Best online bank – Comparison 2023 • Finance hero, online banking – Buying guide – UFC -Que Choisir

online bank

Apple Pay

Best online banks: comparison 2023

Almost one in four French people have a bank account in an online bank and this figure is constantly increasing. This is not a surprise because online banks multiply the advantages: free cards and bank accounts, reduced costs abroad, savings and investment within.

In recent years, they have even developed a credit offer while continuing to innovate in the face of the rise of neobancs.

If online banks are clearly superior to traditional banks, not all. Here is our comparison of the best online banks.

You are business manager, liberal profession or freelance ? Find our comparison of the best online pros banks.

The best general online banks

You want to go to the basics ? Here is our selection of the best banks online. We give you all the details a lower in our comparison. ⤵️

Fortuneo

A free and universal bank. We recommend !

- Free card

- Incommensurate

- Zero costs abroad

- Check

- Cashback

Up to € 230 offered

Balance Bank

The most complete free online bank !

- Costs : from 0 € to 9.90 € / month

- Minimal deposit : 50 €

- Free card

- Incommensurate

- Zero costs abroad

- Check

- Cashback

100 € offered !

Monabanq

Online bank with the best customer service

- Incommensurate

- Zero costs abroad

- Check and cash deposit

€ 120 offered !

Hello Bank!

The innovative online bank to travel with BNP

- Free card

- Incommensurate

- Zero costs abroad

- Check and cash deposit

Up to 180 € offered

The best neobancs, for a secondary account

Revolut

The neobank leader in Europe

- Costs : from 0 € to 13.99 €/month

- Minimal deposit : 10 €

- Free card

- Incommensurate

- Zero costs abroad

- Cashback

10 € offered !

Nickel

The account without bank, without conditions and open to all !

- Incommensurate

- Check and cash deposit

- Cashback

-50% on chrome

![]()

Bunq

An online bank with ecological transition

- Free card

- Incommensurate

- Zero costs abroad

- Species deposit

- Cashback

1 month offered !

The neobancs interest you ? You want a quick secondary account to open ? We tell you more in our comparison of the best neobanques.

The best green, ethical and responsible neobasters

Helios

The positive impact account from the 1st euro

- Free card

- Incommensurate

- Cashback

3 months offered

Onlyone

The ecological and benevolent neobank

- Costs : from € 3 to 6 € per month

- Minimal deposit : 10 €

- Free card

- Incommensurate

- Zero costs abroad

-20% for one year

�� You want to commit yourself to the causes that are dear to you and the ecological transition ? Consult our comparison of the best green and ethical banks !

The top 5 online banks in detail

Fortuneo: free online bank online

Fortuneo is an excellent online bank, offering a complete and free offer that can meet all your needs.

✅ This is why online bank climbs in first place in our comparison:

- Bank cards are free, even the most premium (subject to income);

- Withdrawals and payments are free worldwide, without limit and even with the entry -level card (accessible without income condition);

- Fortuneo investments are efficient : brokerage costs of securities and PEA are among the lowest on the market and Fortuneo life insurance, accessible from € 100, is very good.

Fortuneo also offers real estate loans, although on this point, it is not the most competitive.

➡️ Finally, Fortuneo is the bank of Mr. and Madame everyone, and in our opinion The best online bank for daily operations !

�� Right now with Fortuneo: 230 € max offered

Up to € 230 euros offered by Fortuneo

Boursorama Bank: The best online bank to borrow

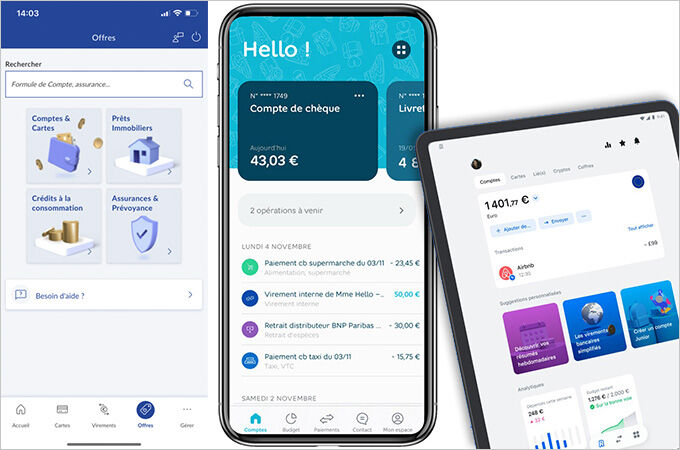

Boursorama Banque is the Leader online Bank, with more than 4 million customers in 2022.

- The Ultim card, comparable to a first visa, is freewithout income conditions. You will enjoy free payments worldwide, as well as a limited number of withdrawals.

- Personal and real estate loans are offered at competitive rates.

- The flawless ergonomics of its site and its mobile application makes it very practical to use on a daily basis.

- An offer for 12-17 year olds called Freedom: to find in our comparison of the best cards for minors.

Boursorama Banque also offers a full range of stock market investments and financial investments (life insurance, PER); But their costs disappoint.

Up to € 100 offered when opening a Boursorama account

Monabanq: Online bank to the best customer service

For the 6th consecutive year, Monabanq customer service has been rewarded in the online banking category. In addition, it offers a full range of savings or financing products, including a good life insurance contract and a “card that saves” both free and practical.

✅ But it is also:

- High -end visa cards accessible without income conditions.

- A guaranteed meeting in 24 hours with a specialized advisor.

- Access to Crédit Mutuel and CIC distributors for species and check deposits.

- An offer for 16-18 year olds and self-employed.

- 1 current account opened = € 1 paid by Monabanq to SOS Children’s villages.

Up to € 120 offered when opening a Monabanq account

Revolut: innovative and international

At the crossroads of a neobank and an online bank, Revolut constantly develops new features to revolutionize the banking world and facilitate the management of your budget. If you mainly need an account and an international payment card, this is an excellent choice.

✅ This is why we think Revolut is one of the best online banks:

- A free account and card in 5 minutes, without conditions.

- Almost unlimited payment ceilings: € 100,000 per month !

- A practical and inexpensive solution to pay in currencies or change.

- Share of expenses, prize pools and innovative tools To control your budget such as subscription management.

10 € offered by Revolut

Nickel: the fastest and accessible

Nickel is the most atypical online bank in France. His particuliarity ? In addition to being available on the internet, Nickel is present at more than 6,500 bebbings or partner traders, throughout the country.

✅ Here are the differentiating points of nickel:

- An account, a card, a RIB in 5 minutes with a simple identity document.

- Open to all : banking prohibitions, over -indebted and more than 190 nationalities !

- For the most in a hurry : Do not wait for your card, it is available directly in stores.

- No need for another account elsewhere : you can feed your account Nickel in cash from the opening.

- Access to more than 6,500 nickel pointsthroughout France for your Cash deposits and withdrawals.

- Sending money all over the world with ria .

