Benefit twice from the eco bonus and the conversion bonus? Ecological bonus – Clean automotive forum, ecological bonus and conversion bonus: changes for 2023 – Avere -France

Ecological bonus and conversion bonus: changes for 2023

For vans (the weight of which is less than 3.5 tonnes), the conversion bonus is maintained in its current amounts, with an increase of 1,000 euros for the most precarious households and large rollers to declare.

Benefit twice from the eco bonus and the conversion bonus?

Clean Automobile is a community information site that is dedicated to everything related to the automobile and the environment. The most popular themes of our Auto Blog are the electric car and hybrids, but we also approach the GNV / GPL car, Hydrogen Auto, Political and Environmental Apects related to the automobile. Internet users are invited to react to blog articles in the comments, but also in the various forums that are made upon them. The most popular of them is certainly the electric car forum which centralizes discussions relating to the arrival of these new vehicles. A lexicon centralizes the definitions of the main technical words used on the blog, while a database of cars (marketed or not) lists electric and hybrid cars.

- All the news

- All briefs

- Electrical utility

- Charging point

- Electric SUV

- Electrical city car

- Hybrid SUV

- Behaviours

- Electric cars

- Recharge

- Hybrid cars

- Electric utilities

- Electric cars

- Hybrid cars

- Rechargeable hybrids

- Hydrogen car

- Electric utilities

- Electric motorcycles

- All forums

- Electric cars

- Hybrid cars

- Electric utilities

- New members

- General discussions

- Electric cars charging cable

- Maxichanger electric cars

- Minichanger electric cars

- Wallbox electric cars

- Vehicle charging equipment

Electric vehicle guide

- Clean automobile – All rights reserved

- |

- Legal Notice

- |

- General conditions of use

- |

- Report illegal content

- |

- Site published by Saabre SAS A company from the Brakson group

Ecological bonus and conversion bonus: changes for 2023

The decree modifying the developments of aid for acquisition for 2023 was published on December 31, 2022 in the Official Journal. In its capacity as a national association for the development of electric mobility, Avere-France takes stock of these changes.

Posted on January 6, 2023

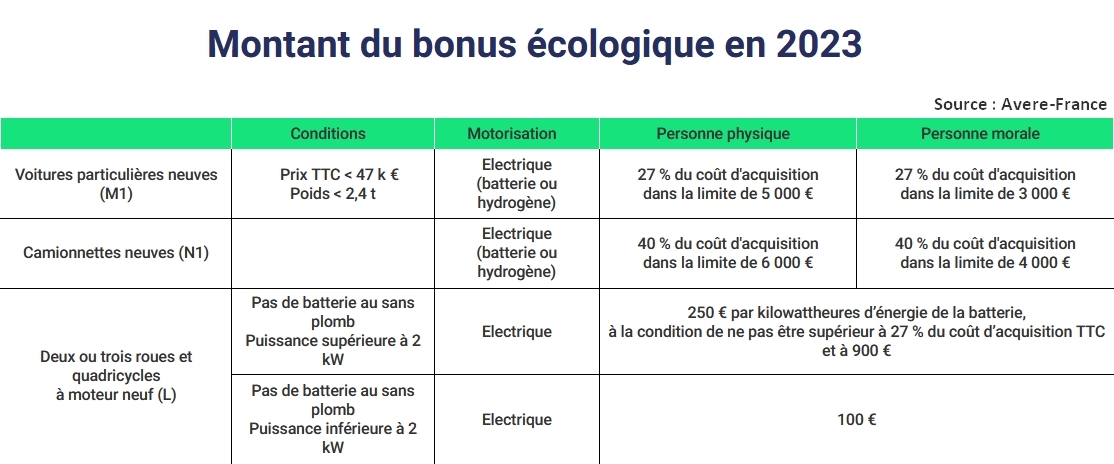

Ecological bonus: Decrease confirmed for passenger cars and abolition of the bonus for cars costing more than 47,000 euros and / or weighing more than 2.4 tonnes

It was planned that in January 1, 2023, the amount of the ecological bonus decreased: the decree published on December 31, 2022 in the Official Journal confirms it. The maximum amount of the ecological bonus is now set at 27 % of the acquisition cost (all taxes included), increased if necessary the cost of the battery if it is taken for rent, up to 5,000 euros if the vehicle is acquired or rented by a natural person or 3,000 euros if the vehicle is acquired or rented by a legal person. This amount can be increased by 2,000 euros “When the vehicle is acquired or rented by a natural person whose tax reference income per share is less than or equal to 14,089 euros “Indicates the decree.

