Boursorama Banque in the App Store, Boursorama Banque – Banque 100% online – The cheapest for 15 years

Join the cheapest bank for 15 years (1)

A bonus of € 20 for the opening of a Boursorama Banque bank account. The sum of € 20 will be credited to the bank account on the day of its effective opening.

And

BOURSORAMA BANK 4+

Frankly a faultless with this online bank. The application is very well optimized, no management problems. Compared to my main bank Instant transfers are free and very fast. There is no annual fee and that’s really great. So you can either make a banking stock market your main bank or use it like me as a second bank in order to place a budget for a field of purchase. The biggest positive point in this online bank is the sponsorship option. Frankly, I didn’t think I could be paid so many silver for sponsorships, I’m too happy. If you want to enjoy this system of sponsorships like me and earn € 130 per sponsored person. These people must return your sponsorship code when registering, these people will also receive a bonus worth € 150 (it’s all benef) and it’s maximum 20 sponsorships per year (I let you do calculation). If you want mine it is: Anva3059 (so you touch € 150 at your opening of EHEH account) it’s been a few months since I have this bank and I have not discerned any defect at the moment. Small advice: to activate your account, they tell you to make a deposit of € 50 but that fully function with € 10. Well, I wish you good continuity with this genius bank and a maximum of sponsorships !!

Developer response ,

Hello, we thank you for taking the time to assess our application. Good day, the Boursorama Banque team.

I recommend 100%

Let me explain: apps and top bank I loved being able to add an instantly compared beneficiary to my old bank whose name I will not cite … Then make an instant transfer that is to say that if for example you have A transfer to be made to block a rental for an apartment or others for the holidays you will be the fastest (what happened to me) then having 0th annual expense is top compared to other banks that we steal. The only little regret that I have to do on Boursorama is that one cannot deposit species even if for my personal case it is not a problem, then as regards sponsorship it is still quite Exceptional the fact of being able to be sponsored with often unbeatable offers and then be able to sponsor up to 20 people per year I find it incredible besides I leave my sponsor code in case you do not have one in your entourage: miri0630 In the end I fully recommend this bank if you want to make your main bank like me, but also to those who want to keep their bank and use it for example to pay on the internet by only depositing the sums for their purchases Internet history not to take risks in case of hacking… top

Developer response ,

Good morning,

We thank you for your positive experience sharing.

Good day, the Boursorama Banque team.

Not badly

Honestly, this online bank is impeccable. The application is perfectly optimized and management is without problem. In comparison with my main bank, instant transfers are free and very fast, at no annual expense, which is appreciable. You can choose to make it your main bank or use it as a second bank to allocate a budget to a specific domain.

The strong point of this online bank is the opportunity for sponsorship. I never thought I would earn so much money thanks to this system. If you want to take advantage of this sponsorship program and earn € 130 per sponsored person, simply enter your sponsorship code when registering. Sponsored people will also receive a bonus of € 150, with a maximum of 20 sponsorships per year. If you need a code, here is mine: Siye7748 (you will receive € 150 when opening your account).

Since I use this bank, I have not noticed any problem. A little advice: to activate your account, they ask you to deposit € 50, but it works just as well with € 10. I wish you excellent experience with this innovative bank and a lot of success in your sponsorships.

Confidentiality of the app

The Boursorama developer indicated that data processing as described below could be among the practices of the app in matters of confidentiality. To find out more, consult the developer’s privacy policy.

Data not establishing any link with you

- Identifiers

- Use data

- Diagnostic

Confidentiality practices may vary, in particular depending on the features you use or your age. Learn more

Information

IPhone compatibility requires iOS 13.0 or later. iPad requires iPados 13.0 or later. iPod touch requires iOS 13.0 or later.

Join the cheapest bank for 15 years (1)

Offer reserved for adults and capable, and valid for any first effective opening of an individual stock market banking account (excluding Boursorama Banque professional account, excluding specific supply, see tariff brochure) with concomitant bank card request made from 08/01/2023.

The account opening request is reserved for any new customer beneficiary of the “BRS100” commercial offer code.

A bonus of € 20 for the opening of a Boursorama Banque bank account. The sum of € 20 will be credited to the bank account on the day of its effective opening.

