Banks for teenagers: is it a good idea and what are the best?, Bank card for minor: What account for your child or teenagers?

Bank card for minor: What account for your child or teenagers

❌ Assistance abroad

Banks for teenagers: is it a good idea and what are the best ?

Teenagers aged 13 to 17 represent a gold mine for banks and many of them are jostling to offer tailor -made offers, or even dedicated applications. But is this a good idea ?

It is on average at the age of 11 that adolescents are starting to receive pocket money and 42 % of parents claim to give their child pocket on a regular basis. Based on this observation, and to register this element in their offers, banks have largely committed the subject of adolescent money for a few years by creating dedicated offers. It is indeed possible for a minor to benefit from a bank card specially dedicated with, for the first argument, the financial independence and responsibility that it will probably be delighted to endorse.

Obviously, the decision to obtain or not for a bank account will come from the parents’ origin and the banks have understood that they wish to keep control over the expenses of their children. Néobanques for example have understood this and highlight the use of an application rather than a bank card, adolescents being already widely equipped according to INSEE.

A “Young” account, the good idea ?

In the batch of the questions that each parent arises on the child and money subject, we find: ” How to empower it on money ? “,” Do I have to give him pocket money directly ? ” Or ” And if he/she had his own bank card ? »». In reality, we cannot give you answers. It all depends concretely on the personality of his child and his responsibility vis-à-vis money. It can also be a good pick for blended families so that parents can have a better look at the money of their separate child between two homes.

If we are not here to give the best step to follow, we have however studied the procedure of banks on the subject and how they sell their famous ” Young accounts »».

In France, obtaining a bank account is exclusive to adults over 18. In reality, what online and other neobanc banks offer with these accounts dedicated to adolescents is to open a new account in his name and whose adolescent will have the use. These offers are above all thoughts to reassure and support parents, more than to really give the right to a teenager to manage his own money. In the main characteristics of these accounts, there are main criteria such as:

- Co -management of the parent/child account

- Easy food for account by parents (bank transfer)

- Definition of a daily, weekly or monthly ceiling

- CONTROL OF LESSED in real time (systematic authorization card)

- Payment methods (bank card or mobile payment)

Other criteria can also enter the balance, such as savings systems, but also financial education tools that certain applications offer in addition to the account, always in this idea of learning to manage money.

Since we talk about these, the famous banking applications like Pixpay, Kard, Vybe or Xaalys, are neither banks nor neobancs, but simple solutions of fintech making a financial link between parents and children via their respective applications and having the same essential criteria seen above.

I want to open an account for my teenager, what are the offers to favor ?

Traditional banks are not very involved in this market in addition to opening savings accounts accessible to the majority. We can cite the postal banking, which duplicates with its neobanques my French bank, with the possibility of granting a bank card for 12-17 year olds in addition to a classic current account.

It is above all online banks and neobancs that rushed into this market, each with their characteristics.

