Ecological bonus 2023 up to € 7,000: Legipermis conditions, all aid for the purchase of an electric car in 2023

All aid for the purchase of an electric car in 2023

If the engine power of your vehicle is at least 3 kilowatts, the aid is 250 € per kilowattheures of energy from the battery. The amount of the aid is capped at € 900 and 27% of the price of the new vehicle (cost including battery rental).

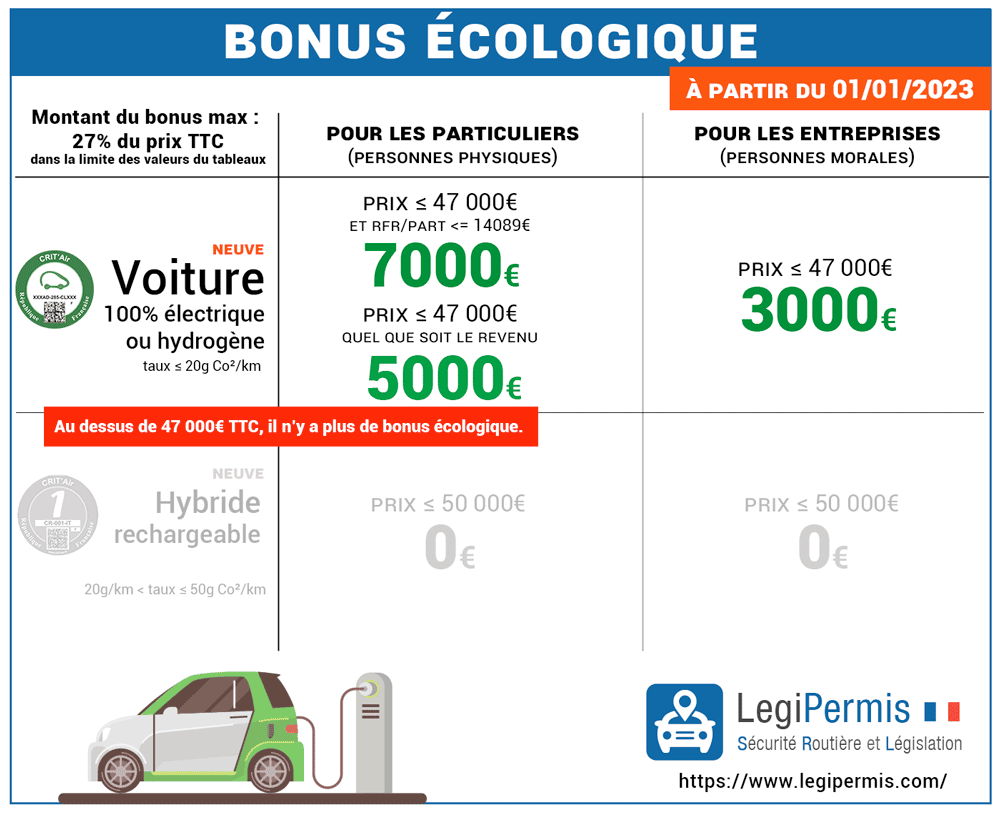

Ecological bonus 2023 up to € 7000: the conditions

The ecological bonus is a assistance in government purchase for new or used electric or hydrogen vehicles. This state aid can go Up to 7000 € in 2023 under conditions.

last news : the conditions of the bonus modified on January 1, 2023

Decree No. 2022-1761 published in the Official Journal on December 31, 2022 modified the conditions of application of the ecological bonus, in particular with regard to the purchase price and resources conditions.

The ecological bonus from 01/01/2023

- 7000 € Maximum for the purchase of a new electric or hydrogen vehicle for a vehicle of less than € 47,000 if the household has a reference tax income per share of 14,089 euros maximum;

- 5000 € Maximum for the purchase of a new electric or hydrogen vehicle for a vehicle of less than € 47,000 regardless of household income;

- 3000 € maximum for the purchase of a new electric vehicle for professionals (legal person) for a vehicle of less than € 47,000 (excluding van Category N1);

- 0 € Maximum for the purchase of a new electric vehicle for a vehicle worth between € 47,000 and € 60,000;

- 1000 € for the purchase of a used electric vehicle (since 09/12/2020);

- 0 € For new rechargeable hybrid vehicles with 50 km of electrical autonomy of € 50,000 maximum (with a CO2 level between 21 and 50 g/km);

The bonus remains limited to 27% of the purchase price including tax of the vehicle.

