Download N26 for Android (Free) – Clubic, N26 reviews (2022): Is the mobile bank serious?

Notice N26 (2022): Is the mobile bank serious

The best known package at N26 is free. It offers a mastercard debit card, and allows you to pay free of charge in all currencies, from the euro to the US dollar via the Swiss franc or the Sterling book. 5 withdrawals are free each month in France, while those abroad are taxed at 1.7%. Only two spaces can be created with this free subscription, while shared spaces are not available. This package is the ideal solution for all those who want to test N26 without paying an idea about their value proposal.

N26 for Android

With its free payment card, mobile bank N26 offers a simple and refined application to manage your account and pay daily purchases. The opening of the account is also fast and at no cost and especially without income conditions.

Open an account in a few minutes

N26 is a only online bank to open a current account for free and make payments, transfers and free operations in France. The creation of an online account takes only a few minutes and requires filling out a form, sending two identity documents, an identity verification by photo and making a first transfer from a account on behalf of the holder.

What about the mobile app ?

For a neobank, the mobile application represents a cornerstone because account management revolves around the smartphone whether to consult its accounts or directly pay for its purchases. Indeed, the app N26 is compatible with Google Pay To make purchases in the blink of an eye with your smartphone.

Manage your account, your card and safety

Available free of charge, the payment card N26 can be fully managed from the app. The blocking of the card in the event of loss, the modification of the PIN code, the activation of mobile payment can be directly made from the Android or iOS app.

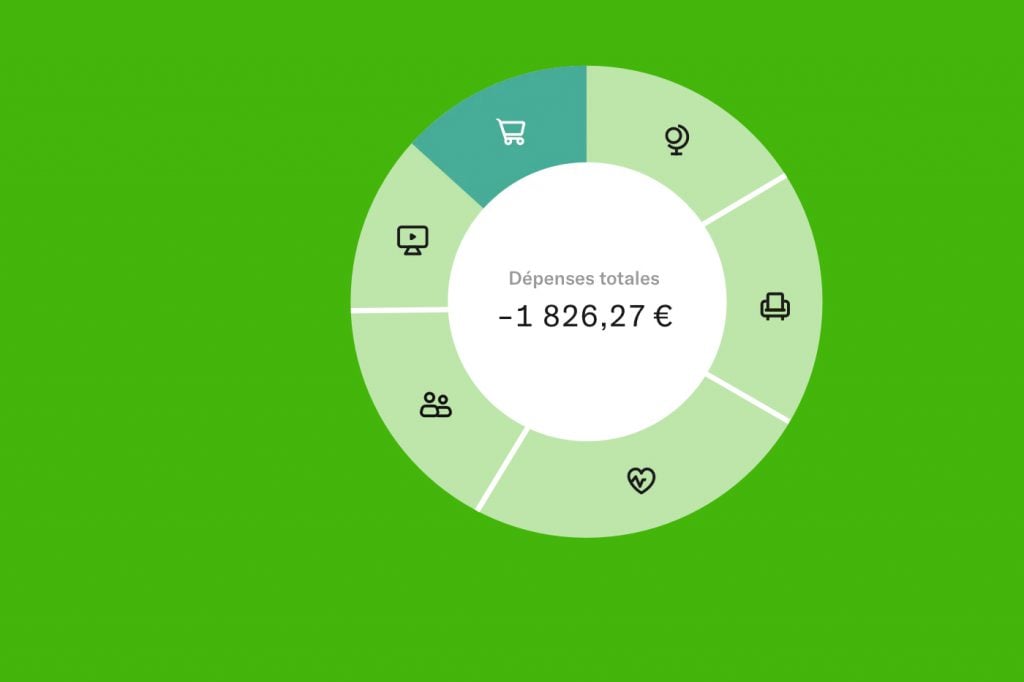

With regard to budget management, the application offers a clear and intuitive interface to consult the balance of the accounts, the expenses and transfers made and the detail of each operation.