And

A premium 80 € for ordering a WELCOME or Ultim bank card: € 80 of premium for any order of WELCOME or Ultim bank card carried out concomitantly at the request for a bank account opening, and accepted by Boursorama Banque. The sum of € 80 will be credited to the bank account on the day of its effective opening subject to acceptance of the bank card application file by Boursorama Banque.

Or

Free of the first 8 contributions for the subscription of the Metal offer: you benefit, in accordance with the price brochure, from the free eight first contributions for the subscription of the concomitant metal offer at the request of opening a first Banking account (tariff in force on 08/01/2023, subject to change of pricing policy by Boursorama), subject to acceptance of your file by Boursorama. A payment of 80 cents will be paid on the same bank account in the 8th month.

In the event of subscription via the route in the application (eligible for Welcome, ultimous cards with systematic authorization only): the file must be complete and comply with the opening of the bank account via the application. Any incomplete file after 5 working days will have to be redone since the first stage of the subscription route. The first payment must reach Boursorama Banque once the electronic signature of the contract is made and the request for a bank card accepted by Boursorama Banque, to open the right to the payment of the commercial premium.

In case of subscription without the application (eligible for Welcome cards, ultimous with systematic authorization only): the file must be complete and conform within two months of the initial request: all supporting documents (outside the first payment, unless the latter is made by check in the event of paper subscription) must be attached before this date. The first payment will have to reach Boursorama Banque no later than 5 working days after receipt of the email which will indicate to the new customer that it can proceed to this first payment to open the right to the payment premium.

Offer limited to a single offer per person and not combined with any other Boursorama Banque offer.

In the event of closing of the customer’s account, either on the initiative of the customer himself, or on the initiative of Boursorama Banque in the event of seriously reprehensible behavior of the customer, during the 24 months following their effective opening, Boursorama Banque reserves the right to deire the amount corresponding to the premium or welcome premiums from which he benefited within the framework of this commercial offer.

Bungeorama Bank: online bank account

Boursorama Banque is the online bank of the Boursorama group whose historic activity is positioned in the online stock market and financial information. Since 2006 Boursorama has been offering a competitive banking offer, it changes its name in 2023 and becomes Boursobank.

�� The Direct Bank of Société Générale is now a leader in France with more than 4 million customers.

September 2023: 100 € offered + The bank card is free with Welcome and Ultim offers without income condition.

What are the Boursorama Banque payment methods ?

Boursorama Banque offers free bank card to its private customers. With its lack of income conditions, Boursorama Banque is among the most accessible banks on the market. Just use your Ultim and Welcome card for what remains free !

The Welcome card:

Welcome is a card Free without income conditions , Ideal for young people. Welcome card withdrawal and payment ceilings are lower than in the standard offer. The systematic authorization card avoids overdraft situations. The free Welcome is very attractive, however, the card will have to be used at least once a month otherwise € 5 costs will be charged for non -use.

Ultim card:

Ultim (comparable to a first visa) is the perfect card for travelers with its higher payment and withdrawal ceilings. In addition, it is also Free without income conditions . You must make at least 1 payment per month to keep the free card, otherwise its price goes to € 9 / month.

What are the advantages of the Ultim card ?

In terms of insurance and assistance, the Boursorama Banque Ultim card is equivalent to the first visa. Totally free, it is above all thought to accompany you in all your trips and allows you to withdraw and pay for free all over the world, up to three times a month. Beyond, withdrawals are billed 1.69 %. On the look side, the Ultim card is distinguished by vertical design, as well as by its chic and refined style. In addition, its card numbers appear on the back for easy reading, in accordance with the Visa Quick Read standard, a first in Europe !

What is the Metal offer of Boursorama Banque ?

The high-end metal offer benefits from a new metal bank card and premium services, it is accessible at a price of € 9.90 per month .

Ultim or metal ? : What are its advantages and how is it so different from the previous Ultim card ? We take stock.

What are the other means of payment of Boursorama Banque ?

As in any bank, it is also possible to pay by check or by bank check.

In addition to previously detailed services, Boursorama attaches profound importance to the modernization of means of payment. The online bank has established several partnerships to allow you to pay differently.

- The Instant Payment : your transfers in less than 10 seconds ! Available 24/7, the Instant Payment allows you to credit any French beneficiary by transfer, in just 10 seconds ! In other words, the funds are fired instantly and the beneficiary immediately has money.

