Bunq: our opinion in 2023 • Finance heroes, bunq reviews: to read before opening an account!

Bunq review: everything you need to know

➡️ Our opinion on the BUNQ application is really positive: it is as practical as it is elegant. The integrated features to manage your daily budget are practical (limits on expenses and subscription management), as is the possibility of creating sub-accounts to save and set expenses, alone or in a group. We only regret that the cashback is reserved for paid offers, even if a partnership program offers you a whole range of discounts.

Bunq: our opinion in 2023

The Dutch neobank stands out from its competitors by highlighting its green and responsible offer: Easy Green. Is it interesting to open an account at Bunq in 2023 ? Here is our full and detailed opinion on the question !

Our opinion in short on Bunq in 2023

- The Easy Green offer which plants a tree every 100 € spent

- International payments

- The bunq pack up to 4 people and its advantageous price

- The possibility of making species deposits !

- Group payment and savings features

- The cashback (with easy money and easy green)

- The free offer is only a paid deposit account (1.56%/year)

- No travel insurance

If you are looking for a green and ethical bank, consult our comparison of the best eco-responsible banks !

The Dutch bank Bunq offers a complete and accessible offer to everyone, close to that of Revolut or N26. Nevertheless, its eco -responsible and ethical aspect could tip the scales on its side, allowing you to reduce your carbon footprint (1 tree planted every 100 € spent) and save to make donations to associations automatically.

In addition to this eco-responsible aspect, Bunq offers many innovative features, including currency exchange, the possibility of having up to 25 sub-accounts, or an automatic savings system each payment by card.

Bank of the free: mobile bank that makes life easier

Bunq’s promise

Is Bunq currently the best online bank ? Could it become your new main account ? Response immediately in our full and detailed opinion ! ��

1 month offered to try bunq

Bunq: the green and ethical online bank that makes life easier ?

Like other neobanks, Bunq was born from the vision of a man wishing to revolutionize the banking sector: Ali Niknam. Since 2012, Bunq has been the Liberty Bank and even managed to obtain its European banking license in 2014, which had not happened for over 35 years. After a year of testing, Bunq was officially launched on November 24, 2015 to the general public. Bunq business will follow in 2016, its professional offer, and a dazzling development to the present day, to reach the status of unicorn in 2021.

But then Bunq holds all its promises in 2023 ? This is what we will see together in our full and objective opinion !

Our opinion on Bunq’s offer

Bunq allows any natural person to open a bank account, without conditions and without obligation. Nevertheless, to take advantage of the eco -responsible aspect of Bunq, it will be necessary to take the most upscale package, or be under 18 years old !

We have analyzed in detail the offers proposed by Bunq in 2022 and here is the essential to remember:

Free offer bunq easy savings

For the modest sum of 0 € per month, you are entitled to:

- A paid deposit account: with an annual rate of 1.56%, the interest of which is paid monthly.

- Participation in the Bunq Jackpot : every month 3 users BUNQ won € 10,000 per lot.

- A savings account open to minors and professionals.

- The possibility of making species deposits in more than 10,000 stores in Europe.

- Please note, deposits greater than € 50,000 are charged !

Bunq Easy Bank at € 2.99/month

The Easy Bank offer offers the advantages of the Easy Savings offer and adds:

- A physical bank card MasterCard.

- Access to international transfers with wise.

- Mobile payment with Apple Pay and Google Pay.

- Instant, free and unlimited transfers.

- The possibility of having a joint account and shared sub-accounts.

- Offer open to minors, who will plant a tree automatically every 100 € spent.

Bunq Easy Money at € 8.99/month

With the premium bunq offer, you have, in addition to the advantages seen previously:

- 4 free withdrawals per month in Europe.

- Up to 3 physical cards and 25 virtual cards offend.

- The possibility of having a “free” metal card : Against a 24 -month preparation.

- Offer open to minors (under parental control) and professionals.

- Manage and expend in 15 currencies, unchanged.

- Payments card without international costs, unlimited.

- Access to an Easy Investments controlled management title account (supplied by BIRDEE).

- The creation of sub -accounts to manage its budget and its currencies.

- A catalog of BUNQ Deals with exclusive discounts and advantages.

- Reformer a friend and he will plant a tree every 100 € spent.

- Purchasing protection with MasterCard.

- Access to the bunq pack: 4 cards and 4 individual accounts for € 23.99/month.

Bunq Easy Green at € 17.99/month

Bunq’s high -end and eco -responsible offer gives you access to:

- A “offered” metal card For a 12 -month preparation.

- A tree planted every 100 € spent : reach carbon neutrality in 2 years !

- Access to responsible investments : you choose where your money is placed.

Bunq for professionals

Bunq Business is the offer dedicated to professionals who will surely be the subject of a full opinion on Finance heroes �� In the meantime, you can consult our comparison of the best pro banks online.

➡️ The hero finance notice on the BUNQ banking offer

Bunq’s banking offer is very good quality, Despite the absence of a real free offer (only a savings account with Easy Savings). The Easy Bank entry -level offer seems a bit limited to us, but can serve as an extra account, or the first account for a minor, under the control of a parent.

It is from the Easy Money offer that Bunq reveals all its potential and unlocks all its features. Finally, the Easy Green formula is an excellent alternative to other metal cards (Revolut, VIVID, N26, etc.), emphasizing reforestation and responsible investments, even if there are neobancs specializing in this today domain (see. Our comparison of the best green, ethical and eco -responsible banks).

1 month offered to try bunq

Our opinion on the costs of BUNQ

Important points regarding BUNQ costs:

- Almost no incident fees : your account cannot be in negative and the few possible incidents do not lead to fees.

- Without inactivity costs: Whether for the use of the card or account.

- International payments without commissions, unlimited : even with the Easy Money offer and in currencies.

- Free and unlimited instant transfers.

➡️ The hero finance notice on the costs of BUNQ

Our opinion on the costs of BUNQ is very good : apart from the monthly subscription, you have very little costs. Even if other neobancs do even better, the Metal Easy Green offer is an excellent alternative to that of Revolut for example (at € 14.99/month), if you want to get started easily and plant trees by spending !

