Banks comparator – UFC -Que Choisir, the main banking rates | Official information website

The main banking rates

There Cheapest Bank in France is Boursorama Banque For the 14th consecutive year (source: Le Monde). The majority of its banking services are without bank charges, and Ultim and Welcome cards are free under conditions. In addition, Boursorama offers a welcome bonus up to € 80.

Banks comparator

You don’t know which bank to choose ? What to choose helps you to compare and find the cheapest classic bank near you or the online bank adapted to your personal needs. From your profile, Que Choisir selects the best banking rates offered by conventional banks, online banks or neobancs to offer you a detailed winner of banking establishments.

The advantages of the UFC-Que Banking Comparison Choose

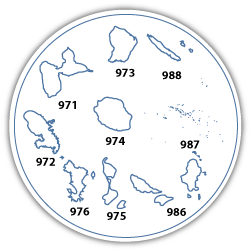

A complete comparison: 155 banks – network banks, online banks or insurer banks in mainland France and DOM The only truly independent comparator: No link with banks, no commercial use of your personal data

Subscribe !

And immediately access all content of the Quechoisir site.org

Already subscribed to the site ?

Identify yourself to display all the content of the site

The main banking rates

Select the search criteria: department, type of bank, services

Welcome

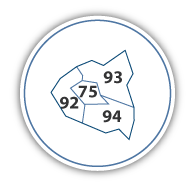

For overseas communities, prices are on www sites.ieom.FR and www.iedom.Fr.

. Or click on the map

- Legal Notice

- Personal data

- Accessibility: non -compliant

- Contact

© Ministry of Economy – 2020

Best French banks in 2023: offers and comparisons

France displays a record banking rate: 99% of French people have at least one bank account according to the microfinance observatory. But difficult to find your way among all these French brands, between traditional banks, online banks or neobancs. What are the best French banks and how to find the best bank according to its profile ? Here is a complete guide on the best banks in France.

up to 120 € offered

Monabanq offers you up to 120 € For a first current account opening.

Boursorama Banque offers you Until 100 € For very first account opening.

Up to € 230 offered

Fortuneo offers you up to 230 € For a first account opening.

Comparison of the best French banks

Find below our comparison of Best banks in France in 2023, with their main advantages as well as their welcome offers.

✔️ 100 € offered

From 0 €/month

- Full offer of banking products

- Among the most advantageous banking on the market

- Free and free income bank cards (in immediate debit)

✔️ up to € 230 offered

From 0 €/month

- A fairly wide range of banking products

- A free card at no cost abroad

- An attractive scholarship offer

Welcome offer: ✔️ up to € 80

From 0 €/month

- Attractive rates, most daily services are free

- Overdraft

- Very varied product range

- Apple Pay, Paylib payment

✔️120 € offered

From 3 €/month

- Bank offers without income conditions

- Wide range of banking products

- Available mortgage

✔️ 80 € offered + Sobrio 1 €/month for 12 months for a Visa or Visa Premier card

from € 3.00/month (Sobrio)

- Sobrio: ✔️ 80 € offered + Sobrio 1 €/month for 12 months for a Visa or Visa Premier + card + insurance + advisor + advisor + advisor

- Interesting cashback system: up to 20% cashback at +1,200 brands

- 0 € account holding costs and without initial payment

- Secure and autonomous management from the app or customer area

Welcome offer: ❌

Price: see conditions relating to the regional fund

✔️ 80 € offered + 1 year of free free spirit and its essentials.

from € 6.46/month

- Agency service and personalized advice

- Complete bank card offer

- Multiple options

Welcome offer: ❌

From 20 €/year

Discover

- Offer for teens or for spending people who need limits

- Network of tobacconists and nickel points

- Telephone line

Classification after consideration, by Selectra, of the price of the offer and its various characteristics. Updated data in September 2023

The banking landscape has largely diversified in recent years. So we find today Several types of banking establishments, offering a more or less rich offer of banking products depending on their nature.

If the traditional banks have a wider range of banking services that online banks or mobile banks, The latter, however, stand out for their very accessible offers (often without income condition) but especially by their extremely competitive prices.

Become HSBC customer: make the choice of a heritage bank to accompany you

HSBC is The multi -reacked bank to help you in your financial strategy : with a wide range of banking products and one Personal advisor by your side, HSBC offers a Attractive current account offer , thought for all premium needs and with products Efficient investment products.