-50% on nickel chrome or € 15 in savings

Bunq: the neobank that plants trees

The Dutch neobank is quite close to Revolut but with a pinch of in addition eco -responsible engagement which can make all the difference.

✅ Here are the important points we retain:

- Accessible physical and virtual cards without income conditions.

- A tree planted every 100 € spent with Easy Green.

- Innovative and responsible investment possibilities.

- A free paid account easy savings to 1.56% annual gross whose interest is paid every month.

- The possibility of having ribs from different countries, including France.

- A very ergonomic and customizable application.

- The bunq pack to have a common account up to 4 people with a reduction on the monthly subscription.

1 month offered to try bunq

The super comparison table of online banks

✅ Today, almost all online banks in our selection offer a free card, with or without conditions.

➡️ It is therefore on other criteria that you will have to make your choice, in particular: your tax residence, your income, or even, if you need an account for your minor child.

Fortuneo recently launched a consumption credit offer in partnership with Younited Credit, which allows it to be very effective. For other loans, Bforbank offers the highest ceilings.

Boursorama Banque innovates by offering “Boursorama Clic”, an offer of consumer credit and payment in 3 times which is obtained in a few clicks. You can get 200 to 2,000 € from only 5 € interest.

Comparison – Banks to save and invest

If you plan to use your bank beyond simple payment services, be aware that all online banks that we have selected also offer a more or less complete range of savings and investment services.

The costs that can vary from one bank to another, here is our comparison with a focus on the savings and investment offer of these online banks.

✅ Fortuneo does not offer PEL or PER, but is distinguished by an interesting stock market investment offer if you place few orders. Indeed, with the “brokerage” offer, you can place two stock market orders for free each month.

�� Right now, Fortuneo is offering one of the best booklets at the boosted rate of 5% for 4 months !

5% annual gross for 4 months for any first opening of a booklet + Fortuneo.

The BforBank securities account has the lowest brokerage costs, which allows it to take second position. Boursorama disappoints on investments, it is indeed far from being the cheapest bank in this niche. Fortuneo is doing very well, with a balanced offer on all stock market products.

Note that only two online banks currently offer the young booklet: Monabanq and Hello Bank!.

As for the placement offers of neobancs, they are almost nonexistent, with the exception, however, of the Revolut trading account which will also allow you to invest in cryptocurrencies. ��

Finally, let us highlight the Helios savings book which assures you that the money placed will not finance polluting projects. Nevertheless, it is not remunerated at the moment.

Although they are better than traditional banks, online banks savings are the most interesting. To invest, we recommend specialized brokers instead. Find our comparisons of the best life insurance, the best stock market brokers and the best PEA !

Comparison – Best online bank to travel

If you often go abroad, this section may well interest you. ��

Indeed, the arrival of neobancs on the market forced certain online banks to lower their costs abroad to remain competitive. Here is the detail of our comparison on international costs.

Comparison – The best customer services

While some people appreciate excellent application that allows them to be 100% autonomous, others prefer to be accompanied by a banking advisor if necessary.

➡️ We therefore compared the best banks online according to the quality of their customer service:

| Our opinion | Note | Offer | |

|---|---|---|---|

| Monabanq | The best customer service in the online banking category for 6 consecutive years. Reachable from 8 a.m. to 9 p.m. on weekdays and until 4 p.m. Saturday, by phone, chat, email and even social networks. | ⭐⭐⭐⭐⭐ | Monabanq: 120 € offered |

| Hello Bank! | We salute the deaf and hard of hearing, deaf and blind or aphasic service which provides you with an advisor in LSF (French sign language), in LPC (completed spoken language) or in TIP (instantaneous transcription of speech). | ⭐⭐⭐⭐ | Hello Bank! : 180 € offered |

| Fortuneo | Customer service available from 9 a.m. to 7 p.m. on weekdays by phone or emails. Simple and effective despite the absence of dedicated advisor. | ⭐⭐⭐ | Fortuneo: 230 € max offered |

| Purse | Advisors that can be reached until 7 p.m. on weekdays and 4 p.m. on Saturdays, by phone or email. Unfortunately, you have to insist with the bot to have an online human and impossible to make an appointment to be recalled by an advisor. | ⭐⭐⭐ | Boursorama Bank: € 100 offered |

| Nickel | Customer service reachable by phone from Monday to Saturday. Otherwise, you can also fill out a contact form or use social networks. | ⭐⭐⭐ | Nickel: 15 € offered |

| Bunq | Reachable by messaging or email, BUNQ customer service has the merit of being in French. In the event of an emergency (loss/flight of card, fraudulent transaction, etc.) your request is prioritized. | ⭐⭐ | Bunq: 1 month offered |

| Revolut | Customer service can only be reached by messaging and not always in French. Better to be English -speaking in case of worries. | ⭐ | Revolut: € 10 offered |

The best online bank for customer service

What are the neobancs worth ?

In this comparison, we especially mentioned the neobancs Revolut and Bunq. The reason is simple: These banks have offers that are closer and closer to those of online banks. Indeed, apart from a few exceptions like BUNQ, there are no or no savings/credit products, it is impossible to deposit a check, species, or to have a discovery.

✅ But mobile banks have other advantages in front of online banks. For example, they generally give the right to A free bank card, To pay in France or abroad at no cost. Even if, as we have seen, it is also the case of Fortuneo and Monabanq.

The advantage of neobanques is therefore another. They are designed to operate on smartphone with very pleasant mobile applications and some interesting innovations. Revolut allows for example to segment your account in several “chests” to achieve savings objectives or save in currencies, and even in cryptocurrency.

The neobank also makes it possible to create shared spaces and prize pools to organize common expenses, or to create a revolut account

✅ In conclusion, neobancs are excellent extensions to a current account in a classic or online bank. They are therefore intended for the youngest who seek to reduce their costs but which are also sensitive to this type of functionalities.

The case of green and ethical neobancs

We have carried out a comparison dedicated to these new players in the banking sector, considered as “mission companies”, who wish to upset established standards. In particular by investing only in projects working for the common good.

The Green Helios neobank is mainly turned towards the ecological transition and offers a cherry wooden visa map of the most beautiful effect. Canb is more generalist, and allows you to make donations very easily for the causes that are important to you: environmental defense, animal protection, social and humanitarian actions … You choose, and take advantage of a tax reduction at the same time ! ��

Find Helios, Canb and many others in our selection of green, ethical and managers banks !

online bank

Reduced costs, a free bank card, welcome offers … Thanks to their attractive offers, online and neobank banks are attracting more and more customers. Their main asset: reduced costs compared to traditional networks. Some brands do not hesitate to highlight the free bank card or various operations. But what do these dematerialized banks really worth ? Are they reliable ? Are they truly cheaper ? Can they replace conventional banking agencies ? Overview of the specificities of this expanding market to help you choose the online bank that best suits you.

- 1. What is an online bank ?

- 2. What are the advantages of an online bank ?

- 3. What are the disadvantages of an online bank ?

- 4. Are remote banks reliable ?

- 5. What conditions do you have to meet to open a bank account ?

