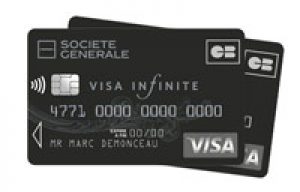

Bank Card CB Visa Infinite – SG, Infinite Société Générale visa: High -end exception card 330 €/year

Infinite Société Générale visa

A premium credit card, the Société Générale Visa Infinite Card has many guarantees and an ultra -complete concierge service. In addition, are part of the Infinite Visa club.

The Infinite Visa CB card

With the Visa Infinite CB card, benefit from highly world payments and withdrawals of payments and withdrawals of insurance and assistance (1), as well as a concierge service available at any time to respond to Your requests (2) .

The + of the infinite visa card

High withdrawal and payment capacities

Optimal insurance and assistance guarantees

Luxury concierge available 24 hours a day, 7 days a week

- Benefits

- Features

- Personalization

- Prices

High -end and exclusive services

- Conciergerie inspired by large hotels, reachable 24 hours a day, 7 days a week (3), all over the world.

- The Visa Infinite club: access a world of unique experiences (4) . Invitations offered for rare cultural and artistic events, negotiated privileges with a selection of large hotels, gastronomic tables, lounges, car rental companies, gift deliveries.

Daily use comfort

- Almost unlimited payment ceilings that adapt to your needs (withdrawals up to € 15,000 per week, payments up to € 300,000 per month);

- Free withdrawals in the euro zone (5)

- Immediate or delayed flow

- Contactless up to 50 euros

And the free dynamic crypto option on request.

Insurance and guarantees

With the Visa Infinite CB card, you have assistance and insurance with extended guarantees in amounts and durations compared to the Visa Premier pack.

- Rental vehicle damage insurance

- Travel insurance including snow and mountain guarantee

- Purchase guarantee (6)

- Card or cash breakdown service in France and abroad

Consult the Practical Guide below for more details on Insurance and Visa Infinite Assistance.

- Which can benefit from the Infinite visa CB card ?

Any customer holding an SG individual account, aged at least 18 years old.

Where to pay and withdraw with the infinite visa cb card ?

- In France: Remove in all CB distributors and pay at More than a million merchants displaying the CB brand ;

- Abroad: Remove in visa ticket distributors and pay at plus 29 million merchants displaying the Visa brand ;

- Also take advantage of the consultation and editing service of your surveys directly on the automata.

What are the removal and payment ceilings of the Infinite Visa CB card ?

Your withdrawal capacities are customizable with your advisor:

- up to € 15,000 over a period of 7 slippery days (France and abroad),

- Up to € 6,000 per day in SG distributors, Credit du Nord in France,

- up to € 2,000 per 7 -day period in distributors of all banks in France.

The payment ceiling is customizable with your advisor, up to € 300,000 per month.

Immediate or delayed flow, at SG, it is you who choose. Everyone has their own way of managing their budget.

With delayed flow, you benefit from more flexibility in the monthly management of your budget. Your payment operations will only be debited once and on a fixed date: 1st, 10 or 20 of the month, depending on your choice.

A good system so that your purchases are only debited after the payment of your income.

What are the advantages reserved for members of the Visa Infinite club ?

To enrich the exclusive experience of the Visa Infinite CB card, access VIP attentions and preferential prices of the Visa Infinite club: from luxury hotels to modes of travel, from gastronomy to oenology, custom fashion to measure to The most refined perfumery.

With the press service first privileges, available on 01 73 60 01 78 (7), you subscribe and receive your favorite press titles at your home, at the best price.

It is without any commitment. The cancellation or modification of your subscription is possible at any time on simple call.

Need additional information on the card ?

Choose your secret code yourself to get it on your fingertips. You can also keep your old code if you want to replace your current SG bank card with a Visa Infinite CB card.

Dynamic crypto option (6)

For your payments on the Internet, set your purchases without communicating your actual card number thanks to the E-Carte Bleue service.

- Contribution of the Infinite Visa CB card

- € 330 per year

- Included: choice of an option between the dynamic crypto option, the blue e-card service and the choice of secret code choice

- Card contribution included, as part of Sobrio: € 27.90 per month

Cash withdrawals

- Free in the euro zone (7) and unlimited displaced withdrawals

- Excluding the euro zone: 2 % of the amount of the withdrawal (versus 2.70 % other SG cards) + € 3

- In the euro zone (5): free

- Excluding the euro zone, two possibilities: payment by card less than € 10, withdrawal of 2 % of the amount of payment (versus 2.70 % other SG cards). Payment by card greater than € 10, withdrawal of € 1 + 2 % of the amount of payment (versus 2.70 % other SG cards).

Prices in force on 01/01/2020.

All prices can be viewed in the price brochure conditions applied to the banking operations of individuals.