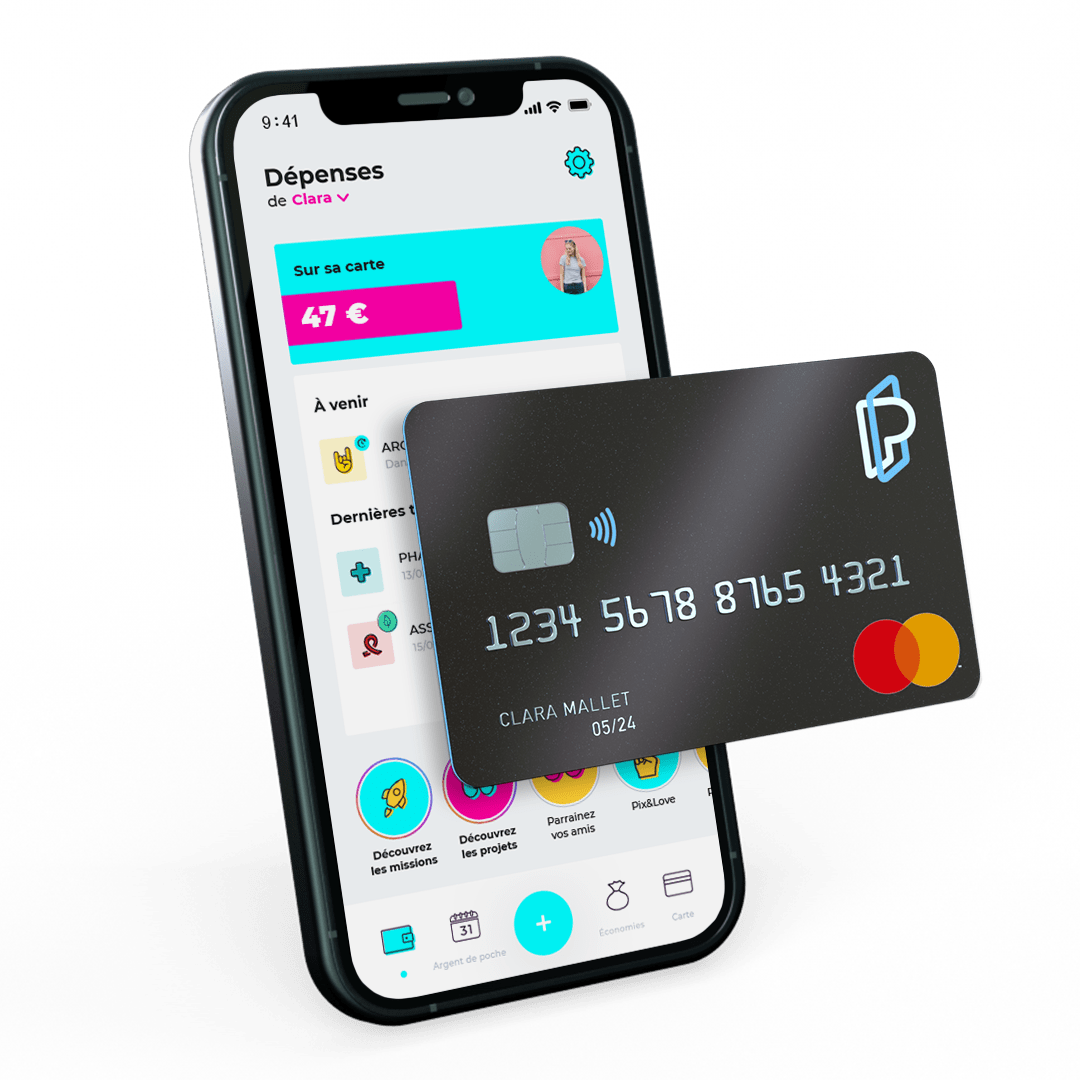

Pixpay: the reference

Launched in 2019, this startup of the fintech French is exclusively dedicated to children and adolescents. It is indeed possible to open an account for a child. It is not a real bank, but more of a banking service provider like Helios, Lydia or Vivid. The account is unique, priced at € 2.99 per month and accessible to minors aged 10 to 18. The whole includes a prepaid bank card managed by the parents (s) and recharging … Of course, no overdraft is allowed.

Registration and order are made by parents on the website or Pixpay mobile app with the supply of personal data to obtain the bank card and the full use of services. The application then split into two access: one for the parents (s) and the other for the child, with specific logins and codes for one or the other.

To supply your teen in the bank account, you can schedule the payment of your pocket money or make occasional recharging. The service does not allow minors to deposit checks, but the RIB makes it possible to receive transfers and thus be paid for odd jobs for example.

In addition to the account, Pixpay gives the right to other products, always in this learning logic, with in particular a kind of savings account giving access to a kitty to finance projects, as well as an annotation system expenses from one side as on the other.

Pixpay also offers a cashback system with partial refunds of their purchases if they are made via partner merchants in store and on the Internet.

Freedom: the young Boursorama Bank offer

Formerly appointed Kador, Boursorma Banque launched its Freedom offer at the end of 2021. It constitutes a logical evolution while competing with the most active neobancs in this sector. Freedom, this is a bank account for teenagers aged 12 to 17, without account holding costs and including a Visa Freedom bank card with systematic authorization. No overdraft is therefore authorized and the account balance is verified before validating a payment or withdrawal.