- Fitbit Pay and Garmin Pay : Pay with your connected watch ! Boursorama also allows you to pay using your connected watch or your activity bracelet. To do this, simply download an application connected to your watch. When paying, you just have to spend your handle on the contactless payment reader. Your transactions are perfectly secure but always at hand. In addition, at Boursorama, it is a completely free service.

- Google Pay, Samsung Pay and call Pay : adjust your purchases with your smartphone ! In the same register, at Boursorama you can also pay with your smartphone. Google Pay, Samsung Pay and Appel Pay applications are now working with Boursorama. These store your bank cards, loyalty cards, plane tickets or shows, … while allowing you to pay more simply. With Boursorama, stroll your free mind, without even taking a portfolio !

What are the Boursorama Banque offers ?

The online bank is aimed above all with active customers, modern in their design of customer relations, with the wish to be able to master everything at a lower cost. On this page you will find all the information on Boursorama Banque, its current account and its bank card.

❤️ The Boursorama Banque strategy is to simplify the banking relationship thanks to “personal finance” tools and the availability of its teleconsilors. Anticipate customer expectations by offering innovative services. 90 % of customers are ready to recommend Boursorama Banque to their relatives (Boursorama study).

What products are marketed by Boursorama Banque ?

The Boursorama Banque offer has quickly enriched itself, today this online bank can completely replace conventional banks. Customers can at their please subscribe:

- Current account (which allows all of your operations to be carried out for free)

- Bank card (free CB with Ultim and Welcome See Conditions)

- Savings products (LDD, PEL, CEL, Livret A)

- Online brokerage

- Banking credits

- Placements (UCITS, Various life insurance and financial products: trackers, bonds, stocks, warrants, etc.) for the pleasure of scholars.

How to get the Boursorama Banque premium ?

At the time of opening the account, you have to think about indicating the promotional offer to benefit from the premium. This welcome bonus will be paid in the next few days opening of the account. This premium will allow you in particular to carry out your first expenses.

What investments are possible at Boursorama Banque ?

Regulated booklets

Boursorama Banque offers booklets for savers. In this establishment you will find booklet A, LDD, housing savings, as well as the Boursorama savings booklet. From this Boursorama point of view is not the most attractive bank, especially in this low rate period.

Life insurance

On the other hand on life insurance, Boursorama is positioned very competitively. His life insurance contract is one of the best on the French market. In addition if you are attentive to promotional offers you can benefit from a welcome bonus. You can open life insurance from € 1,000 without payment costs which makes it an accessible contract.

Online scholarship

Boursorama stock market side is a benchmark. Its stock market portal is the most consulted in France with hundreds of news per day and stock market ratings all over the world. We will appreciate its very practical tools to place orders on the stock market, its technical analysis tool and its very popular stock market forum. The childcare rights are free and you can open a 300 € deposit account

Can we take out a mortgage at Boursorama Banque ?

Real estate has been at the center of the Boursorama Banque strategy in recent years. The online bank now offers an online credit offer to buy real estate. The displayed rate is among the most competitive over 15 years, you can make online simulations and get a quick response from your customer area. There are no file fees on the Boursorama Banque real estate credits and the early reimbursement is also free. To test this credit offer online you must fill out a form to detail your real estate project. Start by presenting your project for example: main residence, second home, work, rental … and if necessary you can call a customer advisor who will guide you in all these steps. The bank will then be able to give you a response in principle, if that suits you you will only have to constitute your file and send the supporting documents.

What account to open at Boursorama Banque ?

To open a Boursorama account, you need to pay a minimum of 300 euros at the opening. Boursorama is used to offer a few tens of euros to new customers for the opening of a account with a bank card or a booklet.

The Kador account for children: a free offer for minor children of Boursorama Banque customers. An offer with the bank card and the mobile application adapted to adolescents.

The Boursorama Pro account: for individual entrepreneurs and micro-entrepreneurs, Boursorama has created a dedicated offer. Entrepreneurs can open a professional account with competitive pricing and a mobile payment terminal. In a few words, the Boursorama Banque professional account is nine euros per month with a classic or first card and its authorized overdraft of € 4,000. The absence of a movement commission is a strong point for this professional account, and the rate of the authorized overdraft is particularly low.