Only passenger cars whose acquisition cost is less than or equal to 47,000 euros (all taxes included, including if necessary the cost of acquiring or rental of the battery) and whose mass “in walking order” is less than 2,400 kg, are affected. Thus, we observe the abolition of the bonus for vehicles whose price is more than 47,000 euros and the integration of a weight criterion (2.4 tonnes) beyond which a vehicle is no longer eligible for the bonus. Other novelties: a natural person can only benefit from an ecological bonus once every three years and the ecological bonus of passenger cars can be granted to the purchase or rental of a “M2” category vehicle ( minibus, in particular) corresponding to the criteria of weight and price previously set out.

The amount of aid for vans (the weight of which is less than 3.5 tonnes) is fixed at 40 % of the acquisition cost (all taxes included), increased if necessary the cost of the battery if This is taken for rent, within the limit of:

- 6,000 euros if the vehicle is acquired or rented by a natural person;

- 4,000 euros if the vehicle is acquired or rented by a legal person.

As for passenger cars, an increase of 2,000 euros is granted when the vehicle is acquired or rented by a natural person whose reference tax income per share is less than or equal to 14,089 euros. Finally, help for rechargeable hybrid vans that can travel more than 50 km on the only electric mode disappears while “N2” category vehicles benefiting from a weight exemption can claim the bonus.

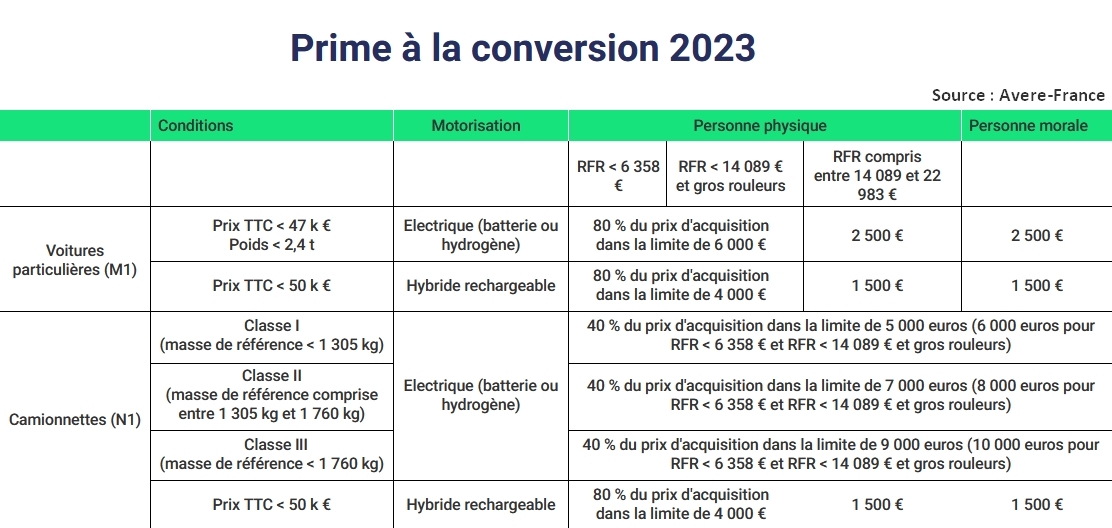

6,000 euros maximum conversion bonus, instead of 5,000 previously

The conversion bonus, paid when scoring a diesel vehicle prior to 2011 or a petrol vehicle prior to 2006, is still topical. This is allocated to any natural person whose tax reference income per share is less than or equal to 22,983 euros. As for the ecological bonus, the conversion premium is removed for vehicles whose price is greater than 47,000 euros. There is also the integration of a weight criterion (2.4 tonnes) beyond which a vehicle is not eligible for the conversion premium.

The amount of the aid is set at 80 % of the acquisition cost, up to a limit of 6,000 euros (and no longer 5,000 euros) if the vehicle is acquired or rented either by a natural person whose reference tax income By share is less than or equal to 14,089 euros (or the first five deciles) and whose distance between his home and his workplace is greater than 30 kilometers or performing more than 12,000 kilometers per year within the framework of his professional activity With his personal vehicle, either by a natural person whose reference tax income per share is less than or equal to 6,358 euros (first two deciles). Aids are thus greater for the most modest households.