Even if its characteristics are close to the classic Balance Banking cards, it has its own advantages:

- Possibility of transfer by SMS

- Activation of mobile payments before even receiving the card (Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay)

- Card without possibility of overdraft and systematic authorization

- Payment and withdrawal ceiling set by parents

- Free and unlimited payments and withdrawals in the SEPA zone

- Visa organization insurance

- Push notifications of real -time operations

Of course, the Freedom account is completely controlled by parents who can take a look at the management of their offspring money directly from their own applications. In addition, teens will also have the possibility of sponsoring their friends so of course the parents are themselves customers of the bank. The objective is obviously to retain a family clientele over time and to push adolescents to switch to offers reserved for adults after their majority.

My French Bank: the outsider

created my French Bank (MFB) in order to seduce a younger audience. Based on a 100 % online ecosystem similar to neobanques, it promises an innovative banking supplement in addition to traditional establishments. Despite its youth, the concept has already attracted hundreds of thousands of customers in France, whether in minors or young adults.

Westart is a bank account for 12-17 year olds allowing an online account opening or in a post office. For € 2/month, the teen has an account, a card and the 3000 La Poste agencies for special operations. Parents control the use of the card and pay pocket money from their mobile application.

The bank also gives access to a savings system called ” Piggy bank “Where the minor can pay his savings to finance a project such as buying a game console or a trip with friends. In the event of emergencies, adolescents can transmit in a few clicks a request to their parents.

The best online banks

In order to find out more about online banks, do not hesitate to consult our comparator of the best online banks.

Certain links of this article are affiliated. we’ll explaine everything here.

The future of Numerama is coming soon ! But before that, our colleagues need you. You have 3 minutes ? Answer their investigation

Bank card for minor: What account for your child or teenagers ?

Your teen is growing and thirsty for independence ? Why not open a bank account for minor ? Several banks in France offer offers of bank card for 10-17 year olds at attractive prices and scalable and fun services. But which children’s account offer to choose ? What’s the best bank card for teenagers ? Follow the guide to choose a teenage account offer adapted to your child.

�� Bank card offers for children

The offers of minor bank account Proposed by online banks, neobancs and traditional French banks compete in assets to seduce parents, children and teenagers. But what account offer and Bank card for minor choose ? Discover our selection of Best children’s bank account offers and teen in 2023 !

Online banking offers dedicated to the minor

The best online banks are known to have attractive bank rates. What are the offers Online banks for cheapest teenagers ?

Only Boursorama Banque is doing well compared to its competitors. Her Banking offer for minor Kador, dedicated to 12-17 year olds, combines several assets:

- A free minor bank account;

- A free bank card to systematic authorization. Without authorized overdraft: no risk of payment incident;

- A suitable mobile application with many features to pilot your daily pocket money.

The offer of Bank account for children has features dedicated to parents:

- Parental control permanent via the mobile application;

- Opening of the bank account with compulsory parent agreement;

- Transfers exclusively authorized to parents;

- Instant transfers to quickly help your minor child.

Only problem : to open a Kador account, it is essential to be Already Customer of Boursorama.

The arrival of neobancs for teens

Mobile banks are a whole new generation of banks. Focused on 100 % mobile services, their account offers and bank card display fearsome, capable of competing with the best traditional banks or online banks.

Some neobancs have Specialized in teenagers, a hitherto secondary target for traditional banks: neobancs for minor are distinguished by services exclusively dedicated to minors.

Their credo ?

- An innovative offer : a bank card + a mobile application + sharp features for Promote learning financial autonomy;

- A reasonable price : a few euros per month are enough for Open an account to your child;

- A modular parental control : parents can manage and consult the their child’s account : blocking/unlocking of the card, SMS notifications in the event of banking transactions, blocking of certain traders (tobacco, online games, etc.)).

