4 solutions to recover data from a broken phone or with a black screen, broken or stolen phone, how to make insurance work?

Broken or stolen phone, how to make insurance work

2) Connect with the account containing the backup.

4 solutions to recover data from a broken phone or with a black screen

Today, smartphones are part of our daily life. They serve us to communicate, take photos, videos, plan our personal appointments and professional meetings. However, it sometimes happens that a fall comes without warning and the result is final, Your phone is found with a black or broken screen. It is then unusable. Nevertheless, as it contains important data, we will have to follow our guide, step by step, for Recover data from your broken phone or with a black screen.

Quick access (summary):

How to recover data from a phone with black screen ?

In this method we will use software called Droidkit. This is a very powerful tool allowing Restore all data in just a few clicks. So, if the touch screen works or not, there is always a solution with Droidkit. Besides, he is Compatible with a majority of Android devices and operates under Windows and Mac.

The screen is broken but the touchline still works

If your screen still works, you can use the “Quick recovery” function which allows you to recover your data in a few steps. Here’s how to do:

1) First, download and install Droidkit.

2) Second, activate the USB debugging on your device and then connect it to your PC.

3) After that, select “Data recovery” then, click on “Quick recovery”.

4) Now choose the data to restore and then click on “Start”.

5) Finally, visualize and select the data, then click on “to PC” or “to the device”.

The screen is broken and the touchdown does not work

If the screen is broken and the tactile does not work, it means that you cannot activate USB debugging. In this case, Droidkit offers another feature called “data extractor” allowing to recover data from a phone with broken screen without USB debugging. This feature allows you to repair your Android system and restore data. So here are the steps to follow:

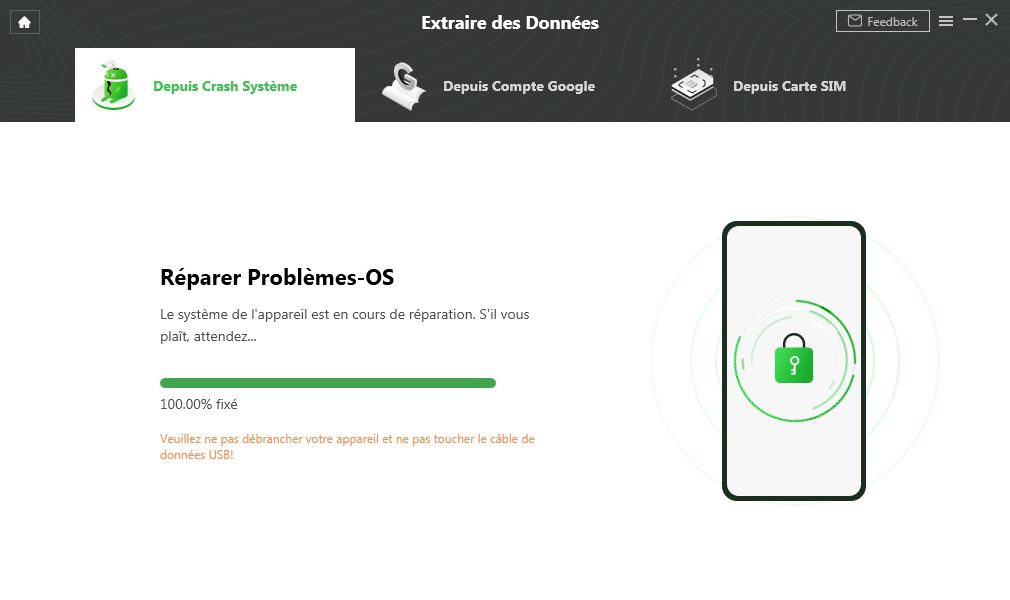

1) Launch Droidkit> Select “Data extractor”> Click “From Crash System”.

2) Connect your Android phone then, select the data to recover then click “Start”.

3) Put your device in recovery mode by following the instructions displayed on Droidkit.

4) Find your phone’s PDA code, enter it and then click Download the firmware.

5) After the end of the download, Droidkit will repair the system.

6) Once the system has been repaired, connect your Android phone and click Next.

7) Finally, select the data to restore and then click on the “to PC” or “to the device” button according to your choice.

