Boursorama Advantages and Disadvantages: All about Boursorama Banque!, Boursorama, your partner to invest

7 good reasons to become a member

Finally, note the rates on authorized discoveries (7 %) and on unauthorized overdrafts (16 %), as well as withdrawal costs in the euro zone (free) outside the euro zone (free according to the card, up to 1.94 %), again significantly lower than those of traditional banks.

Boursorama Advantages and disadvantages: everything you need to know !

You want to know the Boursorama advantages as well as its disadvantages ? You are in the right place ��

Boursorama Banque is the leader of online banking in France, with more than 2 million individual and professional customers. Its banking offer is based on a standard current account, without account holding or intervention commission. It can be subscribed individually or as a joint account. In both cases, this free current account can be associated with one or the other of the following bank cards: Visa Welcome, Visa Ultim and Visa Ultim Metal.

With this file, we wanted to take stock of the advantages of Boursorama Banque and on the weaknesses of its offer, in order to give you a reliable and objective advice on the online bank of Société Générale.

And we start immediately with a table summarizing the advantages of Boursorama Banque: ��

Boursorama Bank advantages

And a more complete painting with other elements: ��

Boursorama Bank review:

the key points

What are the advantages of Boursorama Banque ?

The Boursorama Banque advantages are:

- Competitive prices

- A full service offer

- Flexible access conditions

- Available customer service

- An interesting welcome offer

The Boursorama Banque Benefit in detail

We have summarized the Boursorama Banque and its offer in 6 aspects that we consider to be very significant: competitive prices, a full service offer, flexible access conditions, available customer service, an interesting welcome offer, Modern banking tools. Here are the details of our analysis:

1. Competitive prices

The main advantage of Boursorama concerns its very competitive prices. The online bank is regularly elected the cheapest bank. Most of its costs are indeed free: account holding, intervention commission, commissions on payment incidents, bank card, etc

As proof, for the 11th consecutive year, Boursorama Banque has been elected “the cheapest bank” (Le Monde Money & Placements/ Bestbanque.com) in 2019. In this record, out of 6 customer profiles, online bank appeared as the cheapest on 5 profiles: inactive young (20 years old), young active (20 years), employee (40 years old), executive (40 years), senior executive (40 years) !

His standard current account is free: no account holding fees, no commissions on payment incidents (releases), no intervention commissions. Entry -level and premium visa bank cards are also granted for free.

Finally, note the rates on authorized discoveries (7 %) and on unauthorized overdrafts (16 %), as well as withdrawal costs in the euro zone (free) outside the euro zone (free according to the card, up to 1.94 %), again significantly lower than those of traditional banks.

2. The very complete offer of services

Another advantage of Boursorama: its many savings, life insurance and credit solutions. The online bank offers a large number of banking and financial products thanks to the competition of its parent company, Société Générale.

In addition to his current account, Boursorama offers four regulated savings booklets (Booklet A, LDD, PEL and CEL) as well as an online book account. She even launched a controlled savings account. In terms of life insurance, the specialized press highlights the excellent yields of the Boursorama Vie contract, among the best on the market: +2.31 % net in 2018 on the exclusive euro fund, +1.65 % on the substance EuroSima (OR Trophy for the best 2019 Internet life insurance contract, awarded by magazine Income)).

In terms of credit, finally, we have found that Boursorama, already a pioneer of online mortgage, offers a full offer: personal loan, revolving credit, CLI € (punctual money needs), consumer credit, mortgage mortgage.

3. Flexible access conditions

One of the main advantages of Boursorama Banque is that it offers very flexible conditions of access. The Bank offers accounts and bank cards without income or savings. It is therefore accessible to a very large number of individuals.

With its Welcome offer (2017), then Ultim (2019), Boursorama Banque offers Free current account offers, with free bank card and especially without income conditions or savings level. Without income conditions means that you are not obliged to domicile your salary, and therefore that no proof of income or outstanding savings on your other Boursorama accounts is required by the online bank for that you can open an account !

In fact, Boursorama makes its International (Visa Welcome) and Premium (Visa Ultim) bank cards accessible to the greatest number: young workers, regular stays abroad, retirees, job seekers, people with irregular and even prohibited income banking and adolescents (Kador offer).

4. Customer service available on expanded schedules

Another Boursorama advantage, the customer service available on an expanded time range : from 8 a.m. to 10 p.m. Monday to Friday and 9 a.m. to 4:30 p.m. on Saturday (not available on holidays).

In addition to the autonomy left by the online customer area, the customer has support by phone, email, and even on social networks (teleconsillers are active on Facebook and Twitter platforms).

You can contact 01 46 09 49 49 to share a complaint or ask a question about your contract. You can also use the “Recall me” function on the online portal in order to be recalled by a Boursorama customer advisor.

5. The interesting welcome offer

Another advantage of the Boursorama account is its welcome offer of € 130, Premium offered for any new account opening (with associated bank card request). These are € 130 paid at once, at the latest 48 hours after activating your account: an appreciated format if not acclaimed by customers because immediate and accompanied by relatively easy to meet conditions.

