8 applications that lend money in 2023, application that lends money: the 8 best our advice

Application that lends money: the guide

Some applications can lend you money but maximum sums may not meet all needs. Difficult, generally, to pay an invoice as a mechanic by obtaining only 100 euros or to be able to buy a new dining room table, when the one we have becomes too dilapidated. THE Choice of an application can therefore be done according to several criteria, including that of the sums that it is possible to obtain.

Application that lends money: our top 8

An application that lends money yes it really exists, that you need a small amount to pay a race or want to make a more important loan to buy you a new computer, it is now possible with these applications. Sometimes it happens in life that you have unforeseen events: a car that does not start anymore, a glass of water falling on its computer or simply a higher electricity bill. To not put yourself in the open and pay excessive costs and interests I offer you an application list here that lends money when you need it.

The major advantage of these borrowing applications is that the costs and interest rates are very low, which greatly facilitates reimbursements. These applications are 100% secure and 100% transparent concerning the costs associated with loans so that you are always aware of your consumption. The purpose of these applications is to help you rather than ripping yourself up with unnecessary costs. Here is our top 8.

To go further, you can also consult our selection of applications that make money

1. Bling

You need 100 € right away ? Bling lends them to you. You can of course ask less but if you need to be assumed immediately a sum of money up to 100 € while waiting for your next pay, Bling is the application that lends money that you must. In less than 3 minutes create an account and enter your information: salary, rent, number of dependents. Depending on your bling profile can lend you via an instant transfer of 25 € to 100 € that you can reimburse within 62 days after having borrowed.

In the event of an unexpected, to prevent an overdraft or to simply please you, ask Bling to lend you money. The demand is validated in less than two minutes to ensure you an ultra -fast money lead.

In addition, if you take more time than expected to repay your loan, Bling is flexible and offers another additional 31 day to reimburse what you must. And with its advanced encryption system will be reassured that none of your personal data is sold or stolen.

- 100 € immediately

- Flexibility on reimbursement

- 8% interest if you miss the first reimbursement

Note: 4.8/5

2. Finfrog

Borrow significant sums to make more important purchases is what Finfrog offers with its loan service. From 150 € to 600 €, apply in two minutes after registering and let yourself be guided in the application to be able to recover your money if your request has been validated by the Finfrog services. Once everything is accepted you will receive the funds instantly on your bank account to spend them ! Finfrog offers the best market interest rates and is 100% transparent in reimbursement and money loan: you are still aware of what you need or what you can borrow, all in complete safety.

Using Finfrog is cheaper than being uncovered or borrowing in a bank and Finfrog assures you the best rates to relieve your wallet. Open to all, whatever your income, Finfrog lets you reimburse at your own pace by offering you to repay your loan from 3 to 10 months.

- Large sums quickly

- Reimbursement of the loan at your own pace

- Conflict with certain banks that do not allow

Note: 4.5/5

3. My boost

The ends of month can sometimes be difficult and in addition to this is added the bank charges concerning your overdraft. If you need a boost to finish the month and not finish in the red I recommend the application that lends money “my boost”. French company who wants to help people in need, my boost offers to lend you between 100 and 3000 euros depending on your financial needs. The loan request system is ultra fast and offers to make you a transfer within 10 minutes after your registration, you just have to have your RIB and your identity card to prove that it is you who do the loan request. Once the request has been validated you will receive the money in the moment if you choose the Direct Transfer option (costs apply) or a traditional 48 -hour transfer.

Reliable and fast, this is the service offered by my boost. Besides, you also have the possibility of having several loans at the same time (if they are approved) in the cases you are seriously in need. If you need help for a purchase or do not end up using your discovery, my boost is the perfect application for you.

- Fairly low costs

- Refund in 4 monthly payments to be more flexible

- The application is riddled with bug

Note: 4.6/5

4. Lydia

More than a simple application that lends money, Lydia is also a benchmark in the world of the bank for having created an application that manages your bank account. Very simple to use, Lydia allows you to make express or automatic transfers from your family’s accounts, as well as to create a money collection for your family events. But we are not here to talk about her bank account management, Lydia in addition to all her services, also offers to give you small loans that can go up to 500 euros. As with other applications, take your RIB and identity card and once the request is received directly the money on your bank account or use the LYDIA application to manage your loan and your account, an application for all your needs.