Fancy an expert bank with you mobilized to carry out your projects and build your wealth ? HSBC has recognized expertise and a wide range of financial products to support you in all your projects:

- Finance your projects in the best conditions : mortgage and personal loan

- Save and develop your wealth : Life insurance, more than 10 savings booklets, experts in wealth management councilors

- Invest in stock markets thanks to a wide range of financial investments to recognized expertise

- Adapt to all moments of life : Manage your accounts on a daily basis thanks to a secure mobile application among the best rated on the market.

�� French network banks: the best traditional banks in France

✔️ 80 € offered + Sobrio 1 €/month for 12 months for a Visa or Visa Premier card

from € 3.00/month (Sobrio)

- Kapsul: € 2/month

- Sobrio: from € 6.20/month

- Sobrio: ✔️ 80 € offered + Sobrio 1 €/month for 12 months for a Visa or Visa Premier + card + insurance + advisor + advisor + advisor

- Interesting cashback system: up to 20% cashback at +1,200 brands

- 0 € account holding costs and without initial payment

- Secure and autonomous management from the app or customer area

Welcome offer: ❌

from € 3.75/month

- Visa Classic card: € 3.75/month

- First visa card: € 11.17/month

- Gold Mastercard card: € 11.17/month

- Infinite visa card: € 27.92/month

- Agency support

- Socially responsible investment products

- Free withdrawals around the world in HSBC network distributors

✔️ 80 € offered + 1 year of free free spirit and its essentials.

from € 6.46/month

- Origin card: € 6.46/month

- Visa Classic card: € 6.97/month

- First visa card: € 14.99/month

- Infinite visa card: € 31.17/month (with free spirit offer)

- Agency service and personalized advice

- Complete bank card offer

- Multiple options

Welcome offer: ❌

Price: see conditions relating to the regional fund

- EKO: € 2/month

- Trotting gob: € 2/month

- Essential: price according to the regional fund

- Premium: price according to the regional fund

- Prestige: price according to the regional fund

- Simple: a clear choice between 5 offers with different levels of services

- Personalization: the selection of an offer best corresponds to everyday uses

- Transparency: a single monthly rate according to the pricing in force of the regional fund

- Innovation: a range in line with current consumption methods and innovative services included

- Without commitment: change your formula when you wish !

Classification after consideration, by Selectra, of the price of the offer and its various characteristics. Updated data in September 2023

THE Traditional banks in France are the first banking networks arrived on the market. These are the major French banking brands as Société Générale, Crédit Agricole Or BNP Paribas, which are characterized by their very complete banking services offers.

Traditional French banks offer a range of rich products: in addition to the current account, they have savings solutions, of credit, as well as insurance products.

Traditional or network banks are also characterized by the strong presence of physical agencies in France.

- Wide choice of bank cards

- Rich annexed banking products

- Provision of a banking advisor

- Specificing of species and checks

- Possibility to negotiate suitable solutions: mortgage, life insurance etc.

- Large DAB network

- Munning delay: unsure application, elementary features

- Little transparency on the offers

- Bank costs and high card subscription

- Important costs abroad

- Obligation to go there for certain procedures

�� The best French online banks

THE French online banks are distinguished by their generally 100% dematerialized operation.

Everything happens online: whether to open an account, consult your balance or contact customer service, each of the steps directly on the website or via the bank application.

THE French online banks have therefore No physical agency where customers can meet their advisor.

The local service at online banks revolves around the customer service reachable by phone or internet.

No agency, but low prices: by saving physical agencies, French online banks can thus Show all competition defiant prices.

French online banks, subsidiaries of large groups you should know that the majority of French online banks belong to large banking groups. For example, Hello Bank! belongs to BNP Paribas, Boursorama Banque at Société Générale or BforBank at Crédit Agricole.