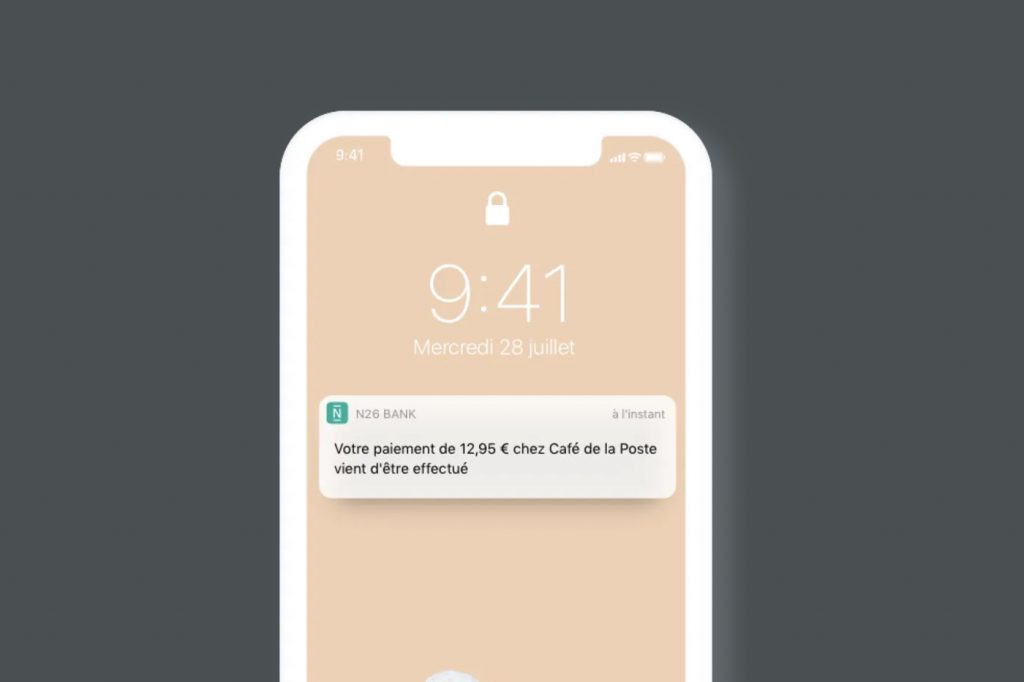

The application also offers an effective notification system which informs in real time about the operations carried out. It is possible to consult a history of operations and apply tags to easily find expenses by categories. RIB download is also available.

Finally, note that N26 also has offers adapted to professionals and people who travel abroad.

Notice N26 (2022): Is the mobile bank serious ?

Tired of traditional banks, I decided to install the N26 mobile application there are more than two. Opening an account took me only a few minutes, and it was completely free: the perfect opportunity to take charge of the service and give you a full report of my experience in recent months. Spoiler: I’m really not disappointed.

Created in 2013 in Berlin, N26 was originally a startup with just 25,000 euros in capital. She has since lifted more than half a billion dollars, supported among others by the Chinese Tencent Holdings and Allianz X. Like its English Revolut counterpart, also available in mobile application, the company wants to be disruptive with conventional banking agencies: at N26, everything is done from the Internet and anyone can open an account.

With 1,500 employees now, the company has since its beginnings conquered many markets, including France and several other European countries such as Spain, Italy and Sweden. More than 7 million use its daily service, mainly in Europe. The neo-banque left the United States after an unsuccessful experience on a very saturated market. But what earned him all this success ? Below, find my opinion on N26 will give you all the elements to understand the banking service.

How to open an account on N26 ?

If the N26 online bank is also practical, it is above all because customers do not need to complete a multitude of forms or to sign contracts in an office several kilometers from their home to start their experience. Indeed, whether from the website or on the mobile application, simply take a picture of your identity card and send it to then receive your debit card a few days later, without spending any penny.

To open a current account at N26, simply click here and follow the different stages required. According to the German platform, 8 minutes are enough to become a member. In particular, you must confirm your registration by email, download the mobile application on your phone (whether it is an iPhone or Android), have your identity checked and finally activate your Mastercard card in a few clicks.

Eligibility conditions are simple: there is none. Obviously, you still have to be a major and have an address in one of the regions where N26 operates, but regardless of your nationality where you come back, you can completely generate your identifiers. Unlike a network bank (or even an online bank) which will ask you for many supporting documents sometimes complicated to bring together.