- A bank loan in an instant

- Manage all your accounts in a single application

- Does not lend more than 500 euros

Note: 4.6/5

The rest of the list includes applications that are not yet available in France but should be in the course of the year. If you are not in France there is a good chance that you can still use them. Likewise if you are abroad and you need a quick money loan to deal with an unexpected these applications can save you the putting.

Read also: our top 8 racing list applications to better manage its budget

5. Reader

Eearnin is an American company that offers to move forward on your next pay if you need help finish the month. Without interest and with very low costs, Earnin just advances you the money you are going to work: by registering your working hours in the application, Earnin knows exactly how much you win and will offer you an equal sum. It is a more loan system than a loan. Practical if you need to buy something before your pay or you don’t want to pay banking fees for being discovered before you have received your salary.

In addition, by adding Earnin to your bank account, the application takes the money directly on the day of your pay so as not to complicate your life. The Earnin consumer service is at your disposal 24 hours a day, 7 days a week, if you have a question do not hesitate to call and ask, they will answer you to facilitate your request in advance and make you access your money faster.

- A money advance more than a loan

- The costs are ridiculously low

- 0 interest

- Does not lend more than what you earn

Note: 4.7/5

6. Dave

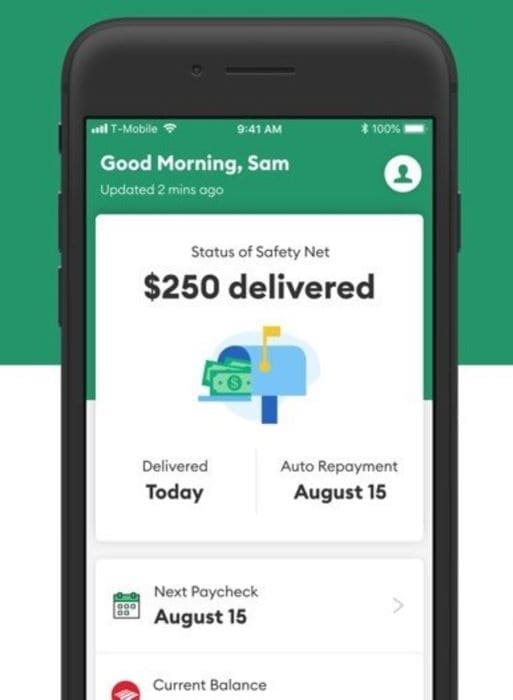

Dave is the little bear that will help you better manage your budget as well as to lend you money when you need it. By installing the application you have the possibility of adding your bank account and which will leave Dave the option to lend you the money for your pay a few days before you receive it ! And all without cost or interest. You can also apply for a loan of 250 euros for free that you receive immediately to spend it in the event of unforeseen events, damn practical help for daily seeds. Join 10 million people who trusted Dave the little bear and you also manage your budget better and get paid earlier to better control your expenses.

Dave is 100% secure and 100% transparent on all costs that can be added to your requests, you will only pay for what you have approved, like that, no unnecessary expenditure or addition of costs after the request made.

- Help to manage your salary

- 0 costs

- Ultra fast loan request

- Not yet available in France

Note: 4.8/5

7. Brigit

There is nothing worse than going to see your bank account and see all the costs that have been added because you have been uncovered or you have made a consumer loan. If you are tired of paying unnecessary costs as soon as you borrow money the Brigit app is there for you. Without unnecessary costs or high interest, borrowing money has never been easy and quiet. Brigit prides himself on being able to lend you money just 60 seconds after your loan request, and makes you an instant transfer to your bank account. More waiting, more stress, pay what you need to pay without wondering when you have the money. As with Dave, let Brigit access to your bank account so that it can advance your pay for you a few days in advance, which allows you to better budget and not be caught in the face of the unexpected of life.

Used by millions of Americans every day to better manage their silver, Brigit is the versatile application that will allow you to no longer spend in unnecessary costs and with its “express” request, borrow 250 euros without questions directly on your account !

- The 250 euros instantaneous without the need to be approved

- Fresh and really low interest

- You need an American number to register

Note: 4.8/5

8. Chime

If you are looking for an application that lends money so that you no longer pay for bank overdraft, do not look, download Chime. Chime is an application that lends money but also offers an overdraft protection service that only makes you discover, you automatically turn a sum of money (up to 200 euros) on your account so that you are always in the green.