1 month offered to try bunq

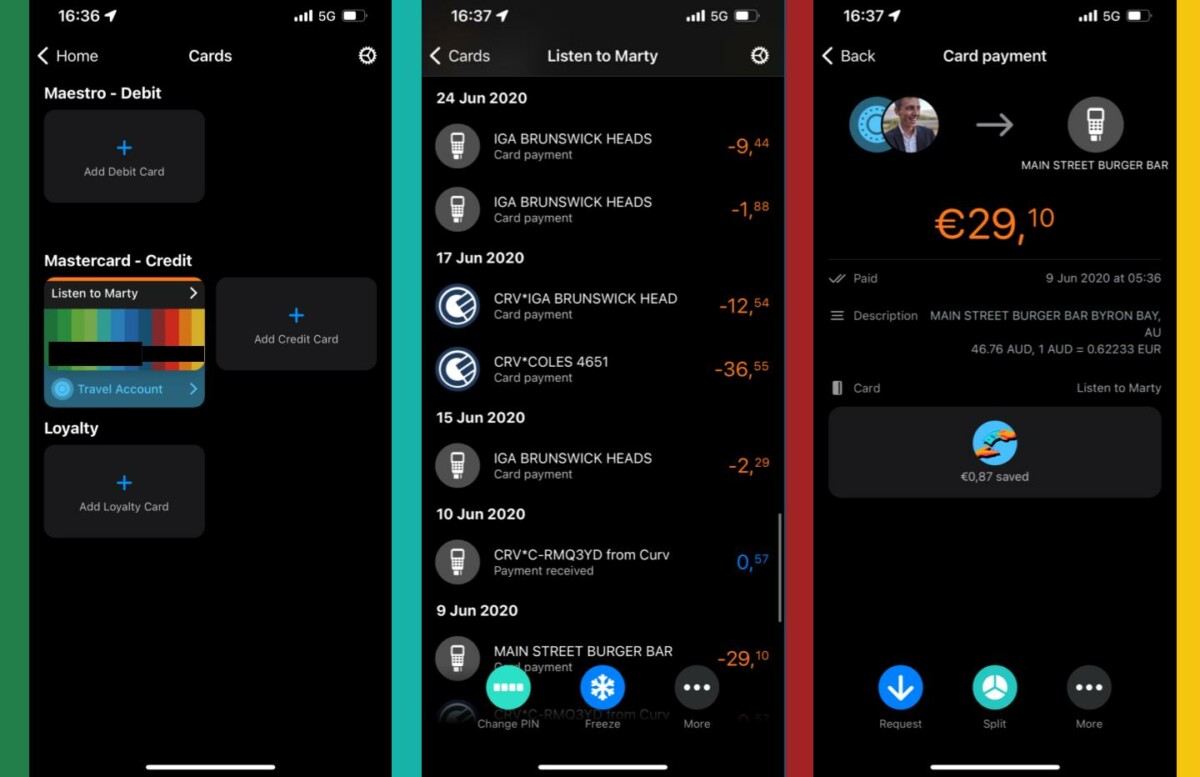

Our opinion on Bunq cards

We have summarized for you the main characteristics of BUNQ cards:

- Accessible without income conditions and without commitment : even if you have to prepare for a year or two to have the metal card for free.

- Mastercard cards with very important payment ceilings: € 50,000/day subject to a available balance, of course. ��

- The 25 free virtual cardsWith offersEasy Bank and Easy Green : usable as soon as it is opened and feeding the account.

- The very practical automatic savings option : your card payments are rounded up to the upper euro and the difference is placed.

- The cashback: 1% cashback on restaurants and bars with easy money + 2% cashback on public transport with Easy Green.

➡️ The hero finance notice on bunq cards

The range of cards offered by Bunq is of good quality and accessible without conditions. The payment ceilings are almost unlimited, the cards being only in immediate debit. Withdrawals in euros, however, are free but limited in number, even on high -end offers. Too bad, as is the absence of a virtual card with Easy Savings and Easy Money offers, or even travel insurance, even with Easy Green.