What are the steps to open a Boursorama Banque account ?

To open an account at Boursorama Banque, no minimum income is required and customers are in no way forced to domicile their income within the online bank. They just have to:

- Complete the online banking stock market form, in just five minutes;

- Sign their online contract, established according to the products chosen;

- Digitally transmit their supporting documents, by scanning or photographing them from their smartphone;

- Wait until the file is checked;

- Make a first payment on their bank account to trigger the sending of their bank card.

What supporting documents to provide Boursorama Banque ?

For security reasons, and in accordance with the obligations to which all financial institutions are subject, Boursorama Banque asks its new customers to provide it with certain supporting documents:

- A valid proof of identity;

- Proof of personal domicile dating from less than 12 months;

- Revenue proof, only if you request an ultimous card with delayed debit or delayed flow metal;

- A RIB of their current account, in their name and first name;

- A handwritten signature photographed or scanned.

Reviews on Boursorama Banque

Writing opinion

Summary of the opinion

Boursorama Banque is one of the first online banks in France, the establishment has always been a pioneer in terms of innovation. The Société Générale subsidiary is found each year in the best position for its particularly low pricing. Also savers and scholars find their account with perfected tools. The management of the online budget will also be facilitated with its practical account aggregator and the transactions categorization. The online bank is particularly accessible, especially since the launch of its Welcome offer which allows you to benefit from the free card (with ceilings however very limited) provided you use it every month (otherwise pricing goes to € 5 per month )).

Why choose Boursorama Banque ?

Because Boursorama Banque is the favorite online bank French people with the greatest number of customers ! Boursorama wishes to position itself as the cheapest bank by offering many free services. The online bank puts innovation within the reach of its customers, in particular to facilitate the management of online accounts.

Boursorama is a historic financial information leader on the web, today this player also develops online brokerage and online banking services. This organization allows the group of meet all expectations customers in terms of personal finance.

Always more innovative, Boursorama continues to stand out from other financial brands. As proof, she is also the first bank to be accessible to the voice from the Google speaker. Your Google assistant is now able to give you the balance of your accounts or notify you of your latest bank movements. Of course, all of these technologies meet very strict standards and controls, which allows them to be completely secure.

How to change for Boursorama Banque ?

If all these advantages have won you and you are not yet a Boursorama customer, know that online banking also offers you a completely free banking mobility service: Easymove. When you open an account, Boursorama invites you to sign a mandate of banking mobility. If you accept this offer at no cost, Boursorama is responsible for all administrative formalities related to your change of RIB. It is she who informs all of your creditors for you. You only have to fill an online mobility request, just 5 minutes. Boursorama is responsible for the rest and all your samples and transfers are automatically transferred.

Who is Boursorama Banque ?

Boursorama was born in 1995, at the start of the Internet era by offering an offer dedicated to online brokerage. Boursorama, with its leadership and its know-how, is then launched in online banking and financial information to offer a complete solution to its customers. Boursorama wishes to assist the customer in his investment decision by the dissemination of continuous information, a guarantee of transparency.

Who owns Boursorama Banque ?

Now the Boursorama group is mainly owned by Société Générale. The French bank intends to develop online bank in France and internationally to assert its leading position.

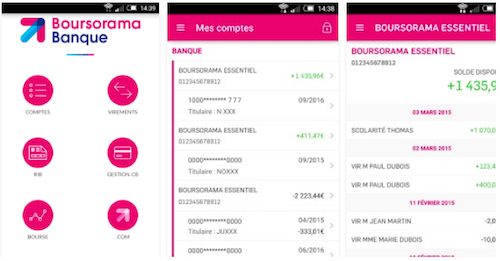

What mobile application for Boursorama Banque ?

The Boursorama application also allows you to add all of your accounts, even those held in other banks. Thus, your dashboard gives you a panorama of your overall budget, thanks to which you can more freely control your budget. All your accounts are now visible from your secure Boursorama banking area. Even better: you can now make transfers directly from your external accounts, that is to say detained in other banks. The categorization of your expenses also takes into account your other accounts, which allows you to have a fairer vision of your budget.