- 6. What documents should be provided for an account opening ?

- 7. What are the deadlines for opening a bank account ?

- 8. Is it possible to open a without deposit account ?

- 9. Which bank account to choose for a child or a teenager ?

- 10. What criteria to take into account to choose an online bank ?

- 11. How to change bank for an online bank ?

In summary

- There are two types of online banks: online banks called “first generation” and neobanques.

- Not all online banks offer the same products and services, but they are increasingly diversifying.

- These banks are betting on reduced, even free costs, and play the card of digitalization, simplicity and autonomy of their customers.

- If it is often highlighted, free bank card can be packaged.

- Some products and services remain payable, although their prices are generally competitive compared to traditional networks.

- The opening of an online banking account is easy and quick, and requires few documents.

- According to the bank, a deposit is not always requested from the opening of an account.

- Some online banks offer specific accounts dedicated to children and adolescents, adapted to their age.

- To choose a bank, several criteria must be taken into account, but you have to keep your projects and needs in mind.

- To change the bank with ease, it is possible to call for free the mobility assistance service.

What is an online bank ?

There are two main categories of online banks: “first generation” online banks and neobancs.

First generation online banks

Online first generation banks are generally backed by a banking establishment. This is particularly the case of Hello Bank! (BNP Paribas) or Fortuneo (Crédit Mutuel Arkéa).

Unlike their parent company, these banks have the distinction of not having agencies: they have no space to accommodate customers, like traditional networks. Consequently, the whole relationship between customers and advisers is dematerialized. The management of the accounts open to it is done exclusively remotely, by internet, mobile application or telephone.

The employees of these banks all work in the same place to meet their customers’ requests. Thanks to this mode of operation, online banking establishments are able to offer much lower prices than those in traditional networks. Indeed, the absence of agencies allows them to considerably reduce real estate costs, but also the number of employees.

Good to know. Online banks are becoming more and more generalist. In parallel with the current account, it is now possible to access many other products (credit, savings, insurance, etc.).

The neobancs

Like first generation online banks, neobanques offer current accounts with classic bank card. But to stand out, neobancas bet on their digital offer accessible from a smartphone, often faster and intuitive than their website.

The offer of this type of mobile banks continues to expand. Among them, Orange Bank (ex-Groupama Bank), nickel (detained by BNP Paribas), Revolut or N26.

What are the advantages of an online bank ?

Online banks offer many advantages.

A simplified account opening

Online, opening an account can now be done in a few minutes. The subscription route wants to be simple, fluid and secure. It can be done directly via the Bank’s site or mobile application whose ergonomics are generally designed to be readable, functional and above all, easy to use. The objective is to be easily usable by all, students, active or retired.

Reduced costs

One of the main assets of online banks undoubtedly lies in particularly competitive management costs. These are indeed up to three times lower than those of conventional banks.

Most online banks do not charge – or little – account holding costs (against amounts that can amount to € 200/year in conventional banks), transfer or levy. Some banks also offer free bank card or bet on gifts when opening a current account (reduced cost offer, welcome bonus, etc.). Nevertheless, if the costs are less, it is not synonymous with free. Number of operations remain invoiced.

Autonomous and simplified management

Online banks offer their customers a 100 % dematerialized account management. It is therefore no longer necessary to move in agency: customer requests are made directly on the internet, in a few clicks, or via a mobile application.

These banks thus provide their customers with personal space. This allows the holder of the account to make, with ease, most of the operations (printing of RIB, implementation of permanent transfers, check-ups, etc.) in total autonomy, 24 hours a day and 7 days a week.

The availability of advisers

If online banks do not offer a physical agency to accommodate customers, most of them nevertheless have advisers to answer the most sharp questions. They are generally reachable by phone, chat or email and during time slots often more extensive than in traditional banks.

Good to know. Although this is not the standard, some online banks offer their customers the opportunity to access agency services. This is particularly the case of EKO (Crédit Agricole), Hello Bank! (BNP Paribas) or Monabanq (Crédit Mutuel). However, possible operations differ from one online bank to another. It is therefore preferable to find out before opening an account.

Great flexibility

Online banks allow you to carry out all kinds of operations directly via the Internet or a mobile application. It is therefore no longer necessary to comply with the opening hours of the banking agency closest to you.

What are the disadvantages of an online bank ?

Although many advantages, online banks are not exempt from disadvantages.

The customer relationship

Online and neobank banks are regularly pointed out for their customer service, in particular the absence of dedicated advisor. They rely on other points, such as a higher hourly amplitude than in agency or the contact method via many channels (telephone, e-mail, chat, social networks, etc.). Nevertheless, the waiting time to reach an advisor can be long, from a few minutes to several hours.

Special conditions of use

In return for a free product or service, some online banks may impose conditions of use. For example, free bank card can be conditioned on a minimum number of payments.

The complexity of certain operations

According to online banks and in the absence of a physical agency, some operations may be complex, in particular with regard to the collection of checks or the payment of cash.

Freely conditioned free

Online banks focus on free number of services. But beyond attractive promises, there are often strict conditions to be fulfilled to benefit from it. This is particularly the case for free bank cards or without deposit accounts.

Are remote banks reliable ?

Yes, without a doubt. In France, online banks all benefit from an approval of the Prudential Control and Resolution Authority (ACPR), backed by the Banque de France, and whose role is to guarantee the seriousness of the establishments and protect your savings.

In addition, one of the main missions of the Financial Markets Authority (AMF) is to protect savings invested in financial products.

You still have a doubt ?

The AMF provides a white list of authorized actors. This can be viewed free online. A doubtful email, an overly attractive promise, a request for transfer … If you still have any doubts, do not hesitate to perform checks before acting. To do this, the AMF offers several tools, such as a blacklist of unauthorized companies and sites or a test to determine if you are the victim of a scam.

Finally, be aware that the majority of remote banks are subsidiaries of traditional banks, insurance companies or mobile telephone operators.

| Head quarter | Subsidiary company |

| Bank Axa | Axa |

| Balance Bank | Societe Generale |

| BforBank/Eko | Agricultural credit |

| Fortuneo | Crédit Mutuel Arkéa |

| Hello Bank! | BNP Paribas |

| Mona Bank | Crédit Mutuel CIC |

| Orange Bank | Orange group |

What conditions do you have to meet to open a bank account ?

The opening of an online account is relatively simple and fast. It is generally necessary to fulfill the following conditions:

- to be of age ;

- be a natural person;

- have a tax residence in France;

- Have a valid phone number;

- Have a valid email address.

Are income conditions due ?

Depending on their strategy or the services offered, some banks require a minimum deposit each month. Nevertheless not all make this choice. In some cases, a payment is also requested at the opening of the account.

What documents should be provided for an account opening ?

As a rule, only a few documents are requested by the banks in order to be able to open a bank account, namely:

- an ID ;

- proof of domicile dating from less than 3 months;

- A signature specimen (manuscript or electronic).

Certain banking establishments may, however, request additional documents, such as a salary slip, a tax notice or even proof of pension payment.

