Declare a lost or stolen card | Visa, bank card – opposition in the event of theft or loss – Type letter – UFC -Que Choisir

Bank card

Visa can block your card number and can put you in contact with your financial institution or your bank. Once the authorization of your bank is authorized, you will receive an emergency replacement card within one to three working days * . In addition, Visa can make arrangements so that species are made available to you near the place where you are within hours of obtaining authorization from your bank.

Your emergency service in a simple phone call

It is easy to declare a flight or loss of card

Wherever you are, we are here to help you. See all green numbers

Block your card

If you know your card number, a visa representative can put it in opposition.*

Get a breakdown card

In collaboration with your bank, Visa can send you a replacement card and ship it worldwide within 24 to 72 hours (depending on the location).

You can call at any time.

Green numbers are available 24 hours a day, 7 days a week. We take charge of calls in a multitude of languages.

- From France, compose the 0 892 705 705, Interbanese server for the opposition of bank cards.

In the event that your destination country does not appear in this list, compose, in PCV* (Collect Call), the visa number in the United States: + 001 303 967 1096.

In the event of theft your card, remember to make the declaration of theft with the competent authorities and confirm I as quickly as possible, by registered letter, the disappearance of your card to your agency by attaching the receipt of the flight declaration.

* Restrictions can apply

Card replacement and provision of emergency liquidity

You need species or an emergency card because it has been lost, damaged or stolen ?

Visa can block your card number and can put you in contact with your financial institution or your bank. Once the authorization of your bank is authorized, you will receive an emergency replacement card within one to three working days * . In addition, Visa can make arrangements so that species are made available to you near the place where you are within hours of obtaining authorization from your bank.

* Restrictions/limits apply

Bank card

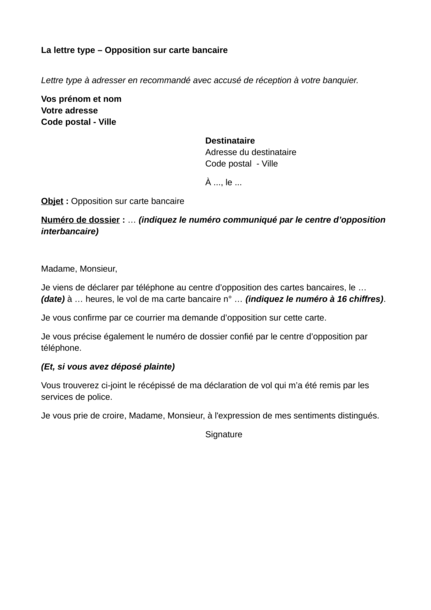

Opposition in the event of theft or loss

We stole your bag that contained your bank card notably contained. Or you think you have lost your bank card. Indeed, you may have returned your home in all directions, it is impossible to put your hands on it. You want to oppose.

Download in .Docx for the versions of Microsoft Office after Office 2007

What the law says

You can only make a general opposition on your bank card in the assumptions listed by law: Loss, theft of your bank card, but also in the event of recovery or liquidation of the beneficiary of payment of payment. It is also possible to oppose in the event of fraudulent use of your card data (see the letter type “Bank card – erroneous invoicing”).

If you are not in these hypotheses, beyond having to return to the bank the sums it has reimbursed you wrongly, you risk criminal sanctions: up to 375,000 euros fine and/or Up to 5 years in prison.

The opposition must intervene as quickly as you realize the event justifying it (see “good to know”). Keep in mind that the opposition is irreversible and cannot be canceled, even if you then find your card.

As soon as you have blocked it, your bank should prevent any use of your bank card. Otherwise, the bank is responsible for itself and the amount debited must be reimbursed to you by it. Check your account statements regularly in order to report, if necessary, any payment by bank card after your opposition. Know that you have 13 months at most, from debit, to challenge an unauthorized operation.

Finally, be aware that opposition declarations are billed by banks. Refer to your pricing conditions.

Articles L. 133-15, L. 133-17, L. 133-20 and L. 133-24 of the monetary and financial code, article 313-1 of the penal code.

What you can do

Call the interbank opposition center (0892 705 705), accessible 24 hours a day and 7 days a week. A file number will be communicated to you after your communication, which should be mentioned in your mail to your bank.

Your telephone opposition must most often be confirmed in writing to your banking agency (see the letter above) by registered letter with acknowledgment of receipt. Take up your bank card agreement on this point.

To note

From a strict point of view, the monetary and financial code does not condition the opposition on a bank card to a complaint for theft.

However, be aware that if you have filed a complaint and an investigation is carried out, the bank cannot oppose professional secrecy to the judicial authority acting within the framework of a criminal procedure (article L. 511-33 of the monetary and financial code).

Good to know

If, following the flight or loss of your bank card, withdrawal or payment, using the secret code, is made before you had time to oppose, know that your bank will not reimburse you the sums that above 50 euros. If the secret code has not been used (payment on a website, for example, with the mentions appearing on the card), this franchise does not apply (article L.133-19 of the monetary and financial code).

On the other hand, you will not obtain any refund, even after opposition, if your banking establishment proves that you have been seriously negligent (for example: bank card left in the car and storage of the secret code in the glove box, Court of Cassation Chamber commercial, 10/16/2012, appeal n ° 11-19981).

Article L.133-19 of the monetary and financial code.

Before what court act

Except in particular cases, when you enter the court, you must justify having taken steps in order to achieve an amicable resolution of the dispute (art. 750-1 of the Code of Civil Procedure). This is, for example, to evoke the different letters you have written as well as the deadlines left to answer you. Otherwise, the judge may invite you to carry out an amicable settlement of your dispute, before contacting him again.

To note

This letter model was written by the UFC-Que-Choice Legal Information Service. Composed of lawyers, he answers questions from subscribers to Que Choisir in order to tell them how to overcome most of the consumption problems they may encounter in their daily lives: defective products and unatstated services , Litigation on insurance or bank, disputes tenants-owners, questions relating to the condominium, etc.

Attention : This letter model is not intended to replace personalized advice that could be provided to you by our local associations or by law professionals. Its purpose is to offer you an argument that you deem relevant with regard to your situation.