CIC PAY: Payment with ease, consultation and modification of the options of your remote bank contract – File | Cic

Consultation and modification of the options of your remote bank contract

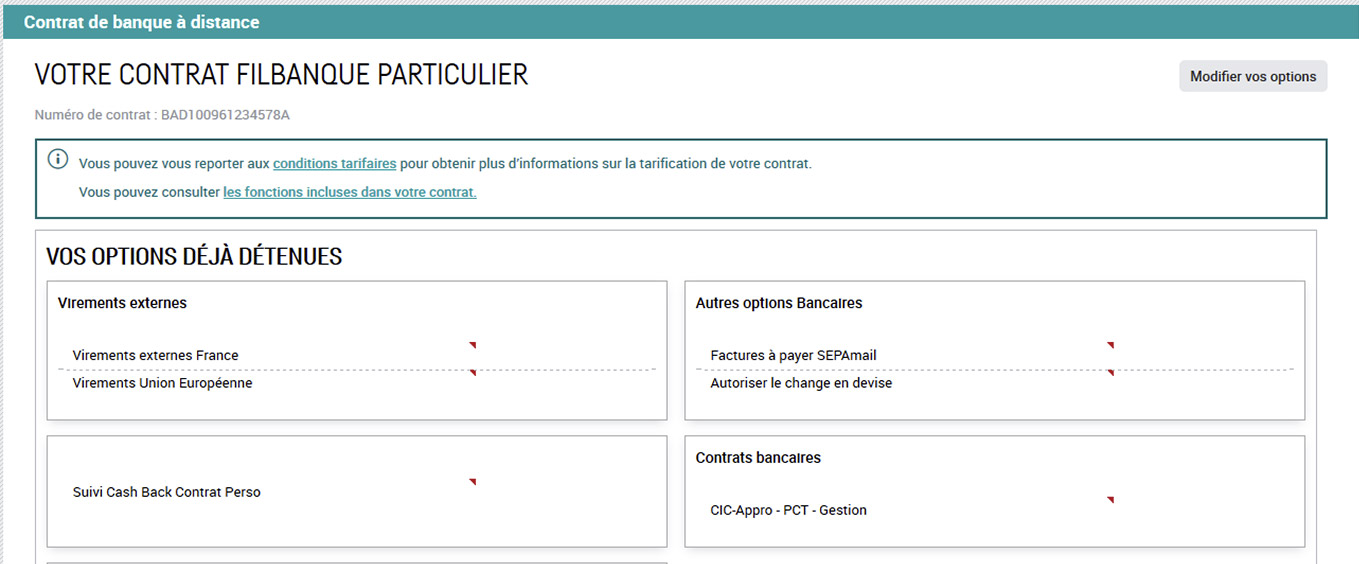

On screen number 3, before clicking the button Modify your options, You can view the options and services already active in your contract by clicking on the informative block.

CIC PAY: Simplicity payment

Pay and fire your loved ones with your smartphone.

- Payment in a gesture thanks to your mobile

- Undo -cost transactions

- Secure and easy to use

Explanation

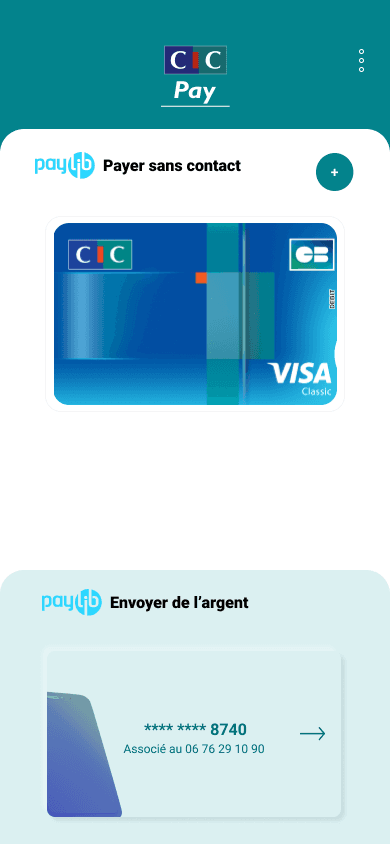

CIC Pay is an imagined payment application and developed by your bank which uses 100% French technology Paylib . It brings together 2 daily practical payment features:

