Boursorama or Hello Bank comparison: what is the best?, Hello Bank or Boursorama Bank: which online bank to choose?

Hello Bank! or Boursorama Banque: comparison – cards, bank charges, customer service

✔️ Free and unlimited

Boursorama or Hello Bank comparison! : what is the best ?

The online bank has established itself as a new standard in the event of the 2000s. However, they all do not have the same characteristics and the same advantages. Among the best in their category, we find Boursorama and Hello Bank. These two actors are also the most popular in France in terms of number of customers. So which one should choose ?

To help you make an informed decision, we have designed A VS Hello Bank Boursorama Boursorama comparison. In this complete guide, we will mention the specificities and prices of each of the two online banks. This should allow you to select the offer most suited to your needs.

Whether at Boursorama Banque or at Hello Bank, there is a current account and various bank cards. These two products are at the center of their strategy. However, online banks go further by also offering savings products, credits as well as life insurance. They can boast of being as complete as traditional banks. This is what we will mention all of this in detail in this comparison below.

Apple Pay Google Pay Pay

Bank less expensive

Apple Pay, Google Pay

Premium card free

Free abroad payments

Conditions: without income condition – Welcome and Ultim cards

Annual costs: 0 € • Initial deposit: 300 €

Check deposit: ✔ • Specific deposit: ✘

Monthly card cost: 0 €

Euro zone withdrawals: Free • Payments EURO Zone: Free

Currency withdrawals: 1.69% • Invitation payments: free

Apple Pay Google Pay Pay

Apple Pay

Offer free and unconditionally

Zero costs abroad

Best booklet savings

Prime : € 1 per month / 6 months

Conditions: without income condition

Annual costs: 0 € • Initial deposit: 10 €

Check deposit: ✔ • Specific deposit: ✔

Monthly card cost: 0 €

Euro zone withdrawals: Free • Payments EURO Zone: Free

Currency withdrawals: free • Invitation payments: free

Apple Pay

Our VS Hello Bank Boursorama Boursorama comparison

Before going into the details of our Boursorama Banque or Hello Bank comparison, it should be remembered that all online banks in France are held by large groups. In this sense, Boursorama Banque is the property of Société Générale. Its success is not long in coming: it arrived on the market in 2003 for a total of more than 4 million customers in summer 2022. For its part, Hello Bank is a brand of BNP Paribas which was formalized in 2013 and which brings together 700,000 customers currently.

Boursorama Banque and Hello Bank are both online banks that are intended for the general public. There is a simple offer accompanied by an application that allows you to manage your budget and your bank card easily – in addition to being able to claim other banking products that are found in traditional banks. From the mobile app or a computer, you can manage your savings yourself, your investments or the credits.

Boursorama was elected “Cheapest Bank in France” in 2022 for the 14th year in a row thanks to an exceptional offer. In an internal survey carried out in 2021, she claims that more than half of her customers have paid no fees. Hello Bank is not to be outdone with two effective bank cards (including one free) and some small exclusive advantages.

Eligibility conditions

Boursorama Banque and Hello Bank display both eligibility conditions that must be respected in order to open an account. These are quite basic, they are also found in other online banks in France.

- To be of age

- Reside in France

- Have a phone number and an email address

- Not be banned banking

A small exception concerns Boursorama Banque: you do not need to reside tax in France to open an account. If necessary, you can request customer support from the online bank to get there. For example, if you live abroad but you want a current account at home, it is possible.

Boursorama vs Hello Bank bank cards

Boursorama Banque and Hello Bank offer a current account with several bank cards. These give access to different advantages in France, but especially abroad. Here is a small summary before mentioning the details of each offer.

