Easymove Boursorama Banque: simplifies banking mobility, Easy Move Boursorama 50 euros: Read to obtain it!

Easy Move € 50 Boursorama: Detailed domiciliation premium

Here are the deadlines for all steps to obtain the bonus 50 euros Easy Move from Boursorama ::

Easymove Boursorama Banque

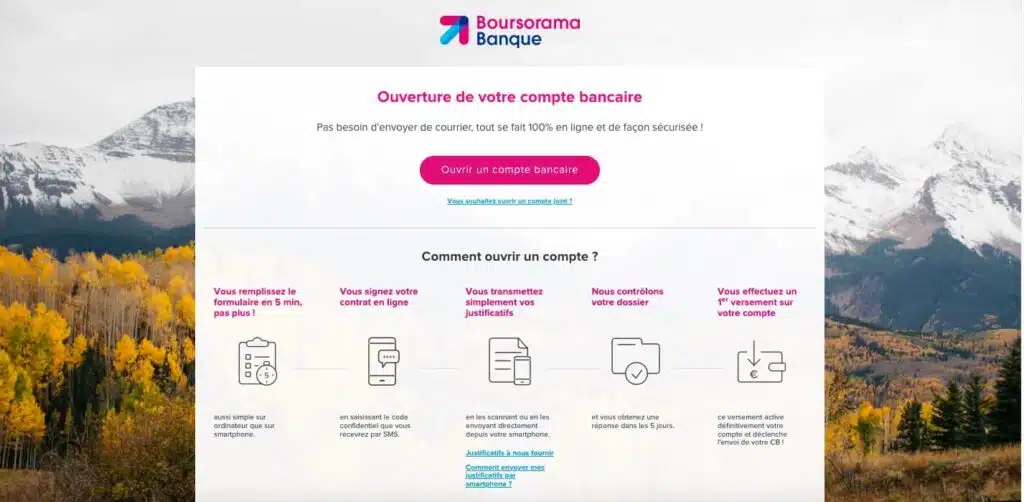

When opening an account at Boursorama Banque, it is possible to benefit from the Easymove service which allows customers to change bank quickly. All procedures are taken care of by Boursorama Banque.

Opt for the monabanq offer that suits you

Up to 120 € offered

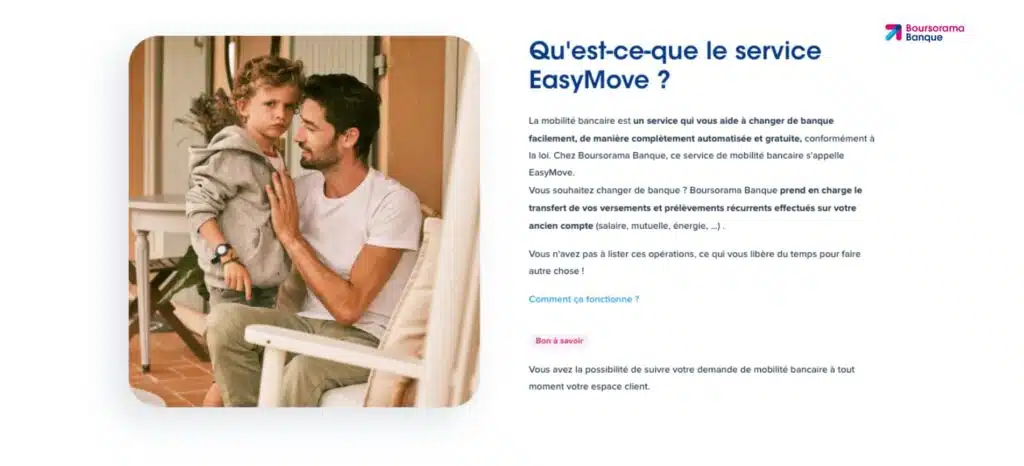

What is Easymove ?

Easymove is a free service offered by Boursorama Banque, which allows its customers to change the bank easily, taking care of all the steps to take.

The service also makes it possible to transfer their banking operations from their old account to their new in just a few clicks. Your new RIB will be transmitted to all organizations that issue samples from your old account. You can also choose to transfer only part of your old levies and operations.

If you have two current accounts (individual and joined for example), you can apply for banking mobility of these two accounts. You will then have access to the two bank mobility mandates from your customer area.

You can make as many requests that you have accounts. However, it is not possible to make the request several times at the same time for the same account.