- A fairly wide range of banking products

- A free card at no cost abroad

- An attractive scholarship offer

- Full offer of banking products

- Among the most advantageous banking on the market

- Free and free income bank cards (in immediate debit)

- Classic visa card: between € 2 and 11 €/month

- Premier visa card: between 5 € and 12 €/month

- Visa Platinum card: between 11 € and 18 €/month

Prices according to your customer profile

- Bank offers without income conditions

- Wide range of banking products

- Available mortgage

- Hello Prime: 0 €/month

- Hello One: € 5/month

- Attractive rates, most daily services are free

- Overdraft

- Very varied product range

- Apple Pay, Paylib payment

- Original card: € 2.90/month

- Ideal card: € 6.90/month

- Opening in a practical post office

- Offer for the whole family

- Interesting cashback

- Classic card: 0 €/month under income conditions

- Gold card: 0 €/month under income conditions

- Infinite card: € 16.67/month

- A very large range of banking products

- Free bank cards (Visa Classic and Premier) and an accessible infinite visa card

- Low high banking costs

Classification after consideration, by Selectra, of the price of the offer and its various characteristics. Updated data in September 2023

Between Fortuneo and Boursorama Banque, your heart balances ? These two online banks are often elbowed, and for good reason, their bank offers are very similar ! To decide between them, we have analyzed their offers in detail and created a comparative guide. Consult our guide on Fortuneo or Boursorama Banque !

The best French neobancs

Recently, the French banking market has grown with The appearance of new generation banks 100% mobile, baptized mobile or neoban banks.

Their main characteristic ? All the banking services offered by neobancs are Accessible by mobile.

100% digital, this type of banks, however, does not generally offer that basic banking services, and have An unstopped offer. No or no credit or savings offer at French mobile banks.

Their main goal is to facilitate the management of current accounts thanks to a simple and intuitive mobile application. Often accessible to all and without income conditions, French neobancs meet the needs of a young and dynamic audience at a more than competitive price.

List of the best known French neobancs:

Learn more about neobancs to find out more about neobancs, Consult our article dedicated to them.

Welcome offer: ❌

From 20 €/year

Discover

Welcome offer: ❌

From 2 €/month

Discover

✔️ No income condition

✔️ No income condition

✔️ No income condition

✔️ Current account

✔️ Teenage account

❌ Joint account

❌ Pro account

❌ Savings

❌ Immal credit and personal loan

❌ Stock market

✔️ Current account

❌ Teen account

❌ Joint account

❌ Pro account

✔️ Savings

✔️ Real estate credit and personal loan

❌ Stock market

✔️ Current account

✔️ Teenage account

❌ Joint account

❌ Pro account

❌ Savings

✔️ Real estate credit and personal loan

❌ Stock market

✔️ Nickel card: € 1.95/month

✔️ My Nickel card: € 1.95/month

✔️ Nickel Chrome card: € 4.20/month

✔️ Nickel Metal card: € 8.30/month

✔️ EKO: € 2/month

✔️ EKO GLOBETROTTER: 2 €/month

- Original card: € 2.90/month

- Ideal card: € 6.90/month

Updated data in September 2023

�� The best banks in France by customer profile

It is difficult to establish the Best banks in France without selecting one or more criteria. Indeed, some Banks in France will be distinguished by their low-cost offers, while others will be prized for their customer service or their offers adapted to students.

Diffrict to unilaterally establish a classification of Best banks in France, both the banking landscape in France and the customer needs are varied.

To choose the right Bank in France, Above all, it is necessary to take stock of your needs and wait. Because if some Banks in France are prized their low-cost offers, others will adapt better to the expectations of a more demanding audience.

The best French banks without minimum income

For small budgets or more precarious profiles, it is often more advantageous to turn to offers without income or savings conditions.

From French online banks without minimum income, We find Boursorama Banque, Fortuneo (Fosfo card) or Monabanq.

- Offers without income conditions in France: our two favorites

- Boursorama Banque Ultim offer : an offer without income condition, with bank card and account management without cost (1 use of the bank card/month to obtain free). More informations.

- The Fosfo of Fortuneo offer: the new fortuneo offer without income condition. The Fosfo Mastercard card is free (subject to being used 1 time a month, otherwise € 3 /month) and free of charge abroad. More informations.

The best French ethical banks

�� Win ✔️ 80 € offered + Sobrio 1 €/month for 12 months for a Visa or Visa Premier card with SG !

Laurent, your Selectra advisor, is at your disposal and helps you in your account for opening up for free.

Ethical banks are still few in France, But some are starting to develop well and offer interesting offers for both French consumers and the company.