Bank -Bank Bank Bank Cards

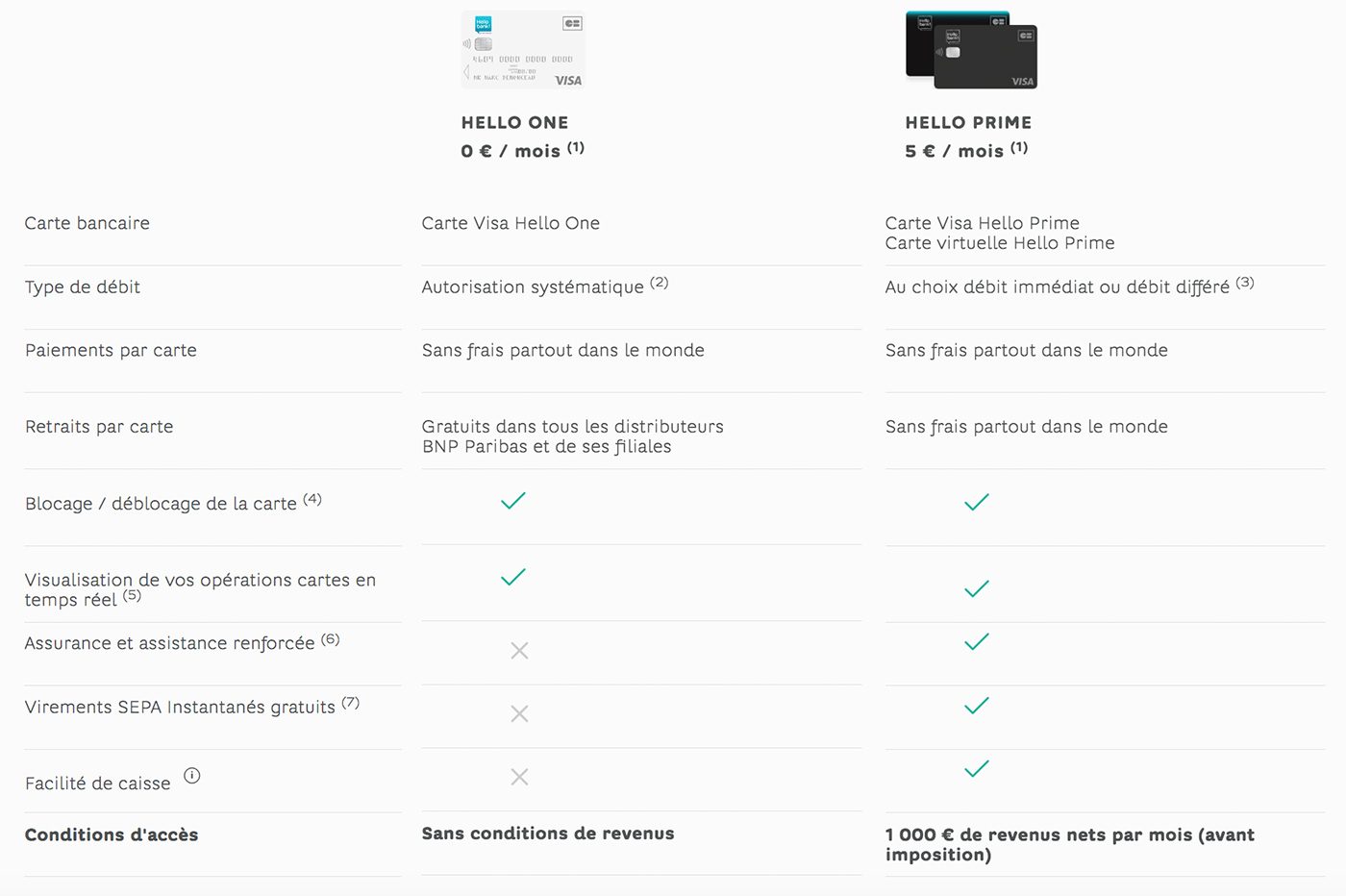

Hello Bank bank cards

The network

Boursorama Banque and Hello Bank both have bank cards based on the Visa network. This means that you have access to more than 30 million traders and automatic distributors worldwide. Overall, the Visa and Mastercard network are very similar, it does not change much for you.

In addition, the bank cards of Boursorama Banque and Hello Bank are accompanied by guarantees and insurance of the level of those of Visa, we will mention it in more detail in the rest of our comparison. Again, Visa and Mastercard have equivalent ranges although the name of their cards are not the same. For example, a mastercard gold is similar to a first visa. A MasterCard Classic is similar to a Classic Visa.

A free offer

Boursorama and Hello Bank both offer a free formula. Besides, the first bet even on two completely free formulas: Welcome and Ultim. These are accessible without any income condition and without obligation: you do not need to prove to take advantage of it. Opposite, Hello Bank displays the hello one offer which is also free of charge and without income condition. Nor should you make a main bank account: you can keep it alongside your current offer.

Whether hello one or the Boursorama accounts, the daily bank is free. We must compare this free with the 215 euros in average banking costs which are deducted by traditional banks from their customers, each year. Choosing Boursorama or Hello Bank is therefore choosing the savings. Without neglecting quality since these banks are as complete as a conventional establishment.

The Welcome offers from Boursorama Banque and Hello One from Hello Bank are in direct competition, these are the most accessible in their range. The free Société Générale’s free card is accessible as soon as you have 50 euros in outstanding your account, it is an immediate debit card with systematic authorization. It must be used once a month, failing which the online bank has the costs of 5 euros. For its part, the hello one card by Hello Bank follows the same principle and will be billed 3 euros per month if you do not use it.

The Welcome and Hello One maps do not allow the overdraft: these are formulas that are intended for people who do not want to excess. The ceilings are also limited, which prevents excess. For young people, it can be a good compromise to learn how to manage your budget. For those who want more flexibility, we will then advise to turn to the Ultim card. This is also free and unconditionally, but it offers much more flexibility.