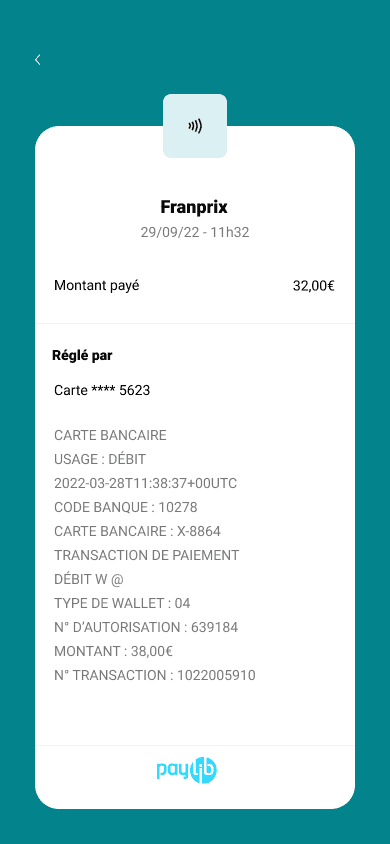

- THE Contactless payment 1 Allows you to pay with your smartphone as if you are paying with your bank card. Contactless payment is available even beyond € 50.

Note, this service is only available via CIC Pay for Android users. You can save up to 10 cards. For iPhone carriers, this service is available via Apple Pay 2 .

- THE Simplified, instant 3 and free mobile transfer (for Apple or Android users). The phone number is enough to make a free transfer and credited in real time on the beneficiary’s bank account. (this service is not available for minors).

These services are fully secure and free. Your CIC Pay application is constantly connected with your bank application 4 .

The Health advance card available on mobile !

Holders of a CIC health insurance contract can also add to their mobile their health card to set their medical expenses to healthcare professionals, without advance 5 . On CIC Pay for Android users and Apple Pay for Apple users.

CIC Pay users

To be able to use this application you must be a customer .

The little + of CIC Pay: Our application is eligible for minor customers aged 15 to 17 who are holding the course offer. J .

CIC Pay user manual for Android users

Download the application

- Go to your CIC bank application

- Click on ” Accounts “, Then ” Cards »»

- In the frame of your bank card select ” Add the card to CIC Pay »»

- You just have to follow the activation route Automated and secure.

Use the application

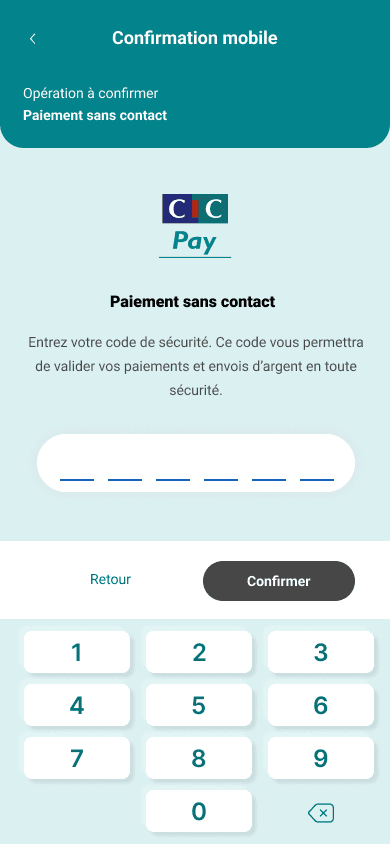

- For the Contactless payment 1:

- Unlock your phone

- Approach your mobile from the payment terminal

- Validate payment with confirmation from you (confidential code, biometric system of your phone (digital imprint or facial recognition))).

By activating quick payment, no need to enter your confidential code under € 50.

If you want to pay with another card, first select your card in the application and approach the phone of the payment terminal.

