Ecological penalty 2023: The scale of the CO2 tax – Legipermis, Bonus -Malus Ecologique: All about the scale 2023 | Mary Automobiles

All about the 2023 scale of the bonus-malus

Devices are in place to reduce this penalty of weight for large families. The mass in walking order of the vehicle is indicated in box G of the gray card.

Ecological penalty 2023: The scale of the CO2 tax

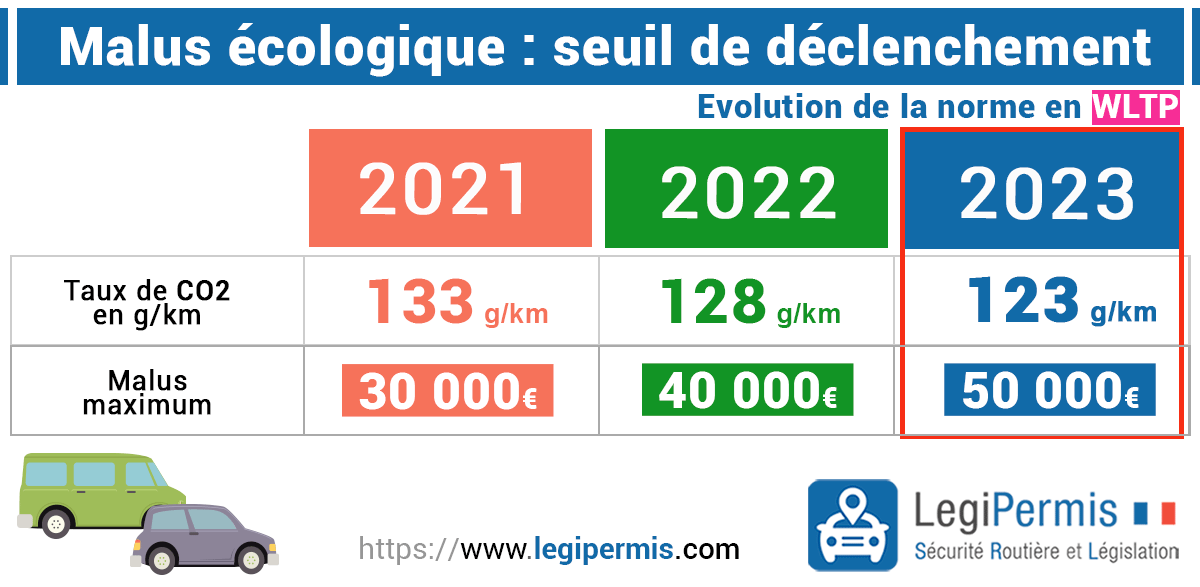

The ecological penalty is a tax to pay at the first registration of a new car according to its CO2 emissions. In 2023, the maximum penalus for emissions superior to 226 g/km is of € 50,000 limited to 50% of the cost of the vehicle. The trigger limit of the penalty is 123 g/km with a minimum penalty 50 €.

There is no more ecological penalty on a used car, nor annual tax on very polluting vehicles.

Note that in addition to the penalty system, there is an ecological bonus for the purchase of a new electric vehicle. Its amount can go up to € 7,000 in 2023. The ecological bonus system makes it possible to encourage French to reduce pollution in the context of ecological transition.

Ecological malus simulator 2023

Malus simulation 2023

Select the vehicle CO2 emission (WLTP):

Malus amount for a car registered in 2023: 0 €

If you prefer you can see the whole full grid of the 2023 penalty.

Ecological penalty scale 2023

Complete table of the Ecological Malus 2023

| Grille du scale 2023 CO2 emission in G/km (WLTP) | Amount of the premium (in €) |