With the Welcome and Hello One cards, payments and withdrawals are free and unlimited in France. The Boursorama Banque card includes free and unlimited payments abroad and free withdrawal per month in currencies and the following are billed up to 1.69 % of the amount withdrawn. For its part, the Hello Bank card gives access to free and unlimited payments in foreign currency, withdrawals are also free if they are made to a distributor of the BNP Paribas network (otherwise, they cause 1 , 50% of the amount withdrawn).

If the Boursorama Banque Ultim card is free, it is more premium-it is the offer that represents almost all of the bank’s accounts of accounts. Also without income condition and it must be used once a month (otherwise it will be billed 9 euros). It exists in immediate or delayed debit, it is not at systematic authorization and you have the right to an authorized overdraft. This is the ideal card if you want to have a current account with flexibility.

The Ultim card highlighted by Boursorama Banque includes free payments in France as well as free payments in euros or foreign currency abroad. You benefit from 3 free withdrawals per month in foreign currency abroad (then 1.69 % of the amount withdrawn). We find insurance and guarantees of the level of a first visa (travel, illness, etc.). It is thus distinguished from the Hello One and Welcome versions which are Visa Classic.

A paid formula

In parallel with their free offers, Boursorama Banque and Hello Bank both count on a paid formula: Metal and Hello Prime. The first is reminiscent of that of neobancs like N26 and Revolut – both in terms of design and advantages. Despite its gray color and its metal finishes, it is accessible without income condition and without condition of use. Its price is 9.90 euros per month.

To order the Metal Card of Boursorama, you just need to have 500 euros in outstanding your account for the immediate speed (2,500 euros in credit flows or 5,000 euros in outstanding delay).

In comparison, the Hello Bank hello prime card comes with a income condition of 1,000 euros net per month (and 2,000 euros net per month for a joint account). Online bank the invoice 5 euros per month, or 60 euros per year. It is with immediate debit or delayed flow according to your preferences. To find out more, you can read our test and review on Hello Bank here.

Whether it is the Metal or Hello Prime card, these formulas include free payments and withdrawals in France as abroad – whether in euros or currency. Even traditional banks rely on premium and more expensive formulas do not do as well on this point.

Insurance and guarantees of PREMIUM CARDS OF BOURSORAMA BANCE and Hello BANK are at the level of a first visa.

Income conditions

It’s time to summarize the conditions of access to request a card from Boursorama Banque or Hello Bank depending on the offer you want to take, here is the detail.

Income conditions at Boursorama Banque

- Welcome: no income condition

- Ultim: no income condition

- Metal: no income condition

Income conditions at Hello Bank

- Hello One: no income condition

- Hello premium: 1,000 euros net per month

The ceilings

At Boursorama Banque and Hello Bank, the ceilings differ according to the bank card that you take. We specify it, because this is not the case with doubt online banks, some are based on your income without taking the card into account (Monabanq, for example). Here is the summary for each offer.

Payment ceilings at Boursorama Banque (over 30 days):

- Welcome: between 1,000 euros and 5,000 euros

- Ultim: between 2,500 euros and 20,000 euros

- Metal: between 5,000 euros and 50,000 euros

Payment ceilings at Hello Bank (30 days):

- Hello One: up to 1,000 euros

- Hello Prime: up to 2,500 euros

Withdrawal ceilings at Boursorama Banque (over 7 days):

- Welcome: between 100 euros and 400 euros

- Ultim: between 300 euros and 2,000 euros

- Metal: between 400 euros and 3,000 euros

Withdrawal ceilings at Hello Bank (7 days):

- Hello One: up to 400 euros

- Hello Prime: up to 1,000 euros

The authorized overdraft

We mentioned the overdraft authorized above in our VS Hello Bank. First, it should be indicated that it is not available with the Welcome and Hello One cards, the entry-level offers from each online bank. However, there is with Ultim and Metal or Hello Prime formulas.

At Boursorama Banque, you can activate the Office of Office authorized at 100 euros upon receipt of the card and directly from the Mobile Application, the implementation is immediate and without condition. Then you can go up to 2,500 euros with the Ultim card and 10,000 euros with the metal card.

With Hello Bank, you are entitled to a cash facility on the Hello Prime card, the amount must be determined with the online bank according to your income.

Boursorama Banque and Hello Bank only levies agios when your account is debtor, but none of the two charge intervention commissions – as is the case with all traditional banks. The debtor rates are 7% and 8% respectively.

The price grid

Our VS Hello Bank Boursorama Boursorama comparison continues with a recall of the prices of each bank card.