The ethical bank offers its customers accounts, savings or credits having a positive cultural, social or environmental impact. The funds submitted and part of the profits are invested in projects in general in the social and solidarity economy.

THE French ethical banks which are distinguished for the moment are:

- Crédit Cooperative: Crédit Coopératif offers all the banking services of a classic bank (bank account, credit card, savings and placement, credits, etc.), with the particularity of offering ethical and solidarity products and services, in particular the AGRE which automatically pays half of the interests of the saver to ecological and solidarity initiatives.

- The nave : NEF is a financial cooperative that offers savings and credit solutions to finance useful projects from a social, ecological and/or cultural point of view. The nave is not yet today a full -fledged bank, but it is intended to become and to ultimately offer the same services as its traditional competitors.

The best French students for students

Students are generally looking for a simple and inexpensive banking offer adapted to their small budget. Several banks stand out to offer students offerings that suit them:

- Balance Bank : Elected best student bank of our list of the best banks for students and young workers, Boursorama offers the best offer on the market. With its offers Welcome and Ultim, Boursorama Banque is an online bank ideal for students. Free card provided of use per month, No account holding fees nor proof of income, and above all No fees abroad With the Ultim offer. In addition, Boursorama offers up to € 80 at the opening of an account. Take advantage of the offer.

- Eko by Ca : the Low-Cost Agricole offer is perfectly suited to a student. For € 2 per month, the student has access to a current account and a payment card, as well as a mini checkbook. The absence of an authorized overdraft allows the student to manage his finances without worry.

- My French Bank : the neobank of the Postal Bank, offers an offer at € 2.90 per month, without commitment and free of charge abroad. The student can benefit from a complete application to carry out their current operations as well as the post counters. Learn more about my French Bank.

Find the best bank according to your profile it is sometimes difficult to find your way among all the banks and the plethoric offer of these different establishments. But for Choose the right bank, It is essential to ask the right questions and define your needs. Take stock of your personal situation : salary, type of contract, age, heritage, trips abroad, all this information is very important to choose your bank, since some will be more interesting for students while others will be ideal for making a heritage fruit. Define its banking needs : single current account, savings account, mortgage, payment card abroad … According to your criteria and your needs, a bank will be able to meet your expectations better than another.

�� Which bank to choose ? The characteristics to be taken into account

Once everything is clearly defined, it remains Take into account the characteristics of the bank in herself. Before turning to a bank or another, it is important to check and compare:

- Banking prices : this is the first criterion of choice and comparison when you try to find the best bank. It is important to take a look at the pricing grid but also to the conditions of access (first payment or savings), if there are.

- Bank costs : the most important costs to check are account management fees as well as inherent costs with a bank card. It is also judicious to know the costs applied during payments and withdrawals in foreign currency abroad.

- Financial products : financial products are an important element to take into account when choosing the best bank. What are the available savings booklets ? What are the applied rates and ceilings ? What are the insurance offered ?

Which bank to choose ? Instead online bank Or traditional bank ? You must also have these questions in mind because there are real differences according to the type of bank. And you must choose a bank that responds to your expectations !

Online banks

Online banks are on the rise in recent years. And for good reason: attractive prices, cards without income conditions, little or no fees abroad. Their 100% dematerialized operation attracts many customers, especially young workers. There is therefore no personal or physical agency advisor and their banking offer can be a bit limited (no savings or credit product)

Traditional banks

Traditional banks are known for their panel of banking products, which can also be negotiated in order to have a suitable and personalized banking solution. These banks enjoy a certain renown which anchors them in the banking landscape. You also have access to a large network of physical agencies, with a regular banking advisor.

�� FAQ on French banks

What is the cheapest French bank ?

There Cheapest Bank in France is Boursorama Banque For the 14th consecutive year (source: Le Monde). The majority of its banking services are without bank charges, and Ultim and Welcome cards are free under conditions. In addition, Boursorama offers a welcome bonus up to € 80.

What are the large banking groups in France ?

In France, 6 large French groups The banking market share:

We call ” The three old »The oldest French banks in the banking landscape: Société Générale, BNP Paribas and LCL (bought by Crédit Agricole).

What is the first French banking group ?

The classification of larger French banking groups depends on the criterion taken into account:

- Turnover: the group BNP Paribas

- Number of customers: Group Agricultural credit

- Number of employees: the group BNP Paribas