I am banned, can I still open an account ?

Banks systematically check the situation of their new customers. If you are banking banking to the Banque de France, the establishment is entitled to oppose the opening of your account. However, this situation is in no way irreparable. You can indeed apply for a “right to account” from a branch of the Banque de France, a decree of March 11, 2022 made the law procedure easier and rapid.

This will then allow you to have some basic banking services. More concretely, you will benefit from a withdrawal card, a RIB, the possibility of making transfers, making payments by TIP (Interbank Payment title). You can also make deposits and withdrawals of cash and have an account statement.

What are the deadlines for opening a bank account ?

Online, the opening of a bank account is relatively fast. This approach can generally be carried out in just a few clicks. But to be able to take advantage of all the advantages of his account, the holder must sign and return the contract by post to the banking establishment which will then take care of verification of supporting documents. A period of a few days is therefore necessary before the opening is effective. According to a study by the D-Rrating digital performance rating agency, this period can go from single to double depending on banks.

Average opening time of online banks

| Banking establishment | Deadline |

| Hello Bank! | 13 days |

| Fortuneo | 10 days |

| Purse | 8 days |

| Source : D-acting | |

The deadlines for this process are, however, shorter on the side of the neobancs.

Meaning opening times of neobanques

| Banking establishment | Deadline |

| Hello Bank! | 13 days |

| Fortuneo | 10 days |

| Purse | 8 days |

| Source : D-acting | |

Nickel, a subsidiary of BNP Paribas, therefore appears to be the fastest to obtain an operational account in record time. A shortened delay which is explained by the particularity of distributing bank cards in boxes sold in tobacco offices. This distribution mode thus allows immediate use.

Good to know. Please note, activation of the account is sometimes conditioned on a money deposit.

Is it possible to open a without deposit account ?

If there is no legal obligation imposing any deposit when opening a bank account, most online banks still require a minimum payment that varies from one establishment to another, going from ‘A hundred euros at 300 euros depending on the offer chosen.

Only fortuneo is an exception. This does not ask for any deposit for its Fosfo offer when subscribed via the application of the bank with a Fosfo Mastercard card.

Which bank account to choose for a child or a teenager ?

There are specific offers, suitable for minors, whether to learn how to manage your pocket money or start taking financial independence.

Among the available offers are Westart (My French Bank), Freedom (Boursorama Banque), Revolut Junior (Revolut), Vybe, Kard, Pixpay or Orange Bank Pack Premium. Please note, some offers are reserved for children from customers. This is particularly the case of Revolut, Orange Bank or Boursorama Banque. On the other hand, the opening of an account to a minor must imperatively be initiated by one of the parents or legal representative of the child. The latter must then generally provide:

- his identity document;

- the child’s identity document;

- Recent proof of domicile;

- A copy of the family booklet.

Before opening a bank account to your child, here are some criteria to take into account.

The age of the child

Traditional banks quickly solicit young parents to offer a savings book to their children. One of the most widespread uses is to open a booklet A. A child book can also be opened from the birth of the child. The question of the current account and the bank card – payment or withdrawal – often does not come until later, generally around 12 years.

Some banks offer tools allowing children to familiarize themselves with the management of their savings, such as prize pools or pigers on which the child can turn money.

The type of card

Depending on the age of the child and the use intended, there are two types of card:

- withdrawal cards;

- Payment cards.

The first is generally offered from the age of 12. From the age of 16, the withdrawal card can be replaced by a payment card with systematic authorization. It must then be associated with a current account.

Some online banks offer the possibility of entrusting a payment card to children from the age of 12, even 7 years with Revolut Junior. They can be used for all types of purchase, online or in store. Contactless payment can also be activated. Parents keep an eye on their child’s expenses through mobile applications and control tools and can block or limit certain actions.

Parental control

More than in traditional banks, online bank accounts facilitate parental monitoring thanks, in particular, to mobile applications. Various features make it possible to remotely control the use that the child makes of his account. Depending on the banks, it is thus possible to:

- Punctually block the use of the bank card;

- block online payment;

- Disable contactless payment;

- modify the ceilings;

- Prohibit expenses in certain brands;

- etc.

On smartphone, nothing could be simpler than making purchases in application stores such as Apple Play, Google Play or Samsung Pay. To avoid unpleasant surprises, many banks online limit the possibility – or even block access – depending on age.

The cost

Most of the online banks offer online accounts for children and adolescents at very competitive prices, but they are not free. Billing is generally done:

- either through a monthly subscription;

- either by pricing certain operations.

Pixpay and Xaalys invoice € 2.99/month, My French Bank (We Start account) € 2/month. Only the Young Nickel account offers an annual subscription at a price of € 20. For this price, these banks offer free payments and withdrawals in the euro zone.

Other banks offer free accounts and only the operations considered to be exceptional are billed, for example to make a withdrawal. This is particularly the case of Revolut or Vybe (€ 1.50 per withdrawal).

Outside the euro zone, operations are mainly paid. Some exceptions: card payments with Vybe, Freedom and Kard are without commission, including in a foreign country. Only the westart offers from my French Bank and the Orange Bank Premium Pack offer free of all operations abroad (payments as withdrawals), for € 2/month and € 12.99/month respectively.

To note. Although fun and very practical on a daily basis, online banks for children are fairly limited in terms of savings. It may be interesting to combine these options with offers from traditional networks such as a young booklet, a booklet A or even life insurance with a traditional bank.

What criteria to take into account to choose an online bank ?

In recent years, more and more online banks have been created. Among the multitude of offers, so it is sometimes difficult to navigate. Because if they all look alike, they actually have each of their particularities.

To find the bank most suited to your situation, ask yourself a few questions:

- What are my projects ?

- What are my needs ?

- What banking services do I need ?

There are also some essential criteria to verify.

Entry conditions

To open an account or obtain a bank card, most establishments require their customers a minimum level of income. Its amount is more or lower. It is also frequently asked to justify a home. This condition is nevertheless infrequent to open an account with a neobank.

The conditions of the welcome bonus

If online banks show attractive welcome bonuses without complex, some nevertheless condition the possibilities of receiving it. Before you are seduced, check that you are well eligible for the displayed offer. The latter can in particular be conditioned on a minimum number of payments in a given time.

The conditions of offers without income condition

If the bank does not display any income condition, check any counterparts before subscribing. Remember in particular to check:

- the type of card delivered;

- The conditions of use of the card.

The costs of operations and procedures

Remember to check the related rates:

- in the daily use of the bank account. Compare, if there are any, account holding costs, transfers, withdrawals, etc. ;

- International uses. If you are traveling a lot, don’t forget to check the conditions that apply abroad;

- to exceptional procedures. These may be the conditions for loss of the bank card, authorization for overdrafts, payment incidents, etc.

All banking establishments have obligation, on the site, to present a standard extract from the prices of the most common products or services linked to the management of a deposit account or a payment account.

In the event of a change, banks have two months to inform you. If you dispute them, you can request the closure of your account. Your bank can also take this initiative.