Recover data from an Android phone with broken screen from Google Drive backup

If you have already made a backup on Google Drive, you can Restore your data easily on your PC. Here’s how to do:

2) Connect with the account containing the backup.

3) Download it by right click with the mouse and then click on “Download”.

Recover data from an Android phone with black screen using an adapter

Here is another method that works If your Android phone is compatible with DisplayPort or MHL. However, it is essential that the touch of your phone works in order to be able to use this method, if this is not the case, you must connect a keyboard and a mouse. Here’s how to do:

1) Connect the USB adapter of your smartphone.

2) Then connect an HDMI cable connecting your screen to the adapter.

3) Finally, unlock your phone to copy the data.

Conclusion

There are different methods for Recover data from a phone with a black or broken screen. However, if the tactile no longer works, the best way is to use Droidkit to recover data from your phone without USB debugging. This software is very effective and its success rate is very high. We advise you to use it to recover your data.

If this guide helped you to Recover data from your phone with broken or black screen, Do not hesitate to share.

This article was written by a guest partner as part of a sponsored partnership

Broken or stolen phone, how to make insurance work ?

�� You pay more than 100 € per year your home insurance for 60 m2 accommodation ? Find cheaper by comparing !

Your mobile phone, like many other nomadic devices, is now an integral part of your daily life. However, these equipment is often subject to theft and breakage, so much so that insurers have changed their offers to set up specific guarantees. In general, you can be covered for breaking your smartphone as part of your home insurance. But what are the reimbursement methods and how to play your insurance ?

- The claim took place at home

- The type of claim is provided for in the contract

�� Tip: play your home insurance for a broken phone

You want to make insurance for a broken laptop and be reimbursed ? First, reread in detail the general conditions of your contract. Indeed, you can easily find a trick for the assurance of a broken phone, such as: for example:

- Check the list of objects supported in the case of a fire, explosion, burglary, natural disaster or water damage: generally Your home multi -risk contract provides all the goods present in the accommodation during the loss;

- Look if there are specific clauses related to a mobile phone or smartphone, and in particular by consulting Mentions dedicated to “nomadic devices” ;

- See Exclusions of guarantees, informed (according to the insurer) either by claim or in a dedicated paragraph, even both;

- Make a walk a warranty extension (often called “breakage” or “ice cream” warranty) that you would have subscribed in addition or which would be included automatically to your contract: indeed, some insurers offer warranty extensions to protect your nomadic devices, even outside of your accommodation, and therefore your smartphone in case of breakage or flight, etc.

�� What to say to insurance for your broken phone ?

When your phone is protected as part of mobile insurance, it generally takes into account the case of accidental breakage. But that exactly this term signifies and at what level of coverage does it correspond ?

So that the accidental breakage is proven, It must be sudden and unpredictable material damage which directly affects the operation of your smartphone. In other words, if your phone works normally despite a crack or the breakage of an external element, the insurance will not be able to take care of the damage.

Generally, The “accidental breakage” guarantee covers the following cases ::

- The screen of your mobile phone breaks after falling to the ground;

- Your smartphone fell into the water (a swimming pool, a bathtub for example);

- You walk on your phone without doing it on purpose;

- Your device fell to the ground while you move by bike, on foot, etc.

Please note, to operate, the accidental breakage guarantee generally imposes certain conditions and in particular:

- Your smartphone must be under 5 years old;

- Your device has been purchased in the European Union;

- You must have maintained your smartphone well and used it according to the manufacturer’s recommendations;

- You should not have tried to repair it yourself, etc.

Let us help you choose your home insurance

Estimated time: 5 min (free and non -binding brokerage service)

If you meet all these conditions, to make accidental breakage insurance work, you will need to send your insurer an accidental phone breakdown .

To help you in your approach, Here is a phone breakdown model On which you can rely on to write your mail.

Firstname name

Address

Phone number

E-mail address

Insurer name

Insurer contact details

Done to “City”, the “xx/xx/xxxx”

Subject: Declaration of broken phone loss

By the present, I share the breakage of my mobile phone “brand”, “serial number” caused by “reason for the accident” and occurred on the “XX/XX/XXX”.