Balance Banking Bank Bank Cards Prices

- Welcome: free

- Ultim: Free

- Metal: 9.90 euros per month

Hello Bank bank card prices

- Hello One: Free

- Hello Prime: 5 euros per month

The current account

Boursorama Banque and Hello Bank are based on an offer that includes a current account with their bank card. If we have quickly mentioned the eligibility conditions, it should be noted that the procedure to open an account is done online from the site or the mobile application.

At Boursorama Banque and Hello Bank, it takes less than 10 minutes to fill out the form and add the documents. Subsequently, the two establishments take a few days to confirm your file and check your situation before the opening of your account. As soon as your account is accessible, you must make an initial deposit of 300 euros for the majority of offers. Therefore, your account will be officially active.

The bank card you have chosen is sent by post in a few days.

Account food

Online banks do not have physical agencies such as traditional banks, which partly explains why their offers are more accessible than those of the latter. The question of supplying the current account arises.

Feed your account with Boursorama Banque

- Bank transfer

- Check deposit (via postal shipping)

Feed your account at Hello Bank

- Bank transfer

- Species deposit (via a deposit automaton in a BNP Paribas France Metropolitan) agency)

- Check deposit (via a BNP Paribas agency or the scan functionality of checks)

This is a big advantage of Hello Bank against Boursorama Banque: online bank takes advantage of the support of its BNP Paribas parent company to allow customers to deposit species and checks directly from the automatic counters of the traditional bank. In France, there are therefore more than 2,000 agencies that can accept deposits of species and checks. At Boursorama, you will not be able to deposit cash and the checks must be sent by post.

Account management

Boursorama Banque and Hello Bank each offer a mobile application that allows you to manage your account. In both cases, there are several size options, here is the detail. Note that Boursorama was elected best digital bank in Europe by the d-trating agency. By using its website or mobile application, you can manage all your banking products independently.

Boursorama Bank features

- Consultation of the balance of your account

- Automatic categorization of expenditure

- Visualization of invoices

- Aggregation of bank accounts

- SMS and email alert notifications

- Modification of payment and withdrawal ceilings

- Modification of the PIN code

- Activation and deactivation of contactless payment

- Transfers in instant France (Instant Payment Boursorama)

- Online check

- Virtual safe

- Easymove banking mobility service (to change bank)

- Opposition service in the event of loss or theft of the card

- Mobile payment

The features of Hello Bank

- Consultation of the balance of your account

- Automatic categorization of expenditure

- Visualization of invoices

- Aggregation of bank accounts

- Alert notifications according to account movements

- Modification of payment and withdrawal ceilings

- Activation and deactivation of contactless payment (up to 50 euros)

- Instant separate transfers

- Hello Start + banking mobility service (to change bank)

- Opposition service in the event of loss or theft of the card

- Mobile payment (Apple Pay, Google Pay and Paylib)

Boursorama Banque stands out with mobile payment because it is online bank that is compatible with the largest number of solutions in France. Thus, we find the Apple Pay, Google Pay, Samsung Pay, Paylib, Fitbit Pay and Garmin Pay. At Hello Bank!, You will have to be satisfied with Apple Pay and Paylib. However, it is recalled that Apple Pay now represents an archi majority of smartphone payments, Hello Bank! So don’t have a real disadvantage.

Banking products

Our VS Hello Bank Bankrama comparison continues with other banking products. As we have said, online banks are not just about a current account with bank cards. This is what makes them go further than neobancs like N26 and revolut while competing traditional banks.

Savings booklets

Savings booklets are present at Boursorama Banque and Hello Bank. The most popular is booklet A and it is regulated by the State, which means that its characteristics are similar in all banks. Apart from Orange Bank, all other online banks offer this essential booklet among the French. It is 55 million booklet A that were opened in France. It is recalled that a single booklet A is accepted by anyone.

A booklet

- Favorite French booklet

- Ceiling: 22,950 euros

- Compensation rate: 2% net

- Limit: 1 booklet per person

Otherwise, Boursorama Banque also offers an LDDS, another savings product regulated by the State and appreciated by the public.

LDDS (Sustainable and Solidarity Development Booklet)

- Complementary booklet of booklet A

- Ceiling: 12,000 euros

- Compensation rate: 2% net

- Limit: 1 booklet per person

Boursorama Banque also displays a PEL (Housing Savings Plan) and a CEL (Housing Savings Account) in its range, which is not the case with Hello Bank. However, the two online banks have a state -regulated savings book which can also be relevant so as not to let the money stagnate in a current account.

The Boursorama Bank booklet account

- Free and free

- Ceiling: no ceiling

- Compensation rate: 0.05% gross annual

- Subject to tax and social security contributions

The savings book Hello +

- Free and free

- Ceiling: no ceiling

- Compensation rate: progressive (0.02 % annual gross for the 0 euro tranche and 49,999 euros then 0.05 % gross annual for the section greater than or equal to 50,000 euros)

- Subject to tax and social security contributions

Whether it’s the Boursorama Banque or Hello Bank savings booklets, all are free and free of charge. In parallel savings is also accessible at any time and it is enough to make an internal transfer to your current account. Conversely, you can easily save with free payments or programs of the amount of your choice. These savings booklets are subject to the PFU, it will therefore be necessary to pay 30% to the State on your return.