1 month offered to try bunq

Our opinion on Bunq’s features

Our opinion on the BUNQ mobile application

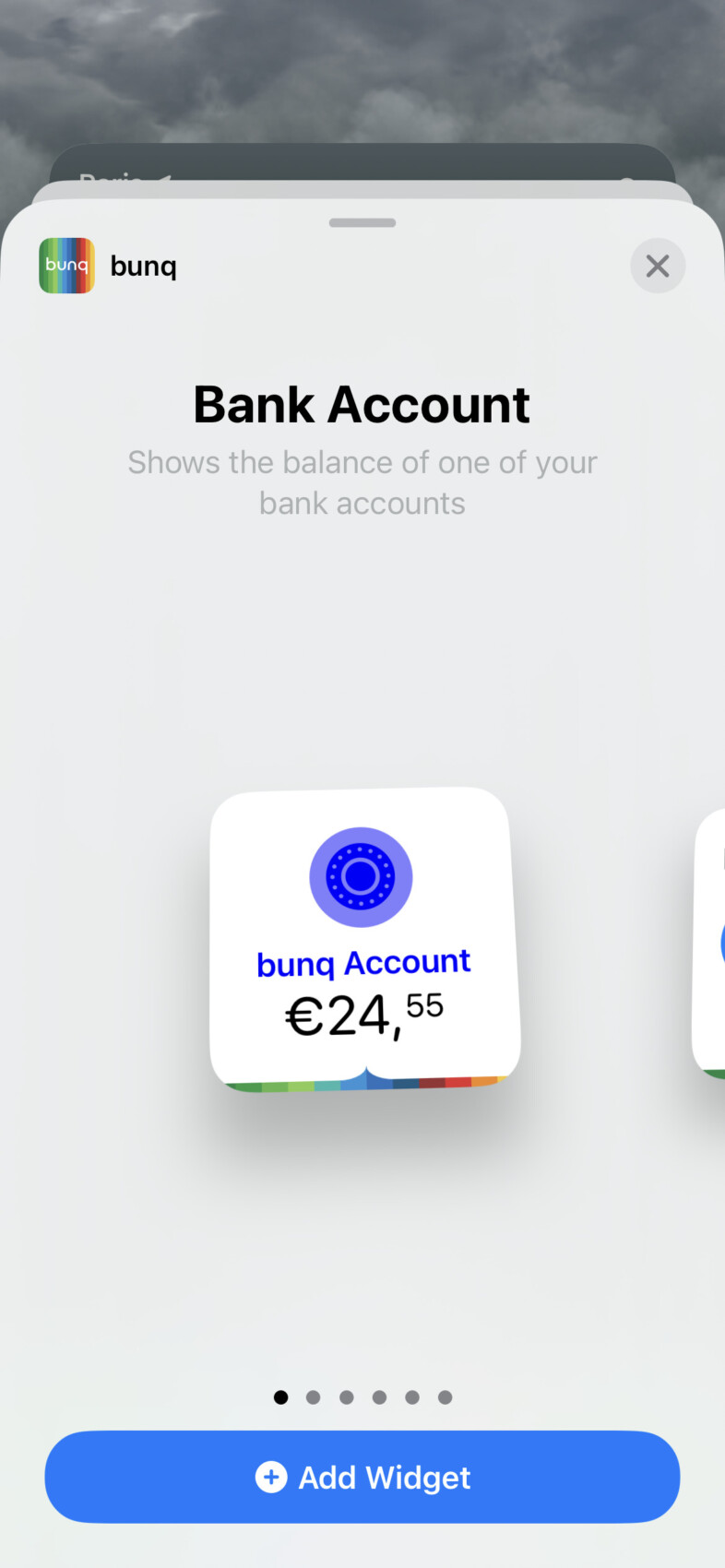

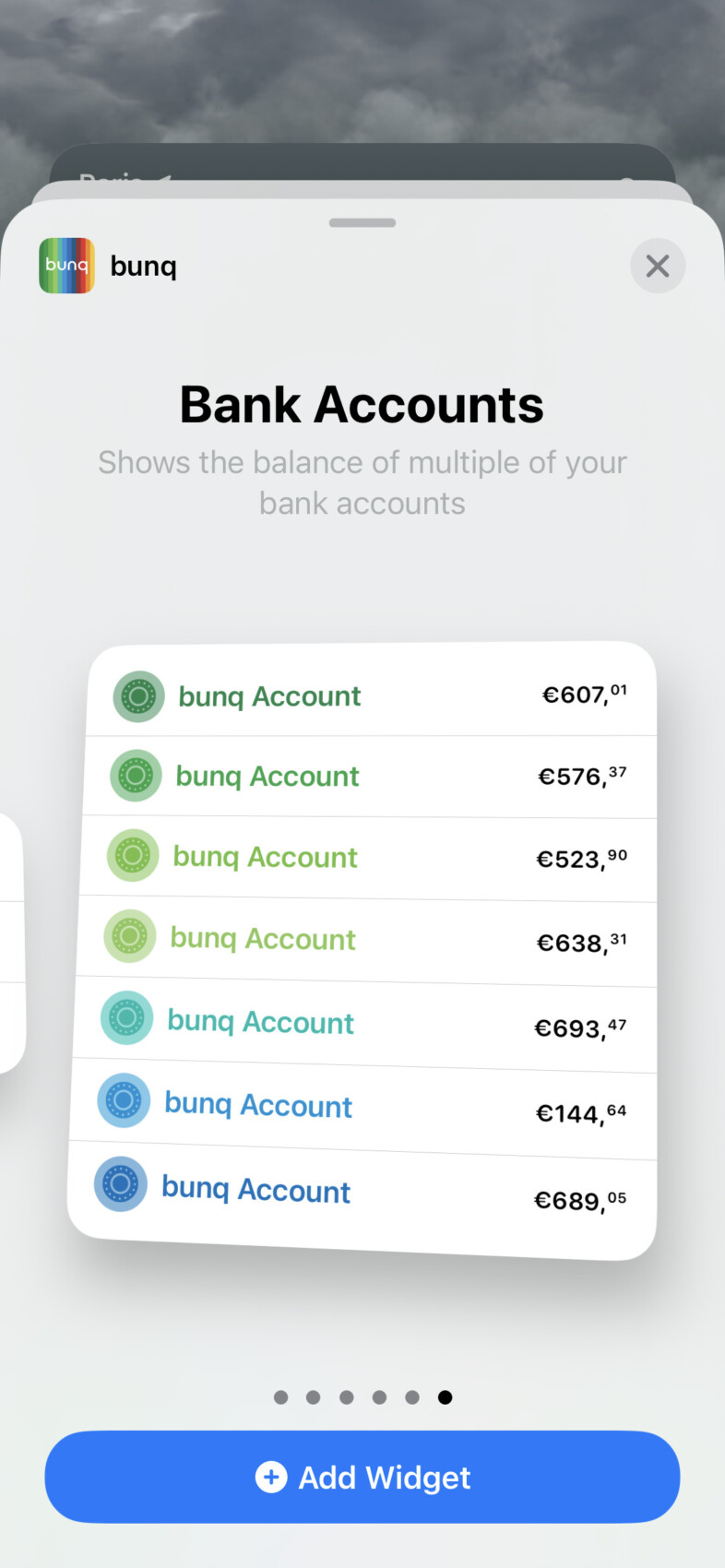

Bunq offers an application to the sober and efficient design, giving easily access to many innovative features, such as:

- Complete management of your physical and virtual cards.

- Monitoring your expenses and your budget in detail, with the possibility of setting limits and notifications for each operation.

- The creation of currency sub-accounts, that you have the possibility of sharing, in order to save or pay expenses, alone or with several.

- International transfers in partnership with WISE: announced 9 times cheaper on average than a conventional bank.

- An automatic savings option : your card payments are rounded up to the upper euro, the difference is placed in a dedicated sub-account.

✅ Apple Store’s opinions are excellent overall with a score of 4.3 / 5 on more than 1,500 reviews. The Google Play version is also noted 4.3 / 5 of more than 18,000 reviews. The application is very regularly updated, whether to correct bugs or add features.

➡️ Our opinion on the BUNQ application is really positive: it is as practical as it is elegant. The integrated features to manage your daily budget are practical (limits on expenses and subscription management), as is the possibility of creating sub-accounts to save and set expenses, alone or in a group. We only regret that the cashback is reserved for paid offers, even if a partnership program offers you a whole range of discounts.