(1) Supply of a debit card (international payment card with immediate debit) – CB infinite visa or supply of a credit card (international payment card with delayed debit) – € 330/ year (price in force in the 01/01/2023). See tariff conditions in the brochure “Conditions and prices applied to banking – individuals” operations, available in agency and individuals.SG.Fr

(2) Within the limit of contractual provisions. Insurance and assistance contracts subscribed by Visa Europe Limited with AXA France Vie, AXA France Iard and Mondial Assistance France. Companies governed by the insurance code.

(3) Depending on the general conditions of use provided for in the information notice relating to this service. Agreements concluded between the concierge and visa Europe Limited service.

(4) Depending on the conditions described in the Infinite Visa Guide the Club.

(5) Country of the euro zone: Germany, Austria, Belgium, Cyprus, Spain, Estonia, Finland, France, Greece, Ireland, Italy, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Latvia, Lithuania. For payments and withdrawals outside the euro zone, prices can be viewed in the brochure “Conditions and prices applied to banking – individuals” operations.

(6) Within the limit of contractual provisions. Insurance contract signed by SG, through SPB, with Allianz Iard. Companies governed by the insurance code.

(7) Monday to Saturday from 9 a.m. to 6 p.m. Communication cost according to operator.

(8) Free to the choice of the blue e-card or dynamic crypto option or choice of secret code for holders of an Infinite CB card.

(9) Option subject to conditions. The price of the option (€ 26/year – Price on 01/01/2023) is added to the contribution of your card. The option exempts fixed and variable SG commissions on the EURO zone card operations (excluding exchange commission in the case of conversion into currencies and any commissions levied by the corresponding bank).- Our bank cards

- Savings and investments

- Our consumer credits

- Our life insurance

- Personalize your bank card

Infinite Société Générale visa

A premium credit card, the Société Générale Visa Infinite Card has many guarantees and an ultra -complete concierge service. In addition, are part of the Infinite Visa club.

What credit card to choose ? Thanks to our online credit cards comparison, quickly find the best cards you really need. The criteria for selection of a primordial sound card to choose the right card: free online bank or reduced bank charges, large promo offer, advantageous joint, free bank card, online banking sponsorship, placement, fee by to pay, the options available, insurance where assistance available, ect..

Infinite Société Générale visa

- Description

- Further information

- Notice (0)

Description

Infinite Société Générale visa

The Infinite Société Générale visa card is a tailor -made card that can meet all your most specific needs. Prestigious services and premium advantages. An exceptional credit card with a high withdrawal and payment capacity, as well as optimal insurance and assistance guarantees and finally a luxury concierge service 24 hours a day.

Visa Infinite credit cards are even more prestigious credit cards than Visa Premier and Mastercard Gold cards. You can take advantage of the withdrawal capacity adapted to your most demanding needs, up to 15,000 euros per week. A payment ceiling up to 300,000 euros per month. Finally, in the event of theft or loss of card, a replacement card will be very quickly provided to you.

In addition, having an infinite visa card allows you to access the Visa Infinite club which allows its many members to benefit from many advantages throughout the year.

Prix of the infinite Visa Société Générale

Annual subscription : 330 €/year with inclusive: Dynamic crypto option, blue e-card service, Option choice of secret code.

Payment in the euro zone : free

Excluding euro zone : paying: 2%

Money withdrawals Euro Zone : free

Excluding euro zone : paying 2%Obtain an infinite visa card Société Générale

To be able to request an infinite Société Générale visa card, you must first be of age, that is to say being over 18 at the time of your request for a card. Then you must be a customer and holder of an individual Société Générale account. Of course as for all credit cards, your request will be subject to a slightly more in-depth study before it is accepted.

A substantial salary must also be received to be able to request an infinite visa card. However, there is also the classic visa card available at Société Générale.

Type of flow with an infinite Visa Société Générale

With the Société Générale infinite credit card, you have the choice for your type of debit. Type of debit also means type of reimbursement. The holder of an Infinite Visa card has the choice between an immediate speed or a delayed delay in a manner managed his budget as well as possible.

- With delayed debit, you have more time to reimburse your use of your card. An excellent system for your purchases or payments to be debited only after having received your monthly income/salary.

Where can I pay and withdraw with the infinite Visa Société Générale

Like all cards using the visa network, you can pay and remove money easily wherever you see.

- In France: Remove and pay for more than a million traders

- abroad: pay and remove from more than 29 million merchants.

- In both cases above, take advantage of the consultation service for your surveys directly on the automata.

High withdrawal and payment ceilings

You can withdraw up to € 6,100 per 7 -day period:

- Without exceeding € 770 per day in Société Générale, Credit du Nord and abroad distributors,

- Without exceeding € 900 per period of 7 days in distributors of tickets to all banks in France.

The payment ceiling is customizable with your advisor, up to € 137,300 per month.

Advantages of the Visa Infinite club

Having an infinite visa card gives you access to the Visa Infinite club. A club that will make you enjoy a multitude of exclusive VIP experience. You will have access to preferential prices, exclusive places, discounts ranging from fashion to catering. A bunch of prestigious and precious advantages to help you make the best choices on a daily basis.