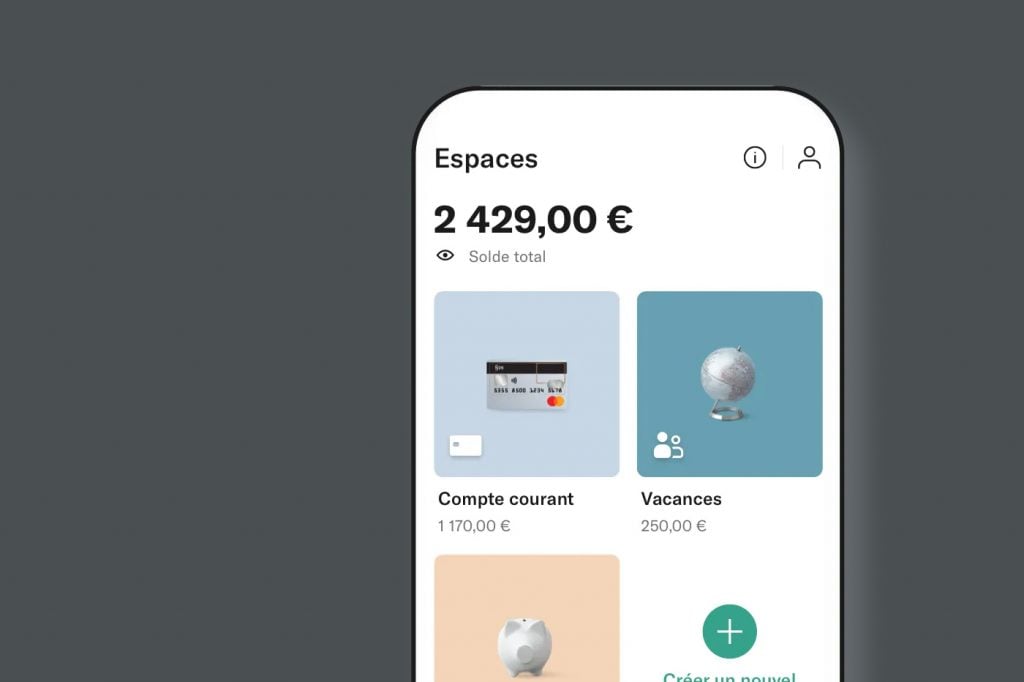

Application N26 © N26 x Iphon.Fr

N26 application test

The N26 mobile bank is available on iOS and on the Google Play Store, at no cost. Update regularly, it guarantees security and confidentiality to its users thanks to password protection and is translated into several languages, including English and French. The iPads are also compatible with N26, but unfortunately there is no application for Apple Watch. A desktop version is however indeed accessible.

Design: an interface 3.0, better than a classic bank

Like everyday life tools such as Spotify or Uber, N26 online bank adopts minimalist ergonomics very easy to use. This greatly reinforced me in my N26 opinion for daily use. A dark mode also makes it possible to call on its mobile application without hurting the evening in the evening. Furthermore, it is also possible to hide sensitive information if you work for example in an open space.

To consume less energy, and if you find it superfluous, you can also deactivate the animations that are linked as you sail among the options. It’s good for the planet, and it doesn’t cost anything. The UX of the N26 mobile application is really at the top, and I never had to complain about it in several months of regular use. I also did not meet a bug, so it’s a 20/20 for this criterion.

Fonctionnalities

With the neo-banque N26, you can manage your accounts without having to call any advisor or move to a partner establishment. The application makes it possible to control everything online, as long as you have a stable connection.

Among the different features of the App N26, we have:

- Moneybeam is the name of instant money transfers that N26 customers can send and receive between them