Bank cards: types, conditions and possible costs

Most online banks offer different categories of bank cards:

- Classic cards, generally Mastercard or Visa Classic;

- high -end cards, such as Gold Mastercard or Visa Premier;

- Premium cards, like Mastercard World Elite or Infinite Visa.

It is also often possible to choose between a card:

- immediate speed;

- with delayed flow.

Depending on the type of card desired, the associated costs may vary from one bank to another. Most online banks nevertheless give the payment card gift. However, this gratuitousness as well as the proposed card category depend on several elements, such as:

- a minimum level of income;

- a minimum level of savings;

- outstanding.

Depending on the banks, these conditions may vary. The most high -end cards are also often paid, although cheaper than in a traditional bank network.

If many online banks offer the payment card to their customers, conditions of use must be respected. Most often, it is:

- a minimum payment amount per month;

- of a determined regular use frequency.

If these conditions of use are not respected, some banks do not hesitate to pay costs.

Bank banking products

Depending on your short or medium term projects, it may be interesting to take a look at other banking products offered. It can be:

- savings products;

- banking booklets;

- real estate credits;

- personal loans;

- stock market products;

- Life insurance contracts.

The mobile application

To manage your account, it is essential that the bank has a mobile application that is both fluid and easy to use. Several criteria must be taken into account, such as:

- ease of use to perform an operation;

- download time;

- the graphic universe;

- the quality of navigation;

- the journey within the application.

To select the application that suits you, do not hesitate to grant yourself a test period. You can, moreover, refer to user comments in the application shop on your phone to help you determine the positive and negative points.

Customer service quality

If all banks offer customer service, this service is not worth from one establishment to another. Do not hesitate to consult the opinions of other customers.

Account holding fees

If traditional banking establishments charge account holding costs, this is generally not the case for online banks. You are not immune to an exception. So remember to check this element.

Withdrawal conditions

If traditional banks encourage their customers to withdraw cash in ATMs (DAB) of their network, this is not the case for online banks. Quite simply because these do not have one. In other words, withdrawing liquidity on French territory will not cost you a penny. At least, most of the time since there are counterexamples. Nickel thus offers 3 free withdrawals per month from tobacconists and points of sale. The following are billed € 0.50 per withdrawal and up to € 1.50 in the event of a withdrawal in an automatic ticket distributor. For its part, N26 makes it possible to make between 3 and 8 free withdrawals per month, depending on the type of account. Beyond, an additional € 2 is to be expected with each operation.

In the euro zone

In most cases, the withdrawal of liquidity to a distributor of a country in the euro zone is not increased. This is particularly the case with brands such as Axa Banque, Fortuneo, Bforbank, Boursorama Banque or Orange Bank. Some online banks, however, apply additional costs during withdrawals abroad. Before leaving, therefore check the withdrawal conditions to avoid unpleasant surprises.

Outside the euro zone

Outside the euro zone, removing liquid can be expensive. For this type of operation abroad, online banks align their prices, costs that can quickly increase. So be careful if you travel regularly to other continents.

As a rule, banks apply:

- fixed fixed costs, up to € 2 per withdrawal;

- variable costs between 1.7 and 2 % of the amount of the operation.

Among the least gourmet banks is hello bank!. Indeed, its customers can take advantage of the Global Network network of the BNP Paribas group allowing free withdrawals in more than 50 countries.

Bank overdrafts

A large majority of online banks allow the overdraft. As a rule, they all align themselves with the same scale, namely 7 or 8 % per year. On the other hand, when this amount is exceeded, the overdraft becomes unauthorized and is invoiced 16 %.

Some neobancs do not allow us to have an account in the red. This is particularly the case with Revolut, Nickel or N26.

Chequiers

Although its use tend to back up, the checkbook may be necessary in certain situations of daily life. Most of the online banks therefore offer this option, but this is not the case for all. Thus the neobancs N26 and Nickel do not offer them.

In the absence of an agency, the checkbooks are sent by La Poste. It can be a simple, follow -up or recommended letter. Please note, this shipment may have a cost.

Good to know. Watch out for unpleasant surprises. If the operation is carried out by phone, the request for a checkbook can be invoiced. This amount varies between 3 and 5 €.

Means of payment insurance

If it is very useful, this protection can be quite expensive. The difference between the annual contributions of the various brands is indeed important: from ten euros to almost € 100. If you are interested in the option, it is better to check the prices upstream.

→ Thanks to its banks comparator, What to choose helps you find the online bank best suited to your personal needs and at the best price.

How to change bank for an online bank ?

Change bank without banking mobility

It is possible to change the bank yourself, without involving the bank mobility assistance service offered by your future bank. To make a manual change, just take a few steps:

- Open a new bank account by following the different stages of the online bank chosen;

- Send a registered letter with acknowledgment of receipt to request an account closure;

- Restore your payment methods directly from an agency or, failing that, destroy them.

Also think of:

- Communicate your new bank details to creditors and debtors;

- Cancel your permanent transfer and levy orders;

- Leave enough money on your old account for operations that have not yet been debited.

Change bank with banking mobility

Since 2017, the Macron law has offered all customers of banks free aid for banking mobility. This option makes it possible to make a change of banking domiciliation with ease: it is the new bank that takes care of administrative formalities and no longer the customer.

To use this service, simply request it to your new bank by giving it a mobility mandate. She will then be able to take care of:

- the transfer of recurring operations of your old account to the new, such as your taxes, the payment of your salary or your internet invoices;

- Communication, to all your creditors, of your new bank details, in other words, your RIB.

It is also possible to ask your new bank to close your old account.

The main online banks in detail

Traditional banks still in the race

Even if they lose ground on online banks and neobancs, traditional banking networks are still mostly used by the French. If you want to change the bank, you can use our comparator to find the cheapest bank near you and adapted to your personal needs.

Best online bank: the comparison for 2023 (guide)

This is a fact: the French easily leave their traditional bank to turn to an online bank. These establishments have represented more than a third of all account openings in 2023. Internet finance has been developing exponentially for a few years on all types of banking products.

Our online banking comparison gives you an overview of the actors present. We have only taken into account establishments that offer a complete alternative to traditional banks. They offer at least a current account, a card, a savings book, investment and credits. The neo-banks can be found here.