In fact, concerning the categorization of your income and expenses, Boursorama has enriched its sections. From now on, all your banking movements can be listed, most of which are even automatically categorized. Thus, Boursorama saves you precious time ! The Boursorama mobile application is accessible on smartphones or tablets for free. It allows you to carry out all the remote operations quickly and intuitively.

Notifications on your smartphone to never miss anything

In order for you to give any notable events on your accounts, Boursorama invites you to receive emails, SMS or notifications on your smartphone, as soon as important information is detected. This may concern an overdraft on the account as a savings opportunity, a suspicion of fraud or a ceiling exceeding. The customer is free to configure his sending of notifications himself. With this system, nothing escapes you, even without being connected to your online space.

How to use the Boursorama Banque customer area ?

Boursorama Banque is regularly investing in innovation and provides its customers with a latest generation customer area. Presentation of the customer area to connect to your Boursorama account.

Boursorama Banque favors responsive design, that is to say that the customer area adapts to the typology of your terminal: computer screen, smartphone, tablet.

When you connect to the customer area you have an overview of your accounts in the form of a dashboard. This is customizable, you can see the movements to come, the balance and the latest operations. The idea of having quick visibility on your bank account.

You access all accounts on the left of your screen: current account, savings or placement. All your bank supporting documents are also available for download such as the RIB or account statement for example. The very electronic chest allows, among other things, to put online and secure personal documents such as invoices or your income taxes.

This new customer area has been able to disorient the loyal customers at the start since the updates are major. By cons after recurring use we realize that this customer area is well thought out to facilitate navigation. The aggregation of accounts is better visible and accessible. This is an option that collects all data from bank accounts outside of Boursorama Banque and thus have global visibility on your financial assets. Without forgetting that the Easymove service is also present to help you make Boursorama your main bank.

The Internet customer area is so practical and mobile that you will not need to use the Boursorama Banque application. Indeed Customer Space has been designed to operate on both computer and smartphone.

To connect, just type your username then your password. On mobile, rapid operations are accessible at the bottom of your screen: transfer, RIB, bank card management and check management. The interface is fluid and the update instantaneous when an operation is carried out.

From this customer area it is possible to configure the notifications that will alert you in real time new expenses or an arrival of money. All products present in this customer area can be subscribed online. And for mortgage mortgage it is possible to obtain a real -time response. Finally you also access the stock market portal of Boursorama which is highly requested from investors.

What is the real price of Boursorama Banque ?

Boursorama Banque communicates that it has been the cheapest bank for 10 years. Indeed the Internet bank of Société Générale reviews its pricing each year to be the cheapest on the market. This price offer allows it to regularly win the price of the cheapest bank in magazines. Note that free of charge concerns the bank card under conditions and current banking operations such as withdrawals, transfers, withdrawals. The bank does not charge account for accounting unlike traditional banks. On the other hand a pricing may apply for exceptional operations such as successions or a change of bank card before the expiration date. So despite some paying Banqueorama paid services still remains the cheapest bank. As specified in our online banking guide, if Boursorama can display such a low pricing, it is because it does not offer a network of banking agencies, and customer service is managed 100 % online.

Boursorama “The bank you want to recommend” for its many advantages, starting with its prices !

Boursorama is undoubtedly one of the most popular online banks on the market. There is no longer the number of awards obtained by the brand and Boursorama is very often highlighted for the quality of its services. What is more, it is also distinguished by its very advantageous prices. If most of them are free, some operations are paid. Focus on the main tariff conditions applied by the bank.

The opening and operation of the account

The opening, transformation and fence of a Boursorama account are free. Electronic monthly account statements are available directly on the site but can also be sent by mail. Boursorama does not charge any account holding fees and delivers a RIB for free. Only the settlement of a succession is billed € 300.

Of course, the management of your internet account (from a mobile, a tablet or a computer) is completely free.

Payment methods

Boursorama also puts different Free bank cards available to its customers. The allocation of these means of payment depends on certain income conditions. Then, any withdrawal and payment in the euro zone are free. The renewal of the card before the deadline is billed € 10, in the same way as its change in type of flow. Finally, the reference of the secret code amounts to € 7.

The transfers, whether occasional or permanent are free, as well as the costs of implementation or opposition on the samples. On the other hand, transfers abroad (excluding Sepa) or in currencies cause a cost of 0.1 % of the sum and at least € 20.

A checkbook is set up for free for all customers and Boursorama does not charge any opposition fees on one or more checks.