Offers when transferring account with easymove

Boursorama Banque regularly offers offers for its new customers who wish to take advantage of the Easymove service. You can benefit from € 50 offered for first use of the service.

Customers who want to benefit from it will be able to affect the premium only twice per person. Breast Bank Professional Accounts are excluded from the offer.

There are also other offers that you can touch as a new customer:

- A bonus of € 80 with the welcome offer

- A bonus of up to € 60 with the first and ultimous cards

- A premium of € 50 with the Welcome offer for a Visa Classic card

Boursorama Banque also launches commercial offers during Pink Weekend, which will allow you to benefit from premiums up to € 130.

How to use easymove ?

To take advantage of the Easymove service, simply connect to your customer area, complete the online request form and electronically sign the mobility mandate. It will take you less than 5 minutes, and you will have nothing more, no document will be asked.

By choosing total mobility, you will let Boursorama Banque take care of the termination of your old contract.

If you choose à la carte mobility, you can keep your old bank account and select the operations and samples you want to transfer to your Boursorama Banque or not.

If you have savings products or current credits in your old bank and you choose to close the account on which the withdrawals are made, your original bank may ask you to keep it.

Opt for the monabanq offer that suits you

Easy Move € 50 Boursorama: Detailed domiciliation premium !

You want to know more about the premium Easy Move Boursorama of 50 euros ? You are in the right place �� !

Easy Move allows you to easily change from bank by domiciled at Boursorama a part or all of your recurring operations from your old bank account. You want to use this service and receive 50 euros as a bonus ? We explain to you in detail how to do.

Here is a summary table of the Easy Move Boursorama offer 50 euros: ��

Easy Move Boursorama 50 euros 2023:

the essential

– Be a new Boursorama customer

– Use the Easy Move banking mobility service

2. Sign a mandate of banking mobility

3. Validate the list of movements to be transferred

4. Sending the RIB to organizations

How to get 50 euros with Easy Move from Boursorama ?

Here are the 4 steps to obtain 50 euros with Easy Move Boursorama:

- Become a Boursorama customer

- Sign a mandate of banking mobility

- Validate the list of operations to be transferred

- Sending the new RIB to the organizations concerned

1. Become a Boursorama customer

To obtain 50 euros with Easy Move, you must first become a Customer of Boursorama. The EASY MOVE Prime of Boursorama 50 euros is only open to online banking customers, as it is a banking domiciliation offer. To become a Boursorama customer, you must fill out an online questionnaire and choose an ultim or Welcome bank card.

Then, it is necessary to provide the necessary supporting documents and wait to receive your RIB. Finally, you can activate your new Boursorama bank account with a first payment of 50 or 300 € minimum.

Here are the conditions for becoming a Boursorama customer and receiving the Easy Move 50 euros premium ::

- To be of age

- Reside tax in France

- Already have a bank account domiciled in France or European Union

- Not be banned banking

It is also necessary to provide the necessary documents requested. To validate your bank account opening, you will need a valid identity document (CNI, passport or residence permit). You will also need a RIB in your name/first name in a European Union bank.

If you request a deferred debit bank card (with the Ultim offer), you must also provide proof of income (tax notice or salary slip).

�� Once you have received the RIB from your new bank account, it is necessary to activate the account by making a first payment. You will not be able to carry out the following steps to obtain the EASY MOVE BOURSorama Prime 50 euros offered if you have not activated your account. To do this, you have to make a first payment of minimum 50 euros with the Welcome offer and minimum 300 euros with the Ultim offer.

The transfer must be made from the bank account associated with the RIB provided at registration.

2. Subscribe to Easy Move

Once you have validated your Boursorama Banque bank account, you will need to subscribe to Easy Move. The 50 euros bonus offered Boursorama Easy Move is only intended for those who use the banking mobility service for the first time. This must therefore be your first registration in the Boursorama banking mobility service.

Easy Move allows you to repatriate to your Boursorama account at least one withdrawal or recurring transfer organization.

�� To subscribe to the Easy Move service, you must connect to your customer area on the Boursorama website or on the mobile application. Then you must complete the banking mobility request form which is available online. It will then be necessary to sign the banking mobility mandate which allows Boursorama to recover the recurring operations of the last 13 months on your old bank account. The signature is electronic.

3.Choose the operations to be transferred

Once you have subscribed to Easy Move and signed the bank mobility mandate, the bank will first recover the list of movements to be transferred from the old bank, then you can select the movements to be transferred. You then have the choice between two options: total mobility or à la carte mobility. The condition for receiving the Easy Move Boursorama Prime 50 euros in 2023 is to domiciliate at least a banking movement on your new account.