See the 10 cheapest electric cars in 2023 still eligible for the ecological bonus on the legipermis blog.

Evolution of conditions in 2024: a bonus taking into account an environmental score

A draft government decree, notably from the Ministry of Energy Transition, offers a methodology to calculate the environmental score of an electric vehicle in order to benefit from the ecological bonus from January 1, 2024.

The minimum environmental score to have the bonus will be 60.

Environmental calculation criteria take into account the carbon footprint of vehicle production, including the carbon footprint for steel and aluminum, battery production, and other factors.

For vans since January 1, 2023

Since 07/26/2021, new N1 category vans (up to 3.5 tonnes according to article R311-1 of the Highway Code), have a higher ecological bonus and regardless of the price of the utility vehicle. He’s from:

- € 8,000 maximum if the cleaning has a reference tax income per share of 14,089 euros maximum;

- € 6,000 regardless of the taxable household income;

- 4000 € maximum for a legal person (like a company);

The amount of the special van ecological bonus cannot exceed 40% of the price of the vehicle.

Elongated invoicing period

Note that the possible billing period of these vehicles is extended until June 30, 2023 for vehicles ordered before December 31, 2022.

Ecological bonus amount from January 1, 2023

| Vehicle type | Vehicle cost | Until 12/31/2022 | From 01/01/2023 |

|---|---|---|---|

| new electric vehicle | Price ≤ 47000 € With an RFR/Part ≤ 14089 € | – | 7000 € |

| € 47,000 < Prix ≤ 60000€ | 2000 € | 0 € | |

| Price ≤ € 47,000 (professional) | 4000 € | 3000 € | |

| New rechargeable hybrid vehicle | All cost | 1000 € | 0 € |

| Electric van Category N1 CO2 emission ≤ 20g/km | All cost Physical person | 7000 € | 7000 € |

| All cost Corporation (professional) | 5000 € | 5000 € | |

| Used electric car (since 09/12/2020) | All | 1000 € | 1000 € |

How to benefit from the ecological bonus of € 7000 ?

The amount of the ecological bonus is € 7000 maximum In 2023 for the purchase of a new electric car whose price is less than or equal to € 47,000 including tax for an individual with conditions of resource limited to a tax income of reference by part less than or equal to 14089 euros.

The ecological premium cannot exceed 27% of the price including tax of the vehicle purchased or rented which is either a private car or a van whose PTAC (total authorized weight in load) is less than or equal to 3.5 tonnes. The price of the battery if it is for rent can be added to the purchase price.

In the event of RFR/Part greater than 14089 euros, the bonus for the aquisition of a new electric vehicle is 5000 euros.

The ecological bonus for professionals (legal persons including communities) is capped at 3000 € For new electric electrics costing less than € 47,000.

More bonuses beyond € 47,000

The bonus is removed for vehicles worth more than 47,000 euros including tax since January 1, 2023.

Ecological bonus for used cars

On 12/10/2020, the Minister for Transports Jean-Baptiste Djebbari announced the establishment of an ecological bonus of € 1000 for used cars without means of resources. Thus new vehicles are no longer the only ones who can benefit from it, all to be able to touch the most modest households.

This bonus is accessible since December 9, 2020 for the purchase of a private car or a used electric van. You have to be of age and domiciled in France. There is no resource condition for the used bonus.

Conditions to have the used bonus:

- To be of age ;

- Being domiciled in France;

- For the purchase of a used 100% electric vehicle with a CO2 emission rate less than or equal to a maximum of 20 g/km;

- Keep the vehicle at least 2 years (or rent it at least 2 years);

- Be registered in France in a final series for at least 2 years on the billing date;

Source: Article 1 of decree n ° 2020-1526 of December 7, 2020 published in the Official Journal on December 8, 2020.