|---|---|

| Less than 123 g/km | 0 € |

| 123 g/km | 50 € |

| 124 g/km | 75 € |

| 125 g/km | 100 € |

| 126 g/km | 125 € |

| 127 g/km | 150 € |

| 128 g/km | 170 € |

| 129 g/km | 190 € |

| 130 g/km | 210 € |

| 131 g/km | 230 € |

| 132 g/km | 240 € |

| 133 g/km | 260 € |

| 134 g/km | 280 € |

| 135 g/km | 310 € |

| 136 g/km | 330 € |

| 137 g/km | 360 € |

| 138 g/km | 400 € |

| 139 g/km | 450 € |

| 140 g/km | 540 € |

| 141 g/km | 650 € |

| 142 g/km | 740 € |

| 143 g/km | 818 € |

| 144 g/km | 898 € |

| 145 g/km | 983 € |

| 146 g/km | € 1,074 |

| 147 g/km | € 1,172 |

| 148 g/km | € 1,276 |

| 149 g/km | € 1,386 |

| 150 g/km | € 1,504 |

| 151 g/km | € 1,629 |

| 152 g/km | € 1,761 |

| 153 g/km | € 1,901 |

| 154 g/km | 2,049 € |

| 155 g/km | € 2,205 |

| 156 g/km | € 2,370 |

| 157 g/km | € 2,544 |

| 158 g/km | 2,726 € |

| 159 g/km | € 2,918 |

| 160 g/km | 3,119 € |

| 161 g/km | € 3,331 |

| 162 g/km | € 3,552 |

| 163 g/km | € 3,784 |

| 164 g/km | € 4,026 |

| 165 g/km | 4,279 € |

| 166 g/km | 4,543 € |

| 167 g/km | € 4,818 |

| 168 g/km | € 5,105 |

| 169 g/km | € 5,404 |

| 170 g/km | € 5,715 |

| 171 g/km | € 6,039 |

| 172 g/km | € 6,375 |

| 173 g/km | € 6,724 |

| 174 g/km | 7,086 € |

| 175 g/km | 7,462 € |

| 176 g/km | 7,851 € |

| 177 g/km | 8,254 € |

| 178 g/km | € 8,671 |

| 179 g/km | € 9,103 |

| 180 g/km | 9,550 € |

| 181 g/km | 10,011 € |

| 182 g/km | 10,488 € |

| 183 g/km | € 10,980 |

| 184 g/km | 11,488 € |

| 185 g/km | 12,012 € |

| 186 g/km | € 12,552 |

| 187 g/km | 13,109 € |

| 188 g/km | € 13,682 |

| 189 g/km | 14,273 € |

| 190 g/km | 14,881 € |

| 191 g/km | € 15,506 € |

| 192 g/km | 16,149 € |

| 193 g/km | 16,810 € |

| 194 g/km | 17,490 € |

| 195 g/km | 18 188 € |

| 196 g/km | € 18,905 |

| 197 g/km | € 19,641 |

| 198 g/km | 20,396 € |

| 199 g/km | 21,171 € |

| 200 g/km | € 21,966 |

| 201 g/km | € 22,781 |

| 202 g/km | 23,616 € |

| 203 g/km | € 24,472 |

| 204 g/km | 25,349 € |

| 205 g/km | € 26,247 |

| 206 g/km | 27,166 € |

| 207 g/km | 28,107 € |

| 208 g/km | € 29,070 |

| 209 g/km | 30,056 € |

| 210 g/km | 31,063 € |

| 211 g/km | 32,094 € |

| 212 g/km | 33,147 € |

| 213 g/km | 34,224 € |

| 214 g/km | € 35,324 € |

| 215 g/km | € 36,447 |

| 216 g/km | € 37,595 |

| 217 g/km | € 38,767 |

| 218 g/km | € 39,964 |

| 219 g/km | 41,185 € |

| 220 g/km | € 42,431 |

| 221 g/km | € 43,703 |

| 222 g/km | € 45,000 |

| 223 g/km | € 46,323 |

| 224 g/km | € 47,672 |

| 225 g/km | 49,047 € |

| Rejections greater than 225 g/km | € 50,000 |

Source: Article L421-62 of the Code of Taxes on goods and services .

This ecotax or carbon tax cannot exceed 50% of the purchase price including tax of the vehicle.

Who pays the ecological penalty ?

The vehicles concerned by the ecological penalty are as follows:

- M1 category car : TRADIES (VP) designed for transporting people and which can accommodate a maximum of 8 passengers (in addition to the driver). The registration certificate of this type of vehicle is indicated by the genus “VP”;

- N1 category vehicle : light utility vehicles of less than 3.5 tonnes designed and built for the transport of goods with at least 5 seats. The registration certificate of this type of vehicle is indicated by the genus “CTTTE”. This vehicle should not be assigned to the exploitation of ski lifts and ski areas.