�� Total mobility involves closing your old bank account : Boursorama will take care of transferring all recurring operations and to close your departure account. Mobility à la carte allows you to keep your old bank account and select the movements (withdrawals or recurring transfers) that you wish to transfer to your Boursorama Bank account.

This selection step is not necessary for those who have opted for complete mobility.

4. Sending the new RIB to the organizations concerned

Once all these steps are completed, when the list is validated, Boursorama will contact the organizations concerned by the change of bank. The finish bank (Boursorama Banque) takes care of everything, you have no proof to provide and no additional approach to do. It is this final step that allows you to trigger the payment of the Easy Move bonus of 50 euros offered.

�� To summarize, here are the steps to follow after signing the banking mobility mandate. First, Boursorama recovers the list of recurring operations for the last 13 months on your old bank account. Then, you choose total or à la carte mobility: if you have chosen à la carte mobility, you select the operations you want to domicile on your Boursorama account.

If you have chosen total mobility, you do not need to select the movements, and Boursorama is responsible for closing your starting bank account.

Easy Move Boursorama 50 euros 2023: the FAQ !

You have questions about the operation of the Easy Move Boursorama 50 euros in 2023 ? Find out everything you need to know in our Easy Move Boursorama FAQ 50 euros: Conditions, how it works, what banking operations are concerned and what is the time to receive the premium of 50 euros.

�� What conditions to receive 50 euros with Easy Move from Boursorama ?

Here are the conditions to receive 50 euros with Easy Move from Boursorama ::

- Be of age and domiciled tax in France

- Have a bank account domiciled in France

- Be a new Boursorama customer

- Use Easy Move for the first time

To receive 50 euros with Easy Move from Boursorama, you must first become a Boursorama customer. To open an account at Boursorama, you must be of age and domiciled tax in France, and you must not be banned banking. To domicile your account in the online bank using the Easy Move banking mobility service, it is necessary to have an account held in a French bank, because only bank movements between French banks are transferable.

For example, if you receive a transfer from a foreign bank, then you will have to take the procedures to transfer the operation.

To be eligible for the 50 euros offer offered with Easy Move, you have to choose the Welcome or Ultim offer and provide the requested supporting documents. Then you have to activate your account and register for the Easy Move Banking Mobility Service for the first time. Finally, the premium of 50 euros will be triggered once you have taken all the procedures to transfer to your new Boursorama account at least one withdrawal or recurrent transfer organization.

�� It is quite possible to register for the Easy Move service with a rib domiciled in the EU. However, you should know that, because banking domiciliation only concerns French territory, only the movements issued from a French bank to another French bank can be domiciled.

�� Is it compulsory to domicile your account to have the premium of 50 euros Easy Move Boursorama ?

No, it is not compulsory to domicile your account to receive the premium of 50 euros Easy Move Boursorama. To be eligible for the Easy Move Boursorama 50 euros offer, it is only necessary to domicile a recurring movement on its new Boursorama account, whether it is a levy or a transfer. You don’t have to repatriate all operations to your new account and close your departure account.

�� When you fill out the Easy Move service registration form, Boursorama leaves you the choice between two options. You can choose total mobility, which involves closing your old account and the domiciliation of all your movements at Boursorama. But you can also choose à la carte mobility, which allows you to keep your old bank account and domiciliate only certain movements, which you can select.

�� How to subscribe to Easy Move Boursorama to receive 50 euros ?

Here’s how to subscribe to Easy Move from Boursorama to receive 50 euros ::

- Become a Boursorama customer

- Connect to your Boursorama customer area

- Complete the online banking mobility request form

- Electronically sign the mandate of banking mobility

�� To receive 50 euros with the Easy Move Boursorama offer, you must subscribe to Easy Move for the first time. This offer is therefore intended only for new Boursorama customers, who have never used the Easy Move banking domiciliation service. Please note, however, to subscribe to Easy Move and receive a premium of 50 euros, you must domicile at least a recurrent sampling or transformation organization on your new Boursorama Bank account.

This last step will trigger the premium of 50 euros.

�� What banking operations are excluded from the premium 50 euros Easy Move Boursorama ?

The banking operations excluded from the bonus of 50 euros Easy Move from Boursorama are the transfers to supply a regulated savings account (Pel, Cel, Livret A) or all the movements that are issued from abroad or to a bank with a foreign rib. Indeed, although it is quite possible to transmit a domiciled RIB in EU, banking mobility concerns only French territory.