Finally, be aware that it is possible to have you delivered currency at home for an amount of € 17 in mainland France and € 30 in Corsica.

Irregularities and incidents

In the event of payment incidents, Boursorama does not charge any intervention commission or any costs of blocking the bank card. On the other hand, a declaration to the Banque de France for abusive use of the card is billed 25 € and its capture costs 30 €.

Note that Boursorama also invoices € 20 maximum fees for rejection of withdrawals for lack of provision and € 30 per check rejected for the same reasons. Finally, the costs per notice to third party holder, opposition to third party holder, conservatory entry or attribution entry are € 88.80.

Discoveries and credits

A rate of 7 % per year applies to the authorized accounts in account. It amounts to 16 % per year for unauthorized overdrafts.

Boursorama also offers its customers other types of consumer or real estate credits whose conditions are directly to be discussed with an advisor.

Savings and investments

Boursorama puts multiple savings products and free investments available to its customers. Only the transfer of a PEL, CEL or PEP to another establishment is billed € 50.

Financial stock market investments are accessible at particularly advantageous prices, in the same way as Boursorama EUROs or any other life insurance support.

Insurance and provident

Boursorama includes in its offer loss or theft insurance of payment methods. It also offers global insurance protection insurance for € 11.88 per year for a holder or € 12 per year for two insured people.

Family insurance quotes are to be made directly online and your accounts can be covered for only € 24 per year.

Specific offers

Finally, Boursorama offers certain specific offers. The Kador offer is aimed at all young people aged 12 to 17 and offers them to use their first free debit card. The ceilings are lower than for a classic offer, which is very beneficial to get them used to managing their money independently.

Boursorama also offers a professional offer For only € 9.90 per month.

What are the services offered by Boursorama Banque ?

The announcement fell recently and has made a big noise in the banking environment: the online bank Boursorama has just passed the 3 million customers of customers ! Between responsiveness, competitive prices, listening and permanent innovation, it must be said that the brand has much seducing. Its customers are its most fervent ambassadors and its attractiveness keeps growing. So, let’s discover together what are his banking services that earn him such a craze ..

Everything about Boursorama Banque customer service

Boursorama Banque is a particularly popular online bank with French customers. As she says so well in her advertisements, she is a “bank that we want to recommend”. If the brand owes its appeal at its unbeatable prices, it is clear that it is not out of customer relations either. Here is a quick overview of the Boursorama Banque customer service: contact means, its complete interface, its distinctions.

Managing your daily budget by Boursorama

Of course, Boursorama offers its customers the whole range of products and services that are expected of a bank worthy of the name, namely deposit accounts, means of payments, savings investments or even credits. What is more, to this is also added a lot of other additional more innovative and practical services than the other.

The possibility of controlling your bank card

Holders of a Boursorama account can intervene directly on their bank card, remotely, from their online account or their application. In particular, they can increase their withdrawal and payment ceilings instantly, on the sole condition of being Boursorama customers for more than three months. Likewise, contactless technology can be activated or deactivated at the customer’s initiative, as many times as it suits him.

The digital checkbook

In parallel, Boursorama has also decided to modernize and dematerialize the traditional checkbook. As an alternative to the transfer, the online bank allows you to trigger the editing and the sending of a bank check to the recipient of your choice. To do this, simply enter the information requested online, necessary for the editing of this payment method. Similarly, a digital check for checking checks has been set up, to allow you to collect your money faster and simply.

Wicount, the new coach of your budget

To help you better manage your budget, Boursorama invites you to discover its Wicount service, a real financial coach made available to you. The latter gives you an overview of all your heritage and gives you advice to help you better save. Thanks to him, putting money aside has never been easier ! Wicount helps you to acquire good reflexes to materialize your projects and better distribute your financial heritage.

A safe to secure your documents

Finally, to help you keep and secure all of your important documents, Boursorama provides you with a personal safe. This tool allows you to classify, store and view all of your invoices and administrative documents.

Le MoneyCenter

The MoneyCenter allows you to manage your budget, in particular thanks to a system of alerts, automation and categorization of expenses or income. The synchronization of external accounts on Boursorama is also possible �� The objective of such a tool is to assist customers in the management of their personal finances. But that’s not all, other services are available.