Comparison: The best online banking 2023

![]()

Apple Pay Google Pay Pay

Gold Mastercard free

Black Card available

Abroad: 100% free

Excellent ass-life

Annual costs: 0 € • Initial deposit: 300 €

Check deposit: ✔ • Specific deposit: ✘

Monthly card cost: 0 €

Euro zone withdrawals: Free • Payments EURO Zone: Free

Currency withdrawals: free • Invitation payments: free

Apple Pay Google Pay Pay

Apple Pay Google Pay Pay

Bank less expensive

Apple Pay, Google Pay

Premium card free

Free abroad payments

Conditions: without income condition – Welcome and Ultim cards

Annual costs: 0 € • Initial deposit: 300 €

Check deposit: ✔ • Specific deposit: ✘

Monthly card cost: 0 €

Euro zone withdrawals: Free • Payments EURO Zone: Free

Currency withdrawals: 1.69% • Invitation payments: free

Apple Pay Google Pay Pay

Apple Pay

Offer free and unconditionally

Zero costs abroad

Best booklet savings

Prime : € 1 per month / 6 months

Conditions: without income condition

Annual costs: 0 € • Initial deposit: 10 €

Check deposit: ✔ • Specific deposit: ✔

Monthly card cost: 0 €

Euro zone withdrawals: Free • Payments EURO Zone: Free

Currency withdrawals: free • Invitation payments: free

Apple Pay

Apple Pay

0 € minimum income required

Checks and species deposit

FIRST VISA/Platinum without condition

Customer service of the year 2023

Conditions: without income condition

Annual costs: € 36 • Initial deposit: € 50

Check deposit: ✔ • Specific deposit: ✔

Monthly card cost: 0 €

Euro zone withdrawals: Free • Payments EURO Zone: Free

Currency withdrawals: 2% • Payments in currency: 2%

Apple Pay

The market leader, Boursorama Banque, crossed the threshold of 4 million customers in 2022. The online bank of the Société Générale group is experiencing phenomenal growth with an offer that is just as much. Competition is struggling to resist: its dolphin ING announced at the end of 2021 that it closed its activity in France. Since then, he has transferred part of the accounts of his customers to Boursorama Banque.

Just behind Boursorama Banque, we find the bnp paribas subsidiary: Hello Bank!. The latter is positioned with two complementary offers that are on the rise (Hello One and Hello Prime). Otherwise, among the best banks online, we also find Monabanq, Bforbank and to a lesser extent Orange Bank. In the end, the market is relatively limited.

Among the reference players, we also note the presence of Fortuneo Banque. The latter also has a complete offer with all daily banking products. It should reach one million customers informed of 2023. Like Boursorama Banque, it has experienced strong popularity for its scholarship products.

For this online banking comparison, the table summarizes the services of each banking establishments. This goes from the current account, with a bank card, savings, scholarships and credits until the welcome bonus. Depending on the profile and the needs of each customer, the best online bank can therefore change. The fact remains that some banks differentiate themselves to the overall for their offer.

Online bank, a strong trend

More than 10 million customers in France

The online bank has gained popularity and visibility to the French public over the past few years. According to regulator figures (ACPR), these establishments have recorded more than 1.3 million customers in 2018. Growth has accelerated over time: in 2022, Boursorama alone recruited more than 1.4 million customers !

In total, Online bank would have convinced more than 10 million customers, Or more than 15% of the French population. This figure does not include neo-banks which are considered as payment solutions. N26 alone has more than 2 million customers in France alone. Revolut has crossed the million users. The Nickel account reached 3 million customers in early 2023.

Ranking of the best online bank in 2023:

- Balance Bank

- Hello Bank!

- Fortuneo Bank

- Monabanq

- Orange Bank

- Bforbank

- Fortuneo Bank

- N26

- Revolut

- My French Bank

ING no longer appears in this comparative ranking of the best online bank in 2023. The Dutch giant threw in the towel on the French market. He thus leaves the way for players like Boursorama Banque, Hello Bank!, Fortuneo or Monabanq. Orange Bank is struggling, the telecom group would like to get rid of it. ING customers were invited to transfer their account to Boursorama Banque, which a large part of the customers has done.

Change to an online bank

The loyalty of the French to their historic bank is eroding. They no longer hesitate to change bank to find a better online bank like one of our comparison. According to the Consulting Bath firm, 5% of French people changed bank in 2018, 2 times more than in 2014. In 2023, the trend will be even stronger.

This figure should further increase in the coming years because the French are less attached by emotions to their bank. If loyalty has long been an asset of retail banks, the French are tired of paying too much. Often, high costs are not justified or not transparent. In an exchange with press-citron, Paul de Leusse, the director general of Orange Bank summed up the situation: “It is irritating to see a bank take costs for reasons that you do not understand”.

This tendency to change the bank benefits online banking. The young generation is logically more sensitive to online banks and it is less faithful to the starting banking establishments. In 2018, 7% of the 25 to 34 year olds have changed bank and the online bank is the winner of these changes. In 2023, the situation will be the same.

In addition, the pandemic favored remote banking management. The French are now used to managing their accounts in distant without having to request their physical banking advisor. For this reason, they can also more easily turn to online bank. It was the black point of the latter (although it has customer support by phone much better than a traditional bank), it is no longer an obstacle.

A full range of products

The best online bank is the one that provides the most answers to its customers – at the best price. Beyond the current account, it is necessary to take into account the banking products of the offer which allow to make the online bank its main account. Banks like Hello Bank!, Monabanq, Fortuneo or Boursorama have a range of products similar to that of a network banking. There are Bank cards, life insurance, savings, stock market, mortgage or consumer loan.

It is interesting to see that the millions of online banking customers have not all subscribed to the current account. For the time being, there are more than 10 million current online accounts, out of a total of 80 million bank accounts in France. Some French people have chosen to focus on other products from a digital bank.

Over the past few years, Internet establishments have recorded crazy growth at the expense of conventional banks. Also according to the Bath cabinet study, The best online banks of our comparison have taken about 14% more customers on the last 3 financial years. Some have done better, such as Boursorama Banque which increased from 700,000 to 4.4 million customers between 2016 and early 2023.

The criteria for choosing an online bank

�� Why choose a bank on the Internet ?

Online bank presents itself as a serious alternative to conventional network banks. In the majority of establishments on the Internet, there are ranges of products as complete as in basic banks, at a lower cost. Besides, most online banks have a free offer. Boursorama Banque explained in 2018 that 53% of its customers did not pay any bank charges.

If you are tired of paying too much costs, and if you want a bank in your pocket, the online bank is the solution. Today, 6 million French people have succumbed to offers on the Internet, and this trend is strengthening over time.

⚪️ What is the best online bank ?

Each client has different needs, and there is therefore no better universal online bank. Nevertheless, some banks are distinguished for their global offer, for the aggressiveness of their prices and for their customer support. In our online banks comparison, you can discover those that are best on certain criteria.

Over the years, these online banks have evolved – and they are still evolving. To deal with the arrival of neo-banks, many have redesigned their offer. This is the case of Hello Bank!, ING, Boursorama Banque or Fortuneo who arrived with unanswered and free options.

�� What parameters take into account in his choice ?

If as many people decide to take the plunge and go towards a better online bank like those of the comparison, it is because the latter offer a level of service up. All this goes beyond the fears of a dematerialized relationship. Among the advantages of an online bank, we can cite free life operations such as account management or deposits.

Then, the facilitated management of the account, the quality of the banking products offered and the suitable customer support are 3 strong arguments which contribute to the success and the development of the online bank. Below in our Best Online Bank Comparison Guide, the essential points to consider when you are looking to go on a new establishment.

�� Are online banks free ?