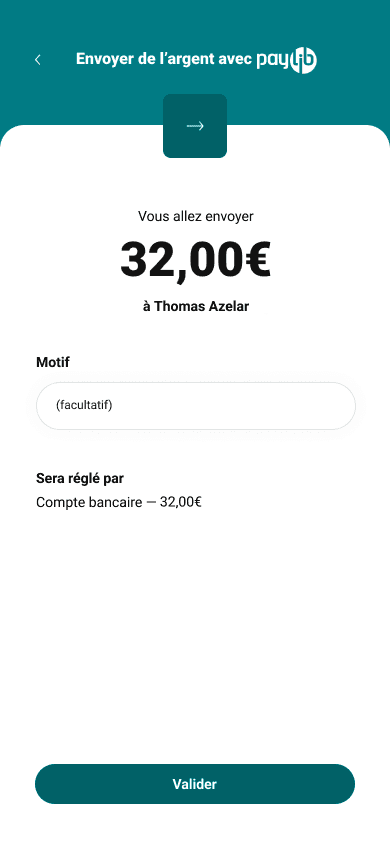

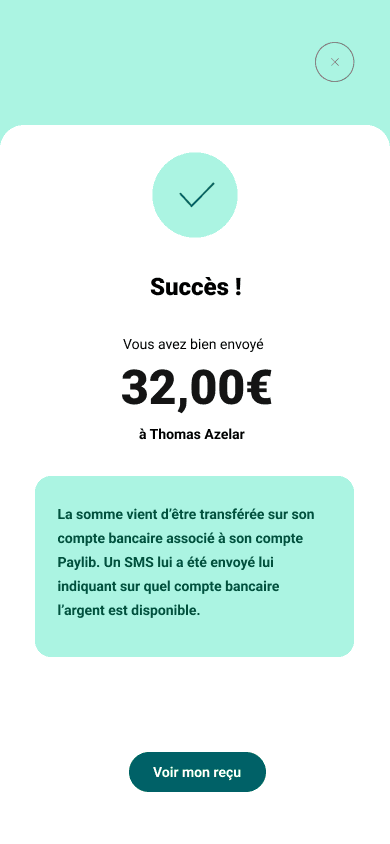

- For the Transfer by mobile number 3:

- Open the CIC Pay application

- Click on ” Send money »»

- Choose the beneficiary in your contacts or enter his phone number

- Enter the amount to send

- Validate payment with confirmation from you (confidential code, biometric system of your phone (digital imprint or facial recognition))).

CIC Pay user manual for Apple users

Download the application

- Go to your CIC bank application

- Click on ” Transfers »»

- Select ” Transfer by mobile number »»

- You just have to follow the activation route Automated and secure.

Use the application

- For the Payment with friends:

- Select the bank account on which you want to be debited in the tab ” Send money »»

- Choose the beneficiary’s contact if it is previously recorded in your phone you will just have to enter their name and first name otherwise enter your phone number

- Enter the amount to send

- You enter your confidential mobile confirmation code or use your fingerprint or facial recognition to validate the sending.

1 service subject to conditions, for customers holding an eligible payment card. Contactless payment with compatible smartphones among equipped traders. Requires the download of the CIC Pay Mobile Payment Application, a compatible and configured device as well as the Paylib service subscription . See detailed conditions in CIC agency and on www.cic.Fr.

2 Apple Service Pay offered by the ICR to eligible and Apple payment card holders. Contactless payment with Apple devices compatible with equipped merchants. List of devices compatible with Apple Pay, consult support.Apple.com/km207105. Apple, Apple logo, Apple Pay are apple incl ., recorded in the United States and other countries. Service subject to conditions. See details in CIC agency and on www.cic.Fr.

3 service subject to conditions, for customers holding an eligible payment account. Instant transfer in euros. Requires the download of the CIC Pay Mobile Payment Application, a compatible and configured device as well as the Paylib service subscription . See detailed conditions in CIC agency and on www.cic.Fr.

4 As part of your online banking service and subject to downloading the free CIC mobile application . The subscription to remote banking services, accessible via the Internet, does not include the subscription to the Internet service provider.