✔️ no authorized overdraft

✔️ Mobile application

✔️Sav reachable by phone

✔️ Parental control

✔️ No fees in the euro zone / excluding euro zone: 2% tax on payments + € 2 per withdrawal

❌ Assistance abroad

✔️ Open to all

✔️ no authorized overdraft

✔️ Mobile application

✔️ Opening online or in a post office

✔️ Parental control

✔️ No fees all over the world

✔️ Insurance (Visa)

✔️ Open to all

✔️ no authorized overdraft

✔️ Mobile application

✔️ Customer service: telephone line

✔️ Parental control

✔️ No fees all over the world

✔️ insurance (visa plus) + smartphone insurance

✔️ Open to all

✔️ no authorized overdraft

✔️ Mobile application

❌ dedicated banking advisor

✔️ Parental control

✔️ No fees in euro zone + international option (€ 15/month)

❌ Assistance abroad

✔️ Open to all

✔️ no authorized overdraft

✔️ Mobile application

❌ dedicated banking advisor

✔️ Parental control

✔️ No fees all over the world

✔️ Assistance abroad

❌ Reserved for Parents Orange Bank customers

Comparabanques has selected 4 Neobanques for teenagers Among the best on the market:

☑️ Xaalys from € 2.99/month ::

The new mobile bank for Ado Xaalys has set itself the mission of allowing adolescents to better manage their budget via a fun mobile application. Accessible from 12 years old, the offer of Xaalys relies on pedagogy with a set of services for empower the child (prize pools, savings module, quiz and games);

☑️ Kard from € 2.99/month ::

Kard, the neobank of minors, offers an offer of Child account thought for the whole family. The subscription starts from € 2.99 for a child, and only € 4.99/month for 2 or more children: an ideal formula for large tribes ! Another strong point of theBanking offer for minor Kard : bank charges are free abroad (payments and withdrawals). We also like customizable cards, delivered for free, as well as the smartphone insurance included, for your ultra -connected teenager.

☑️ Orange Bank from € 12.99/month ::

The neobank Orange Bank launches its teenage account. Its premium pack offer, although more expensive than its competitors, is Ideal for traveling : insurance and assistance pack on the international bank card, free withdrawals and payments abroad. Notice to budding globettroter ! To note : only Parents Orange Bank customers can open an account for their child.

☑️ Pixpay from € 2.99/month ::

Accessible from 10 years old, the offer of Bank account for teen pixpay is without commitment to duration and without hidden expenses. Thanks to attractive bank rates and an efficient mobile application, the mobile bank for minor Pixpay has seduced many parents looking for a bank account for practical and suitable minor : unlimited and free withdrawals in the euro zone, French RIB for transfers, virtual bank card, etc. Find our opinion on Pixpay

The best offers from traditional banks

THE classic banks also offer Minor account offers, who have nothing to envy to the offers of neobancs or online banks. Real efforts have been undertaken for better Adapt to the needs of their younger customers.

✔️ no authorized overdraft

❌ dedicated banking advisor

✔️ Forests abroad reduced

✔️ Assistance abroad

❌ Open only to customer parents

✔️ no authorized overdraft

✔️ Mobile application

✔️ dedicated banking advisor

✔️ Parental control

❌ Free fees abroad

✔️ Assistance abroad

❌ Open only to customer parents

✔️ no authorized overdraft

✔️ Mobile application

✔️ dedicated banking advisor

✔️ Parental control

✔️ Free fees abroad

✔️ Assistance abroad

❌ Open only to customer parents

We have selected the 2 best minor account offers on the market :

- Société Générale dusts his teen offer with bankup : an offer Account, card and free teenager app. The offer includes a dedicated application, designed to facilitate the management of your pocket money; Parents when they can manage the expenses of their young inch.

- BNP also illustrates by Myb’s, a free minor account offer : this offer includes a bank account, a International card with systematic authorization and an application with parental control.

☑️ To note :

- THE Bank charges On the minor accounts will be generally higher with a traditional bank than to an online bank;

- These offers are Reserved for parents and already customers form the bank.

�� Can we open a bank account to a minor ?

From what age, should a child become a bank account ? The question is legitimate for many parents, anxious to find the right balance between independence and responsibility. On this point, the legislation is very protective of children : if access to a bank account or a booklet is quite flexible, the freedom of use, however, will be Delimited according to the age of the minor.