The XX/XX/XXXX, I have subscribed to mobile insurance with your services, “contract number” that I wish to play today in order to be taken care of for the damage suffered.

I attach to my mail all the documents necessary for the constitution of my file and to the good care of my claim.

I remain of course at your disposal for any additional information.

I beg you to accept, madam, sir, the expression of my most sincere feelings.

Good to know to accelerate the support for your file, remember to provide all the supporting documents you have: purchase invoice, serial number of your phone, manufacturer’s manual, etc.

❌ The reasons why home insurance does not support a broken phone

The assumption by the home insurance of the breakage of your phone, or from any other nomadic device varies considerably from one insurer to another. Each insurer is free to ensure or not a nomadic device As part of multi -risk home insurance, and associate all the exclusions of guarantee that he wishes (such as the accidental breakdown of the laptop). Then be sure to read the general conditions of sale (CGV) in order to know precisely the level of coverage to which you subscribe.

⭕ At Groupama for example, you are covered for your mobile phone (or smartphone) provided that your device is under 5 years old and that you have an invoice issued by a professional. Added to these conditions of other exclusions from guarantees, so you will not be supported if:

- The serial number (or IMEI number) is altered and/or illegible;

- The damage suffered by your phone reach the external parts of your device, without harming its proper functioning;

- Damage occurred on the occasion of its dismantling, reassembly, maintenance, refurbishment or repair;

- Damage results from the wear of your smartphone, fouling or a lack of maintenance on your part;

- Damage occurs after connection or use not in accordance with the manufacturer’s recommendations;

- Damage linked to corrosion or oxidation when it is not the consequence of an accidental event;

- Damage is due to an exposure to rain, sun, frost, etc.

⭕ At the MAAF for example, nomadic devices are covered by home insurance As part of a specific guarantee called “mobility protection” available only for “classic” and “integral” formulas provided that your phone only makes the object of private, out -of -competition use and that it belongs to you , or to one of the people insured in the contract. The guarantees are provided even abroad, worldwide, but only for stays not exceeding three months.

⭕ Youassur for example also offers housing insurance for broken phone, In spite of everything, including certain limits: nomadic devices are guaranteed up to 70 % of the purchase value (after deduction of obsolescence) and within the limit of 500 € per object. There is also an annual ceiling for this type of warranty amounting to € 1,500. In addition, there is no warranty exclusions for which you will not be supported and in particular if the damage has been intentionally caused by you or with your complicity or if your phone is broken following a computer virus or hacking your data , etc.

⭕ Luko insurer also supports specific guarantees linked to the detention of a smartphone by an insured person and in particular accidental, partial or total destruction; Ice break in case of assault or accidental screen break affecting the proper functioning of the device. On the other hand, Luko imposes certain exclusions and in particular deficiency deadlines. Thus, the mobile phone can be ensured if its screen is broken following an assault after a deficiency period of one month (6 months for an accidental ice broken which does not affect the operation of the device). Are also excluded the following cases:

- Breakdowns due to an internal origin to the device;

- Damage which is the manufacturer’s warranty;

- “Aesthetic” damage like dead pixels for example;

- External damage that does not harm the proper functioning of the device as a flary, scratch or scratch, etc.

Good to know how to be very rigorous in reading the general conditions of sale (CGV) when you subscribe to your home insurance because certain insurances simply exclude the management of nomad devices. Some insurers limit for example the management to a specific number of claims per year.

�� broken phone: am I insured outside my accommodation ?

Generally, Your phone is provided as part of your home insurance contract, provided that the claim takes place at your home and that the type of claim is also provided for in the contract (water damage, fire and explosion, natural disaster, etc.))

To be covered outside your accommodation, you will have to call on another type of insurance: your car insurance if the damage takes place in your vehicle (provided your car insurance contract provides, it is rarely The case if you are insured to third party for example); or specific mobile phone insurance that you can subscribe to an insurer but also with a telephone operator for example.

Whatever type of coverage you take for your phone’s assurance in case of breakage or flight, Remember to check the clauses of your contract so as not to have a bad surprise following a disaster.

Let us help you choose your home insurance

Estimated time: 5 min (free and non -binding brokerage service)

Want to pay less for your home insurance ? Compare them !