1 month offered to try bunq

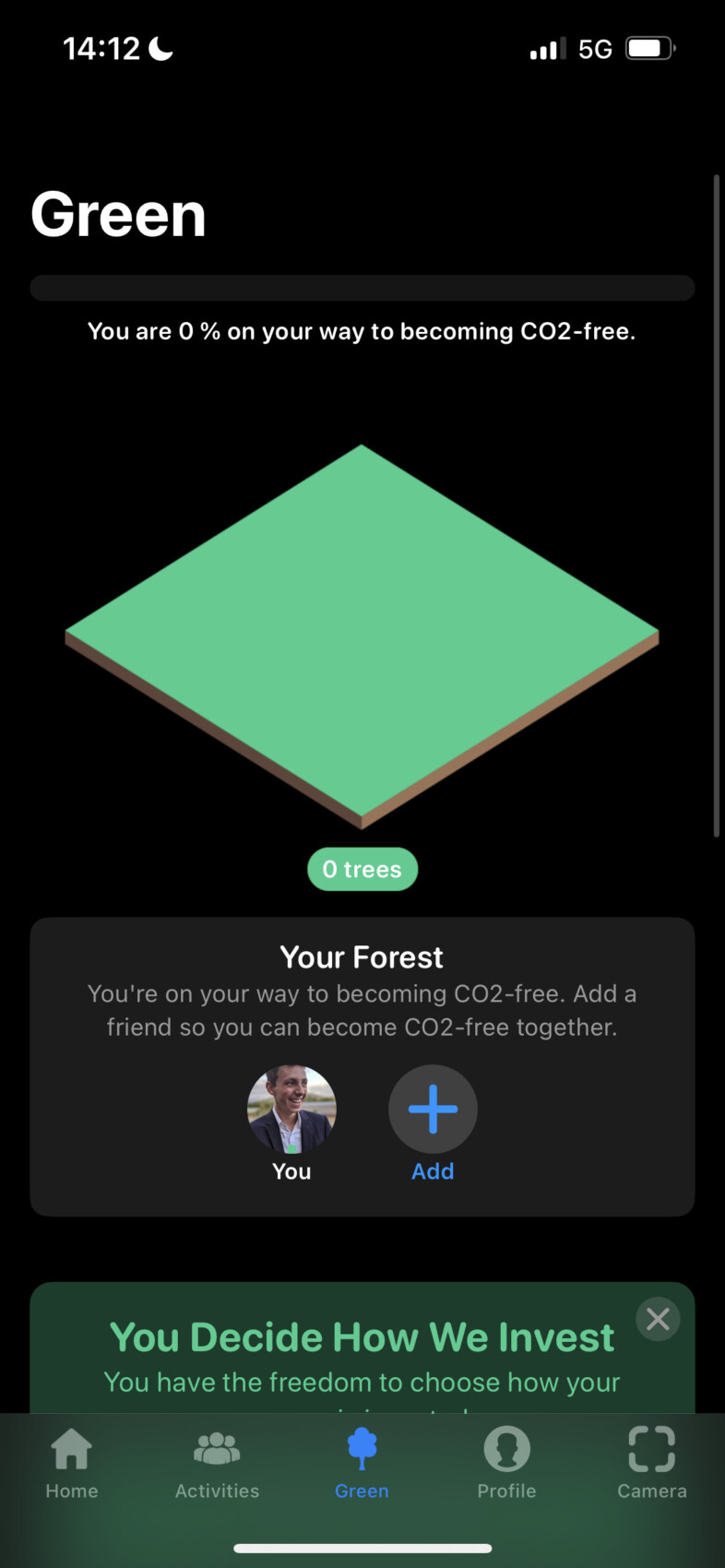

Our opinion on the eco -responsible aspect of Bunq

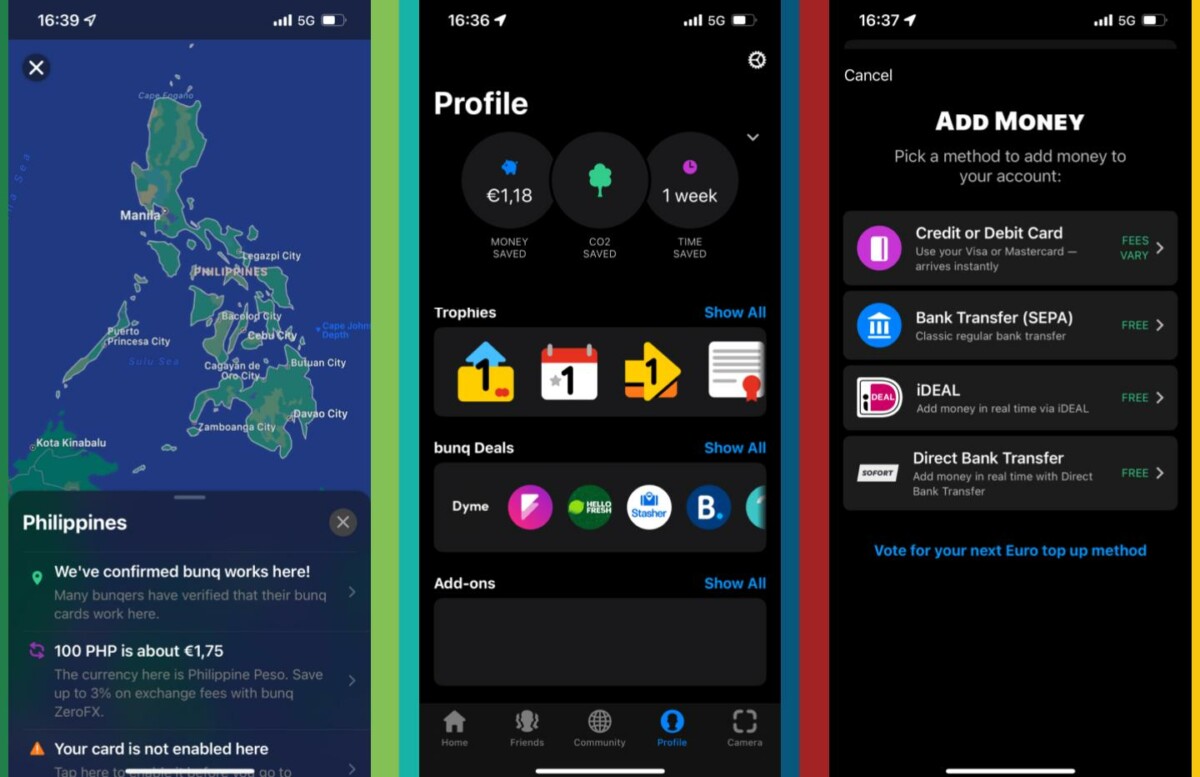

Bunq highlights its reforestation action, in partnership with the Eden reogenic project Association which provides a fair salary to premises to plant trees, in Madagascar, Nepal, Haiti, Indonesia, Mozambique and Kenya.

If you spend 1000 €/month with BUNQ, you will therefore plant 10 trees per month and can reach carbon neutrality in less than two years !

Even if Easy Green highlights its ecological action, this is not the case for its other offers. We also do not know how Bunq uses your deposits on current accounts.

If you want to really know how to be used is used your money and commit to sustainable development and/or humanitarian and social actions, consult our comparison of the best green, ethical and eco -responsible banks.

1 month offered to try bunq

Our opinion on loans with BUNQ

❌ As you can see, Bunq does not offer any credit offer, not even an authorized overdraft … perhaps later, in partnership with a specialist ? In the meantime, if you are looking for an online bank capable of funding you, you can consult our comparison of the best online and neobank banks.

Our opinion on Bunq’s investments

Bunq offers, in terms of savings, only a paid account at 1.56% per year, whose interests have the distinction of being paid every month. It’s the Easy Savings account that’s 100% free.

✅ Since February 2022, Bunq offers, in partnership with Birdee (Robo Advisor of a subsidiary of BNP Paribas Asset Management), a secrecy allowing to invest in ethical and eco-responsible companies, that is with the automatic savings that you constitute each payment card, either by paying it. You have the possibility of programming your investments at different frequencies: weekly, monthly, quarterly, etc

Since BIRDEE also offers life insurance contracts, it is not impossible that BUNQ subsequently offers it ..

1 month offered to try bunq

Our opinion on BUNQ in practice

How to open your BUNQ account ?

Only one solution to open your BUNQ account : go through the mobile application.

The Netherlands Neobank announces an account opening in 5 minutes and it is not a lie!

�� Here are the steps to follow in the application:

- Choose

- Inform your personal data

- Send your identity document

- Take a video selfie to check your identity

- You have finished !

- It remains to wait for the validation of Bunq and possibly, your physical card

You will understand, it is very easy to open your account at Bunq, there is just a manual verification of your identity, but it is common today.

1 month offered to try bunq

Our opinion on BUNQ customer service

✅ BUNQ offers customer service reachable 7 days a week, 24 hours a day.

No telephone line but messaging within the application, an email address, or you can call on the community of Bunq, with a system of questions and answers close to a forum.

There is also a telephone line for emergency cases only: I find that it is an excellent initiative to prioritize requests. If you call, it is that you really have a serious and/or urgent need and you will be supported in priority.

Conclusion: When to open an account at Bunq ?

As a conclusion, our opinion on Bunq is positive : it is an innovative and accessible neobank, with a pinch of eco -responsible engagement that can make all the difference.

Here are the important points that we remember:

- Accessible physical and virtual cards without income conditions.

- An ideal solution to have currency accounts and change very easily.

- Innovative and responsible investment possibilities.

- A paid account to 1.56% annual gross whose interest is paid every month.

- The possibility of having ribs from different countries, including France.

- A very ergonomic and customizable application.

Bunq seems to listen to his community and keep improving : the features continue to expand and we hope that those dedicated to responsible investment, donations to associations and the financing of the ecological transition will develop even more.

A neobank for which profile ?

Bunq is ideal for everyone who needs to access different currencies easily, with advantageous exchange rates, whether to travel or send money abroad. With the possibility of acting for the environment if you are minor or choose the Easy Green metal card.

Nevertheless, the supply of savings and investment is today quite limited, and it will be necessary to turn to other green and ethical neobancs, even an online bank if this aspect interests you.