Can we combine the ecological bonus and conversion bonus ?

Yes, It is possible to combine the help of the ecological bonus and the conversion bonus.

In 2023, the amount of financial aid may amount to € 13,000, in total for a new electric vehicle whose price does not exceed € 47,000, with € 7,000 of bonuses and € 6,000 in government conversion for government conversion for The 20% of the most modest households (with a tax income of reference less than or equal to € 6358) and households with an RFR/Part ≤ 14089 € obliged to long professional trips (at least 60km/days or 12000km/year) with a personal vehicle.

Ecological bonus cumulation and conversion bonus bonus in 2023

| Vehicle | Max amount of the ecological bonus | Max amount of the conversion bonus | Total max premiums |

|---|---|---|---|

| New or hydrogen electric vehicle (max 20g of CO2/km) | 7000 € | 6000 € | 13000 € |

| New professional electric vehicle or hydrogen (max 20g of CO2/km) | 3000 € | 2500 € | 5500 € |

| New rechargeable hybrid vehicle | 0 € | 0 € | 0 € |

For the purchase of a petrol car with a Crit’Air 1 thumbnail, only the scrap premium (government conversion bonus) is eligible with the rebuilding of a polluting vehicle in an Approved Vhu center.

How to benefit from the ecological bonus ?

The bonus is either deducted from the price of the vehicle by the dealer himself or then reimbursed after the purchase of the vehicle if you request it. If you have a bonus and the conversion bonus at the same time (scrapping bonus), only one file must be made.

The file can be carried out online on the Internet on the government teleservice or by post.

The form is to be sent to a 6 months from the billing date for the purchase of a vehicle or 6 months from first payment of the schedule As part of a rental (leasing lease-lease Cbail, LLD or LOA).

To simplify administrative procedures and reduce the reimbursement period of the ecological bonus, some professionals deduce from the purchase price the amount of the ecological bonus. Thus, the concessionaire, who established an agreement with the Service and Payment Agency (ASP), advances the costs by taking them in charge, he will be reimbursed for the amount of the bonus and will take care of requesting your place.

What are the conditions for obtaining the ecological bonus ?

If you acquire a little polluting vehicle or if you rent a LLD long -term rental car, rental with LOA purchase option or lease credit lasting at least 2 years you can claim the bonus ecological respecting the following conditions:

- For a private car or electric van or VASP (self -propelled vehicle specially furnished for transporting people);

- emitting less than 20 grams of CO2/km (in quantity of carbon dioxide emitted);

- a maximum weight of 2.4 tonnes (2400 kg);

- For a new car, 1st registration or demonstration vehicle of less than 12 months;

- You have to be of age and be domiciled in France;

- The number of ecological bonuses is limited to 1 times every 3 years for a natural person;

In the event of the bonus by the dealer or the garage

The professional seller can advance the ecological bonus to the vehicle buyer. It is then necessary to think of sending a copy of your gray card (registration certificate) within 4 months of delivery of the vehicle.

What year is taken into account for the calculation of the ecological bonus ?

As a reminder, the year taken into account for obtaining the bonus is the date of the order and the date of invoicing of the vehicle (while the ecological penalty applies to the first registration in France of the vehicle according to a scale of the CO2 tax). For example, a car ordered in 2022 and billed in 2022, but whose delivery date is scheduled for 2023, will benefit from the bonus planned in 2022.

Note that the possible billing period of these vehicles is extended until June 30, 2023 for vehicles ordered before December 31, 2022.

In addition, it is essential to keep your new vehicle for a period of 12 months (decree n ° 2022-669 of April 26, 2022) after its date of first registration and you must have traveled more than 6000 kilometers for a car or a van Before you can sell or assign it as mentioned in article D251-1 of the energy code.

2 wheels, 3 wheels or electric quadricycle

When the maximum net engine power is less than 2 kilowatts (EU 168/2013 regulations) or 3 kW (2002/24/EC directive), the amount of the ecological bonus for a 2 wheels, 3 wheels or quadricycle is set at 20 % the cost of acquisition including tax of the vehicle within the maximum limit of € 100.