In principle, the offer is limited by Boursorama Banque over time. In fact, Boursorama regularly renews its welcome offer, which ultimately makes it permanent. On numerous occasions during the year, the welcome bonus is even increased, reaching for example € 100 depending on the type of bank card during the “pink weekends”.

Add to that a premium of € 50 offered if you choose to domicile your income on your Boursorama account, which makes a total of € 180 offered !

6. Modern banking tools

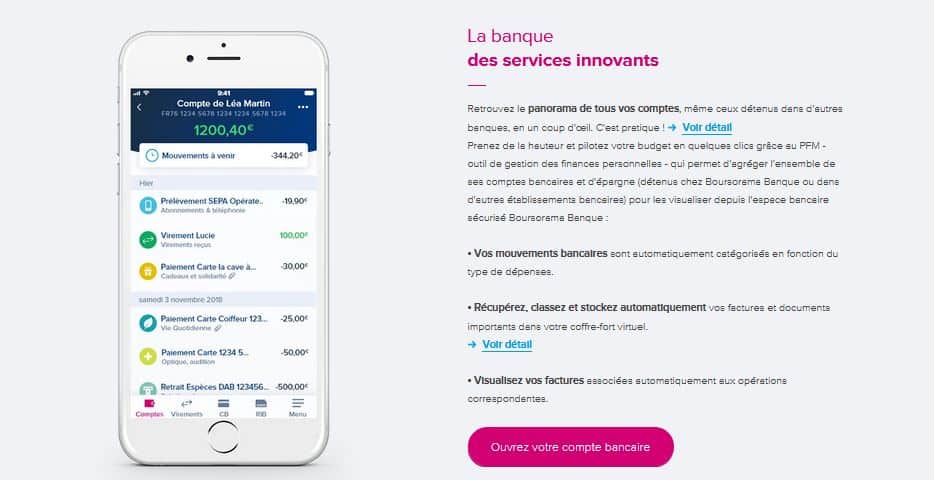

An appreciable stock market advantage concerns its modern banking tools. Thanks to its mobile application and website, customers have access to many digital and practical services.

Like the other online banks, Boursorama has made digitalization a key characteristic of its current account: mobile payment, contactless payment, temporary locking of the card, etc. It has a mobile application and tablet recognized on the Market to access all its services: consultation of accounts, opening of an account, request for personal / real estate loan, management of its budget, management of alerts and notifications.

In addition to being recognized to be a portal of financial and stock market information and an exchange portal between users, Boursorama also offers an online banking portal. Thanks to this portal, you have efficient tools: archiving of your invoices, digital storage space, management of accounts other than Boursorama ..

What are the disadvantages of Boursorama Banque ?

The disadvantages of Boursorama Banque are ::

- Some hidden costs

- Less flexible conditions for current customers

- The obligation to have an account already opened

- The absence of physical agencies

It is not, strictly speaking, disadvantages of Boursorama Banque but rather points that we identify within the editorial staff as perfectible, especially with regard to what is done in other online banks, neobancs and other mobile banks.

The disadvantages of Boursorama Banque in detail

As with the Boursorama Banque benefits Here in detail the disadvantages of Boursorama. We have targeted 4: hidden costs, lack of flexibility of conditions for already customers, the obligation to have an account to become a Boursorama customer and finally the absence of physical agencies. Here are the details of our analysis:

1. Some hidden costs

One of the main disadvantages of Boursorama is in certain hidden costs. Certain hidden costs are often pointed out by users on Trustpilot and we were also able to note in the price brochure:

- The inactivity costs of the visa cards announced as free: indeed, these cards are free subject to carrying out a minimum number of operations per month (1 operation for the visa Wellcoma and the Ultim Visa)

- The cost of a normally free operation, but that you perform by using a television: € 5

- The cost of publishing a duplicate account of account: € 12

- The cost of settlement of succession in the event of the death of the holder: € 250

- The cost of delivering a checkbook: € 5

- Replacing your card before deadline: € 10

- The cost of delivery of a check: tax stamp because sending by post

Nevertheless, by analyzing the “exceptional” operations, the level of these costs remains comparable if not lower than those of traditional network banks.

2. Less flexible conditions for current customers

Another Boursorama disadvantage concerns its conditions of access which prove to be less flexible for current customers than for new customers. In the subscription route, current customers and new customers are imposed on different conditions. In particular, the offers stamped “without conditions of income and savings” are actually accompanied by income conditions for current Customers of Boursorama Banque.

For example, a current customer who would like to transform his account into an ultim -type account will have to justify at least € 1,800 in net monthly income over the last 3 months or at least € 5,000 in savings investments on their various accounts or Even at Boursorama.

Likewise, current customers cannot claim the welcome offer of € 80. This is a real disadvantage of Boursorama Banque, knowing that at Fortuneo Banque for example, the bonus of € 80 is valid as much for the new account openings as for card requests on already open accounts, and this same for several years.

3. The obligation to have an account already opened

Another disadvantage raised by Boursorama Banque customers: you must have an already open and active account in another bank to open a new account at Boursorama Banque.