Services included with the Société Générale infinite visa

Who says infinite says prestigious services included. You automatically benefit from a private concierge service, as well as assistance and insurance for you and the whole family.

Insurance and assistance included

- Medical assistance and repatriation, helps to continue your trip ..

- Cancellation insurance: modification, cancellation, travel interruption

- Travel insurance: loss, theft or damage to luggage, plane delay, your luggage, rental vehicle, snow and mountain warranty, death and disability.

- Liability insurance abroad: legal protection abroad.

- Insurance on your purchases: Purchase and prolonged warranty guarantee.

Concierge service inspired by large hotels

A concierge service 24/7 and around the world. High -end privileges on a selection of large hotels, gastronomic tables, lounges, car rental companies, delivery of gifts and other unique experiences.

Advantages and disadvantages

- Prestige card

- 2 possible speed type

- Concierge Service

- Reinforced assistance and insurance

- High withdrawal and payment ceiling

- Ultra-polyvalent card

- Tailor -made assistance service

- Watch out for withdrawal costs abroad

Summary of Infinite Visa Prices Société GENERALE

- Annual subscription: € 330

- Account holding costs: € 2 per month or 24 €/year

- Inactive account: 30 €/year

- Paylib and Apple Pay payment solution: free

- Blue e-card option: € 12/year

- Dynamic crypto option: € 12/year

- Payment in euros: free

- Payment in currencies: 2.70% of the amount if the amount is less than € 10, otherwise € 1 + 2.70% of the amount

- Removal in euros: free

- Agency transfer: € 5 (free online)

- Withdrawal from a dab other than that than SG in Euro: € 1 per withdrawal from the 4th withdrawal per month

- Removal in currencies: € 3 + 2.70% of the amount

- Secret code change: 10 €

The editorial staff gives a note from:

Choose the Infinite Société Générale visa if you are looking for a daily quality service.

- Affordable Premium Credit Card

- Multitude of advantages and privileges

- Reinforced insurance and assistance

- High ceilings

- Withdrawal costs abroad

Further information

Specification: Infinite Société Générale visa

Immediate at the end of the month, by staggering

Routing drugs, assistance in the event of legal proceedings, medical assistance, purchasing insurance, cancellation insurance, snow and mountain insurance, rental car rental, travel insurance, advance on costs hospitalization, death and repatriation, repatriation pets, luggage or transport

Notice (0)

User Reviews

There is no opinion yet.

Be the first to leave your opinion on “Visa Infinite Société Générale” Cancel the answer

Similar products

Platinum Visa Savings Bank

Add to the comparator

Visa Axa Classic

Add to the comparator

Visa Electron Sensea Savings Bank

Add to the comparator

Visa First Savings Fund

Add to the comparator

Visa First BNP Paribas

Add to the comparator

Visa Classic CIC

Add to the comparator

Compare the other cardsOrange Bank Premium visa

Add to the comparator

Visa First Boursorama

Add to the comparator

Mastercard Eko Crédit Agricole

Add to the comparator

Mastercard World Elite N26

Add to the comparator

Infinite Visa Caisse Savings

Add to the comparator

Our platform compares for you the different payments available in France. We are an independent organization offering simple and clear content for all of our visitors. The goal is to make your job easier in your research for an online credit card request.

- Visa Classic BforBank

- Visa Classic HelloBank

- Visa Premier Cetelem

- Visa Classic Boursorama

- Visa Classic Société G.

- Visa Aurore Cetelem

- Mastercard Cetelem Aurore

- Mastercard Fortuneo Standard

- Mastercard Gold ING

- Mastercard World Elite N26

- Mastercard Prepaid Viabuy

- Mastercard World Elite Fortuneo

- Mastercard Prepaid Anytime

- Revolut Mastercard

- Mastercard Gold Fortuneo

- Mastercard World Elite Fortuneo

- Aurore Cetelem card

- Mastercard Standard Fortuneo

2019 Cartes-of-Credit comparator.Fr. All Rights Reserved.

Manage consent to cookiesTo offer the best experiences, we use technologies such as cookies. Consenting to these technologies will allow us to process data such as navigation behavior and this data will be used to offer you a tailor -made service such as advertising customization such as Google Ads. The fact of not consenting or withdrawing your consent may have a negative effect on certain characteristics and functions.

Functional functional always activated

Storage or technical access is strictly necessary in the end of the legitimate interest to allow the use of a specific service explicitly requested by the Subscriber or the User, or for the sole purpose of transmitting the transmission of Communication on an electronic communications network.

Preferences Preferences

Storage or technical access is necessary for the purpose of legitimate interest to store preferences that are not requested by the subscriber or the user.

Statistical statistics

Storage or technical access which is used exclusively for statistical purposes. Storage or technical access which is used exclusively in anonymous statistical purposes. In the absence of a summons to appear, voluntary compliance on the part of your Internet access provider or additional records from a third party, the information stored or extracted at this end cannot generally not be used to identify you.

Storage or technical access is necessary to create user profiles in order to send advertisements, or to follow the user on a website or on several websites with similar marketing purposes.