1 month offered to try bunq

Antoine was heritage advisor and private banker before joining Finance heroes. He puts his service and his experience in the banking environment at your service.

Comments

January 23, 2023

It is true that Bunq really makes life easier, in particular thanks to its application. Depending on the offer chosen, it is possible to make instant payments, organize your budget in advance and obtain interest on your deposits.

Merle de Chateaub

February 14, 2023

I don’t think the lack of travel insurance is a defect. It is above all a bank. Of course, it would be interesting to be able to benefit from such a service, but I think they will add something to the future. For the moment, I am content to take advantage of their application which is very practical.

February 15, 2023

Good morning,

Indeed, it is not necessarily a problem for everyone. �� But when other online or neobank banks offer insurance for the same price or even cheaper, it is important to emphasize it, see. Comparison of the best neobancs 2023 & best online banks: comparison 2023

February 24, 2023

It was an instructive and quality reading. I had already heard of Bunq but I did not know that they had so many useful features. I can’t wait to try some by myself ! I particularly liked the way they set out to conclude partnerships to reduce the cost of international transfers. Today it is much easier to use it rather than usual banks.

It’s a good bank. I use very few features, but I will still order an additional card.

What I prefer is that all the manipulations that I do on the site take a short time. They are not trying to put obstacles, it is appreciable.

Good morning,

Thank you for your feedback. ��

Bunq review: everything you need to know !

You want to have a BUNQ opinion To help you know if you have to open an account in this mobile bank ? You are in the right place ! ��

We offer with this guide on Bunq to review the advantages and disadvantages of the products and services of the Dutch neobank. We will see together the positive points and the negative elements that seem to emerge, to build our opinion on this establishment.

Our goal is to allow you to have a full opinion on BUNQ to see if you want to test this mobile bank to you with full knowledge of the facts.

And we start immediately with a table that sums up the BUNQ opinions that must be known: ��

Bunq reviews: In summary

✔️ Lot of 25 free sub-accounts

✔️ Bank with concrete ecological dimension

✔️ Free payments

✔️ Advantagey international fees

✔️ Well thought for globetrotters

– Balance

BUNQ review: In summary !

Our BUNQ opinion is rather positive. Mobile bank is interesting to easily or collectively manage an account. Ecological values are marked with the freedom to place your money to finance environmental projects. Several services offer the opportunity to save money and facilitate the management of your personal or pro accounts. The disadvantages aim for the constraints of an authorization card and the absence of French RIB.

�� Our BUNQ opinion in summary::

- A range of full features

- PRO PRACTICAL offers

- an interesting ecological sensitivity

- Paid but affordable offers

- Our opinion on BUNQ is positive ✔️

Bunq review: our more detailed analysis !

We present to you in this first part of our opinion BUNQ accounts for individuals. The mobile bank offers three formulas. We start by seeing the standard offer bunq easymoney personal. We continue with the more original offer Bunq Easytravel dedicated to travelers.

Finally, we finish with the ecological offer called Bunq Easygreen Personal ��. To know everything, follow the guide !

Bunq reviews: Accounts for individuals

�� Bunq review: the Easymoney Personal account

Our opinion on Bunq Easymoney Personal is that the standard offer of the neobank is efficient on account management services. The customer has great freedom and many tools to control his savings. Alert notifications are useful to be quickly informed. Savings remuneration is also attractive. The negative points concern the paid offer, a product limited to mainland France and non -French IBAN not always practical.

Bunq Easymoney Personal

Here are the main assets of the Easymoney Personal de Bunq offer:

- ��Easy money management : the Easymoney Personal de Bunq offer allows simple management of its budget. It is the standard offer of the establishment which differs from competition by associated functionalities such as the creation of sub-accounts with dedicated IBAN or the possibility of linking a bank card to two sub-accounts via patented Dual Pin technology

- ��Remuneration of his interesting savings : BUNQ offers to remunerate sleeping money on the account systematically and without needing to think about it. The interest rate is 0.27%. In addition, like Revolut, Bunq Easymoney Personal offers to feed a kitty with the rounding for each payment by card made

- ⏳A very fast subscription : Opening an Easymoney Personal account at Bunq is fast and only requires 5 minutes. The customer only needs a smartphone, an identity document and an address. It is enough for him to send a photo and voila

Now let’s see the advantages and disadvantages of the Bunq EasyTravel offer in the next part of our opinion on the BunQ offer.

�� BUNQ reviews: the EasyTravel account

Our BUNQ opinion is that the EasyTravel card is attractive to travelers. The international bank card operates in the euro zone as abroad. No account holding fees. Exchange rates are real for cheaper transactions than in traditional banks.

Expenditure monitoring is automatic, optimal security with the possibility of activating or deactivating international payments. The disadvantage is control of the account balance with less freedom.

- ��A free card without conditions : The EasyTravel card is free, the customer paying no monthly subscription to have one or account holding fees. The customer just has to pay the card order. He uses it in the euro zone and abroad, without risk of overdraft since it is a system with systematic balance.

- ��Attractive savings on the exchange rate : the EasyTravel Bunq card is interesting to take advantage of real exchange rates without additional addition. The mobile bank thus makes it possible to achieve up to 3% of saving compared to traditional banks for each payment in currencies

- ��A real credit card valid around the world : This easytravel card is a useful mastercard credit card for travelers that works all over the world. It is therefore a practical solution to pay for the rental of a car abroad, to reserve your accommodation or to settle at the end-line terminals in planes

Place now in our opinion on the Bunq Bank for the analysis of the advantages of the Easygreen card ! On the program: ecology !

�� Bunq review: the Easygreen Personal account

Our BUNQ opinion is that the Easygreen Personal card is original. The customer benefits from all the features of an Easymoney Bunq card. It also benefits from a singular card more respectful of the environment. This ecological profile is reflected in the financing of reforestation programs. The metal card is also greener, more durable, using half less plastic. The drawback is that this card is paying and does not allow overdrafts.

Bunq Easygreen Personal

The main assets of the Easygreen Personal de Bunq card are as follows:

- ��An ecological map : Easygreen holders contribute to sustainable development. They allow you to plant a tree at each slice of 100 euros spent with their Easygreen card. In addition to reforestation, the customer can choose the metal card, less consumer of plastic and more sustainable over time.

- ⚙ A range of full features : Management of the account linked to the Easygreen Personal is very simple thanks to the functionalities identical to the Easymoney Personal Bunq card. The customer can easily manage his budget, save effortlessly, travel serenely and keep the absolute control of his personal finances

- ��A quick registration : membership in Easygreen Bunq is 100% dematerialized. Registration lasts only 5 minutes and requires only few documents and information (a telephone, an address and an identity card)

We will see in the next part of our opinion on BUNQ cards, the offer set up for professional customers.

Bunq reviews: Accounts for professionals

Our BUNQ opinion is now attacking the offer dedicated to professionals. Mobile Bank declines its product range in two solutions. First, the establishment offers its standard offer, the Easymoney Business account, which we will review all the advantages. Then, BUNQ distributes its ecological version called Easygreen Business, with the possibilities oriented sustainable development that we will decode. Let’s go ! ��

�� Bunq review: Easymoney Business account

Our BUNQ opinion on the Pro offer is that this is a flexible solution. The business manager takes advantage of a powerful pro account. Annex services are interesting to save time. The offer includes accounting tools and operations monitoring notifications. Security is maximum. The disadvantages concern the account holding costs which are paid and the absence of French IBAN.