- N1 Multiple Use vehicle : light utility vehicles of less than 3.5 tonnes designed and built for the transport of goods. It is ctte on the gray card. This vehicle is intended for the transport of travelers, their luggage or their goods and must have at least 2 rows of seats.

Vehicles exempt from the ecological penalty

- Vehicles accessible in wheelchair, or acquired by a person with an inclusion mobility card with the invalidity or a military disability card, or by a person with a minor child or dependent in their tax household who has an inclusion mobility card (CMI) bearing The invalidity or a military disability card without an ecological penalty. This exemption can only concern one vehicle per beneficiary and also applies in the event of a long -term rental formula. A copy of the invalidity card must be attached to the request for a registration certificate (gray card);

- Electric vehicles are not subject to the tax on CO2 emissions;

- Rechargeable hybrid vehicles With an autonomy in all electric mode in town greater than 50 km is not subject to the CO2 penalty;

Former Malus scale 2022

| 2022 scale CO2 emission in G/km (WLTP) | Tariff 2022 |

|---|---|

| < 128 | 0 € |

| 128 | 50 € |

| 129 | 75 € |

| 130 | 100 € |

| 131 | 125 € |

| 132 | 150 € |

| 133 | 170 € |

| 134 | 190 € |

| 135 | 210 € |

| 136 | 230 € |

| 137 | 240 € |

| 138 | 260 € |

| 139 | 280 € |

| 140 | 310 € |

| 141 | 330 € |

| 142 | 360 € |

| 143 | 400 € |

| 144 | 450 € |

| 145 | 540 € |

| 146 | 650 € |

| 147 | 740 € |

| 148 | 818 € |

| 150 | 983 € |

| 151 | € 1,074 |

| 152 | € 1,172 |

| 153 | € 1,276 |

| 154 | € 1,386 |

| 155 | € 1,504 |

| 156 | € 1,629 |

| 157 | € 1,761 |

| 158 | € 1,901 |

| 159 | 2,049 € |

| 160 | € 2,205 |

| 161 | € 2,370 |

| 162 | € 2,544 |

| 163 | 2,726 € |

| 164 | € 2,918 |

| 165 | 3,119 € |

| 166 | € 3,331 |

| 167 | € 3,552 |

| 168 | € 3,784 |

| 169 | € 4,026 |

| 170 | 4,279 € |

| 171 | 4,543 € |

| 172 | € 4,818 |

| 173 | € 5,105 |

| 174 | € 5,404 |

| 175 | € 5,715 |

| 176 | € 6,039 |

| 177 | € 6,375 |

| 178 | € 6,724 |

| 179 | 7,086 € |

| 180 | 7,462 € |

| 181 | 7,851 € |

| 182 | 8,254 € |

| 183 | € 8,671 |

| 184 | € 9,103 |

| 185 | 9,550 € |

| 186 | 10,011 € |

| 187 | 10,488 € |

| 188 | € 10,980 |

| 189 | 11,488 € |

| 190 | 12,012 € |

| 191 | € 12,552 |

| 192 | 13,109 € |

| 193 | € 13,682 |

| 194 | 14,273 € |

| 195 | 14,881 € |

| 196 | € 15,506 € |

| 197 | 16,149 € |

| 198 | 16,810 € |

| 199 | 17,490 € |

| 200 | 18 188 € |

| 201 | € 18,905 |

| 202 | € 19,641 |

| 203 | 20,396 € |

| 204 | 21,171 € |

| 205 | € 21,966 |

| 206 | € 22,781 |

| 207 | 23,616 € |

| 208 | € 24,472 |

| 209 | 25,349 € |

| 210 | € 26,247 |

| 211 | 27,166 € |

| 212 | 28,107 € |

| 213 | € 29,070 |

| 214 | 30,056 € |

| 215 | 31,063 € |

| 216 | 32,094 € |

| 217 | 33,147 € |

| 218 | 34,224 € |

| 219 | € 35,324 € |

| 220 | € 36,447 |

| 221 | € 37,595 |

| 222 | € 38,767 |

| 223 | € 39,964 |

| ≥ 224 | € 40,000 |

LEGI allowed .com also provides you with a list of cars with the corresponding 2020 penalty.