The credits

Boursorama Banque and Hello Bank also have credits in their range. Among the two online banks, there is a mortgage and a consumer credit that allows you to carry out the personal project of your choice.

Whatever the credit you take from Boursorama and Hello Bank, you request directly online and then receive an answer in immediate principle. Then you have to wait a few days for the final response of the online bank. On this point, the two establishments are alike. We can however observe that Boursorama is a more efficient notch on the rates displayed.

Life insurance

Life insurance is part of the Boursorama Banque and Hello Bank offers. The Société Générale subsidiary leaves you the choice between free management and controlled management while the second only offers controlled management. In both cases, it is recalled that this banking product is subject to market developments.

More generally, your savings are invested in supports in account unit or euro funds with life insurance. Management is done according to your profile and the risk you want to take. In any case, we recommend that you choose controlled management.

In conclusion, Boursorama Banque or Hello Bank ?

It’s time to finish Our VS Hello Bank Boursorama Boursorama comparison. It must be said immediately that it is not easy to elect a winner because the two online banks have many advantages while intended for the same audience with accessible offers. Without surprises, they are also on the first and second places of the best online banks in France – also in number of customers.

In our eyes, it is still Boursorama Banque that takes the ascendancy thanks to its ultit offer. This free offer and without income condition is aimed at both people who stay in France and those who travel, if only because payments are free and unlimited in the world-whether in Euro or in currency. This is clearly the formula to favor. If the free formula hello one is limited to a classic visa, the Ultim card is similar to a first visa: you therefore have guarantees and insurance included.

However, Hello Bank has several advantages on its premium offer. First, his Hello Prime card benefits from payments and fully free withdrawals worldwide (in euros and currencies) for only 5 euros per month. In comparison, the Metal Card of Boursorama Banque has the same qualities abroad, but for 9.90 euros per month.

The other advantage of Hello Bank is the fact that it allows its customers to make cash deposits directly from the automatic distributors of its parent company BNP Paribas, all in an unlimited and free way. This is also what explains that our comparison between the two online banks is very tight. If you have cash to manage, you will have to opt for this solution. Boursorama does not supply your account with species.

We appreciate the fact that Boursorama and Hello Bank both rely on a wide range of banking products with savings booklets, credits or even life insurance. On the range of products, neither of them has to envy traditional establishments: they are at the same level. In short, you can completely choose one of the two banks to make it your main bank account.

Hello Bank! or Boursorama Banque: comparison – cards, bank charges, customer service

Online banks offering many offers just as attractive as each other, it can be difficult to make your choice. How to choose between Boursorama and Hello Bank! ? That these two banks offer online ? How hello bank! and Boursorama differentiate themselves ?

Hello Bank! : Take advantage of 180 € offered with Hello Prime and Hello One !

Here is the detail by offer:

- One: € 80 offered for any 1st account opening + € 100 in vouchers (for any bank mobility with Hello Start +)

- Premium: 80 € offered for all 1st account opening + € 100 in vouchers (for any bank mobility with Hello Start +) + € 1 per month for 6 months

Take advantage of this offer from August 17 to October 9, 2023

�� Hello Bank! or Boursorama Banque: which online bank to choose ?

- Current account

- Teenage account

- Joint account

- Pro account

- Saving

- Real estate credit and personal loan

- Sotck exchange

✔️ Current account

✔️ Teenage account

✔️ Joint account

✔️ Pro account

✔️ Savings

✔️ Real estate credit and personal loan

✔️ BOURSE

✔️ No income condition

✔️ No income condition

✔️ Full offer of banking products

✔️ An offer dedicated to teens

✔️ Bank costs among the most advantageous on the market

✔️ Discovered authorized

✔️ Foreign costs, payment and withdrawals, competitive

✔️ free bank card offers and without income conditions

✔️ an innovative mobile application

✔️ Promotional offers (sponsorship, welcome bonus)

✔️ Quick account opening, 100% online

✔️ Check deposit

✔️ Customer service reachable by phone

✔️ Attractive rates, most daily services are free

✔️ Discovered authorized

✔️ Range of very varied products

✔️ Mobile application with HELLO BANK positive reviews

✔️ National Network of BNP Paribas agencies

✔️ A checkbook.