Bunq Easymoney Business

- ⚙ Useful management tools : BUNQ makes business management faster by offering many practical tools. This is the case with the direct connection between the Easymoney Business account and the company’s accounting software or automatic monthly export

- ��Perfectly readable professional finances : the mobile bank offers an immediate overview of the company’s finances. Professionals save time by organizing their accounts with sub-accounts or by linking a BUNQ bank card with two separate accounts

- ��Information on real -time accounts : the Easymoney Business account holder is permanently informed thanks to instant alert notifications. Each operation triggers the sending of a notification for monitoring reactive transactions, the business manager retaining control over the cards and the limits of real time. He can also make very useful forecast projections

What is the added value of the Easygreen Business card distributed by the mobile bank ? This is what we will see in the next part of this opinion on Bun Bun.

�� BUNQ reviews: the Easygreen Business account

Our Bunq Easygreen Business opinion is that this is an ecological pro solution above all. Companies contribute to reforestation for each payment. The money paid on the account can be oriented to finance green projects. Professionals take advantage of many services used to save time and save money. The downside is that the offer is paid and monthly withdrawals also from a number.

Bunq Easygreen Business

Let’s examine the main characteristics of the Bunq Easygreen Business offer:

- ⏳An account for rapid management : the mobile bank allows the business manager an appreciable time saving. Several features are made available to it such as invoice divider, Slice Auto or compatibility with mobile payment solutions (Apple Pay, Google Pay)

- ��An account to boost your ecological footprint : The Easygreen Business account is favorable to reducing carbon dioxide emissions. The mobile bank offers a reforestation program and leaves the professional free to choose where to enclose his deposits.

- ��An economic account for its finances : BUNQ allows professionals to control their finances optimally and personalized. All subscriptions are grouped in the same place in order to visualize any excess. Other sources of savings: Zerofx service to gain 3% on foreign exchange operations or individual travel assistance to maximize its travel budget

After having carefully scrutinized the offer for the pro mobile bank, let us now observe the prices in our Bunq review in detail.

�� BUNQ reviews: prices

Our BUNQ opinion and its prices is that the establishment has paid offers. The mobile bank has account holding costs except for the easytravel which is free. The establishment is flexible regarding the conditions of access or income. Payments are free as withdrawals but not unlimited. Business account costs are higher. The negative point concerns the recharges of the account by paid card.

Bunq prices

Here are the main elements to remember on the prices applied not the Bun Bunq bank:

- Pro more expensive than private accounts : the costs of accounting for professional offers are higher than those of offers for individuals. However, the range of services and tools available is identical except that some are useless for individuals

- Competitive costs on transactions from one country to another : Mobile Bank customers go through the International TransferWise money transfer service to advantageous prices. Transactions are exempt from commissions unlike those that involve a traditional bank

- Paid withdrawals from 10 per month : the negative point of BUNQ prices concerns the cost of withdrawals. They are free but from the eleventh carried out in the month, the operation is billed 0.99 euros.

Our opinion on BUNQ now takes us to look at the assets of the mobile application, in particular by studying user feedback on download platforms.

�� BUNQ review: the mobile app

Our BUNQ opinion is that the functionalities of the mobile application are rich and efficient. The customer can manage their account and card in a simple way. The creation of sub-accounts is easy as is the distribution of savings. The app also promotes the sharing of payments with friends and time saving for professional customers. The negative points concern technical bugs and absent features such as bank aggregation or card management.

Bunq mobile app

Here are the main features of the Bunq mobile app:

- �� Very simple budget management : in a few clicks, the customer can open a sub-account dedicated to an objective and program regular payments to power this kitty. Each sub-account has an IBAN (CAUTION IBAN NON-French) to initiate direct debits, transfers and payments by CB. Not to mention sources of savings with the exchange rate or the rounding system at the upper euro

- �� Many features for real account management : the BUNQ app has multiple tools to save time and money to its private customers and professionals. A real piloting center, the BUNQ mobile application allows you to instantly know the state of the provisional account balance thanks to push notifications or budget projections remaining for the end of the month

- �� Perfectly secure account management : the application is compatible with iOS and Android securely. The data is not used by the mobile bank for commercial purposes. Messaging is secure to keep the confidentiality of exchanges. Finally, Bunq guarantees deposits up to 100,000 euros thanks to its European banking license

- ❤️ Very good notes on blinds : Then here are the reviews on the BUNQ app on the main blinds with the following user notes: 4.4/5 on AppStore (950 reviews), 4.1/5 on Google Play (8750 reviews)

The positive points on the BUNQ app according to users concern the range of features. Customers believe that many possibilities allow you to have optimal control on the account. They also appreciate the tools for managing money in a few clicks.

The negative points on the BUNQ app according to users mainly come from the implementation of a new version in the summer of 2020. Navigation seems less fluid to users. The customer experience suffers from technical bugs and an ergonomics to improve.

Now let’s review customer feedback in our BUNQ review on the overall offer of banking products and services.

�� What is the opinion of Bunq customers ?

BUNQ customer reviews are positive and negative. Customers like the range of bank account offers. They appreciate the flexibility offered by the number of bank cards and the functionalities of the mobile application. Other customers complain about technical bugs that damage their user experience. Critics evoke cases of closing incomprehensible accounts and regret the ergonomics of the old version of the mobile application. On Trustpilot, Bunq collects the average note of 2.6 out of 5 stars.

The 1,500 BUNQ customer reviews are very clear and distributed as follows ::

- 39% excellent

- 6% good

- 4% average

- 6% low

- 46% bad

The positive feedback on the bunq offer say they appreciate access to 3 physical cards in the Easymoney Personal offer. They like to have payment cards with different confidential accounts and codes to distribute CB between family members. They are also happy to have virtual cards for their online purchases. They highlight the fact of being able to link several cards to a single account or sub-account.

For people who travel abroad, Bunq also appears relevant. The fees are limited, thanks to real -time exchange rates and transactions without overflows initiated with the partner and specialist TransferWise.

The possibility of blocking the card in the event of loss or flight on the app is put forward, especially since it is enough to use the second to continue your stay without worry. Finally, the instant notifications and the upper rounding that allows you to save are praised.

Negative opinions on BUNQ focus mainly on the misadventures of certain customers, in particular those who have seen their bank account temporarily blocked. The quality of customer service is not always optimal, especially since English is the language of exchange. Other criticisms of the new version of the mobile application which seems less fluid and less navigable. We note that the developer teams are reactive to erase the technical bugs as quickly as possible.

Some negative criticisms evoke the problems of transfers. This question comes back to that of IBAN. Bunq is a Dutch establishment that associates its account with a European Iban. It is perfectly legal except that in France certain administrations refuse to use another IBAN than French. Other foreign neobancs also undergo this problem while it is the French administrations that have the obligation to adapt.

Once Bunq’s customer reviews have passed under our magnifying glass, the time is up to the balance sheet and synthesis in our review Bunq.