You do not pay for this service but you can leave a “tip” if you appreciate the quality of the service offered. Chime will just ask that you have 200 euros on your bank account to be able to open an account with them, once you have completed all the papers and proven your identity, let it take care of everything, nothing better For peace of mind. Of course you can also apply for an immediate loan if you need money immediately, nothing could be simpler, Chime takes care of everything, just request and you will have the money transferred to your account in bank.

- Chime protection to no longer be uncovered

- Instant transfer

- Requires an American or English bank account

Note: 4.9/5

Do not stay in need, download an application that lends money and no longer pay the exorbitant costs of the banks when you are uncovered. Whether you want to end the month quietly without worrying about money or you want to crack for the new iPhone, take a short -term loan to have interest rates and very low costs. So don’t wait any longer and make your request with one of the applications on the list !

Application that lends money: the guide

Life is made of needs. Whether it is a computer that breaks down, races that we are struggling to do, due to weak resources, a higher energy bill than what we expected after a moving in: it is easy to find ourselves discovered as soon as one cannot transfer money from certain savings products.

Being uncovered at the level of your bank requires costs (Agios) and can be harmful when a banker examines the history when requesting a mortgage or consumer credit so that it does not happen, it is best to find other alternatives. There are applications thanks to which it is possible to obtain money. Paying the repairs of a car to go to work or canvassing employers becomes again possible when you are in the integration or professional reintegration phase.

Nothing to fear in terms of the costs requested or Interest rates that we necessarily expect to find very high ; which could interfere with reimbursement, with this type of application. As the reimbursement must be relatively quickly, the rates are low, because the entities take less risks than with long loans. The nature and the amount of the costs are also stipulated in a transparent way so that the consumer wants to use them as soon as he needs the need.

100% secure for the transfer of funds, they are the ideal solution when you need small sums punctually or more or less regular. However, while the market extends, you have to find the right players not to regret your choice. We have listed here The 8 best applications to be able to borrow money. Description, strengths but also small imperfections; We have passed each of them in a sifting so that you can choose the one that seems to correspond the most to what you expect from this type of service.

1. Lydia

That is sure One of the best known applications (at least name) by the French who need money but not only. The banking sector has put it in the spotlight, because Lydia is also an application that helps manage its bank account in a simpler way when you have a complicated relationship to money. It is therefore an application that offers different financial services such as being able to fire money to loved ones, via their bank account or even collect funds for events who are close to your heart (the communion of a little sister, your grandmother’s birthday etc …).

Another service and which explains the presence of the Lydia application in this top: the fact of power therefore lend money to individuals And this, up to 500 euros. It is enough; as often with this type of services; of a RIB and an identity card to create an account and be able to ask for money. If the request is validated, the money arrives very quickly on the bank account. Of course, by downloading the application, we automatically take advantage of budget management services; which will apply for the amount that it is a question of reimbursing.

Why choose Lydia for your money loan ?

- Lydia is used by many banking establishments: Mini loans can therefore be more easily granted as long as we prove its solvency.

- Sum of money loaned easily and management of reimbursement and costs: all this with a single application, what more ?

The drawbacks of this application

This application is so practical and reliable that one can only regret that the maximum amount does not exceed 500 euros. Other applications are less timid, but let’s not sulk our pleasure because Lydia is really an application to know when you have a quick need for money.

2. Finfrog

Some applications can lend you money but maximum sums may not meet all needs. Difficult, generally, to pay an invoice as a mechanic by obtaining only 100 euros or to be able to buy a new dining room table, when the one we have becomes too dilapidated. THE Choice of an application can therefore be done according to several criteria, including that of the sums that it is possible to obtain.

In the case of Finfrog, if you can borrow at least 150 euros, The maximum amount amounts to 600 euros. Not bad when you have an urgent need of liquidity, to settle an invoice. After registering on the application, the request only takes a few minutes. Finfrog’s services; With regard to the information requested to verify solvency; are responsible for validating or not the request. When this is the case, the funds are immediately transferred to your bank account.

This application is known for its transparency in terms of operation, requested costs or applied interest rates. No chance to have a bad surprise with this application If you need money. While many are based on income, which limits the field of possibilities of certain users, this application is more open -minded and makes it possible to reimburse the amount requested for a period of 3 to 10 months.

Finfrog’s strengths

- Difficult not to find appreciable that the mini loan is not necessarily correlated with a high level of resources.

- Unlike applications that are more shy in terms of maximum sums loaned, Finfrog allows you to obtain in a few minutes up to 600 euros.

- Be able to reimburse over 10 months maximum : What manage your budget optimally.