If the engine power of your vehicle is at least 3 kilowatts, the aid is 250 € per kilowattheures of energy from the battery. The amount of the aid is capped at € 900 and 27% of the price of the new vehicle (cost including battery rental).

The motorcycle, the scooter, all 2, 3 wheels or electric quadricycle must be new, That is to say it is a first registration and must not be sold in the 1st year of purchase and must have traveled more than 2000km.

Electric retrofit: the other solution for the future ?

Legal rendering in France Since April 4, 2020, the electric retrofit allows you to convert an old thermal car (petrol or diesel) to an electric battery car or fuel cell battery.

This electrification process is nevertheless rather expensive and must obey specific conditions with regard to the age, power and mass of the vehicle transformed.

Ecological bonus electric bike

Bike bonus in 2023

If you have a reference tax income by share of the year preceding the purchase of the bike less than or equal to 14,089 €, The amount of aid for an electric bike is 300 €.

For very modest income with an RFR/share below € 6,58 or people with disabilities, this special ecological bonus electric bike is brought to 400 €. There is no longer any need to have benefited from local help to have this help.

The bonus is per person and not by home. The cycle must be new, with a unleaded battery and an electric auxiliary engine with a maximum continuous power of 0.25 kilowatt. Electric assistance bike cannot be sold in the acquisition year.

Also, to touch the electric bonus with electric assistance, you have to be of age and be domiciled in France.

For cargo bikes

The bonus for the purchase of an electrical assistance cargo bike is maximum € 2000 for very modest households with a reference income less than or equal to € 6,58 and for disability situations, and this up to 40 % of the acquisition cost. The help is € 1000 maximum for people with a reference income less than or equal to € 14,089.

You can request it even if you have not benefited from help from your local authority. Vélo-cargo is a cycle set up for the transport of people like a child or a person with disabilities or the transport of goods. The bonus also applies to the purchase of an electric bicycle trailer.

Straight sources and texts

- Articles D251-1 to D251-6 of the energy code: on conditions to benefit from the ecological bonus.

- Articles D251-7 to D251-13 of the energy code: on the different amounts of the ecological bonus.

All aid for the purchase of an electric car in 2023

The purchase of an electric car is still slowed down because of the still high sale price. However, there are state aid that reduces the cost. Here are the main aids to buy an electric car.

Ecological bonuses 2023 for the purchase of an electric car

The ecological bonus for the purchase of a new electric car

There were many changes on January 1, 2023, especially in the vehicles concerned. These must no longer have an acquisition price which exceeds € 47,000. In addition, the vacuum weight of the vehicle must be within 2.4 tonnes. In reality, no model under € 47,000 exceeds this weight.

L’purchase assistance is always granted to all drivers. The amount is € 5,000. However, for people who have a reference tax income per share under € 14,090, the bonus is increased at € 7,000.

For legal persons, the bonus is € 3,000.

Please note, in all cases, the bonus cannot exceed 27 % of the purchase price. Thus, for a basic Spring at € 20,800, the bonus is limited to € 5,616.

The ecological bonus increased in the overseas departments

Faced with the prices of cars much superior to the metropolis, the government has introduced a surprise for Guadeloupe, Martinique, Guyana, Reunion, Mayotte and Saint-Pierre-et-Miquelon. It is € 1000 for new vehicles. The vehicle must run in these departments within six months of the acquisition.

This gives a bonus of € 6,000 or € 8,000 for people with a reference tax income per share under 14,090 €.

The ecological bonus for used electric vehicles

Electric vehicles are increasingly present on the second -hand market. More accessible for certain buyers, they remain even more expensive than hybrid or thermal vehicles. Since the end of 2020, purchase aid include a bonus of 1.000 € for any used electric car purchase. The vehicle in question must have more than two years.

Good point, this premium is without any condition of income or scratching. However, the government reserves this Help for the purchase of an electric car from individuals, and not to businesses.