Auto penalties

The Government has noted the implementation of an auto penalties for vehicles whose date of first registration is from 2022. There Mass tax in walking order (TMOM) concerns new vehicles weighing more than 1.8 tonnes. Its amount is 10 € per kg above of this limit of 1800 kg.

The total of the ecological penalty and the weight penalus will not be able to exceed the maximum penalus, that is to say 50.000 € in 2023.

Devices are in place to reduce this penalty of weight for large families. The mass in walking order of the vehicle is indicated in box G of the gray card.

What are the exceptions to the penalty ?

Received in the European Union

The ecological penalty is calculated according to the CO2 emission rate per kilometer (km) of the vehicle if it has been the subject of a community reception (European), this is the case for example for an import of Germany.

How do you pay the ecological penalty ?

The penalty (new vehicle) is paid for:

- In the dealer: in the registration fees mentioned on the invoice;

- If not in the case of a particular sale to particular: with the tax on the gray card (registration certificate) when registering on the Ants site;

The calculation of the amount of the penalty is determined at the vehicle registration date and not on the date of invoice or on the order date.

How to avoid the ecological penalty ?

There are cases where the ecological penalus is reduced or even exempt.

Numerous family reduction

Minor for large families concerns families who respect the following 3 conditions:

- 3 or more dependent children;

- Be beneficiary of family allowances (CAF);

- Buy or rent a vehicle with 5 or more seats;

If the conditions are met, the reduction is to 20g of CO2/km per dependent child in the scale. The tax is first due in its entirety then the reimbursement is then made in the form of a tax refund.

Exemption for disabled people

People with disabilities do not pay the ecological penalty, the CO2 tax or the annual tax on very polluting vehicles within the limits of a single vehicle. Are concerned precisely:

- vehicles registered bodywork handicap;

- A vehicle acquired by a person holding the Mobility Card Inclusion with the invalidity mention;

- A vehicle acquired by a person with a minor child or dependent in their tax household who holds this card;

The tax is not to be paid, it is necessary to attach the photocopy of the disability card with the registration request.

Exemption from certain vehicles

The ecological penalty and the CO2 tax do not apply to certain vehicles such as vans (CTTE) See the section on exempt vehicles.

Pay the penalty and touch the conversion bonus ?

Yes, it is possible to have the conversion bonus to change vehicles and still pay a little penalty in the context of the ecological transition. We have in 2023:

- The conversion bonus to change car against the rebuilding of an old polluting vehicle in a VHU center. This new breakage bonus allows you to renew the French car fleet, especially for the most modest households. This premium is possible for the purchase of a vehicle emitting maximum 132g/km (WLTP standard) of CO2.

- The ecological penalty is paid From 123 g/km From CO2 in 2023 (WLTP standard), it aims to combat air pollution for all households.

- Find a permitted point internship

- Frequent questions – internships

- Secure internship payment

- Legal Notice

- Contact

All about the 2023 scale of the bonus-malus

The scale of the ecological bonus-malus makes it possible to reward the least polluting vehicles and to penalize the most emitting greenhouse cars. Depending on the vehicle CO2 emission, an amount is deducted or added to the insurance price. This scale is revised every year and the changes come into force on January 1 of the following year. Here is the scale of the ecological bonus-malus for the year 2023.

The ecological penalty, what is ?

The ecological penalty is a tax on the most polluting vehicles. It is calculated according to the amount of CO2 issued by the vehicle. The most polluting vehicles pay the ecological penalus, which is deducted from the ecological bonus to which they are entitled. It is a tax which is due during the first registration of the vehicle, to encourage buyers to turn to less polluting cars, such as electric or hybrid vehicles. The more polluting the chosen vehicle, the higher the tax is.