What we like less about Finfrog

Some banks do not have the same open -mindedness as this application and there may be conflicts when banking establishments believe that demand cannot get a positive response.

3. My boost

Inflation and therefore therefore Loss of purchasing power may have a terrible impact on budget management. The end of the month arrives well before the 15th. The result: an overview that is inexorable and agios that become more and more important. It is time to break this spiral by taking advantage of the benefits of the money loan application “my boost”.

An evocative name which explains very well what it can do for you at the financial level. While some applications are of foreign origin, My boost is 100% French. A criterion of choice, perhaps, who knows ? If you only need 100 euros, that is good because it is the minimum sum you can claim thanks to this application. But in terms of the maximum sum, it exceeds for the moment the actors that we have started to describe, since it is possible to obtain up to 3,000 euros.

Your registration is made and your request validated ? This first is facilitated by the number of documents requested. A RIB of course allows you to receive money on the account. As for the identity document, it is she who proves to agents working for the application that you are well behind the request for money. Perfect, all you have to do is choose between the two possible transfers. If your request is not too urgent, opt for the traditional transfer and you will have the money requested on your bank account within 48 hours at most.

If the need for money is more pressing, the transfer can be instantaneous, but then we must expect pay for additional feess (which would also be the case in your bank, in general).

The assets of my boost

- In the application sector that lends money, that of my boost is in excellent position in terms of costs

- Refund in four times, this is interesting to better control your budget.

- You need several mini loans at the same time ? Just prove your solvency so that requests are accepted, it’s as simple as that.

The black dots of this application

Unfortunate that the user is faced with regular bugs As soon as he goes to the application: a easily perfectible thing.

4. Bling

L’BLING APPLICATION Do not provide large sums, but for some people, knowing that they can get up to 100 euros maximum will be enough for their happiness, if that is what they need before receiving their salary. It only takes a few minutes to create an account and provide all the information that the application needs to be able to see the feasibility of the request (the salary that we receive, the rent or credit to be reimbursed for the home, the number of people with a household living at home).

The minimum amount that can be borrowed via this application is 25 euros and It therefore goes up to a maximum of 100 euros. After creating the account and sending the request, it is validated within two minutes. You can’t reimburse right away ? No problem with bling which gives you up to 62 days maximum to do it.

However, even when you are keen to repay the amount loaned, life is not always easy and an unexpected can come and put a grain of sand in the cog. No worries with this flexible application which then offers an additional time of a maximum of 31 days to pay what we have to. This facility allows not to have to pay agios being uncovered at the bank.

Bling’s advantages

- We appreciate being able to borrow up to 100 euros very easily and in a few minutes

- Flexibility is not necessarily a quality that is associated with loan establishments. This application proves that this is not a generality.

- Fear that your personal data will be the subject of a flight or exploitation by third parties ? Impossible with sound efficient encryption system.

The inconvenients

Flexibility yes, but this has consequences because if you cannot reimburse right away, the application is responsible for requesting 8% interest.….

5. Reader

This is not a French application. However, the money loan should not be a problem. Who never ended up in money while pays soon arrives on the bank account ? In the meantime, however, you must pay the races or respond to financial imperatives, unforeseen or not.

In order not to be in an overdraft, which can quickly turn to the vicious circle, to know Applications that lend money easily is a good plan not to pay agios when you are able to reimburse what you are about to ask. Earnin is an American application which does not require any fees and no interest costs. What want to test it, certainly.

However, it must be understood its functioning which is more like a fee what money lending as it is understood in France.

The sum it is possible to obtain is exactly the one we receive thanks to his salary. For that, The application requests to be transparent on your job, What you earn but also your working hours so that you can ask pro rata of the number of hours worked.

As for the refund, it is done almost without you realized it since the application knows when you are going to be paid (you will enter it during registration). As soon as your salary falls, the advance that has been made to you and which you took advantage of is deducted and you have reimbursed your debt: Practice.

Why choose Earnin if you need money ?

- An application that does not ask for any interest in the money she lends : we think you dream

- She hardly catches up with the costs, which is another asset

- When you just need an advance and you are put off by the idea of the loan, this is the ideal solution.

- We appreciate the Consumer service quality that you can reach any time of day and night to answer any questions or to get money even faster if the request is urgent.

The points to consider

- The amount of money loaned is correlated, no more and no less than the one you receive with your salary. If you need more, this is not the application you need

- The fact that it is not a French application can be hesitated but the service is operational and serious.