5 The Health advance card does not exempt from a possible remainder.

- Agencies and distributors

- Assistance

- Accessibility

- Contacts

- Newsletter

- Social networks

- Fraud and banking security

Consultation and modification of the options of your remote bank contract

No need to go to your CIC agency to add or delete features of your Filbanque contract. You can change your online options !

Consulting the options and services of your contract

Once connected to your personal space, you can access all the information related to your remote bank contract.

- The options you have taken out or not. These are features that may or may not be activated for your contract.

- Functionsincluding automatically to your contract:

- Banking services, which are only accessible to holders of a bank account (e.g. the IBAN / RIB printing service)

- other services, who do not require a bank account (eg messaging, appointment, etc.))

The modifiable options of your contract

What is the SEPA area (single Euro Payments Area) ?

In French, the acronym SEPA means single payment space in euros. This area aims to create unified payment procedures between the different countries of the European area (European Union, Iceland, Norway, Liechtenstein, Switzerland and Monaco).

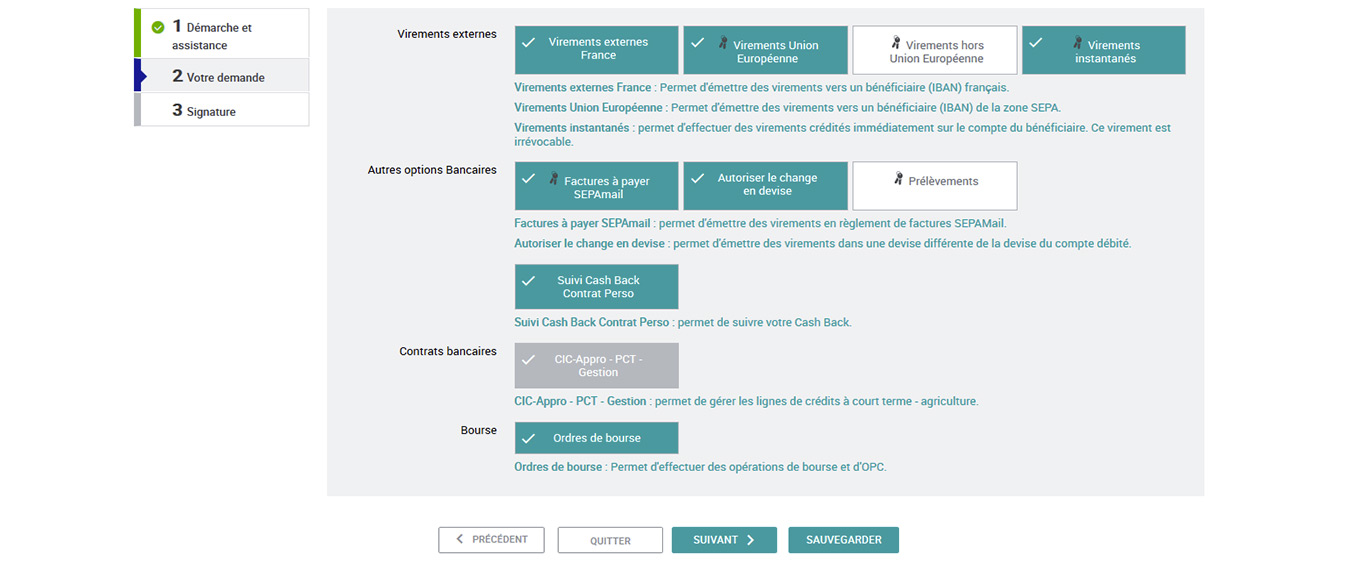

External transfers

- External transfers France: Allows to emit transfers to a beneficiary with an account in France.

- European Union transfers: makes it possible to issue transfers to a beneficiary of the SEPA zone .

- Transfers outside the European Union: makes it possible to emit transfers to a beneficiary outside the SEPA zone .

- Instant transfers: allows you to make sent transfers immediately on the beneficiary’s account. This transfer is irrevocable.

Other banking options

- Invoices to be paid: Allows you to issue transfers in payment of separate invoices .