✔️ Customer service reachable by phone 6J/7

❌ Bank cards with systematic authorization

❌ No real balance

❌ No species deposit

❌ Free with free and unlimited currency withdrawals accessible only with Ultim Metal

❌ Income conditions for delayed flow with Metal and Ultim Metal

❌ Systematic authorization cards

❌ No intermediate offer

❌ Prices raised on exceptional operations

❌ No Google Pay

❌ income conditions (hello prime)

Updated data September 2023

Hello Bank! and Boursorama Banque are two online banks which are in common to be linked to large French banks : BNP Paribas for the first and Société Générale for the second. They both offer accessible and practical offers abroad.

Balance Bank ::

- created in 1998, The Boursorama market information site launched its online banking offer in 2005 and then became Boursorama Banque

- owned by the Societe Generale Since 2014;

Balance Bank, Who was again elected the cheapest bank in 2020, remains the most advantageous for a customer who seeks to reduce his bank charges. Indeed, Boursorama Banque offers slightly lower prices and does not charge certain services. This advantage is however marginal if the customer does not wish to subscribe to insurance of means of payment, the only service on which the difference in prices is substantial.

Hello Bank! ::

- Was created in 2013 by the BNP Paribas;

- benefits from the BNP Paribas agency network as well as the Mother House banking catalog;

�� Bank costs comparison: Hello Bank! or Boursorama ?

Bank costs: VS Hello Bank Boursorama Bank!

Welcome

0 €/month

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: 5 €/month if no CB use in 1 month

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free and unlimited

�� Withdrawal outside the euro zone: 1 free withdrawal per month 1.69% beyond

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: 0.07

�� Unauthorized discovered: 0.16

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free

�� SEPA transfer: ✔️ Free

�� International transfer: In euros: € 20 in currency costs: free

Ultim

0 €/month

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: 9 €/month if no CB use in 1 month

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free and unlimited

�� Withdrawal outside the euro zone: 3 free withdrawals per month 1.69% beyond

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: 0.07

�� Unauthorized discovered: 0.16

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free

�� SEPA transfer: ✔️ Free

�� International transfer: In euros: € 20 in currency costs: free

Boursorama Ultim Metal

€ 9.90/month

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: None

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free and unlimited

�� Withdrawal outside the euro zone: ✔️ Free and unlimited

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: 0.07

�� Unauthorized discovered: 0.16

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free

�� SEPA transfer: ✔️ Free

�� International transfer: ✔️ Free

Hello One

0 €/month

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: 30 €/year

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free * Free in a distributor of the BNP Paribas network, otherwise € 1/withdrawal

�� Withdrawal outside the euro zone: ✔️ Free * Free in a distributor of the BNP Paribas network, otherwise 1.5% of the amount of withdrawal

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: ❌ No authorized overdraft

�� Unauthorized discovered: ❌

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free between Hello Bank accounts

�� SEPA transfer: ✔️ Free

�� International transfer: ✔️ Free

Hello prime

5 €/month

Choose

☑️ Current costs:

�� Account holding costs: ✔️ Included

�� Inactive account holding costs: 30 €/year

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free * Free in a distributor of the BNP Paribas network, otherwise € 1/withdrawal

�� Withdrawal outside the euro zone: ✔️ Free and unlimited

✈️ Payments abroad: ✔️ Free and unlimited

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: 0.08

�� Unauthorized discovered: 18.40%

☑️ Fresh on transfers:

�� Instant transfer: ✔️ Free between Hello Bank accounts

�� SEPA transfer: ✔️ Free

�� International transfer: ✔️ Free

Offers classified with consideration by selectra by price and characteristics. Updated data September 2023

Assessment: advantage for Boursorama Banque The account holding prices are extremely similar. The difference is on tariff lines concerning a limited number of users: non -separate transfers and means of payment for payment.

On the other hand, costs on payment or irregularity incident on the bank account is much higher at Hello Bank!.

�� Boursorama vs hello bank! : bank cards

Hello Bank! And Boursorama Banque offer different types of cards, entry -level cards with more premium cards. Obtaining these cards is not governed by the same conditions under both banks.

BOURSORAMA BANK and Hello Bank bank accounts!

Welcome

0 €/month

Hello One

0 €/month

International visa card with systematic authorization

✔️ Immediate debit | ❌ Delayed

International visa card with systematic authorization

✔️ Immediate debit | ❌ Delayed

✔️ No income condition

✔️ No income condition

✔️ Visa Classic insurance

❌ No insurance coverage

✔️

Subject to acceptance by the bank

Up to € 5,000/30 days

✔️ Free and unlimited

✔️ Free and unlimited

1 free withdrawal per month

1.69% beyond

✔️ Free and unlimited

✔️ Free and unlimited

Updated data September 2023

Assessment: advantage for Boursorama Banque The offers are rather similar. The differences are made on payments and withdrawals abroad with conventional cards. Knowing that the equivalent of a standard card at Hello Bank! is the hello one offer that corresponds more to the Welcome card as there is no overdraft authorization and that it is without income condition.