Indeed, to open a bank account at Boursorama it is compulsory to pay a minimum of € 300 on your future account either by transfer or by a check issued from a bank account that belongs to you.

This is not a disadvantage in itself, but for people who do not yet have an account (a young asset, for example), they will then have to open an account in a traditional bank before being able to make their request for opening account at Boursorama.

4. The absence of physical agencies

Another Boursorama Banque disadvantage lies in its absence of physical agencies. Customers are not able to go to an agency to meet an advisor or carry out their banking operations (check delivery, etc.).

Online banks have the distinction of not having physical agencies. Nevertheless, certain online banks, which are subsidiaries of large network banks, offer their customers to carry out numerous agency operations: checks of checks, request for various certificates … This is particularly the case with Hello Bank, which allows to its customers to go to BNP Paribas agency to carry out some of their operations.

With Boursorama, however, this possibility with the agencies of Société Générale is absent. The whole banking relationship at Boursorama Banque is dematerialized : it is done either by the mobile and tablet app, or by the online portal, or with the help of a television. It is a disadvantage of Boursorama Banque which is particularly raised in forums by people who find it difficult to use Internet tools in a completely autonomous and ensured manner.

The advantages and disadvantages of Boursorama: in conclusion

Boursorama Banque is not lacking in assets. We have detailed in this file the advantages of the Boursorama offer: attractive prices in France and abroad, attractive welcome offer, available customer service, flexible access conditions, large offer of investments and credits … Boursorama Banque is therefore a banking reference in flexibility, accessibility and mobility.

Nevertheless, by making our file on the advantages and disadvantages of Boursorama, while trying to make it as reliable and objective as possible, we have noted some weaknesses. Starting with hidden costs and certain paradoxes of the subscription route for holders of a Boursorama product who wish to open an additional account.

Our additional resources:

- Boursorama card comparison

- Kador Boursorama Avis

- Boursorama Pro Avis

- Boursorama Bank sponsorship opinion

- Boursorama Bank Customer Reviews

- Carapass opinion

- Boursorama Protection Notice

- PEA Boursorama Avis

- Boursorama Banque comparison

- Boursorama Avis mortgage loan

- Boursorama Life Insurance Notice

A suggestion or a remark on the Boursorama Banque advantages ? Put us a little comment, we will be happy to answer you or bounce back on your remarks !

7 good reasons to become a member

Join the Boursorama community, ask your questions, give your points of view and see what others think, gain in expertise and share your knowledge .

Reason n ° 2

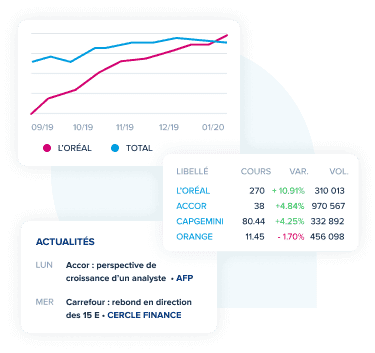

Your favorite values gathered on the same page

Create lists of values and easily follow all the information concerning the values that interest you thanks to:

- A general view of course, exchange volumes, variations, etc.

- Fundamental analysis indicators

- News, forums and agendas

- Historical graphs to monitor and compare the performance of different values

Reason n ° 3

Buy and sell values virtually

Train and test your risk-free strategies for your wallet using market data.

Follow the performance of your investments over time. You can create different virtual portfolios to test several strategies.

Reason n ° 4

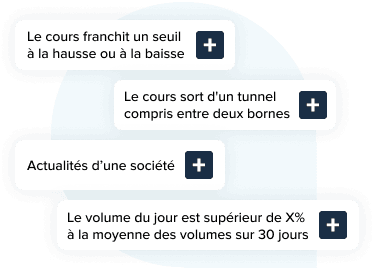

Receive personalized alerts

Be informed instantly:

- Variations on the values of your choice: crossing courses or technical indicators, variations of volumes, etc.

- Of the latest information from the companies you select.

You can thus make your decisions as quickly as possible depending on the evolution of the markets and the courses.

Reason n ° 5

Share and save your technical analyzes

Keep the configurations of your graphics and share your technical analyzes on forums and social networks.

Reason n ° 6

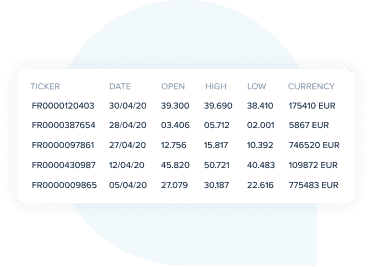

Download the values courses history

Make the personal analysis of the values that interest you thanks to a detailed Excel document.

Reason n ° 7

Be informed every week

Receive the newsletters of the Boursorama editorial staff:

- Stock market newsletter (weekly)

Key information from previous days, agenda of the main events that will influence stock markets the coming week, etc. - Newsletter heritage (monthly)

The latest information and practical sheets to help you manage taxes, retirement, real estate, succession or savings.