As you can see above on this online banks comparison table, most online banks are actually free. Zero euro account holding costs, € 0 costs for the card and € 0 costs for daily operations. It is therefore logically more than half of the customers in these establishments have no bank charges for the year: their online bank is therefore really free.

While a traditional bank takes an average of € 200 for bank costs per year from its customers, online bank is therefore already a revolution at this level. And it is not only satisfied with a basic offer since certain establishments like Hello Bank!, Bforbank or Boursorama Banque offer a free premium bank card (Visa Premier) to its customers, subject to monthly income condition. However, it should be remembered that the best online bank is free for those who will justify a minimum level of monthly income or a savings deposit.

In some cases, bank customers still have access to physical agencies and distributors to make deposits (checks or cash), transfers or see their account live. All, once again for free. This is the case for example at Hello Bank! which offers access to 2,000 BNP Paribas agencies across France.

Often considered to be the best online bank of comparisons, Monabanq offers access to CIC distributors (to make deposits and transfers since the latter) through France to its customers, but it requires a monthly contribution (certainly very low, but from the blow it is not free). The particularity of Monabanq is that it does not require any condition on income.

⚪️ What products are offered in these banks ?

The best online banking model like those we have presented to you in the above comparison is interesting because it is very similar to that of a basic network bank – and it is therefore distinguished from all new fintechs who are often specialized in a fair fairly technical banking product (international transfers with TransferWise, mobile payment, payments abroad with Revolut).

Indeed, most French online banks offer a range of banking products similar to that we have in a classic bank: current account, bank card, real estate credits and consumption, savings book, scholarship, life insurance or insurance. In the majority of cases, remuneration for all savings solutions offered by online banks are higher than that of conventional banks. Likewise, credits in general have more advantageous rates on the Internet. All these banking products are accessible via the customer area, on the Internet. There are few traditional banks that have now managed to offer the management of all their online products.

�� Is the customer support of these banks reactive ?

The great fear of many French people when they migrate to a better online bank like that of our comparison is the fear of losing customer relations with his advisor. In reality, it is ultimately very different. The awards obtained by the Monabanq bank in 2018, 2019 and 2020 as “customer service of the year” illustrate that these establishments today offer a much more constructive and intelligent relationship than in many traditional establishments. Due to the fear of the dematerialized and not physical relationship, online banks therefore worked on their customer support.

This support is accessible by many means, and on very wide hours (in most cases, until 9 p.m. or 10 p.m. on weekdays, and 6 p.m. on Saturday). It is also important to highlight the responsiveness of these best online banks which responds in a few minutes thanks to customer supports based in France and where each advisers specializes in a bank product: you therefore have the best advice on each of the products. Conversely, you can sometimes wait a few days for your traditional banking advisor to answer your questions, sometimes with a lack of knowledge.

How are they structured ?

Banking groups

In this best online bank comparison, all players are the property of established banking groups. The latter have a solid reputation and have no difficulty in finding funding. This also implies that your money is safe in a digital bank. This is however not the case of neo-banks who cannot advance this argument. It is also a good way to take advantage of the expertise of a group, in particular on certain support functions.

For example, Boursorama Banque is a subsidiary of the French Société Générale group, Hello Bank! of the BNP Paribas, Monabanq network of the Crédit Mutuel CIC group, Fortuneo Bank of the Arkea and Bforbank group of the Crédit Agricole group. However, online banking offers are different from those that we see in conventional banks.

The groups advance the significant cost of agencies as a reason that justifies the costs of conventional banks. Conversely, online banks of this comparison do not have physical presence (outside Hello Bank! which is based on the network of BNP Paribas and Monabanq agencies which benefits from automatic counters of Crédit Mutuel), which explains that the costs are lower. On average, a customer in an online bank saves 200 euros in costs per year.

With a dematerialized model, customers are the winners. While traditional banks encourage their customers to use dematerialized interfaces for budget management (on computer or smartphone), they converge on online banks. Remains the price, which does not converge. This is why they lose customers.

Online banks: welcome bonuses in 2023

| online bank | Bonus | Cost | Note |

|---|---|---|---|

| Purse | 150 euros | Free | 97/100 |

| Hello Bank! | 180 euros | Free | 93/100 |

| Fortuneo Bank | 80 euros | Free | 92/100 |

| Monabanq | 120 euros | Between 3 and 9 € | 92/100 |

| Orange Bank | 100 euros | Free | 82/100 |

| Bforbank | 80 euros | Free | 82/100 |

Advantages to choose a bank on the Internet

The best online bank is perceived as free. The customer will not pay any fees for accounting, the card and the operations of everyday life. There is just Monabanq which requests a subscription from € 3 per month with its Pratiq account+. The Crédit Mutuel group subsidiary refused its offer in 2020 with 3 coherent formulas.

At Boursorama Banque, around two thirds of customers pay no fees. On average 2021 overall, customers paid 7.79 euros in costs. It is for this reason that it was elected “the cheapest bank” for the 15th consecutive year in December 2022. Others like the best online banks Hello Bank! where Fortuneo hold the same promise of free in their offer.

With the free online bank presented in our comparison, you should know that establishments sometimes find it difficult to reach financial balance. The support of their parent company is essential to continue to grow and finance growth. The director general of Boursorama Banque, Benoit Grisoni, told us that she could “Be immediately profitable if they stopped acquisition costs”.

The first online bank in France does not know any stops: it records 100,000 new customers per month in 2022. It crossed the 4 million customers aware of the summer of 2022 and it should exceed 5 million in the first quarter of the year 2023. Very quickly, it should converge on the number of customers of more traditional banks like BNP Paribas or Société Générale.

Competition that intensifies

Online bank can retain customers on products where the margins are stronger. Credits can be a windfall for these establishments over time. Unfortunately, the population on the web is still not very sensitive to these products. Indeed, only 10% of online banking customers have subscribed to a credit. And yet online establishments are much more competitive on loans than network banks.

If online banks are ready to concede so much efforts today (and even lose money on the acquisition of customers), it is because they want to get ahead of new banking services that are born. If neo-banks are direct rivals, it may be that the technology giants (GAFA) are getting there shortly. Free has embarked on the payment of professionals during the month of September 2022: he could one day develop for individuals.

Apple also took its first step in finance with a card via a collaboration with the American Goldman Sachs (Apple Card). This card is specific to American use, but it could one day arrive in Europe. Finally, Google is present in mobile payments with its Google Pay solution.

Each bank is different

It is difficult to say which is the best online bank of the comparator for a given customer profile. Depending on the needs of each, banks have advantages and disadvantages. According to customer profiles, internet banks do not have the same characteristics, the same price and the same service. You can see in our guide that depending on the income we can prove, the bank card offer is different.

To help you make your choice, beyond the comparative table above, we have developed a summary below. This will allow you to know strengths of each bank. It will allow you to find out quickly what are the advantages of each online bank and which profiles they target. You can look beyond this online banks comparison on these latter’s websites to see what it is.