- Classic transfers, which often take less than 48 hours

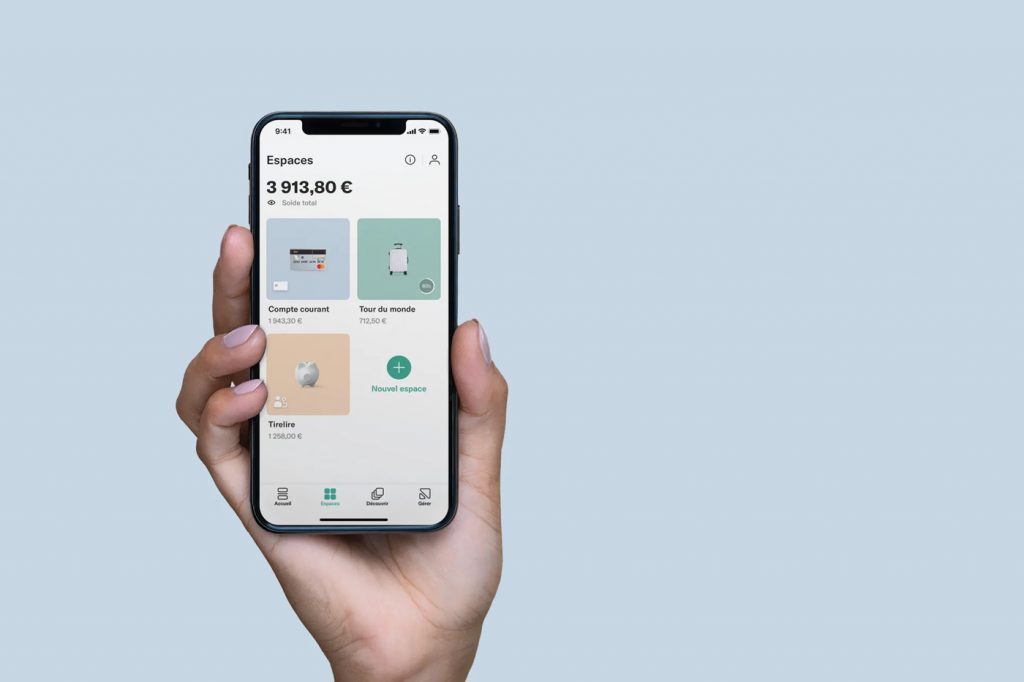

- Spaces: “virtual sub-accounts” to put aside, create prize pools or simply separate your income

- The shared spaces, which allow as their name suggests to share funds with friends, family or roommates

- The possibility of setting up recurring direct debits, for subscriptions such as Disney+ or Deezer

- the list of transactions carried out in stores or on websites

- Statistics on operations (depending on categories such as food, leisure, savings, etc.)

- account statements, downloadable in .Pdf

- a search bar, to find a past purchase or a forgotten merchant

- Partnership offers: at the moment, a month is offered at Blinkist

- blocking the card in the event of theft or loss

- Resetting the PIN code of the card

- Bank card order

- activation of withdrawals to the distributor, online and abroad payments

- the installation of daily limits (ceilings) to manage its budget

- A map of distributors around you, depending on the geographical position

- the display of the Iban and the BIC, to copy them with a click

German customers (who handle a lot of cash, liquid payments being legion with our Germanic neighbors) also have access to a rather practical service. They can indeed submit tickets or parts to the exit of certain supermarkets (such as ReWe), which the cashier then takes care of depositing on their account immediately. Unfortunately, it is not yet possible to do so in France, and it’s really a shame.