High -end bank cards at Boursorama Banque and Hello Bank!

Ultim

0 €/month

Boursorama Ultim Metal

€ 9.90/month

Hello prime

5 €/month

Choose

International visa card with systematic authorization

✔️ Immediate debit | ✔️ Delayed flow

Metal visa card with systematic authorization

✔️ Immediate debit | ✔️ Delayed flow

International visa card with systematic authorization

✔️ Immediate debit | ❌ Delayed

✔️ Immediate debit: none

❌ Delayed flow: € 1,500 net of monthly income

✔️ Immediate debit: none

❌ Delayed flow: € 2,500 net of monthly income

from € 1000 in net income per month

✔️ Visa Insurance Premier

✔️ Visa Insurance Premier

✔️ Visa Insurance Premier

✔️

Subject to acceptance by the bank

✔️

Subject to acceptance by the bank

✔️

Subject to acceptance by the bank

Up to € 20,000/30 days

Up to € 50,000/30 days

up to € 2,500/30 days

✔️ Free and unlimited

✔️ Free and unlimited

✔️ Free and unlimited

3 free withdrawals per month

1.69% beyond

✔️ Free and unlimited

✔️ Free and unlimited

✔️ Free and unlimited

✔️ Free and unlimited

✔️ Free and unlimited

Updated data September 2023

Assessment: Slight advantage for Boursorama Banque as for standard offers, premium offers have many similarities. The advantage for Boursorama Banque is played out on free insurance means of payment and payment excluding the euro zone. Hello Bank! replaced the Visa Premier card for Hello Prime at the opening of an individual account.

�� Savings booklet at Boursorama and Hello Bank!

Hello Bank! and Boursorama Banque, like a large part of the banks, offer regulated booklets such as booklet A, LDDS, PEL and CEL.

In addition to these regulated booklets, The Boursorama Banque offer is fairly limited in savings. There is a booklet account with a rate of 0.10%, But little more interesting booklet. However, the bank, faithful to its initial activity, offers a financial savings account led to boosted rates.

In addition to regulated booklets, Hello Bank! offers a more developed savings offer offer ::

- THE Hello booklet is a rather classic non-regulated booklet: paid to 0.20%, without ceiling, taxable, whose operations must be of a minimum of 10 €

- THE Hello booklet + has the same characteristics as the hello booklet except that it is at an evolutionary rate remunerated up to 1% increasing according to the funds available in the booklet

On the other hand, the two online banks offer contractslife insurance, accounts PEA (Action Savings Plan) as well as an offer of Sotck exchange.

Assessment: advantage for Hello Bank! On savings hello bank! offers a range of much more complete savings booklets and with more advantageous rates than those offered by Boursorama.

�� The customer experience: Boursorama Banque vs hello bank!

The subscription route

Registration stages at Boursorama Banque or Hello Bank! are very similar : The form is to be completed online, the signing of the contract is done electronically and the supporting documents are to be downloaded from the site. The opening of the account is finalized during the first payment.

According to the test carried out by the editorial staff, the hello bank subscription route!! seems faster and clearer. If the user performs his subscription to several steps, he will regularly receive an email “The point on your account opening”, appreciable to navigate.

Websites

The Boursorama Banque site brings together all the offers in a single tab and the different pages include a lot of information in which it may be easy to get lost. Conversely, The Hello Bank site! is more ergonomic and each banking product is categorized in a section.

Mobile applications

✔️ 100 € offered

From 0 €/month

Google Play: ⭐ 4.8/5

Apple Store: ⭐ 4.8/5

�� Budget management

❌ Real -time balance

✔️ RIB download

✔️ Consultation of the card code

✔️ Personalization of the card code

✔️ Categorization of expenses

❌ Sub-accounts

✔️ Expenses statistics

❌ Pockets

✔️ Digital safe

❌ Virtual card

✔️ Modification of ceilings

�� Design and ergonomics

✔️ Elegant design

✔️ Loading speed

✔️ Accessibility of main functionalities

✔️ Easy to hand

✔️ Identification by fingerprint

✔️ Identification by facial recognition

✔️ 3D Secure

✔️ Opposition Bank Card

✔️ Blocking/Unlocking of the card

❌ Secure messaging

✔️ Telephone line

❌ Chatbot (virtual assistant)

❌ Online cat

Welcome offer: ✔️ up to € 80

From 0 €/month

Google Play: ⭐ 3.7/5

Apple Store: ⭐ 3.2/5

�� Budget management

❌ Real -time balance

✔️ RIB download

❌ Consultation of the card code

❌ Personalization of the card code

✔️ Categorization of expenses

❌ Sub-accounts

✔️ Expenses statistics

❌ Pockets

❌ Digital safe

❌ Virtual card

✔️ Modification of ceilings

�� Design and ergonomics

✔️ Elegant design

✔️ Loading speed

✔️ Accessibility of main functionalities

✔️ Easy to hand

✔️ Identification by fingerprint

❌ Facial recognition identification

✔️ 3D Secure

✔️ Opposition Bank Card

✔️ Blocking/Unlocking of the card

❌ Secure messaging

✔️ Telephone line

❌ Chatbot (virtual assistant)

❌ Online cat

Updated data September 2023

Boursorama Banque wins the English Channel with more advice to a better average than Hello Bank! : we also find Boursorama Banque at the Best place in the finance classification of the App Store than Hello Bank!.