Parental responsibility from 0 to 18 years old:

- Parental authorization is compulsory for the opening of a minor bank account or young booklet;

- There legal responsibility parents are committed to banking movements and Banking incidents (debts, overdraft, etc.);

- Parents can freely have sums Present on the account or booklet of their minor child.

Before 12 years old, booklets and savings account

Before 12 years old, the minor child has a still limited use of banking services ::

- Parents can open a bank account and a savings book to their child without their authorization;

- The child cannot use his bank account alone (transfer, payment, etc.)).

From 12 years old, the young booklet and the withdrawal card

From the age of 12, the minor child is released about banking solutions:

- With the agreement of his parents, he can Open a young account with a withdrawal card;

- The child can make cash deposits and withdrawals from its accounts and booklets as he pleases. Generally, the withdrawal card is subject to very limited withdrawal ceilings.

In adolescence, the first real bank card

At 16 years old, The teenager has more extensive freedom:

- The 16 -year -old can open a bank account associated with a Classic bank card and even a checkbook (under parental authorization);

- He can perform withdrawals and payments alone;

- He can also make withdrawals from his booklets without parental agreement.

�� Why open a minor account ?

If opening an account to your teenager can sometimes seem precipitated, know that this can also be an opportunity for your teenager Learn about financial autonomy ::

- Become more independent : A Bank account for minor Allows the child to take responsibility until his majority;

- Of the first secure steps : Most free bank account offers for young people are Without overdraft authorization and a bank card with systematic authorization;

- An account that grows with him : the features associated with the application allow flexible management and adapted to their needs (limited and modular ceilings by parents, payment card or international withdrawal, etc.)).

Applications for minor accounts a Bank account for children or teenagers is not a conventional current account: the bank account and the bank card are inseparable from a mobile app, real rudder to manage the account and supervise it ! This is one of the assets master of tenders of Bank account for minor, Parental control: blocking/unlocking the bank card, increase/decrease in payment/withdrawal ceilings, activation/deactivation of contactless payment, etc.

⚙️ How to open a teen bank account ?

For Open a child account, it is very simple :

- In a traditional bank, theOpening of the minor account can be done directly in agency with a banking advisor;

- In an online or neo -bank bank, theopening will be online or on mobile.

- The necessary administrative documents:

- An identity document of one of the parents and that of the child;

- The copy of the family booklet.

❓ FAQ: Minor account

�� Can a child open a bank account alone ?

No, a minor child cannot open a bank account alone. Before his 18th birthday, thewritten authorization of his legal representative is compulsory. Except for an emancipated 16 -year -old minor who benefits from all the rights granted to an adult.

���� separated or divorced parents: how to open a teenage account ?

L’Opening an account for young teenagers is subject to the authorization of a legal representative. When parents are divorced or separated, theagreement of a single parent is enough To open a bank account to your child.

�� What is the cheapest bank for teenagers ?

Several banks are distinguished by their offer of Bank account for free teenagers : Traditional Société Générale and BNP banks but also online banks like Boursorama Banque. Conversely, neobancs offer Paid account offers for young minors.

For Choose a bank for your child, Be sure not to ignore other arguments such as the quality of the mobile application, bank prices on current operations or the type of bank card (withdrawal card, payment card, visa or mastercard, prepaid card, etc.)).

�� Count for minor: what happened to the majority ?

The majority arrival implies many changes: Your child becomes the only responsible for his bank account. Consequently, he no longer needs to have the authorization of his parents to carry out banking operations (separate transfers, deposits, samples, etc.), have the bank card of your choice and open a savings or investment product.

The majority passage also involves new responsibilities. The young adult is responsible in the event of a banking overdraft or debts contracted with third parties.

It is also theOpportunity to change for a young bank account offer, more suited to its current needs.

If your child greeted a minor account with a generalist bank, he can easily choose a more suitable offer. If you had taken out an offer in a specialist neobank, on the other hand, it will have to change bank. Bank account offers for young people (assets or students) online banks are particularly indicated.

�� Good deals ��

Banking promotions

Up to 160 €

See the offer

Until 100 € offered See the offer

160 € offered See the offer

The most read finance guides

- Change bank: procedures, user manual and deadline

- Free bank card: Find the best offers !

- Black Card: What conditions to obtain a black card ?