The scale of the ecological bonus-malus in 2023

The ecological penalty scale is a scale that determines the amount of the premium that motorists must pay according to the pollution of their vehicle. This scale is updated each year by the government and will be applicable from January 1, 2023. The ecological penalty will penalize vehicles rejecting at least 123 g/km of CO2, against 128 g/km in 2022. The maximum amount of the penalty will drop from € 40,000 to € 50,000 for cars rejecting from 226 g/km of CO2. Regarding the weight penalty for vehicles over 1,800 kg it will take 10 euros per additional kilo.

| CO² emission (g/km) | 2022 scale (in euros) | 2023 scale (in euros) |

|---|---|---|

| 123 | – | 50 |

| 124 | – | 75 |

| 125 | – | 100 |

| 126 | – | 125 |

| 127 | – | 150 |

| 128 | 50 | 170 |

| 129 | 75 | 190 |

| 130 | 100 | 210 |

| 131 | 125 | 230 |

| 132 | 150 | 240 |

| 133 | 170 | 260 |

| 134 | 190 | 280 |

| 135 | 210 | 310 |

| 136 | 230 | 330 |

| 137 | 240 | 360 |

| 138 | 260 | 400 |

| 139 | 280 | 450 |

| 140 | 310 | 540 |

| 141 | 330 | 650 |

| 142 | 360 | 740 |

| 143 | 400 | 818 |

| 144 | 450 | 898 |

| 145 | 540 | 983 |

| 146 | 650 | 1074 |

| 147 | 740 | 1172 |

| 148 | 818 | 1276 |

| 149 | 898 | 1386 |

| 150 | 983 | 1504 |

| 151 | 1074 | 1629 |

| 152 | 1172 | 1761 |

| 153 | 1276 | 1901 |

| 154 | 1386 | 2049 |

| 155 | 1504 | 2049 |

| 156 | 1629 | 2370 |

| 157 | 1761 | 2544 |

| 158 | 1901 | 2726 |

| 159 | 2049 | 2918 |

| 160 | 2205 | 3119 |

| 161 | 2370 | 3331 |

| 162 | 2544 | 3552 |

| 163 | 2726 | 3784 |

| 164 | 2918 | 4026 |

| 165 | 3119 | 4279 |

| 166 | 3331 | 4543 |

| 167 | 3552 | 4818 |

| 168 | 3784 | 5105 |

| 169 | 4026 | 5404 |

| 170 | 4279 | 5715 |

| 171 | 4543 | 6039 |

| 172 | 4818 | 6375 |

| 173 | 5105 | 6724 |

| 174 | 5404 | 7086 |

| 175 | 5715 | 7462 |

| 176 | 6039 | 7851 |

| 177 | 6375 | 8254 |

| 178 | 6724 | 8671 |

| 179 | 7086 | 9103 |

| 180 | 7462 | 9550 |

| 181 | 7851 | 10 011 |

| 182 | 8254 | 10,488 |

| 183 | 8671 | 10 980 |

| 184 | 9103 | 11,488 |

| 185 | 9550 | 12,012 |

| 186 | 10 011 | 12,552 |

| 187 | 10,488 | 13,109 |

| 188 | 10 980 | 13,682 |

| 189 | 11,488 | 14,273 |

| 190 | 12,012 | 14,881 |

| 191 | 12,552 | 15,506 |

| 192 | 13,109 | 16 149 |

| 193 | 13,682 | 16 810 |

| 194 | 14,273 | 17,490 |

| 195 | 14,881 | 18 188 |

| 196 | 15,506 | 18,905 |

| 197 | 16 149 | 19 641 |

| 198 | 16 810 | 20,396 |

| 199 | 17,490 | 21 171 |

| 200 | 18 188 | 21 966 |

| 201 | 18,905 | 22 781 |

| 202 | 19 641 | 23 616 |

| 203 | 20,396 | 24,472 |

| 204 | 21 171 | 25,349 |

| 205 | 21 966 | 26 247 |

| 206 | 22 781 | 27,166 |

| 207 | 23 616 | 28 107 |

| 208 | 24,472 | 29,070 |

| 209 | 25,349 | 30 056 |

| 210 | 29 247 | 31 063 |

| 211 | 27,166 | 32 094 |

| 212 | 28 107 | 33 147 |

| 213 | 29,070 | 34 224 |

| 214 | 30 056 | 35 324 |

| 215 | 31 063 | 36,447 |

| 216 | 32 094 | 37 595 |

| 217 | 33 147 | 38,767 |

| 218 | 34 224 | 39 964 |

| 219 | 35 324 | 41 185 |

| 220 | 36,447 | 42,431 |

| 221 | 37 595 | 43 703 |