Casse premiums in 2023

The rules and amounts of the scrap premium in 2023

There were significant changes on January 1, 2023. Already, the premium is now reserved for those whose reference tax income per share is under € 22,984, even if you buy an electric. The car in question must have an acquisition price under € 47,000. No change on the other hand for the vehicle to be scanned: it must be a petrol vehicle registered before 2006 or a diesel before 2011.

The amount of the aid is € 2,500. But it is increased to € 6,000 if your reference tax income per share is less than € 6,359. Or if your reference tax income per share is less than € 14,090 and if you are a big roller for work (the home/work distance is greater than 30 km or you do more than 12,000 km per year for work).

The scrap premium can be combined with the ecological bonus.

Surprising in areas with low emissions (ZFE)

More and more numerous and now concerning most of the major French metropolises, ZFEs are low -emission zones. Their main measure is to gradually prohibit the circulation of old thermal vehicles, more polluting. To support residents, the State allocates a surprise of € 1,000 in addition to the conversion bonus.

In addition, if your local authority (municipality, department, region, etc.) has paid you aid to buy or rent a clean vehicle, the Surprit ZFE is increased within the limit of € 2,000 additional. For example, if local aid is € 3,000, the surprise is € 1,000, increased by € 2,000 = € 3,000.

TV exemption for electric cars

Electric vehicles are exempt from TVS (tax on company vehicles). Companies will therefore not pay TVs on the electric cars of their fleet.

Aids for installing a charging station

The government offers assistance for recharging terminal equipment by an individual. It materializes in the form of a tax credit equal to 75% of the amount of expenses incurred for the acquisition and installation of equipment, with a limit threshold of € 300 per recharging system.

Aids to buy a regional and local electric car

Grand Paris

Since 2019, the Métropole du Grand Paris, bringing together 131 municipalities, has offered assistance in the purchase of a new or used electric vehicle (less than 50.000 €). It is a scrap bonus that is added to that of the government. The vehicle put in the rebuilding must be criminals 3 or lower for RFRs less than 13.€ 489, and Crit’Air 4 and less for the others.

Aid depends on the reference tax income by share. It starts at € 1,500 and can reach € 6,000 when the RFR/P is under € 6,300. To find out the conditions, go to the dedicated site of Grand Paris.

Occitanie region: assistance in the purchase of a used electric car

The Occitanie Region has set up a financial aid system. Objective: to encourage their citizens to acquire a rechargeable electric or hybrid vehicle. The vehicle must be an opportunity for at least a year and less than 30.000 €. It must be purchased from January 1, 2023 from a professional exercising his activity in the territory of the Occitania region. The aid can be combined with the state conversion premium, for this same vehicle (subject to compliance with the conditions set out in article D251-3 of the energy code).

The amount of this aid varies depending on the situation:

- For a major natural person whose reference tax income per share does not exceed € 14089: 30 % of the cost of acquisition, capped at € 2,000

- For caregiver or educational and social support whose reference tax income per share does not exceed € 14089: 30 % of the cost of acquisition, capped at € 4,000

Consult the Occitanie region’s website to find out more about this help.

Certain regions such as Occitania offer aid for used electric vehicles

Metropolis of Nice-Côte-d’Azur

The Metropolis of Nice grants aid for new electric vehicles (not registered already). We can obtain aid of 500 to 3,000 € depending on the income. The maximum is granted to a household whose reference tax income is less than or equal to € 40,000.

Here are the conditions and forms on the official website.

Monaco offers a big bonus for the purchase of an electric vehicle

The Principality of Monaco has subsidized the purchase of an electric car since 2019. It offers aid corresponding to 30% of the purchase price including tax, capped at € 10,000. The Monegasque bonus is not compatible with other French aid.

For more information on the Monegasque electric bonus, go to the Monaco website.

You know other aids ?

If you know other aids for the purchase of an electric car or a rechargeable hybrid vehicle, do not hesitate to let us know ! We will be able to complete this file. There is the government site “I change my car” bringing together most of the national and local aid, but its information is not always fresh.

If you still hesitate between an electric or hybrid vehicle, you can read our file on the aid for the purchase of a hybrid car.

You want to be sure not to miss anything about the news of electric cars ?