For vans (the weight of which is less than 3.5 tonnes), the conversion bonus is maintained in its current amounts, with an increase of 1,000 euros for the most precarious households and large rollers to declare.

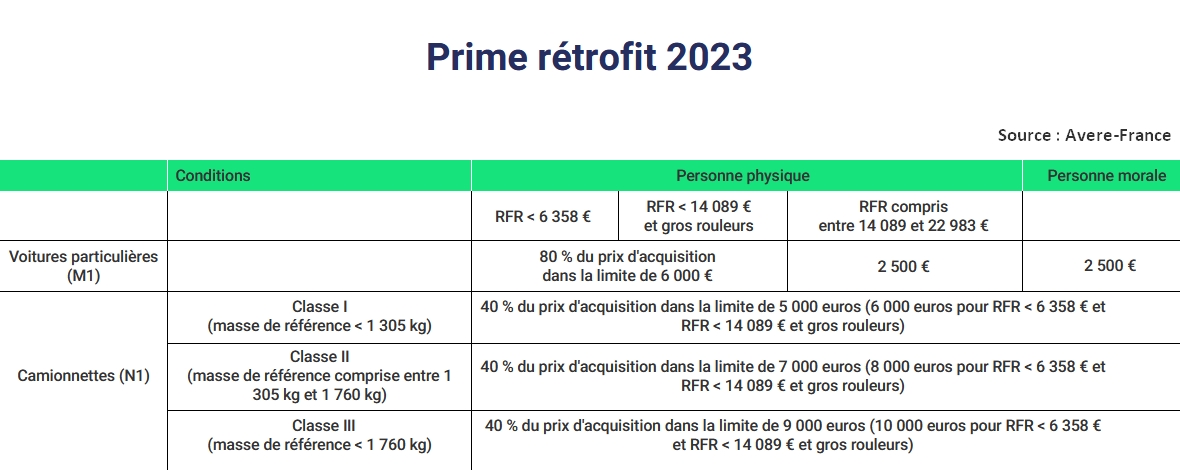

What about the retrofit bonus ?

A premium is always established for the transformation of a thermal engine vehicle into an electric battery or fuel cell engine motorization. This is allocated to any natural person whose tax reference income per share is less than or equal to 22,983 euros. This is valid for the transformation of passenger cars and vans.

For passenger cars, aid is equivalent to 80 % of the cost of transformation, up to a limit of 6,000 euros if the vehicle is acquired or rented either by a natural person whose reference tax income is less than or equal to 14,089 euros and the distance between his home and his workplace is more than 30 kilometers or performing more than 12,000 kilometers per year as part of his professional activity with his personal vehicle, or by a natural person whose tax income reference by share is less than or equal to 6,358 euros. For vans, the amount of the planned aid is set at 40% of the cost of the transformation, within the limit of:

- 5,000 euros, if the vehicle has a reference mass of less than 1,305 kg;

- 7,000 euros, if the vehicle has a reference mass between 1,305 and 1,760 kg;

- 9,000 euros, if the vehicle has a reference mass greater than 1,760 kg.

The ecological bonus and the premium to the deleted conversion for heavy vehicles

Last novelty of this decree: it removes the ecological bonus for heavy vehicles (trucks, bus, etc.), with the exception of M2 and N2 category vehicles benefiting from a weight derogation. It also removes the electrical retrofit bonus for heavy vehicles, with the exception of small tourist road trains and M2 and N2 category vehicles benefiting from a weight derogation.

We will recall that a call for projects “Ecosystems of heavy electric vehicles” aimed at finance the acquisition projects of heavy electric vehicles and the terminals necessary to recharge them was published on the ADEME website. The subsidy may reach 65 % of the acquisition cost difference between the electric vehicle and its diesel equivalent, according to a scale which will take into account the type of vehicle and its weight: electric buses and buses can thus be subsidized until At 100,000 euros, as is electric heavyweights whose maximum weight is less than 26 tonnes. From 26 tonnes and beyond, aid will reach 150,000 euros. The installation of charging points dedicated to these vehicles may be supported up to 60 %. The government has also confirmed the continuation of the work of the Task Force on heavy vehicles, engaging in a new phase focused in particular on technical and long -term technical and energy prospects.