6. Brigit

The French admit be in the open. A unpleasant situation that does not necessarily have to have with their way of managing their money. It is easy to have an unexpected expenditure and that the sum usually dedicated to loads does not cover. In this case, costs apply and we can say that banks are not stingy in terms of costs requested (the famous agios). In order not to have to undergo this kind of disappointment, to be able to call in case of necessary a Application that lends money is a solution to discover if this is not already the case. Brigit is one of those flagship actors in the matter.

Upon registration made, you can make your first request. While it is sometimes necessary to wait 48 hours to get the money on your current account, here, It happens in less than a minute (Instant transfer). To reimburse yourself, Brigit asks you to enter the amount of your salary and the date on which you receive it. Thus, on D -Day, you reimburse what you need without having any additional approach to perform.

The assets of the Brigit application

- Each time you can get up to 250 euros in just one minute and your request does not even need to be approved : who says better ?

- We can only highlight the interest rate which is very low and the costs which are just as much: never a salary lead has been so easy.

The negative points noted

If we had to find a defect in the Brigit application, we are forced to highlight the fact that it is necessary enter an American number. Better to know someone in the United States who can provide you with this little service.

7. Chime

Being in the open is a situation that makes you very uncomfortable and anxious you ? It is true that it is easy to achieve this, with the stagnating wages and the increase in the cost of living. Yet, Chime could help you get out of this bad step And that, in a very simple way.

Not only can you borrow money, but you will never be uncovered again because as soon as it is about to arrive, Chime makes a transfer to your account that can go up to 200 euros. Perfect if you plan to request a mortgage and you fear that Examination of your banking history Do not play against you.

To do this, just open an account and Provide supporting documents including an identity document. Sometimes money is an emergency. No problem with the instant transfer.

Chime takes care of all formalities to consider money more serene !

Chime: the ideal solution ?

- Do not wait 48 hours to get the money on your account, that’s fun: thank you the instant transfer that this application offers.

- Never again being uncovered: it is possible, with a regular transfer of small sums made by Chime.

Weak points we were able to note

Impossible for the moment to claim the services of this formidable application If you do not have a American or English bank account. Too bad, hope that the application will open to France soon.

8. Dave

Materialized by a most sympathetic bear, the Dave money loan application is at the same time; Like Lydia, by the way; A great tool when you need help to manage your money but also when you need a certain amount of money. Just like Earnin; Another application that we have just talked about; This is more of a salary lead than a real mini loan, But what a relief to be able to pay your bills at the most appropriate time or to have fun, even before the pay sheet is given to you !

10 million people already use this application To obtain up to 200 euros. Depending on the requests and even if Dave does not ask for the money loan, certain costs may apply. A unpleasant surprise in general that this application wishes to minimize: everything is clearly explained, so that the consumer acts in any event. This application is 100%secure, which is appreciated so as not to see your personal data used in particular.

Why choose Dave ?

- Touching a salary and knowing how to manage it are not necessarily compatible elements in some people: have a clever management tool seems a good solution to make it change.

- No fees generally and no interest rates taken for the demand for money; we ask for more

- It only takes a few minutes to get an answer and receive the money you need

Dave: a solution that is not free from defects

This application seems perfect: yet, She is not yet available in France And you have to be patient to be able to trust him soon and have less difficult months, at the financial level.

To remember in short before opting a mini loan

Applications described in this complete guide Allow money within 48 hours, Sometimes instantly with the eponymous transfer (be careful, this generally presupposes costs which are not included in the initial offer and must be taken into account). We can only appreciate the common transparency to all concerning the fees, but also the interest rate (when the latter is requested, which is not always the case).

These applications make it possible to obtain sums of less importance, even if some go up to 3,000 euros to meet punctual and regular financial concerns. Some lend money in the traditional sense of the term with a repayment schedule and others are more to be considered as advances on salary. It is not always possible or easy to negotiate this with your boss because you don’t necessarily want to expose your money problems. With this type of applications, this public unpacking is not necessary.

In a few minutes, we create an account and send the supporting documents to quickly receive the money we need. As the amounts of money requested are not very important, the interest rate when they exist are not high And finally, we do not reimburse much more than what we asked for. Some tools offer interesting additional services such as budget management. All this can constitute criteria of choice to take the most suitable application according to its needs !

To find out more about credits without supporting documents, you can consult our dedicated guide !