Only the samples issued from a French bank to another French bank can be transferred.

�� The bank movements that you can transfer to receive the offer from Boursorama Easy Move 50 euros are all the movements transmitted by your old bank in Boursorama, namely the transfers and samples received recurring and the permanent transfers issued from your bank account.

Recurrent transfers designate transfers of the same transmitter received at least twice over the last 13 months. You have the possibility of choosing the movements you want to domicile when filling out the bank mobility request form.

�� What period to obtain 50 euros with Easy Move from Boursorama ?

The deadline to obtain 50 euros with Easy Move from Boursorama is 60 days from the signing of the bank mobility request form. Once you have completed the bank mobility request form and you have signed it electronically, you will have to wait 60 days maximum for the 50 euros to be sent directly to your new Boursorama bank account.

Here are the deadlines for all steps to obtain the bonus 50 euros Easy Move from Boursorama ::

- 10 minutes to open your online banking stock market

- 5 days for Boursorama to study your request

- 48 hours to activate your bank account

- 5 minutes to subscribe to Easy Move

- 22 working days to transfer operations (deadline set by law)

- 60 days to receive the Easy Move premium

�� In which case Boursorama recovers the premium of 50 euros Easy Move ?

Boursorama recovers the premium of 50 euros Easy Move in the following cases ::

- You do not maintain your banking domiciliation more than 12 months

- You close your bank account

- You have manifested reprehensible behavior

- Boursorama closes your bank account

�� After receiving the bonus of 50 euros Easy Move, there are rules to respect to keep the premium, in particular that of maintaining your banking domiciliation for at least 12 months. If you do not comply with the rules of the contract and remove your domiciliation less than 12 months after signing the banking domiciliation mandate, or you close your Boursorama bank account, the bank reserves the right to take the premium of 50 euros on Your current account.

�� What are the other Boursorama Banque bonuses ?

The other Boursorama Banque bonuses are ::

- Welcome bonuses: 100 euros offered

- The Ultim Metal offer: 100 euros offered

- Pink weekends: 150 euros offered

- Sponsorship: 100 euros offered

Here is a summary table of other Boursorama Banque bonuses: ��

Boursorama Bank:

Other premiums

Detail of the offer

Learn more

– Be a new Boursorama customer

– Being a stock market bank

Boursorama Banque offers an interesting welcome bonus for new customers who opt for the Welcome or Ultim offer. They can benefit from a premium of 100 euros currently with the BRS100 code. € 20 is paid for the opening of a Boursorama account and € 80 for ordering a Welcome or Ultim card.

For new customers who opt for the Boursorama Pro offer or for the offer dedicated to minors (12-17 years), a bonus of € 80 is also available.

The Pink Weekend offer is valid for a few days once a month, at the start of the month. It concerns Welcome, Ultim and Ultim Metal offers. It gives the right to a welcome bonus of 150 euros, broken down into 3 stages: 20 euros for the opening of a Boursorama account, 80 euros for ordering a bank card among eligible offers (or 8 months of subscription offered For Ultim Metal), and 50 euros for the use of the Easy Move service.

This offer is interesting when the welcome offers allow you to earn only 130 euros.

�� Finally, the Banqueorama Banque sponsorship allows bank customers to receive 100 euros when they recommend online bank to their loved ones. The godson, which must be of age and a new Boursorama client, receives 150 euros as a bonus following the effective opening of a first bank account at Boursorama. The offer is available several times in the year randomly.

EASY MOVE BANK BOUTHORAMA 50 euros: in conclusion !

The EASY MOVE BOURSORAMA 50 euros offer of 2023 is a very attractive offer for new Boursorama customers. It allows you to receive 50 euros of premium if, after opening a bank account at Boursorama Banque with the Welcome offer or the Ultim offer, you choose to domicile at least a recurring operation on your new Boursorama account with the Easy service Move.

�� Easy Move is the Boursorama banking domiciliation service. It allows you to change the bank more easily by carrying out banking domiciliation of your recurrent banking movements automatically. The Easy Move Boursorama Bank 50 euros offer is subject to conditions, including that of maintaining banking domiciliation for at least 12 months to be able to keep the premium.

A suggestion or a remark on the Easy Move offer from Boursorama ? Put us a little comment, we will be happy to answer you or bounce back on your remarks ! ��