| 222 | 38,767 | 45,000 |

| 223 | 39 964 | 46 323 |

| 224 | 40,000 | 47,672 |

| 225 | 40,000 | 49 047 |

| > 226 | 40,000 | 50,000 |

Aids for the purchase of an electric car

In 2023, aid for the purchase of an electric or hybrid car will always be present. The scale of the ecological bonus will be modified, up to € 7,000 in cumulative aid. You can also turn to the conversion bonus, which sets up up to € 5,000 in aid. Also think of local aid ! The regions and departments often offer advantageous aid, with a moving from the state of € 1,000 if you live or work in a ZFE (low -emission zone).

How the ecological bonus works ?

The ecological bonus is attributed to clean vehicles, that is to say which emit little CO2. To benefit from the bonus, you must therefore choose a car that meets the standards in force. The bonus amount depends on the type of vehicle and its power. To better understand this help, Mary Automobiles explains everything in her guide on the ecological bonus !

Go to your Mary Automobiles sales for more information, or contact us via the contact form below.

Here is the new ecological penalty scale for 2023

Here is the new hardening of environmental standards due to too polluting engines. This bonus-malus system has been created so that as many customers go to hybrid or electric.

From January 1, 2023, the bonus and the ecological penalty evolve. The first will further drop, while the second will further increase. Worse, no change is for the benefit of buyers. In terms of ecological bonuses and penalty, 2023 will not escape relatively notable updates. For example the maximum bonus will decrease while the maximum penalus will increase while its trigger threshold goes from 128 to 123 g/km of CO₂. We take stock of what awaits motorists on January 1.

Ecological bonus

Unless last minute change, as in the last two deadlines, the ecological bonus should decrease. We have a complete file on this subject.

| Vehicles | In 2022 | From January 1, 2023 |

|---|---|---|

| electrical. Below 47,000 euros | 6,000 euros or 27 % of the purchase price | 5,000 euros or 27 % of the purchase price |

| electrical. Between 47,000 and 60,000 euros | 2,000 euros | 1,000 euros |

| hydrogen at less than 60,000 euros | 2,000 euros | 1,000 euros |

| PHEV for less than 50,000 euros | 1,000 euros | – |

| electrical. Over 2 years old | 1,000 euros | 1,000 euros |

Know that Emmanuel Macron announced, during the World Cup 2022, that a new ecological bonus of 7,000 euros (instead of 6,000 euros) would be available according to home revenues. Among the discussions, he is also debated that this bonus should only be applied to electric cars made in France or Europe.

Ecological penalty

On the ecological penalty side, its trigger threshold Pass from 128 to 123 g/km of Co₂. You will also notice that The maximum penalus goes from 40,000 to 50,000 euros, Above 226 g/km of Co₂. Typically, a Porsche 911 Carrera is indicated at 245 g/km of Co₂, basic, which therefore requires 50,000 euros more, to be added to 120,000 euros.

