For services concerning heritage expertise, make up the number 08 11 135 135.

The website and email

As online banking, Fortuneo has set up an available and responsive customer service that you can contact directly via its website. This service can be reached 7 days a week and 24 hours a day. Its objective is to support you and answer all your questions concerning the services of the bank. If necessary, the customer advisor can also put you in touch with the service adapted to your requests, for those which are specific.

You are already a bank customer, you can reach customer service from your personalized space. You will be redirected to a contact form and it is on the latter that you will make your request. In addition, you can also contact Fortuneo via social networks like Facebook, Twitter and Google Plus. To do this, you will only have to click on the “Contact us” tab in your customer area, more precisely at the top and right of your screen.

In addition, you should know that the bank does not yet offer a chat on its site. So, if you are not a fortune customer and you wish to contact customer service by email, you would have to fill out the contact form.

To be closer to its customers, the bank also offers a mobile application. The latter is compatible with iOS and Android systems and it can be downloaded for free. On this application, you can consult the operations carried out on your account in real time and it also allows you to contact the bank advisor directly.

Sending postal mail

If you want to send packages or letters to the bank, you can always choose the post. To do this, send them to the following address:

Fortuneo Bank

380 rue Antoine de St Exupéry

29490 Guipavas