1) Boursorama Banque

If it is considered the best online bank by many French people, it is because Boursorama Banque has managed to offer competitive products for all profiles. With 4.4 million customers to its credit at the beginning of 2023, the Société Générale group is the largest online banking. In December 2022, she was re -elected “The cheapest bank in France” For the 15 year in a row according to a study of the world.

In recent months, Boursorama Banque has blew up all the eligibility conditions. Its classic formula, Ultim, is accessible to everyone with no condition of income. It is free and only withdrawals abroad (beyond the third) will be invoiced. It includes a current account and especially a first visa card without condition. In short, for daily use, that is all that can be dreamed of at an unbeatable price.

2) Hello Bank!

Hello Bank! is one of the best online banks and its new offer has something to seduce. The brand of the BNP PARIBAS group divides its offer in two: Hello One and Hello Prime. The first is an unconditional and free account, which allows you to have a card and all the tools to use your daily bank. Hello Prime is reserved for premium customers, who prove € 1,000 net per month and who will have to pay 5 € of subscriptions for this account. It is associated with a card that benefits from the same advantages as a first visa.

If we judge that it deserves its place among the best banks online, it is because Hello Bank! offers a wide range of products similar to that we have in a neighborhood bank. To this is one of the few banks on the Internet to offer its customers to access automatic counters and BNP Paribas agencies to deposit checks and species. If you handle liquid, Hello Bank! is ideal. Boursorama Banque cannot boast of doing so much.

3) Fortuneo Bank

Like Boursorama, Fortuneo first was successful thanks to its stock market portal. Since then, the establishment has developed very well. With soon a million customers to her credit, she appears as the second largest online bank in France. Renowned for many banking products (including life insurance), it offers a complete choice for its customers.

Online bank also knows how to be very innovative. You have access to many mobile payment solutions, instant transfers as well as real -time monitoring of your accounts on the mobile application and the website.

4) Monabanq

Monabanq is a subsidiary of the Crédit Mutuel group, and lists hundreds of thousands of French customers. In April 2020, the online banking reject its range of accounts: Pratiq+, Uniq and Uniq+. The first is ideal for daily bank, while UNIQ/UNIQ+ formulas are intended to offer a solution for travelers (absence of costs abroad on payments and withdrawals).

If Monabanq is one of our favorite online banks, it is because it is open. By subscribing to it, you have no need to justify a income level. In return, it requires its customers a contribution between 3 and 9 € per month to have this account. A first visa card and a Platinum visa are accessible without income condition, and against € 3 and € 9 in addition to months per month. The bank facilitated its price grid, you will not have a unpleasant surprise. Note that Monabanq also opens the CIC counters to allow species and check deposits.

Finally, it is also recalled that Monabanq has been “Elected Customer Service of the Year” for 5 years. If you are afraid of lacking support through an online bank, Monabanq is the most comforting. Remember that its basic formula, Pratiq+ to 3 euros per month therefore returns to a total of 36 euros per year. To give you a point of comparison, the average French pays 219 euros in bank charges per year in a traditional bank.

5) Bforbank

Bforbank also belongs to the best banks on the French market. The Crédit Agricole group’s subsidiary was originally exclusive and demanding on the conditions of its customers: it was necessary to justify € 1,600 in income to have an account (which came with a first visa). Today, she has largely revised her downward requirements since it only takes 1,200 € net to hold an account.

Bforbank is the only bank on the web to offer its customers a Visa Infinite bank card in addition to the Visa Classic and the Visa Premier. If it belongs to the best banks, it is because it also advances a range of quite long products. Often, it also rewards the opening of products such as the savings book, life insurance or the stock market with convincing bonuses.

Available banking products

The current account

The current account is the most popular product on the Internet. All online banks offer one and neo-banks too. It is often necessary to have an account to then access the second part of the products. For example, it will take one to obtain a savings card or booklet. In some cases, banks offer advantageous conditions on credits if you have an account.

In general, the current account is free. On the other hand, it is access to a bank card that will be billed by the bank. Very often, the two are correlated, but it is the card that is really billed. Each online bank advances its own conditions for the current account. In some of them, it will be necessary to justify a minimum income to hold an account. At Monabanq, Boursorama Banque or Hello Bank!, You can go without having to justify a income level.

The credit card

In our best online bank comparison, the bank card is a key element of the offer. According to the bank, you will benefit from a card on the Visa or Mastercard network. From one to the other, there are few differences. That said, each of these networks offers different levels of bank cards – which give more or less advantages. At Visa, we find classic, first, infinite or platinum cards. At MasterCard, it’s Standard, Gold or World Elite.

Depending on the income level you can justify in the bank, you will receive a more or less premium card. In general, internet banks require an average of € 1,000 in income to access a free Visa (or standard Mastercard) free of charge). To obtain a first visa, it will be necessary to justify between 1,600 and € 1,800 in income. Finally, the Carte Noire (Infinite or World Elite) is reserved for a very small part of the customers, on file.

If you want to know more about CB, our bank card comparator here will give you all the elements to consider in your choice. Be aware that online banks have put themselves on the page of neo-banks. In other words, you can take advantage of certain bank cards without obligation and without justifying income.

Savings and scholarships

If you have capital to grow, the online bank offers a series of savings or investment solutions. Whether it is booklet A, life insurance or the stock market, these investments are available in the majority of the establishments of our comparator. They have a range of products equivalent to that of a traditional bank. The only difference is that they are much cheaper, and that the costs are known.

For savings, current market rates mean that the remuneration of booklets is not very advantageous. On the other hand, the scholarship can allow you to generate interesting profits (but beware of risk). Boursorama Banque has been the most renowned for this part for years. The bank capitalizes on the stock market news portal to differentiate itself and attract its first audience. Fortuneo Banque does the same.

Credits in an online bank

Credit begins to develop in online bank. That said, it is less than 10% of all the customers of these establishments that succumb to a loan. The main banks of the web of our comparison offer both options: consumer credit and mortgage. The courses are 100% online, so you don’t have to go to physical appointments.

Again, credit is much more relevant in a digital bank than in a traditional establishment. If you open an account in the bank, you can also take advantage of an even lower interest rate. For high amounts, using a credit broker is a good solution to obtain the lowest possible rate.

Conclusion: What is the best bank in 2023 ?

In our banks comparison, there is not a single one “Best online banking” in 2023. Each meets different expectations and needs. It is therefore up to everyone to see which one will best answer their profile. Some establishments stand out from the overalls like Hello Bank!, Fortuneo, Monabanq and especially Boursorama Banque.

Our favorite is still for Boursorama Banque and its Ultim card. This is a free, unconditional CB and which is of the first visa type. No other online bank provides you with such a card with such flexibility. The range of Boursorama Banque products is also the most complete and aggressive market. Its applications (computers and mobiles) are excellent, as is its customer service.

The table at the top of the page is updated to highlight the offers and formulas of each of the banks. Please see each bank’s website to see the prices and all the conditions associated in real time. If online banks tend to keep the same (free) prices throughout the year on daily operations, these are the costs of operations abroad whose price evolves.