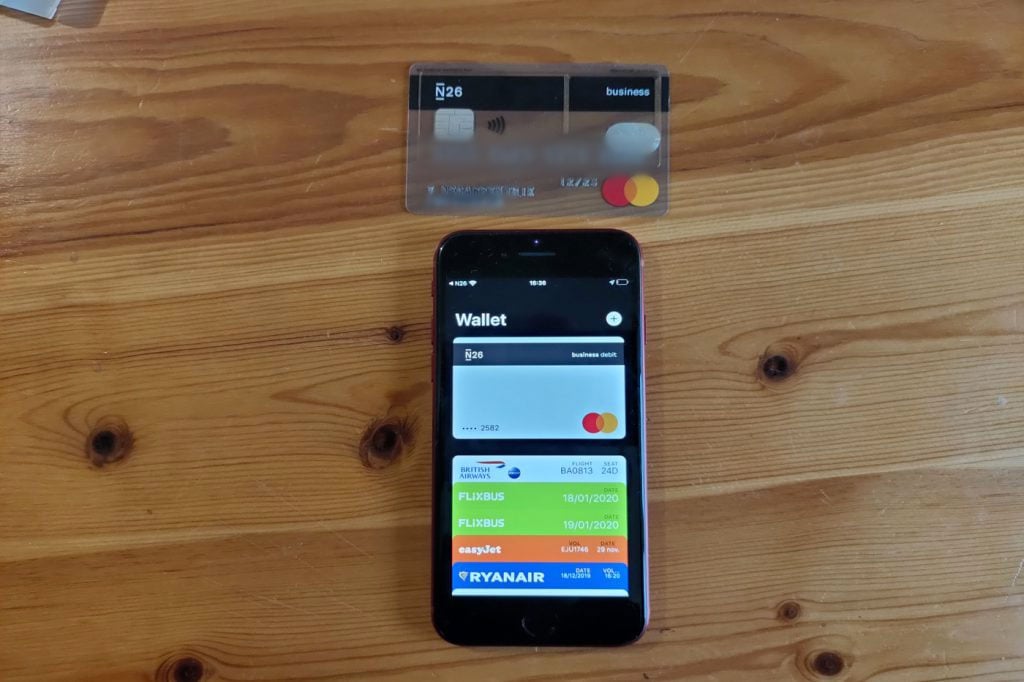

The specifics of the N26 mobile bank with iOS

Now let’s move on in my opinion N26 to the specificities that allow the bank to differentiate itself. The advantage of the N26 app is that it fits particularly well with all iPhone models, including the highest -end like the 11 Pro and the 11 Pro Max. We can therefore easily synchronize an N26 bank card with Apple Pay (via Wallet), to adjust its shopping at the store without getting it out of its pocket thanks to the NFC chip of its smartphone.

In addition, iOS users can also secure their N26 app thanks to the TrueDepth Biometric Sensor from Face ID on products that are equipped with it, such as the iPhone XR, which is cheaper than the family of iPhone 11. This technology, recognized for its effectiveness, detects all facial features and then or not allow access to the account (whether its holder is recognized). On the new iPhone SE 2020, this technology is not present and it will be necessary to use the touch button to confirm its footprint and trigger the transaction.

The quality of service at the rendezvous

Like any good service, the N26 online bank offers reactive and free customer support. This aid is accessible from the application, via the LiveChat where a bot answers the most frequently asked questions before putting in relation to an operator if necessary.

On the App Store, the neo-banque N26 displays a note of 4.8 stars out of 5, which is excellent. On the Play Store, on the other hand, its overall assessment is a point below. As for the opinions on N26 on Glassdoor, they are even more mixed with only 3.3/5, 55% of employees approving the CEO, Valentin Stalf. Finally, Trustpilot gives a scoring “GOOD”With more than 10,000 opinions in total, highlighting, among other things, a“Excellent service” And “The best online bank» “very fast”. Our colleagues from the Citron press also did a N26 test, and they put 9.5/10.

N26: Prices comparison

The N26 online neo-banque offers several subscriptions, depending on each profile and each with its own assets. Here is a quick overview, to help you make your choice if you are not already convinced. This is a key element for my opinion N26.

Prices for individuals

The best known package at N26 is free. It offers a mastercard debit card, and allows you to pay free of charge in all currencies, from the euro to the US dollar via the Swiss franc or the Sterling book. 5 withdrawals are free each month in France, while those abroad are taxed at 1.7%. Only two spaces can be created with this free subscription, while shared spaces are not available. This package is the ideal solution for all those who want to test N26 without paying an idea about their value proposal.

N26 You (previously called N26 Black) is the cheapest paid alternative (€ 9.99/month) for individuals. This subscription allows you to choose between five different colors of card, does not punctuate commission on withdrawals in foreign currency, and also offers all the advantages of its free equivalent.

In the same way, customer service via Live Chat is only available there between seven hours and twenty-three hours, but we can however create up to ten virtual sub-accounts, and share them with others users. With this price, N26 also offers promotions from partners such as WeWork or Hotels.com: practice for the most nomads. Travelers will indeed be very well served, because medical coverage abroad is also there, as well as insurance and sport insurance.

The last package, N26 Metal, costs 16.90 euros per month, offers the same options as the previous one with the possibility of ensuring its car rental and mobile phone (in the event of a flight or breakage screen for example). Again, withdrawals are free until the fifth every month.

Spaces N26 © N26 X Iphon.Fr

Price for professionals

For freelancers or small businesses, N26 imagined 2 formulas with a few more options compared to the plans for individuals.

The first, N26 Business, offers to use the online bank for free thanks to a Business Mastercard debit card, to be able to pay with no cost in all currencies. 1.7% exchange fees are applied to withdrawals abroad, while customer service is available from 7 a.m. to 11 p.m. Finally, two sub-accounts can be managed in the mobile application, and 0.1% cashback is offered during each purchase with the card, which you cannot choose the color.

With N26 Business You, on the other hand, 5 colors are available, and the removal of foreign currency is not billed. The 0.1% cashback is also included, this time with the possibility of categorizing its income in 10 sub-accounts to the maximum. Discounts with partner companies are also offered (as on N26 You), as well as a full family of guarantees to move without fear:

- Emergency medical coverage abroad

- Flight and baggage delay insurance

- Winter sports and ski insurance

- Car insurance, cycling and self-service scooters

- Car rental insurance on a trip

Count 9.99 euros per month for N26 Business You. Note that after the fifth withdrawal made per month, the following are billed two euros each. The classic N26 package is without commitment, but the N26 you is issued with a 12 -month commitment.