| CO2 emissions (g/km) | 2022 scale (in euros) | 2023 scale (in euros) |

|---|---|---|

| 123 | – | 50 |

| 124 | – | 75 |

| 125 | – | 100 |

| 126 | – | 125 |

| 127 | – | 150 |

| 128 | 50 | 170 |

| 129 | 75 | 190 |

| 130 | 100 | 210 |

| 131 | 125 | 230 |

| 132 | 150 | 240 |

| 133 | 170 | 260 |

| 134 | 190 | 280 |

| 135 | 210 | 310 |

| 136 | 230 | 330 |

| 137 | 240 | 360 |

| 138 | 260 | 400 |

| 139 | 280 | 450 |

| 140 | 310 | 540 |

| 141 | 330 | 650 |

| 142 | 360 | 740 |

| 143 | 400 | 818 |

| 144 | 450 | 898 |

| 145 | 540 | 983 |

| 146 | 650 | 1,074 |

| 147 | 740 | 1,172 |

| 148 | 818 | 1,276 |

| 149 | 898 | 1,386 |

| 150 | 983 | 1,504 |

| 151 | 1,074 | 1,629 |

| 152 | 1,172 | 1,761 |

| 153 | 1,276 | 1,901 |

| 154 | 1,386 | 2,049 |

| 155 | 1,504 | 2,049 |

| 156 | 1,629 | 2,370 |

| 157 | 1,761 | 2,544 |

| 158 | 1,901 | 2,726 |

| 159 | 2,049 | 2,918 |

| 160 | 2,205 | 3 119 |

| 161 | 2,370 | 3,331 |

| 162 | 2,544 | 3,552 |

| 163 | 2,726 | 3,784 |

| 164 | 2,918 | 4 026 |

| 165 | 3 119 | 4,279 |

| 166 | 3,331 | 4,543 |

| 167 | 3,552 | 4,818 |

| 168 | 3,784 | 5 105 |

| 169 | 4 026 | 5 404 |

| 170 | 4,279 | 5,715 |

| 171 | 4,543 | 6,039 |

| 172 | 4,818 | 6,375 |

| 173 | 5 105 | 6 724 |

| 174 | 5 404 | 7,086 |

| 175 | 5,715 | 7,462 |

| 176 | 6,039 | 7,851 |

| 177 | 6,375 | 8 254 |

| 178 | 6 724 | 8,671 |

| 179 | 7,086 | 9 103 |

| 180 | 7,462 | 9,550 |

| 181 | 7,851 | 10 011 |

| 182 | 8 254 | 10,488 |

| 183 | 8,671 | 10 980 |

| 184 | 9 103 | 11,488 |

| 185 | 9,550 | 12,012 |

| 186 | 10 011 | 12,552 |

| 187 | 10,488 | 13,109 |

| 188 | 10 980 | 13,682 |

| 189 | 11,488 | 14,273 |

| 190 | 12,012 | 14,881 |

| 191 | 12,552 | 15,506 |

| 192 | 13,109 | 16 149 |

| 193 | 13,682 | 16 810 |

| 194 | 14,273 | 17,490 |

| 195 | 14,881 | 18 188 |

| 196 | 15,506 | 18,905 |

| 197 | 16 149 | 19 641 |

| 198 | 16 810 | 20,396 |

| 199 | 17,490 | 21 171 |

| 200 | 18 188 | 21 966 |

| 201 | 18,905 | 22 781 |

| 202 | 19 641 | 23 616 |

| 203 | 20,396 | 24,472 |

| 204 | 21 171 | 25,349 |

| 205 | 21 966 | 26 247 |

| 206 | 22 781 | 27,166 |

| 207 | 23 616 | 28 107 |

| 208 | 24,472 | 29,070 |

| 209 | 25,349 | 30 056 |

| 210 | 26 247 | 31 063 |

| 211 | 27,166 | 32 094 |

| 212 | 28 107 | 33 147 |

| 213 | 29,070 | 34 224 |

| 214 | 30 056 | 35 324 |

| 215 | 31 063 | 36,447 |

| 216 | 32 094 | 37 595 |

| 217 | 33 147 | 38,767 |

| 218 | 34 224 | 39 964 |

| 219 | 35 324 | 41 185 |

| 220 | 36,447 | 42,431 |

| 221 | 37 595 | 43 703 |

| 222 | 38,767 | 45,000 |

| 223 | 39 964 | 46 323 |

| 224 | 40,000 | 47,672 |

| 225 | 40,000 | 49 047 |

| > 226 | 40,000 | 50,000 |

Since 2022, the penalty cannot exceed 50 % of the price of the new car. Finally, there is also A weight penalty For vehicles displaying more than 1,800 kg, which will not evolve. It will always be 10 euros per additional kilo And its cumulation with the ecological penalty, above, cannot exceed a maximum of 50,000 euros.

Already be aware that hybrid cars with more than 50 km in electric mode (according to the WLTP standard) as well as 100 % electric cars are exempt from this penalty of weight.

Want to join a community of enthusiasts ? Our discord welcomes you, it is a place of mutual aid and passion around tech.