Bunq card review: in conclusion !

Our BUNQ opinion is positive. The offer is accessible to everyone without income condition. Individuals have the opportunity to choose to invest their money on ecological projects. They can also save on their transactions. Professionals benefit from practical tools to save time. The negative points concern the balance control card, the non -French RIB, the invoicing of withdrawals from the tenth and the latest version of the low -ergonomic mobile app.

�� Regarding bank accounts for individuals, BUNQ’s offer is based on three formulas. The standard Easymoney Personal offer, accessible to all, allows you to have up to 3 cards for free and a batch of 25 sub-accounts. The customer pilots his account with all the services at no cost. The other two formulas are the easytravel for travelers without account holding and the Easygreen Personal Environment.

���� Regarding pro bank accounts, Regardless of their status, companies have the choice between Easymoney Business and Easygreen Business. These offers include specific management tools (accounting, number of bank cards, access to employees, etc.). The negative aspect constitutes higher banking costs than for individuals, in particular free secondary services for some for others.

�� If we talk about prices, Bunq opted for paid offers. Only the EasyTravel card is free but the card order is paying. Some operations are advantageous such as the exchange rate, transfers abroad or payments.

This is less the case for withdrawals billed from the eleventh or certain methods of recharging the account for which a commission applies. Choosing the BUNQ pack allows you to obtain 4 BUNQ Easymoney bank cards (or 3 BUNQ Easymoney and 1 Easymoney Business) for € 19.99/month (less than € 5/person/month).

��About the mobile application, User reviews were excellent until the new version in July 2020. This updating has disrupted the user experience in terms of ergonomics, navigation and access to information. As a mobile bank, Bunq makes every effort to quickly correct these technical bugs.

��As for BUNQ customer reviews Online, the nuance predominates. Some criticize the bank following a bad experience (typically following a blocked account). Others believe that for this standard service, competition does as well if it is not better compared to bank charges.

�� So what to conclude ? Quite simply that neobancs like Bunq continue to progress by listening to their customers’ returns. The mobile bank essentially targets travelers, young people and the self -employed. And despite some faults, the offer is flexible, original with ecological orientation and improved by autonomous and intelligent management tools.

A suggestion or the desire to give your opinion on Bunq ? Put us a little comment, we will be happy to answer you or bounce back on your remarks. ��

A comment on “Bunq review: everything you need to know ! »

Excellent and exhaustive analysis ! However, one of the greatest weakness mentioned (systematic authorization) for bank cards has been corrected. The offer has changed and there is now an offer for the Travel Card which is a real credit card, accepted by car rental companies and hotels and deposit. It made me blow up.

Bunq: the neobank who wants to do everything without excelling everywhere

The Dutch neobanks Bunq is already one of the deans of the genre and has changed its offer over the years without forgetting its target heart: globetrotters. But today with a flourishing banking offer, does Bunq still have its place in your wallet or smartphone ?

Bunq characteristics

| Opening prime | None |

| �� Income ratings | None |

| ��carte banking | MasterCard |

| Initial ��Depot | None |

| ��Frais of account holding | None |

| ��Parraine | Yes |

| �� Application | Android / iOS |

| Mobile | Apple Pay / Google Pay |

| ��3D Secure | Yes |

Bunq bank is what ?

Of Dutch origin, Bunq was founded in 2012 by a Canadian entrepreneur named Ali Niknam. The latter is not from the Fintech, but rather from the web since he is also founder of a company specializing in the recording of domain names launched at his 16th birthday (Transip) and another (The Data Center Group) which offers cloud solutions to companies.

Bunq was part of this vague pioneer of neobancs long before the headliners that are N26 or Revolut. The initial idea was of course to get rid of traditional banking establishments and to offer a simple mobile application to manage your accounts. But Bunq was not satisfied to draw inspiration from what had already been done in competition. The bank also highlights an identity eco-friendly By proposing to plant trees via an international program in partnership with local NGOs in the countries concerned. It also reached the symbolic figure of 5 million trees planted in the world at the end of 2021 thanks to the activity of its customers.

Regarding the application, it was born at the end of 2015. Small anecdote: when it comes out, users discovered that the Android application stored unprotected identity photos, allowing other applications on the same device to access it, the problem has obviously been solved since. Bunq holds a Dutch banking license.

With the Aquisition of Tricout in 2022, Bunq thus ensured a basis of more than 5 million users suspectable to open an account. No specific figures for the number of customers, but Bunq announced in 2019 to have a portfolio of 1.2 million customers, we imagine without problem that this figure is much more important.

Bunq card: rates high enough for a neobank

Bunq’s offer revolves around 3 types of current accounts and a savings account. The first 3 accounts have relatively similar services while comprising some exclusives:

| Easy Bank | Easy Money | Easy Green | |

|---|---|---|---|

| Price | € 2.99/ month | € 8.99/ month | € 17.99/ month |

| Initial deposit | None | None | None |

| Type of flow | Systematic authorization card | Systematic authorization card | Systematic authorization card |

| Income conditions | None | None | None |

| Payment abroad | Free and unlimited | Free and unlimited | Free and unlimited |

| Withdrawals abroad | 5 withdrawals at € 0.99 each then € 2.99 per operation. | 5 withdrawals at € 0.99 each then € 2.99 per operation. | 5 withdrawals at € 0.99 each then € 2.99 per operation. |

| Payment ceiling | € 50,000 / month | € 50,000 / month | € 50,000 / month |

| Removal ceiling | None | None | None |

| Closing account | Free | Free | Free |

This is only part of the gigantic pricing grid offered by the bank on its site, even if we have a filling of filling. It is still interesting to note the difference in the budgeting of accounts which is much more complete from the Easy Money subscription. We have for example right to the opening of 25 sub-accounts to better organize his savings, budgets or even placements where an Easy Bank account has only one. Other features in the same theme are activated, such as automatic spending or pooling of loyalty cards. We will especially remember the possibility of paying with a single card for two different accounts, also called function Dual-pin.

The Easy Money and Easy Green offers have only too few significant differences to justify such a price difference. We therefore advise to fall back on Easy Bank with a view to a secondary account.

Finally, the Easy Saving account recently added to the global offer. However, this is an account exclusively turned to savings with an internet rate announced amount up to 1.56%. However, it only offers two free withdrawals per month and the BUNQ gives no information as to investments made via this account, too bad for a bank that is intended to be turned towards projects with ecological vocations.

How to feed your account ?

Once the BUNQ account has been created, no initial deposit is requested before having full powers on it, it is necessary to be careful at the first levy intervening after two days after the opening of the account. To feed your account, several solutions are possible. The first being to recharge directly by bank card by recording it in the application, but costs apply and vary depending on the banks (0.5 % of the amount and a limit of 500 euros per day). The other solution is the conventional bank transfer so as not to undergo costs, but the delay is longer (from 1 to 2 working days). Finally, it is possible to cash in cash via the partnership with Landscafecard. It is a much less practical solution than to deposit cash in the bank in a conventional manner, however it has at least the merit of existing.