- Authorize the currency exchange: allows you to emit transfers in a currency different from the currency of the debited account.

- Samples: makes it possible to issue withdrawals (a separate creditor identifier must be provided to your advisor).

Sotck exchange

- Stock exchange orders: allows you to carry out stock market and OPC operations (collective investment organization).

The steps to modify them online

And after ?

You can choose to transmit the endorsement to your advisor who will send you. The changes will be taken into account after return to the signed contract.

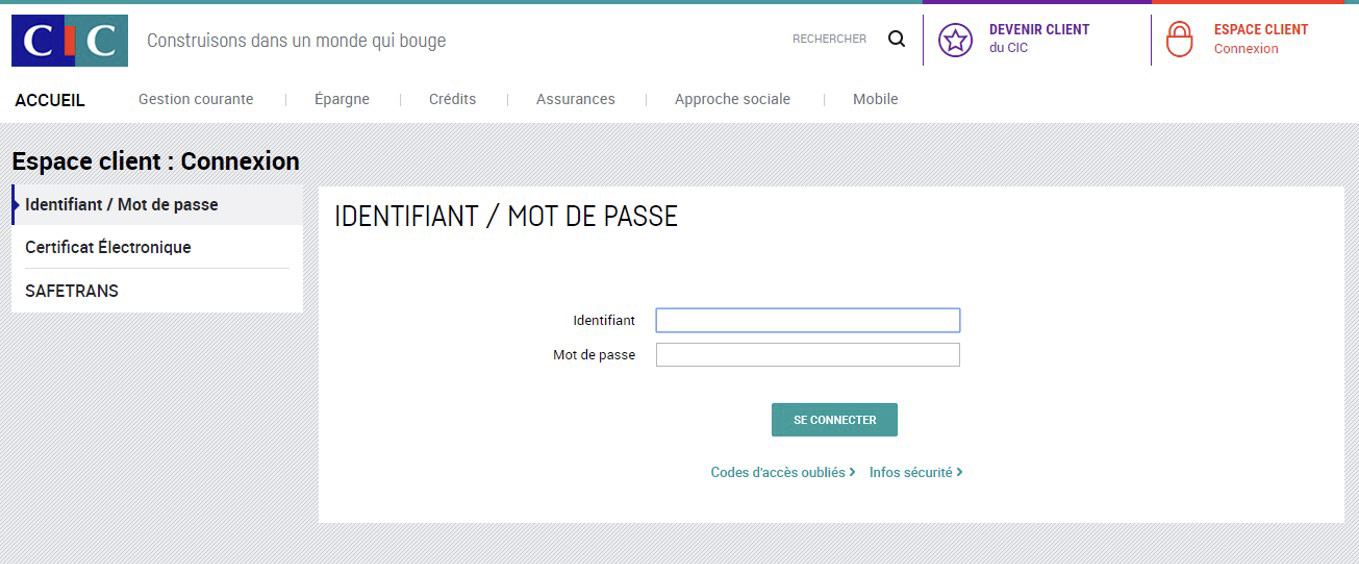

- Connect to your Customer Area 1

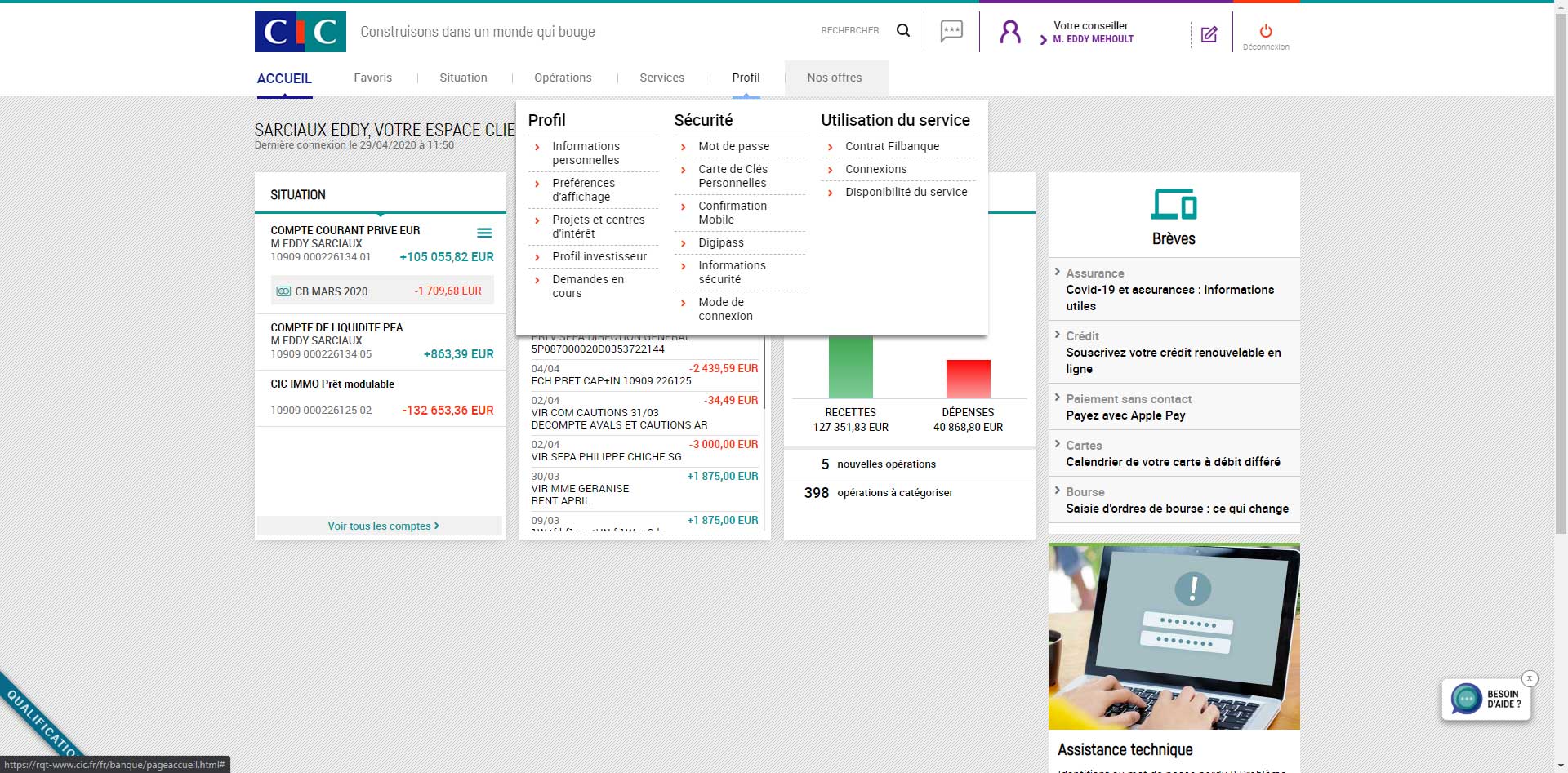

- In the menu, click on the tab Profile Then on the entrance Remote bank contract

- At the top right of the screen, click the button Modify your options

- Bring your Personal keys card. If your personal details are up to date, click on To start

- Enter the desired changes by clicking on the options (addition, deletion, etc.)). Click on the button Following When you have finished

- Choose the signature method and click on To validate

- Confirm the modification of your contract with the confirmation code sent by SMS (only for electronic signature)

Did you know ?

On screen number 3, before clicking the button Modify your options, You can view the options and services already active in your contract by clicking on the informative block.

Do you know all the features of your remote bank contract ?

To view all the functions included in your Filbanque contract, click on the dedicated link in the green box, at step 3 level.

- Accounts functions

- Consultation and operations

- Transfers

- Specimens

- Insurance

- Bank cards

- Personal space

- Other services

© CIC – February 2019

1 service reserved for customers holding a remote bank contract.

2 examples of sensitive options: transfer in and excluding European Union, invoices to be paid on Sepamail, management of credit levies, etc.

Strong authentication for your accounts

Strong systematic authentication allows you to access all the features of your customer area.