N26 is not just an online account

In addition to its application which allows you to manage your online bank account, N26 offers other related services which are especially useful for daily customers or travel. This makes N26 in our opinion a global player who will meet all the needs of the general public. However, they require an investment in addition, in time or in money, but their added value really makes it possible to advance more quickly to its objectives.

Insurance

As seen above in the packages, N26 provides certain guarantees with its N26 You, N26 Metal and N26 Business you packages. It is thanks to the Allianz partner (first European group in its sector, installed in a 140-meter skyscraper next to Treptower Park in Berlin) that contracts can be set up, the signature being there too completely electronic.

Above all, N26 therefore provides medical coverage for travel, to provide for health, dental or winter sports emergencies to one million euros, also protecting your partner and your children: practical and really ideal for family life and holidays. The N26 Mobile Bank also offers compensation up to 500 euros in the event of a delay in your plane over four hours, and the same amount for luggage found after twelve hours, with up to 2,000 euros in the event of total loss. In addition, cancellation or travel interruption insurance is provided, up to 10,000 euros.

N26 also markets insurance for the rental of self-service vehicles. If you are used to traveling using self-service scooters to go to your workplace for example, you are open up to 20,000 euros in the event of damage. Free floating bicycle accidents or for electric car rental are also concerned. With the N26 Metal version, insurance for travel is also accompanied by the coverage of rented vehicles in another country, also up to 20,000 euros.

© Unsplash / Sebastian Bednarek

To finish with insurance, be aware that N26 can also protect your mobile phone. Only with the N26 Metal package, if you are stolen from your iPhone or falls and damages (even with a good silicone shell, it’s still fragile !), then N26 can reimburse you up to 1,000 euros, a sufficient amount for most of the most basic repairs.

Credit

In order for its customers to launch projects more easily, the neo-banque N26 has created a credit simulator accessible directly from its application. We must then respond to a quick form, which offers a quote in five minutes. Loans range from 1,000 to 50,000 euros, with monthly payments from 17 euros. The categories of eligible expenditure are the purchase of household appliances, electronic equipment, a new or used car, the planning of a stay abroad, work in its home, a move, the order of furniture or the birth of a child.

Sponsorship

By inviting your friends to join N26, you can be rewarded. The online bank thus pays a premium directly to your account, as soon as your knowledge has made a first transaction with its Mastercard. The numbers can vary depending on the packages, but with a free N26 formula, we obtain for example 15 euros more as soon as his godson also spent 15 euros.

Cryptocurrency

On the cryptocurrency part, N26 acknowledged that she had lagged behind. During confinement, Revolut experienced a flight by opening the trading of cryptocurrencies to its 20 million customers. The German neo-banque was not ready-and it is still not in 2022. The founder of the company admitted that they had missed a train and he said that this feature was under development. We can therefore hope that it is available aware of the year 2023.

Among the other small shortcomings of N26, we can cite for example the concern of discrimination in IBAN. With a German Iban which is associated with your account, there are certain providers who are not ready to accept transfers or samples. Although it is illegal, sometimes some French employers refuse to turn the salary on an account that is not based in France. Likewise, some telecom operators refuse to take the monthly subscription to a mobile package from a account with a foreign IBAN. Revolut has resolved this challenge during the year 2022: French customers now have their French IBAN.

Conclusion and opinion: N26, for whom ?

It is now time to conclude this N26 opinion with a global summary. The application of the N26 online bank is very complete and really reactive. Fluidity is there both on the software side and with customer service, and compatibility with the majority of web and mobile platforms allows you to consult your accounts anytime and from anywhere. The free N26 formula is more than enough to try this new bank before choosing to switch to a higher plan. These are also very provided in optional services, allowing both professionals or more imposing incomes to find shoe at their foot.

We may regret the impossibility of using live cryptocurrencies or depositing liquid at the cash register in France and paid withdrawals, but for the rest it is a faultless. Obviously, we do not use all the features of N26 from the start of its registration, but their multiplicity makes it possible to take the time to review them to find out which one corresponds to us most. Finally, Moneybeam is practical at a time when traditional banks still sometimes take four days to make transfers. Unfortunately, this feature is not available in France.

To discover the N26 service, it’s here:

And you, give us your opinion on N26 in comments !