A bunq account opening in a few minutes

Like most neobancs, the opening of a BUNQ account is very fast. Everything is done via the mobile application in just a few minutes. It is through this that a customer must choose the offer that suits him. After providing the contact details and classic information, an identity document is asked to send an identity document (identity card, permit, passport or residence permit). To check your identity, it will then be necessary to record a video of a few seconds in Selfie mode, even if this step is feasible after opening the account.

Finally, to complete the registration, even if BUNQ does not ask for any initial deposit, it is necessary to pay a minimum of 10 euros on the account which corresponds to the cost of manufacturing and sending the card (if necessary). This first payment is via recharging by bank card. Good news, it is possible to use the card via Google Pay even before having received it by post.

A few days after opening the account, you will have to enter your tax identification number. Note that Bunq recently offers the possibility of choosing the IBAN of its accounts and sub-accounts to make them compatible with 4 countries: Spain, France, Germany, Netherlands. In the same register, Bunq introduced a system ofAuto-Currency allowing the automation of currencies as a function of the country where we are, and thus to avoid the sometimes prohibitive exchange rates (on the Easy Money/Green accounts only).

Initial deposit and overdraft management

Bunq is not intended to copy the model of online banks and even less traditional banks. No amount is therefore requested in deposit at the opening of the account. In addition, the overdraft is not authorized, it will therefore be necessary to supply the account to guarantee a positive balance. No payment will be taken into account if the amount were to exceed that present on the account.

Welcome premiums

Like most neobancs, Bunq does not offer any welcome premium and prefers to focus on sponsorships or offers to its partners to seduce its customers.

A more ecological than pecuniary sponsorship bonus

Bunq offers a sponsorship program, but it is a little different from other neobancs. Instead of issuing an amount of money for each person opening an account, BUNQ undertakes to plant a tree for each invitation and 20 others for a registration validated by sponsorship. It is a way for Bunq to compensate for the carbon footprint of each client. Besides, Bunq’s environmental policy is highlighted via the regular update of its report available here.

BUNQ insurance and services

Unlike MasterCard cards at N26 or Boursorama who guarantee the holder a major insurance coverage, Bunq is strangely the protections and assistance that the organization can provide. This means that the bank does not cover any costs in the event of a person accident, loss or theft of equipment during travel and travel abroad, which is paradoxical for a bank that highlights a designed offer for globetrotters. So you have to have this aspect in mind if you ever choose Bunq as an exclusive bank for your vacation abroad. Bunq is content to protect the deposits (up to 100,000 euros) and purchases via an extensive warranty extension (with an Easy Green account only), which is very light for a account at 17.99 euros/month.

Bunq is also very active on the subject of savings accounts. For example, the bank has increased its interest rates of its paid accounts very strongly to deal with inflation (also to take advantage of the increase in the key rate of the ECB). This is an element to consider if you want to make your money grow in a neobank. It is the only type bank offering this kind of product with such a high remuneration rate.

Cashback

Bunq does not have a cashback program strictly speaking, but distills partnerships with some brands, websites, online booking platforms or even various insurance. For the moment, the program is a bit just in content and does not compete in with what Vivid Money, N26 or Revolut can offer on this point.

Note that this feature is only accessible from a Bunq Easy Money account.

Customer service

BUNQ provides you with several communication channels to reach its customer assistance. The most efficient option is of course live cat, available from the application. It is also possible to contact BUNQ customer service by email even if the response time is necessarily longer. The bank is also very active on its social networks.

And cryptocurrency ?

Although Bunq accepts monetary transfers from cryptocurrency exchange platforms, the bank has no possibility of purchase, resale or taking into account tokens or corners. Logic when you know its environmental commitments.

How to contact Bunq ?

BUNQ customer service is announced as available 24 hours a day, 7 days a week directly on the mobile application. Otherwise, it is always possible to send an email to online bank customer service.

Our opinion on the Bunq mobile application

The least we can say is that the first steps on the application are far from being as easy as on other platforms. Bunq being very rich in content, the indexing is a bit anarchic and we often go around in circles before finding the menu initially sought.

In addition, the emphasis is on gamification. For example, the Profile tab displays gauges giving the total money, saved time thanks to Bunq. We are also entitled to trophies to unlock according to our actions. Bunq highly highlighting the ecological aspect of his steps and his application ecosystem, the ” Green Tab “ go in this direction. Concretely, this tab acts as a participative game inviting users to make recommendations or to have more eco -responsible behavior. In the bank’s ecosystem, this means favoring purchases and investments in establishments highlighting ecology.

Therefore, we then obtain ” trees To fill its digital forest; You can then compare your score with other users. It is even possible to join a community and participate in the planting of a ” virtual forest »». It is really difficult to give credit to this type of functionality as its interest lies in being completely anchored in the ecosystem of the application, all without speaking on the side Greenwashing relatively obvious, Especially when we talk about a bank.

Bunq has also included the use of widgets to carry out rapid operations via pastilles to be placed on the main page of your smartphone as well as a new interface which optimizes the system of customizable pastilles already present previously.

However, even if one has the impression of crumbling under the features, Bunq made the effort to make its interface relatively refined. On the main page, we come across a simple overview of the various sub-accounts and cards available, in addition to the options for sending, receiving and adding money. Note all the same that there are still some translation concerns, certain terms and paragraphs are still offered in English.

Since we are talking about money, it should be noted that each sub-account has its own IBAN, a little like pockets at VIVID MONEY. It is therefore possible to receive your salary on the first, to configure the automatic samples from the second and so on. This therefore makes it easier to organize your budget.

BUNQ – The Libertic Bank

Bunq also emphasizes his community by offering beautiful ideas thought for travelers. We think in particular of the travel assistant who gives information on the local currency and who confirms or not that the BUNQ card works well in the country of destination. Let us also underline the presence of a tab dedicated to the scan of receipts and invoices and another to expenditure statistics. Function ” Group expenditure Recently appeared and is piloted by Tricout, Bunq having recently acquired. If this feature was already present before, it only concerned the bank’s customers, which necessarily reduces its usefulness. The whole allows you to share expenses between several users or not from the bank.

On the security side, the BUNQ application is as eclectic as possible with the signature of the device, unlocking by code or fingerprint and automatic disconnection after a certain time of inactivity. Finally, the management of mobile payments such as Google Pay or Apple Pay is another advantage although we would have liked other systems to complete everything.

Our opinion on BUNQ

In essence, Bunq is still a neobank worthy of interest. It offers practical features, has an eco -friendly mind that makes sense and its interest in a young audience and travelers are no longer to prove.

However, Bunq suffers today from comparison with other neobancs and even online banks that offer types of accounts that are often more advantageous for the targeted public. We are thinking in particular of the lack of insurance quite incomprehensible for the requested price. Its application environment and its complex offer to read can also put off the least patient, where VIVID Money or Lydia are focusing on more accessibility.

The Dutch neobank would therefore benefit from clarifying its offer and reviewing its application to be more competitive on a market that no longer lacks competition.

- An ideal bank for travelers (zero costs on payments abroad)

- Very practical budgeting functions

- No free current account

- Few differences between the Easy Money and Easy Green accounts

- No insurance coverage, regardless of the offer

- A “gas factory” type application

The note is representative of five elements: the opening of the account, the prices, the application, the features and the bank cards offered. The remuneration of savings, financial products and credit solutions are not taken into account in this note.