Regarding applications, these are very similar. The application of Boursorama is however more complete and diversified:

- Virtual locking and unlocking of the bank card if the holder thinks he has lost it

- Discovery control in real time and exceptional species removal if necessary

- Possibility to benefit from the budgetary coach Wicount To view your Savings diagnosis

Despite many features and frequent updates, many users complain of bugs on both applications:

- For Boursorama Banque, Users say that the application built, that it is still not ergonomic and deem it “archaic” compared to competition; The application still redirects to the website

- Regarding Hello Bank!, Users complain of connection bugs or the impossibility of making bank transfers

*Study of customer comments on the App Store on May 13, 2020

The best customer service: Boursorama or Hello Bank! ?

Hello Bank! multiplies the means by which its customers can reach it, In addition, the opening hours are more attractive than at Boursorama Banque. The Hello Bank site! even offers a functionality indicating the best slots to reach customer service.

- Available on the Hello Bank application

- Available on the Hello Bank website

Updated data September 2023

For its customers, Boursorama Banque has a telephone line, with reduced time slots, although its online cat service is available to 9 a.m. to 9 p.m For new customers. However, This cat is not indicated in the contact section and does not appear automatically when you connect to the site.

Updated data September 2023

Assessment: hello bank advantage! For the customer experience if Boursorama Banque is distinguished by its mobile application offering slightly more advanced features, Hello Bank! However, wins with a more fluid subscription route, a site that seemed clearer to our editorial staff as well as a more available customer service.

�� For specific profiles: Hello Bank! or Boursorama Banque ?

What a bank for an active young ?

Profile of a young asset : This has just started in working life and is looking for an inexpensive bank; He needs to be advised in the management of his banking affairs so must easily have access to customer service; He appreciates digital.

In terms of prices : Boursorama Bank, elected bank the cheapest by the world money for young workers, remains slightly more competitive, but on the sidelines. In terms of customer service: Hello Bank! has a customer service opened later and reachable by phone or cat. In terms of applications : although Boursorama Banque is a little better rated, The Hello Bank application! is more modern and intuitive. In addition, Hello Bank! has implemented additional applications such as good accounts, account management tool, dispatching expenses made during an activity with friends.

Regarding bank cards, since January 2020, Hello Bank! Offers Hello One, free offer and without income condition and Hello Prime, paid card and accessible with an income of at least € 1,000 per month but without costs of withdrawal and payment abroad. With his Hello One, Hello Bank card! Boursorama Banque competition and also offers an accessible card. But Boursorama remains cheaper and offers two offers without any income condition against only one for Hello Bank!. Knowing that the Ultim offer, although having lower payment ceilings and withdrawals as well as an unimportant overdraft, is also free of charge abroad.

The Boursorama Banque assessment is slightly cheaper, but Hello Bank! offers customer service and application more suited to the typical profile of the young asset.

Hello Bank! Smiles to students at Hello Bank!, Students can benefit from a current account without having to have a minimum income or open a booklet. To find out more, consult our comparison of online banks for students.

New Hello Bank customers! can also claim a sponsorship bonus.

What a bank for a person without income ?

Bank cards offered by Hello Bank! were, for the most part, conditioned by a minimum income. It was necessary to have an income of at least € 1,000 for a Visa Classic card or, if necessary, it is necessary to place an outstanding at least € 5,000 on a hello booklet!.

However, with hello one, benefit from the offense and services palette hello bank! is no longer conditioned for an income of at least € 1,000. In addition, there is no conditions of use.

Boursorama Banque, with the Welcome offer, offers a bank card without income condition. However, free bank card with the Welcome offer is conditioned by using it. The owner must do at least 1 operation / month, otherwise he will have to pay € 5 per month.

Since June 2019, Boursorama also offers Ultim offer allowing users to benefit from the advantages specific to other Boursorama Banque offers as well as Free withdrawals and payments abroad.

Review: Advantage for Boursorama Boursorama was one of the few online banks to offer a bank card without income and free. Now, most online banks, except Bforbank offers. The choice is therefore made on services and banking prices. Boursorama was elected the cheapest for the 12th consecutive year in 2019, making it an interesting choice for a person without income. For more information, see our guide: which online bank without income conditions ?